As a Mattress Firm employee, it's important to have your W2 form in order to file your taxes correctly. But with so much information and paperwork, it can be overwhelming trying to figure out how to retrieve your W2. Luckily, we've put together a step-by-step guide to help you get your W2 from Mattress Firm with ease.How to Get Your W2 from Mattress Firm

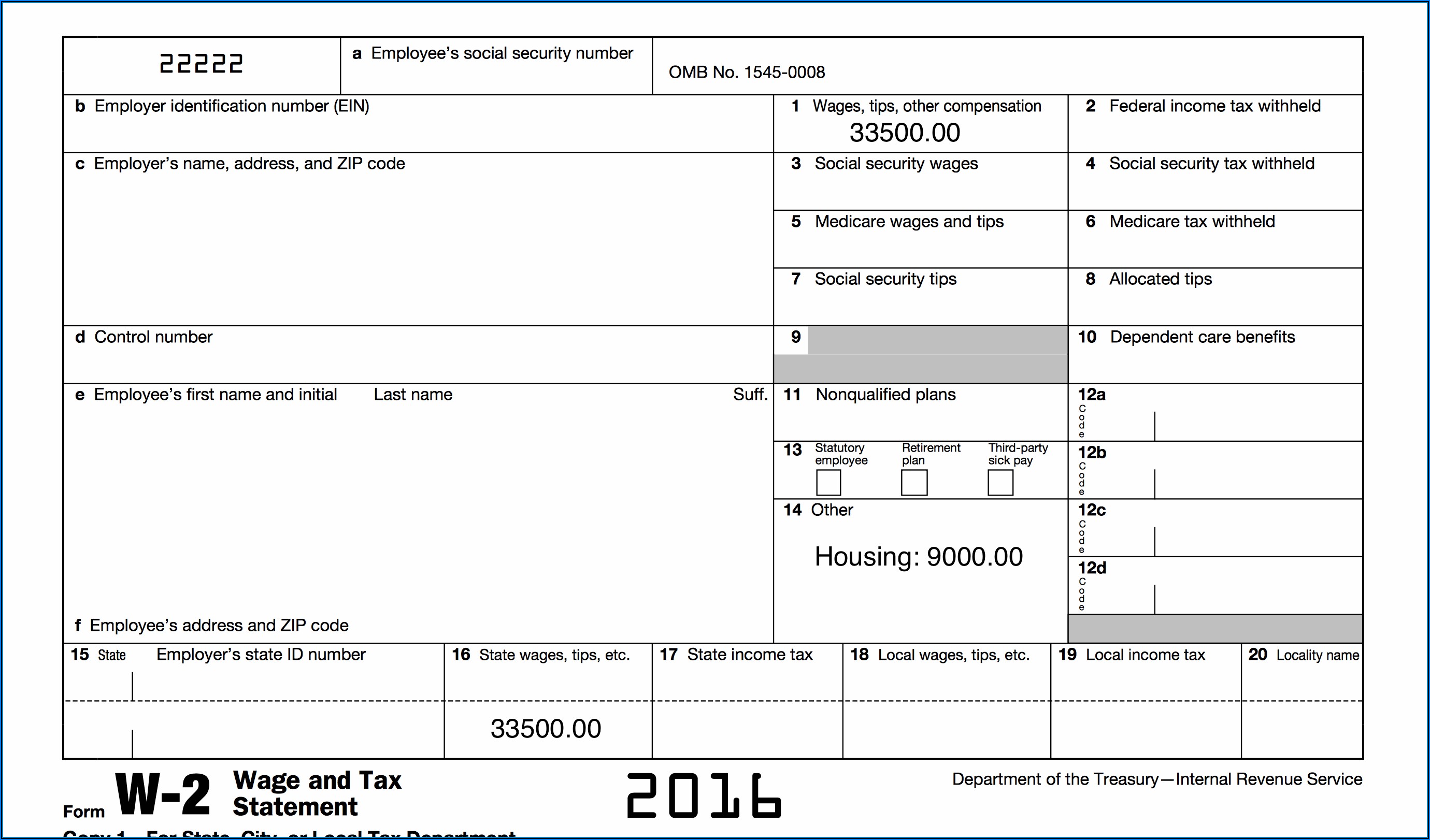

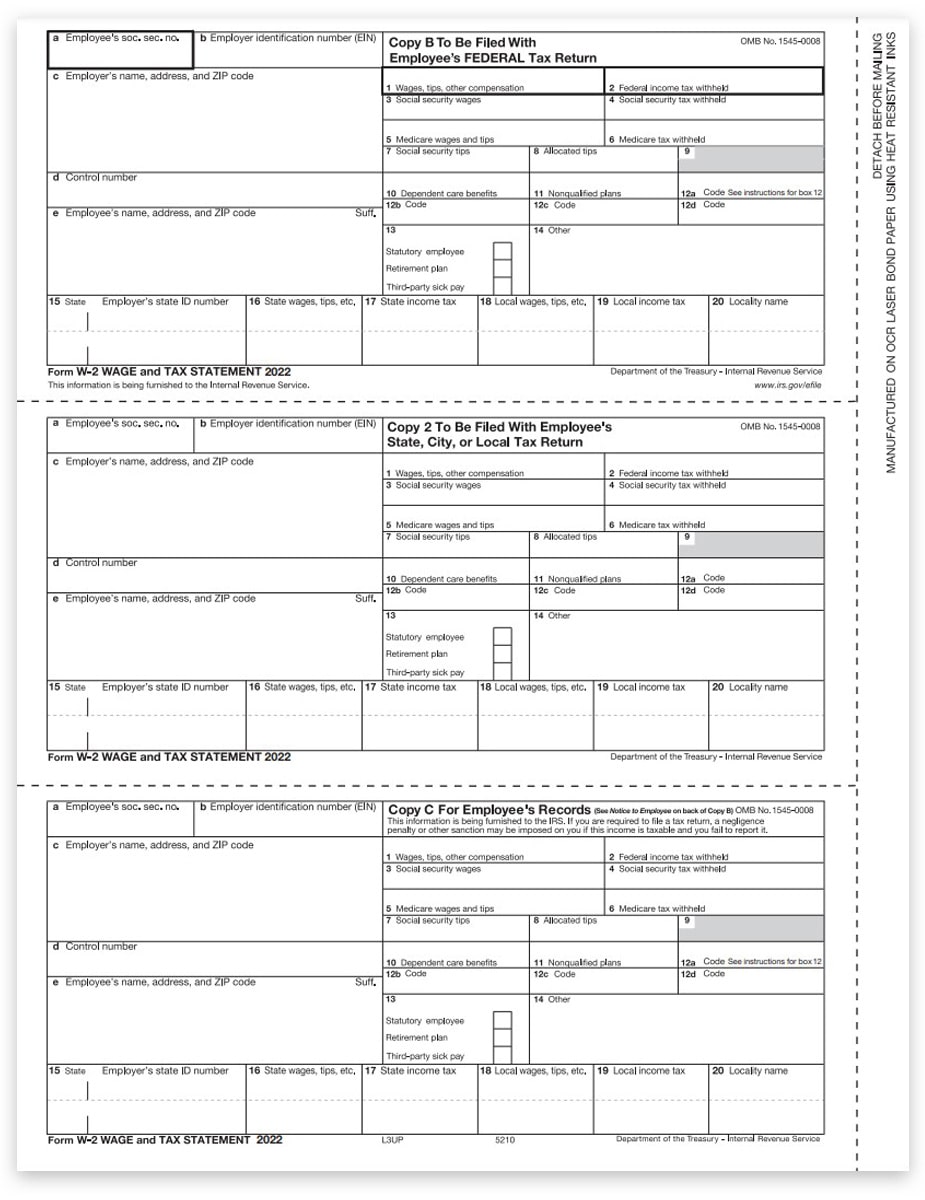

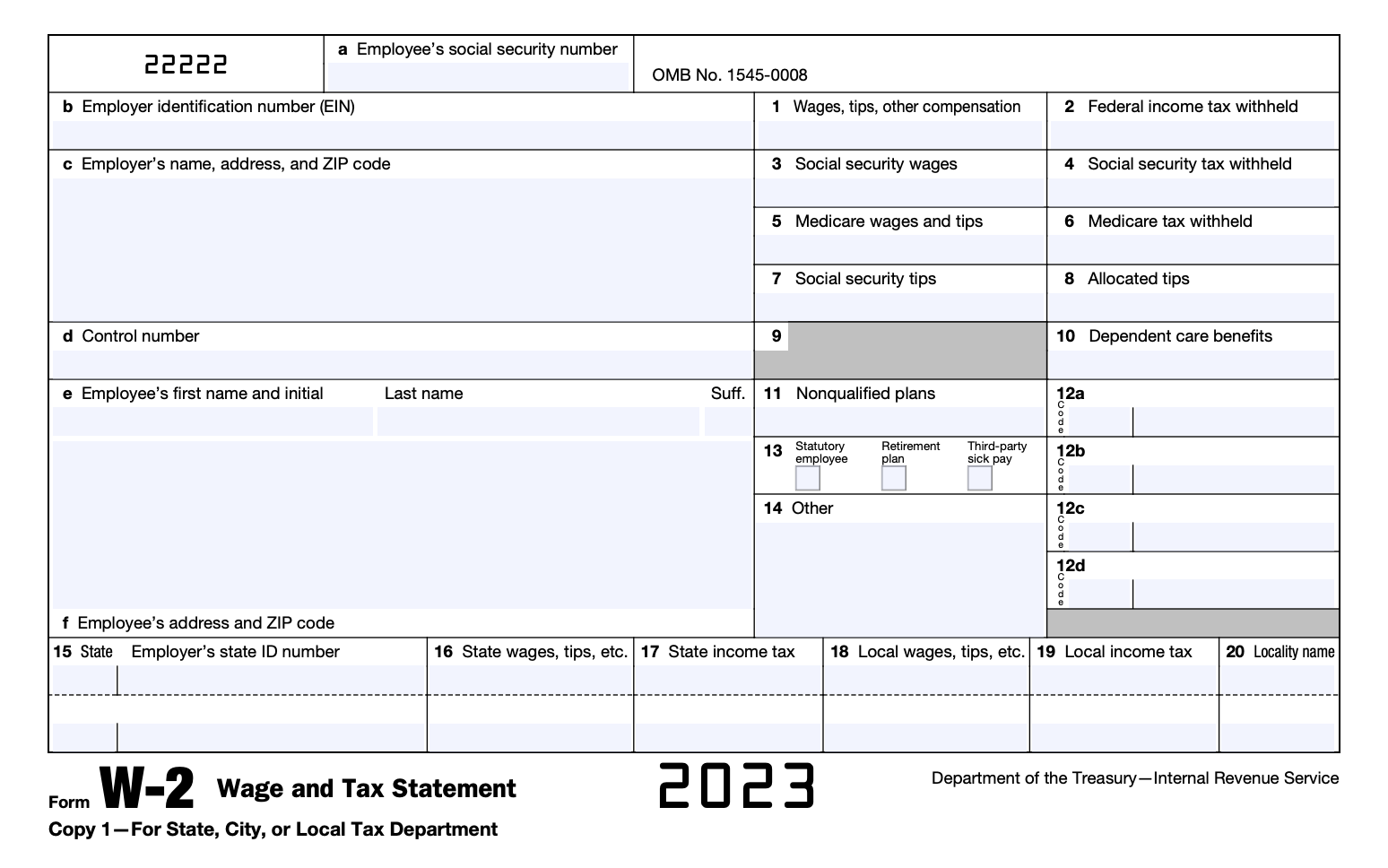

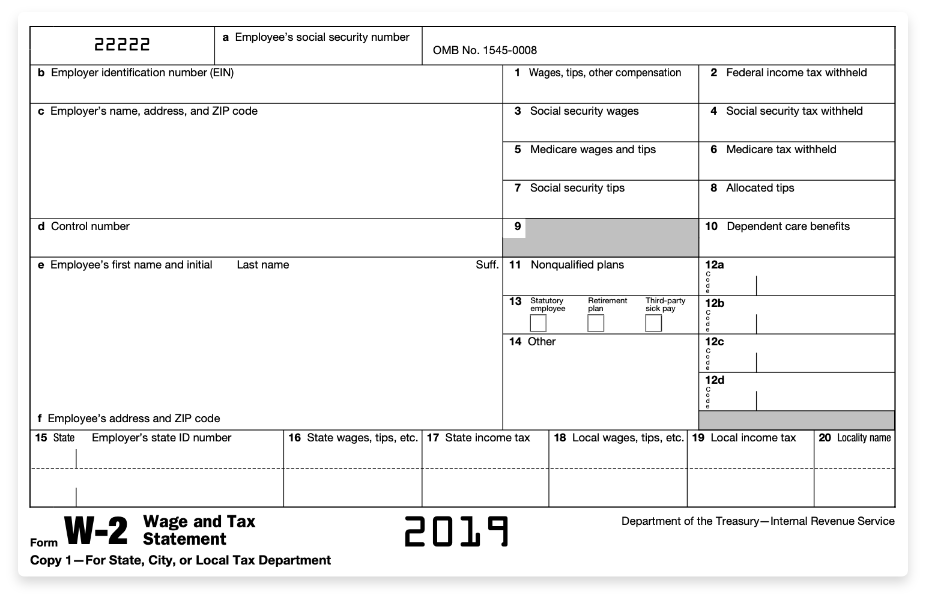

