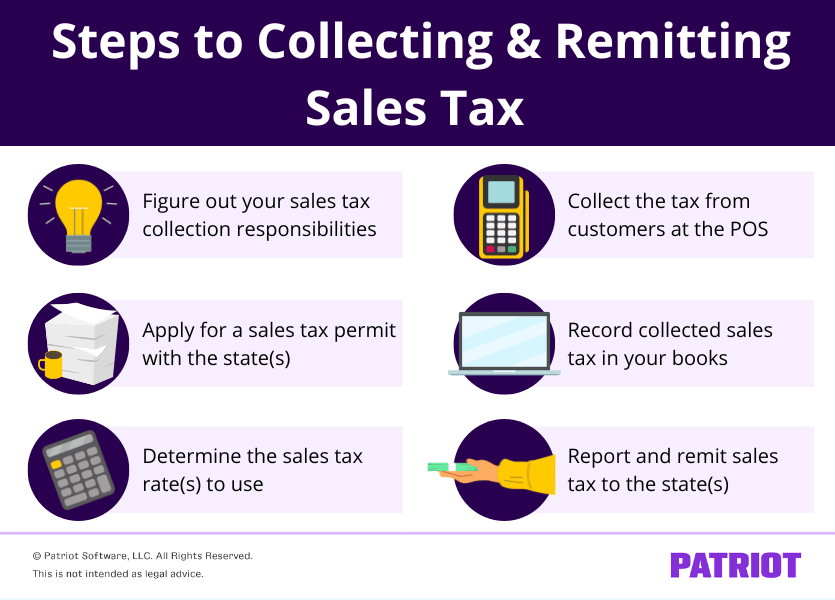

When purchasing a Purple mattress, it's important to understand the role of sales tax in the overall cost. Sales tax is a percentage added to the purchase price of goods and services, and it varies by state and even by city or municipality. In this guide, we'll break down everything you need to know about sales tax for Purple mattress purchases, including how to calculate it, state tax rates, and exemptions.Understanding Sales Tax for Purple Mattress Purchases

