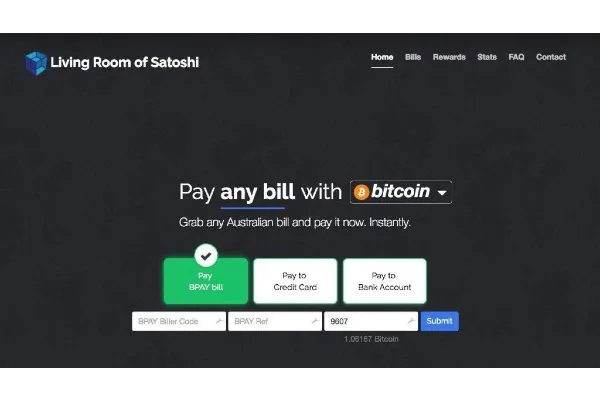

Living Room Of Satoshi is an Australia-based payment platform that allows users to pay their bills and invoices using various cryptocurrencies, including Bitcoin, Litecoin, and Ether. While this service has gained popularity among the crypto community for its convenience and low fees, many users are still unsure about the tax implications of using this platform. In this article, we will discuss the top 10 things you need to know about the taxation of Bitcoin in Australia when using Living Room Of Satoshi.Living Room Of Satoshi Tax Australia

In 2017, the Australian government announced that it would treat Bitcoin as property for tax purposes. This means that any gains made from buying, selling, or using Bitcoin will be subject to capital gains tax (CGT). However, the tax treatment of Bitcoin can vary depending on the specific circumstances of the individual or business. This is where Living Room Of Satoshi Tax Australia comes into play.Taxation of Bitcoin in Australia

