1. Mattress Warranty and Insurance Policies

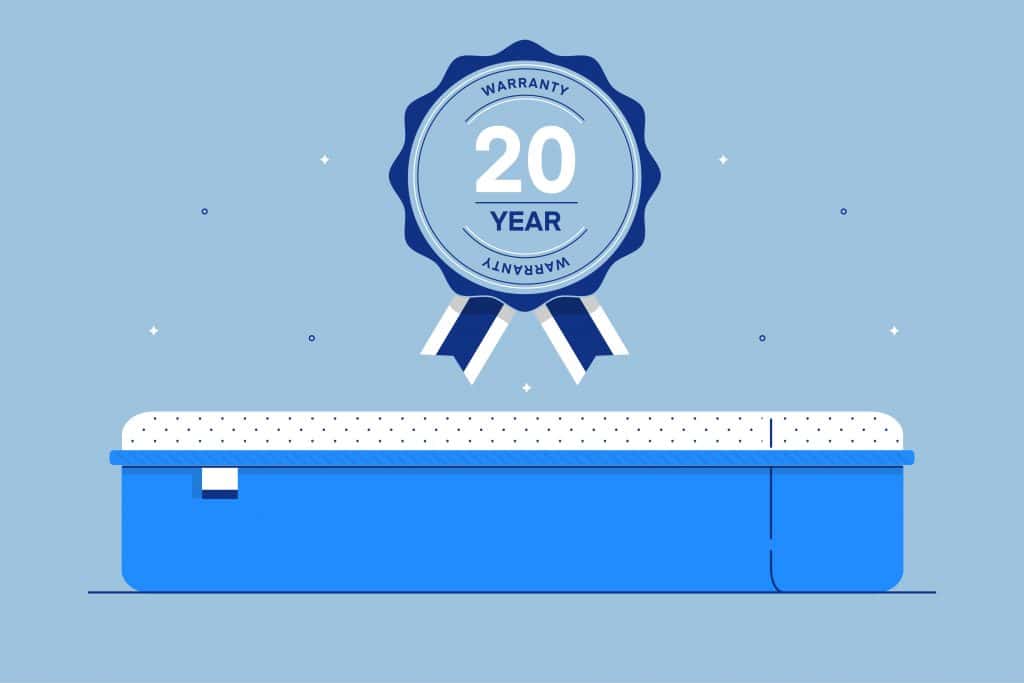

When purchasing a new bed mattress, one of the main concerns for many consumers is how to protect their investment. After all, a high-quality mattress can be quite expensive, and no one wants to have to replace it prematurely due to accidents or wear and tear. This is where mattress insurance policies come in, offering peace of mind and financial protection against unexpected damages or defects. However, it's important to understand the difference between a mattress warranty and insurance policy, and how they work together to provide comprehensive coverage for your bed.

2. Protect Your Bed with Mattress Insurance

While most mattresses come with a manufacturer's warranty, these typically only cover defects in materials or workmanship. This means that if your mattress is damaged by accidents, spills, or other non-manufacturer-related issues, you may not be covered. This is where mattress insurance policies come in, providing coverage for a wide range of damages, including stains, punctures, and even bed bug infestations. By having both a warranty and insurance policy, you can ensure your bed is fully protected from all potential risks.

