IRS Publication 502: Medical and Dental Expenses

When it comes to filing taxes, it's important to understand what medical expenses are eligible for deductions. The Internal Revenue Service (IRS) has a publication specifically dedicated to this topic – Publication 502: Medical and Dental Expenses. This publication outlines what expenses are considered deductible and how to claim them. Let's take a closer look at what it says about claiming a mattress on your taxes.

Can You Deduct Medical Expenses on Your Taxes?

The short answer is yes, you can deduct certain medical expenses on your taxes. However, there are certain requirements that must be met in order for these expenses to be eligible for deductions. These requirements include having expenses that are not reimbursed by insurance, meeting a certain threshold of total medical expenses, and having expenses that are considered "necessary and reasonable".

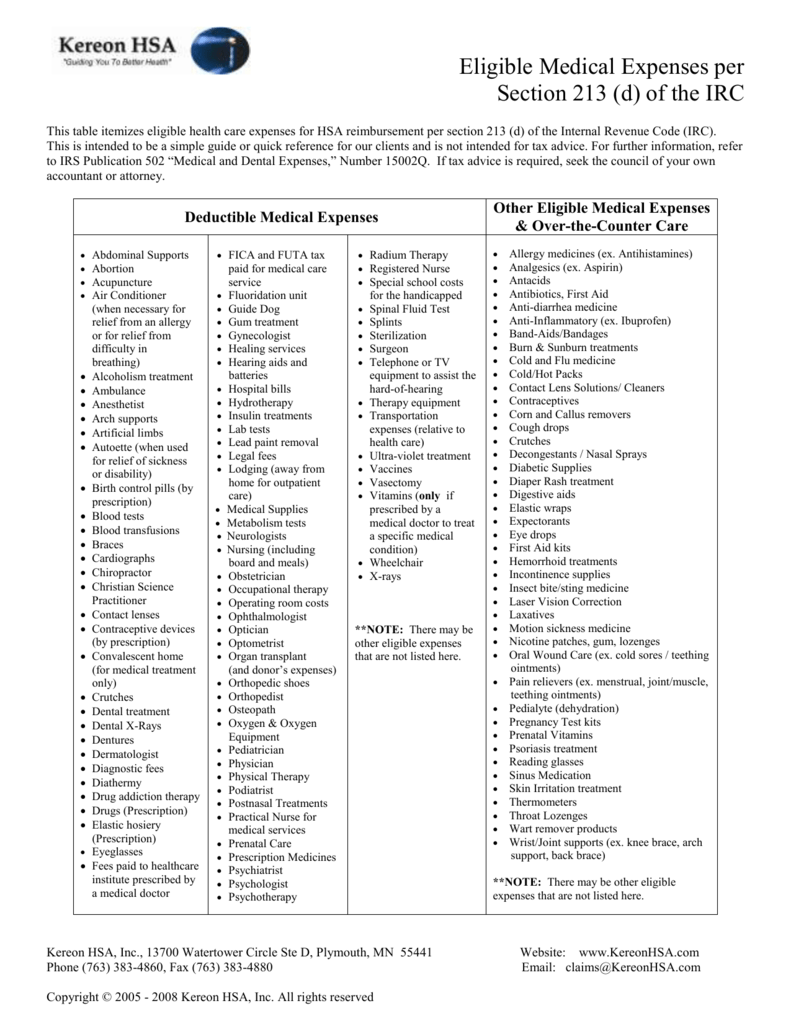

What Medical Expenses Are Tax Deductible?

According to Publication 502, medical expenses that are considered necessary and reasonable for the prevention or alleviation of a physical or mental defect or illness are tax deductible. This can include expenses for diagnosis, treatment, cure, mitigation, or prevention of a disease or condition. It also includes expenses for treatments that affect any part or function of the body, such as a mattress for back pain or sleep apnea.

Can You Claim a Mattress as a Medical Expense?

