When it comes to purchasing a new mattress, one of the most important factors to consider is the credit rating of the company you are buying from. A good credit rating indicates that the company is financially stable and can be trusted to provide quality products and services. In this article, we will take a closer look at the credit rating of Mattress Firm, one of the leading mattress retailers in the United States.1. Mattress Firm Credit Rating |

Mattress Firm has a strong credit score of AA- from Standard & Poor's, one of the top credit rating agencies in the world. This rating reflects the company's financial stability and ability to meet its financial obligations. With such a high credit score, customers can have peace of mind knowing that they are purchasing from a reputable and financially sound company.2. Mattress Firm Credit Score |

In addition to its credit score, Mattress Firm also has strong financial ratings from other credit rating agencies such as Moody's and Fitch. These ratings take into account the company's financial performance, liquidity, and debt levels. With consistent high ratings from multiple agencies, Mattress Firm has proven to be a financially responsible and stable company.3. Mattress Firm Financial Ratings |

With a strong credit score and financial ratings, Mattress Firm has demonstrated its creditworthiness in the market. This means that the company has a low risk of defaulting on its financial obligations and is considered a safe bet for investors and customers alike. This is especially important for customers who are looking to finance their mattress purchase, as a company's creditworthiness can impact the interest rates and terms of the loan.4. Mattress Firm Creditworthiness |

If you are interested in learning more about Mattress Firm's credit rating and financial standing, you can access the company's credit report from credit rating agencies or financial websites. This report will provide a detailed breakdown of the company's credit score, financial ratings, and other important financial information. It can help you make an informed decision when choosing where to buy your next mattress.5. Mattress Firm Credit Report |

With its strong credit rating and financial stability, Mattress Firm has a solid credit standing in the market. This not only benefits the company in terms of financing and business operations but also gives customers confidence in their purchases. A company with a good credit standing is more likely to provide high-quality products and services and maintain a good reputation in the industry.6. Mattress Firm Credit Standing |

When evaluating a company's creditworthiness, credit rating agencies consider various factors such as market trends, competition, and financial performance. Mattress Firm has consistently received high ratings due to its strong financial performance and position in the mattress industry. This evaluation is a testament to the company's success and reliability as a business.7. Mattress Firm Credit Evaluation |

A thorough credit analysis of Mattress Firm would reveal its financial strengths and weaknesses, as well as any potential risks. This analysis is crucial for investors, creditors, and customers to make informed decisions about the company. With its strong credit rating and financial stability, Mattress Firm has passed the test of credit analysis with flying colors.8. Mattress Firm Credit Analysis |

The credit rating agency responsible for assigning Mattress Firm's credit score is Standard & Poor's. This agency has a long history of providing accurate and reliable credit ratings for companies around the world. Their rating of AA- for Mattress Firm is a testament to the company's financial strength and stability.9. Mattress Firm Credit Rating Agency |

Standard & Poor's credit rating scale ranges from AAA (highest) to D (default). The AA- rating for Mattress Firm falls within the "high grade" category, indicating a low risk of default and a strong creditworthiness. This is a positive sign for customers as it shows that the company is financially secure and capable of fulfilling its financial obligations.10. Mattress Firm Credit Rating Scale

The Importance of Credit Ratings for Mattress Firms

Why Credit Ratings Matter in the Mattress Industry

When it comes to purchasing a new mattress, consumers often rely on the reputation and quality of the brand. However, behind the scenes, the financial stability and credit rating of a mattress firm play a crucial role in its success.

