The House Democrats’ tax plan would include six tax brackets for individuals with their rates based on each taxpayers’ income. Under this plan, individuals earning up to $40,000 would be subject to a 10% tax rate, individuals earning $40,001 to $85,000 would be taxed at 12%, individuals earning $85,001 to $160,000 would be taxed at 22%, individuals earning $160,001 to $226,000 would be taxed at 24%, individuals earning $226,001 to $408,000 would be taxed at 32%, and individuals earning more than $408,000 would be taxed at 35%.Individual Income Tax Brackets in the House Democrats' Plan

The House Democrats’ plan would affect corporations with an income tax rate based on the size of a company’s annual income. Corporations with an annual income of $2 million or less would be subject to a 15% tax rate, while corporations with an annual income of more than $2 million would be taxed at a 25% rate. The tax reform plan also includes a 15% minimum tax on corporations with an income of more than $100 million that currently benefit from the United States’ corporate tax loopholes.Corporate Income Tax Brackets in the House Democrats Plan

The House Democrats’ plan looks to increase estate taxes on the wealthy by adding a new 45% tax for estates with a value of $1 billion or more. Currently, the estate tax rate is 40% for estates worth $10.98 million or more. According to estimates, this change would only affect the wealthiest 0.02% of Americans.Estate Tax Brackets in the House Democrats' Plan

The House Democrats’ plan seeks to raise the top marginal tax rate on long-term capital gains and qualified dividends from the current rate of 20% to as high as 39.6%. The plan would only affect people whose adjusted gross income exceeds $1 million each year. The plan would also make the lower tax brackets more favorable. For example, the plan would reduce the current 15% tax on long-term capital gains received by individuals earning between $40,001 and $431,000 to a rate of 0%.Capital Gains Tax Rates in the House Democrats' Plan

Exploring the Tax Brackets in the House Plan

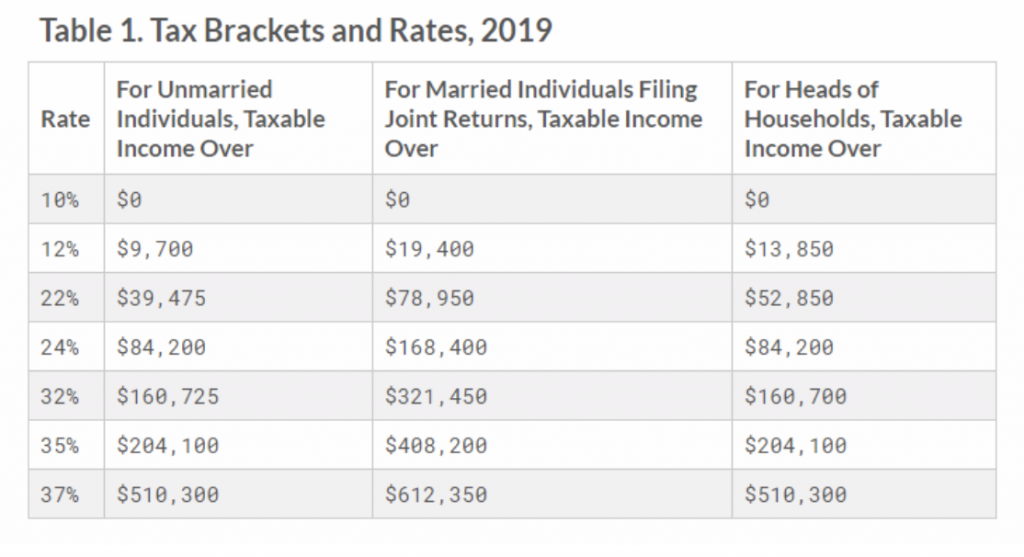

Many households must deal with the often daunting task of budgeting and deciding how best to allocate their income to cover necessary expenses. When it comes to filing taxes, there is an additional need for understanding the different tax brackets and how much of their earnings they will need to report on their annual return. The House plan proposes one such system for federal taxes and it includes multiple tax brackets to account for the varied income levels many households experience.

