When it comes to protecting our belongings and investments, insurance is often the first thing that comes to mind. From our cars to our homes, we want to make sure that in case of any damage or loss, we are covered. But what about our mattresses? Can a mattress be covered by insurance? The answer is yes, but it depends on the type of insurance you have and the circumstances surrounding the damage.Can a Mattress Be Covered by Insurance?

If you own your home, chances are you have homeowners insurance. This type of insurance typically covers the structure of your home and its contents, including your mattress. However, not all homeowners insurance policies are the same, so it's important to check the details of your specific policy to see if your mattress is included in the coverage.Does Homeowners Insurance Cover Mattresses?

Aside from homeowners insurance, there are other types of insurance that may cover your mattress. This includes renter's insurance, which covers your personal belongings in a rented property, and landlord insurance, which covers the structure and contents of a rental property owned by the landlord.What Types of Insurance Cover Mattresses?

The best way to check if your mattress is covered by insurance is to review your insurance policy or contact your insurance provider. Look for keywords such as "personal property" or "contents coverage" to see if your mattress is included. If you're unsure, it's always best to double-check with your insurance provider to avoid any surprises in case of an incident.How to Check if Your Mattress is Covered by Insurance

If your mattress is damaged and covered by insurance, the first thing you should do is take photos of the damage and contact your insurance provider. They will guide you through the process of filing a claim and may require you to provide proof of purchase or a receipt for the mattress. They may also ask for an assessment of the damage from a professional.What to Do if Your Mattress is Damaged and Covered by Insurance

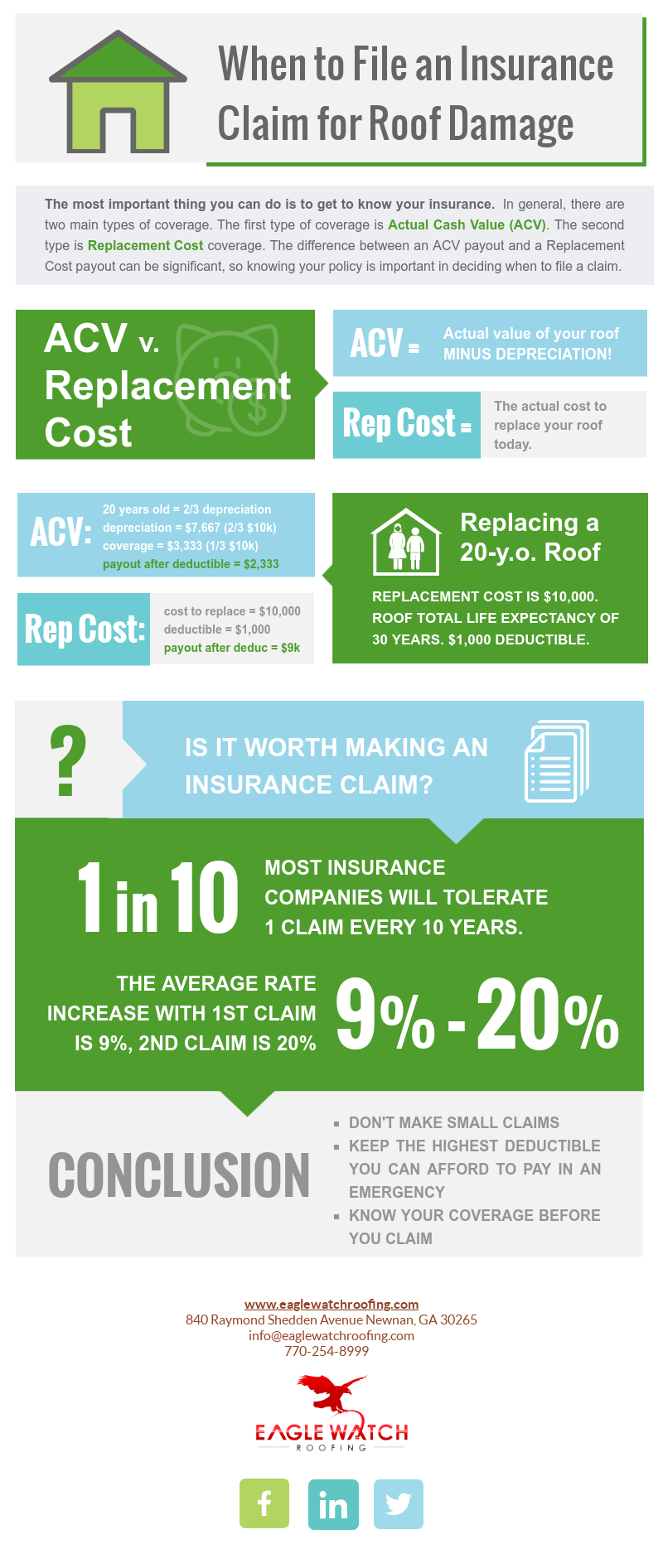

It's important to understand what your mattress insurance coverage includes and excludes. Some policies may only cover accidental damage, while others may cover both accidental and non-accidental damage. It's also important to know the maximum amount that your insurance will cover for a damaged mattress. Understanding these details will help you make an informed decision when choosing a mattress insurance policy.Understanding Mattress Insurance Coverage

