If you're in the market for a new mattress and need financing options, the Mattress Firm credit card may be a great option for you. With this card, you can take advantage of special financing offers for up to 48 months on select purchases, making it easier to afford that perfect mattress. The Mattress Firm credit card is a store credit card, meaning it can only be used at Mattress Firm locations. This can be a downside for some, but if you're a frequent shopper at Mattress Firm, it can be a great way to save money and build your credit. With the Mattress Firm credit card, you can also earn rewards for your purchases. For every $1 you spend at Mattress Firm, you'll earn 5 points. Once you reach 1,000 points, you can redeem them for a $10 reward certificate to use towards future purchases.1. Mattress Firm Credit Card

Aside from the Mattress Firm credit card, there are other financing options available for those looking to purchase a new mattress. Mattress Firm offers a variety of financing plans through third-party financing companies, such as Synchrony and Progressive Leasing. These financing options may have different terms and interest rates compared to the Mattress Firm credit card, so it's important to research and compare before making a decision. Some may require a down payment or have different payment schedules, so be sure to read the fine print. Additionally, some Mattress Firm locations may offer layaway programs, allowing you to make payments towards your mattress over a certain period of time. This can be a great option for those who may not qualify for financing or prefer to pay off their purchase over time without accruing interest.2. Financing Options for Mattress Firm

