As a real estate investor, understanding cap rates is essential to making informed decisions about potential properties. And when it comes to popular retail brands, Starbucks is definitely at the top of the list. But what exactly is the Starbucks cap rate and why is it important? Let's dive in and explore everything you need to know about this crucial metric.Starbucks Cap Rate: What You Need to Know

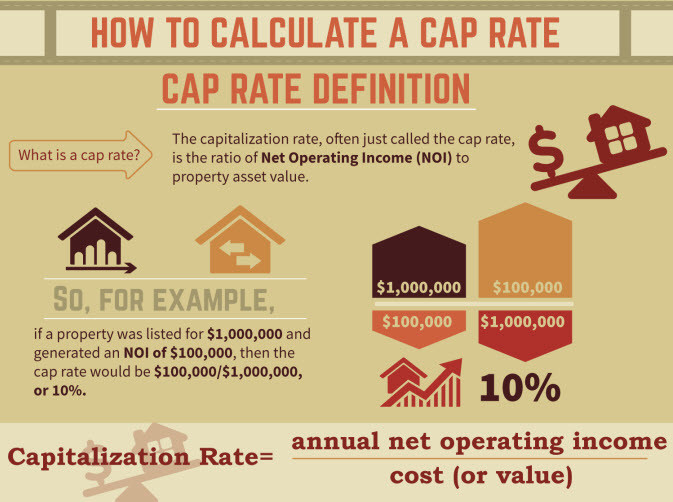

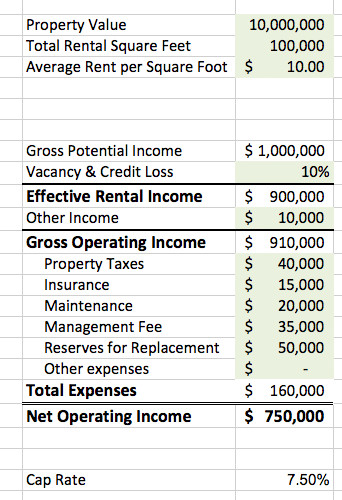

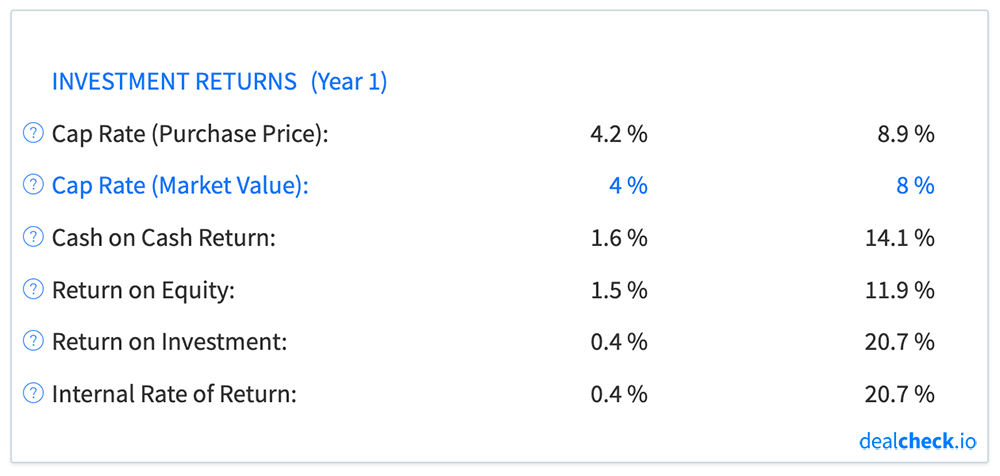

Investing in real estate is all about numbers, and the cap rate is one of the most important figures for investors to consider. The Starbucks cap rate is a measure of a property's annual net operating income (NOI) compared to its purchase price. In other words, it shows the potential return on investment for a property. As a highly popular and successful retail brand, Starbucks' cap rate is a reflection of its stability and profitability in the market.Starbucks Cap Rate: What Investors Need to Know