As mentioned earlier, in order for a medical expense to be tax deductible, it must be considered necessary and reasonable. This means that a mattress can be claimed as a medical expense if it is recommended by a doctor for the treatment of a specific condition, such as chronic back pain or sleep apnea. However, simply purchasing a new mattress for general comfort or better sleep would not be considered a deductible expense.

How to Claim a Medical Expense Tax Deduction

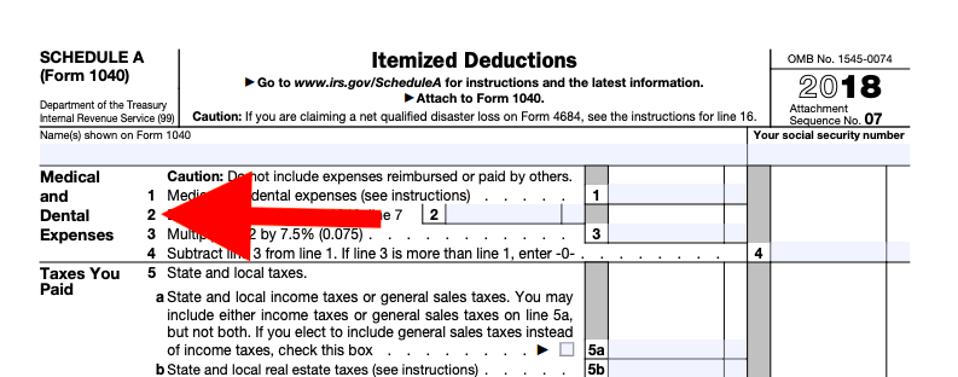

In order to claim a medical expense tax deduction, you must itemize your deductions on your tax return using Schedule A. This means that you will need to keep thorough records of your medical expenses throughout the year, including receipts and documentation from your doctor. You will also need to meet the threshold for total medical expenses, which for the 2020 tax year is 7.5% of your adjusted gross income.

What Medical Expenses Are Not Tax Deductible?

It's important to note that not all medical expenses are eligible for tax deductions. According to Publication 502, non-deductible medical expenses include expenses that are purely for cosmetic purposes, over-the-counter medications, and expenses that are reimbursed by insurance. Additionally, any expenses that are not considered necessary and reasonable for the treatment of a specific condition would not be eligible for deductions.

Can You Claim a Mattress on Your Taxes for Back Pain?

For those who suffer from chronic back pain, a good mattress can make all the difference in getting a good night's sleep. If your doctor recommends a specific type of mattress to help alleviate your back pain, then yes, you can claim it as a medical expense on your taxes. However, if you purchase a mattress simply for general comfort or without a doctor's recommendation, it would not be eligible for deductions.

How to Deduct Medical Expenses on Your Taxes

To deduct medical expenses on your taxes, you will need to fill out Schedule A, which is part of the Form 1040 tax return. You will need to list your total medical expenses for the year, including any expenses for a mattress that have been recommended by a doctor. It's important to keep thorough records and documentation of all your medical expenses in case of an audit.

What Medical Expenses Can You Claim on Your Taxes?

