If you're in the market for a new mattress, you may have come across the Purple Mattress – a popular option known for its unique comfort and support. But did you know that you may be able to purchase your Purple Mattress tax-free? That's right, by obtaining a tax exempt form for Purple Mattress purchases, you can save money and make your mattress buying experience even better. Here's what you need to know about this beneficial form.1. Tax Exempt Form for Purple Mattress

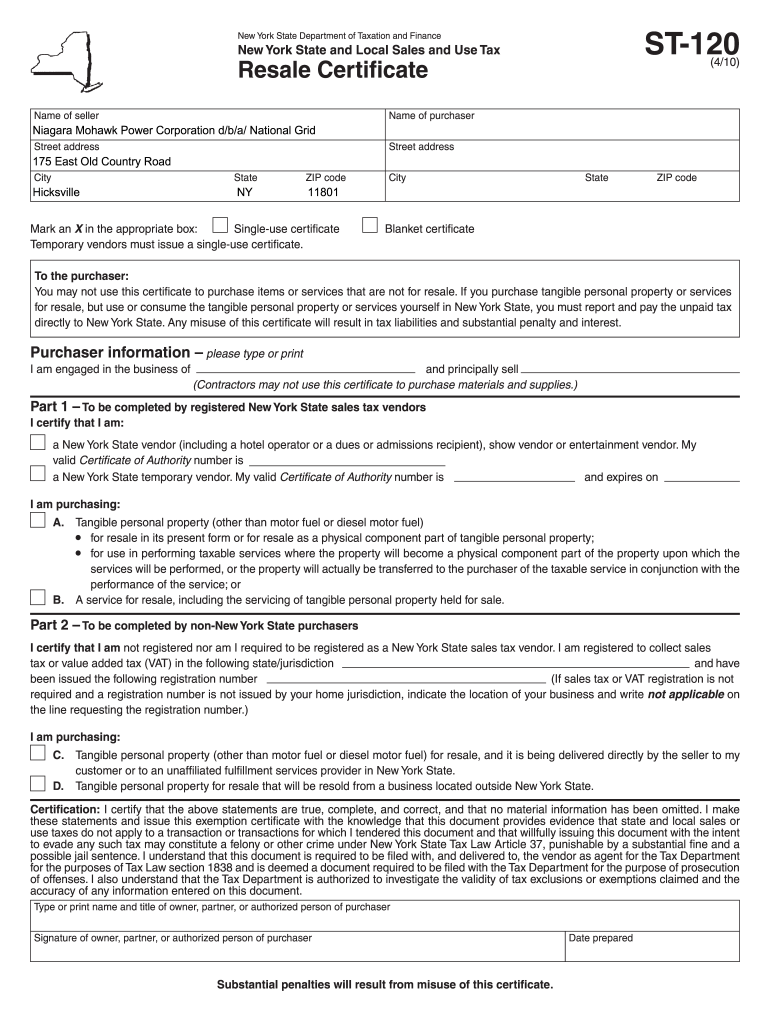

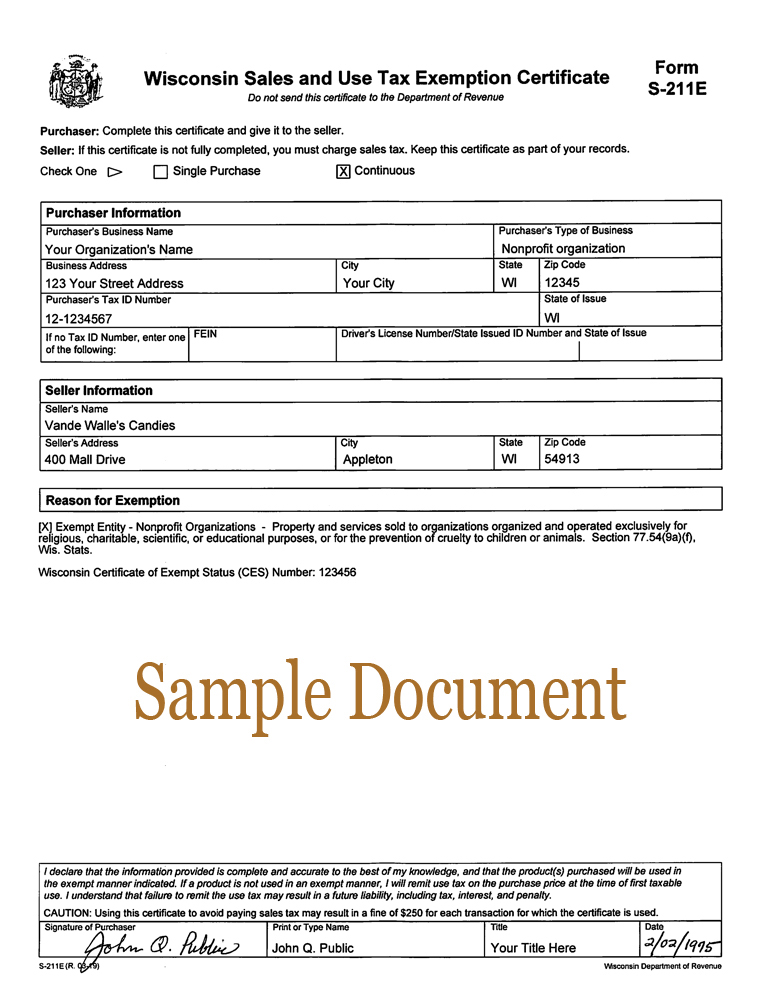

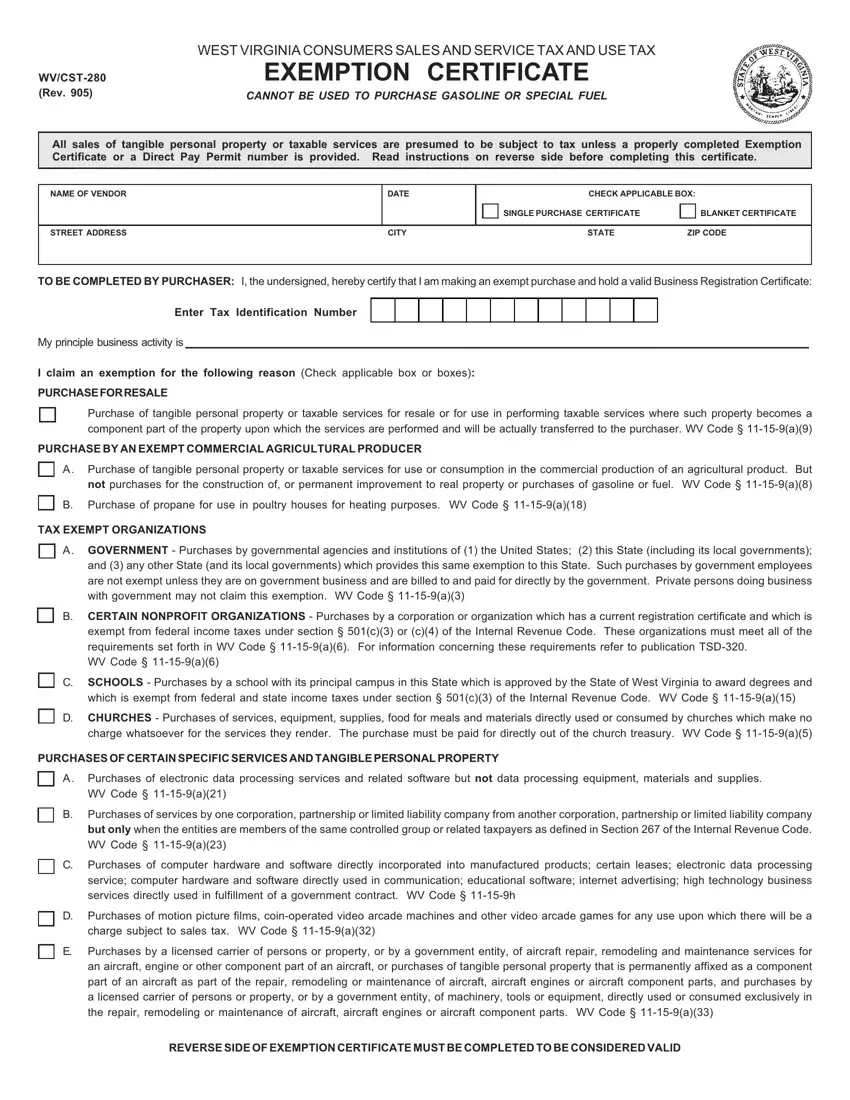

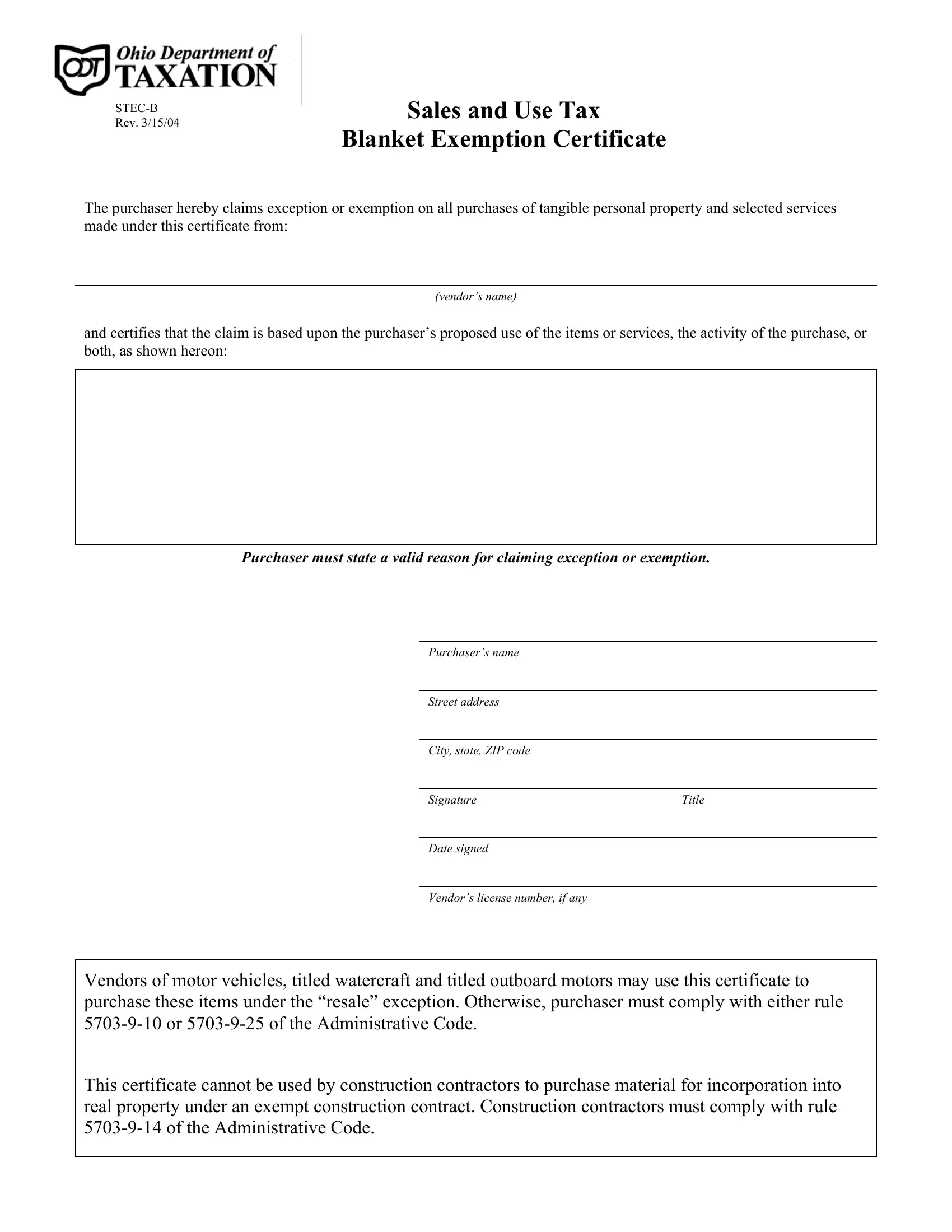

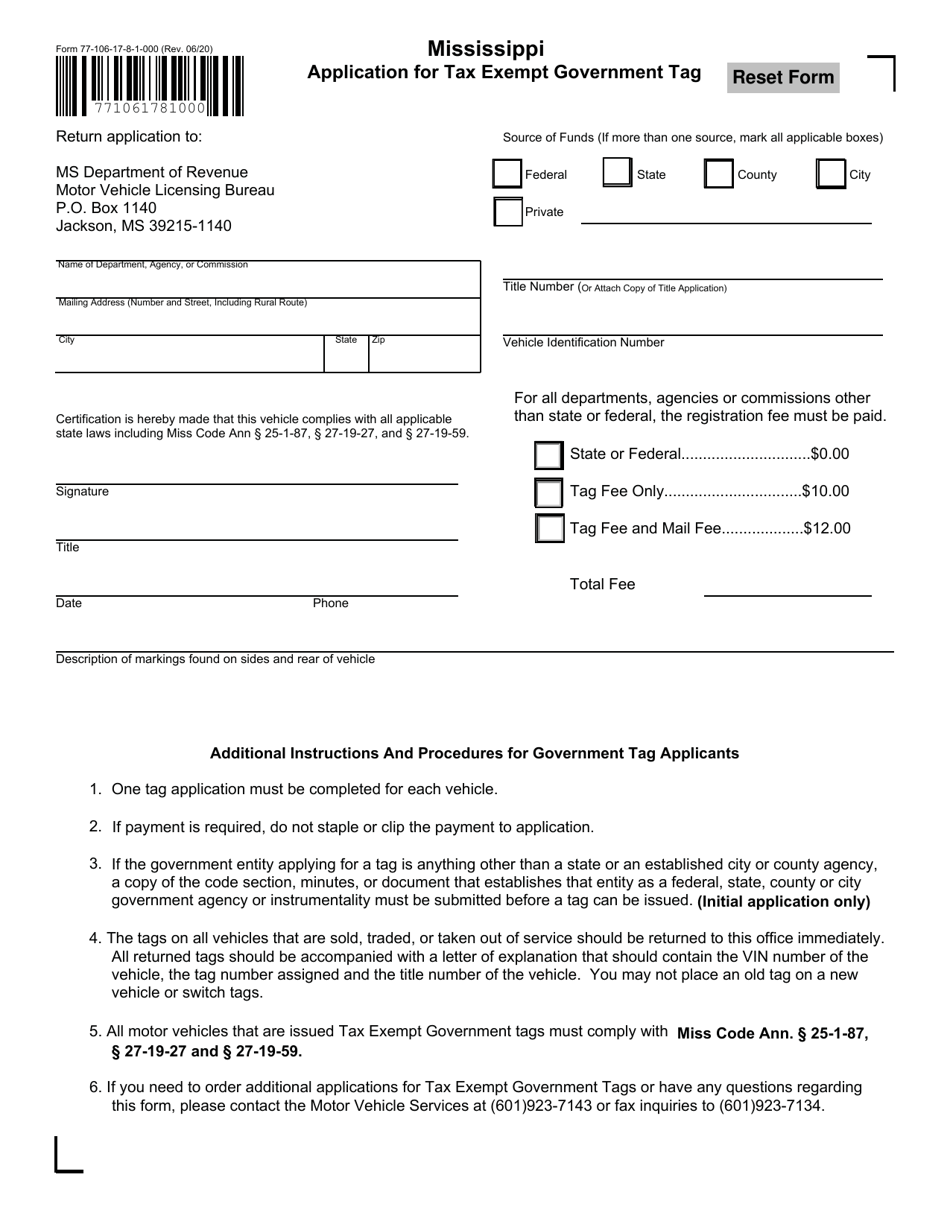

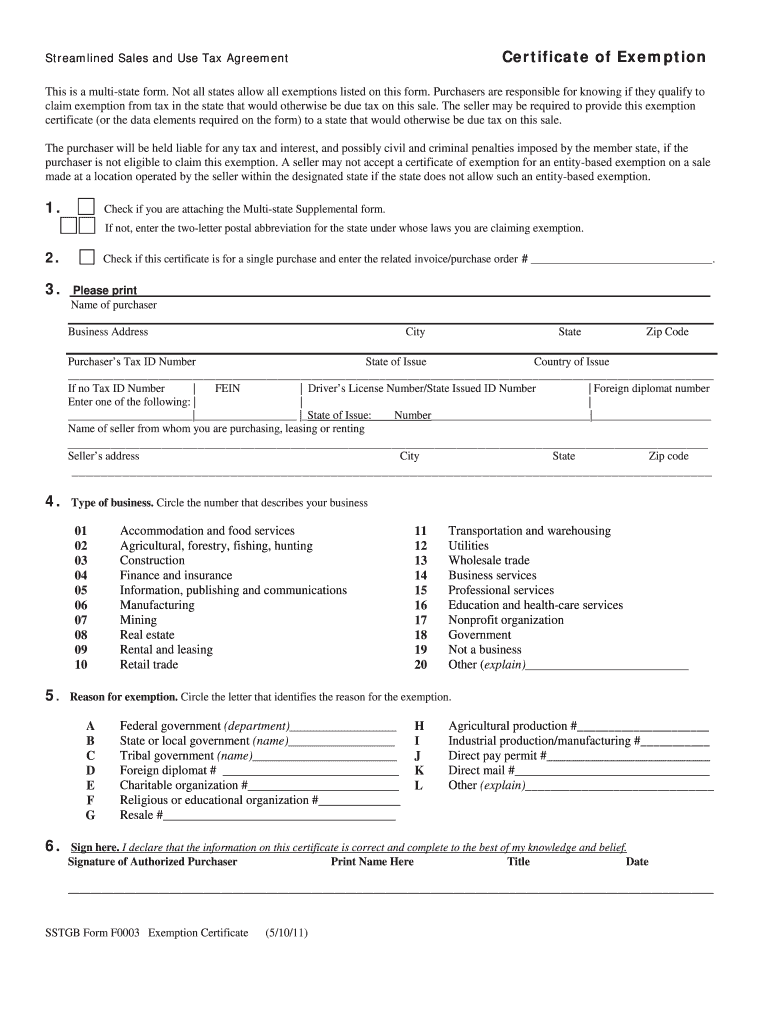

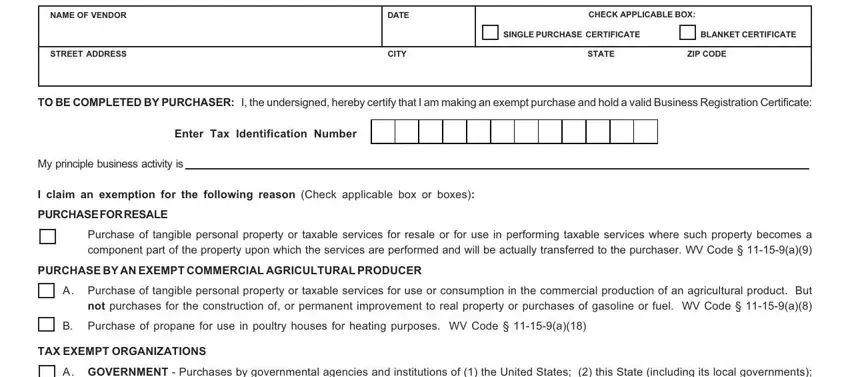

The process of obtaining a tax exempt form for your Purple Mattress is quite simple. All you need to do is