Are you looking to upgrade your living room with a new set of furniture but don't have the funds to make a large upfront purchase? Look no further, as there are plenty of financing options available to help you achieve your dream living room without breaking the bank. One popular option for financing living room sets is through furniture retailers themselves. Many stores offer their own financing plans that allow you to pay for your purchase in installments over a set period of time. This can be a great option for those with a steady income and the ability to make monthly payments. Another option for financing your living room set is through a personal loan. This type of loan can be obtained from a bank or credit union and can be used for any purpose, including purchasing furniture. With a personal loan, you can typically borrow a larger amount and have a longer repayment period, giving you more flexibility in your budget.1. Financing Options for Living Room Sets

Financing a living room set doesn't have to break the bank. There are many affordable financing options available that can help you furnish your living room without draining your savings. One option is to look for retailers that offer zero-interest financing for a certain period of time. This allows you to make monthly payments without accruing any interest, making it a more affordable option. Just be sure to pay off the balance before the zero-interest period ends to avoid any additional fees. You can also consider financing through a credit card with a low interest rate. This can be a great option for those who have good credit and can qualify for a card with a low APR. Just be sure to make timely payments to avoid any interest charges.2. Affordable Living Room Set Financing

If you're looking for more flexibility in your financing options, there are several ways you can finance your living room set without being tied down to a long-term loan or financing plan. One option is to use a credit card with a promotional financing offer. Many credit cards offer 0% APR for a certain period of time, typically 12-18 months, on new purchases. This can be a great option for those who want to spread out payments without incurring any additional fees. You can also consider using a layaway plan, where you make payments towards your living room set and once it's paid off, you can take it home. This can be a great option for those who don't have access to credit or want to avoid any interest charges.3. Flexible Financing for Living Room Sets

Many furniture retailers offer financing plans specifically for living room sets. These plans often have low or no interest rates and can be a great option for those who want to make a large purchase without paying for it all upfront. One popular financing plan is the "buy now, pay later" option. With this plan, you can take home your living room set and make no payments for a certain period of time, typically 6-12 months. After the promotional period ends, you can either pay off the balance or start making monthly payments with interest. Some financing plans also offer the option to defer interest, meaning you won't accrue any interest as long as you make timely payments. This can be a great option for those who need a little more time to pay off their purchase.4. Living Room Set Financing Plans

If you have bad credit or don't have a credit history, you may be worried about qualifying for financing. However, there are options available for no credit check living room set financing. One option is to look for rent-to-own furniture stores. These stores allow you to make payments towards your furniture and once it's paid off, you can take it home. No credit check is required, making it a great option for those with poor or no credit. You can also consider financing through a peer-to-peer lending platform. These platforms connect borrowers with individual investors and often have less strict credit requirements compared to traditional loans.5. No Credit Check Living Room Set Financing

For those who want to finance their living room set but also want to keep interest charges to a minimum, there are options available for low interest rate financing. One option is to look for credit cards with a low APR. These cards can offer rates as low as 0% for a certain period of time, making it a cost-effective option for financing your purchase. You can also consider a personal loan from a bank or credit union. With a good credit score, you may be able to qualify for a loan with a low interest rate, giving you the flexibility to make monthly payments without accruing too much interest.6. Living Room Set Financing with Low Interest Rates

Financing a living room set doesn't have to be a complicated process. There are easy financing options available that can help you furnish your home without any hassle. Many furniture retailers offer online financing options that allow you to apply for financing and make payments from the comfort of your own home. This can be a convenient option for those with a busy schedule. You can also look for furniture stores that offer instant financing approvals. With this option, you can get approved for financing on the spot and take your living room set home with you the same day.7. Easy Financing for Living Room Sets

Having bad credit doesn't mean you can't finance a living room set. There are options available for those with less than perfect credit. One option is to look for retailers that offer in-house financing. These stores often have more lenient credit requirements and can help you finance your purchase even with a lower credit score. You can also consider using a co-signer for a loan or financing plan. This can be a friend or family member with good credit who is willing to vouch for your ability to make payments.8. Living Room Set Financing for Bad Credit

If you want to take home your living room set now but don't have the funds to pay for it all upfront, buy now, pay later financing options may be the solution for you. One option is to use a credit card with a zero-interest promotional period. This allows you to make monthly payments without accruing any interest for a set period of time. You can also consider using a layaway plan, where you can make payments towards your purchase and take it home once it's paid off. This can be a great option for those who want to avoid any interest charges.9. Buy Now, Pay Later Living Room Set Financing

