When it comes to purchasing a new mattress, having a good credit score can make all the difference. Not only does it affect your ability to get approved for financing, but it can also impact the interest rates and terms you receive. If you're looking to buy a mattress from Mattress Firm, it's important to understand how your credit score plays a role in the process. In this article, we'll discuss everything you need to know about your credit score for Mattress Firm purchases. Mattress Firm Credit Score: What You Need to Know

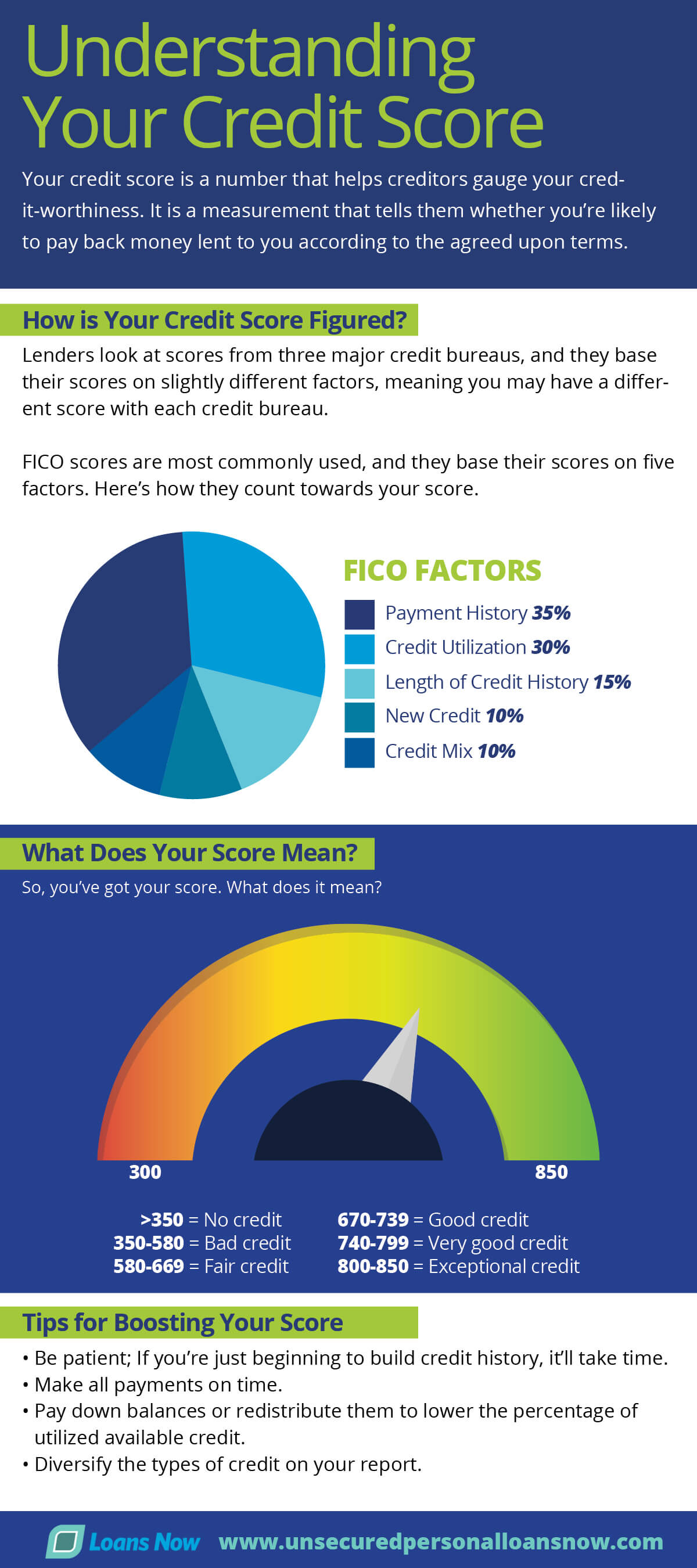

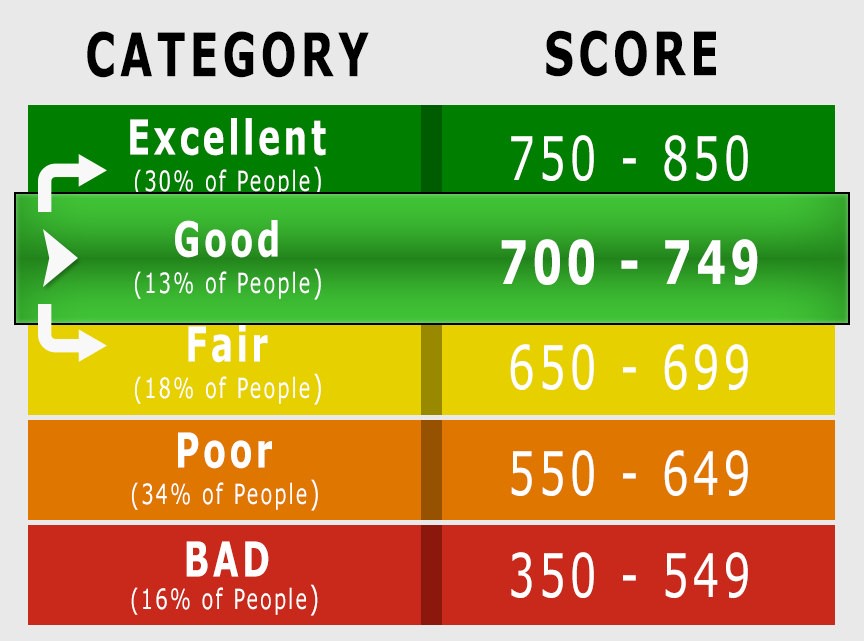

Your credit score is a three-digit number that represents your creditworthiness. It is calculated based on your credit history, including factors such as payment history, credit