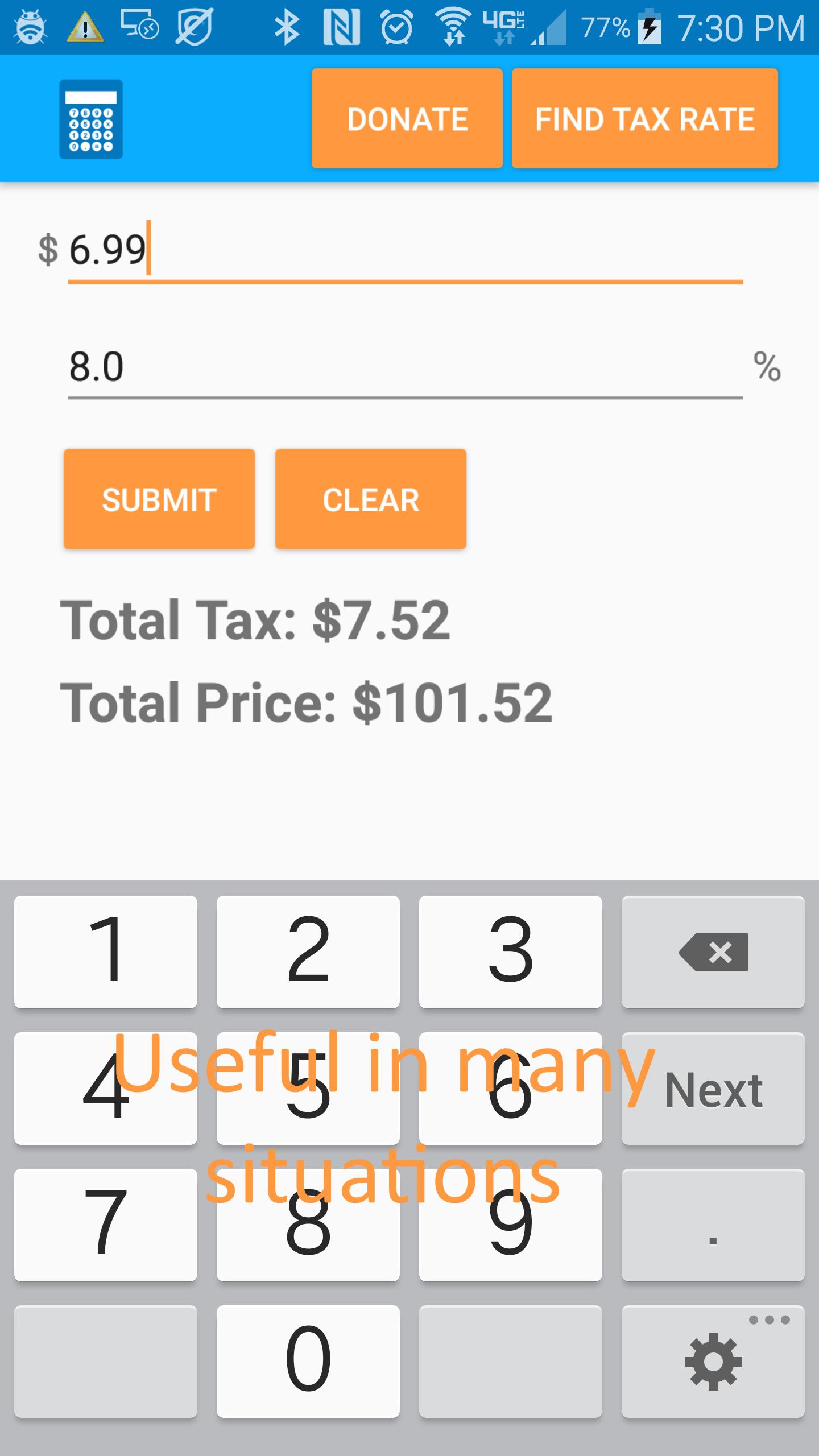

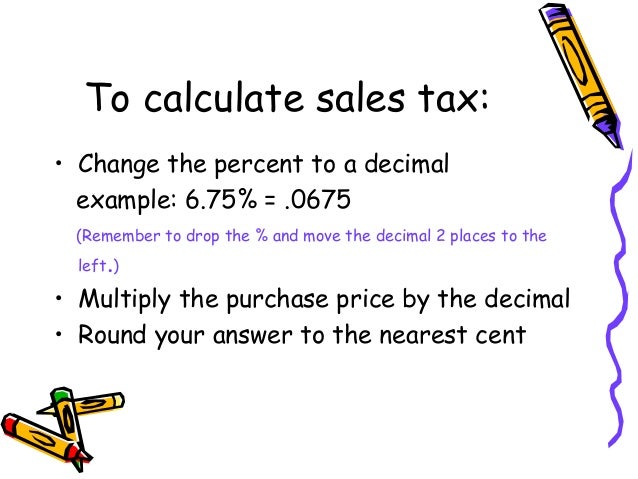

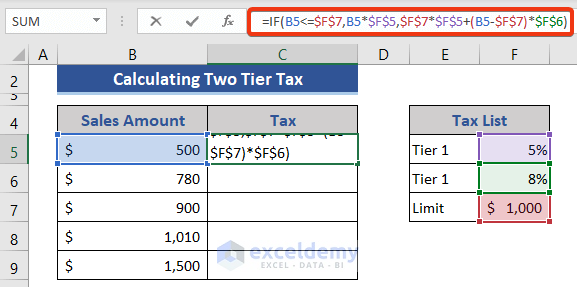

The first step in understanding sales tax for Purple mattress purchases is knowing how to calculate it. The formula is simple: purchase price x sales tax rate = total sales tax. For example, if a Purple mattress costs $1,000 and the sales tax rate is 6%, the total sales tax would be $60 ($1,000 x 0.06). Keep in mind that some states have different sales tax rates for different types of goods and services, so be sure to check the specific rate for mattresses.How to Calculate Sales Tax on a Purple Mattress