To calculate the Starbucks cap rate, you simply divide the property's annual net operating income by its purchase price. For example, if a Starbucks property has an NOI of $100,000 and was purchased for $1,000,000, the cap rate would be 10%. This is a simplified example, as there are other factors that can affect the calculation, but it gives a general understanding of how cap rates work.Starbucks Cap Rate: Understanding the Basics

When considering investing in a Starbucks property, it's important to do your research and thoroughly analyze the cap rate. This involves understanding the market trends, the property's location and condition, and any potential risks. A comprehensive guide to cap rates can help you make informed decisions and ensure a successful investment.Starbucks Cap Rate: A Comprehensive Guide

The Starbucks cap rate is a reflection of the brand's success and popularity. With over 30,000 locations worldwide and a loyal customer base, Starbucks properties are highly desirable for investors. This leads to a lower cap rate, as the demand for these properties drives up their purchase price. It's important to keep this in mind when comparing the cap rates of different retailers.Starbucks Cap Rate: Explained

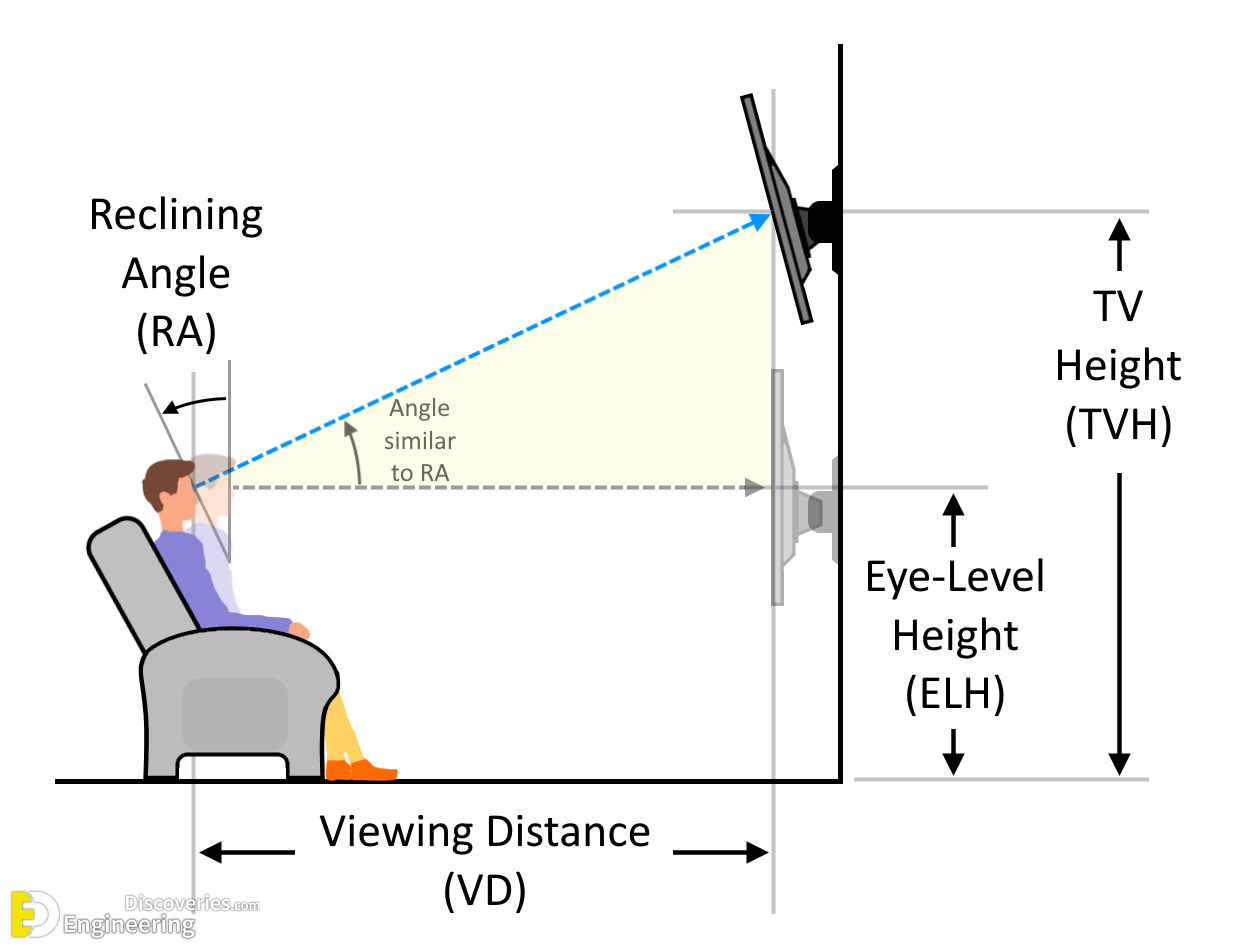

As mentioned before, calculating the Starbucks cap rate is a simple formula. However, analyzing it involves considering other factors such as the property's location, lease terms, and potential for future growth. A property with a lower cap rate may still be a better investment if it is in a prime location and has the potential for higher rental income in the future.Starbucks Cap Rate: How to Calculate and Analyze

Several factors can affect the Starbucks cap rate, including the overall economy, the retail market, and the specific location of the property. A strong economy and high demand for retail properties can lead to a lower cap rate, while a struggling economy or oversaturated market may result in a higher cap rate.Starbucks Cap Rate: Factors That Affect It

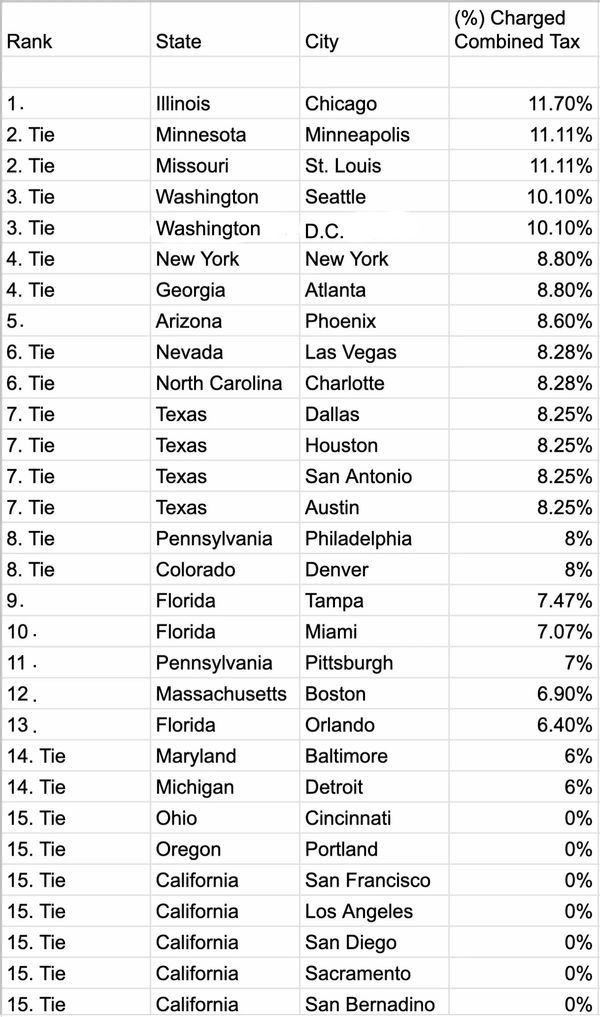

When analyzing the Starbucks cap rate, it's important to compare it to other retailers in the market. This can give you a better understanding of how the brand is performing and how it measures up against its competitors. It's also crucial to consider the overall trends in the retail market and how they may affect cap rates in the future.Starbucks Cap Rate: Comparing to Other Retailers