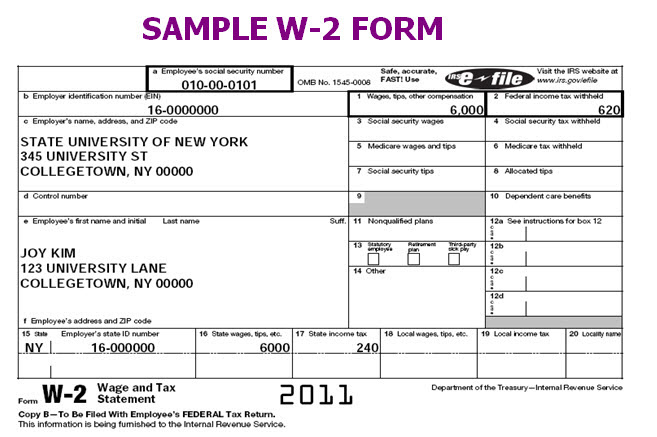

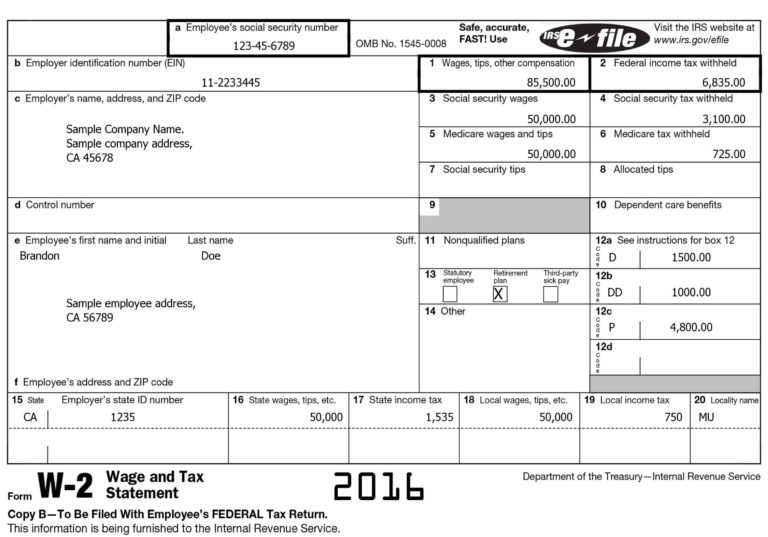

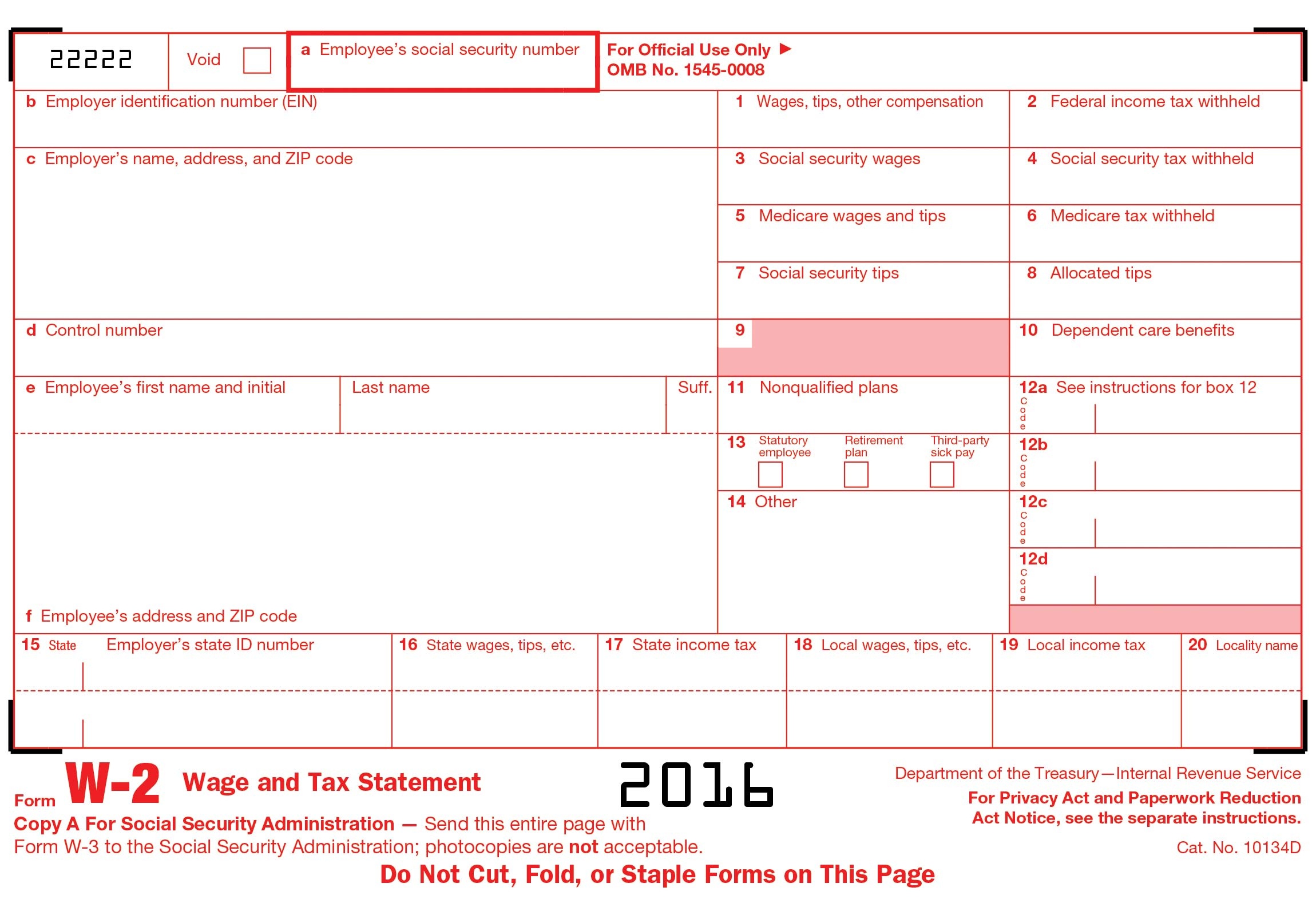

The W2 form is a crucial document that shows your earnings and taxes withheld for the previous year. This information is necessary for filing your taxes and determining if you are eligible for any deductions or credits. As a Mattress Firm employee, you should receive your W2 form by the end of January, either electronically or through the mail.Mattress Firm Employee W2 Form