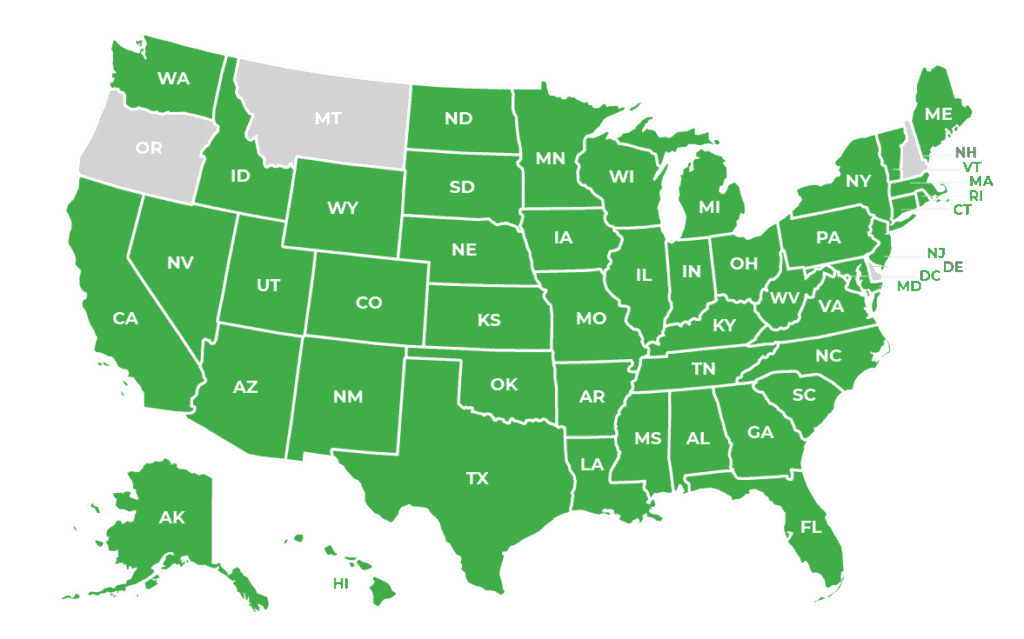

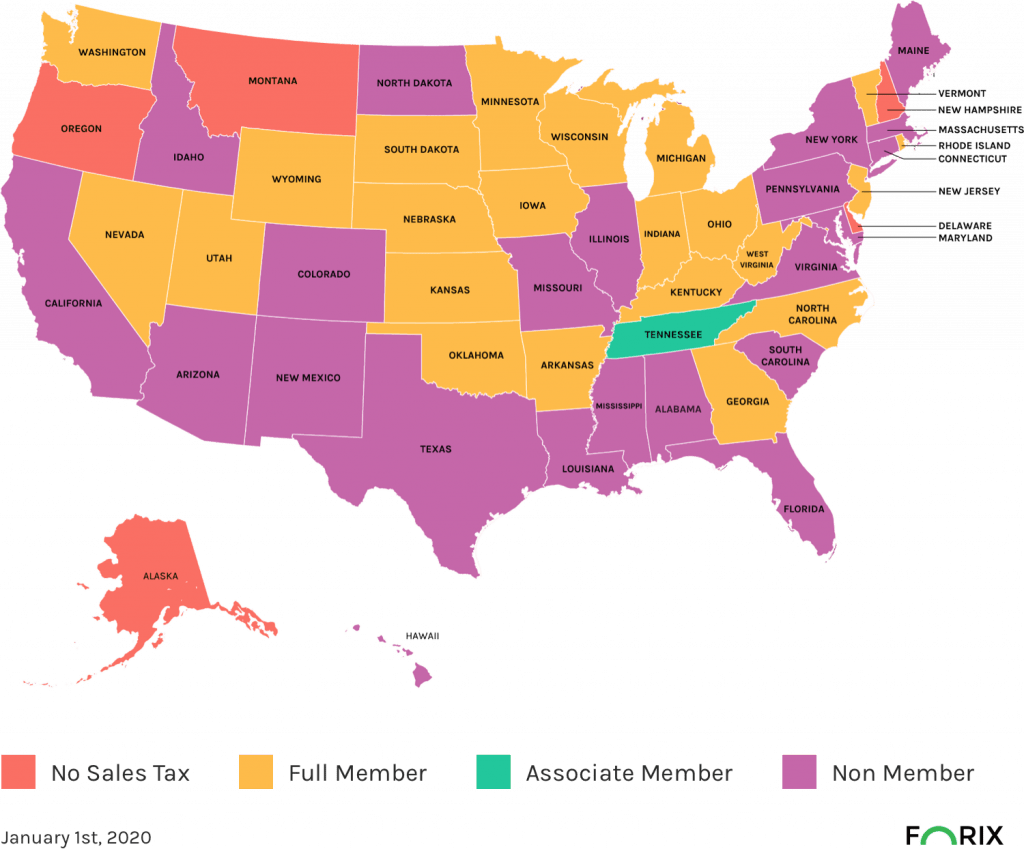

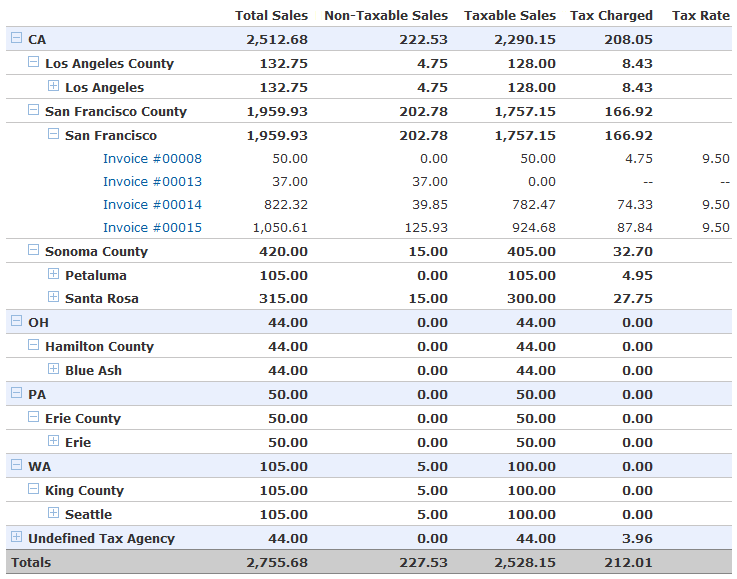

As mentioned, sales tax rates vary by state. Some states have no sales tax at all, such as Alaska, Delaware, Montana, New Hampshire, and Oregon. Other states have a state-wide sales tax rate, while some allow local municipalities to add additional sales tax on top of the state rate. It's important to research your state's specific sales tax rate before making a Purple mattress purchase.State Sales Tax Rates for Purple Mattress Purchases

