Steinhoff International

Steinhoff International, a South African company, made headlines in the retail world when it acquired Mattress Firm, one of the largest mattress retailers in the United States. This acquisition was a major move for both companies and had a significant impact on the stock market and the retail industry as a whole. Let's take a closer look at what led to this merger and what it means for the future of both companies.

Mattress Firm

Mattress Firm was founded in 1986 and quickly became one of the top players in the mattress industry. With over 3,500 stores nationwide, it was known for its extensive selection of mattresses and competitive pricing. However, in recent years, the company has been struggling with financial troubles and bankruptcy rumors. This led to a decline in sales and a decrease in its stock value, making it an ideal target for an acquisition.

Acquisition

In September 2016, Steinhoff International announced its acquisition of Mattress Firm for $2.4 billion, making it one of the largest retail deals of the year. This move was seen as a strategic decision by Steinhoff to expand its presence in the United States and gain a foothold in the highly competitive mattress market. The acquisition was completed in November 2016, with Steinhoff taking control of Mattress Firm's operations.

Retail

The retail industry is constantly evolving, and companies are constantly looking for ways to stay ahead of the competition. The acquisition of Mattress Firm by Steinhoff was a prime example of this. By joining forces, both companies could leverage their strengths and resources to create a stronger and more competitive retail entity. This move was also seen as a way for Steinhoff to diversify its portfolio and reduce its reliance on the South African market.

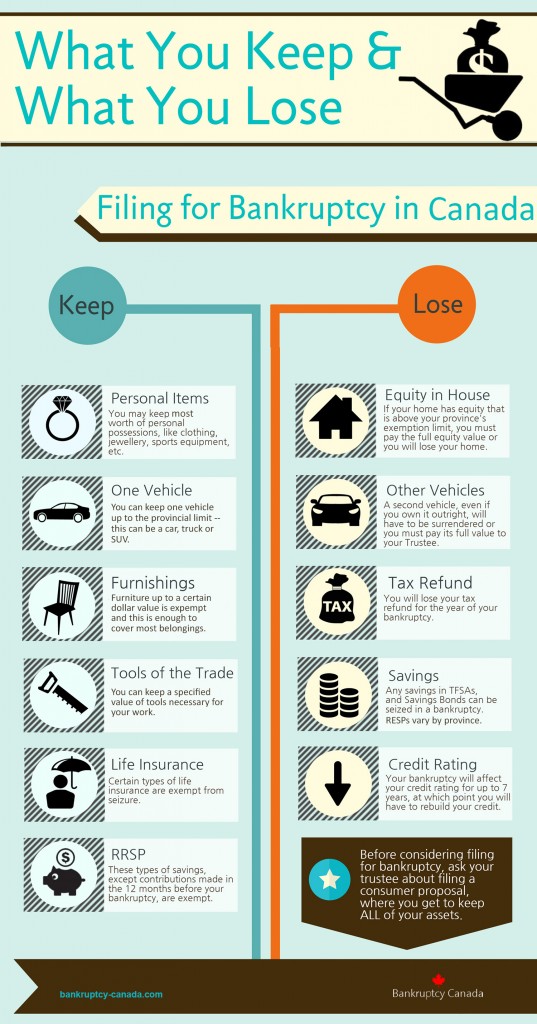

Bankruptcy

Before the acquisition, Mattress Firm was facing financial troubles and was on the brink of bankruptcy. This was mainly due to the stiff competition from online retailers and other brick-and-mortar stores offering similar products at lower prices. The acquisition by Steinhoff provided Mattress Firm with the much-needed financial stability and support to navigate through its bankruptcy and emerge as a stronger company.

Financial Troubles

The financial troubles faced by Mattress Firm were not solely due to competition. The company had also been facing issues with its supply chain and inventory management, leading to excess stock and a decrease in profit margins. With the resources and expertise of Steinhoff, Mattress Firm was able to address these issues and improve its financial standing.

South African Company

Steinhoff International is a South African company and one of the largest retailers in Africa. Its decision to acquire Mattress Firm was a strategic move to expand its presence in the United States and gain access to a new market. This acquisition also helped Steinhoff to diversify its portfolio and reduce its reliance on the South African market, which was facing economic challenges at the time.

