If you're in the market for a new home, one of the last things you may be thinking about is the kitchen sink. After all, it's just one small part of a larger space. But when it comes to getting a mortgage, the absence of a kitchen sink can actually be a major issue. So, can you still get a mortgage if your dream home is missing this essential feature? Let's find out.Can I Get a Mortgage with No Kitchen Sink?

The short answer is yes, you can get a mortgage without a kitchen sink. However, it may not be as straightforward as you might think. Lenders typically have strict requirements when it comes to the condition of a property, and a missing kitchen sink can be seen as a red flag. But don't worry, there are still options available to you.How to Get a Mortgage with No Kitchen Sink

One option for financing a home without a kitchen sink is to apply for a renovation loan. These types of loans allow you to borrow money to make repairs or improvements to a property. However, keep in mind that not all renovation loans will cover the cost of installing a kitchen sink. You may need to do some research and find a lender that offers this specific type of loan. Another option is to negotiate a lower price for the home. If the kitchen sink is missing, it's likely that there are other issues with the property that may need to be addressed. Use this to your advantage and try to negotiate a lower price for the home. This can help offset the cost of installing a new kitchen sink.Options for Getting a Mortgage without a Kitchen Sink

If you've already purchased a home without a kitchen sink and are now looking to get a mortgage, there are a few things you can do to increase your chances of approval. One option is to install a temporary kitchen sink. This can be a portable sink or a sink attached to a countertop. This will show lenders that you are actively working towards fixing the issue and may make them more likely to approve your mortgage application. You can also provide evidence that you have the funds to install a kitchen sink. This can be in the form of a quote from a contractor or proof of savings. Showing that you have the means to address the issue can also help alleviate any concerns from lenders.What to Do if Your Home Doesn't Have a Kitchen Sink

The short answer is yes. However, it's important to note that every lender is different and may have their own requirements. Some may be more willing to approve a mortgage for a home without a kitchen sink, while others may be more hesitant. It's important to do your research and find a lender that is willing to work with you.Can You Get a Mortgage with a Missing Kitchen Sink?

If you're struggling to get a traditional mortgage for a home without a kitchen sink, there are other options available. One option is to look into a rent-to-own program. These programs allow you to rent a property with the option to buy it at a later date. This can give you time to save up for the cost of installing a kitchen sink while still being able to live in the home. You can also consider asking a family member or friend to co-sign your mortgage. This can help alleviate any concerns from lenders and increase your chances of approval. Just make sure you have a solid plan in place to repay the loan on time.Alternative Solutions for Financing a Home without a Kitchen Sink

If you've found your dream home but it's missing a kitchen sink, don't be afraid to negotiate. This is a common tactic in the real estate world and can help you save money in the long run. Consider making a lower offer on the home and use the absence of a kitchen sink as a bargaining chip. You may be surprised at how much you can save. Another option is to ask the seller to cover the cost of installing a new kitchen sink. This can be done through a credit towards the purchase price or by having the seller install the sink before the close of the sale. Just make sure to have any agreements in writing to avoid any misunderstandings.How to Negotiate a Lower Price for a Home without a Kitchen Sink

While it may seem insignificant, a kitchen sink plays a crucial role in the mortgage process. Lenders want to ensure that the property they are lending money for is in good condition and will hold its value. A missing kitchen sink can be seen as a sign of neglect and may make lenders hesitant to approve a mortgage. However, with the right approach and options, you can still get the home of your dreams without a kitchen sink.The Importance of a Kitchen Sink in the Mortgage Process

When searching for a lender who will approve a mortgage for a home without a kitchen sink, it's important to do your research. Look for lenders who specialize in renovation loans or who have experience working with unconventional properties. You can also ask for recommendations from friends or family who have gone through a similar situation. It's also important to have all your documentation and evidence in order when applying for a mortgage. This includes quotes from contractors, proof of savings, and any other relevant information that can help reassure lenders.Tips for Finding a Lender Who Will Approve a Mortgage without a Kitchen Sink

Before applying for a mortgage on a home without a kitchen sink, it's important to understand the potential challenges and have a plan in place. This may include researching lenders, budgeting for the cost of installing a new kitchen sink, and being prepared to negotiate with the seller. You should also consider the overall condition of the home and any other potential issues that may need to be addressed. It's important to have a comprehensive understanding of the property before making a decision to purchase.What to Know Before Applying for a Mortgage on a Home without a Kitchen Sink

Can I Get a Mortgage With No Kitchen Sink?