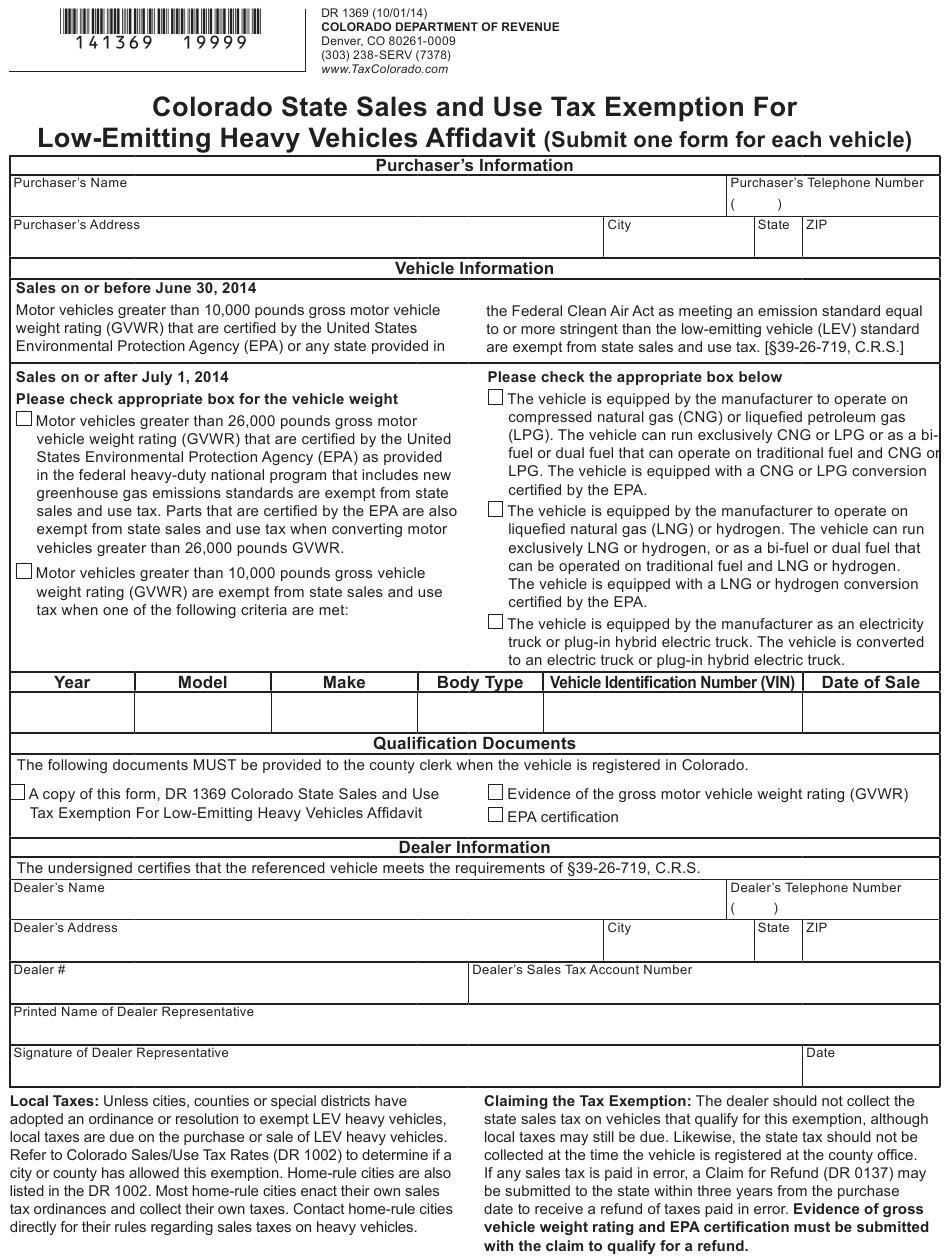

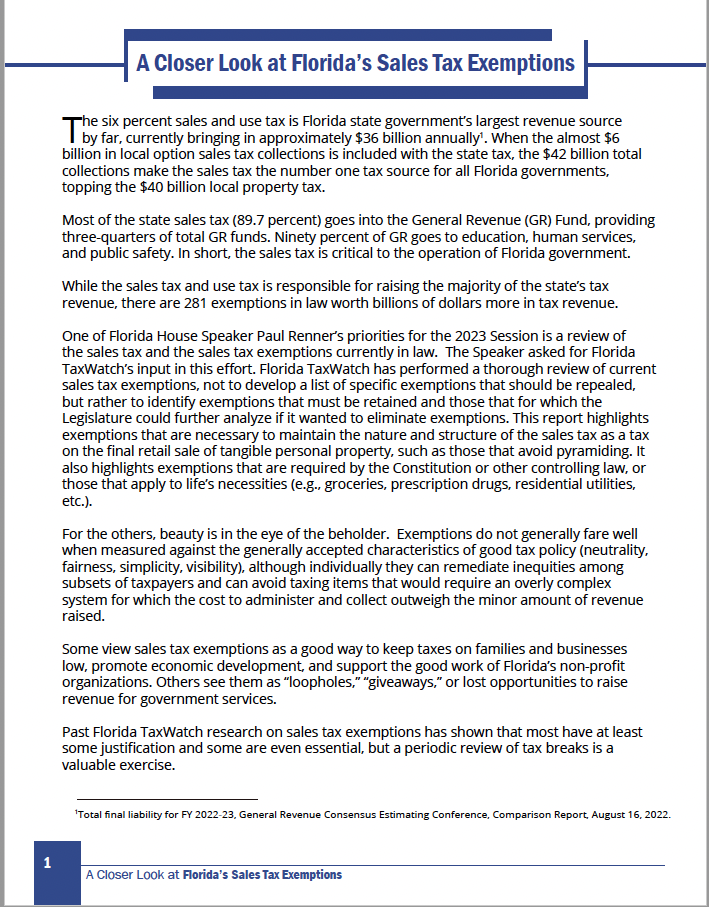

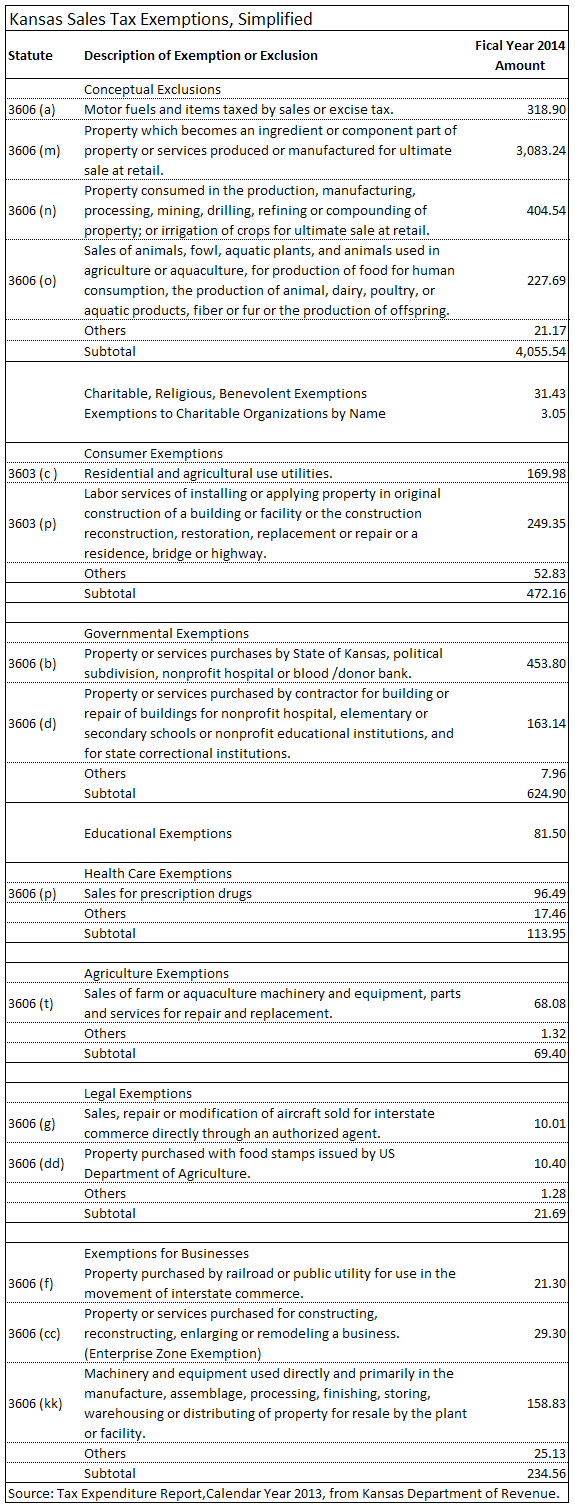

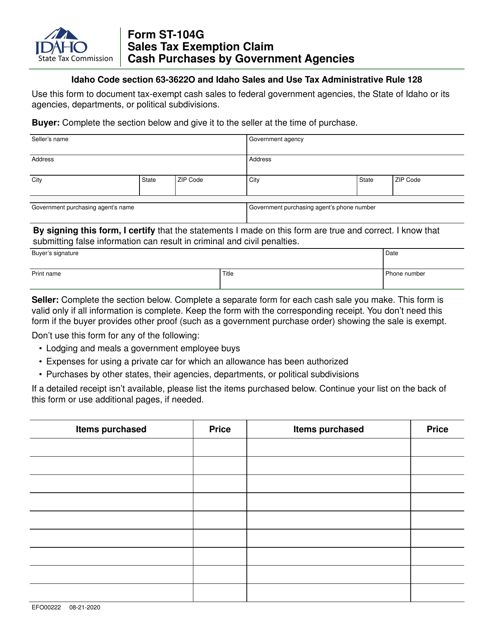

While sales tax is typically added to the purchase price of a Purple mattress, there are some exemptions that may apply. For example, if you are purchasing a Purple mattress for a medical reason, such as for a chronic back condition, you may be exempt from paying sales tax. Additionally, some states have specific exemptions for certain types of goods or services, so it's worth looking into before making your purchase.Exemptions from Sales Tax for Purple Mattress Sales

In recent years, there has been a lot of debate and changes surrounding online sales tax. In the past, online retailers were not required to charge sales tax unless they had a physical presence in the state where the purchase was being made. However, with the rise of e-commerce, many states have implemented an online sales tax, including for Purple mattress purchases made online. Be sure to check your state's laws regarding online sales tax.Online Sales Tax for Purple Mattress Purchases

While sales tax is a necessary part of most purchases, there are some ways to potentially avoid paying it on your Purple mattress. One option is to purchase from a retailer that does not have a physical presence in your state. As mentioned, this may not always be possible with the implementation of online sales tax laws, but it's worth looking into. Another option is to purchase your Purple mattress during a sales tax holiday, if your state offers them.How to Avoid Paying Sales Tax on a Purple Mattress

It's important to note that sales tax laws are subject to change at any time. This means that the sales tax rate for Purple mattress purchases may change in your state, or exemptions may be added or removed. It's important to stay up to date on your state's sales tax laws to ensure you are paying the correct amount when making a purchase.Sales Tax Laws for Purple Mattress Sales