Stock Market

As with any major acquisition, the stock market had a significant reaction to the news. The announcement of the acquisition caused a spike in Mattress Firm's stock value, while Steinhoff's stock value saw a slight decline. However, as the deal was completed, Steinhoff's stock value also saw an increase, indicating investor confidence in the acquisition and its potential benefits.

Investment

The acquisition of Mattress Firm by Steinhoff was a significant investment for both companies. It allowed them to combine their resources and expertise to create a stronger and more competitive retail entity. This investment also had a ripple effect on the retail industry, with other companies looking to make similar moves to stay ahead of the competition.

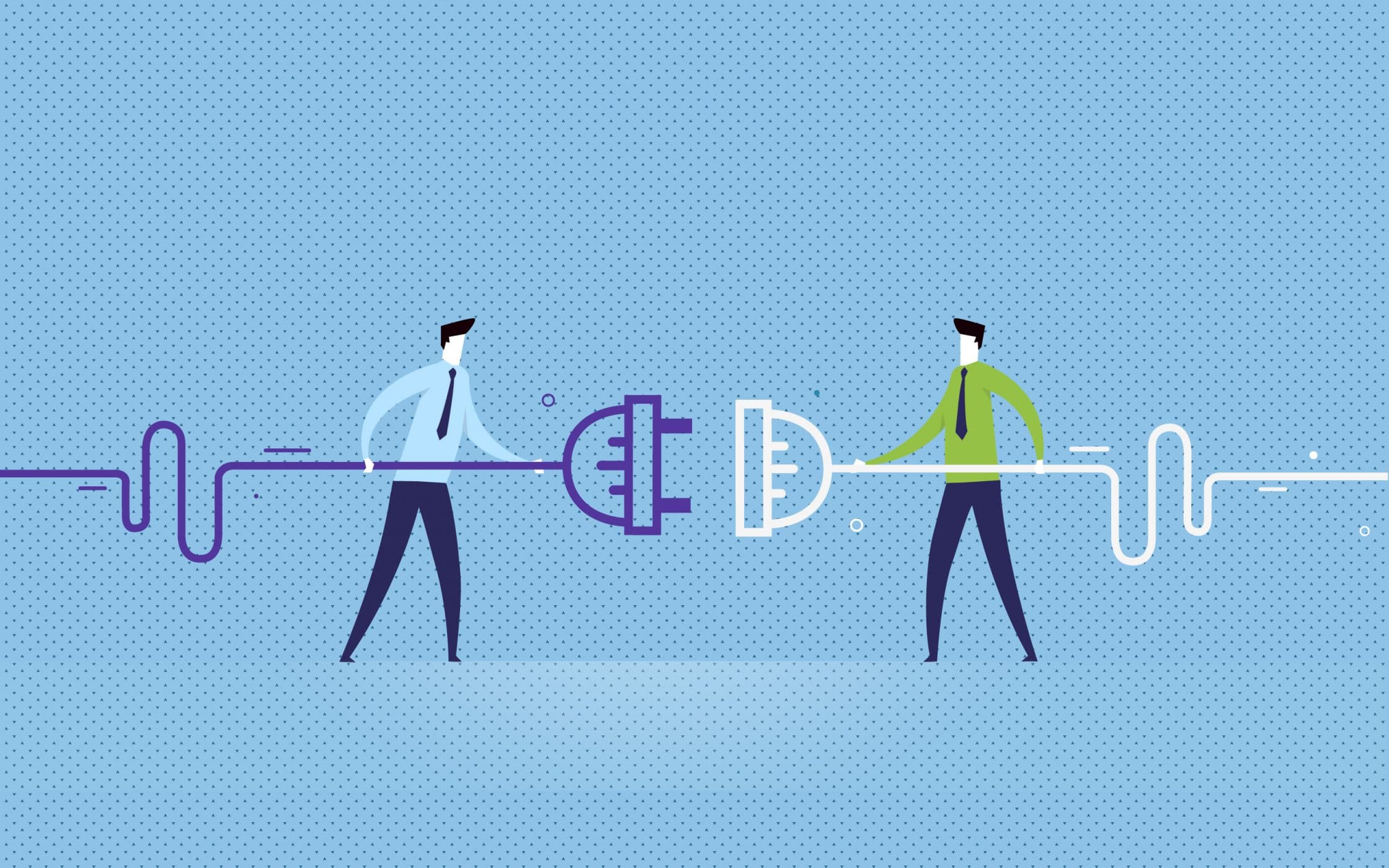

Merger

The acquisition of Mattress Firm by Steinhoff was, in essence, a merger of two major retail players. By joining forces, both companies were able to leverage their strengths and resources to create a stronger and more competitive entity. This merger also had a significant impact on the retail industry, setting the stage for more mergers and acquisitions in the future.

The Impact of the Steinhoff Acquisition on Mattress Firm

What Led to the Acquisition?