utilization, length of credit history, and types of credit. The higher your credit score, the more likely you are to be approved for financing and receive favorable terms. Credit Score for Mattress Firm: What Is It?

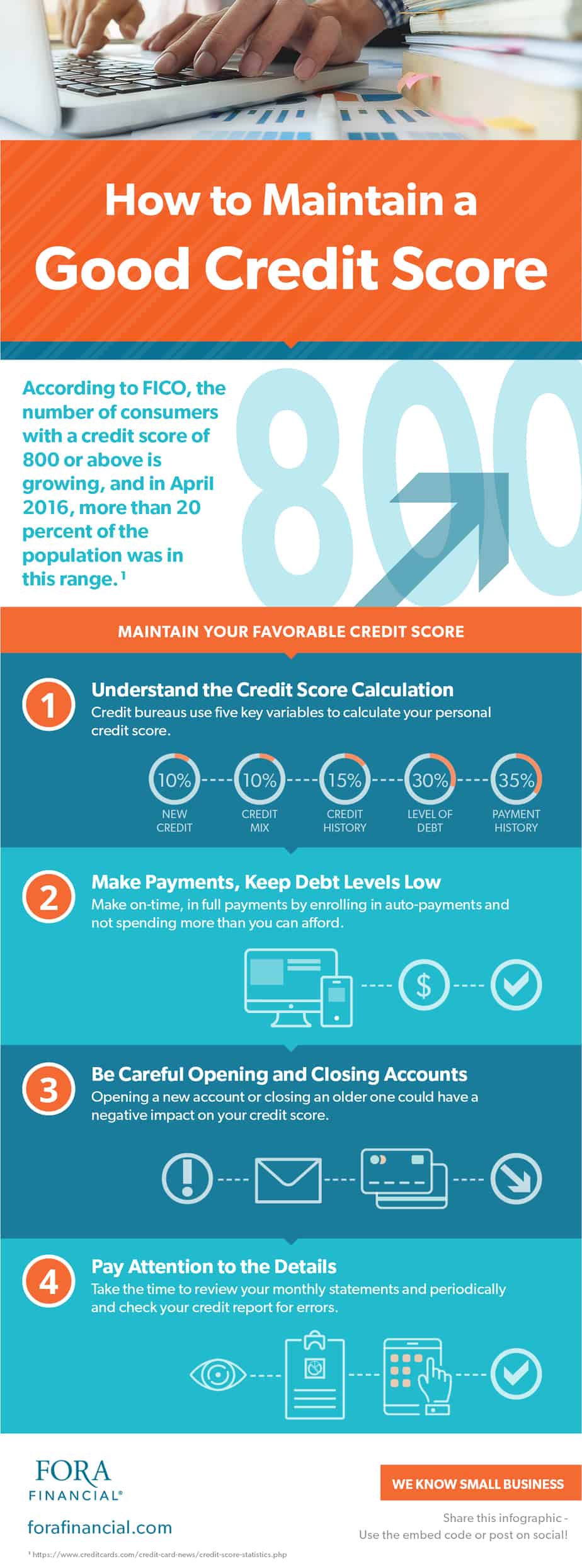

If you have a less-than-perfect credit score, don't worry. There are steps you can take to improve it and increase your chances of getting approved for financing at Mattress Firm. First, make sure to pay all of your bills on time. Late payments can have a significant impact on your credit score. Additionally, try to keep your credit card balances low and avoid opening new lines of credit. It's also a good idea to regularly check your credit report and dispute any errors you may find. How to Improve Your Credit Score for Mattress Firm