The Importance of a Kitchen Sink in Home Design

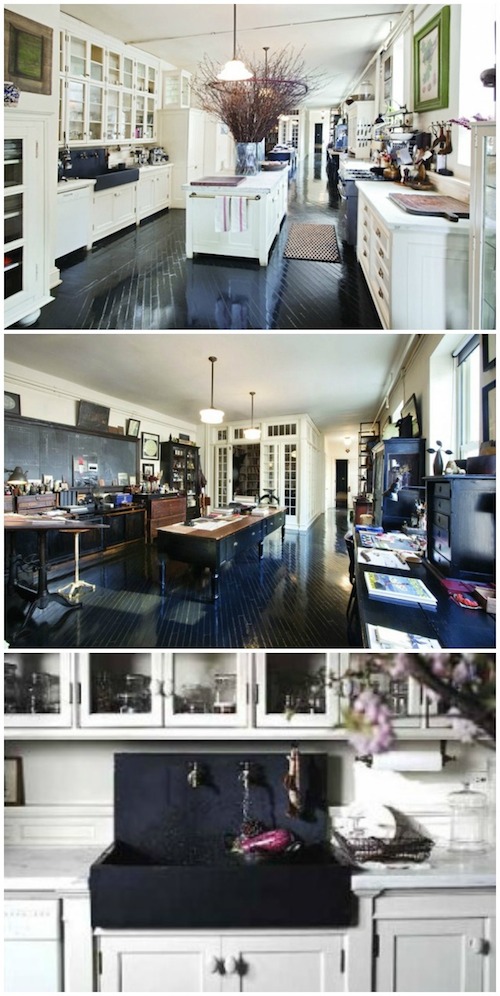

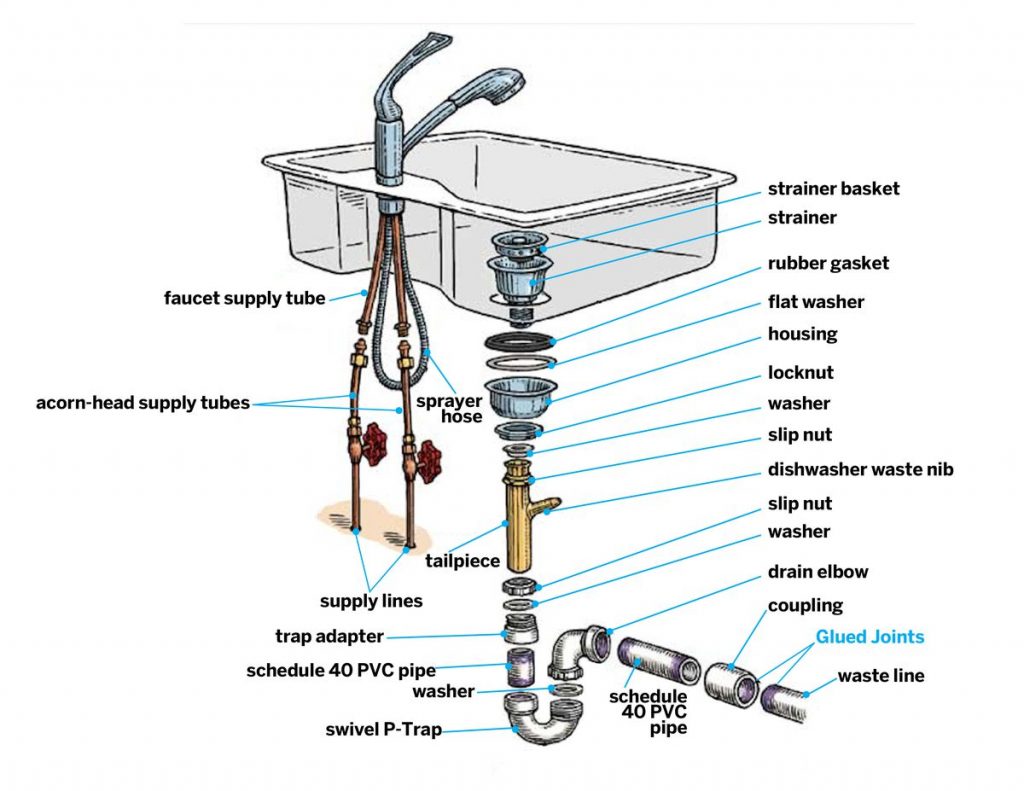

When it comes to home design, the kitchen is often considered the heart of the home. It is where meals are prepared, memories are made, and families gather together. And at the center of this important space is the kitchen sink. It may seem like a small detail, but a kitchen sink serves a crucial purpose in a home. It not only provides a place to wash dishes and prepare food, but it also adds to the overall aesthetic and functionality of the kitchen.

So, can you get a mortgage for a home without a kitchen sink?

The simple answer is no. Lenders require certain standards to be met in a home before approving a mortgage loan, and having a functional kitchen sink is one of them. This is because a kitchen sink is considered a basic necessity in a home and its absence can greatly affect the value of the property.

When it comes to home design, the kitchen is often considered the heart of the home. It is where meals are prepared, memories are made, and families gather together. And at the center of this important space is the kitchen sink. It may seem like a small detail, but a kitchen sink serves a crucial purpose in a home. It not only provides a place to wash dishes and prepare food, but it also adds to the overall aesthetic and functionality of the kitchen.

So, can you get a mortgage for a home without a kitchen sink?

The simple answer is no. Lenders require certain standards to be met in a home before approving a mortgage loan, and having a functional kitchen sink is one of them. This is because a kitchen sink is considered a basic necessity in a home and its absence can greatly affect the value of the property.