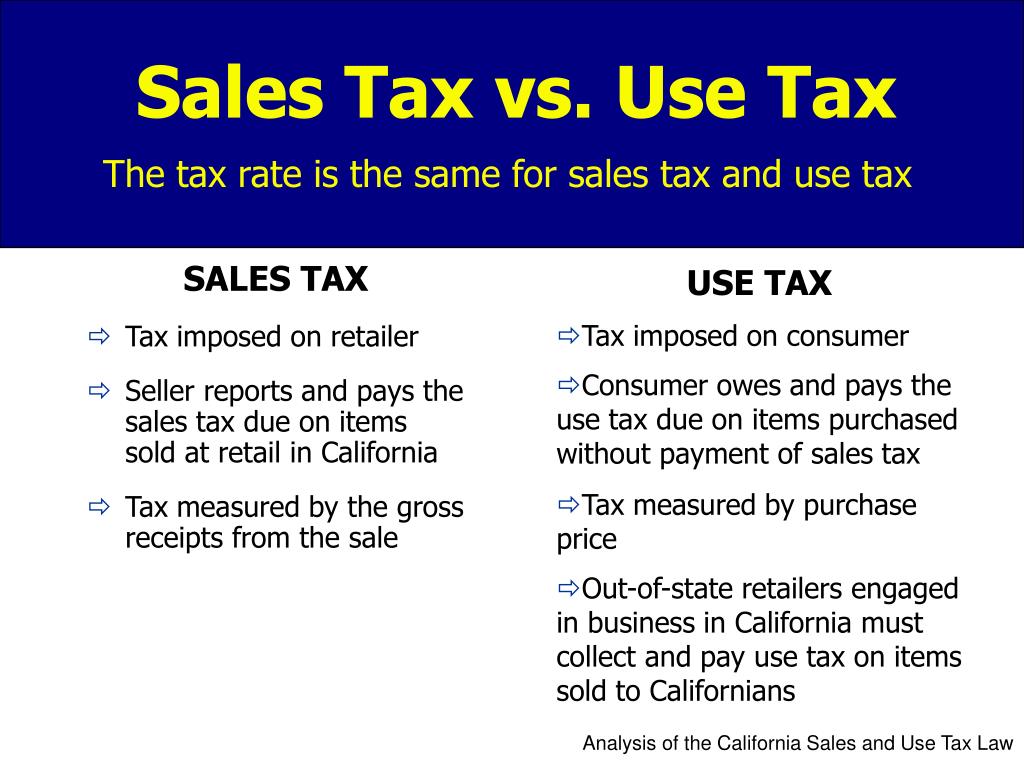

While sales tax is the most common form of tax on purchases, there is also a tax called use tax that may apply to your Purple mattress purchase. Use tax is a tax on goods and services purchased out of state or online, and it is meant to make up for the sales tax that would have been paid if the purchase was made in-state. However, use tax rates are typically the same as sales tax rates, so you won't be paying more by purchasing out of state.Understanding Use Tax for Purple Mattress Purchases

So, which tax applies to your Purple mattress purchase? In most cases, it will be sales tax, as it is the more common form of tax. However, if you purchase your Purple mattress from an out-of-state retailer that does not charge sales tax, you may be responsible for paying use tax on the purchase. As always, it's important to research and understand your state's specific tax laws.Sales Tax vs. Use Tax for Purple Mattress Sales

Once you have made your Purple mattress purchase and have paid the applicable sales tax, you may be wondering how to report it. In most cases, sales tax will be automatically added to your purchase and you won't need to worry about reporting it. However, if you purchase from an out-of-state retailer that does not charge sales tax, you will need to report and pay the use tax on your state tax return. Understanding sales tax for Purple mattress purchases is important to ensure you are paying the correct amount and not overpaying. Be sure to research your state's specific laws and rates, and don't hesitate to reach out to a tax professional if you have any questions or concerns. Happy mattress shopping!How to Report Sales Tax on a Purple Mattress Purchase