provide proof that you or your organization is tax-exempt. This could be in the form of a tax-exempt certificate, a letter from the Internal Revenue Service (IRS), or any other official document that shows your tax-exempt status. Once you have this proof, you can submit it to Purple's customer service team to receive your tax exempt form.2. How to Get a Tax Exempt Form for Purple Mattress

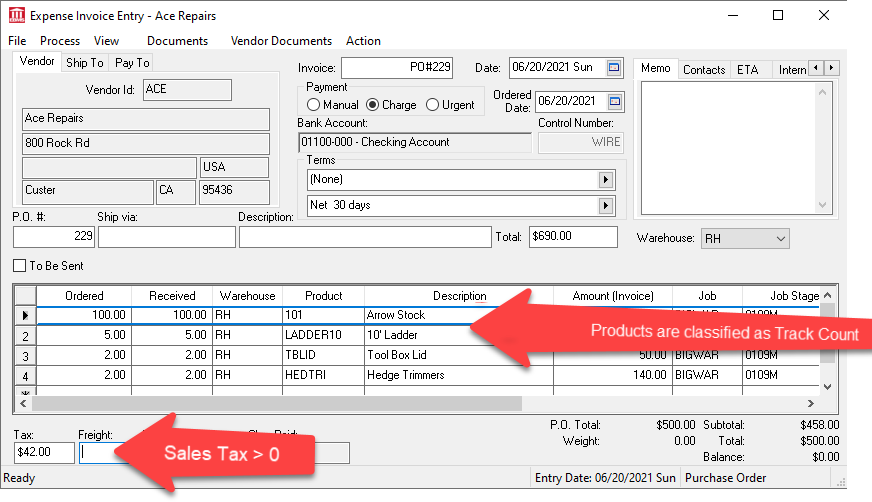

The Purple Mattress tax exemption process is designed to make things easier for those who are eligible for tax-exempt status. By obtaining this form, you can avoid paying sales tax on your mattress purchase, saving you a significant amount of money. The process typically involves filling out a form and providing the necessary documentation, which can then be submitted to Purple for verification.3. Purple Mattress Tax Exemption Process

