Can I Expense a Mattress for Business?

As a business owner, it's important to understand what expenses you can deduct on your taxes in order to maximize your profits. One question that often comes up is whether or not a mattress can be expensed for business purposes. The short answer is yes, but there are certain criteria that must be met. In this article, we'll discuss the ins and outs of expensing a mattress for your business.

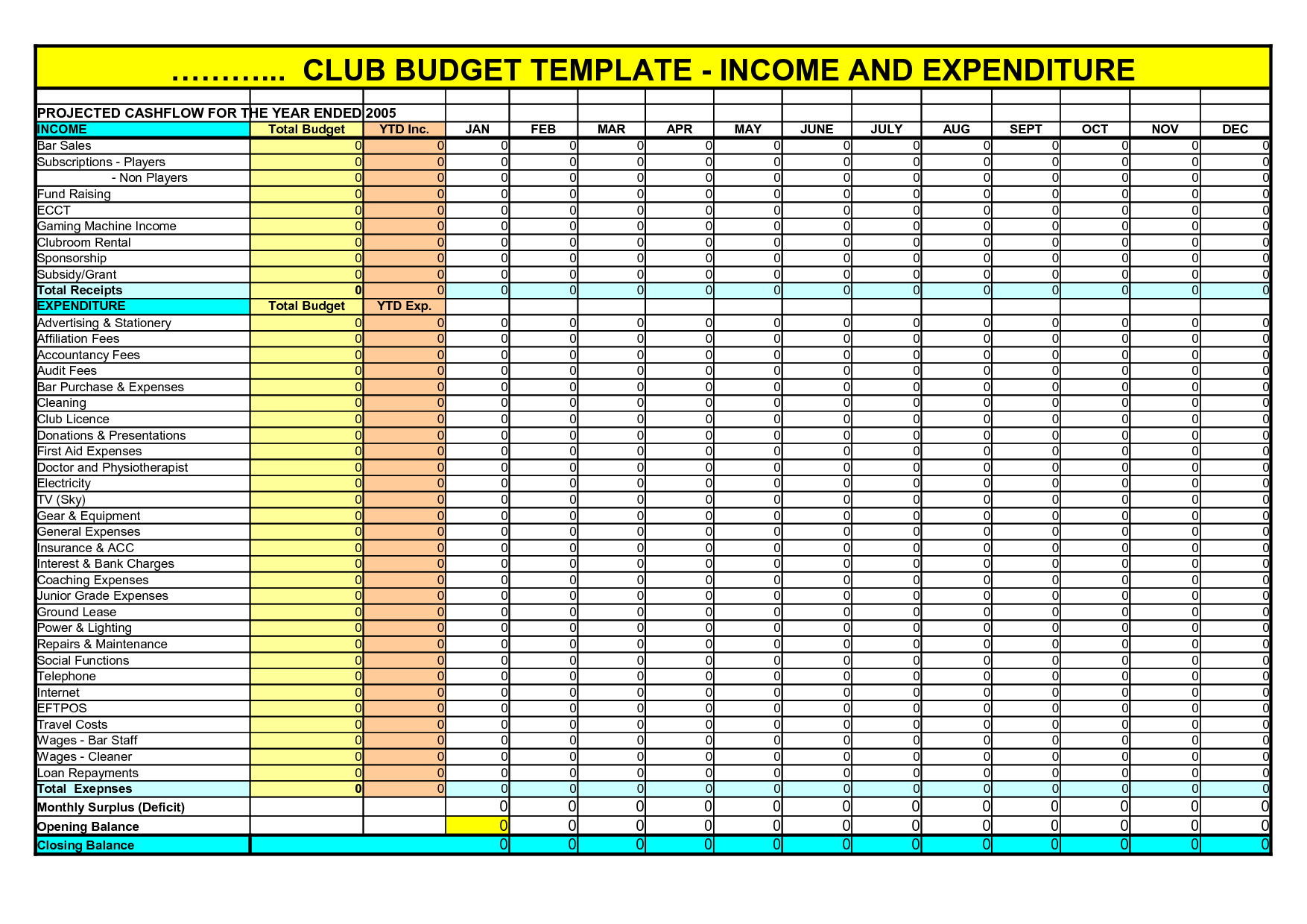

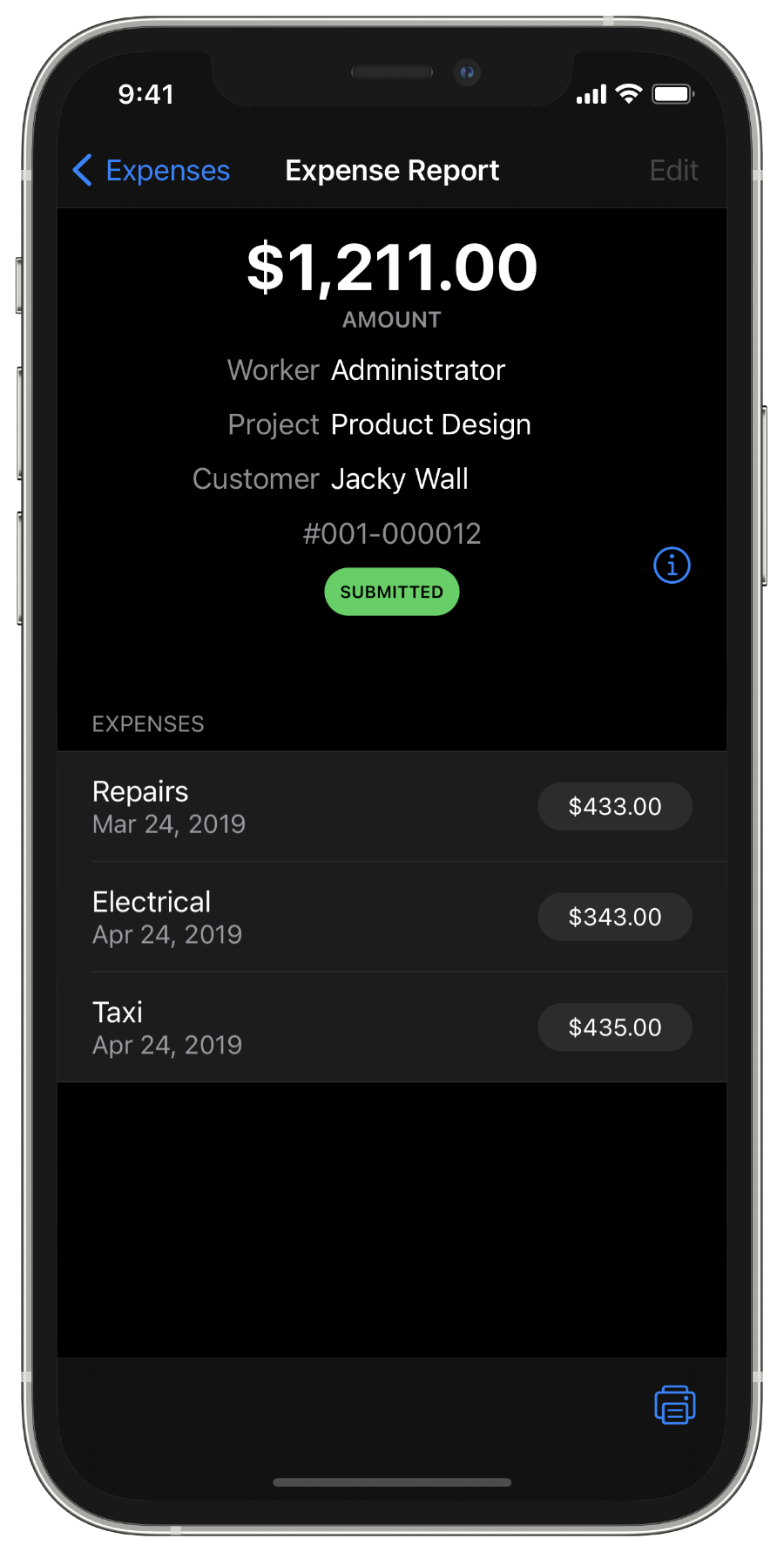

How to Expense a Mattress for Business

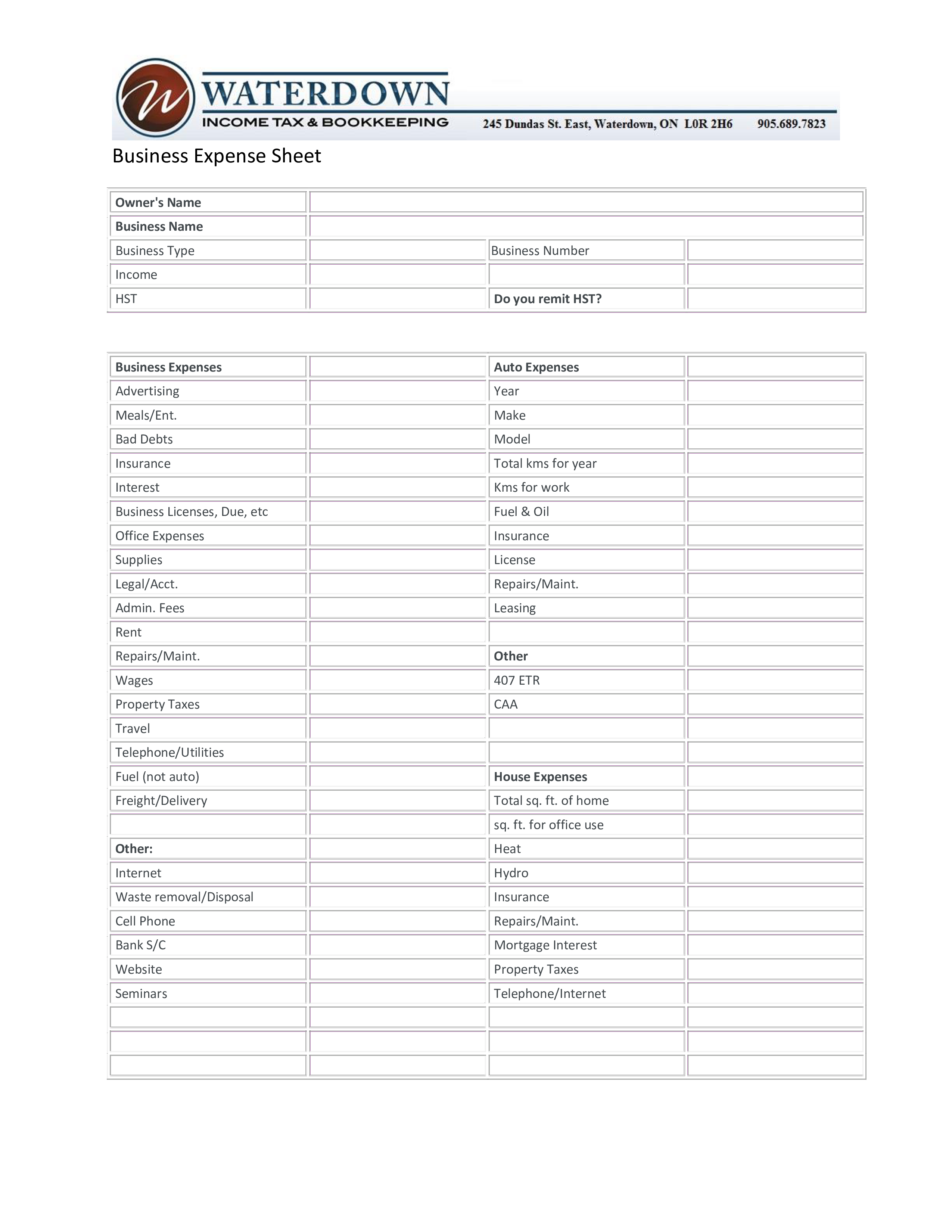

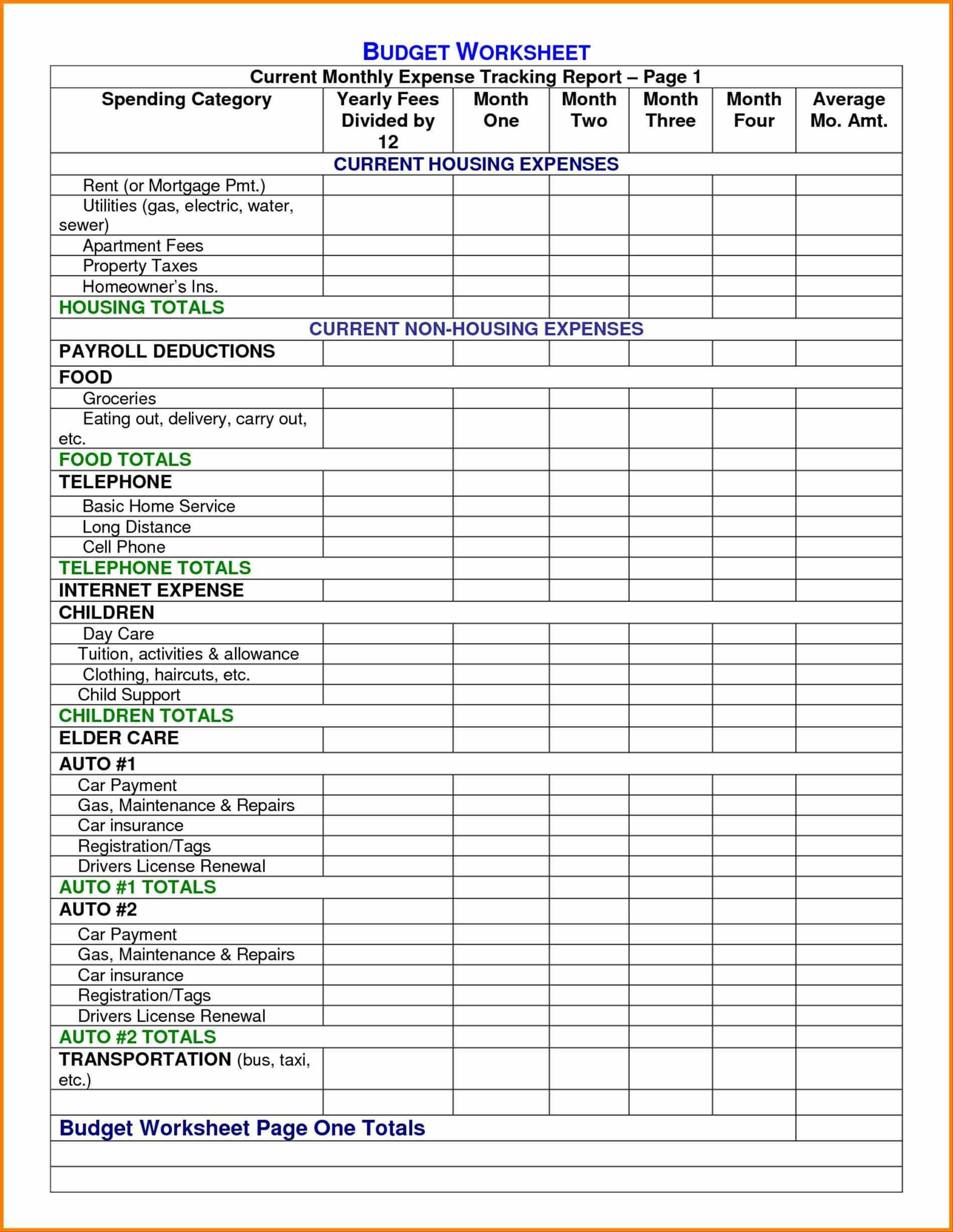

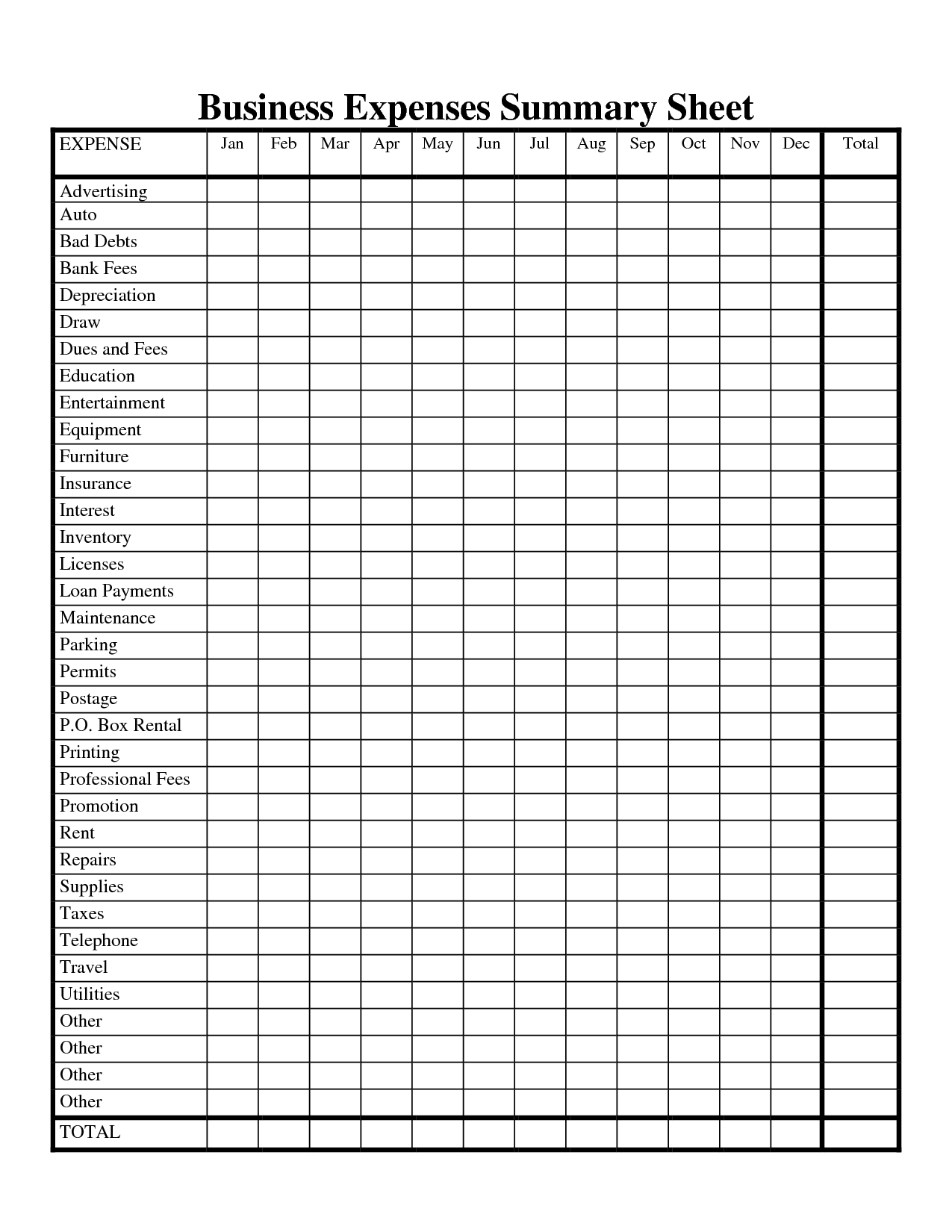

