How to Calculate Sales Tax on a Mattress in Texas

If you're a mattress retailer in Texas, you need to understand how to calculate sales tax on your products. The process may seem complicated, but it's actually quite simple. Here's a step-by-step guide to help you calculate sales tax on a mattress in Texas.

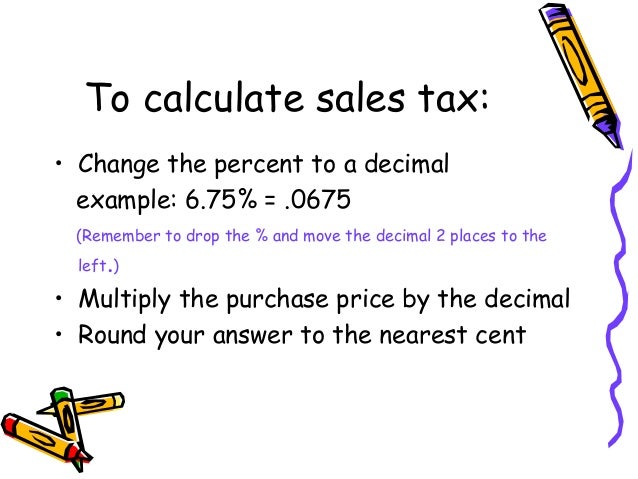

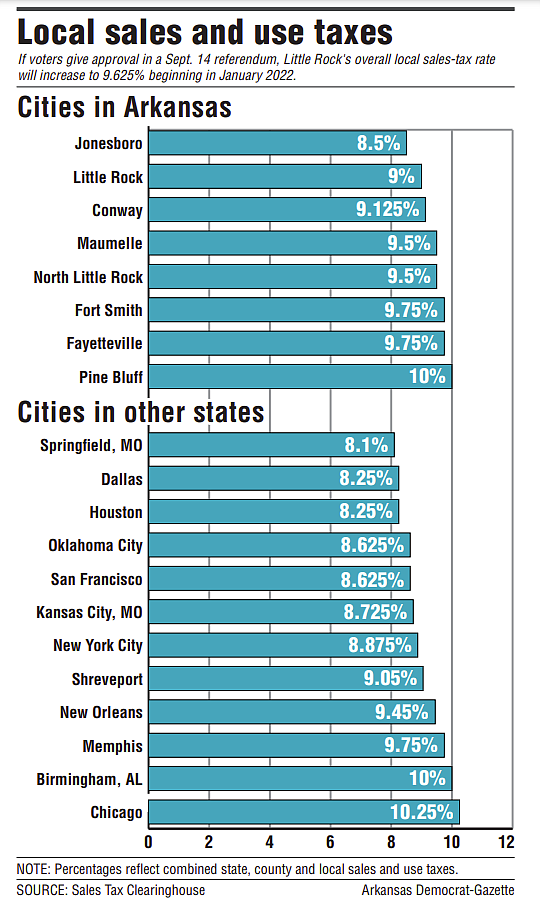

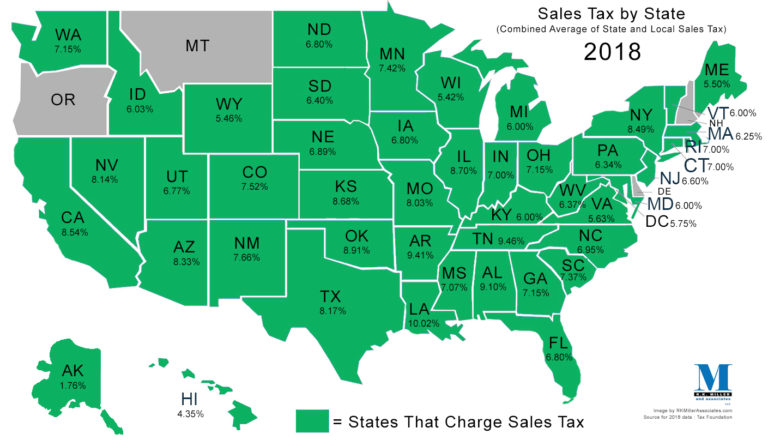

First, you need to determine the sales tax rate for your location. In Texas, the state sales tax rate is 6.25%. However, cities and counties can also impose additional sales taxes, so you'll need to check with your local government to find out the exact rate for your area. You can also use the Texas Comptroller's website to look up the sales tax rate for a specific address.

Next, you need to determine the sales price of the mattress. This includes not just the cost of the mattress itself, but also any additional charges such as delivery or installation fees. If you're selling the mattress for a discounted price, you'll need to use the discounted price as the sales price for tax purposes.

Now, multiply the sales price by the sales tax rate to get the amount of sales tax owed. For example, if the sales price of the mattress is $1,000 and the sales tax rate is 8.25%, the sales tax owed would be $82.50.

Finally, add the sales tax to the sales price to get the total amount the customer will pay for the mattress. In our example, the total cost would be $1,082.50.

Texas Sales Tax Guide for Businesses

As a business owner in Texas, it's important to understand the state's sales tax laws. Sales tax is imposed on most tangible personal property and some services, including mattresses. This guide will provide you with the information you need to comply with Texas sales tax laws for your mattress business.