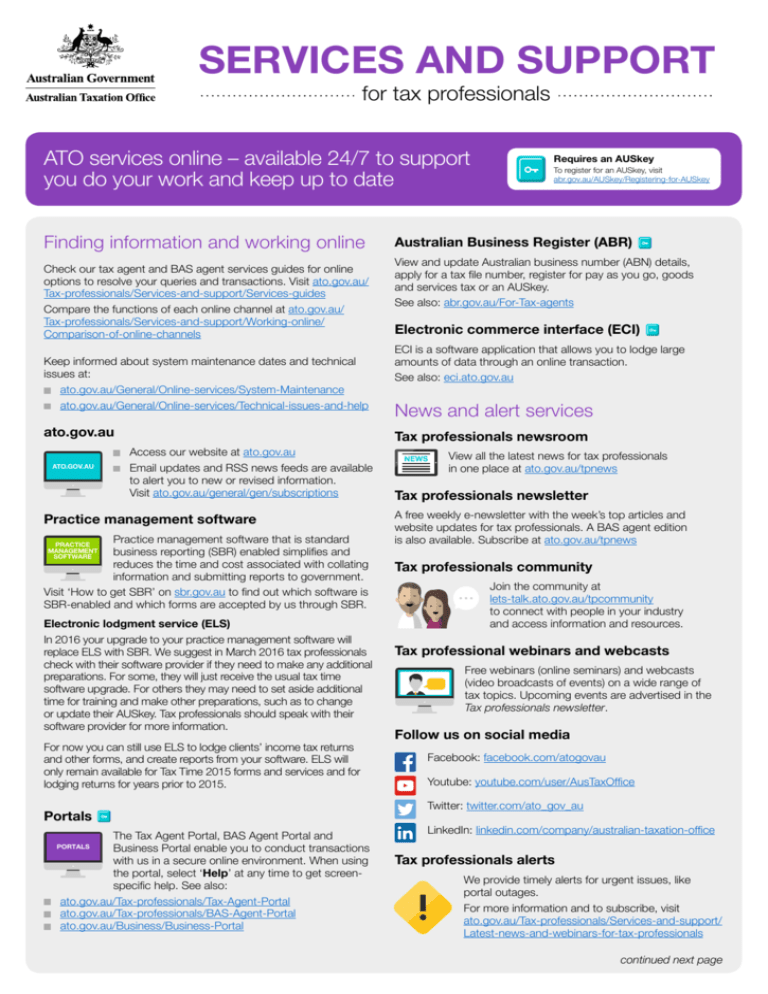

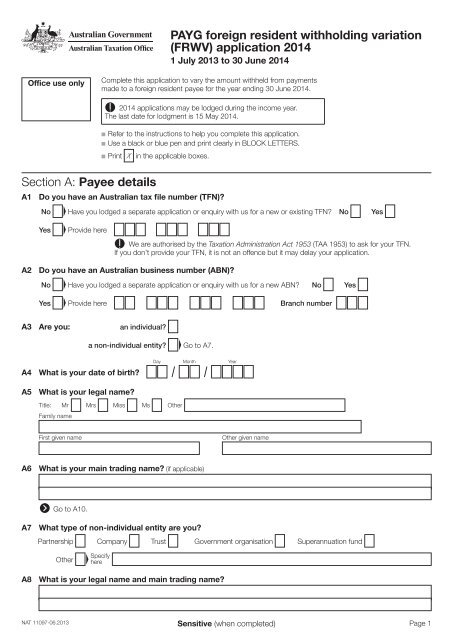

While the Australian Taxation Office (ATO) treats Bitcoin as property, it does not have specific laws for the taxation of other cryptocurrencies. This can make it challenging for individuals and businesses to understand their tax obligations when using Living Room Of Satoshi or other crypto payment platforms. However, the ATO has released guidance on the tax treatment of cryptocurrencies, which can help users navigate this complex area.Cryptocurrency Tax Laws in Australia