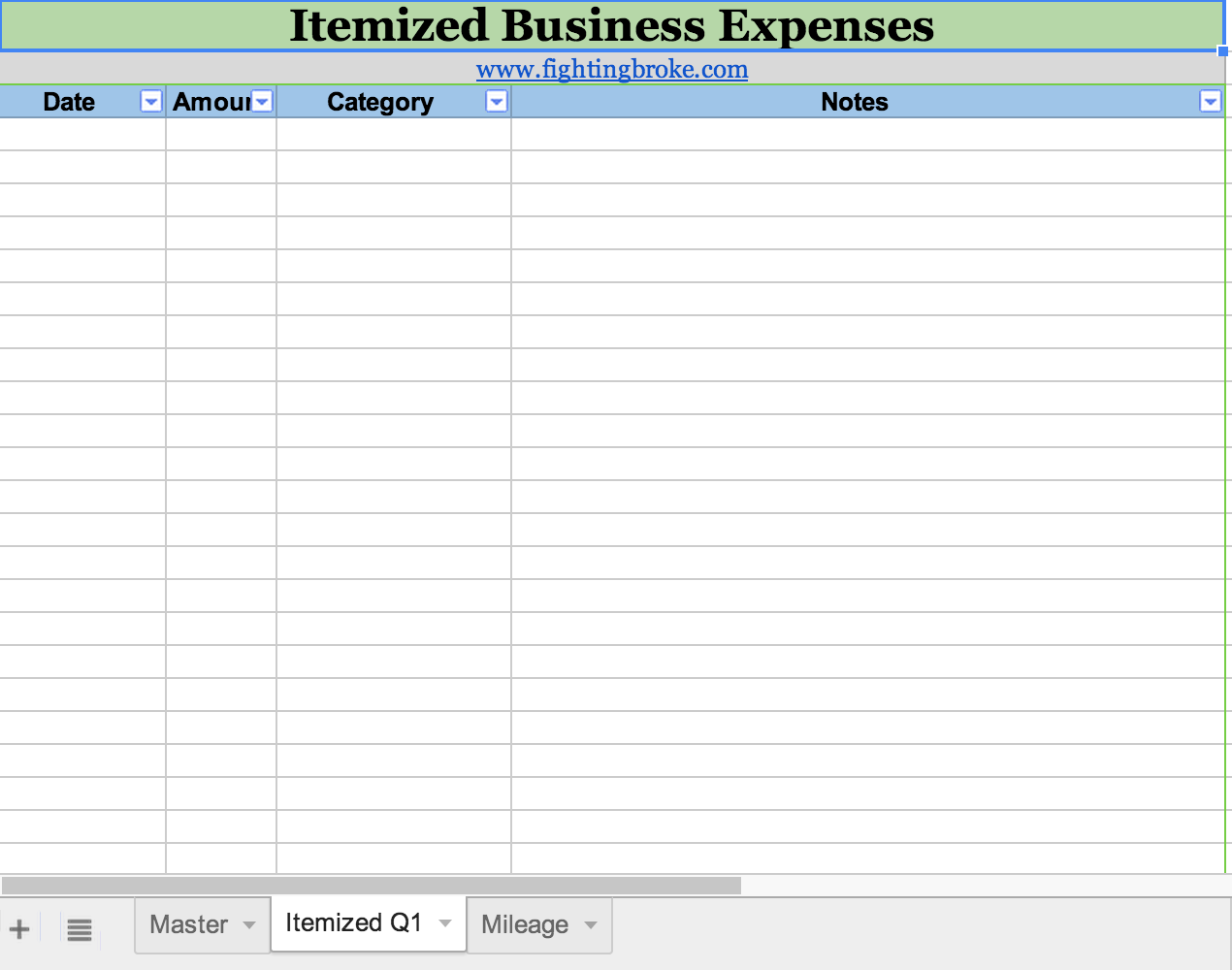

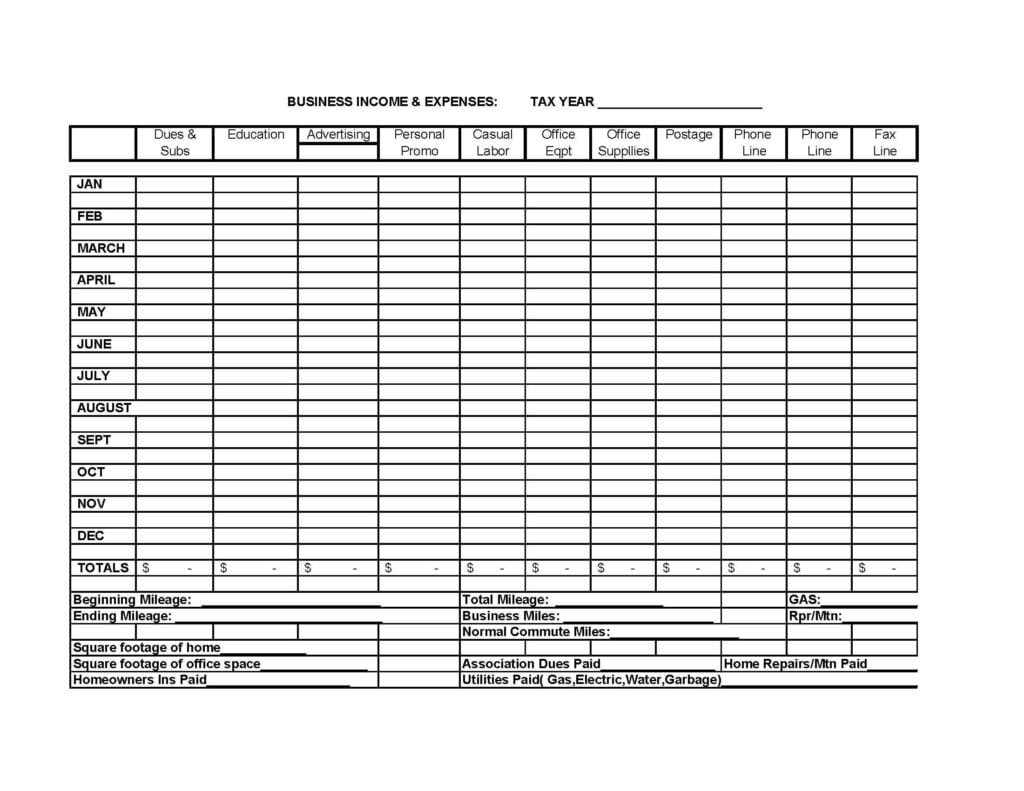

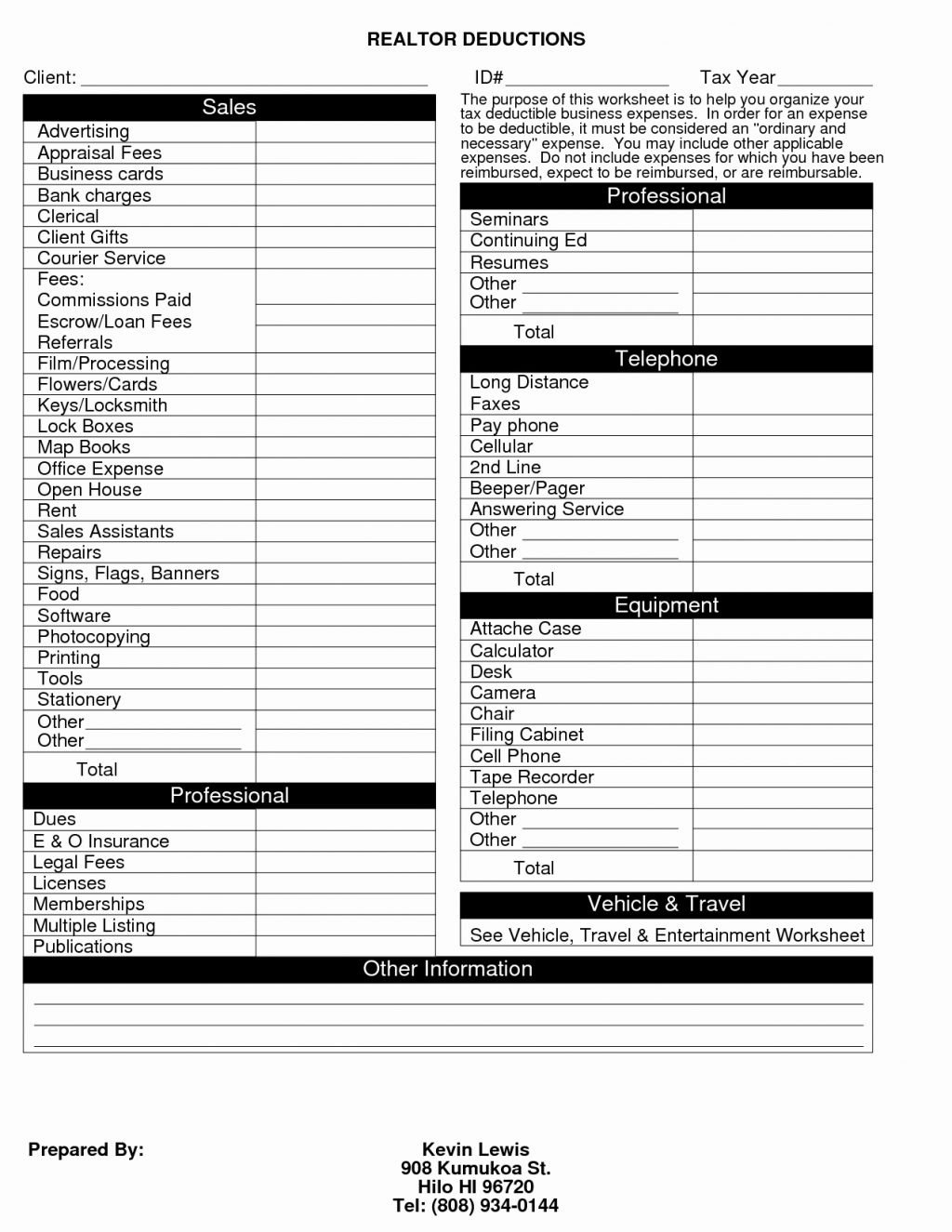

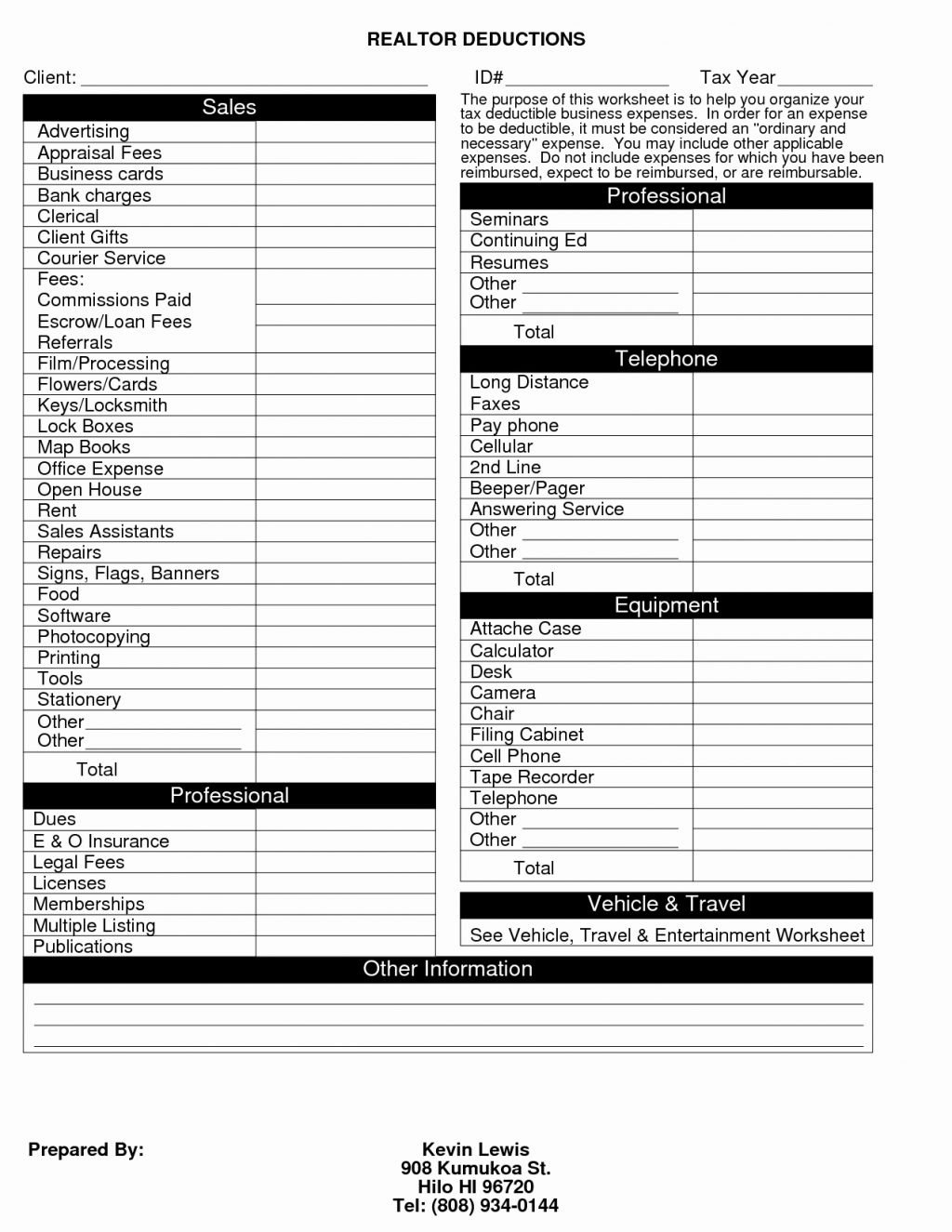

The first step to expensing a mattress for your business is to determine if it meets the criteria for being a legitimate business expense. In order for a mattress to be considered a business expense, it must be used for business purposes at least 50% of the time. This means that if you have a home office and use your mattress for work-related tasks, you may be able to deduct a portion of the cost on your taxes.

Business Expense for Mattress

When it comes to expensing a mattress for your business, there are a few key things to keep in mind. Firstly, the mattress must be used for business purposes, such as working from home or meeting with clients. Additionally, the mattress must be considered a necessary expense for your business. This means that it cannot be a luxury item or used solely for personal reasons.