Another popular retail brand, Mattress Firm, can serve as a good comparison for the Starbucks cap rate. While both are successful and well-known brands, their cap rates may differ due to various factors such as location, market trends, and lease terms. Analyzing the differences between the two can help you make a more informed decision about which brand may be a better investment for you.Starbucks vs. Mattress Firm: A Cap Rate Comparison

Ultimately, the cap rate is just one factor to consider when investing in a property. It's important to look at the bigger picture and consider all aspects of a potential investment. By analyzing the cap rates of Starbucks and Mattress Firm, as well as other relevant factors, you can make a well-informed decision and potentially see a successful return on your investment.Starbucks and Mattress Firm: Analyzing Their Cap Rates

The Impact of Starbucks and Mattress Firm on Real Estate Investment: Exploring Cap Rates

Understanding Cap Rates

Cap rate, short for capitalization rate, is an important metric used in real estate investment to determine the potential return on a property. It is calculated by dividing the net operating income (NOI) by the property's current market value. The resulting percentage represents the expected annual return on investment, making it a key factor in determining the value and profitability of a property.

Cap rate, short for capitalization rate, is an important metric used in real estate investment to determine the potential return on a property. It is calculated by dividing the net operating income (NOI) by the property's current market value. The resulting percentage represents the expected annual return on investment, making it a key factor in determining the value and profitability of a property.

The Rise of Starbucks and Mattress Firm

Two major players in the retail industry have been making waves in the real estate market - Starbucks and Mattress Firm. These two companies have been rapidly expanding their presence, with Starbucks opening an average of 2 stores per day and Mattress Firm acquiring over 3,500 locations in just a few years. This has not only changed the landscape of the retail industry, but it has also had a significant impact on the real estate market.

Two major players in the retail industry have been making waves in the real estate market - Starbucks and Mattress Firm. These two companies have been rapidly expanding their presence, with Starbucks opening an average of 2 stores per day and Mattress Firm acquiring over 3,500 locations in just a few years. This has not only changed the landscape of the retail industry, but it has also had a significant impact on the real estate market.