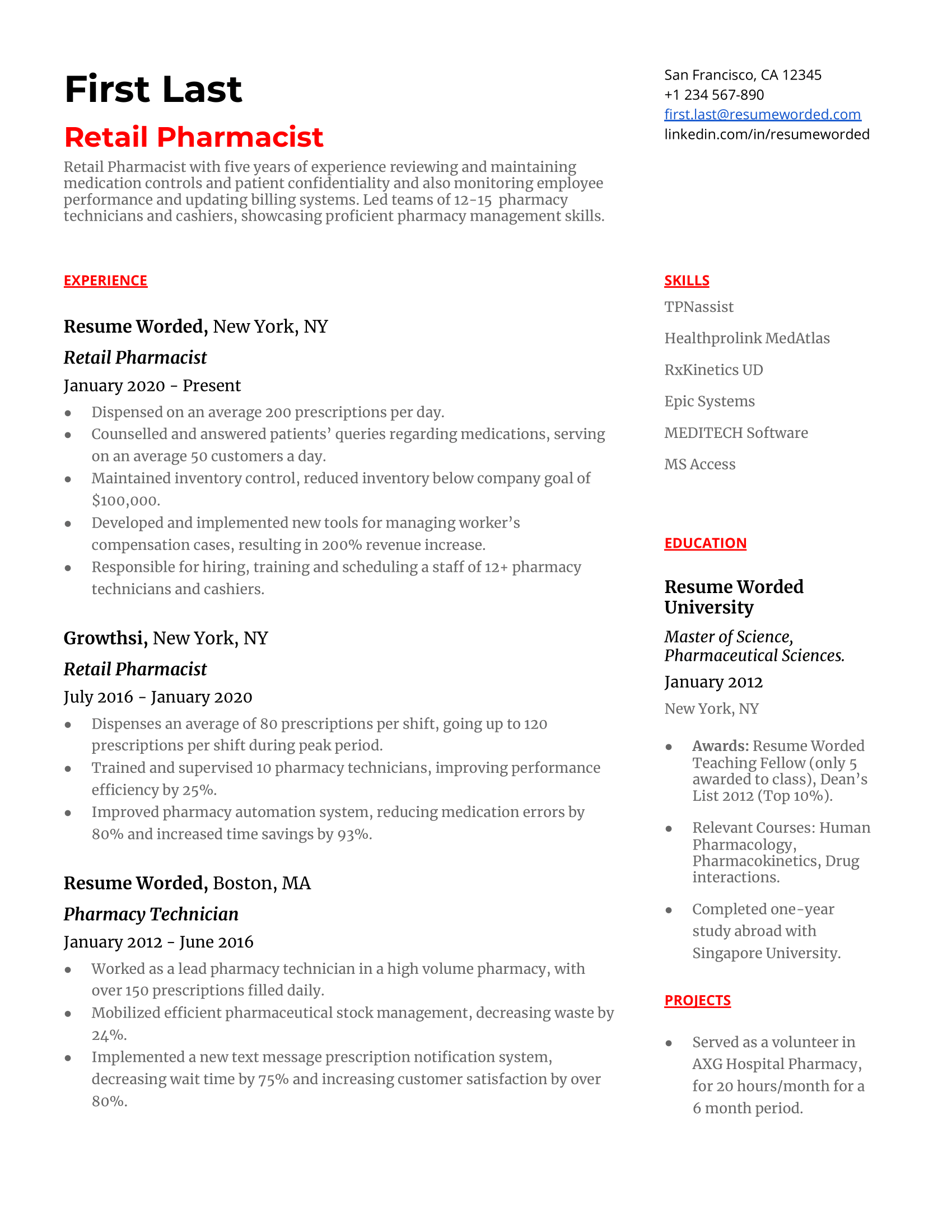

In 2016, European retail giant Steinhoff International Holdings NV acquired Mattress Firm, the largest mattress retailer in the United States. This acquisition was a result of Steinhoff's strategy to expand its presence in the American market and diversify its product offerings. Mattress Firm, on the other hand, was struggling financially due to increased competition from online retailers and a decline in brick-and-mortar sales. The acquisition was seen as a lifeline for Mattress Firm, with the company's CEO stating that it would provide the resources needed for them to continue to grow and thrive in the industry.

In 2016, European retail giant Steinhoff International Holdings NV acquired Mattress Firm, the largest mattress retailer in the United States. This acquisition was a result of Steinhoff's strategy to expand its presence in the American market and diversify its product offerings. Mattress Firm, on the other hand, was struggling financially due to increased competition from online retailers and a decline in brick-and-mortar sales. The acquisition was seen as a lifeline for Mattress Firm, with the company's CEO stating that it would provide the resources needed for them to continue to grow and thrive in the industry.

What Does This Mean for Mattress Firm?

The acquisition by Steinhoff has brought about significant changes for Mattress Firm. One of the main changes is the introduction of new products and brands to their stores. Steinhoff's portfolio includes various furniture and household brands, and these are now being integrated into Mattress Firm's stores. This allows customers to not only buy mattresses but also other furniture and household items, making Mattress Firm a one-stop-shop for all their home needs.

Furthermore, the acquisition has also led to changes in the company's operations and marketing strategies. Mattress Firm is now able to take advantage of Steinhoff's global supply chain, resulting in improved efficiency and cost savings. The company has also rebranded its stores, giving them a modern and updated look to attract more customers.

The acquisition by Steinhoff has brought about significant changes for Mattress Firm. One of the main changes is the introduction of new products and brands to their stores. Steinhoff's portfolio includes various furniture and household brands, and these are now being integrated into Mattress Firm's stores. This allows customers to not only buy mattresses but also other furniture and household items, making Mattress Firm a one-stop-shop for all their home needs.