Can I Deduct a Mattress for Business

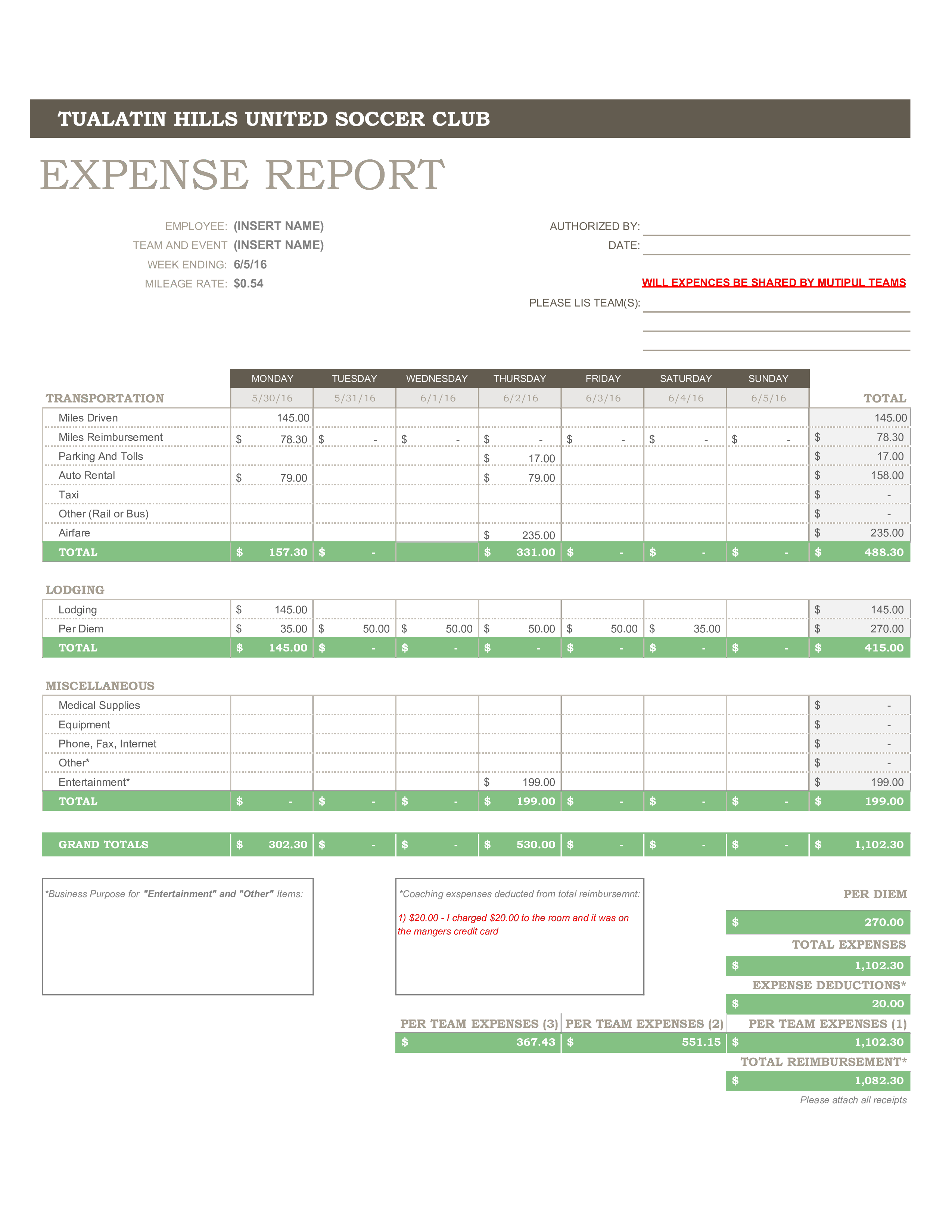

If you meet the criteria for expensing a mattress for your business, you may be wondering how much you can actually deduct. The amount you can deduct will depend on the percentage of time the mattress is used for business purposes. For example, if you use your mattress for business 50% of the time, you can deduct 50% of the cost. Keep in mind that only the cost of the mattress itself can be deducted, not any additional expenses such as sheets or pillows.

Business Expense for Mattress Purchase

If you are purchasing a new mattress specifically for business purposes, you can deduct the entire cost as a one-time expense. However, if you are replacing an old mattress, you can only deduct the portion that is used for business. For example, if your old mattress was used for business 50% of the time and you replace it with a new one, you can only deduct 50% of the cost of the new mattress.

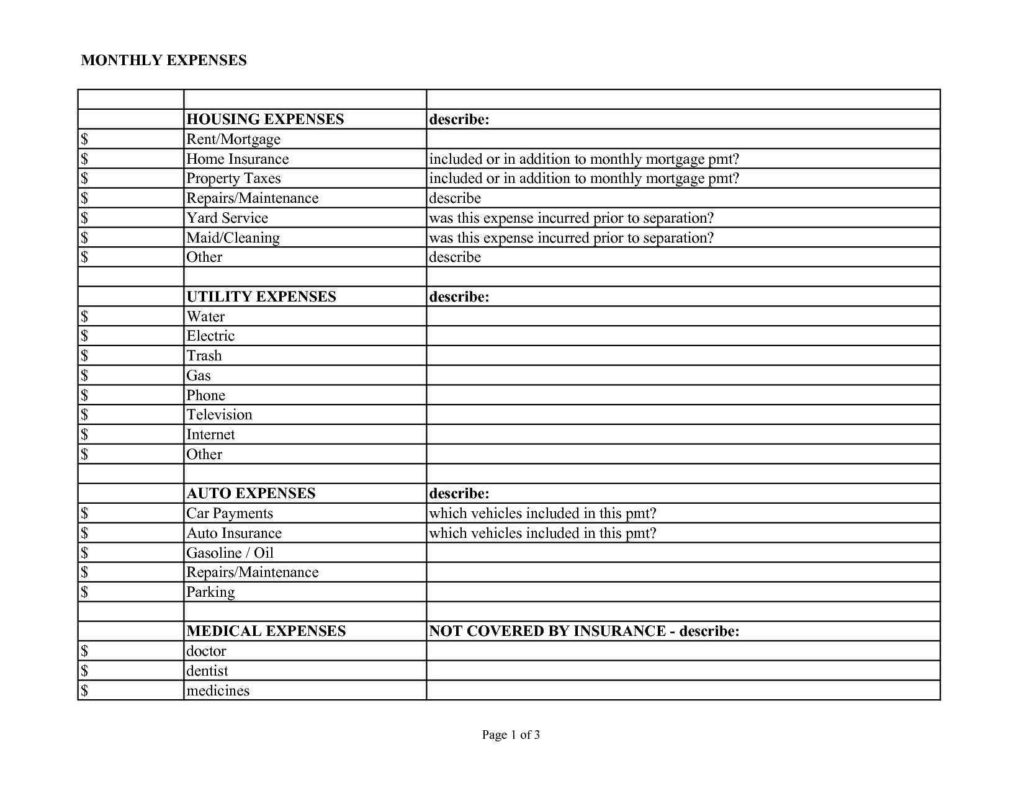

Can I Write Off a Mattress for Business

Another term often used when discussing business expenses is "writing off." This simply means deducting the expense on your taxes. So if you are wondering if you can write off a mattress for your business, the answer is yes, as long as it meets the necessary criteria.

Business Expense for Mattress Replacement

If you need to replace your mattress due to wear and tear or for any other reason, you can deduct the cost as a business expense. However, keep in mind that the same rules apply - you can only deduct the percentage that is used for business purposes.

Can I Claim a Mattress as a Business Expense

Claiming a mattress as a business expense is similar to writing it off. As long as the mattress is used for business purposes and meets the necessary criteria, you can claim it as an expense on your taxes. This can help lower your tax liability and increase your profits as a business owner.