No matter what your budget may be, there are financing options available to help you furnish your living room with a new set of furniture. If you have a tight budget, you can consider financing through a rent-to-own furniture store or using a layaway plan. These options allow you to make small payments towards your purchase over time. If you have a more flexible budget, you can look for zero-interest financing plans or use a credit card with a low APR. These options can help you spread out payments without incurring too much interest. Overall, there are plenty of financing options available for living room sets, so you can find the one that best fits your budget and lifestyle. With the right financing, you can create the perfect living room without breaking the bank.10. Living Room Set Financing Options for Every Budget

Transform Your Living Room with the Perfect Living Room Set Finance

Creating a Beautiful and Comfortable Living Space

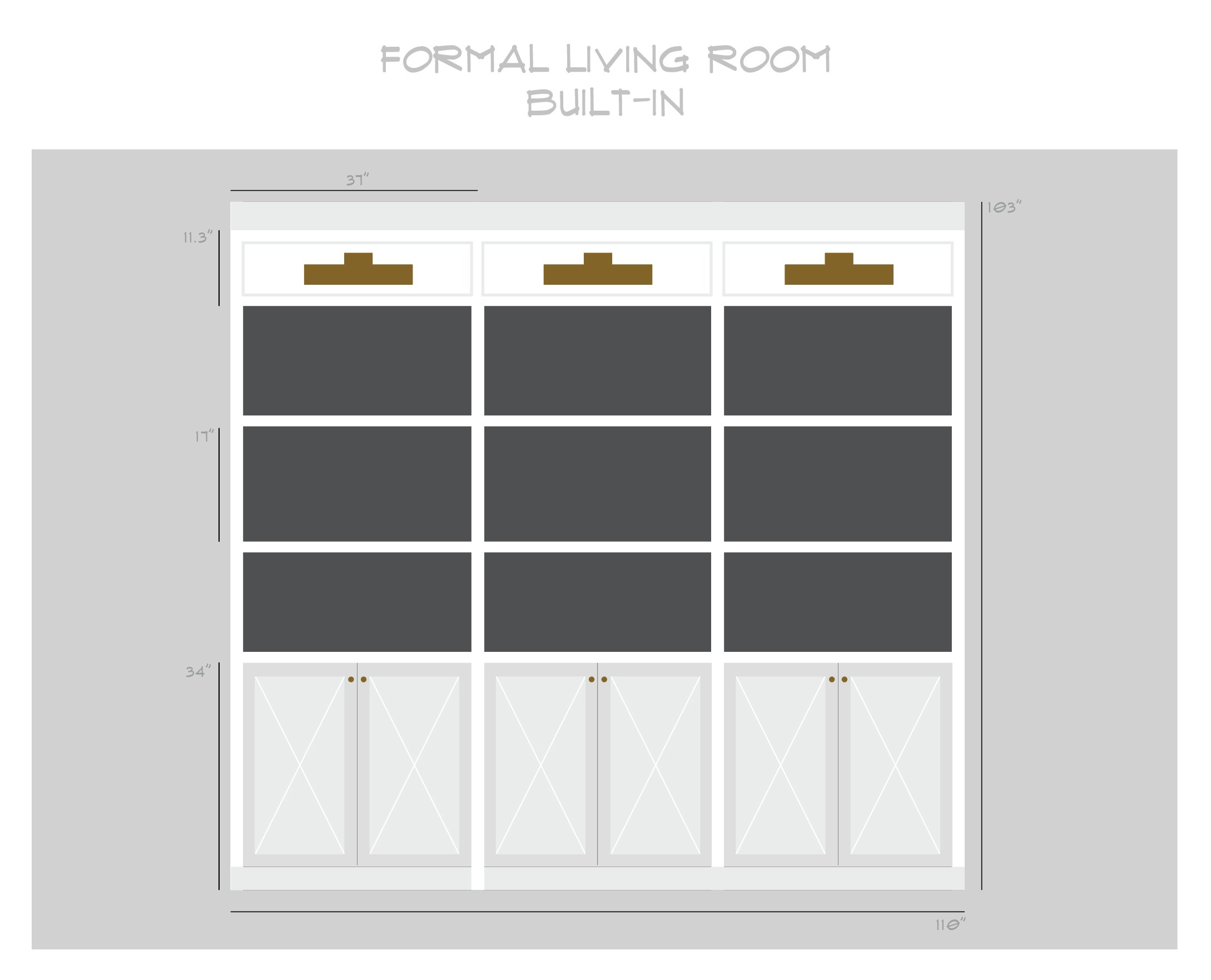

When it comes to designing our homes, the living room is often the first area we think of. It's the space where we relax, socialize, and spend quality time with our loved ones. Therefore, it's essential to have a living room that not only looks aesthetically pleasing but also provides comfort and functionality. One of the best ways to achieve this is by investing in a

living room set

that fits your style and budget.