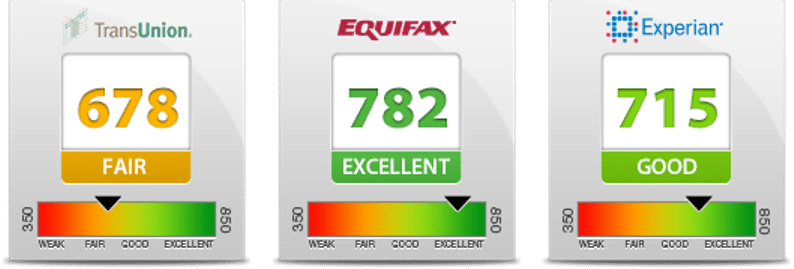

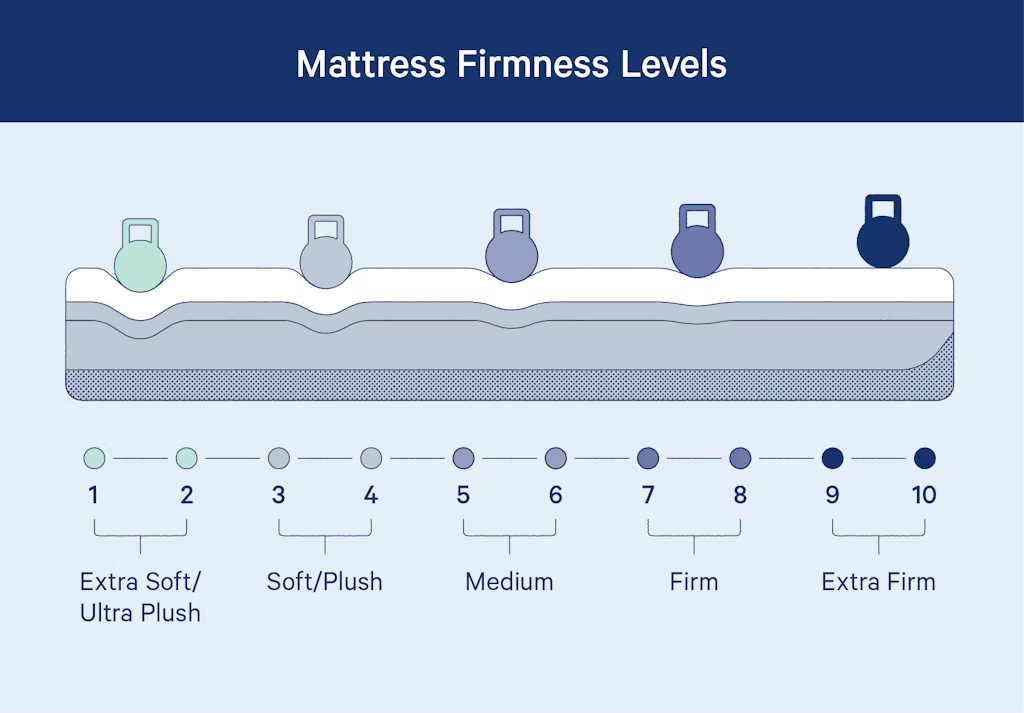

When it comes to financing, your credit score plays a crucial role in determining your eligibility and interest rates. For the Mattress Firm credit card, a minimum credit score of 600 is typically required, but it may vary depending on the financing company. If your credit score falls below 600, you may still be able to qualify for financing through third-party companies, but you may be subject to higher interest rates. It's important to check with the specific financing company for their credit score requirements. Keep in mind that even if you have a low credit score, it's still worth applying for financing as you may be approved or have the opportunity to improve your credit through responsible payments.3. Credit Score Requirements for Mattress Firm Financing

If you have a low or poor credit score, you may still be able to qualify for financing at Mattress Firm. As mentioned, third-party financing companies may have more lenient credit score requirements and may offer options for those with bad credit. One option for those with bad credit is through Progressive Leasing, which offers a lease-to-own program. With this program, you can make payments towards your mattress over a period of 12-18 months and own it at the end of the lease term. Keep in mind, this option may have higher interest rates compared to traditional financing. Another option is to have a co-signer with good credit. This can increase your chances of being approved for financing and may also result in lower interest rates.4. Mattress Firm Financing with Bad Credit

When applying for financing at Mattress Firm, your approval odds will depend on various factors, including your credit score, income, and payment history. If you have a good credit score and a stable income, your chances of being approved for financing will likely be higher. However, even if you have a low credit score, you may still have a chance of being approved through alternative financing options. It's important to keep in mind that each financing company may have different approval criteria, so it's best to research and compare your options before applying.5. Mattress Firm Financing Approval Odds

The application process for financing at Mattress Firm is relatively simple and can be done in-store or online. If you choose to apply in-store, a sales associate can assist you with the process and answer any questions you may have. If you prefer to apply online, you can do so through the Mattress Firm website or through the financing company's website. You will need to provide personal information, such as your income and social security number, for the application to be processed. The approval process can take a few minutes to a few days, depending on the financing company and your credit history. Once approved, you can begin shopping for your new mattress.6. Mattress Firm Financing Application Process

The interest rates for financing at Mattress Firm will vary depending on the financing option and your credit score. The Mattress Firm credit card offers special financing offers with 0% APR for up to 48 months, but after that, the APR can range from 29.99% to 30.24%. For third-party financing options, interest rates can range from 10% to 30%, depending on your creditworthiness. It's important to read the terms and conditions carefully to understand the interest rates and how they may change over time. Remember, the higher your credit score, the lower your interest rates will likely be. If you have a low credit score, it may be worth taking the time to improve it before applying for financing.7. Mattress Firm Financing Interest Rates

When financing a mattress at Mattress Firm, you will have different payment options depending on the financing company. For the Mattress Firm credit card, you can make payments online, in-store, or through the mobile app. Third-party financing companies may offer different payment options, such as automatic withdrawals, online payments, or mailed checks. It's important to understand the payment options and choose one that works best for you. Remember, it's important to make your payments on time and in full to avoid late fees and potential damage to your credit score.8. Mattress Firm Financing Payment Options

When applying for financing at Mattress Firm, a credit check will be performed by the financing company to assess your creditworthiness. This will result in a hard inquiry on your credit report, which can temporarily lower your credit score. It's important to understand that multiple hard inquiries within a short period of time can have a negative impact on your credit score. It's best to research and compare your financing options before applying to minimize the number of hard inquiries on your credit report.9. Mattress Firm Financing Credit Check

Using financing to purchase a mattress from Mattress Firm can have both positive and negative impacts on your credit score. On one hand, making timely payments can help improve your credit score and show responsible credit management. On the other hand, missing payments or defaulting on your financing can have a negative impact on your credit score and make it difficult to qualify for credit in the future. It's important to carefully consider your financial situation and ability to make payments before choosing to finance a mattress at Mattress Firm. In conclusion, Mattress Firm offers various financing options for those looking to purchase a new mattress. Whether you have a good or bad credit score, there are options available to help make your mattress more affordable. Just be sure to do your research, understand the terms and conditions, and make responsible financial decisions to avoid any negative impact on your credit score. Sweet dreams!10. Mattress Firm Financing Credit Score Impact