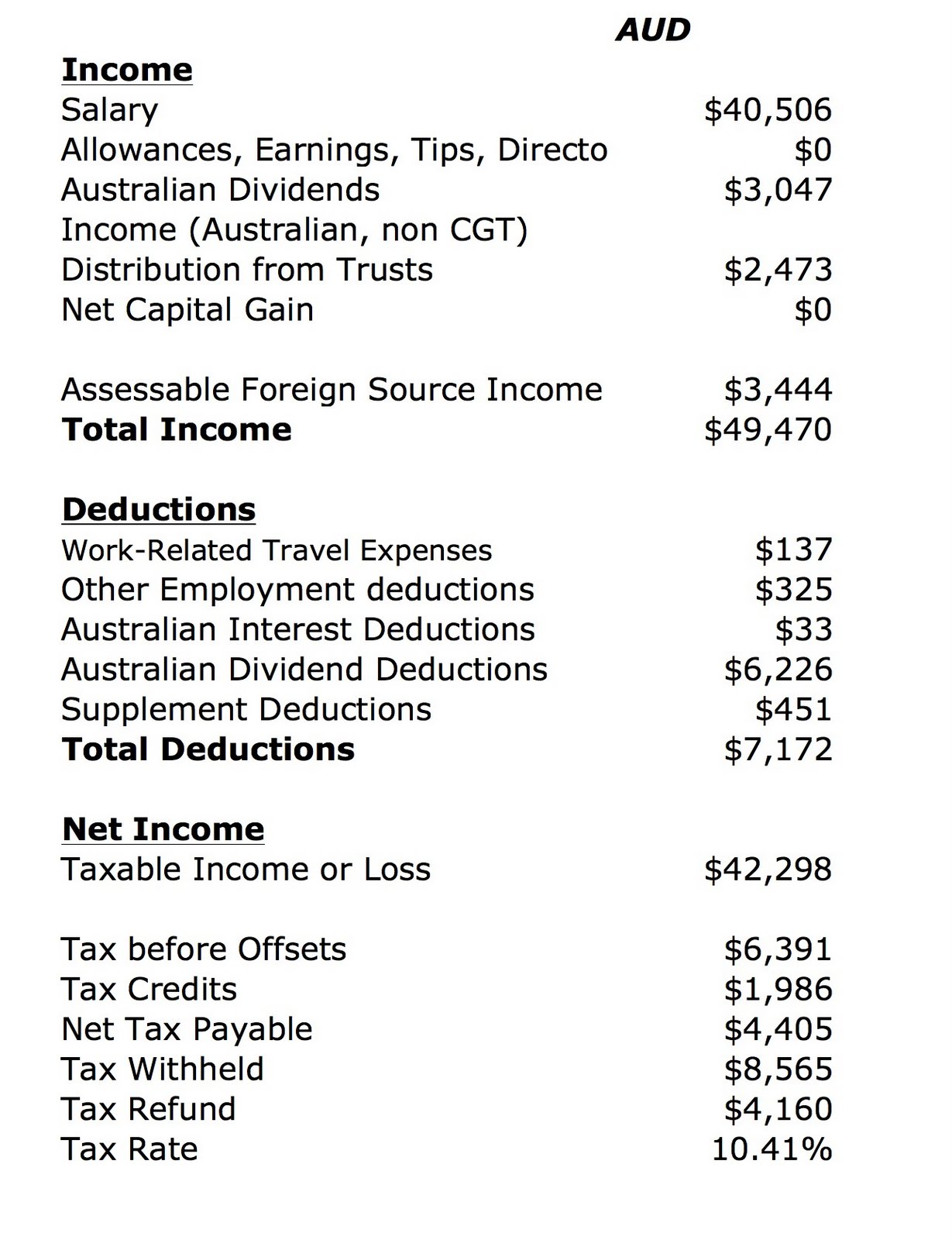

The ATO has made it clear that any gains made from buying, selling, or using Bitcoin will be subject to CGT. This means that if you use Living Room Of Satoshi to pay your bills using Bitcoin, you will need to keep detailed records of the transaction. This includes the date of the transaction, the value in Australian dollars, and the purpose of the transaction. Failure to keep accurate records can result in penalties from the ATO.ATO Bitcoin Tax

The ATO has also stated that any losses made from buying, selling, or using Bitcoin can be used to offset capital gains from other assets. This means that if you have any losses from using Living Room Of Satoshi, you can deduct them from your overall tax liability. However, it is essential to note that the ATO expects individuals and businesses to declare their cryptocurrency transactions in their tax returns. Failure to do so can result in penalties and audits.Australian Tax Office and Bitcoin

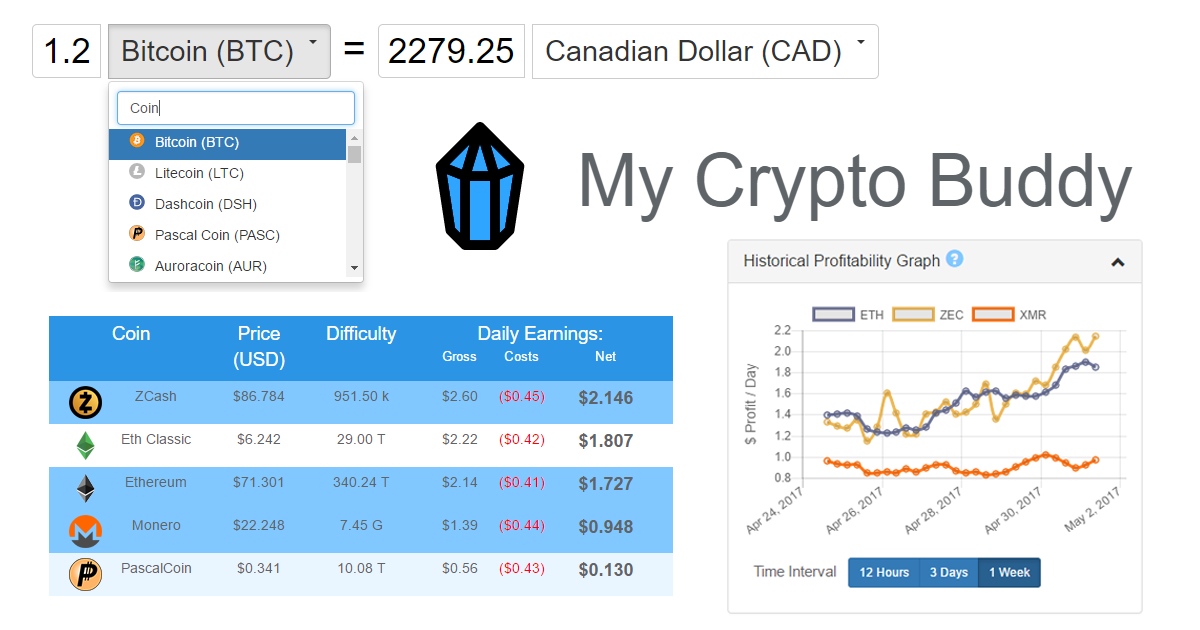

Calculating the tax on your Bitcoin transactions can be a complicated process. To make things easier, the ATO has developed a Bitcoin tax calculator that can help you determine your tax liability. However, this calculator is only a guide, and it is still essential to seek professional tax advice to ensure you are meeting your tax obligations correctly.Bitcoin Tax Calculator Australia