Filing a claim for a mattress covered by insurance is a straightforward process. Once you have contacted your insurance provider and provided all necessary documentation, they will review your claim and determine the amount of compensation you will receive. You may also be required to pay a deductible, depending on your policy.How to File a Claim for a Mattress Covered by Insurance

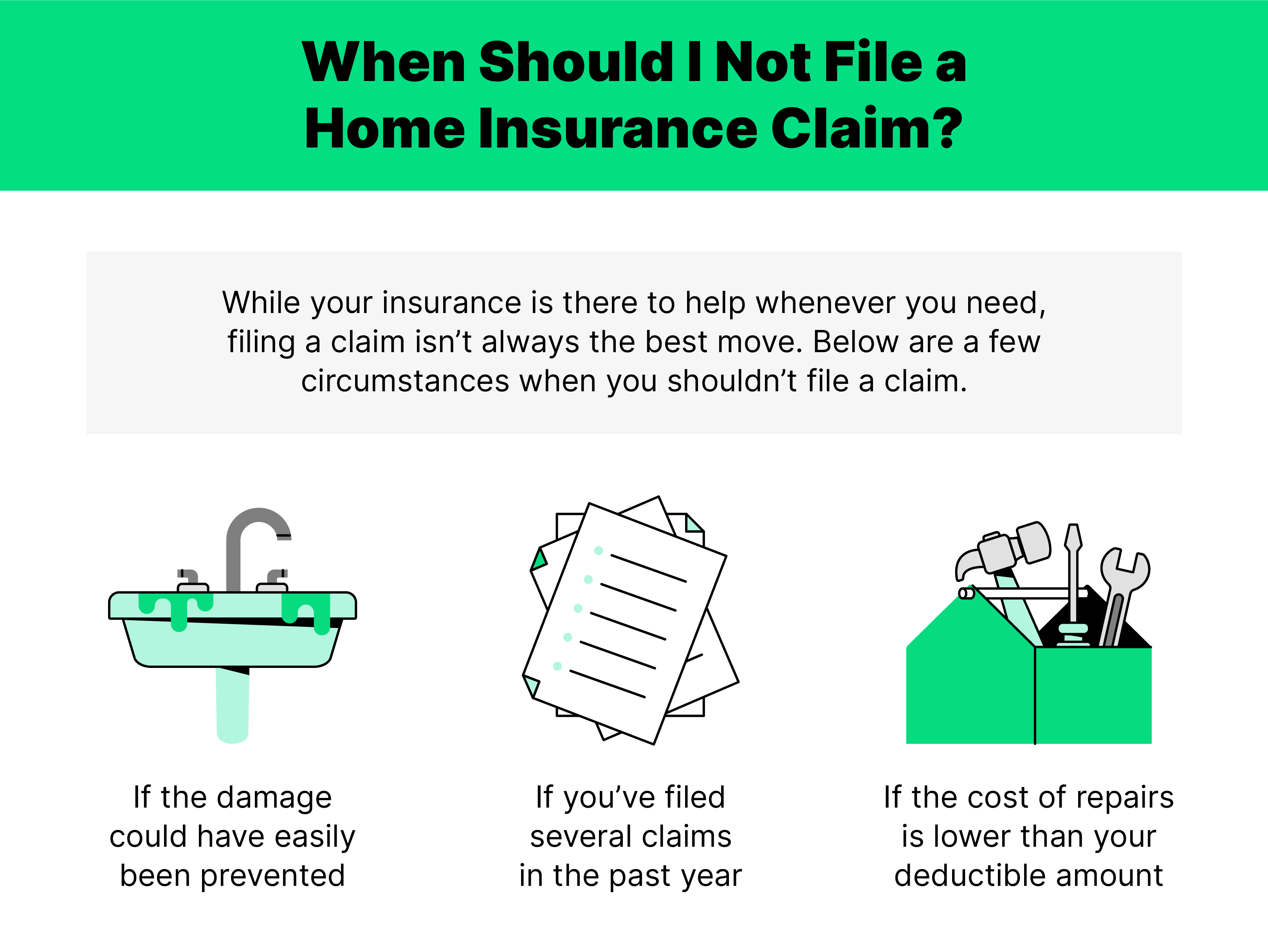

When looking for a mattress insurance policy, there are a few key things to consider. First, make sure the policy covers the type of damage you are most concerned about. If you have a pet or children, you may want to consider a policy that covers accidental damage. Additionally, consider the premium and deductible amounts, as well as the maximum coverage for a damaged mattress. It's also important to read the fine print and understand any exclusions or limitations.What to Look for in a Mattress Insurance Policy