Mattress Firm Financing: How Your Credit Score Can Affect Your Purchase

The Importance of a Good Credit Score

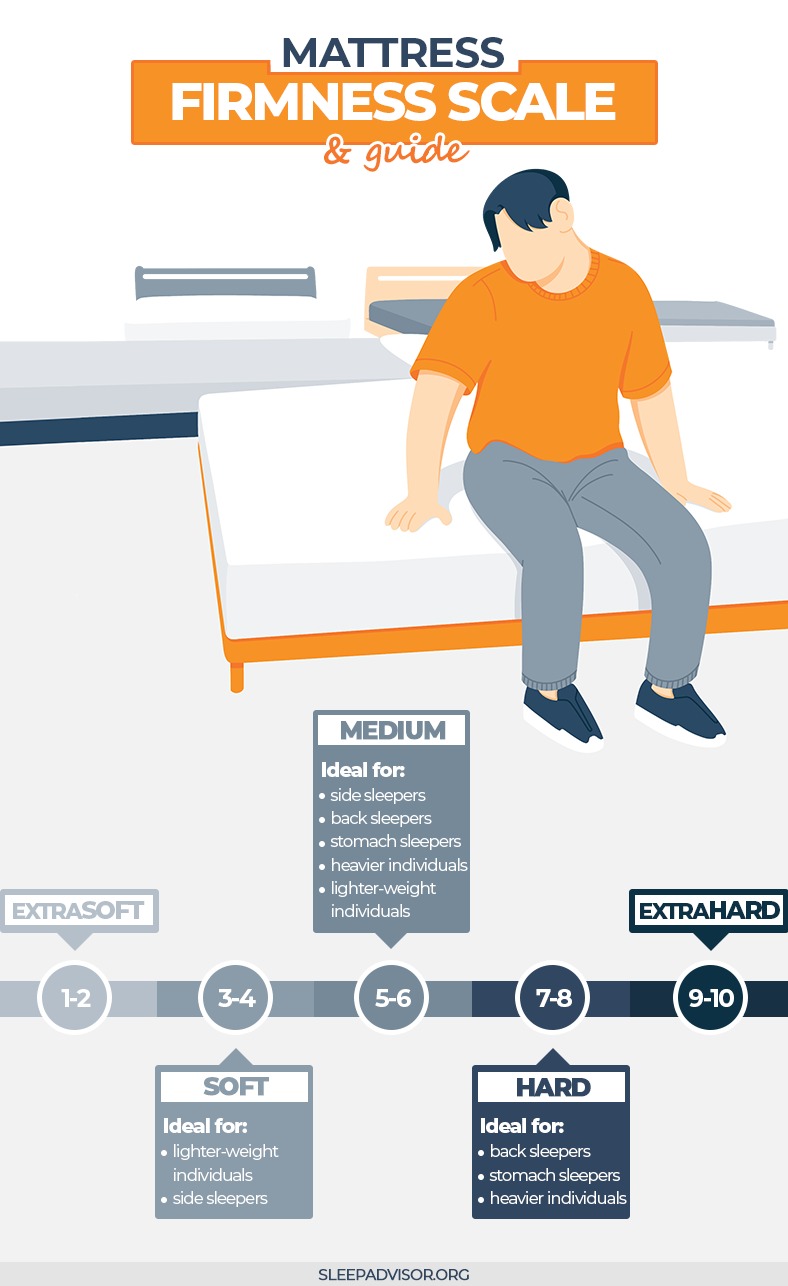

When it comes to making big purchases, such as buying a new house or a new car, our credit score plays a crucial role. But did you know that it also affects our ability to finance a mattress from a mattress firm? Yes, that's right. Your credit score can impact your chances of getting financing for a new mattress.

Credit score

is a three-digit number that represents your creditworthiness. It is based on your credit history and helps lenders determine how likely you are to repay your debts. A good credit score can open doors to better interest rates and financing options, while a poor credit score can limit your options and even lead to higher interest rates.

When it comes to making big purchases, such as buying a new house or a new car, our credit score plays a crucial role. But did you know that it also affects our ability to finance a mattress from a mattress firm? Yes, that's right. Your credit score can impact your chances of getting financing for a new mattress.