Furthermore, the acquisition has also led to changes in the company's operations and marketing strategies. Mattress Firm is now able to take advantage of Steinhoff's global supply chain, resulting in improved efficiency and cost savings. The company has also rebranded its stores, giving them a modern and updated look to attract more customers.

The Future of Mattress Firm

With Steinhoff's financial backing and resources, Mattress Firm is in a much better position to compete in the ever-evolving mattress industry. The company is now able to offer a wider range of products and services, making it more appealing to customers. It also has the financial stability to weather any future challenges and continue to grow and expand its reach in the market.

In conclusion, the acquisition of Mattress Firm by Steinhoff has had a significant impact on the company. It has provided a much-needed boost for the struggling retailer and positioned them for future success. With the integration of new products, improved operations, and a strong financial backing, Mattress Firm is now better equipped to meet the demands of the ever-changing market and provide customers with a diverse and satisfying shopping experience.

With Steinhoff's financial backing and resources, Mattress Firm is in a much better position to compete in the ever-evolving mattress industry. The company is now able to offer a wider range of products and services, making it more appealing to customers. It also has the financial stability to weather any future challenges and continue to grow and expand its reach in the market.

In conclusion, the acquisition of Mattress Firm by Steinhoff has had a significant impact on the company. It has provided a much-needed boost for the struggling retailer and positioned them for future success. With the integration of new products, improved operations, and a strong financial backing, Mattress Firm is now better equipped to meet the demands of the ever-changing market and provide customers with a diverse and satisfying shopping experience.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/6OMQPRJJWUD64DEUIZI5Y3CA6Q.jpg)

:max_bytes(150000):strip_icc()/mergersandacquisitions-ef12384a42704419beaf9c960c5f1354.jpg)

:max_bytes(150000):strip_icc()/merger-4192955-175cc5ac5e73455a833807739955b48a.jpg)