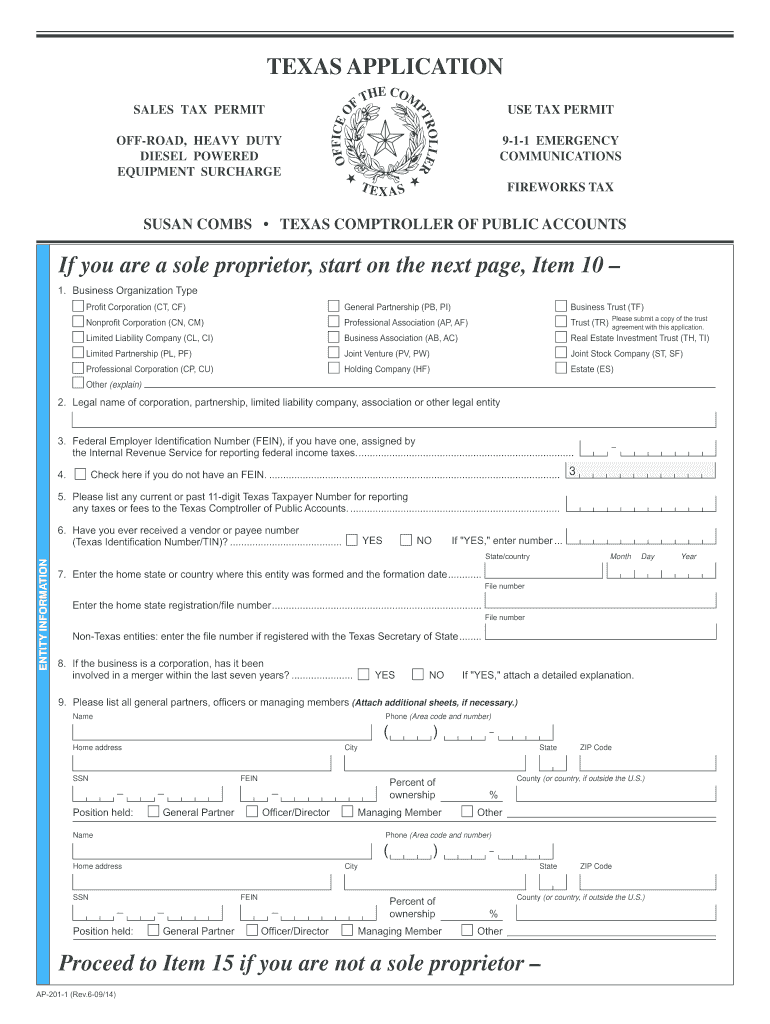

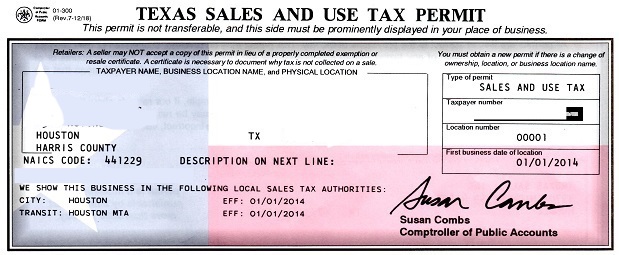

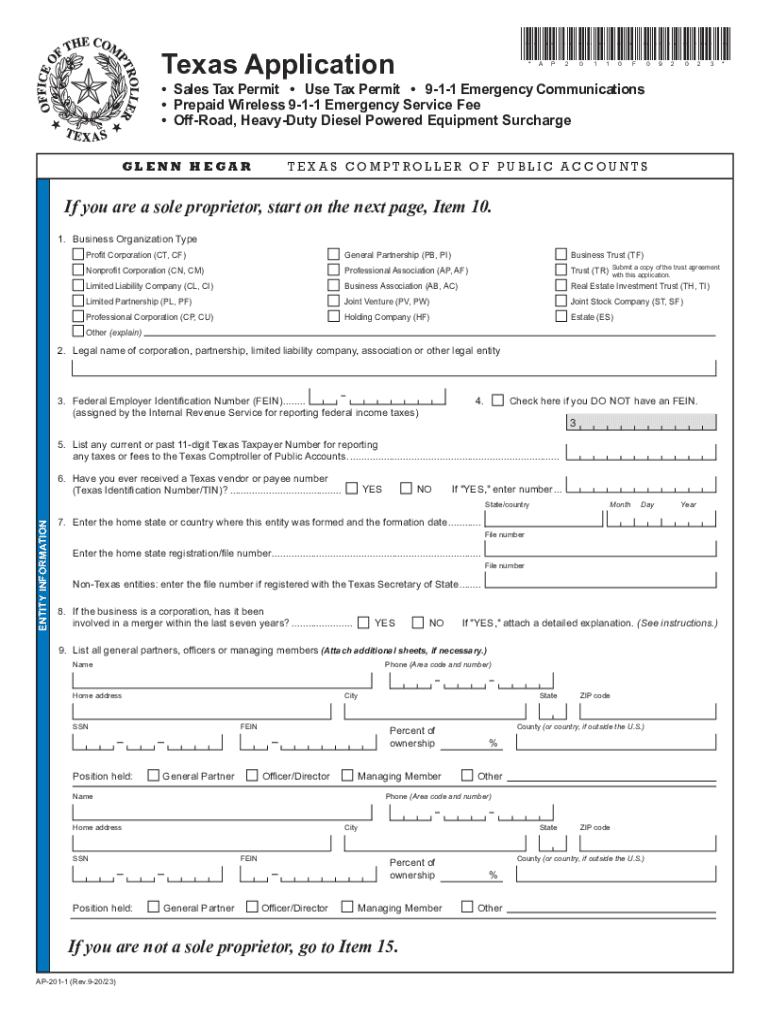

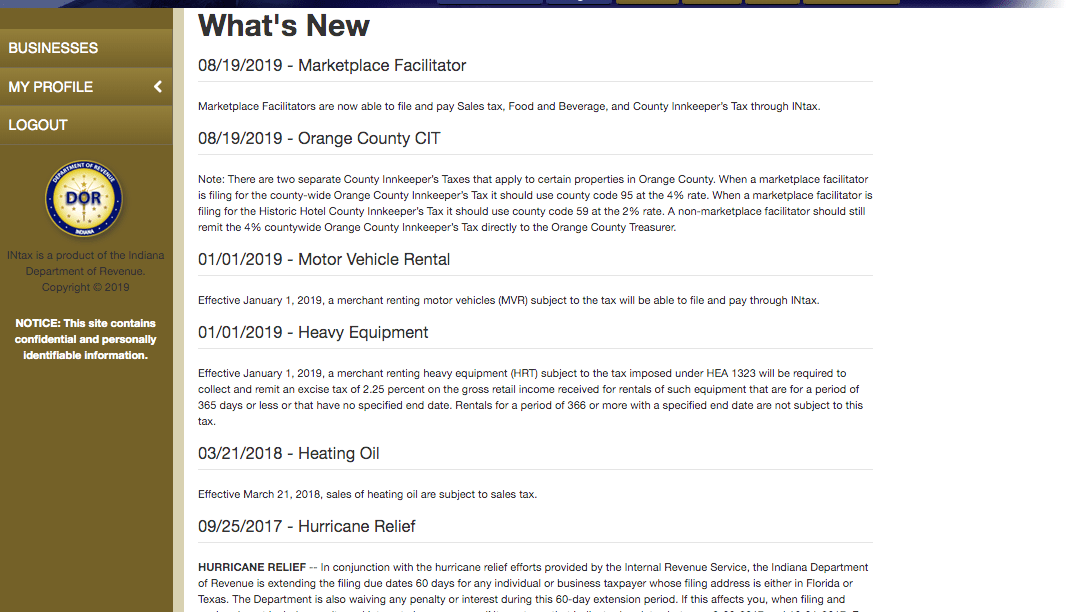

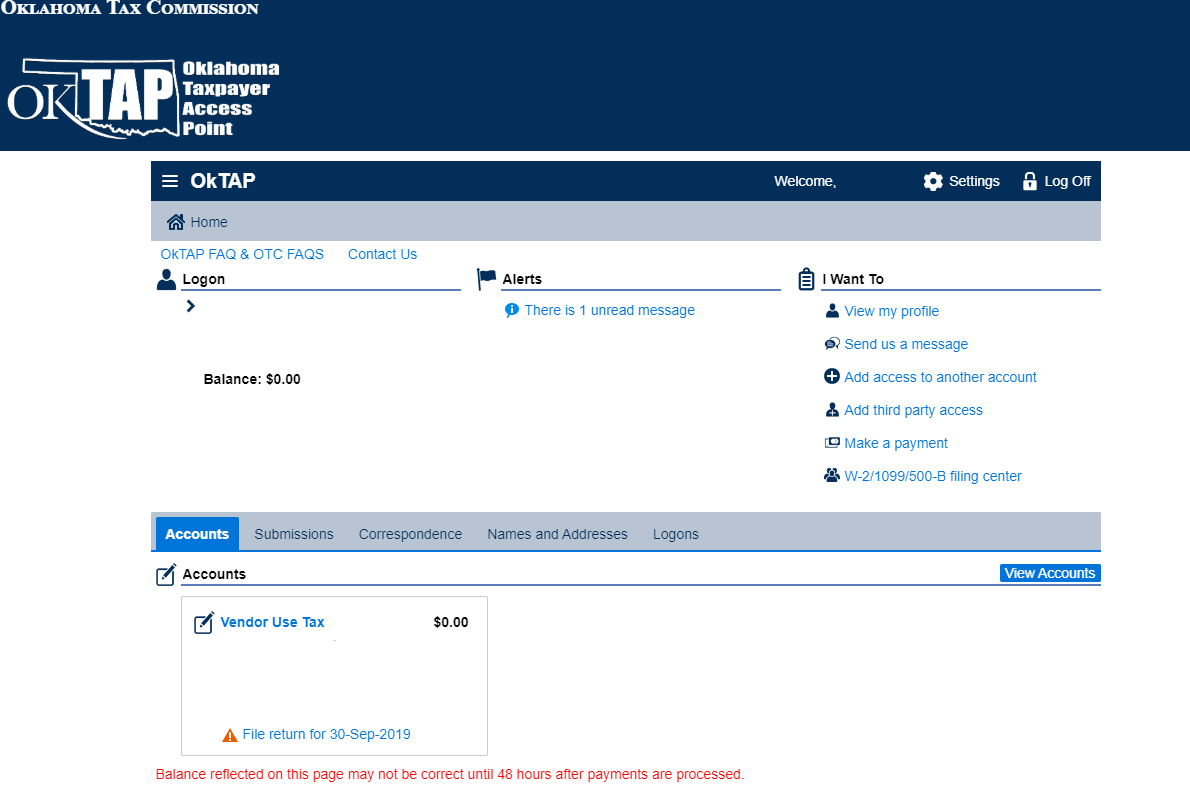

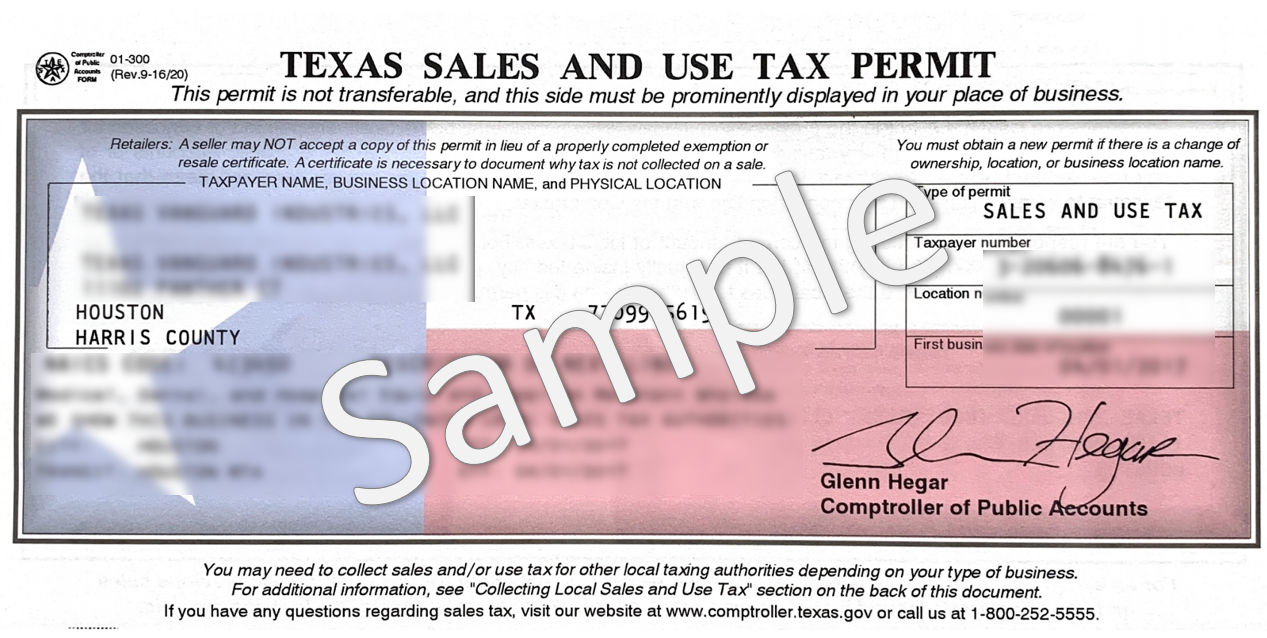

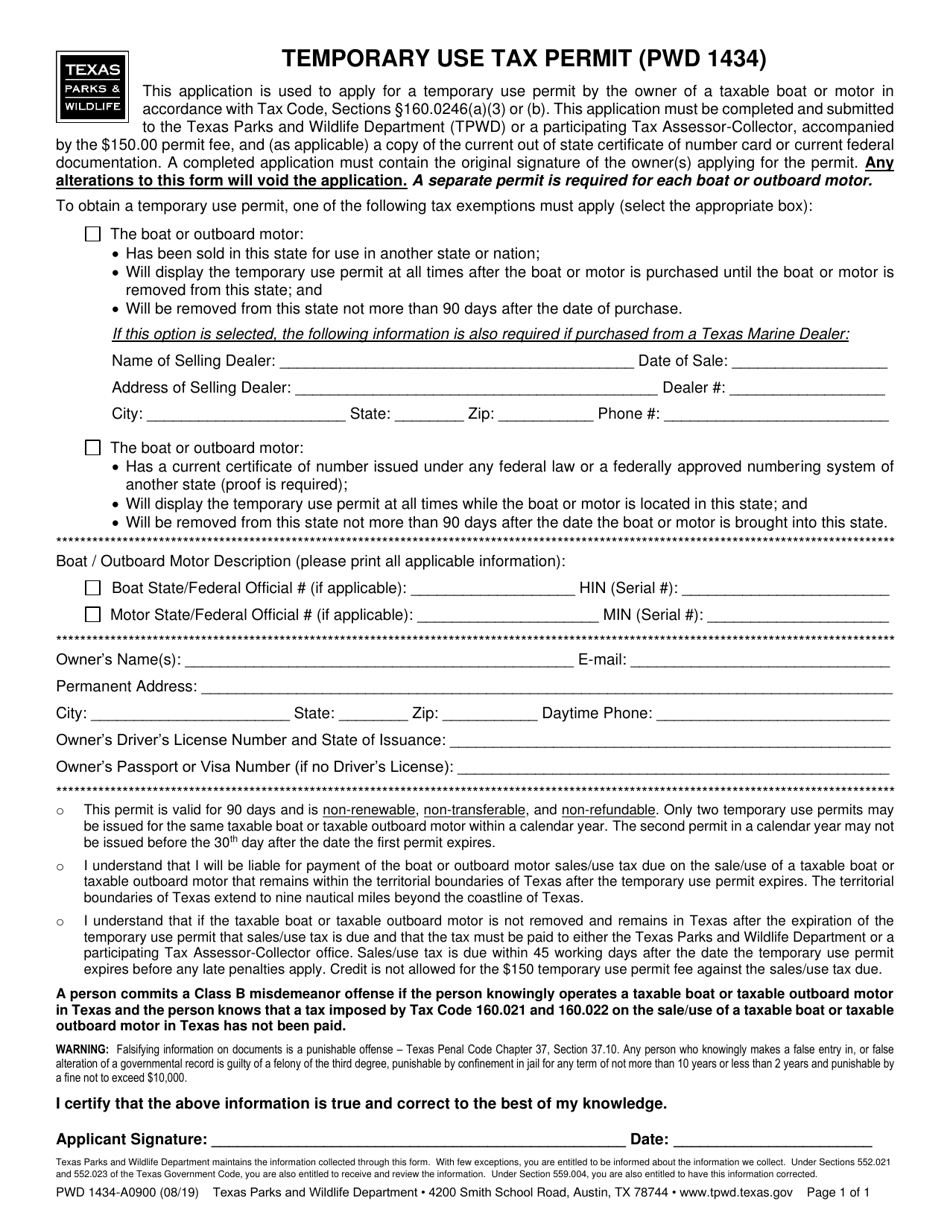

First, you'll need to register for a sales tax permit with the Texas Comptroller's office. This can be done online or by