If you're not convinced that mattress insurance is the right option for you, there are some alternatives you can consider. Some mattress companies offer warranties that cover damage and defects for a certain period of time. Additionally, investing in a quality mattress protector can help prevent damage and prolong the life of your mattress.Alternatives to Mattress Insurance Coverage

While having mattress insurance can provide peace of mind, there are steps you can take to protect your mattress and avoid having to file a claim. Regularly rotating and flipping your mattress can help distribute weight evenly and prevent sagging. Using a mattress protector can also protect against spills, stains, and allergens. And finally, avoid jumping or placing heavy objects on your mattress to prevent damage.Tips for Protecting Your Mattress and Avoiding Insurance Claims

Why You Should Consider Insuring Your Mattress

Protect Your Investment

When it comes to buying a new mattress, it's not uncommon for individuals to spend thousands of dollars. After all, a good night's sleep is essential for our overall health and well-being. But what happens if your mattress gets damaged or ruined? This is where insurance comes in.

Insuring your mattress can protect your investment and save you from having to spend a significant amount of money on a replacement.

Many insurance policies cover accidental damage, such as spills or tears, as well as natural wear and tear. This means that if your mattress becomes damaged, you can file a claim and receive compensation for the cost of repairs or replacement.

When it comes to buying a new mattress, it's not uncommon for individuals to spend thousands of dollars. After all, a good night's sleep is essential for our overall health and well-being. But what happens if your mattress gets damaged or ruined? This is where insurance comes in.

Insuring your mattress can protect your investment and save you from having to spend a significant amount of money on a replacement.

Many insurance policies cover accidental damage, such as spills or tears, as well as natural wear and tear. This means that if your mattress becomes damaged, you can file a claim and receive compensation for the cost of repairs or replacement.

Peace of Mind

We all know that accidents happen, especially in a household with children or pets.

By insuring your mattress, you can have peace of mind knowing that if anything were to happen, you wouldn't have to stress about the cost of repairs or replacement.

This can help alleviate any anxiety or worry you may have about your mattress, allowing you to fully enjoy your investment without any added stress.

We all know that accidents happen, especially in a household with children or pets.

By insuring your mattress, you can have peace of mind knowing that if anything were to happen, you wouldn't have to stress about the cost of repairs or replacement.

This can help alleviate any anxiety or worry you may have about your mattress, allowing you to fully enjoy your investment without any added stress.

Extended Warranty

Many insurance policies also offer extended warranties for mattresses. This means that even after the manufacturer's warranty expires, you can still have coverage for your mattress.

This can be especially beneficial for those who have invested in a high-quality, expensive mattress that may come with a shorter manufacturer's warranty.

With an extended warranty, you can continue to have peace of mind and protection for your mattress for an extended period.

Many insurance policies also offer extended warranties for mattresses. This means that even after the manufacturer's warranty expires, you can still have coverage for your mattress.

This can be especially beneficial for those who have invested in a high-quality, expensive mattress that may come with a shorter manufacturer's warranty.

With an extended warranty, you can continue to have peace of mind and protection for your mattress for an extended period.

Cost-Effective Option

While it may seem like an added expense, insuring your mattress can actually save you money in the long run. Without insurance, you may have to pay out of pocket for any damages or replacements.

But with insurance, you can pay a smaller monthly or annual premium and have coverage for any potential damages.

This can be a cost-effective option, especially if your mattress is damaged early on in its lifespan.

While it may seem like an added expense, insuring your mattress can actually save you money in the long run. Without insurance, you may have to pay out of pocket for any damages or replacements.

But with insurance, you can pay a smaller monthly or annual premium and have coverage for any potential damages.

This can be a cost-effective option, especially if your mattress is damaged early on in its lifespan.

Final Thoughts

In conclusion,

insuring your mattress is a smart and practical choice for protecting your investment and providing peace of mind.

Be sure to research different insurance policies and choose one that best fits your needs and budget. With insurance, you can sleep soundly knowing that your mattress is covered and you won't have to worry about any unexpected expenses.

In conclusion,

insuring your mattress is a smart and practical choice for protecting your investment and providing peace of mind.

Be sure to research different insurance policies and choose one that best fits your needs and budget. With insurance, you can sleep soundly knowing that your mattress is covered and you won't have to worry about any unexpected expenses.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

/filters:quality(60)/2022-11-02-Does-Homeowners-Insurance-Cover-AC.jpg)