3. Understanding Insurance Coverage for Your Mattress

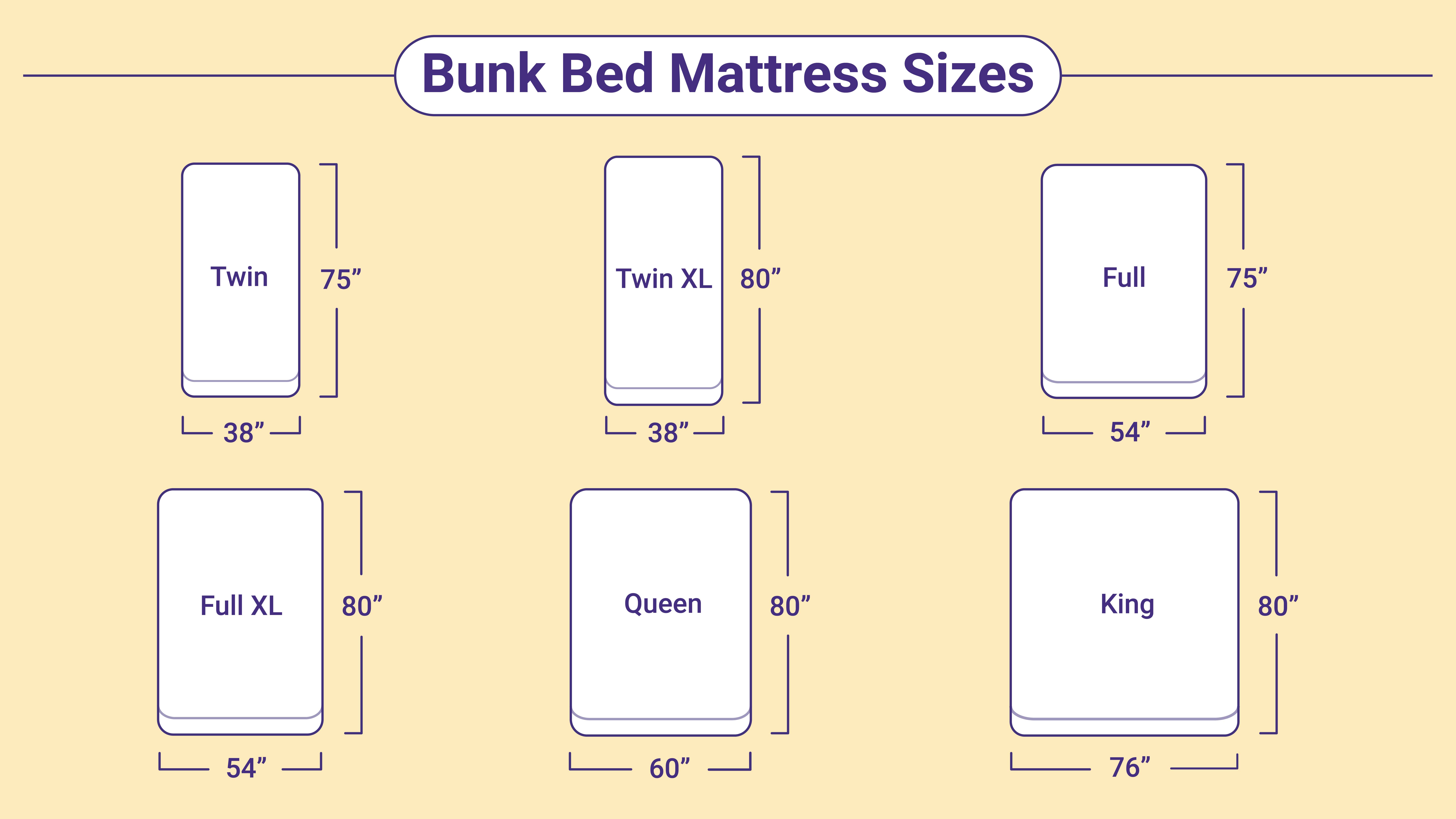

Mattress insurance policies can vary in terms of coverage, so it's important to carefully read and understand the terms and conditions before purchasing. Some policies may only cover specific types of damages, while others may have exclusions for certain materials or bed sizes. Additionally, there may be a limit on the amount of coverage provided, so it's important to assess your needs and choose a policy that offers adequate protection for your specific mattress.

4. The Importance of Having a Mattress Insurance Policy

While some may question the necessity of having mattress insurance, it's important to consider the potential costs of not having it. Accidents and damages to your mattress can happen unexpectedly, and the cost of repairs or replacement can be significant. Having an insurance policy can provide peace of mind and financial protection, ensuring that you won't have to spend a large sum out of pocket should something happen to your bed.

5. What to Look for in a Bed Mattress Insurance Policy

When shopping for a mattress insurance policy, there are a few key factors to consider. Firstly, make sure the policy covers a wide range of damages, including stains, spills, and tears. It's also important to check for any exclusions or limitations, as well as the amount of coverage provided. Additionally, look for policies that offer easy and hassle-free claims processes, as well as good customer service and support.

6. Mattress Insurance: Is It Worth the Cost?

When deciding whether or not to purchase a mattress insurance policy, it's important to weigh the cost against the potential benefits. While the upfront cost may seem unnecessary, the potential savings and peace of mind can make it well worth it in the long run. Additionally, some policies may offer the option to transfer coverage to a new mattress if you decide to upgrade in the future, making it a valuable investment for your overall sleep comfort.