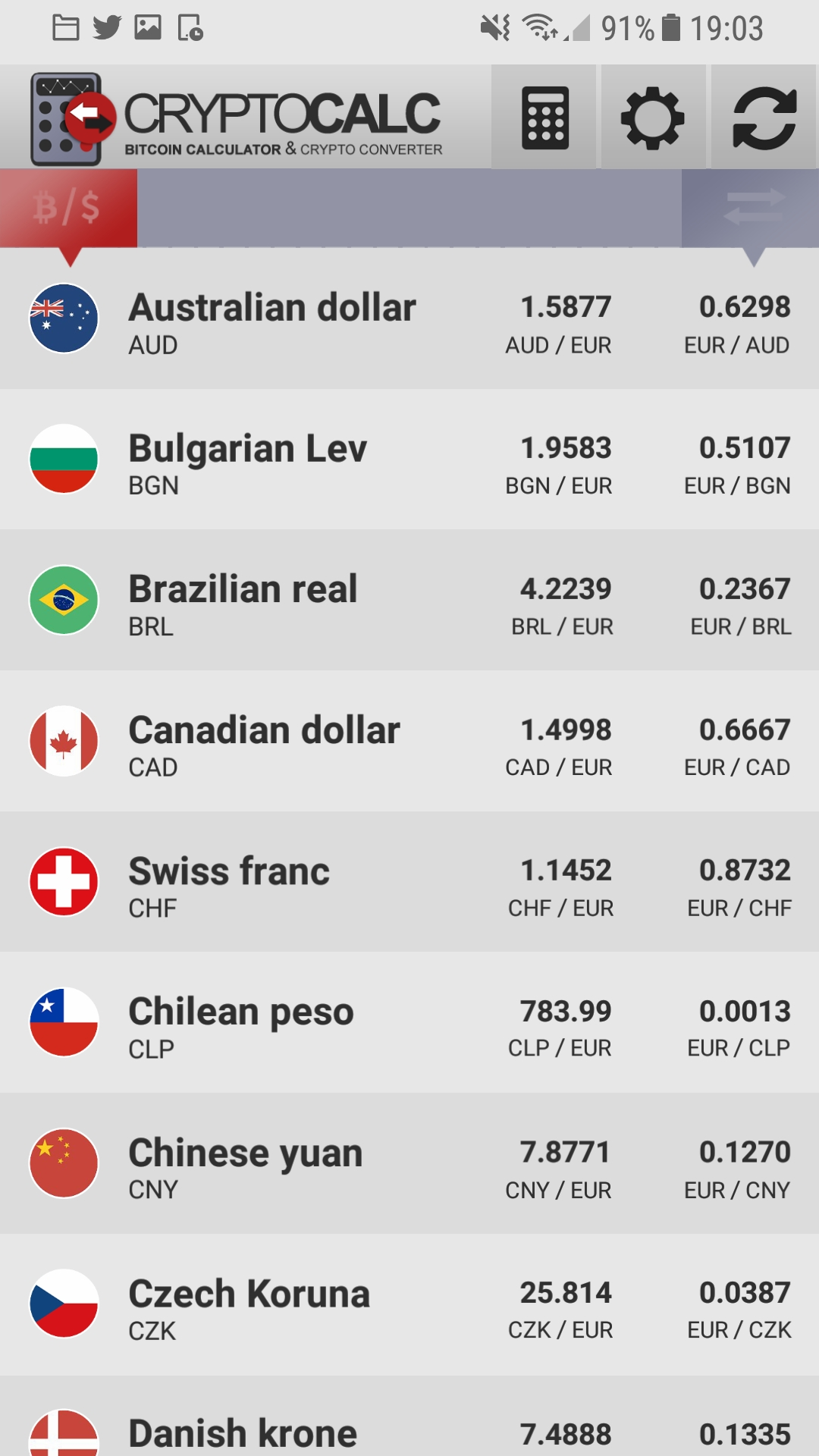

While Bitcoin is the most well-known cryptocurrency, there are thousands of other digital currencies in the market. The tax treatment of these other cryptocurrencies can vary, and it is crucial to seek professional tax advice when using them. This is especially true if you are using Living Room Of Satoshi, as the ATO's guidance may not cover these other cryptocurrencies.Crypto Tax Australia