Credit score

is a three-digit number that represents your creditworthiness. It is based on your credit history and helps lenders determine how likely you are to repay your debts. A good credit score can open doors to better interest rates and financing options, while a poor credit score can limit your options and even lead to higher interest rates.

Why Does Mattress Firm Check Your Credit Score?

Financing a mattress

is a big decision, and mattress firms want to make sure that their customers are financially responsible and able to make their payments on time. By checking your credit score, they can assess your financial stability and determine if you are a low-risk borrower. This helps them decide whether or not to approve you for financing and the terms and conditions of the financing.

Financing a mattress

is a big decision, and mattress firms want to make sure that their customers are financially responsible and able to make their payments on time. By checking your credit score, they can assess your financial stability and determine if you are a low-risk borrower. This helps them decide whether or not to approve you for financing and the terms and conditions of the financing.

How Your Credit Score Affects Mattress Financing

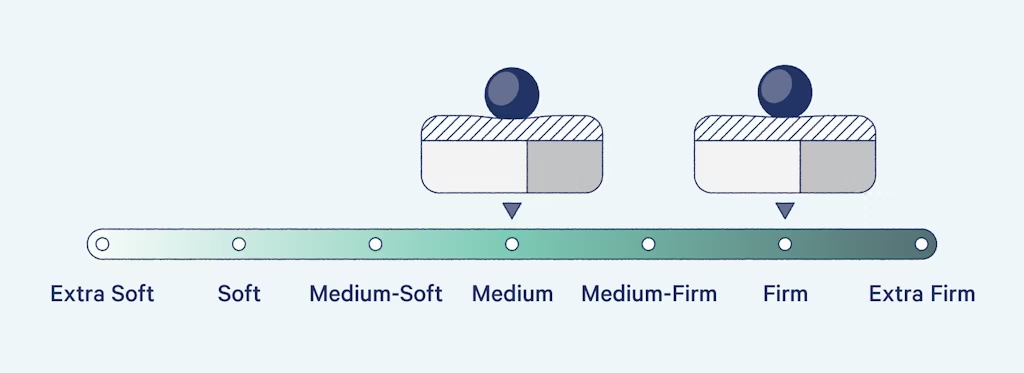

A good credit score can help you get approved for financing from a mattress firm with ease. You may also be eligible for

special financing offers

and lower interest rates, making it more affordable to purchase a high-quality mattress. On the other hand, a poor credit score can make it difficult to get approved for financing. You may have to settle for higher interest rates, which can significantly increase the overall cost of your mattress.

A good credit score can help you get approved for financing from a mattress firm with ease. You may also be eligible for

special financing offers

and lower interest rates, making it more affordable to purchase a high-quality mattress. On the other hand, a poor credit score can make it difficult to get approved for financing. You may have to settle for higher interest rates, which can significantly increase the overall cost of your mattress.

Improving Your Credit Score for Better Financing Options

If you have a less-than-ideal credit score, don't worry. There are steps you can take to improve it and increase your chances of getting better financing options from a mattress firm. Start by

checking your credit score

and identifying any errors that may be dragging it down. You can also work on paying off any outstanding debts and making sure to pay your bills on time.

If you have a less-than-ideal credit score, don't worry. There are steps you can take to improve it and increase your chances of getting better financing options from a mattress firm. Start by

checking your credit score

and identifying any errors that may be dragging it down. You can also work on paying off any outstanding debts and making sure to pay your bills on time.

Conclusion

In conclusion, your credit score plays a crucial role in your ability to finance a mattress from a mattress firm. It is important to maintain a good credit score to have access to better financing options and lower interest rates. If you have a less-than-perfect credit score, take steps to improve it, and you can enjoy a comfortable and restful night's sleep on a new mattress from a mattress firm.

In conclusion, your credit score plays a crucial role in your ability to finance a mattress from a mattress firm. It is important to maintain a good credit score to have access to better financing options and lower interest rates. If you have a less-than-perfect credit score, take steps to improve it, and you can enjoy a comfortable and restful night's sleep on a new mattress from a mattress firm.

:max_bytes(150000):strip_icc()/_hero_4109254-feathertop-5c7d415346e0fb0001a5f085.jpg)