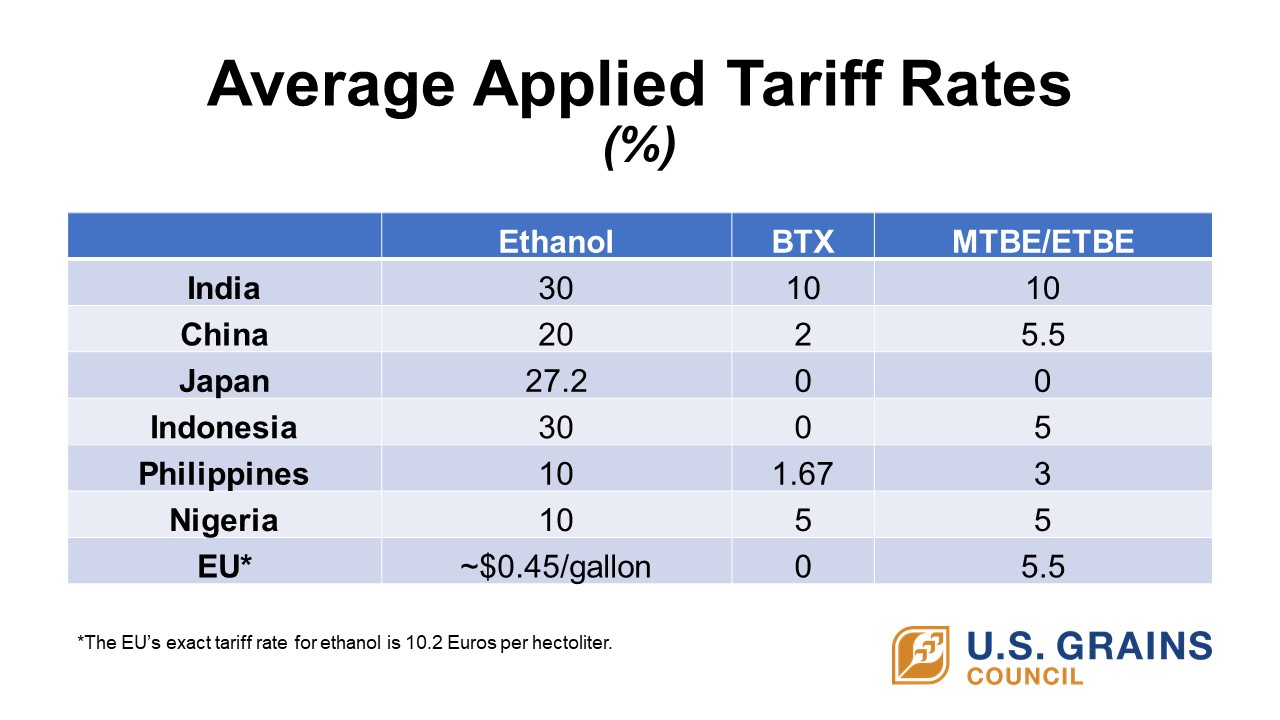

What is a tariff?