mail. Once you have your permit, you'll be responsible for collecting and remitting sales tax to the state.

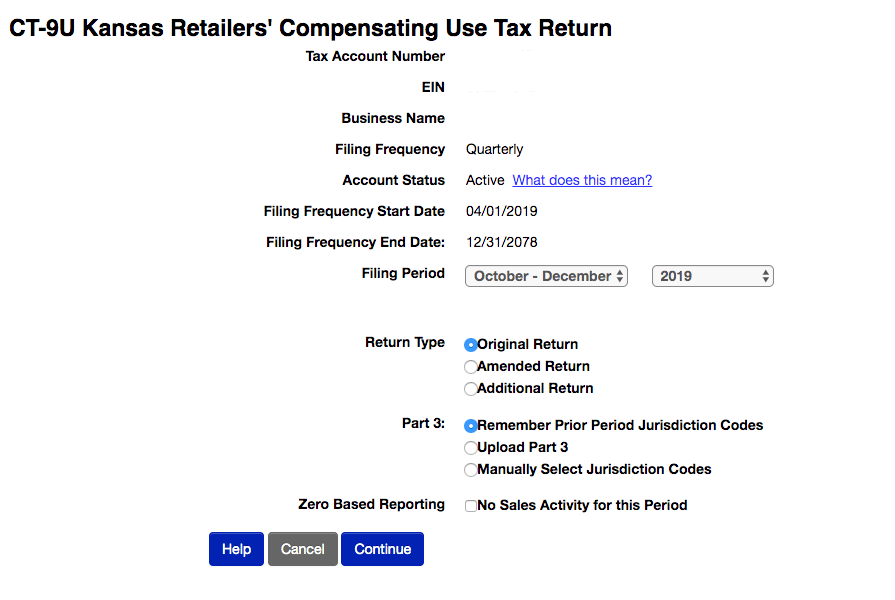

Texas has a "destination-based" sales tax system, which means that sales tax is based on the location of the buyer, not the seller. This means that if you sell a mattress to a customer in a different city or county than your business is located, you'll need to charge the sales tax rate for their location.