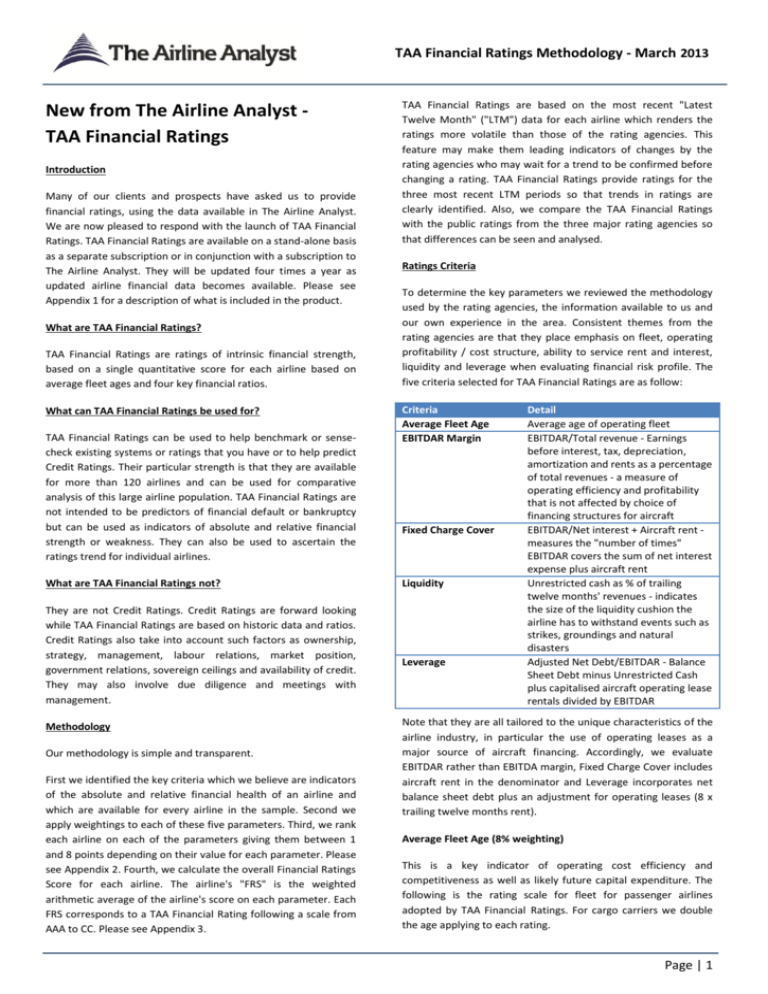

Credit ratings

are essentially a measure of a company's financial health and ability to pay back its debts. They are determined by independent credit rating agencies and can greatly impact a company's access to capital, interest rates, and overall perception in the market.

When it comes to purchasing a new mattress, consumers often rely on the reputation and quality of the brand. However, behind the scenes, the financial stability and credit rating of a mattress firm play a crucial role in its success.

Credit ratings

are essentially a measure of a company's financial health and ability to pay back its debts. They are determined by independent credit rating agencies and can greatly impact a company's access to capital, interest rates, and overall perception in the market.

The Impact of Credit Ratings on Mattress Firms

In the competitive mattress industry,

credit ratings

can make or break a company. A high credit rating signifies financial stability and reliability, making it easier for a mattress firm to secure loans and investments at lower interest rates. This, in turn, allows the company to invest in research and development, expand their product line, and ultimately grow their business.

On the other hand, a low credit rating can have severe consequences for a mattress firm. In addition to higher interest rates and limited access to capital, a poor credit rating can also damage a company's reputation and make it difficult to attract customers and business partners. This can lead to a downward spiral of financial struggles and even bankruptcy.

In the competitive mattress industry,

credit ratings

can make or break a company. A high credit rating signifies financial stability and reliability, making it easier for a mattress firm to secure loans and investments at lower interest rates. This, in turn, allows the company to invest in research and development, expand their product line, and ultimately grow their business.

On the other hand, a low credit rating can have severe consequences for a mattress firm. In addition to higher interest rates and limited access to capital, a poor credit rating can also damage a company's reputation and make it difficult to attract customers and business partners. This can lead to a downward spiral of financial struggles and even bankruptcy.

The Role of Credit Ratings in Consumer Confidence

In today's digital age, consumers have access to information and reviews about companies at their fingertips. This includes a company's credit rating, which can significantly impact their perception and trust in a brand. A high credit rating can instill confidence in consumers, assuring them that the mattress firm is financially stable and reliable. This can lead to increased customer loyalty and positive word-of-mouth, ultimately driving sales and business growth.

In contrast, a low credit rating can raise red flags for consumers and make them question the stability and quality of a mattress firm. This can result in lost sales and a damaged reputation, impacting the company's bottom line.

In conclusion,

credit ratings

play a crucial role in the success of mattress firms. They not only impact a company's financial health but also their reputation, consumer perception, and overall growth potential. As a consumer, it is important to research and consider a mattress firm's credit rating when making a purchase, as it can be a strong indicator of their stability and reliability in the market.

In today's digital age, consumers have access to information and reviews about companies at their fingertips. This includes a company's credit rating, which can significantly impact their perception and trust in a brand. A high credit rating can instill confidence in consumers, assuring them that the mattress firm is financially stable and reliable. This can lead to increased customer loyalty and positive word-of-mouth, ultimately driving sales and business growth.

In contrast, a low credit rating can raise red flags for consumers and make them question the stability and quality of a mattress firm. This can result in lost sales and a damaged reputation, impacting the company's bottom line.

In conclusion,

credit ratings

play a crucial role in the success of mattress firms. They not only impact a company's financial health but also their reputation, consumer perception, and overall growth potential. As a consumer, it is important to research and consider a mattress firm's credit rating when making a purchase, as it can be a strong indicator of their stability and reliability in the market.