The Starbucks Effect

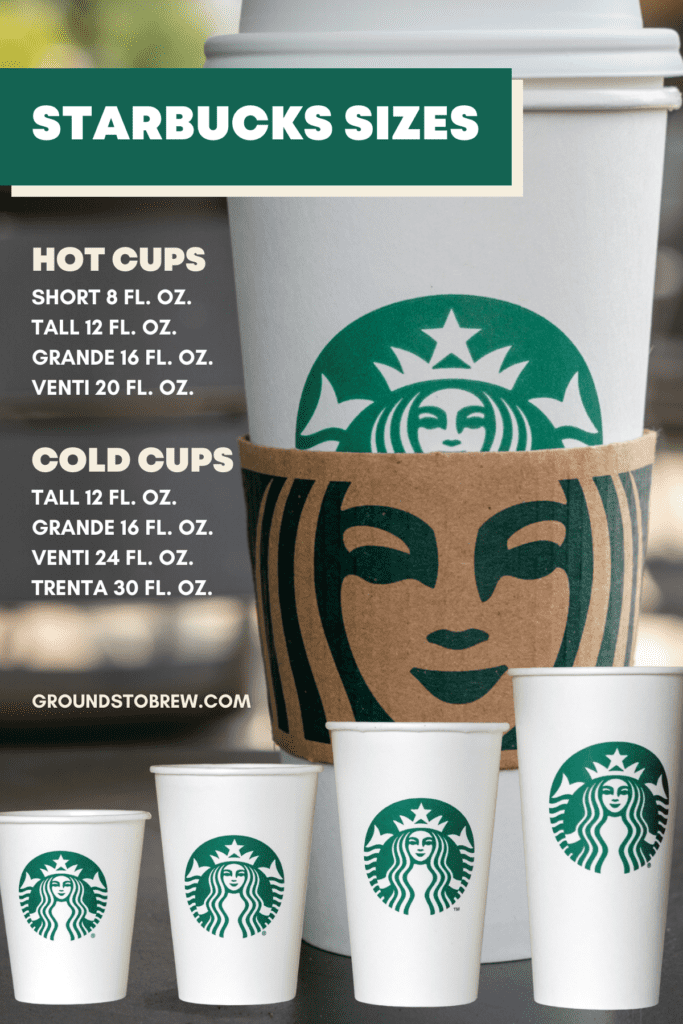

Starbucks

has become a household name, with its signature green mermaid logo adorning thousands of storefronts around the world. The company's success has been attributed to its strategic location choices, often opting for high-traffic areas with high visibility. This has led to a surge in demand for properties near Starbucks locations, driving up the property values and subsequently, the cap rates.

Starbucks

has become a household name, with its signature green mermaid logo adorning thousands of storefronts around the world. The company's success has been attributed to its strategic location choices, often opting for high-traffic areas with high visibility. This has led to a surge in demand for properties near Starbucks locations, driving up the property values and subsequently, the cap rates.

The Mattress Firm Factor

Mattress Firm

has also been making headlines in the real estate world, particularly in the commercial sector. The company's rapid expansion has caused a shift in the retail landscape, with many malls and shopping centers now anchored by a Mattress Firm store. This has increased the value of these properties, leading to higher cap rates.

Mattress Firm

has also been making headlines in the real estate world, particularly in the commercial sector. The company's rapid expansion has caused a shift in the retail landscape, with many malls and shopping centers now anchored by a Mattress Firm store. This has increased the value of these properties, leading to higher cap rates.

The Impact on Real Estate Investment

The presence of these two retail giants has had a significant impact on the real estate market, particularly in terms of cap rates. With higher demand for properties in their vicinity, investors can expect to see higher cap rates in these areas. This presents a golden opportunity for real estate investors looking to maximize their returns.

The presence of these two retail giants has had a significant impact on the real estate market, particularly in terms of cap rates. With higher demand for properties in their vicinity, investors can expect to see higher cap rates in these areas. This presents a golden opportunity for real estate investors looking to maximize their returns.

The Future of Cap Rates

The ongoing expansion of Starbucks and Mattress Firm shows no signs of slowing down, meaning the impact on cap rates is likely to continue in the future. This presents an opportunity for savvy investors to capitalize on the rise in property values and secure higher cap rates. However, it is important to carefully consider the location and stability of these retail giants before making any investment decisions.

As the retail industry continues to evolve and expand, it will undoubtedly have a direct impact on the real estate market and cap rates. With the rise of companies like Starbucks and Mattress Firm, investors must stay informed and adapt their strategies to take advantage of the changing market conditions.

The ongoing expansion of Starbucks and Mattress Firm shows no signs of slowing down, meaning the impact on cap rates is likely to continue in the future. This presents an opportunity for savvy investors to capitalize on the rise in property values and secure higher cap rates. However, it is important to carefully consider the location and stability of these retail giants before making any investment decisions.

As the retail industry continues to evolve and expand, it will undoubtedly have a direct impact on the real estate market and cap rates. With the rise of companies like Starbucks and Mattress Firm, investors must stay informed and adapt their strategies to take advantage of the changing market conditions.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/KLUUC3DHR7L327K7LY3QCHZOYU.jpg)

:max_bytes(150000):strip_icc()/Capitalizationrate-122a804a049444c788fceb400986e3df.jpg)

/sizes-of-starbucks-drinks-765336-v3-5bb7adf346e0fb0051ff0419.png)

:max_bytes(150000):strip_icc()/sizes-of-starbucks-drinks-765336-FINAL-ad968e80f9c644ddb16457df10f6352e.png)

/how-to-install-a-sink-drain-2718789-hero-24e898006ed94c9593a2a268b57989a3.jpg)