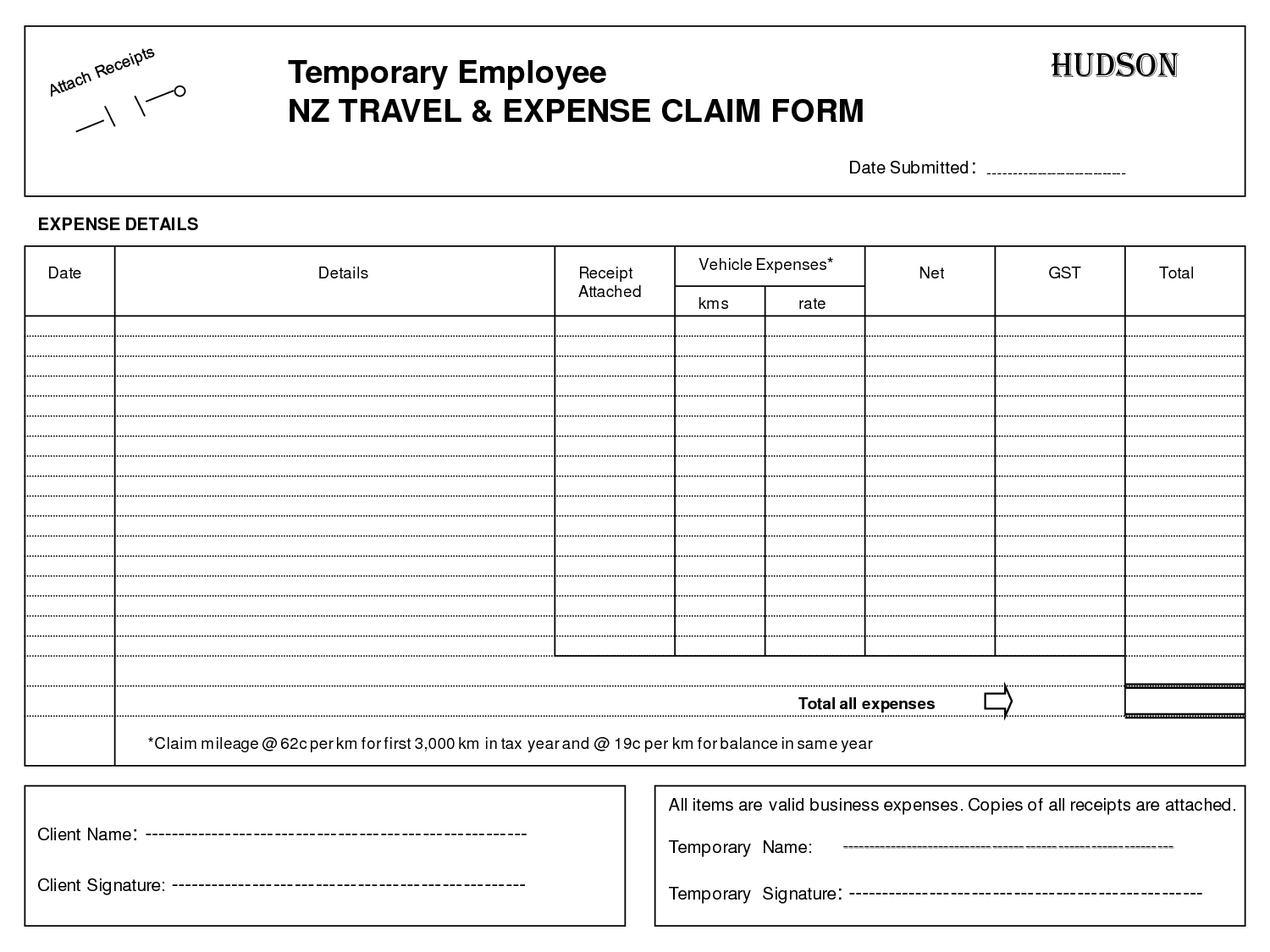

Business Expense for Mattress Upgrade

If you are upgrading your mattress to a higher quality or more expensive model, you can still deduct the cost as a business expense as long as it meets the necessary criteria. However, keep in mind that the percentage you can deduct will still depend on the amount of time the mattress is used for business purposes.

Can I Expense a Mattress for Home Office

If you have a home office and use your mattress for work-related tasks, you may be able to expense a portion of the cost on your taxes. However, it's important to note that this only applies to mattresses used in a home office, not in a traditional office setting.

In conclusion, the answer to the question "can I expense a mattress for business" is yes, as long as it meets the necessary criteria. Keep in mind that you should always consult with a tax professional for specific advice regarding your individual business and expenses. With the right documentation and understanding of the rules, you can save money on your taxes and improve your bottom line as a business owner.

The Importance of Proper Sleep for Business Success

Investing in a Quality Mattress for Your Home Office

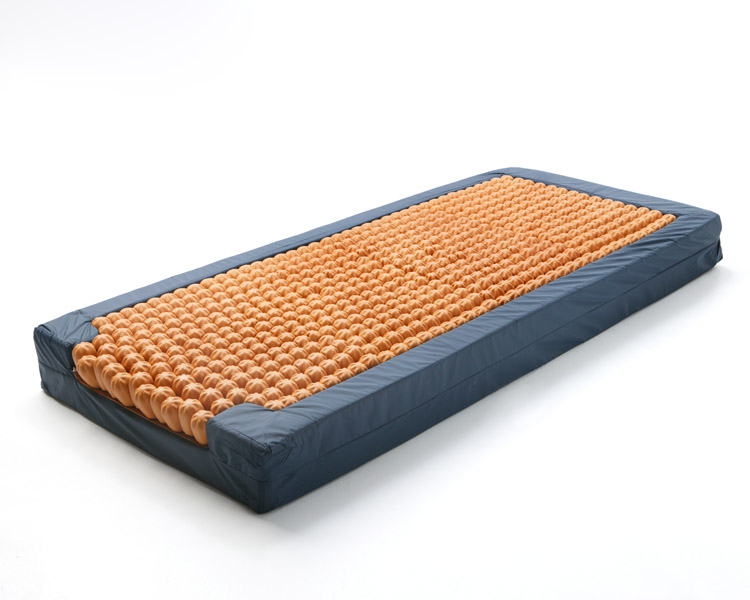

In today's fast-paced business world, entrepreneurs and professionals are constantly striving to find ways to increase productivity and efficiency. While many focus on implementing the latest technology and time management techniques, one often overlooked factor that can greatly impact success is sleep quality. As we spend a significant portion of our lives in bed, it's crucial to prioritize a good night's rest. This is especially true for those who work from home, as the line between personal and professional life can easily blur. Investing in a quality mattress for your home office can have a significant impact on your overall well-being and ultimately, your business success.

Proper Sleep Leads to Better Performance

Research has shown that sleep deprivation can have a negative impact on cognitive function, including memory, decision-making, and problem-solving skills. This can lead to decreased productivity, poor decision-making, and increased stress levels. On the other hand, getting enough restful sleep can improve concentration and creativity, resulting in better performance in the workplace.

Creating a Productive Work Environment

A comfortable and supportive mattress is essential for creating an ideal work environment in your home office. Working from a bed that is too firm or too soft can cause discomfort and distractions, leading to poor posture and potential back pain. This can then affect your focus and productivity, hindering your ability to work efficiently. By investing in a high-quality mattress, you can ensure that your body is properly supported while you work, allowing you to stay focused and productive.

