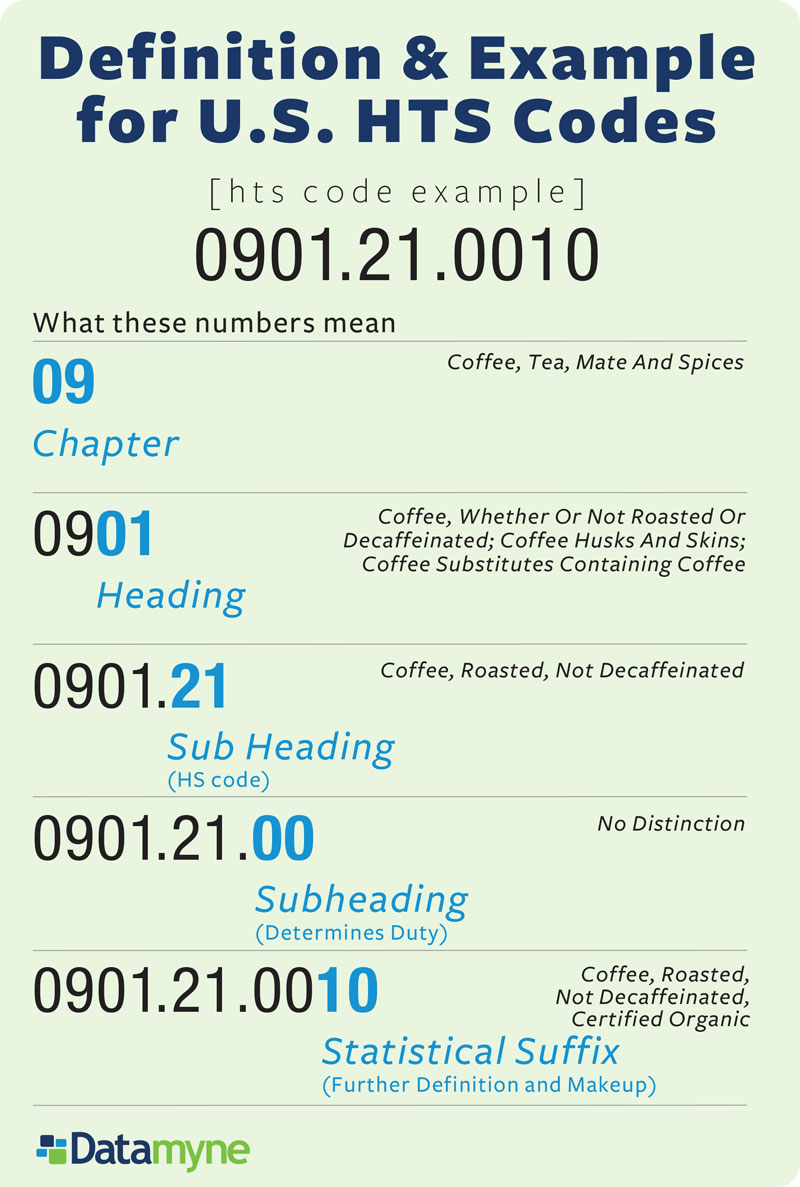

Are you in the market for a new kitchen sink? If so, you may have come across the term "HS code" while researching different options. But what exactly is a stainless steel kitchen sink HS code and why is it important? In this article, we'll break down everything you need to know about HS codes for stainless steel kitchen sinks.Stainless Steel Kitchen Sink HS Code

Before we dive into the specifics of stainless steel kitchen sink HS codes, let's first understand what an HS code is. HS code stands for Harmonized System code and it is a standardized system used to classify and identify goods for international trade. This system was developed by the World Customs Organization (WCO) to facilitate the efficient and accurate movement of goods across borders. The HS code for a stainless steel kitchen sink falls under the category of "Articles of Iron or Steel" and is classified under code 7324.10. This code includes various types of sinks made from stainless steel, such as kitchen sinks, bar sinks, and utility sinks.HS Code for Stainless Steel Kitchen Sink

For those looking to import a stainless steel kitchen sink from another country, it is important to know the HS code for customs purposes. As mentioned earlier, the HS code for a stainless steel kitchen sink is 7324.10, which is used for both the import and export of these products. When importing a stainless steel kitchen sink, you will need to provide the HS code to the customs authorities. This code will help them determine the appropriate duties, taxes, and other charges that may apply to the imported goods. It is important to ensure that the HS code provided is accurate to avoid any delays or additional fees.Stainless Steel Kitchen Sink Import HS Code