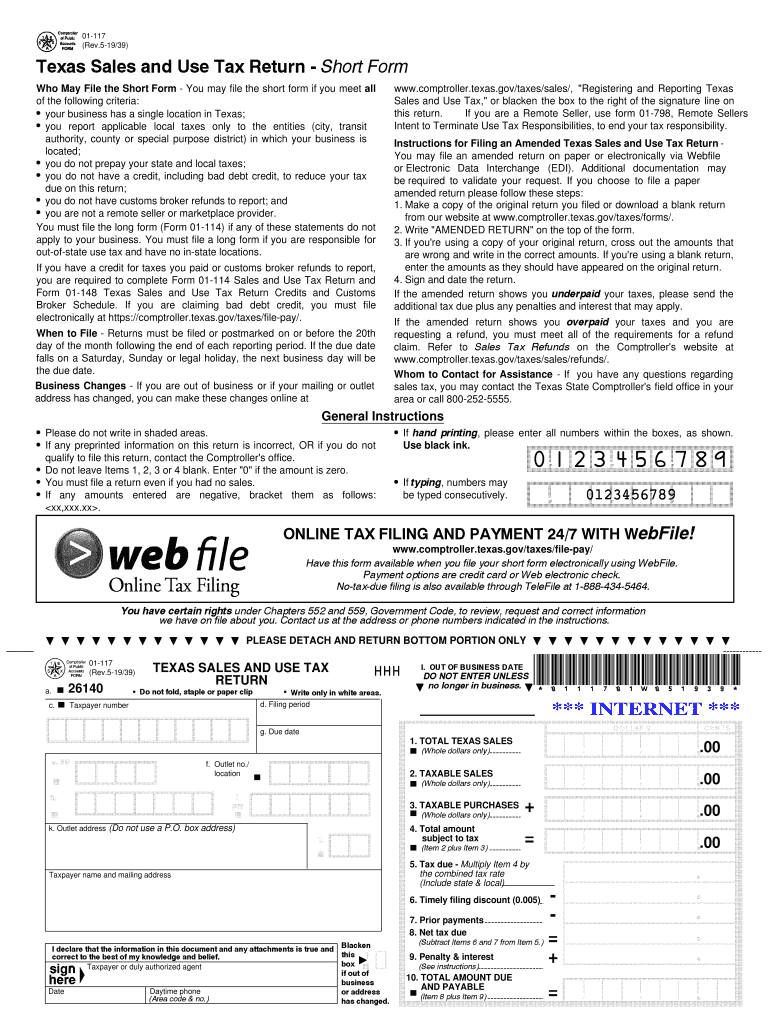

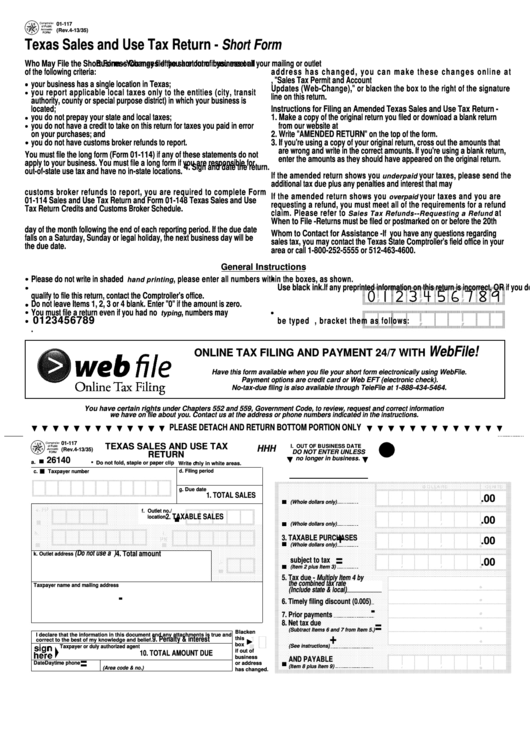

It's important to keep detailed records of all your sales and the corresponding sales tax collected. You'll need this information for filing your sales tax return, which is due on the 20th of each month. If the 20th falls on a weekend or holiday, the due date will be the next business day.