The Impact of a Missing Kitchen Sink on Home Value

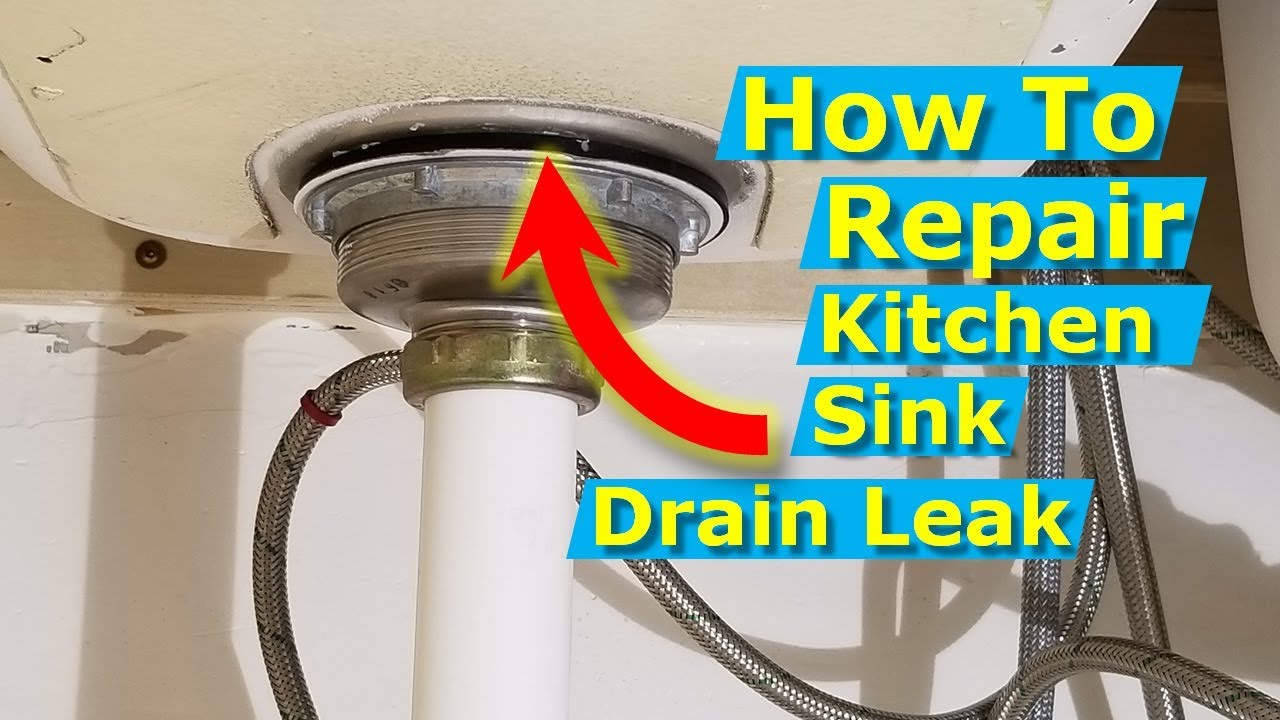

A kitchen without a sink not only makes daily tasks like cooking and cleaning more difficult, but it also lowers the value of a home. A missing kitchen sink can be a red flag to potential buyers and can make it harder to sell the property in the future. It may also affect the appraisal value of the home, which can ultimately impact the amount of a mortgage loan that a lender is willing to provide.

Additionally, a missing kitchen sink can be a sign of other potential issues in the home.

It could indicate plumbing problems or structural issues that could be costly to fix. Lenders want to ensure that the property they are financing is in good condition and a missing kitchen sink could raise red flags and lead to loan denial.

A kitchen without a sink not only makes daily tasks like cooking and cleaning more difficult, but it also lowers the value of a home. A missing kitchen sink can be a red flag to potential buyers and can make it harder to sell the property in the future. It may also affect the appraisal value of the home, which can ultimately impact the amount of a mortgage loan that a lender is willing to provide.

Additionally, a missing kitchen sink can be a sign of other potential issues in the home.

It could indicate plumbing problems or structural issues that could be costly to fix. Lenders want to ensure that the property they are financing is in good condition and a missing kitchen sink could raise red flags and lead to loan denial.

Alternative Options for a Kitchen Without a Sink

If you are considering buying a home without a kitchen sink, it may be worth exploring alternative options. For example, you could negotiate with the seller to have a kitchen sink installed before closing on the property. This way, the home will meet the required standards and you can proceed with the mortgage process.