If you have a good credit score, you have a variety of financing options available to you at Mattress Firm. You may be able to qualify for 0% interest financing for a certain period of time or receive a lower interest rate overall. Additionally, you may be able to negotiate better terms with the salesperson by leveraging your good credit score. Financing Options for Mattress Firm with Good Credit Score

It's important to understand that Mattress Firm may use different credit scoring models than what you see when checking your own credit score. This is because they may have their own criteria and calculations for determining creditworthiness. However, the basic principles of credit scoring still apply, so having a good credit score overall will still be beneficial. Understanding Credit Scores for Mattress Firm Purchases

If you're not quite ready to make a big purchase like a mattress, you may want to consider using a credit card for smaller purchases at Mattress Firm. Some credit cards offer rewards or cash back for purchases at certain retailers, including Mattress Firm. Look for cards that offer these benefits and also have a lower interest rate to make the most of your purchase. Best Credit Cards for Mattress Firm Purchases

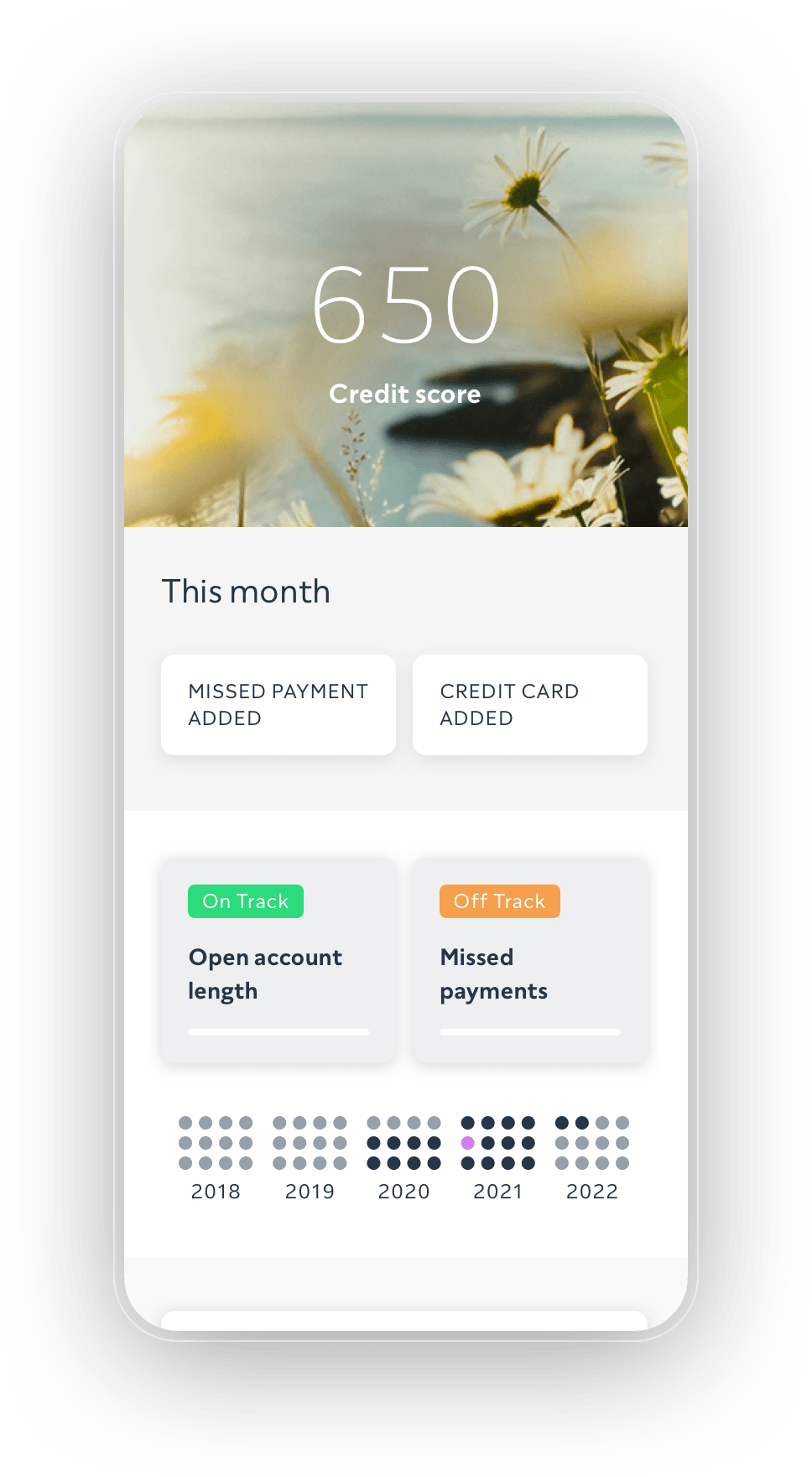

There are several ways to check your credit score for Mattress Firm purchases. You can use a free credit score service, such as Credit Karma or Credit Sesame, to get an estimate of your credit score. You can also request a free credit report from each of the three major credit bureaus once a year. Additionally, some credit cards offer free credit score monitoring as a perk for cardholders. How to Check Your Credit Score for Mattress Firm

If you're planning on making a big purchase at Mattress Firm in the near future, it's important to start building your credit now. This can be done by making timely payments on your bills, keeping your credit card balances low, and avoiding opening new lines of credit. It's also a good idea to diversify your credit by having a mix of different types of credit, such as credit cards, loans, and mortgages. Tips for Building Credit for Mattress Firm Purchases

While there is no specific credit score requirement for financing at Mattress Firm, having a good credit score will increase your chances of approval and better terms. Some financing options may have minimum credit score requirements, so it's important to check with Mattress Firm or the financing company directly to see what their requirements are. Credit Score Requirements for Mattress Firm Financing

If you have a low credit score, you may still be able to get approved for financing at Mattress Firm. However, you may need to provide a larger down payment or have a co-signer. It's also a good idea to shop around and compare financing options from different companies to find the best terms for your situation. How to Get Approved for Mattress Firm Financing with a Low Credit Score

The Importance of a Good Credit Score for Buying a Mattress