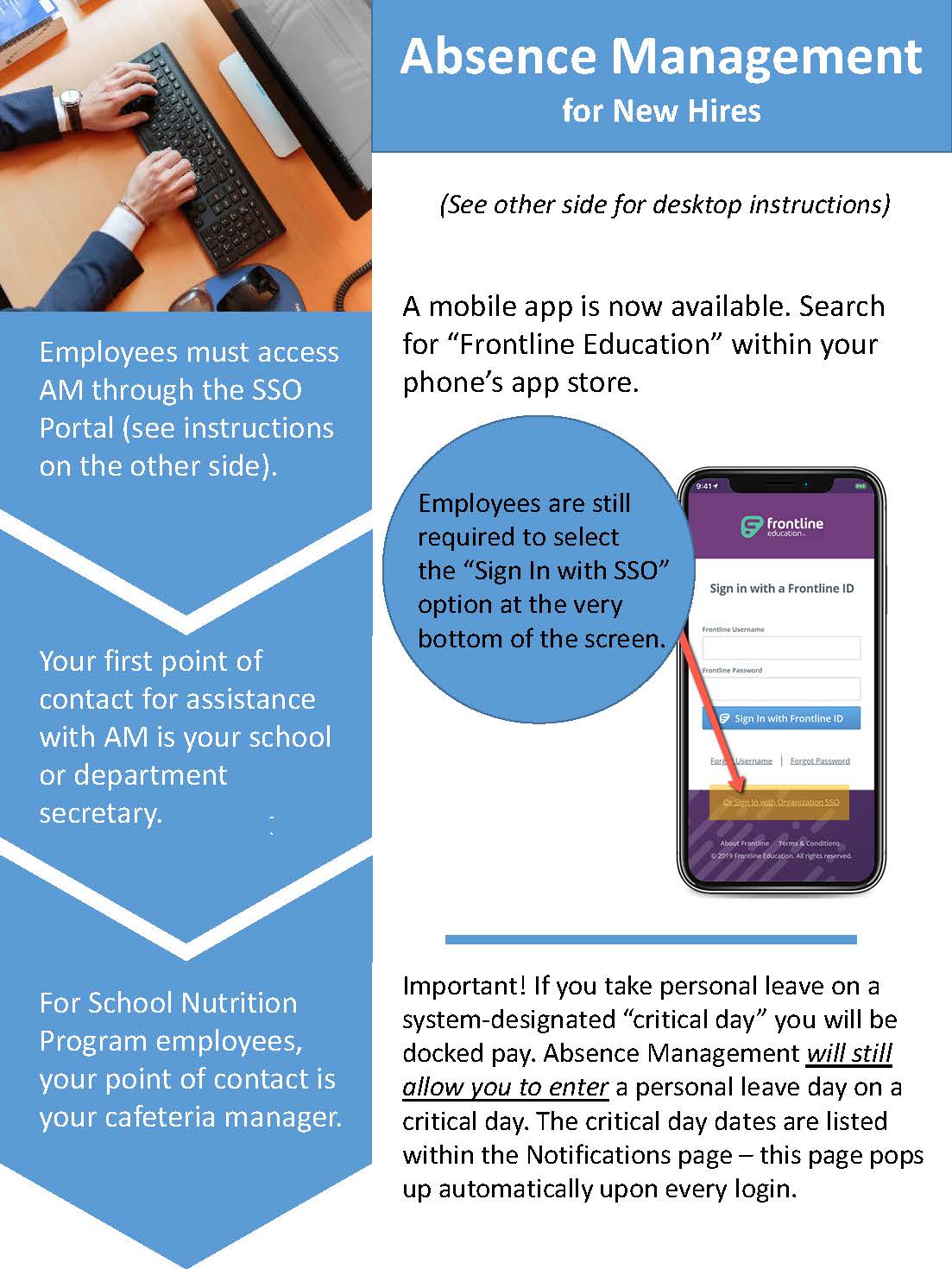

If you have not received your W2 form by the end of January, there may be a delay in the processing and mailing of your form. In this case, you can contact your HR representative at Mattress Firm to inquire about your W2. You can also log into the employee portal to access and print your W2 form.W2 Forms for Mattress Firm Employees

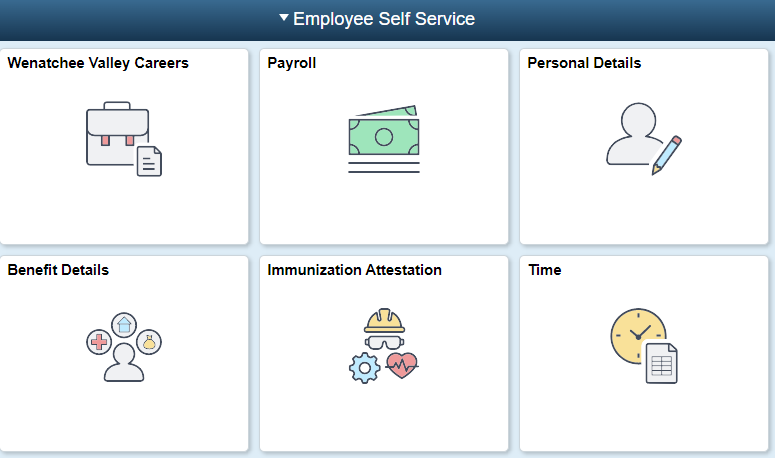

The most convenient way to access your W2 form as a Mattress Firm employee is through the employee portal. Simply log in with your credentials and navigate to the "Pay" section. From there, you should be able to view and print your W2 form. If you have any trouble accessing your form, reach out to HR for assistance.Accessing Your W2 as a Mattress Firm Employee

