If you're in the market for a new mattress, you may have come across the popular Leesa brand. With its high-quality materials and innovative design, Leesa mattresses have become a top choice for many sleepers. However, like any other product, there are additional costs to consider when purchasing a Leesa mattress, including sales tax. In this article, we'll break down everything you need to know about Leesa mattress sales tax and how it may impact your purchase.1. Leesa Mattress Sales Tax: What You Need to Know

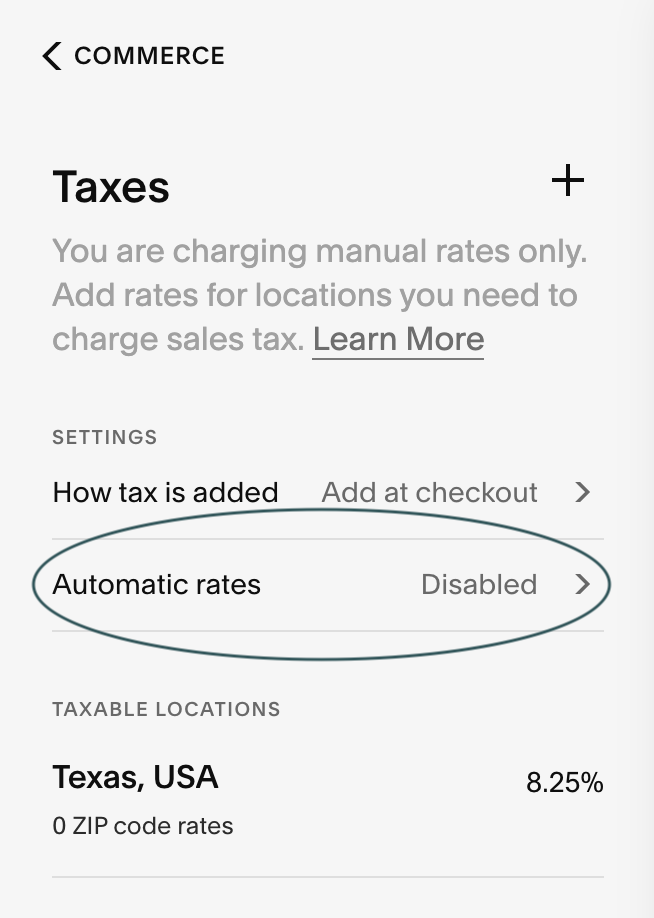

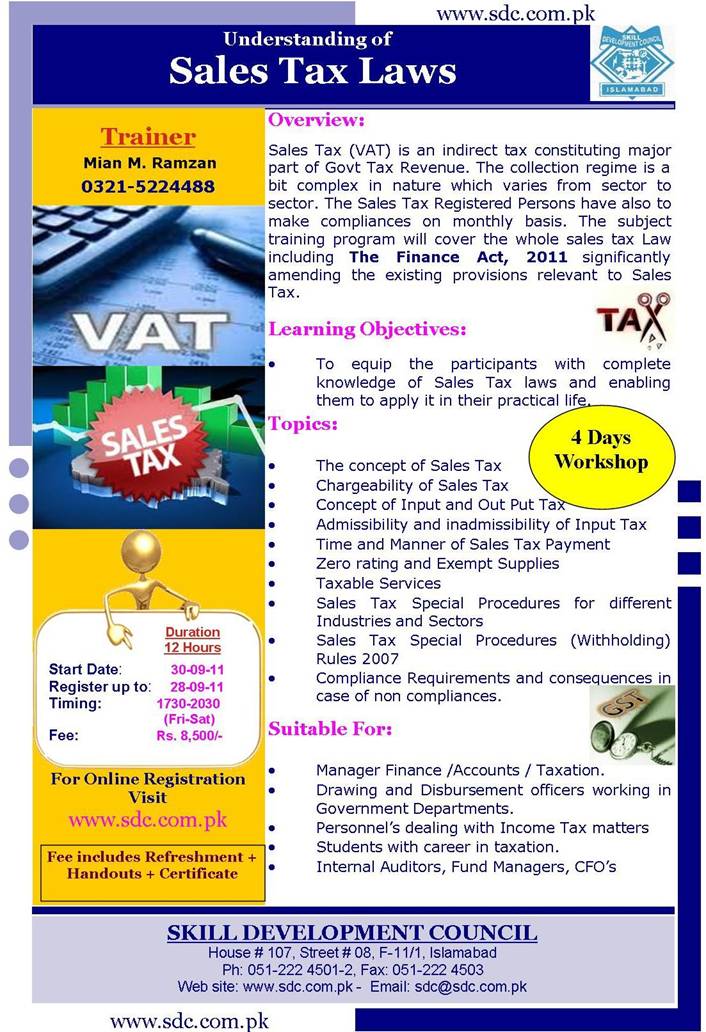

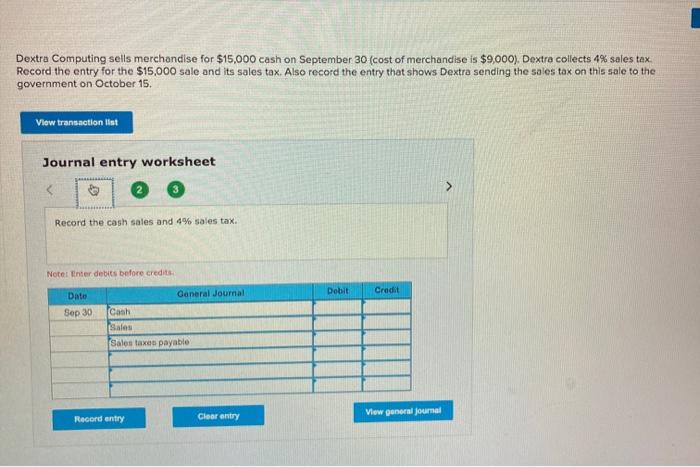

Sales tax is a type of consumption tax that is added to the price of goods and services at the time of purchase. It is typically calculated as a percentage of the total cost and varies depending on the state and local tax laws. When it comes to mattresses, sales tax is usually applied to the full purchase price, including any additional fees or delivery charges. So, when buying a Leesa mattress, you can expect to pay sales tax on the total amount.2. Understanding Sales Tax on Mattresses: Leesa's Guide