If you sell mattresses online, you may also be responsible for collecting and remitting sales tax for out-of-state sales. Check with the Texas Comptroller's office for more information on these laws.

Understanding Texas Sales Tax Laws for Mattresses

When it comes to sales tax on mattresses in Texas, there are some important laws and regulations to be aware of. Here are a few key points to keep in mind:

- Mattresses are considered tangible personal property and are subject to sales tax in Texas.

- If you offer financing options to your customers, you'll need to collect sales tax on the entire sales price of the mattress, even if the customer only makes a down payment.

- If you offer a warranty or protection plan for your mattresses, the sales tax rate for the warranty or protection plan will be the same as the sales tax rate for the mattress itself.

- If you sell mattresses at a discounted price, you'll need to charge sales tax on the discounted price, not the original price.

It's important to stay up-to-date on any changes to Texas sales tax laws and regulations to ensure that you are in compliance and avoid any penalties or fines.

What is the Sales Tax Rate for Mattresses in Texas?

The sales tax rate for mattresses in Texas can vary depending on the location of the sale. The state sales tax rate is 6.25%, but local cities and counties can add additional sales tax on top of that. This means that the total sales tax rate for mattresses in Texas can range from 6.25% to 8.25%.

To determine the sales tax rate for a specific sale, you can use the Texas Comptroller's website or consult with your local government. It's important to charge the correct sales tax rate to ensure that you are collecting the correct amount of tax from your customers.

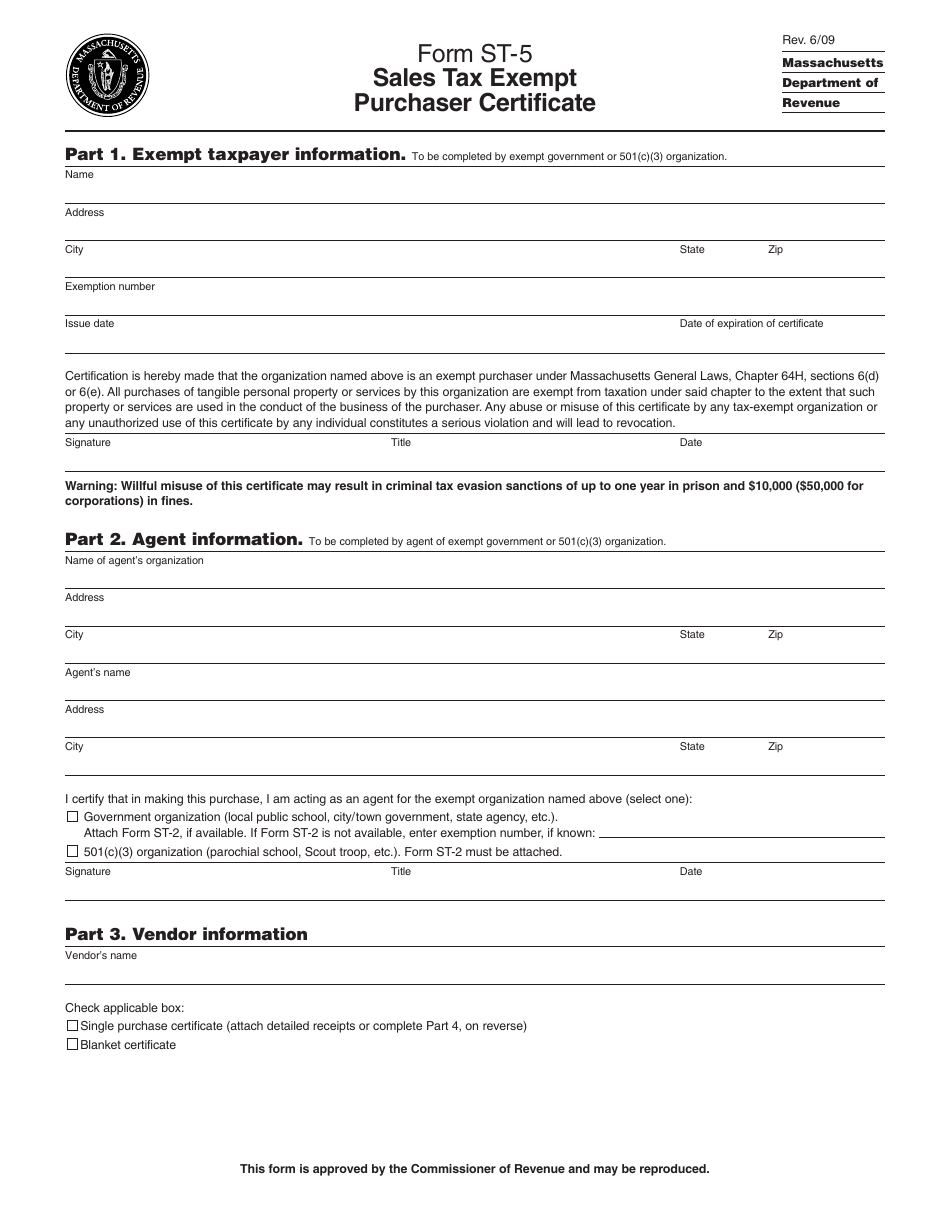

Exemptions from Sales Tax on Mattresses in Texas

While mattresses are generally subject to sales tax in Texas, there are some exemptions that may apply. These include:

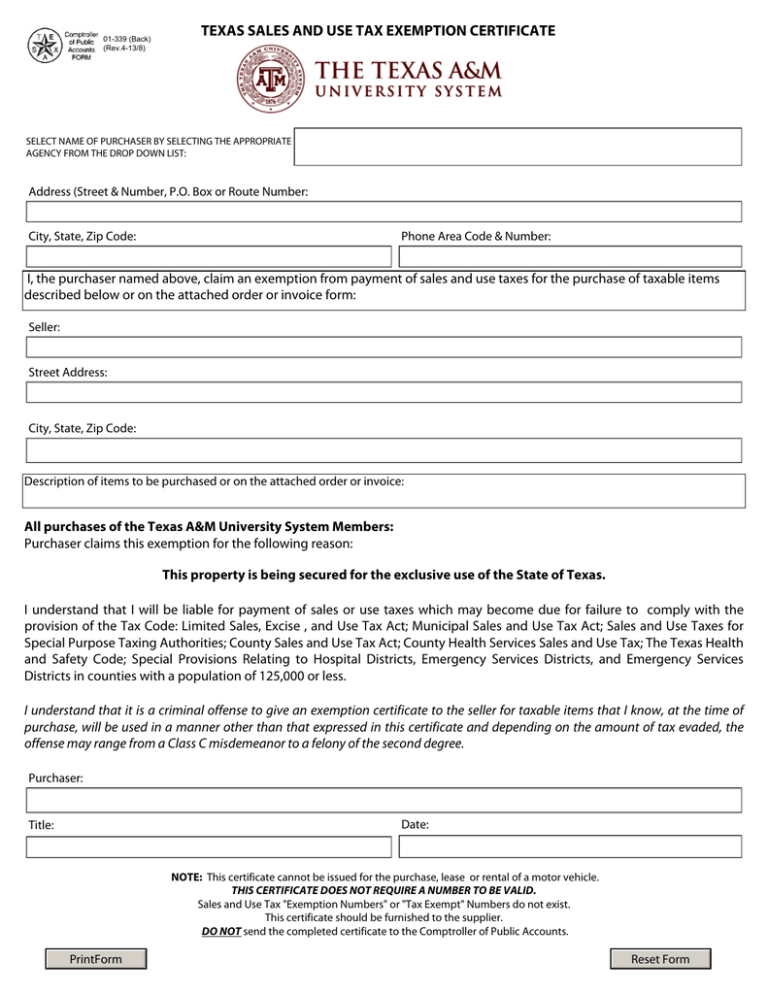

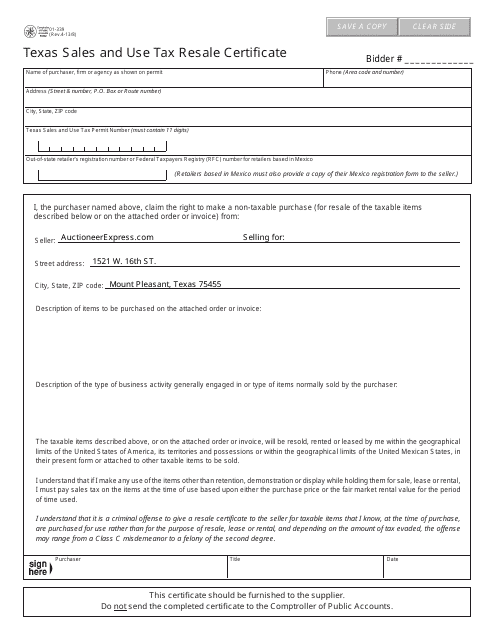

- Mattresses purchased for resale. If you are a retailer who purchases mattresses from a wholesaler for resale, you can provide a resale certificate to the wholesaler and not pay sales tax on the purchase.

- Mattresses purchased with food stamp benefits. If a customer purchases a mattress with food stamp benefits, the sale is exempt from sales tax.

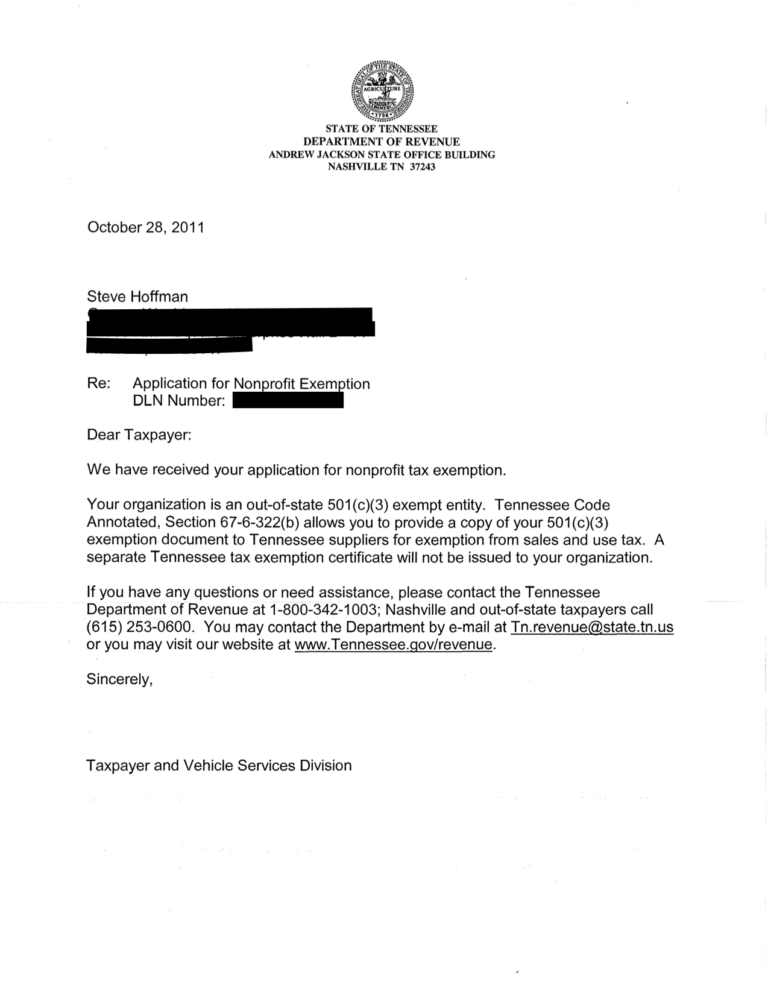

- Mattresses purchased for use in an exempt organization. If a mattress is purchased for use in a qualifying exempt organization, such as a non-profit or religious organization, the sale may be exempt from sales tax.

It's important to carefully review the exemptions and requirements for each to ensure that you are not charging sales tax on exempt sales.

How to File and Pay Sales Tax for Mattresses in Texas

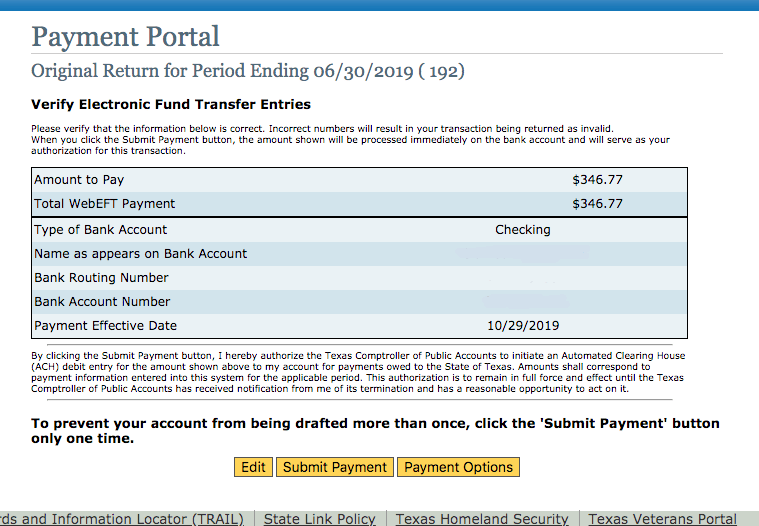

As a business owner in Texas, it's your responsibility to file and pay sales tax on your mattress sales. Here's how to do it:

- Collect and record sales tax on all applicable sales.