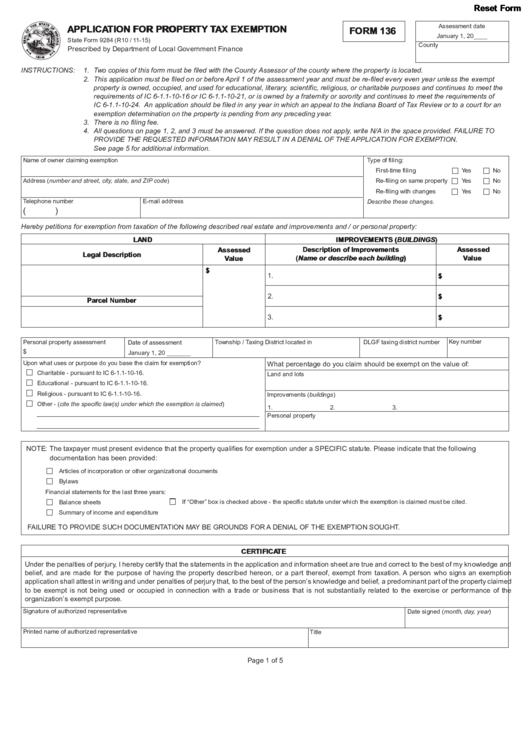

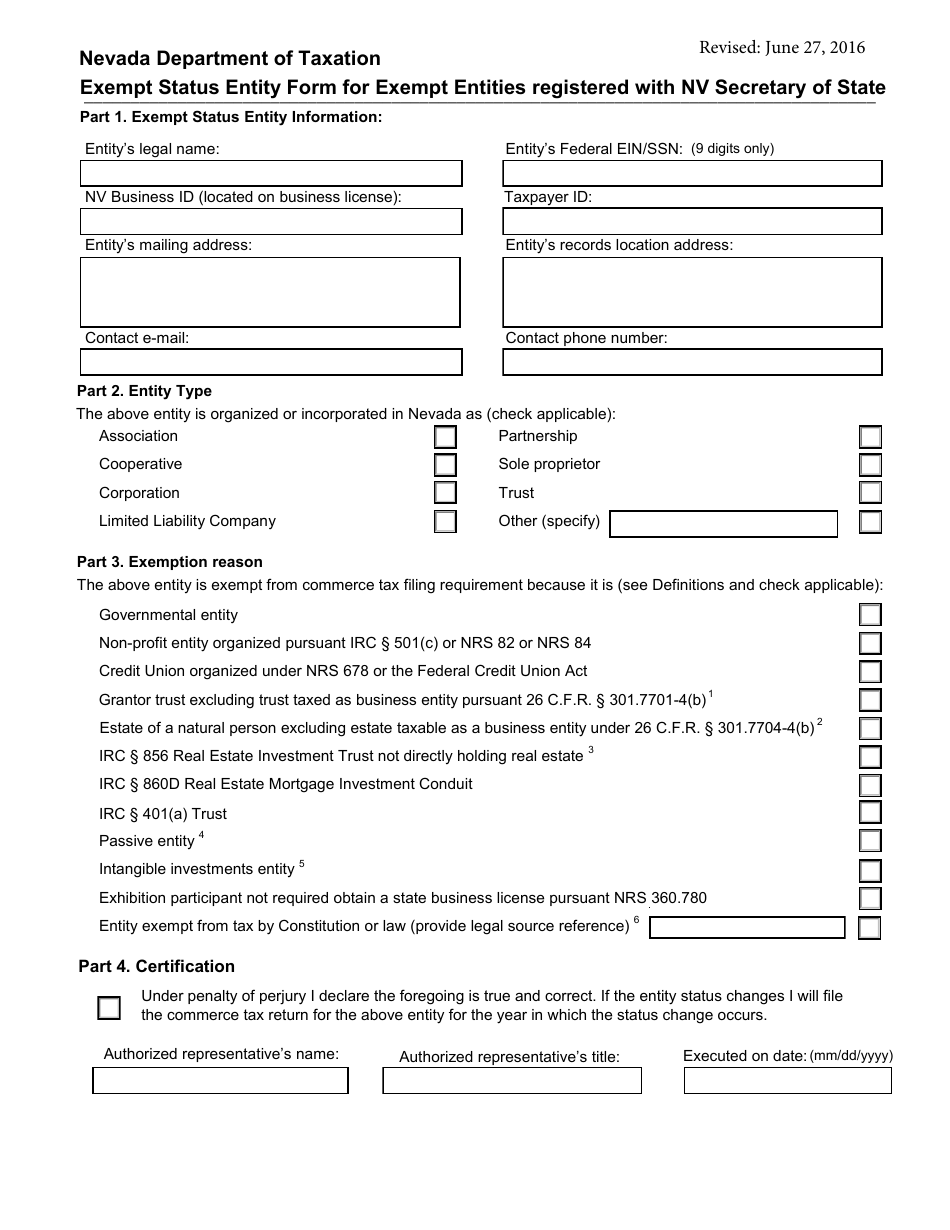

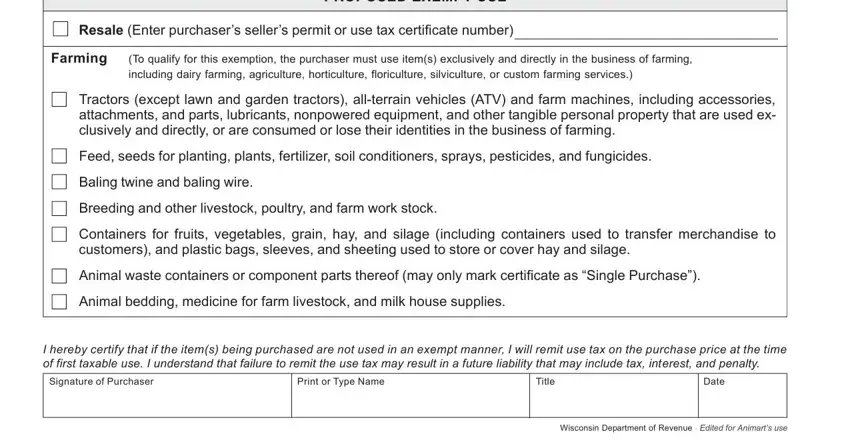

Tax-exempt status for Purple Mattress purchases is available to a wide range of individuals and organizations, including non-profit organizations, schools, and government agencies. If you fall into one of these categories, you may be eligible for tax-exempt status and can benefit from a reduced price on your Purple Mattress.4. Tax Exempt Status for Purple Mattress Purchases

Before applying for a tax exempt form for your Purple Mattress, it's important to familiarize yourself with the guidelines and requirements. These may vary depending on your location and tax-exempt status, so it's best to consult with Purple or your tax advisor to ensure you have all the necessary information and documentation before submitting your form.5. Purple Mattress Tax Exempt Guidelines

Applying for tax-exempt status for your Purple Mattress is a simple and straightforward process. As mentioned, you will need to provide proof of your tax-exempt status, which can be obtained from the IRS or other relevant tax authority. Once you have this, you can submit it to Purple's customer service team to receive your tax exempt form.6. Applying for Tax Exempt Status for Purple Mattress

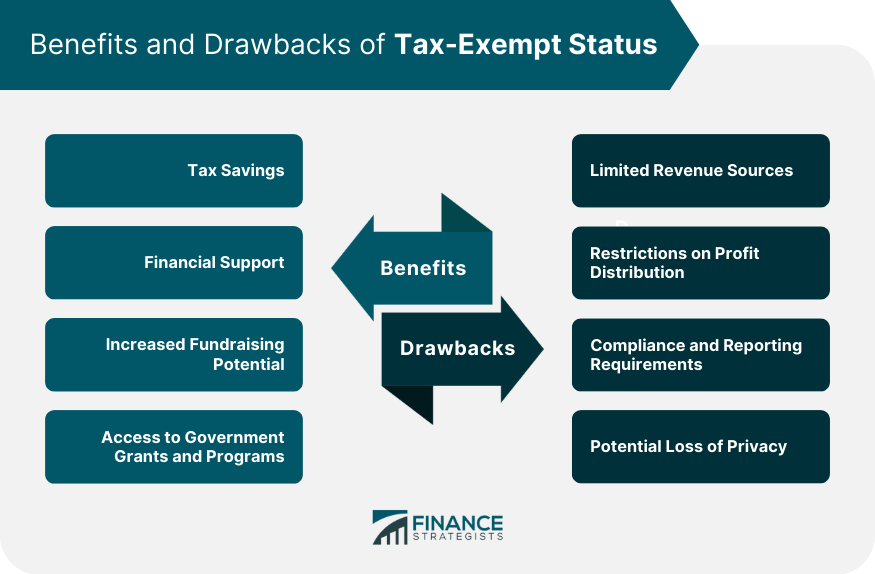

Tax exempt forms for Purple Mattress buyers are a valuable tool to help save money on your purchase. By obtaining this form, you can avoid paying sales tax, which can significantly reduce the overall cost of your mattress. This is especially beneficial for bulk purchases or organizations that may be buying multiple mattresses.7. Tax Exempt Forms for Purple Mattress Buyers