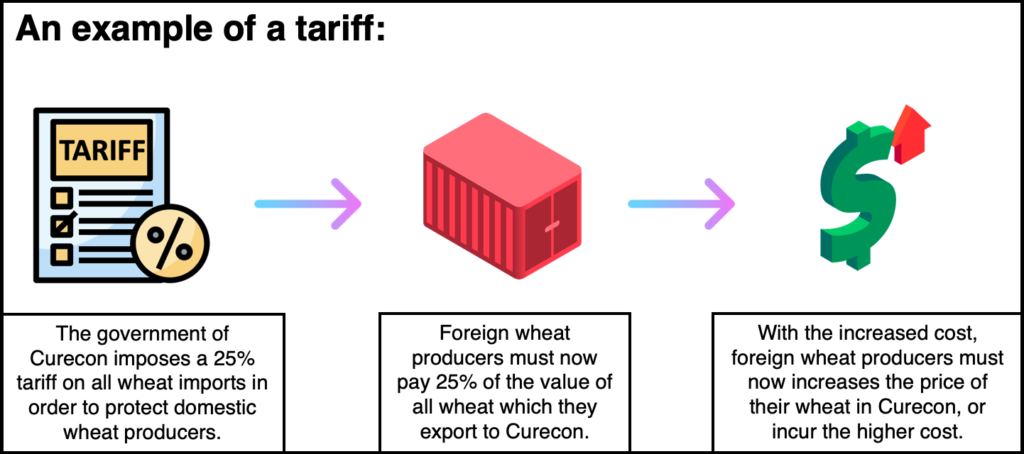

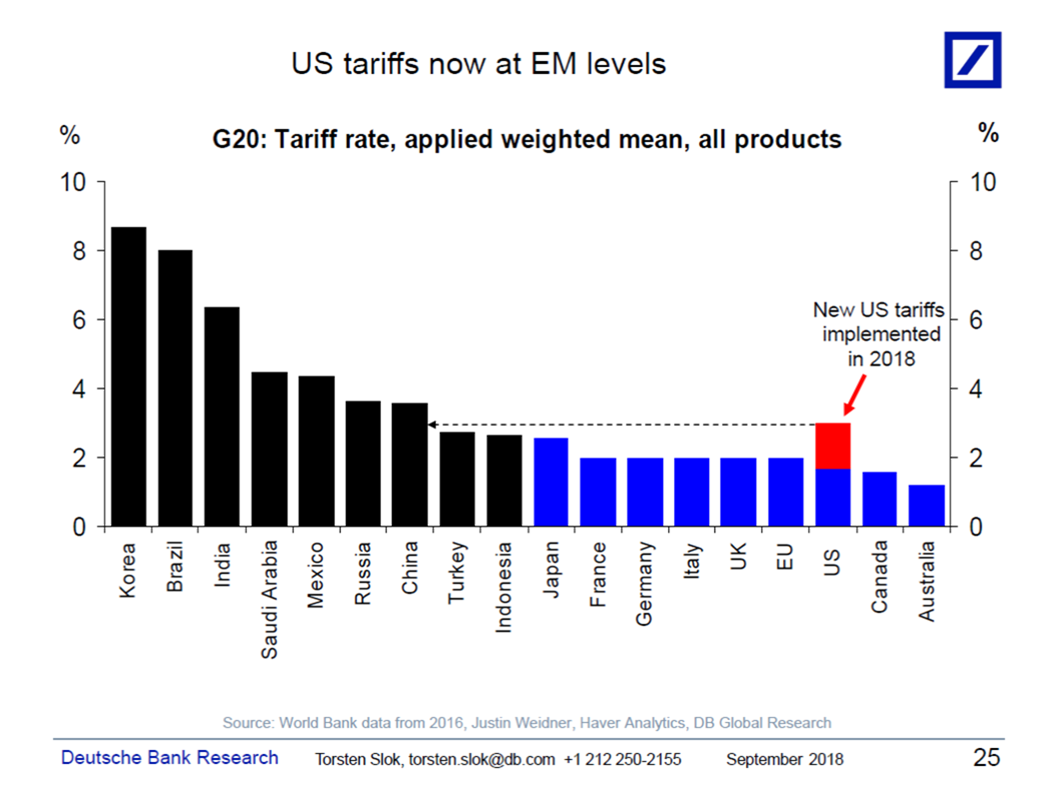

A tariff is a tax or duty imposed by a government on imported goods. It is an additional cost that must be paid by the importer, which is then passed on to the consumer in the form of higher prices. Tariffs are often used as a way to protect domestic industries and promote local production of goods.

What is the tariff rate for mattress pads?

The tariff rate for mattress pads varies depending on the country of origin and the type of mattress pad. In the United States, the current tariff rate for mattress pads is 10%, but this may change depending on trade agreements and policies.

How do tariffs affect the price of mattress pads?