Alternatively, you could also consider getting a renovation loan that includes the cost of installing a kitchen sink in the loan amount. This way, you can still purchase the home and have the necessary funds to make the necessary improvements.

In conclusion, a kitchen sink is a crucial component of a home and its absence can greatly affect the mortgage approval process.

It is important to make sure that the property you are interested in meets the necessary standards before proceeding with a mortgage loan. With a functional and aesthetically pleasing kitchen sink, you can not only enjoy a beautiful and functional kitchen, but also ensure a smooth and successful mortgage process.

If you are considering buying a home without a kitchen sink, it may be worth exploring alternative options. For example, you could negotiate with the seller to have a kitchen sink installed before closing on the property. This way, the home will meet the required standards and you can proceed with the mortgage process.

Alternatively, you could also consider getting a renovation loan that includes the cost of installing a kitchen sink in the loan amount. This way, you can still purchase the home and have the necessary funds to make the necessary improvements.

In conclusion, a kitchen sink is a crucial component of a home and its absence can greatly affect the mortgage approval process.

It is important to make sure that the property you are interested in meets the necessary standards before proceeding with a mortgage loan. With a functional and aesthetically pleasing kitchen sink, you can not only enjoy a beautiful and functional kitchen, but also ensure a smooth and successful mortgage process.

-1.png#keepProtocol)