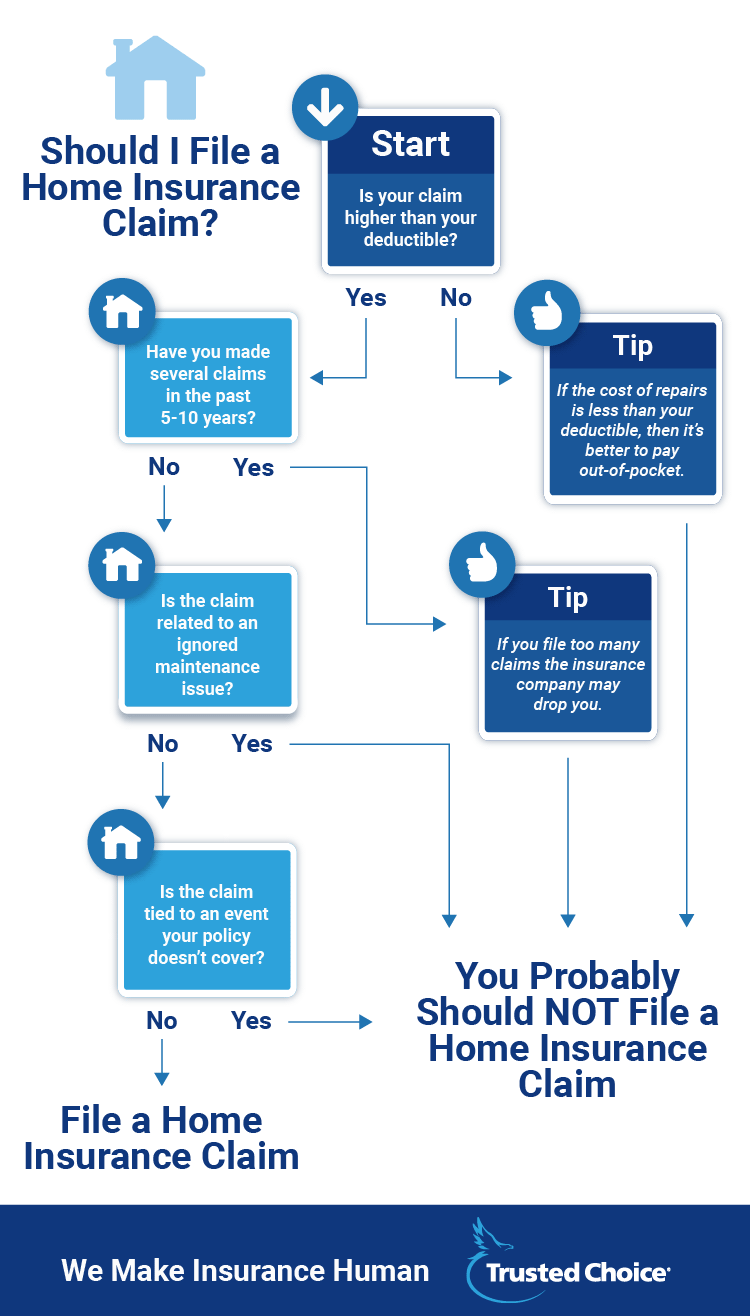

7. How to File a Claim with Your Mattress Insurance Policy

If you do experience damages to your mattress, it's important to understand the claims process for your insurance policy. Most policies will require you to provide proof of purchase, as well as documentation of the damages. It's important to act quickly and follow all instructions provided by the insurance company to ensure a smooth and successful claim. Some policies may also offer additional services, such as professional cleaning or repair, so be sure to check for any added benefits.

8. Comparing Different Mattress Insurance Policies

Just like with any type of insurance, it's important to compare policies from different providers to find the best fit for your needs. Look for policies that offer comprehensive coverage, good customer service, and a hassle-free claims process. You may also want to consider the cost and the length of coverage, as well as any additional benefits or discounts offered. By doing your research and comparing options, you can find the best mattress insurance policy for your specific bed and budget.

9. Tips for Choosing the Right Bed Mattress Insurance Policy

When it comes to choosing a mattress insurance policy, there are a few tips that can help you make the best decision for your needs. Firstly, consider the type of mattress you have and any potential risks or damages it may be prone to. This can help guide your search for a policy that offers the most relevant and comprehensive coverage. Additionally, read reviews and ask for recommendations from friends or family who have experience with mattress insurance policies.