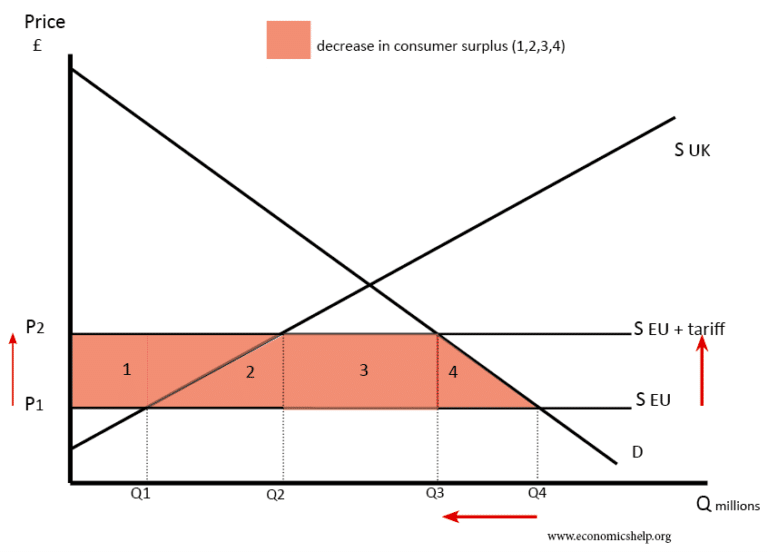

Tariffs can significantly impact the price of mattress pads. As mentioned before, tariffs are an additional cost that must be paid by the importer, which is then passed on to the consumer. This means that the price of mattress pads can increase due to these additional fees, making them more expensive for consumers.

Why are tariffs imposed on mattress pads?

Tariffs are typically imposed on mattress pads to protect domestic industries and promote local production. By adding a tax on imported goods, the government aims to make domestically produced goods more competitive in the market and stimulate the local economy.

How can I find out if a tariff applies to the mattress pad I want to buy?

To find out if a tariff applies to the mattress pad you want to buy, you can check the country of origin and the type of mattress pad. You can also consult with the retailer or manufacturer to see if they have any information on the tariff rates for their products.

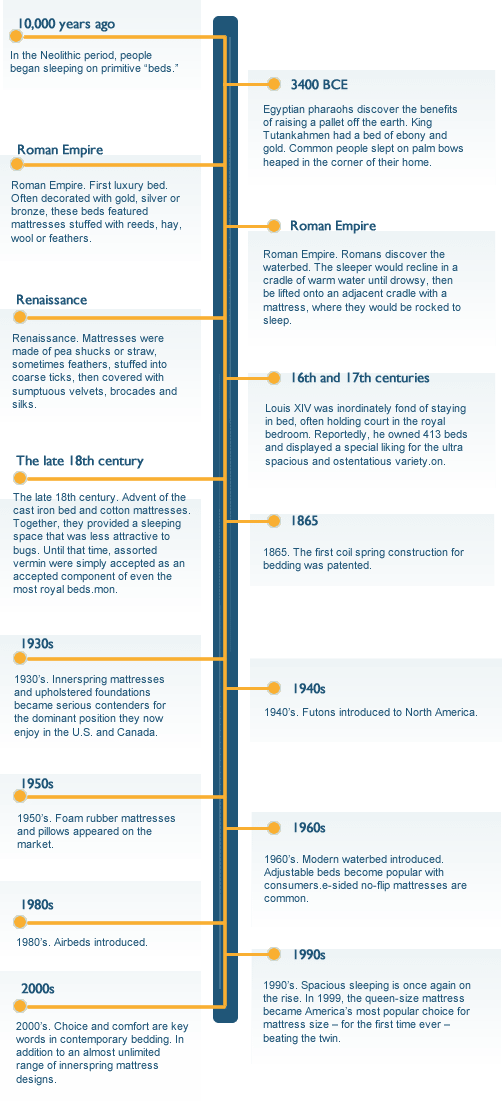

What is the history of tariffs on mattress pads?

The history of tariffs on mattress pads dates back to the early days of trade between countries. In the United States, tariffs were first introduced in the late 18th century and have since been a controversial topic in politics and global trade.

How do tariffs on mattress pads impact the mattress industry?

Tariffs on mattress pads can have a significant impact on the mattress industry. With increased costs and potentially higher prices for consumers, it can affect the demand for imported mattress pads and potentially benefit domestic manufacturers.

What are the current tariff rates for mattress pads?

As mentioned before, the current tariff rate for mattress pads in the United States is 10%. However, this rate may change depending on trade policies and agreements with other countries. It is essential to stay updated on any changes in tariff rates for imported goods.