- File a sales tax return with the Texas Comptroller's office by the 20th of each month. The return can be filed online or by mail.

- Pay the sales tax owed by the due date.

- Keep detailed records of all sales and sales tax collected for at least four years.

It's important to file and pay sales tax on time to avoid any penalties or fines. If you have any questions or need assistance, you can contact the Texas Comptroller's office for help.

Texas Sales Tax Exemption for Mattresses Purchased for Resale

If you are a mattress retailer in Texas, you can purchase mattresses from a wholesaler without paying sales tax by providing a resale certificate. This certificate proves that you intend to resell the mattresses and that sales tax will be collected at the time of the sale to the end consumer.

To obtain a resale certificate, you'll need to register for a sales tax permit with the Texas Comptroller's office. Once you have your permit, you can provide it to the wholesaler when making purchases for resale.

It's important to keep detailed records of all your purchases for resale and the corresponding sales to ensure that you are in compliance with Texas sales tax laws.

Common Sales Tax Mistakes to Avoid for Mattress Retailers in Texas

When it comes to sales tax on mattresses in Texas, there are some common mistakes that retailers should avoid. These include:

- Not charging the correct sales tax rate for the location of the sale.

- Charging sales tax on exempt sales, such as those purchased for resale.

- Failing to file and pay sales tax returns on time.

To avoid these mistakes, it's important to stay informed on Texas sales tax laws and regulations and to keep detailed records of all sales and sales tax collected.

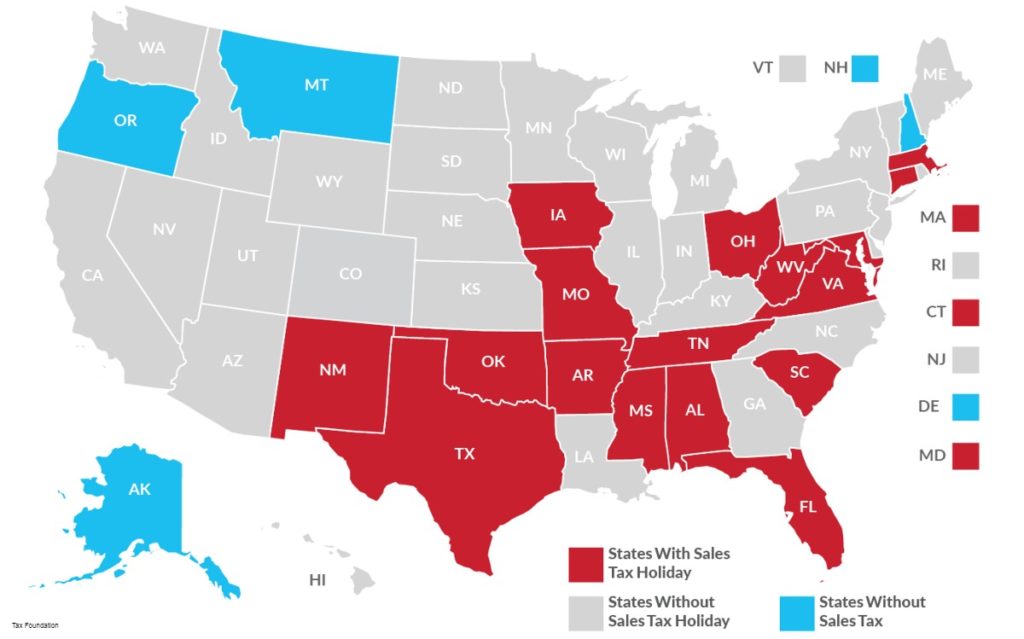

Sales Tax Holidays for Mattresses in Texas

Texas offers sales tax holidays for certain items, including clothing, school supplies, and energy-efficient appliances. However, mattresses are not included in these tax holidays.

Some cities and counties in Texas may offer their own sales tax holidays, so it's important to check with your local government to see if mattresses are exempt from sales tax during these events.

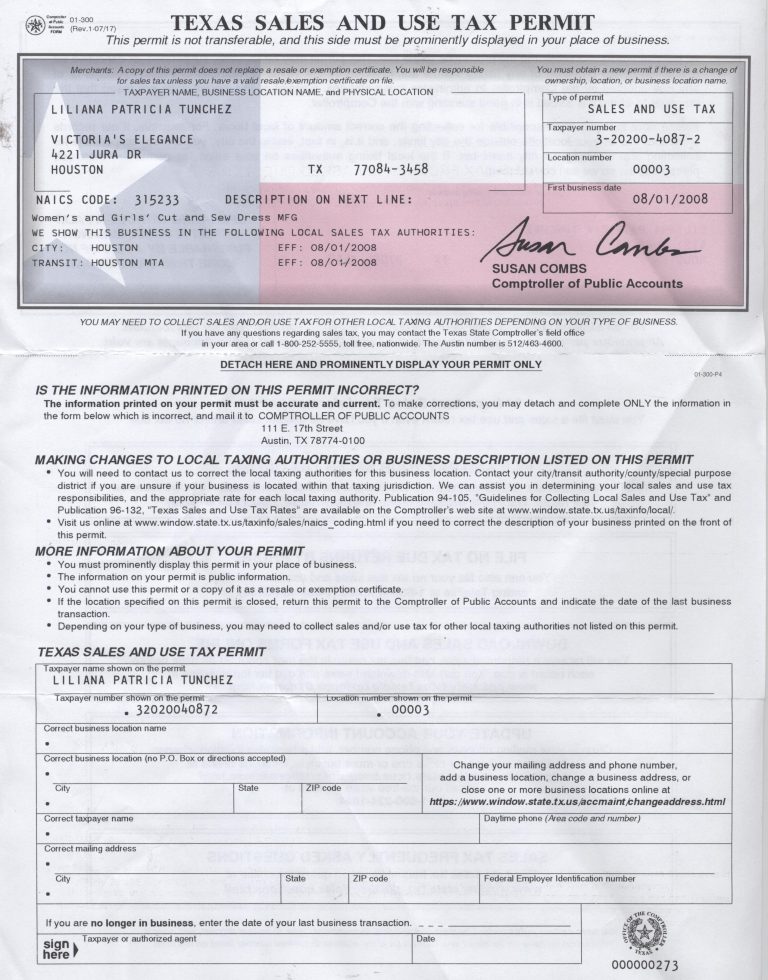

How to Register for a Sales Tax Permit in Texas for Mattress Sales

If you plan to sell mattresses in Texas, you'll need to register for a sales tax permit with the Texas Comptroller's office. Here's how:

- Visit the Texas Comptroller's website and click on the "Apply for a Sales Tax Permit" link.