While the HS code 7324.10 specifically refers to stainless steel kitchen sinks, it is also used for other types of stainless steel sinks. This includes bathroom sinks, laundry sinks, and even industrial sinks. This code is used to classify all sinks made from stainless steel, regardless of their intended use. If you are importing or exporting a stainless steel sink of any kind, it is important to use the correct HS code to avoid any issues with customs authorities. Using the wrong code can result in incorrect duties and taxes being applied, which can be costly for both the importer and exporter.HS Code for Stainless Steel Sink

The HS code for a stainless steel kitchen sink also falls under the category of "Tariff Code." This is a code used to determine the tariff rates for specific goods. Tariffs are taxes imposed on imported goods by the government, and they can vary depending on the type of goods and their country of origin. The tariff rates for stainless steel kitchen sinks may differ depending on the country you are importing from. It is important to research the tariff rates for your specific country to ensure you are paying the correct amount for your imported goods.Stainless Steel Kitchen Sink Tariff Code

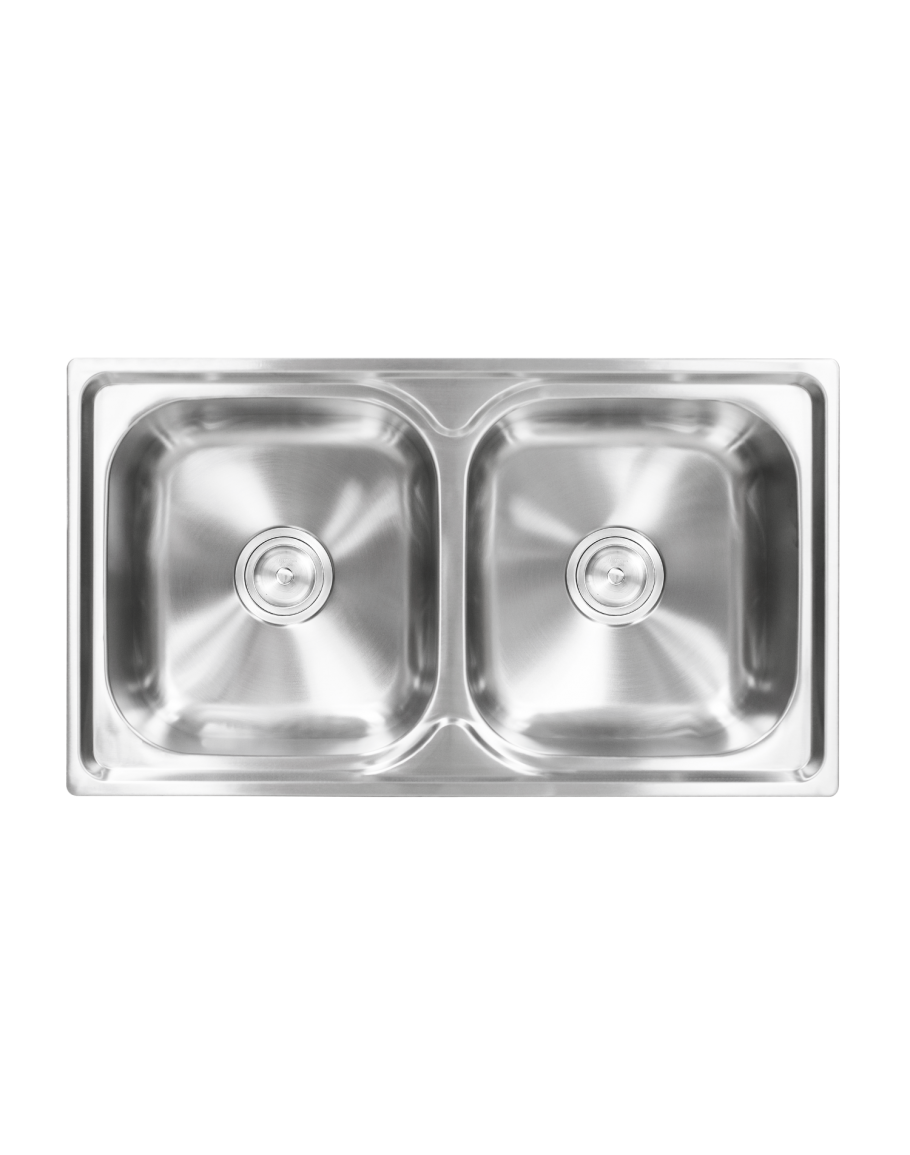

While 7324.10 is the HS code for stainless steel kitchen sinks, it is also used for other types of kitchen sinks. This code is used for all types of kitchen sinks made from any material, including stainless steel, cast iron, and porcelain. This includes both single and double bowl sinks, as well as sinks with or without a drainboard. If you are in the market for a new kitchen sink, it is important to know the HS code for customs purposes, regardless of the material it is made from. This will ensure a smooth and efficient import or export process.HS Code for Kitchen Sink