The Benefits of Purple Mattress Sales Tax

Why Paying Sales Tax on a Purple Mattress is Worth It

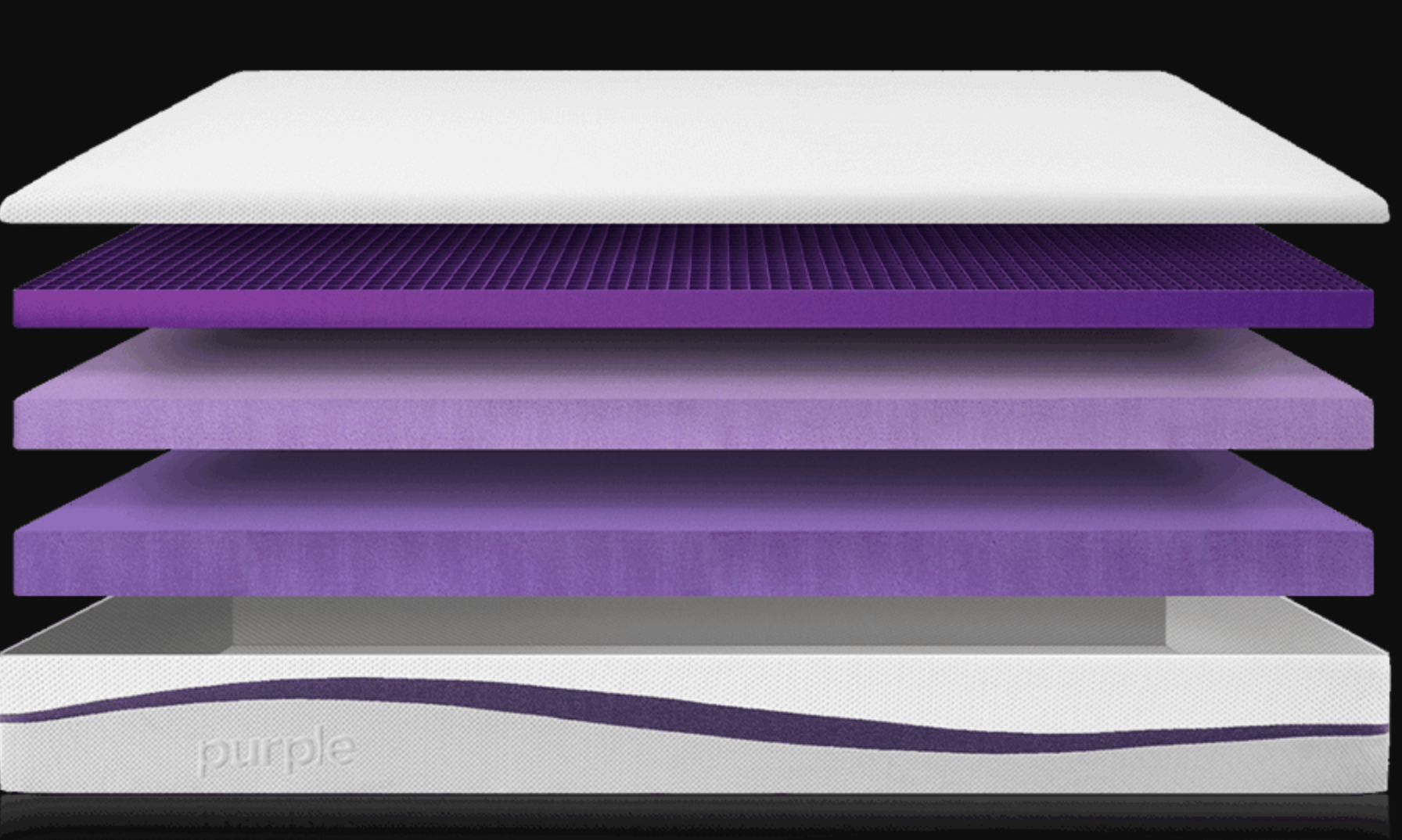

Purple mattresses have become increasingly popular in recent years due to their unique construction and ability to provide a comfortable and supportive sleep experience. However, one aspect that often gets overlooked is the sales tax associated with purchasing a Purple mattress. While some may see this as an extra expense, there are actually many benefits to paying sales tax on a Purple mattress. In this article, we will explore the advantages of paying sales tax on a Purple mattress and why it is worth the investment.

1. Supports Local Economy

One of the main reasons why paying sales tax on a Purple mattress is beneficial is because it supports the local economy. When you purchase a Purple mattress, a portion of the sales tax goes towards funding public services, such as schools, roads, and emergency services in your community. This helps to create jobs and improve the overall well-being of your community. By paying sales tax on your Purple mattress, you are contributing to the growth and development of your local economy.

2. Compliance with State Laws

Another benefit of paying sales tax on a Purple mattress is that it ensures compliance with state laws. Each state has its own set of tax laws, and failing to pay the proper sales tax can result in penalties and fines. By purchasing a Purple mattress and paying the associated sales tax, you are following the law and avoiding any potential legal issues.