10. Common Misconceptions About Mattress Insurance Policies

Despite the benefits of having a mattress insurance policy, there are still some common misconceptions that may deter people from purchasing one. One of the main misconceptions is that the cost of the policy outweighs the potential savings. However, as previously mentioned, the peace of mind and financial protection offered by a good policy can make it well worth the cost. Another misconception is that warranties provide sufficient coverage, but as we've discussed, insurance policies offer additional protection for non-manufacturer-related damages. By understanding the facts and weighing the potential benefits, you can make an informed decision about whether or not mattress insurance is right for you.

The Importance of Bed Mattress Insurance Policy for Your House Design

What is a Bed Mattress Insurance Policy?

A bed mattress insurance policy is a type of insurance that provides coverage for your bed mattress in case of damages or accidents. This policy is designed to protect your investment and provide you with peace of mind knowing that your bed mattress is protected.

A bed mattress insurance policy is a type of insurance that provides coverage for your bed mattress in case of damages or accidents. This policy is designed to protect your investment and provide you with peace of mind knowing that your bed mattress is protected.

Why is it Important for House Design?

When it comes to designing your house, the bed mattress is often overlooked. However, it is an essential part of your house design as it not only affects the overall aesthetic but also has a significant impact on your comfort and sleep quality.

Investing in a good bed mattress is crucial, but accidents can happen, and damages can occur. Without a bed mattress insurance policy, you may end up spending a considerable amount of money to replace or repair your mattress, which can be a significant financial burden.

When it comes to designing your house, the bed mattress is often overlooked. However, it is an essential part of your house design as it not only affects the overall aesthetic but also has a significant impact on your comfort and sleep quality.

Investing in a good bed mattress is crucial, but accidents can happen, and damages can occur. Without a bed mattress insurance policy, you may end up spending a considerable amount of money to replace or repair your mattress, which can be a significant financial burden.

How Does it Benefit You?

Having a bed mattress insurance policy can bring numerous benefits to your house design. Firstly, it provides financial protection in case of accidents or damages. This means that you won't have to worry about spending a significant amount of money on a new mattress if something happens to your current one.

Moreover, having a bed mattress insurance policy can also give you peace of mind. Knowing that your investment is protected can help you sleep better at night. You won't have to constantly worry about potential damages or accidents that can ruin your mattress.

Having a bed mattress insurance policy can bring numerous benefits to your house design. Firstly, it provides financial protection in case of accidents or damages. This means that you won't have to worry about spending a significant amount of money on a new mattress if something happens to your current one.

Moreover, having a bed mattress insurance policy can also give you peace of mind. Knowing that your investment is protected can help you sleep better at night. You won't have to constantly worry about potential damages or accidents that can ruin your mattress.

Other Factors to Consider

Aside from damages and accidents, there are other factors that can affect the lifespan of your bed mattress. These include stains, spills, and wear and tear from regular use. With a bed mattress insurance policy, you can also have coverage for these factors, ensuring that your mattress stays in good condition for a longer time.

Aside from damages and accidents, there are other factors that can affect the lifespan of your bed mattress. These include stains, spills, and wear and tear from regular use. With a bed mattress insurance policy, you can also have coverage for these factors, ensuring that your mattress stays in good condition for a longer time.

Conclusion

In conclusion, a bed mattress insurance policy is an essential aspect of house design that should not be overlooked. It provides financial protection, peace of mind, and can help prolong the lifespan of your mattress. When choosing a bed mattress insurance policy, make sure to do your research and select a reputable insurance provider. With this added protection, you can enjoy your house design without worrying about potential mattress mishaps.

In conclusion, a bed mattress insurance policy is an essential aspect of house design that should not be overlooked. It provides financial protection, peace of mind, and can help prolong the lifespan of your mattress. When choosing a bed mattress insurance policy, make sure to do your research and select a reputable insurance provider. With this added protection, you can enjoy your house design without worrying about potential mattress mishaps.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

/GettyImages-1022380154-91d55d4171b94f5a85f2a5aa58d2b709.jpg)

/insurance-faa9df3f80274172970efdd638aca3cb.jpg)