When it comes to designing our homes, the living room is often the first area we think of. It's the space where we relax, socialize, and spend quality time with our loved ones. Therefore, it's essential to have a living room that not only looks aesthetically pleasing but also provides comfort and functionality. One of the best ways to achieve this is by investing in a

living room set

that fits your style and budget.

Why Choose a Living Room Set?

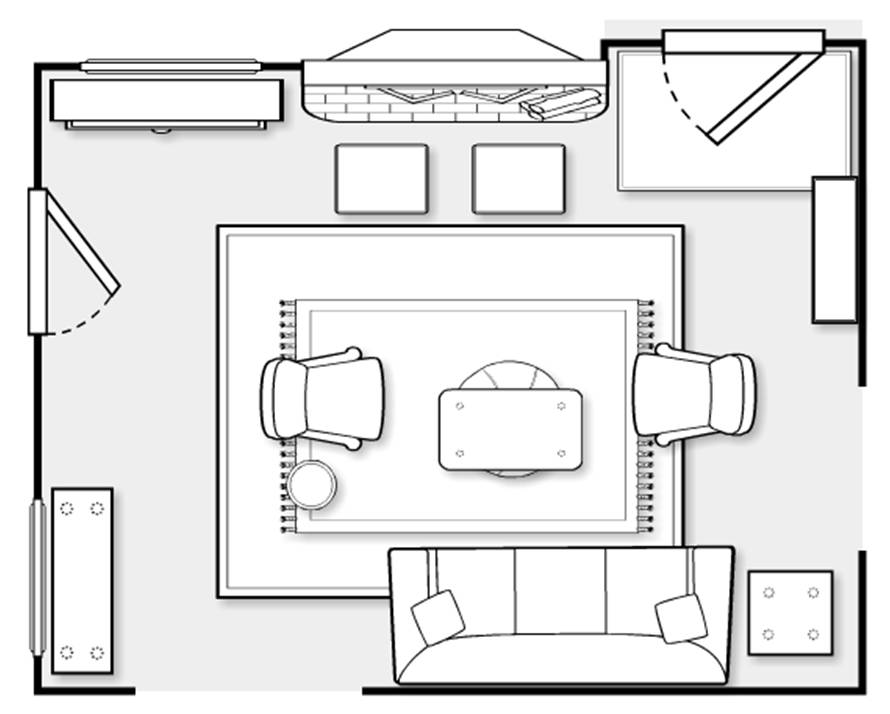

A living room set is a great option for those looking to create a cohesive and well-designed living space. It typically includes a sofa, loveseat, and accent chairs, providing ample seating for guests and family members. By purchasing a

living room set

, you can ensure that all the pieces complement each other perfectly, saving you the hassle of trying to mix and match different furniture items.

A living room set is a great option for those looking to create a cohesive and well-designed living space. It typically includes a sofa, loveseat, and accent chairs, providing ample seating for guests and family members. By purchasing a

living room set

, you can ensure that all the pieces complement each other perfectly, saving you the hassle of trying to mix and match different furniture items.

Benefits of Financing Your Living Room Set

Furniture shopping can be a daunting task, especially when it comes to the living room, where there are so many elements to consider. One way to ease the financial burden is by

financing

your living room set. With affordable monthly payments, you can bring home the furniture of your dreams without breaking the bank. Moreover, financing allows you to choose from a wider range of options, giving you the flexibility to select a set that truly speaks to your style.

Furniture shopping can be a daunting task, especially when it comes to the living room, where there are so many elements to consider. One way to ease the financial burden is by

financing

your living room set. With affordable monthly payments, you can bring home the furniture of your dreams without breaking the bank. Moreover, financing allows you to choose from a wider range of options, giving you the flexibility to select a set that truly speaks to your style.

How to Finance Your Living Room Set

Many furniture stores and online retailers offer

finance options

for their customers. These options usually come with low or no-interest rates, making it easier to pay off the balance over time. Before committing to a finance plan, be sure to read the terms and conditions carefully and understand the payment schedule. It's also essential to have a budget in mind and stick to it to avoid any future financial strain.

Many furniture stores and online retailers offer

finance options

for their customers. These options usually come with low or no-interest rates, making it easier to pay off the balance over time. Before committing to a finance plan, be sure to read the terms and conditions carefully and understand the payment schedule. It's also essential to have a budget in mind and stick to it to avoid any future financial strain.

Final Thoughts

Investing in a

living room set

is a great way to elevate your living space and create a comfortable and stylish environment. By choosing to finance your purchase, you can bring home the perfect set without compromising on quality or your budget. So go ahead and transform your living room with the perfect

living room set finance

option today!

Investing in a

living room set

is a great way to elevate your living space and create a comfortable and stylish environment. By choosing to finance your purchase, you can bring home the perfect set without compromising on quality or your budget. So go ahead and transform your living room with the perfect

living room set finance

option today!