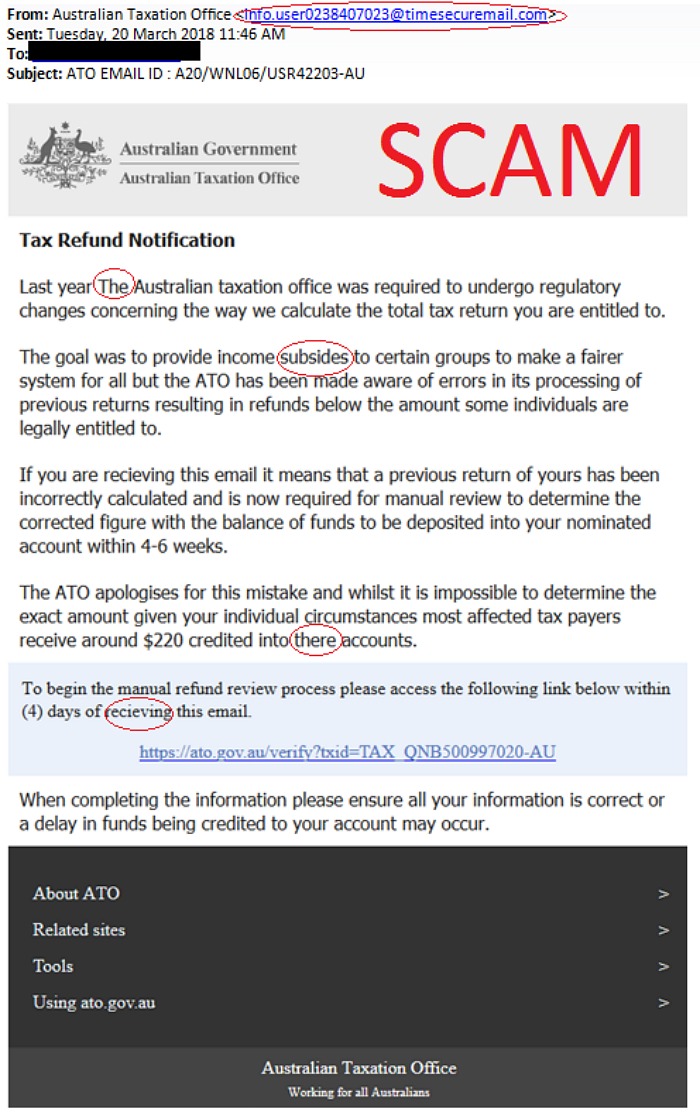

The ATO has made it clear that it expects individuals and businesses to report their cryptocurrency transactions in their tax returns. This means that if you use Living Room Of Satoshi to pay your bills using Bitcoin, you will need to report this in your tax return. Failure to do so can result in penalties and audits from the ATO.Bitcoin Tax Reporting in Australia

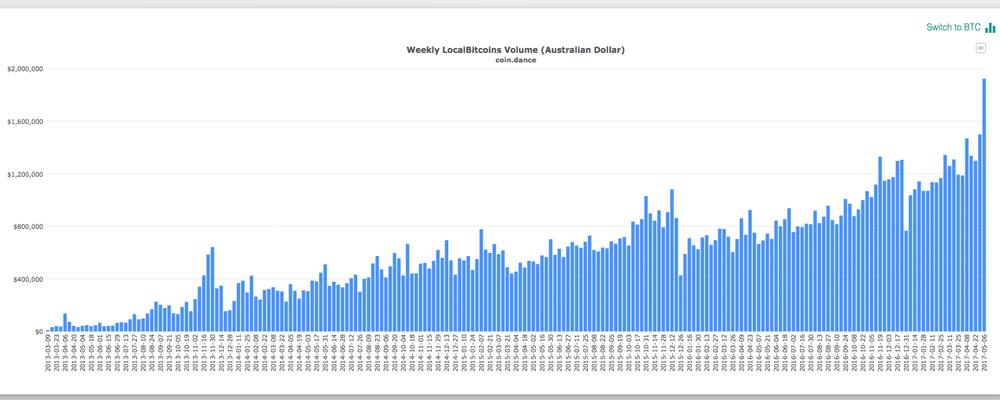

The ATO has recognized the growing popularity of cryptocurrencies in Australia and has taken steps to provide guidance on their tax treatment. They have also recently launched a data-matching program to identify individuals and businesses that may not be meeting their tax obligations when it comes to cryptocurrencies. This highlights the importance of understanding and complying with the tax laws when using Living Room Of Satoshi or any other crypto payment platform.Australian Taxation Office and Cryptocurrency

