Living Room Of Satoshi Tax Implications

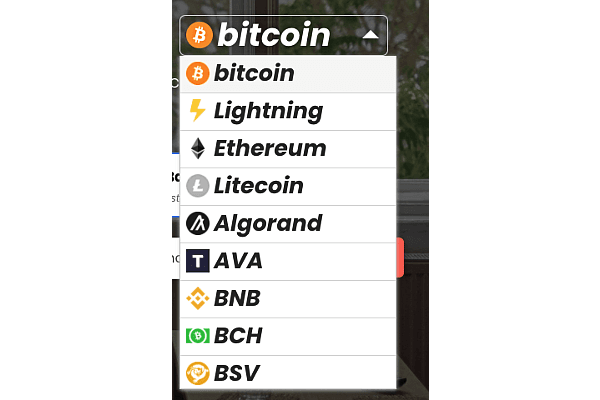

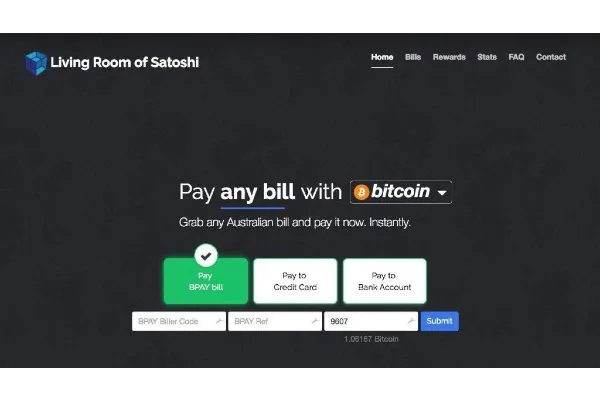

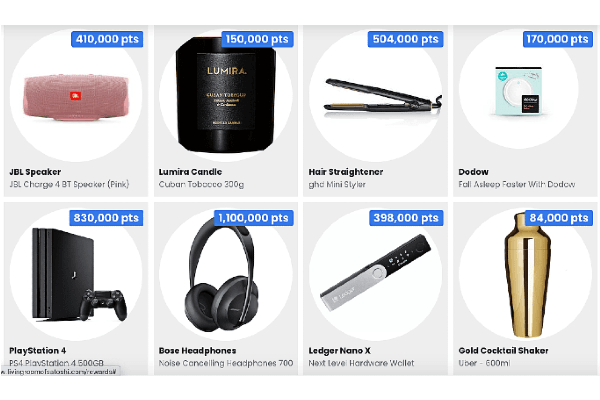

Living Room of Satoshi is a popular service that allows users to pay bills and invoices using various forms of cryptocurrency such as Bitcoin and Litecoin. While this service offers convenience and flexibility, it is important for users to understand the potential tax implications that come with using Living Room of Satoshi for financial transactions. In this article, we will explore the top 10 main tax implications to consider when using Living Room of Satoshi.

Tax Implications for Using Living Room Of Satoshi

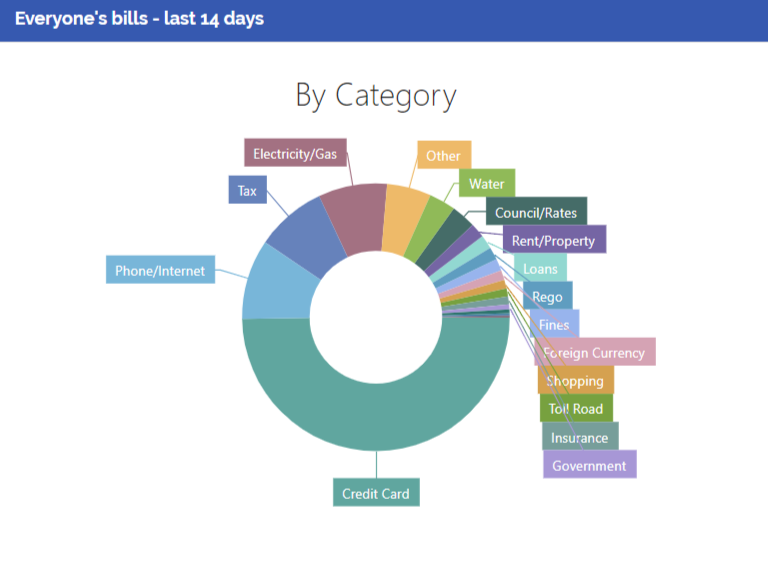

When using Living Room of Satoshi, it is important to keep in mind that all cryptocurrency transactions are subject to taxation. This means that any payments made through Living Room of Satoshi may be subject to capital gains tax, depending on the value of the cryptocurrency at the time of the transaction. It is important to keep accurate records of your transactions in order to properly report them on your tax return.

Understanding the Tax Implications of Living Room Of Satoshi

For many users, cryptocurrency is still a relatively new concept and understanding the tax implications of using Living Room of Satoshi may seem daunting. However, it is important to educate yourself on the potential tax liabilities that come with using this service. This includes understanding the current tax laws and regulations regarding cryptocurrency in your country.

How to Report Living Room Of Satoshi Transactions on Your Taxes

Reporting your Living Room of Satoshi transactions on your taxes may seem complicated, but it is crucial for staying compliant with tax laws. It is recommended to seek the advice of a tax professional to ensure that you are reporting your transactions accurately and in accordance with current tax laws. You may also need to file additional forms, such as a Schedule D, to report your cryptocurrency transactions.