Understanding tax-exempt status for Purple Mattress is important to ensure you are eligible and have the necessary documentation. As mentioned, this status is available to a variety of individuals and organizations, but it's important to determine if you fall into one of these categories before applying for a tax exempt form.8. Understanding Tax Exempt Status for Purple Mattress

The benefits of tax-exempt status for Purple Mattress are clear – by obtaining this form, you can save money on your mattress purchase. This can make a significant difference, especially for larger organizations or those making multiple purchases. Additionally, by saving money on your mattress, you can allocate those funds towards other important expenses.9. Benefits of Tax Exempt Status for Purple Mattress

Using a tax exempt form for your Purple Mattress purchase is as simple as presenting it at the time of purchase. Once you have received your form from Purple, you can use it to make your tax-free purchase either online or in-store. Just make sure to have the form with you, along with your proof of tax-exempt status, to ensure a smooth and hassle-free transaction.10. How to Use a Tax Exempt Form for Purple Mattress Purchases

Why You Should Consider Purchasing a Purple Mattress with a Tax Exempt Form

The Benefits of Owning a Purple Mattress

If you're in the market for a new mattress, chances are you've heard of the popular Purple Mattress brand. Known for its innovative design and comfortable materials, Purple Mattresses have become a top choice for many consumers. But did you know that you can purchase a Purple Mattress with a tax exempt form? This can be a significant advantage for those looking to save some money on their purchase. In this article, we'll discuss why you should consider using a tax exempt form to buy a Purple Mattress and how it can benefit you.