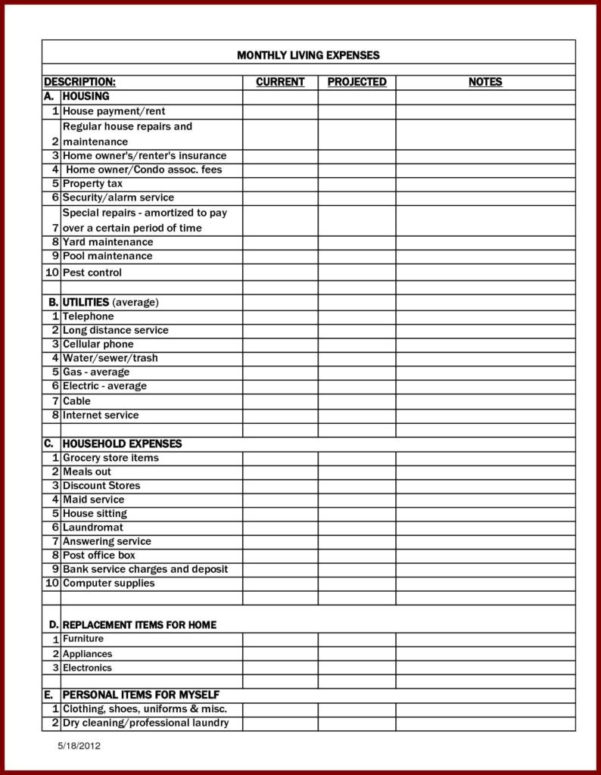

In addition to a mattress, there are a variety of other medical expenses that can be claimed on your taxes, including doctor's fees, prescription medications, medical equipment, and transportation costs for medical care. It's important to keep track of all your medical expenses throughout the year to determine if you meet the threshold for deductions.

Can You Claim a Mattress on Your Taxes for Sleep Apnea?

For those who suffer from sleep apnea, a special type of mattress may be recommended to help improve their symptoms. If you have been diagnosed with sleep apnea and your doctor recommends a specific mattress, then you can claim it as a medical expense on your taxes. However, if you purchase a mattress without a doctor's recommendation or for general comfort, it would not be eligible for deductions.

In conclusion, it is possible to claim a mattress as a medical expense on your taxes if it is recommended by a doctor for the treatment of a specific condition. However, it's important to keep thorough records and documentation of all your medical expenses and to meet the threshold for total medical expenses in order to claim the deduction. Consult with a tax professional for more information and guidance on claiming medical expenses on your taxes.

The Benefits of Claiming a Mattress on Your Taxes

Introduction

As tax season approaches, many homeowners are wondering if they can

claim their mattress on their taxes

. While it may seem like an unusual deduction, there are actually valid reasons for doing so. Not only can you

get a tax break

, but also

improve your sleep and overall well-being

by investing in a high-quality mattress. In this article, we will explore the

benefits of claiming a mattress on your taxes

and how it can contribute to a

well-designed and comfortable home

.

As tax season approaches, many homeowners are wondering if they can

claim their mattress on their taxes

. While it may seem like an unusual deduction, there are actually valid reasons for doing so. Not only can you

get a tax break

, but also

improve your sleep and overall well-being

by investing in a high-quality mattress. In this article, we will explore the

benefits of claiming a mattress on your taxes

and how it can contribute to a

well-designed and comfortable home

.

Improved Sleep Quality

A Tax Break for Home Improvement

Another reason to consider

claiming a mattress on your taxes

is that it can be categorized as a home improvement expense. Many people are familiar with claiming home improvement projects, such as renovations or repairs, on their taxes. However,

upgrading your mattress

can also fall into this category.

A new mattress can

improve the overall design and aesthetic of your bedroom

. It can also

increase the value of your home

by creating a more comfortable and inviting space. By claiming it as a home improvement expense, you can

reduce your tax burden

and potentially save money in the long run.

Another reason to consider

claiming a mattress on your taxes

is that it can be categorized as a home improvement expense. Many people are familiar with claiming home improvement projects, such as renovations or repairs, on their taxes. However,

upgrading your mattress

can also fall into this category.

A new mattress can

improve the overall design and aesthetic of your bedroom

. It can also

increase the value of your home

by creating a more comfortable and inviting space. By claiming it as a home improvement expense, you can

reduce your tax burden

and potentially save money in the long run.

Conclusion

In conclusion,

claiming a mattress on your taxes

can have several benefits. Not only can it lead to

improved sleep quality and overall well-being

, but it can also be considered a home improvement expense and provide a

tax break

. However, it's essential to consult with a tax professional to determine if you qualify for this deduction. By utilizing this benefit, you can not only

improve your sleep and home design

but also

save money

in the process.

In conclusion,

claiming a mattress on your taxes

can have several benefits. Not only can it lead to

improved sleep quality and overall well-being

, but it can also be considered a home improvement expense and provide a

tax break

. However, it's essential to consult with a tax professional to determine if you qualify for this deduction. By utilizing this benefit, you can not only

improve your sleep and home design

but also

save money

in the process.