How can I avoid paying tariffs on mattress pads?

To avoid paying tariffs on mattress pads, one option is to purchase domestically produced mattress pads. These products are not subject to tariffs and can be more affordable for consumers. Another option is to keep an eye on trade policies and agreements that may impact the tariff rates for mattress pads.

What are the potential consequences of tariffs on mattress pads for consumers?

The potential consequences of tariffs on mattress pads for consumers include higher prices for imported mattress pads, limited choices in the market, and potentially lower quality products if domestic manufacturers do not meet the demand. It is crucial for consumers to be aware of the potential impact of tariffs on their purchases.

The Impact of the Proposed Tariff on Mattress Pads on House Design

Understanding the Proposed Tariff on Mattress Pads

When it comes to designing a house, every detail matters. From the color of the walls to the furniture, homeowners put a lot of thought and effort into creating a space that reflects their personal style and meets their needs. However, a proposed tariff on

mattress pads

may soon have a significant impact on the design of homes in the United States.

The proposed tariff, which is part of a larger trade war between the US and China, would impose a 10% tax on imported

mattress pads

. This means that the cost of purchasing a mattress pad, a common household item used to protect and add comfort to a mattress, would increase significantly for American consumers.

When it comes to designing a house, every detail matters. From the color of the walls to the furniture, homeowners put a lot of thought and effort into creating a space that reflects their personal style and meets their needs. However, a proposed tariff on

mattress pads

may soon have a significant impact on the design of homes in the United States.

The proposed tariff, which is part of a larger trade war between the US and China, would impose a 10% tax on imported

mattress pads

. This means that the cost of purchasing a mattress pad, a common household item used to protect and add comfort to a mattress, would increase significantly for American consumers.