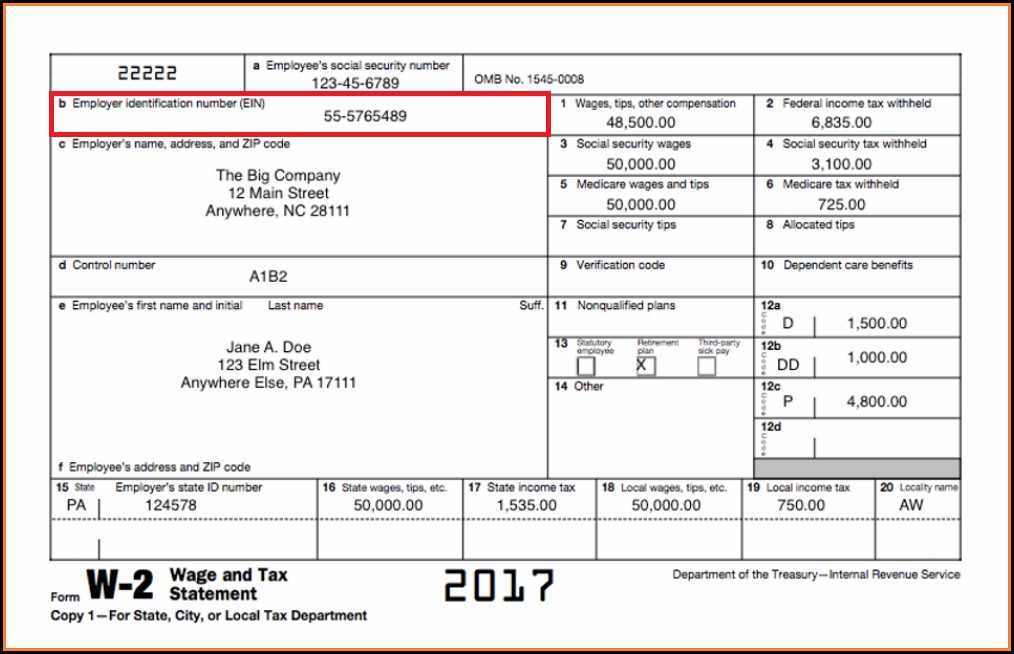

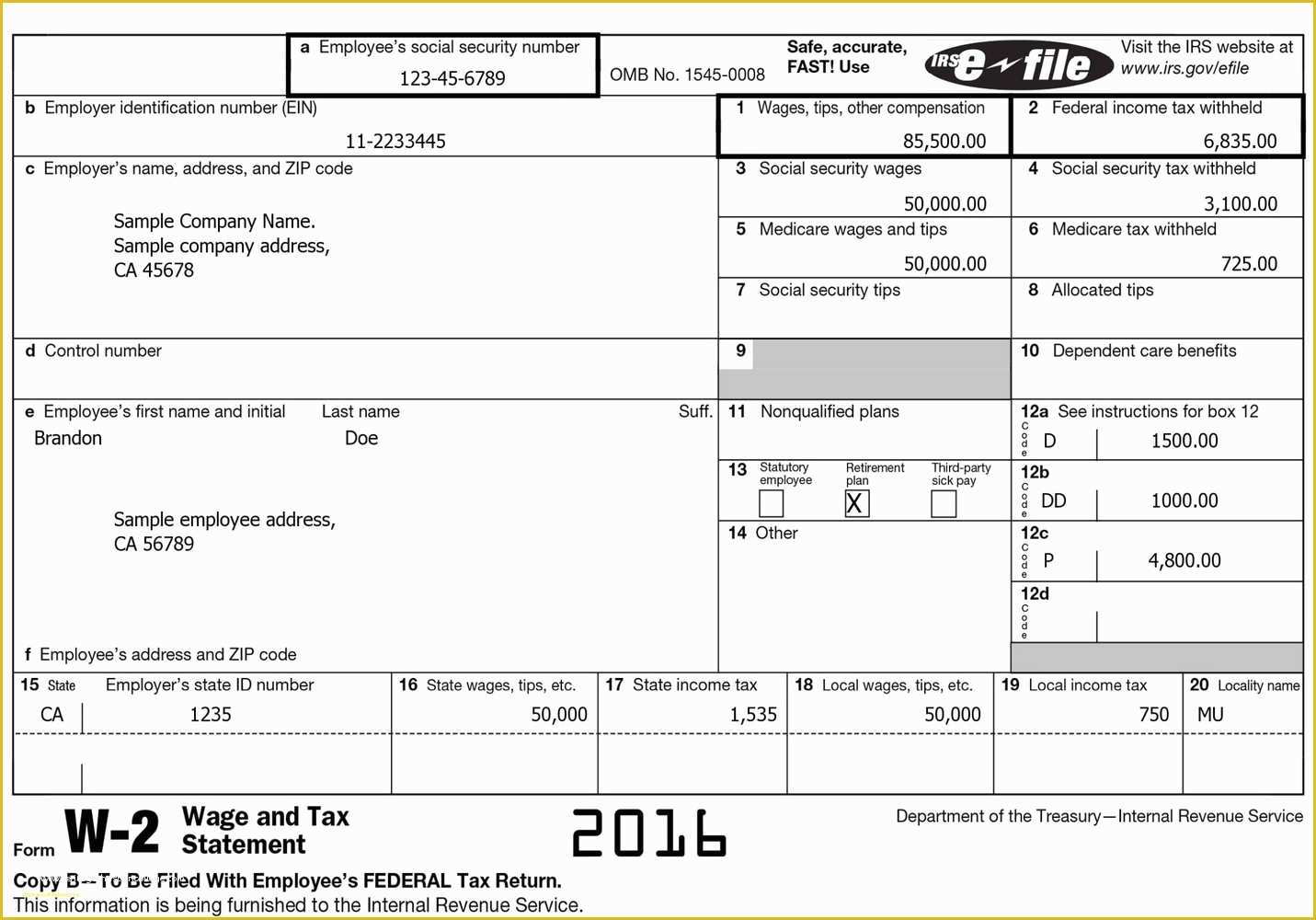

When reviewing your W2 form, be sure to check that all information is accurate, including your name, Social Security number, and earnings. If you notice any discrepancies, contact HR immediately to have them corrected. It's also important to note that the deadline to file your taxes with a W2 form is typically April 15th.W2 Information for Mattress Firm Employees

If you no longer work at Mattress Firm but need access to your W2 form, you can still retrieve it through the employee portal. However, if you are unable to access the portal, you can request a copy of your W2 by contacting HR. They will be able to provide you with a paper copy or resend your electronic W2.Steps to Retrieve Your W2 from Mattress Firm

As mentioned earlier, the deadline to file your taxes with a W2 form is typically April 15th. However, if you need more time to file, you can request an extension from the IRS. Keep in mind that any taxes owed must still be paid by the original deadline to avoid penalties and interest.W2 Deadline for Mattress Firm Employees