As mentioned earlier, the HS code 7324.10 is used for all types of stainless steel sinks, not just kitchen sinks. This includes bar sinks, utility sinks, and even sinks used in industrial settings. The same code is used for all these products as they are all made from stainless steel and fall under the same category of "Articles of Iron or Steel." When importing or exporting a stainless steel sink of any kind, it is important to use the correct HS code to avoid any issues with customs authorities. Using the wrong code can result in incorrect duties and taxes being applied, which can be costly for both the importer and exporter.Stainless Steel Sink HS Code

For those specifically looking to import or export a stainless steel kitchen sink, it may be helpful to use the HS code 7324.10 in combination with the term "stainless steel." This will help narrow down the search results and provide more specific information on the HS code for a stainless steel kitchen sink. Using the term "stainless steel" in conjunction with the HS code will also be helpful when researching the tariff rates for your specific country. This will ensure you are paying the correct amount for your imported goods.HS Code for Kitchen Sink Stainless Steel

Another term you may come across when researching HS codes for stainless steel kitchen sinks is "Customs Code." This term is often used interchangeably with "HS code" and refers to the same standardized system used to classify and identify goods for international trade. Customs authorities use HS codes to determine the appropriate duties, taxes, and other charges that may apply to imported goods. It is important to provide the correct HS code to avoid any delays or additional fees when importing a stainless steel kitchen sink.Stainless Steel Kitchen Sink Customs Code

Last but not least, it is important to know the HS code for a stainless steel kitchen sink when importing this product from another country. As mentioned earlier, the HS code for a stainless steel kitchen sink is 7324.10, and it is used for both the import and export of these products. When importing a stainless steel kitchen sink, it is crucial to provide the correct HS code to the customs authorities to ensure a smooth and efficient process. This code will help them determine the appropriate duties, taxes, and other charges that may apply to your imported goods.HS Code for Stainless Steel Kitchen Sink Import

The Versatility of Stainless Steel Kitchen Sinks: A Must-Have in Every Modern Home

Why Stainless Steel Sinks are the Top Choice for Modern Kitchens

When it comes to designing the perfect kitchen, there are many factors to consider. From the layout to the appliances and fixtures, each element plays a crucial role in creating a functional and aesthetically pleasing space. One of the most important fixtures in any kitchen is the sink, and for modern homes,

stainless steel kitchen sinks

have become the top choice. With their sleek and versatile design, it's no wonder that

stainless steel sinks

have a

HS code

of their own, indicating their widespread use in various industries.

When it comes to designing the perfect kitchen, there are many factors to consider. From the layout to the appliances and fixtures, each element plays a crucial role in creating a functional and aesthetically pleasing space. One of the most important fixtures in any kitchen is the sink, and for modern homes,

stainless steel kitchen sinks

have become the top choice. With their sleek and versatile design, it's no wonder that

stainless steel sinks

have a

HS code

of their own, indicating their widespread use in various industries.