The Impact on House Design

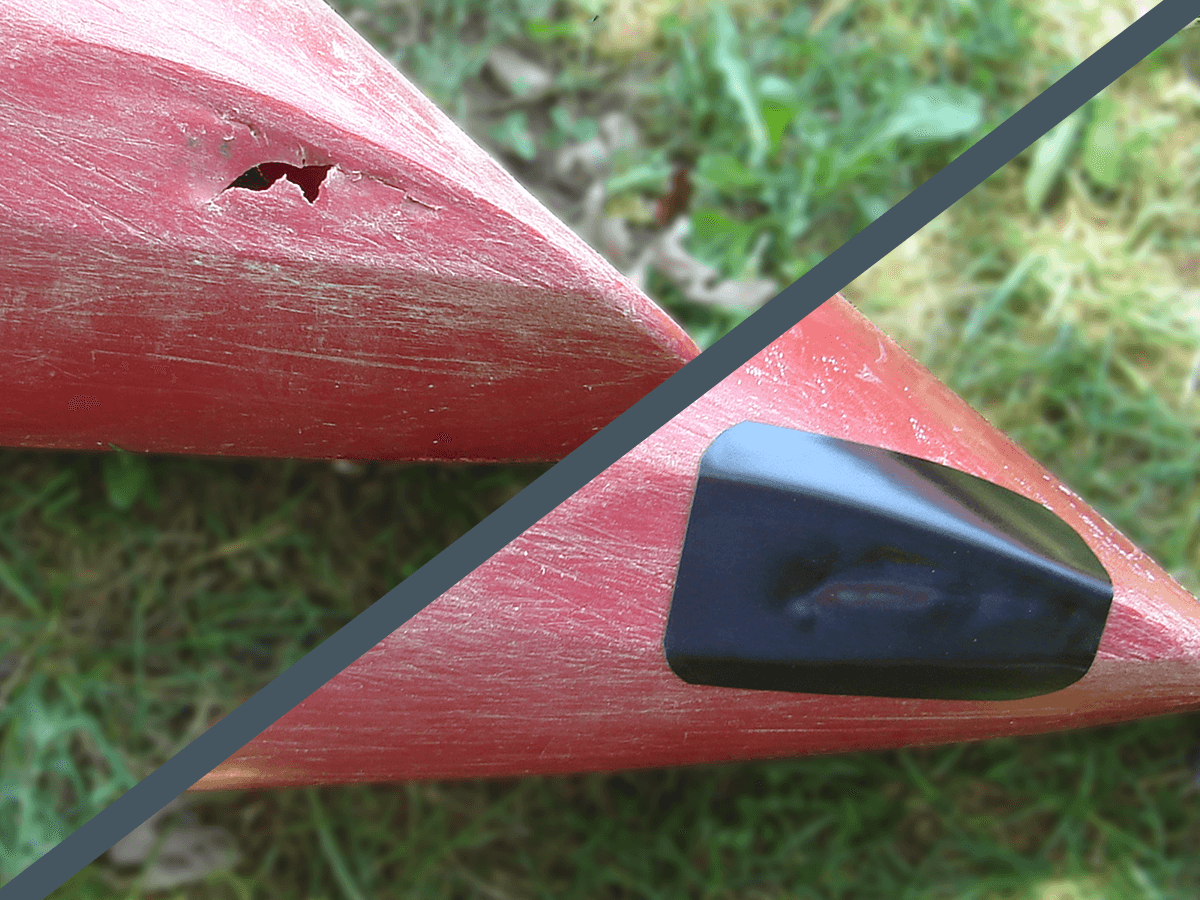

While a

mattress pad

may seem like a small and insignificant item, it actually plays a crucial role in house design. Not only does it protect the mattress from wear and tear, but it also adds an extra layer of comfort for a good night's sleep. With the proposed tariff, the cost of

mattress pads

will increase, making them less accessible for homeowners and potentially changing the way they design their bedrooms.

Without a

mattress pad

, homeowners may have to replace their mattresses more frequently, leading to additional costs and potentially affecting the overall design of their bedrooms. They may also have to compromise on the comfort of their beds, which could impact their sleep and overall well-being.

While a

mattress pad

may seem like a small and insignificant item, it actually plays a crucial role in house design. Not only does it protect the mattress from wear and tear, but it also adds an extra layer of comfort for a good night's sleep. With the proposed tariff, the cost of

mattress pads

will increase, making them less accessible for homeowners and potentially changing the way they design their bedrooms.

Without a

mattress pad

, homeowners may have to replace their mattresses more frequently, leading to additional costs and potentially affecting the overall design of their bedrooms. They may also have to compromise on the comfort of their beds, which could impact their sleep and overall well-being.

Alternative Solutions

As the proposed tariff on

mattress pads

continues to be debated, homeowners may have to consider alternative solutions for protecting and adding comfort to their mattresses. One option could be to invest in higher quality mattresses that do not require a

mattress pad

for protection. However, this may not be feasible for all homeowners, as it would come at a higher cost.