If you're confused about any of the information on your W2 form, don't hesitate to reach out to HR for clarification. They will be able to explain any codes or numbers that may be unclear. It's important to understand your W2 form to ensure the accuracy of your tax return.Understanding Your W2 from Mattress Firm

Here are some frequently asked questions by Mattress Firm employees regarding their W2 form:W2 FAQs for Mattress Firm Employees

Once you have your W2 form, you can file your taxes online or through a tax professional. Make sure to have all necessary documents and information on hand, including your W2, Social Security number, and any other income or deductions. In conclusion, as a Mattress Firm employee, it's essential to have your W2 form for tax purposes. If you haven't received your W2 by the end of January, reach out to HR for assistance. And remember, understanding your W2 and filing your taxes accurately and on time is crucial for avoiding any penalties or issues with the IRS.How to File Your Taxes with a Mattress Firm W2

The Importance of Choosing the Right Mattress for a Good Night's Sleep

The Role of Mattress Firm Employees in Helping You Find the Perfect Mattress

When it comes to creating the perfect bedroom, many people focus on the aesthetics like the paint color, furniture, and decor. However, one important aspect that is often overlooked is the

mattress

. A good mattress plays a crucial role in ensuring a good night's sleep, which ultimately affects our overall health and well-being. As a

Mattress Firm

employee, it is our responsibility to help you find the perfect mattress that meets your specific needs and preferences.

Not all mattresses are created equal, and there is no one-size-fits-all solution when it comes to choosing a mattress. This is where the expertise of a

Mattress Firm

employee comes in. Our employees undergo extensive training and have in-depth knowledge about different types of mattresses, materials, and construction techniques. We understand that everyone has unique sleep preferences, body types, and health conditions, and we take all of these factors into consideration when recommending a mattress.

One of the main reasons why choosing the right mattress is so important is because it can significantly affect the quality of your sleep.

Sleep

is essential for our physical and mental health, and a good mattress can help improve the quality of our sleep. It can also alleviate common sleep problems like back pain, neck pain, and insomnia. Our goal as

Mattress Firm

employees is to help you find a mattress that provides the right amount of support and comfort for your body, ensuring a restful and restorative sleep.

In addition to finding the right mattress, we also understand the importance of creating a comfortable and inviting sleep environment. That's why we offer a wide variety of

bedding

options such as pillows, sheets, and mattress protectors to enhance your sleeping experience. Our employees are trained to guide you through the process of creating a complete sleep system that caters to your specific needs and preferences.

In conclusion, a good night's sleep is crucial for our overall well-being, and choosing the right mattress is a crucial step towards achieving that. As

Mattress Firm

employees, we take pride in our knowledge and expertise in helping you find the perfect mattress for your specific needs. So, the next time you're in the market for a new mattress, don't hesitate to reach out to us for our expert guidance. We are committed to helping you achieve the perfect sleep experience.

When it comes to creating the perfect bedroom, many people focus on the aesthetics like the paint color, furniture, and decor. However, one important aspect that is often overlooked is the

mattress

. A good mattress plays a crucial role in ensuring a good night's sleep, which ultimately affects our overall health and well-being. As a

Mattress Firm

employee, it is our responsibility to help you find the perfect mattress that meets your specific needs and preferences.

Not all mattresses are created equal, and there is no one-size-fits-all solution when it comes to choosing a mattress. This is where the expertise of a

Mattress Firm

employee comes in. Our employees undergo extensive training and have in-depth knowledge about different types of mattresses, materials, and construction techniques. We understand that everyone has unique sleep preferences, body types, and health conditions, and we take all of these factors into consideration when recommending a mattress.

One of the main reasons why choosing the right mattress is so important is because it can significantly affect the quality of your sleep.

Sleep

is essential for our physical and mental health, and a good mattress can help improve the quality of our sleep. It can also alleviate common sleep problems like back pain, neck pain, and insomnia. Our goal as

Mattress Firm

employees is to help you find a mattress that provides the right amount of support and comfort for your body, ensuring a restful and restorative sleep.

In addition to finding the right mattress, we also understand the importance of creating a comfortable and inviting sleep environment. That's why we offer a wide variety of

bedding

options such as pillows, sheets, and mattress protectors to enhance your sleeping experience. Our employees are trained to guide you through the process of creating a complete sleep system that caters to your specific needs and preferences.

In conclusion, a good night's sleep is crucial for our overall well-being, and choosing the right mattress is a crucial step towards achieving that. As

Mattress Firm

employees, we take pride in our knowledge and expertise in helping you find the perfect mattress for your specific needs. So, the next time you're in the market for a new mattress, don't hesitate to reach out to us for our expert guidance. We are committed to helping you achieve the perfect sleep experience.

:max_bytes(150000):strip_icc()/W-2-6a38541136824d2481dfde8e6146cf44.jpeg)