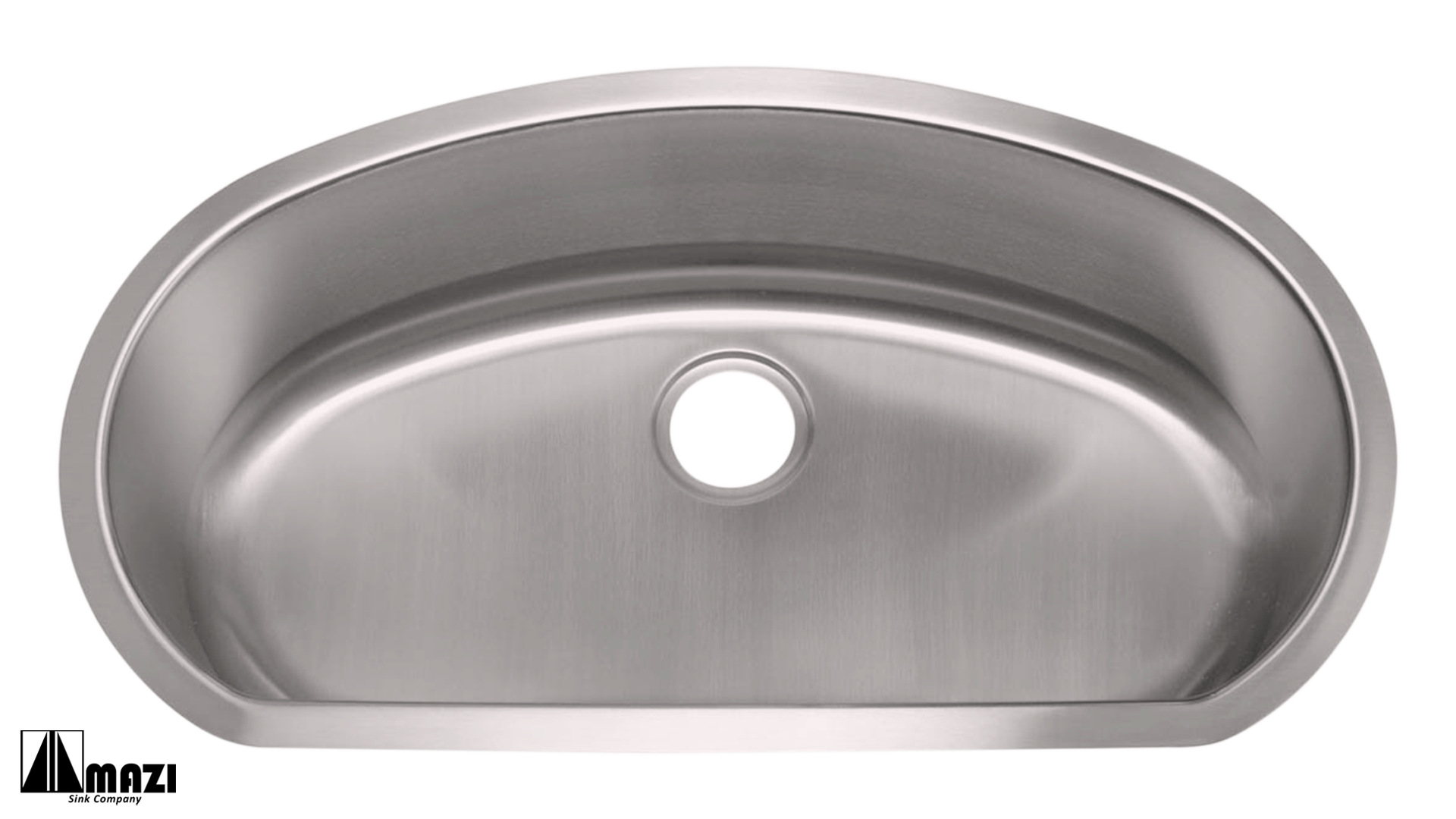

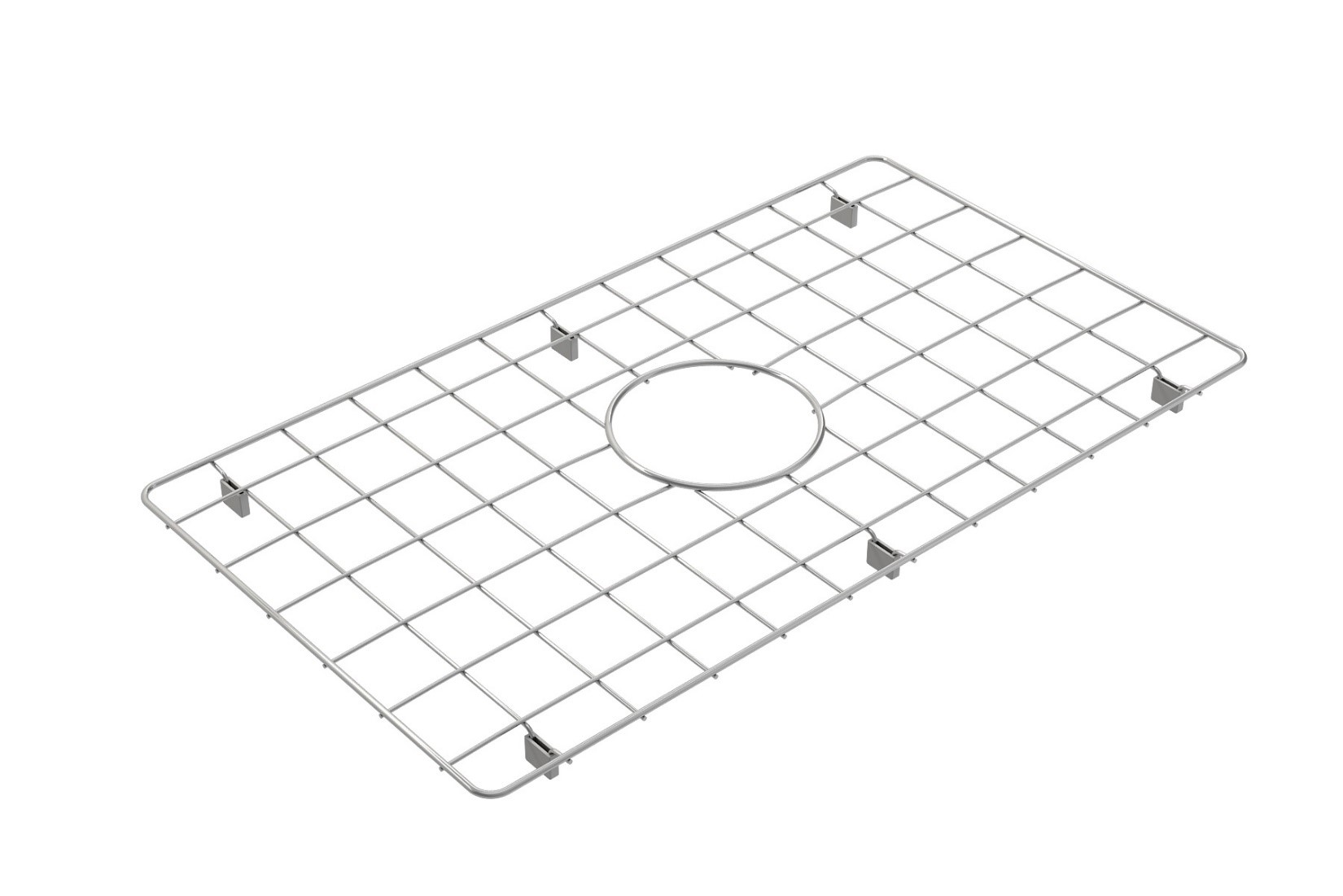

The Advantages of Stainless Steel Sinks

Stainless steel kitchen sinks are made from a durable and corrosion-resistant material, making them a long-lasting addition to any home. They are also easy to clean and maintain, requiring only a simple wipe down with a mild cleanser to keep them looking brand new. In addition,

stainless steel sinks

come in a variety of shapes and sizes, making them suitable for any kitchen design. They can be under-mounted, top-mounted, or even integrated into the countertop, providing a seamless and modern look.

Stainless steel kitchen sinks are made from a durable and corrosion-resistant material, making them a long-lasting addition to any home. They are also easy to clean and maintain, requiring only a simple wipe down with a mild cleanser to keep them looking brand new. In addition,

stainless steel sinks

come in a variety of shapes and sizes, making them suitable for any kitchen design. They can be under-mounted, top-mounted, or even integrated into the countertop, providing a seamless and modern look.

The Perfect Balance of Form and Function

Aside from their practical benefits,

stainless steel sinks

also add a touch of elegance and sophistication to any kitchen. The smooth and shiny surface of the sink reflects light, creating a bright and airy atmosphere in the space. Furthermore,

stainless steel

is a versatile material that can be molded into different shapes and designs, making it a perfect fit for any kitchen style, whether it's modern, traditional, or industrial.

Aside from their practical benefits,

stainless steel sinks

also add a touch of elegance and sophistication to any kitchen. The smooth and shiny surface of the sink reflects light, creating a bright and airy atmosphere in the space. Furthermore,