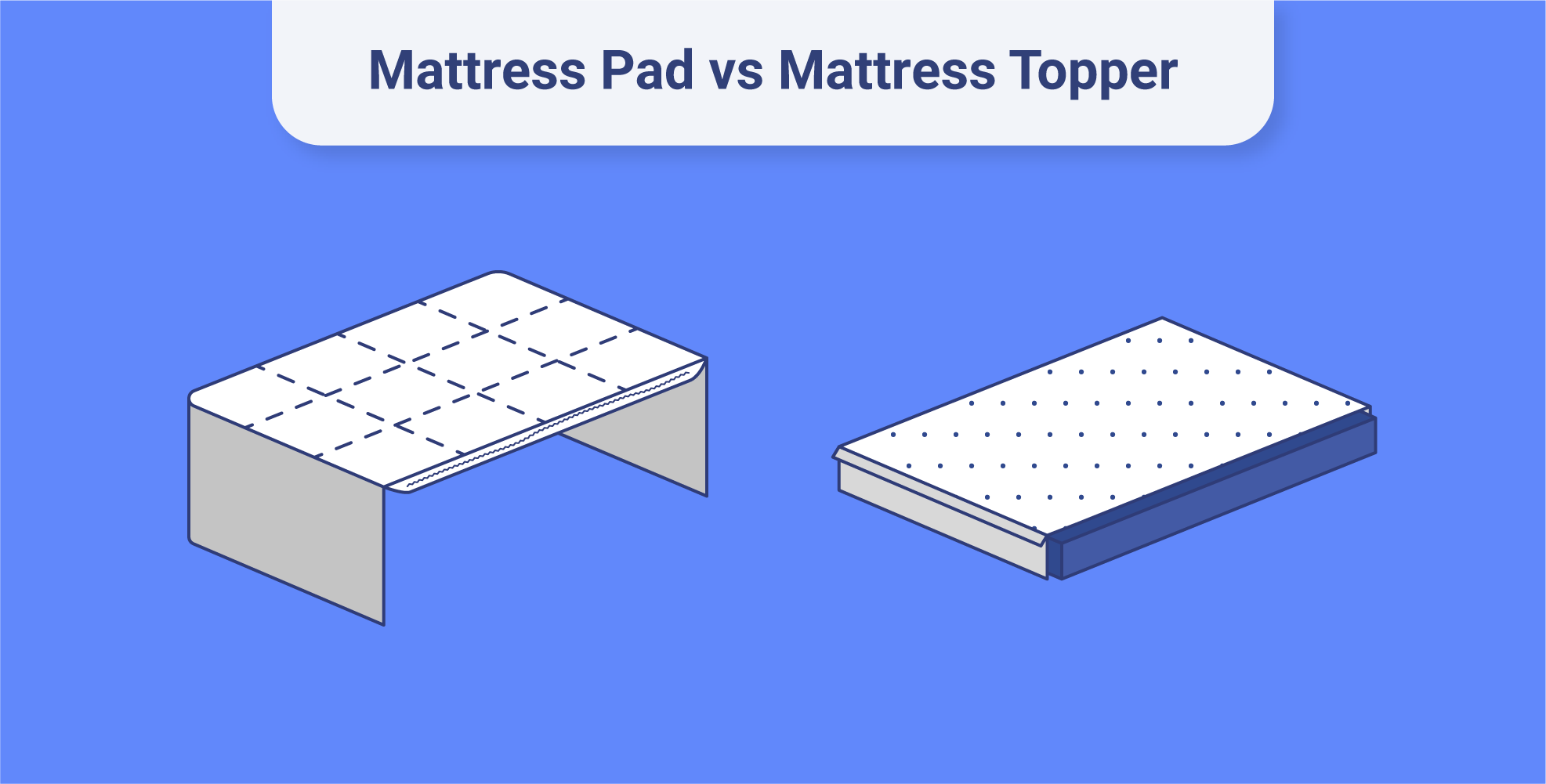

Another solution could be to invest in locally-made

mattress pads

or explore other bedding options such as mattress toppers or protectors. However, these alternatives may not provide the same level of protection and comfort as

mattress pads

and could also come at a higher cost.

As the proposed tariff on

mattress pads

continues to be debated, homeowners may have to consider alternative solutions for protecting and adding comfort to their mattresses. One option could be to invest in higher quality mattresses that do not require a

mattress pad

for protection. However, this may not be feasible for all homeowners, as it would come at a higher cost.

Another solution could be to invest in locally-made

mattress pads

or explore other bedding options such as mattress toppers or protectors. However, these alternatives may not provide the same level of protection and comfort as

mattress pads

and could also come at a higher cost.

In Conclusion

While the proposed tariff on

mattress pads

may seem like a small issue, it has the potential to significantly impact the design and comfort of homes in the United States. As the debate continues, homeowners may have to explore alternative solutions or adjust their budgets to accommodate the increased cost of

mattress pads

. Ultimately, the decision on the proposed tariff will not only affect the mattress industry, but it will also have ripple effects on house design and the overall well-being of American homeowners.

While the proposed tariff on

mattress pads

may seem like a small issue, it has the potential to significantly impact the design and comfort of homes in the United States. As the debate continues, homeowners may have to explore alternative solutions or adjust their budgets to accommodate the increased cost of

mattress pads

. Ultimately, the decision on the proposed tariff will not only affect the mattress industry, but it will also have ripple effects on house design and the overall well-being of American homeowners.

:max_bytes(150000):strip_icc()/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

:max_bytes(150000):strip_icc()/bedroom-window-treatment-ideas-1-tyler-karu-black-rock-5f38ff2d169346449c817ae33d2e6031.jpg)