Tax Tips for Living Room Of Satoshi Users

For those who regularly use Living Room of Satoshi for financial transactions, it is important to stay informed on any changes in tax laws that may affect your tax liability. It is also recommended to keep detailed records of all your transactions and consult with a tax professional for any questions or concerns. Lastly, it is important to set aside funds for potential tax liabilities that may arise from using Living Room of Satoshi.

The Impact of Living Room Of Satoshi on Your Tax Return

Using Living Room of Satoshi may have a significant impact on your tax return, especially if you have a high volume of cryptocurrency transactions. This is because capital gains taxes may be applied to any gains made from the appreciation of cryptocurrency value. It is important to factor in these potential tax liabilities when filing your tax return.

Navigating the Tax Implications of Living Room Of Satoshi

Navigating the tax implications of using Living Room of Satoshi can be challenging, especially for those who are not familiar with cryptocurrency. It is important to stay informed and seek the guidance of a tax professional to ensure that you are following all necessary tax laws and regulations.

Tax Considerations for Living Room Of Satoshi Transactions

In addition to capital gains taxes, there are other tax considerations to keep in mind when using Living Room of Satoshi. For example, if you are using cryptocurrency for business transactions, you may also need to pay income tax on any profits made from these transactions. It is important to consult with a tax professional to determine your tax liability for using Living Room of Satoshi.

Living Room Of Satoshi and Your Tax Liability

As with any financial service, using Living Room of Satoshi may have an impact on your overall tax liability. It is important to understand the potential tax implications and plan accordingly. Keeping accurate records and seeking the guidance of a tax professional can help ensure that you are properly reporting your transactions and minimizing any potential tax liabilities.

Tax Planning for Living Room Of Satoshi Users

For individuals and businesses who regularly use Living Room of Satoshi, tax planning is essential for staying compliant with tax laws and minimizing tax liabilities. This may include setting aside funds for potential taxes, keeping detailed records of transactions, and seeking the advice of a tax professional. By staying organized and informed, you can ensure that you are properly reporting your Living Room of Satoshi transactions on your taxes.

The Benefits of a Well-Designed Living Room

Creating a Welcoming Atmosphere

A well-designed living room can serve as the heart of a home, providing a warm and inviting atmosphere for family and friends to gather. By carefully selecting

furniture and decor

, you can create a space that is both functional and aesthetically pleasing. This is especially important as the living room is often the first room guests see when entering your home, setting the tone for the rest of the house.

A well-designed living room can serve as the heart of a home, providing a warm and inviting atmosphere for family and friends to gather. By carefully selecting

furniture and decor

, you can create a space that is both functional and aesthetically pleasing. This is especially important as the living room is often the first room guests see when entering your home, setting the tone for the rest of the house.

Increase in Property Value

Investing in a well-designed living room can also have significant financial benefits. According to a report by the National Association of Realtors,

homeowners can expect to recoup 58% of the cost of a living room remodel

when selling their home. This is because a well-designed living room can make a strong first impression on potential buyers, increasing the overall value of the property.

Investing in a well-designed living room can also have significant financial benefits. According to a report by the National Association of Realtors,

homeowners can expect to recoup 58% of the cost of a living room remodel

when selling their home. This is because a well-designed living room can make a strong first impression on potential buyers, increasing the overall value of the property.

Maximizing Space and Functionality

A well-designed living room can also improve the functionality of your home. With clever storage solutions and

strategic placement of furniture

, you can make the most out of a small space and create a clutter-free environment. This not only makes daily living more comfortable but also allows for easier entertaining and hosting of guests.

A well-designed living room can also improve the functionality of your home. With clever storage solutions and

strategic placement of furniture

, you can make the most out of a small space and create a clutter-free environment. This not only makes daily living more comfortable but also allows for easier entertaining and hosting of guests.

Creating a Personalized Space

One of the most significant advantages of a well-designed living room is the ability to create a space that reflects your personal style and taste. Whether you prefer a cozy and traditional look or a modern and minimalist vibe, your living room design can be tailored to your unique preferences. This not only makes your home feel more personalized but also adds to the overall enjoyment of living in it.

One of the most significant advantages of a well-designed living room is the ability to create a space that reflects your personal style and taste. Whether you prefer a cozy and traditional look or a modern and minimalist vibe, your living room design can be tailored to your unique preferences. This not only makes your home feel more personalized but also adds to the overall enjoyment of living in it.

The Importance of Professional Design

While it may be tempting to tackle a living room design project on your own,

hiring a professional designer can make all the difference

. A designer can help you create a cohesive and well-balanced space that meets your specific needs and budget. They also have access to resources and materials that may not be available to the general public, ensuring that your living room stands out from the rest.

In conclusion, a well-designed living room offers numerous benefits, from creating a welcoming atmosphere to increasing property value. By investing in professional design and carefully selecting furniture and decor, you can transform your living room into a functional and aesthetically pleasing space that reflects your unique style. So, why wait? Start designing your dream living room today and reap the rewards for years to come.

While it may be tempting to tackle a living room design project on your own,

hiring a professional designer can make all the difference

. A designer can help you create a cohesive and well-balanced space that meets your specific needs and budget. They also have access to resources and materials that may not be available to the general public, ensuring that your living room stands out from the rest.

In conclusion, a well-designed living room offers numerous benefits, from creating a welcoming atmosphere to increasing property value. By investing in professional design and carefully selecting furniture and decor, you can transform your living room into a functional and aesthetically pleasing space that reflects your unique style. So, why wait? Start designing your dream living room today and reap the rewards for years to come.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FI577BW3K5A5FJTHT4OML2V5UA.png)