stainless steel

is a versatile material that can be molded into different shapes and designs, making it a perfect fit for any kitchen style, whether it's modern, traditional, or industrial.

Investing in Quality and Style

When it comes to designing a home, it's important to invest in quality and style.

Stainless steel kitchen sinks

offer both, providing a durable and versatile fixture that adds a touch of modern elegance to any kitchen. With their

HS code

recognition, it's clear that

stainless steel sinks

are a staple in modern homes and a must-have for any homeowner looking to create a functional and stylish kitchen.

When it comes to designing a home, it's important to invest in quality and style.

Stainless steel kitchen sinks

offer both, providing a durable and versatile fixture that adds a touch of modern elegance to any kitchen. With their

HS code

recognition, it's clear that

stainless steel sinks

are a staple in modern homes and a must-have for any homeowner looking to create a functional and stylish kitchen.

Conclusion

In conclusion,

stainless steel kitchen sinks

are an essential element in modern kitchen design. With their durability, ease of maintenance, and versatility, they offer the perfect balance of form and function. So if you're looking to upgrade your kitchen, consider investing in a

stainless steel sink

and enjoy its benefits for years to come.

In conclusion,

stainless steel kitchen sinks

are an essential element in modern kitchen design. With their durability, ease of maintenance, and versatility, they offer the perfect balance of form and function. So if you're looking to upgrade your kitchen, consider investing in a

stainless steel sink

and enjoy its benefits for years to come.