Finally, it is essential to note that the tax treatment of Bitcoin in Australia is still evolving, and the ATO's guidance may change in the future. It is crucial to stay up-to-date with any changes in the tax laws and seek professional tax advice to ensure you are meeting your tax obligations correctly. This is especially important when using Living Room Of Satoshi, as it is a relatively new and innovative way to pay bills and invoices using cryptocurrencies. In conclusion, while Living Room Of Satoshi offers a convenient and low-cost way to pay bills and invoices using cryptocurrencies, it is crucial to understand the tax implications of using this platform. By following the ATO's guidance and seeking professional tax advice, you can ensure that you are meeting your tax obligations and avoiding any penalties or audits. As the world of cryptocurrency continues to evolve, it is essential to stay informed and compliant with the tax laws to avoid any legal issues. Bitcoin Taxation Guidelines in Australia

Welcome to the Living Room of Satoshi Tax Australia

Revolutionizing House Design with Crypto Payments

The world of interior design is constantly evolving, with new trends and technologies emerging every day. But the latest addition to the industry is unlike anything we've seen before –

crypto payments

. And leading the charge in this innovative approach to house design is the Living Room of Satoshi Tax Australia.

Gone are the days of traditional payment methods for home renovations and interior design. With the rise of

cryptocurrency

, more and more homeowners are looking for ways to incorporate this digital currency into their daily lives. And what better way to do so than by using it to pay for their dream living room?

But why choose the Living Room of Satoshi Tax Australia for your crypto payments? For starters, they offer a seamless and secure payment process, making it easy for clients to use their preferred form of digital currency. With a

user-friendly platform

and

24/7 customer support

, you can rest assured that your transaction will go smoothly.

But that's not all – the Living Room of Satoshi Tax Australia also offers a

wide range of services

to cater to all your interior design needs. From furniture selection to color schemes and lighting design, their team of

expert designers

will work closely with you to bring your vision to life. And with their

competitive pricing

and

timely delivery

, you can have the living room of your dreams without breaking the bank.

But what sets the Living Room of Satoshi Tax Australia apart from other interior design companies is their

commitment to sustainability

. With a focus on

eco-friendly materials

and

energy-efficient design

, they not only create beautiful living spaces but also contribute to a greener future.

In conclusion, the Living Room of Satoshi Tax Australia is revolutionizing house design by embracing the world of cryptocurrency. With their seamless payment process, wide range of services, and commitment to sustainability, they are the perfect choice for anyone looking to create their dream living room. So why wait? Start planning your next interior design project with the Living Room of Satoshi Tax Australia today.

The world of interior design is constantly evolving, with new trends and technologies emerging every day. But the latest addition to the industry is unlike anything we've seen before –

crypto payments

. And leading the charge in this innovative approach to house design is the Living Room of Satoshi Tax Australia.

Gone are the days of traditional payment methods for home renovations and interior design. With the rise of

cryptocurrency

, more and more homeowners are looking for ways to incorporate this digital currency into their daily lives. And what better way to do so than by using it to pay for their dream living room?

But why choose the Living Room of Satoshi Tax Australia for your crypto payments? For starters, they offer a seamless and secure payment process, making it easy for clients to use their preferred form of digital currency. With a

user-friendly platform

and

24/7 customer support

, you can rest assured that your transaction will go smoothly.

But that's not all – the Living Room of Satoshi Tax Australia also offers a

wide range of services

to cater to all your interior design needs. From furniture selection to color schemes and lighting design, their team of

expert designers

will work closely with you to bring your vision to life. And with their

competitive pricing

and

timely delivery

, you can have the living room of your dreams without breaking the bank.

But what sets the Living Room of Satoshi Tax Australia apart from other interior design companies is their

commitment to sustainability

. With a focus on

eco-friendly materials

and

energy-efficient design

, they not only create beautiful living spaces but also contribute to a greener future.

In conclusion, the Living Room of Satoshi Tax Australia is revolutionizing house design by embracing the world of cryptocurrency. With their seamless payment process, wide range of services, and commitment to sustainability, they are the perfect choice for anyone looking to create their dream living room. So why wait? Start planning your next interior design project with the Living Room of Satoshi Tax Australia today.

-p-500.png)