A good credit score is essential for many aspects of life, from buying a house to getting a car loan. But did you know that it also plays a role in purchasing a mattress? Yes, you read that right – your credit score can impact your ability to get the mattress of your dreams. In this article, we'll take a closer look at why having a good credit score is crucial when it comes to buying a mattress from mattress firm .

The Role of Credit Score in Mattress Purchases

When you walk into a mattress firm store, you may be focused on finding the perfect mattress for your needs. However, before you can even start browsing through the options, the salesperson may ask you about your credit score. This is because most mattress firm stores offer financing options to their customers, and your credit score will determine your eligibility for these options.

A credit score is a three-digit number that represents your creditworthiness. It is based on your credit history, including your payment history, credit utilization, and length of credit history. A higher credit score indicates that you are more likely to pay back your debts on time and in full, making you a lower risk for lenders.

How Credit Score Affects Mattress Financing

If you have a good credit score, you may be eligible for mattress firm 's financing options, such as a 0% interest payment plan or a low-interest installment plan. This means that you can spread out the cost of your mattress over several months without paying any additional interest charges. This can be a great option if you don't have the cash to pay for the mattress upfront.

However, if your credit score is poor, you may not qualify for these financing options. This means that you will have to pay for the mattress in full at the time of purchase. If you don't have enough money to cover the cost, you may have to settle for a lower-quality mattress or delay your purchase until you can save up enough money. This can be frustrating and may even affect the quality of your sleep.

Improving Your Credit Score for Mattress Purchases

If you have a mattress firm store in mind for your mattress purchase, it's a good idea to check your credit score beforehand. If it's not in the best shape, there are steps you can take to improve it. These include paying your bills on time, keeping your credit card balances low, and avoiding opening new credit accounts. By improving your credit score, you can not only increase your chances of getting approved for financing but also qualify for better interest rates and payment terms.

In conclusion, having a good credit score is crucial for buying a mattress from mattress firm . It not only determines your eligibility for financing options but also affects the quality of the mattress you can purchase. So, before heading to the store, make sure to check your credit score and take steps to improve it if needed. This will ensure that you can get the best mattress for your needs without breaking the bank.

.jpg)