Income Bracket Tax Rates

The tax brackets set under the House Plan are as follows. For taxable incomes at $12,000 or lower, there is a 0-percent rate. From $12,000 to $45,000, the rate is 12-percent. From $45,000 to $100,000, the rate is 25-percent, and from $100,000 to $300,000 the rate is 35-percent. Any taxable income over $300,000 is taxed at a 39.6-percent rate.

Many households must deal with the often daunting task of budgeting and deciding how best to allocate their income to cover necessary expenses. When it comes to filing taxes, there is an additional need for understanding the different tax brackets and how much of their earnings they will need to report on their annual return. The House plan proposes one such system for federal taxes and it includes multiple tax brackets to account for the varied income levels many households experience.

Income Bracket Tax Rates

The tax brackets set under the House Plan are as follows. For taxable incomes at $12,000 or lower, there is a 0-percent rate. From $12,000 to $45,000, the rate is 12-percent. From $45,000 to $100,000, the rate is 25-percent, and from $100,000 to $300,000 the rate is 35-percent. Any taxable income over $300,000 is taxed at a 39.6-percent rate.

Cap on Itemized Deductions

The House Plan also seeks to limit the amount of itemized deductions that households can take. Taxpayers can currently deduct certain costs, such as those associated with mortgage interest and property taxes, from their income prior to calculating their final taxable income. By capping the amount of deductions available, the House Plan seeks to increase the amount of taxable income for households and within the higher income brackets.

The House Plan also seeks to limit the amount of itemized deductions that households can take. Taxpayers can currently deduct certain costs, such as those associated with mortgage interest and property taxes, from their income prior to calculating their final taxable income. By capping the amount of deductions available, the House Plan seeks to increase the amount of taxable income for households and within the higher income brackets.

Child Tax Credit Expansion

The House Plan also proposes an expansion of the available child tax credit. This credit offers an additional tax deduction to those with dependent children living in their households. This expansion of the child tax credit would likely benefit many households who rely on the extra savings associated with this deduction.

The House Plan also proposes an expansion of the available child tax credit. This credit offers an additional tax deduction to those with dependent children living in their households. This expansion of the child tax credit would likely benefit many households who rely on the extra savings associated with this deduction.

Changes to the Alternative Minimum Tax

The House Plan also seeks to adjust the current Alternative Minimum Tax (AMT). This tax is designed to encompass the incomes of higher earners to ensure those at the top of the income scale pay their fair share of taxes. However, due to its current adjustments, the AMT also affects those with less substantial incomes who may have itemized deductions in areas such as medical or charitable expenses. Under the House Plan, those who qualify for the AMT would see a decrease in their required payments due to updated income thresholds.

The House Plan also seeks to adjust the current Alternative Minimum Tax (AMT). This tax is designed to encompass the incomes of higher earners to ensure those at the top of the income scale pay their fair share of taxes. However, due to its current adjustments, the AMT also affects those with less substantial incomes who may have itemized deductions in areas such as medical or charitable expenses. Under the House Plan, those who qualify for the AMT would see a decrease in their required payments due to updated income thresholds.

Impact on Taxpayers

The implications of these changes under the House Plan represent a substantial shift in how taxpayers would need to calculate their required federal tax payments. It is important to understand how these changes, if enacted, would affect each individual household's taxes and what steps they may need to take to preserve their existing level of financial resources or to individually respond to these updates. Additionally, the implications of this plan may also affect the overall economy and, if passed into law, must be evaluated for their impact on economic growth, tax collections, and other factors that could affect the nation's financial health.

The implications of these changes under the House Plan represent a substantial shift in how taxpayers would need to calculate their required federal tax payments. It is important to understand how these changes, if enacted, would affect each individual household's taxes and what steps they may need to take to preserve their existing level of financial resources or to individually respond to these updates. Additionally, the implications of this plan may also affect the overall economy and, if passed into law, must be evaluated for their impact on economic growth, tax collections, and other factors that could affect the nation's financial health.

:max_bytes(150000):strip_icc()/close-up-of-overflowing-bathroom-sink-90201417-579787783df78ceb865822d8.jpg)