If you're in the market for a new mattress, chances are you've heard of the popular Purple Mattress brand. Known for its innovative design and comfortable materials, Purple Mattresses have become a top choice for many consumers. But did you know that you can purchase a Purple Mattress with a tax exempt form? This can be a significant advantage for those looking to save some money on their purchase. In this article, we'll discuss why you should consider using a tax exempt form to buy a Purple Mattress and how it can benefit you.

What is a Tax Exempt Form?

How Can a Tax Exempt Form Help You Save on a Purple Mattress?

Purchasing a Purple Mattress with a tax exempt form can offer significant savings.

Since mattresses are considered a taxable item in most states, using a tax exempt form can help you avoid paying sales tax on your purchase. This can result in savings of hundreds of dollars, depending on the cost of the mattress and the state's tax rate.

For example, if you purchase a Purple Mattress for $1,000 and your state's sales tax rate is 6%, you would save $60 by using a tax exempt form. This may not seem like a significant amount, but when it comes to big-ticket items like mattresses, every dollar counts.

Purchasing a Purple Mattress with a tax exempt form can offer significant savings.

Since mattresses are considered a taxable item in most states, using a tax exempt form can help you avoid paying sales tax on your purchase. This can result in savings of hundreds of dollars, depending on the cost of the mattress and the state's tax rate.

For example, if you purchase a Purple Mattress for $1,000 and your state's sales tax rate is 6%, you would save $60 by using a tax exempt form. This may not seem like a significant amount, but when it comes to big-ticket items like mattresses, every dollar counts.

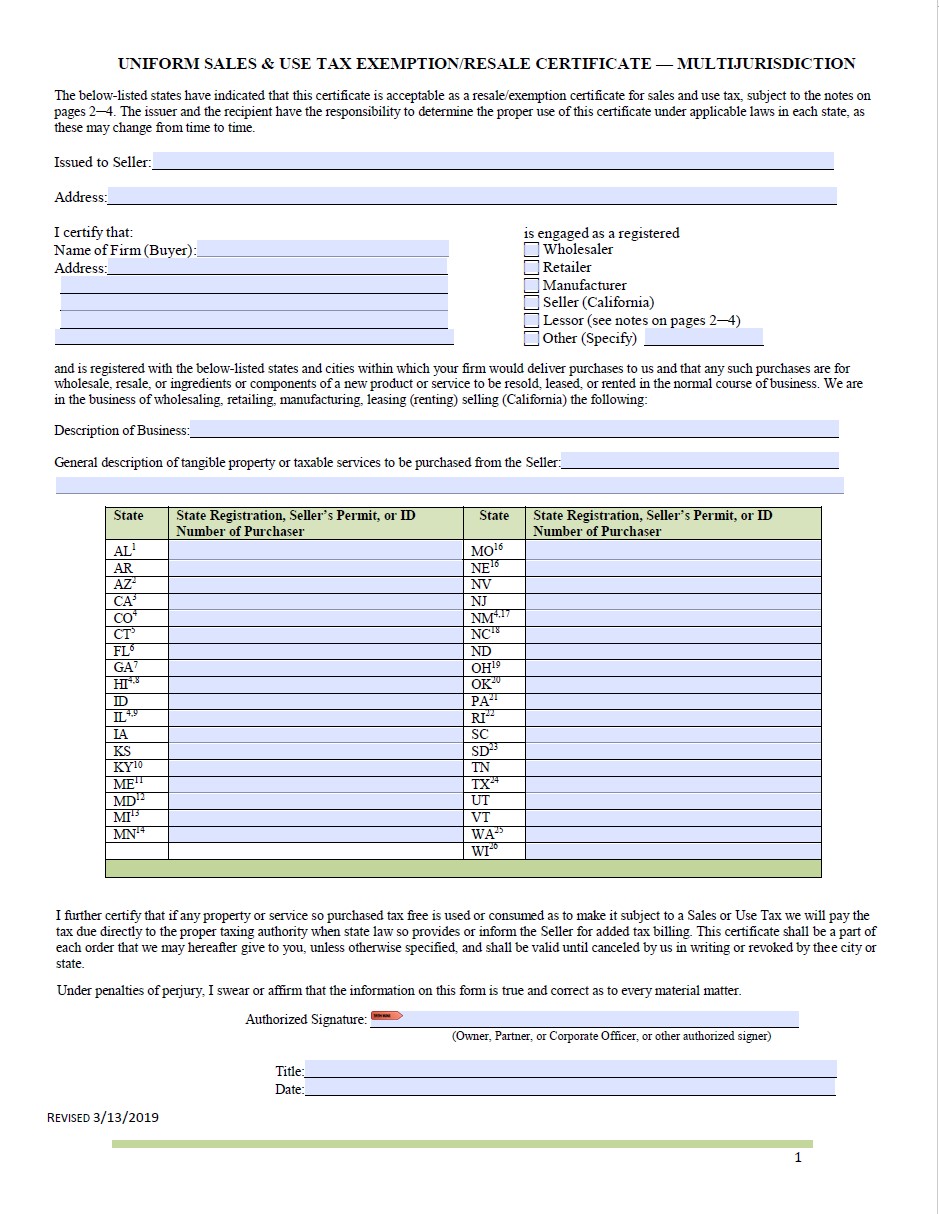

Who Can Use a Tax Exempt Form to Purchase a Purple Mattress?

Not everyone is eligible to use a tax exempt form to purchase a Purple Mattress. Typically, only non-profit organizations, government agencies, and individuals with certain occupations are able to do so. This may include teachers, clergy members, and individuals with disabilities, among others. It's essential to check with your state's tax laws and regulations to determine if you qualify for a tax exempt form.