- Follow the prompts to create an account and complete the application.

- Once your application is approved, you'll receive your sales tax permit in the mail.

It's important to display your sales tax permit prominently in your place of business and to keep it up-to-date to avoid any penalties or fines.

The Impact of Sales Tax on Mattresses in Texas

Understanding the Sales Tax on Mattresses

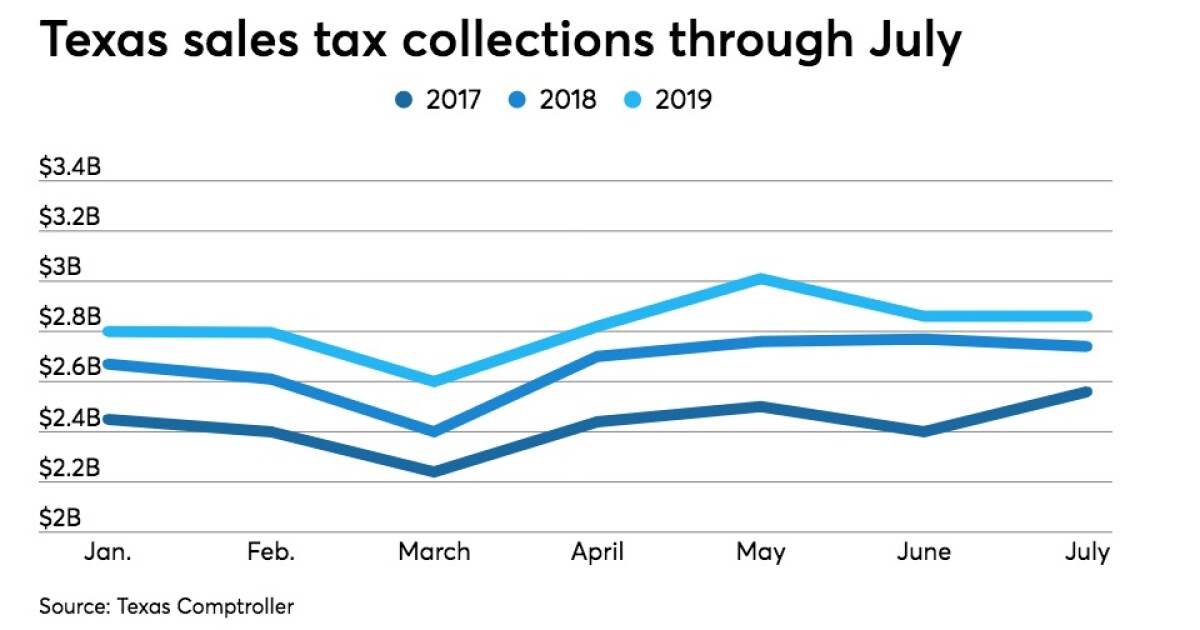

When it comes to purchasing a new mattress, many people are unaware of the additional cost that comes with the sales tax. In Texas, the sales tax rate for mattresses is 6.25%. This means that for every $100 spent on a mattress, an extra $6.25 will be added on top of the retail price. While this may not seem like a significant amount, it can add up, especially when purchasing a higher-priced mattress. It is essential for consumers to understand the impact of sales tax on mattresses and how it can affect their budget.

When it comes to purchasing a new mattress, many people are unaware of the additional cost that comes with the sales tax. In Texas, the sales tax rate for mattresses is 6.25%. This means that for every $100 spent on a mattress, an extra $6.25 will be added on top of the retail price. While this may not seem like a significant amount, it can add up, especially when purchasing a higher-priced mattress. It is essential for consumers to understand the impact of sales tax on mattresses and how it can affect their budget.

The Purpose of Sales Tax

Sales tax is a form of consumption tax that is applied to the sale of goods and services. It is collected by the state government and helps fund public services such as education, transportation, and healthcare. The purpose of sales tax is to generate revenue for the state and to distribute the burden of taxation more evenly among its residents. In Texas, the sales tax on mattresses is used to fund various state programs and services that benefit its citizens.

Sales tax is a form of consumption tax that is applied to the sale of goods and services. It is collected by the state government and helps fund public services such as education, transportation, and healthcare. The purpose of sales tax is to generate revenue for the state and to distribute the burden of taxation more evenly among its residents. In Texas, the sales tax on mattresses is used to fund various state programs and services that benefit its citizens.

The Impact on Consumers

While the sales tax on mattresses may seem like a small amount, it can have a significant impact on consumers. For those on a tight budget, the additional cost can make it challenging to afford a comfortable and supportive mattress. This can lead to individuals settling for lower quality mattresses or delaying the purchase altogether. Furthermore, the sales tax on mattresses can also affect the affordability of other essential household items, as the cost of living continues to rise.

While the sales tax on mattresses may seem like a small amount, it can have a significant impact on consumers. For those on a tight budget, the additional cost can make it challenging to afford a comfortable and supportive mattress. This can lead to individuals settling for lower quality mattresses or delaying the purchase altogether. Furthermore, the sales tax on mattresses can also affect the affordability of other essential household items, as the cost of living continues to rise.

Ways to Save on Sales Tax

Fortunately, there are ways to save on the sales tax when purchasing a new mattress in Texas. Many mattress retailers offer promotions and discounts that can help offset the cost of the sales tax. Some retailers also offer tax-free weekends, where sales tax is waived on certain items, including mattresses. Additionally, purchasing a mattress online may also help save on sales tax, as some online retailers do not charge sales tax in Texas.

In conclusion,

the sales tax on mattresses in Texas is an additional cost that consumers should be aware of when shopping for a new mattress. Understanding the purpose of sales tax and its impact on the budget can help individuals make informed decisions when making a purchase. By exploring different options and taking advantage of promotions and discounts, consumers can save on the sales tax and afford a comfortable and supportive mattress for their home.

Fortunately, there are ways to save on the sales tax when purchasing a new mattress in Texas. Many mattress retailers offer promotions and discounts that can help offset the cost of the sales tax. Some retailers also offer tax-free weekends, where sales tax is waived on certain items, including mattresses. Additionally, purchasing a mattress online may also help save on sales tax, as some online retailers do not charge sales tax in Texas.

In conclusion,

the sales tax on mattresses in Texas is an additional cost that consumers should be aware of when shopping for a new mattress. Understanding the purpose of sales tax and its impact on the budget can help individuals make informed decisions when making a purchase. By exploring different options and taking advantage of promotions and discounts, consumers can save on the sales tax and afford a comfortable and supportive mattress for their home.

/cloudfront-us-east-1.images.arcpublishing.com/gray/5YXZBGUB2JOFHMEMQXP2BPHUCI.jpg)

/KitchenCabinets-5a760414a9d4f90036ac0d8a.jpg)