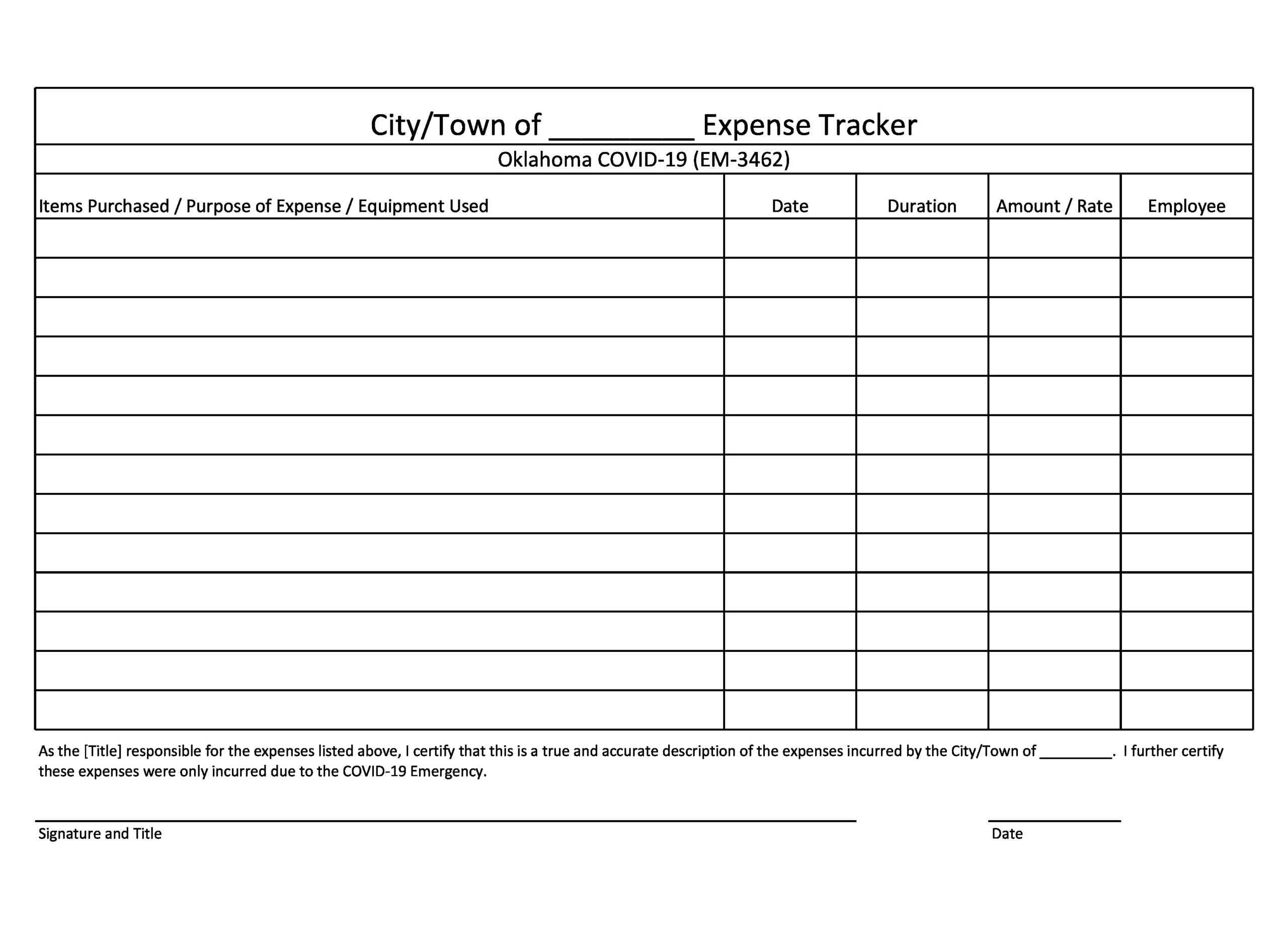

A Mattress as a Business Expense?

Now you may be wondering, can I expense a mattress for business? The answer is yes, as long as it is exclusively used for business purposes. If you have a designated home office and use your mattress for work-related activities such as brainstorming, taking calls, or working on your laptop, it can be considered a legitimate business expense. This can also help reduce your tax liability, making it a financially savvy investment for your business.

The Importance of a Good Night's Rest

Aside from its impact on work performance, a good mattress can also have a significant impact on your overall health and well-being. Getting enough restful sleep has been linked to improved immune function, reduced risk of chronic diseases, and better mental health. By investing in a quality mattress, you are not only investing in your business, but also in your personal health and happiness.

In conclusion, a quality mattress is a worthwhile investment for any professional looking to improve their business success. From better performance and productivity to a healthier mind and body, the benefits of a good night's rest cannot be underestimated. So, if you've been wondering whether you can expense a mattress for business, the answer is yes – and it may just be one of the best investments you make for your business and yourself.

In today's fast-paced business world, entrepreneurs and professionals are constantly striving to find ways to increase productivity and efficiency. While many focus on implementing the latest technology and time management techniques, one often overlooked factor that can greatly impact success is sleep quality. As we spend a significant portion of our lives in bed, it's crucial to prioritize a good night's rest. This is especially true for those who work from home, as the line between personal and professional life can easily blur. Investing in a quality mattress for your home office can have a significant impact on your overall well-being and ultimately, your business success.

Proper Sleep Leads to Better Performance

Research has shown that sleep deprivation can have a negative impact on cognitive function, including memory, decision-making, and problem-solving skills. This can lead to decreased productivity, poor decision-making, and increased stress levels. On the other hand, getting enough restful sleep can improve concentration and creativity, resulting in better performance in the workplace.

Creating a Productive Work Environment

A comfortable and supportive mattress is essential for creating an ideal work environment in your home office. Working from a bed that is too firm or too soft can cause discomfort and distractions, leading to poor posture and potential back pain. This can then affect your focus and productivity, hindering your ability to work efficiently. By investing in a high-quality mattress, you can ensure that your body is properly supported while you work, allowing you to stay focused and productive.

A Mattress as a Business Expense?

Now you may be wondering, can I expense a mattress for business? The answer is yes, as long as it is exclusively used for business purposes. If you have a designated home office and use your mattress for work-related activities such as brainstorming, taking calls, or working on your laptop, it can be considered a legitimate business expense. This can also help reduce your tax liability, making it a financially savvy investment for your business.

The Importance of a Good Night's Rest

Aside from its impact on work performance, a good mattress can also have a significant impact on your overall health and well-being. Getting enough restful sleep has been linked to improved immune function, reduced risk of chronic diseases, and better mental health. By investing in a quality mattress, you are not only investing in your business, but also in your personal health and happiness.

In conclusion, a quality mattress is a worthwhile investment for any professional looking to improve their business success. From better performance and productivity to a healthier mind and body, the benefits of a good night's rest cannot be underestimated. So, if you've been wondering whether you can expense a mattress for business, the answer is yes – and it may just be one of the best investments you make for your business and yourself.