Not everyone is eligible to use a tax exempt form to purchase a Purple Mattress. Typically, only non-profit organizations, government agencies, and individuals with certain occupations are able to do so. This may include teachers, clergy members, and individuals with disabilities, among others. It's essential to check with your state's tax laws and regulations to determine if you qualify for a tax exempt form.

How to Purchase a Purple Mattress with a Tax Exempt Form

If you are eligible to use a tax exempt form to purchase a Purple Mattress, the process is relatively simple. You will need to provide the form to the retailer when making your purchase. They will then process the form and deduct the sales tax from your total cost. It's important to note that not all retailers may accept tax exempt forms for Purple Mattress purchases, so be sure to check with the retailer beforehand.

If you are eligible to use a tax exempt form to purchase a Purple Mattress, the process is relatively simple. You will need to provide the form to the retailer when making your purchase. They will then process the form and deduct the sales tax from your total cost. It's important to note that not all retailers may accept tax exempt forms for Purple Mattress purchases, so be sure to check with the retailer beforehand.

In Conclusion

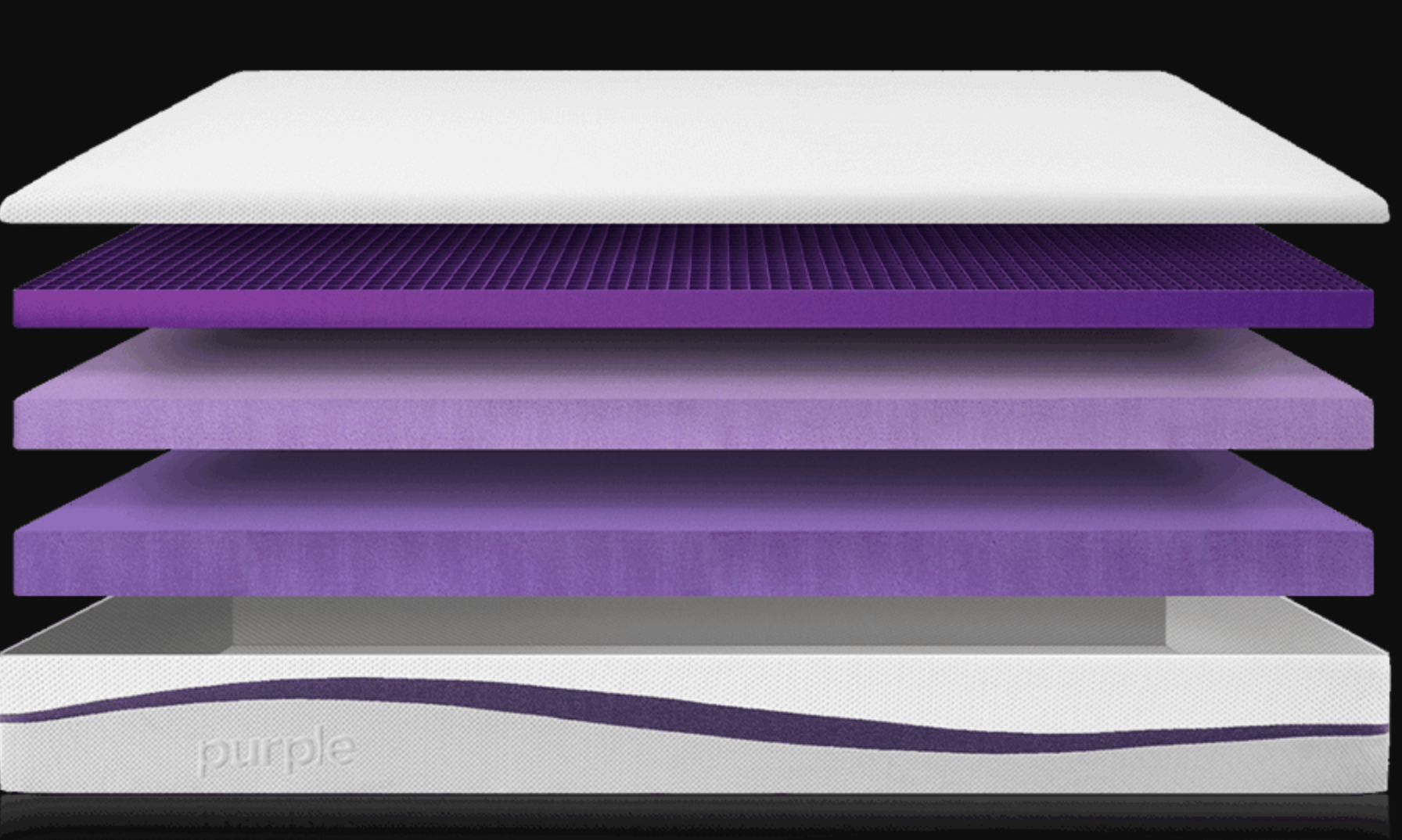

Using a tax exempt form to purchase a Purple Mattress can provide significant savings and is a great option for those who qualify. With its innovative design and comfortable materials, a Purple Mattress is a top choice for a good night's sleep. So why not save some money while investing in your sleep? Consider using a tax exempt form for your next Purple Mattress purchase.

Using a tax exempt form to purchase a Purple Mattress can provide significant savings and is a great option for those who qualify. With its innovative design and comfortable materials, a Purple Mattress is a top choice for a good night's sleep. So why not save some money while investing in your sleep? Consider using a tax exempt form for your next Purple Mattress purchase.