3. Quality Assurance

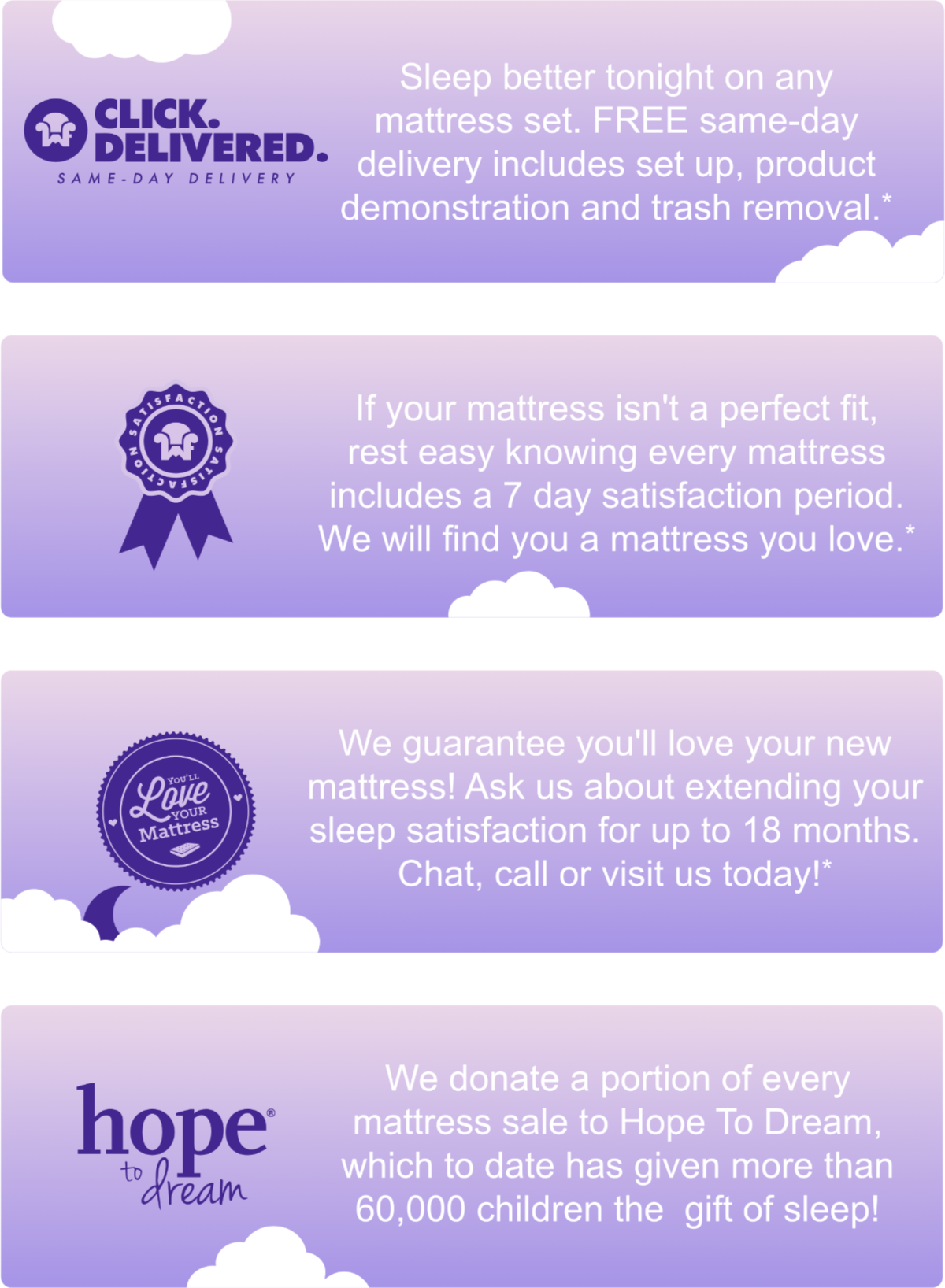

Paying sales tax on a Purple mattress also provides a sense of assurance in terms of quality. In order for a company to charge sales tax, they must have a physical presence in the state. This means that Purple has a physical location in your state, allowing you to easily reach out to them in case of any issues with your mattress. This not only provides peace of mind, but also ensures that you are getting a quality product from a reputable company.

4. Warranty Coverage

In addition to quality assurance, paying sales tax on a Purple mattress also provides warranty coverage. In most cases, warranties are only valid if the product was purchased from an authorized retailer and sales tax was paid. By paying sales tax on your Purple mattress, you are ensuring that your warranty will be honored in case of any defects or issues with your mattress.

5. Investment in Your Sleep Health

Finally, paying sales tax on a Purple mattress is an investment in your sleep health. A good night's sleep is essential for overall well-being and productivity. By purchasing a high-quality mattress like Purple and paying the associated sales tax, you are investing in your sleep health and ensuring that you get the best possible rest every night.

In conclusion, while paying sales tax on a Purple mattress may seem like an extra expense, it actually comes with many benefits. Not only does it support the local economy and ensure compliance with state laws, but it also provides quality assurance, warranty coverage, and is an investment in your sleep health. So the next time you are considering purchasing a Purple mattress, remember the benefits of paying sales tax and make the investment in your well-being.

Purple mattresses have become increasingly popular in recent years due to their unique construction and ability to provide a comfortable and supportive sleep experience. However, one aspect that often gets overlooked is the sales tax associated with purchasing a Purple mattress. While some may see this as an extra expense, there are actually many benefits to paying sales tax on a Purple mattress. In this article, we will explore the advantages of paying sales tax on a Purple mattress and why it is worth the investment.

1. Supports Local Economy

One of the main reasons why paying sales tax on a Purple mattress is beneficial is because it supports the local economy. When you purchase a Purple mattress, a portion of the sales tax goes towards funding public services, such as schools, roads, and emergency services in your community. This helps to create jobs and improve the overall well-being of your community. By paying sales tax on your Purple mattress, you are contributing to the growth and development of your local economy.

2. Compliance with State Laws

Another benefit of paying sales tax on a Purple mattress is that it ensures compliance with state laws. Each state has its own set of tax laws, and failing to pay the proper sales tax can result in penalties and fines. By purchasing a Purple mattress and paying the associated sales tax, you are following the law and avoiding any potential legal issues.

3. Quality Assurance

Paying sales tax on a Purple mattress also provides a sense of assurance in terms of quality. In order for a company to charge sales tax, they must have a physical presence in the state. This means that Purple has a physical location in your state, allowing you to easily reach out to them in case of any issues with your mattress. This not only provides peace of mind, but also ensures that you are getting a quality product from a reputable company.

4. Warranty Coverage

In addition to quality assurance, paying sales tax on a Purple mattress also provides warranty coverage. In most cases, warranties are only valid if the product was purchased from an authorized retailer and sales tax was paid. By paying sales tax on your Purple mattress, you are ensuring that your warranty will be honored in case of any defects or issues with your mattress.

5. Investment in Your Sleep Health

Finally, paying sales tax on a Purple mattress is an investment in your sleep health. A good night's sleep is essential for overall well-being and productivity. By purchasing a high-quality mattress like Purple and paying the associated sales tax, you are investing in your sleep health and ensuring that you get the best possible rest every night.

In conclusion, while paying sales tax on a Purple mattress may seem like an extra expense, it actually comes with many benefits. Not only does it support the local economy and ensure compliance with state laws, but it also provides quality assurance, warranty coverage, and is an investment in your sleep health. So the next time you are considering purchasing a Purple mattress, remember the benefits of paying sales tax and make the investment in your well-being.