The amount of sales tax you'll pay on a Leesa mattress will depend on the state and local tax rates where you live. To calculate the sales tax, you can simply multiply the purchase price of the mattress by the applicable tax rate. For example, if you live in a state with a 6% sales tax and purchase a Leesa mattress for $1000, you can expect to pay an additional $60 in sales tax.3. How to Calculate Sales Tax on a Leesa Mattress

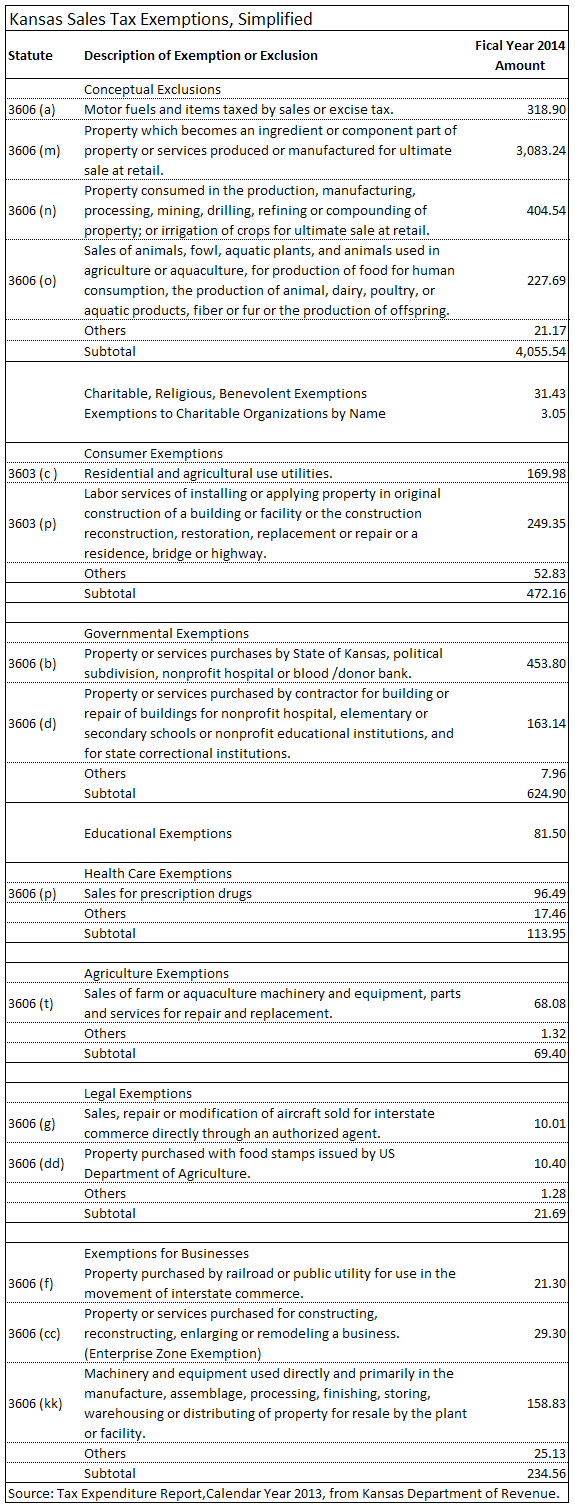

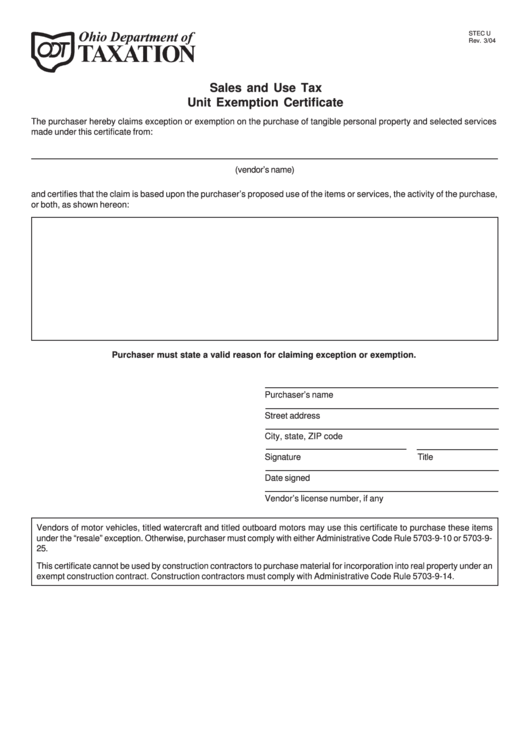

While sales tax is a standard part of purchasing a Leesa mattress, there are some instances where you may be exempt from paying it. In certain states, there are sales tax exemptions for medical necessities, and a mattress may fall under this category if it is deemed medically necessary. Additionally, some states have sales tax holidays where certain items, including mattresses, are exempt from sales tax for a limited time. It's worth checking with your state's tax laws to see if you qualify for any exemptions or sales tax holidays when purchasing a Leesa mattress.4. Sales Tax Exemptions for Leesa Mattresses

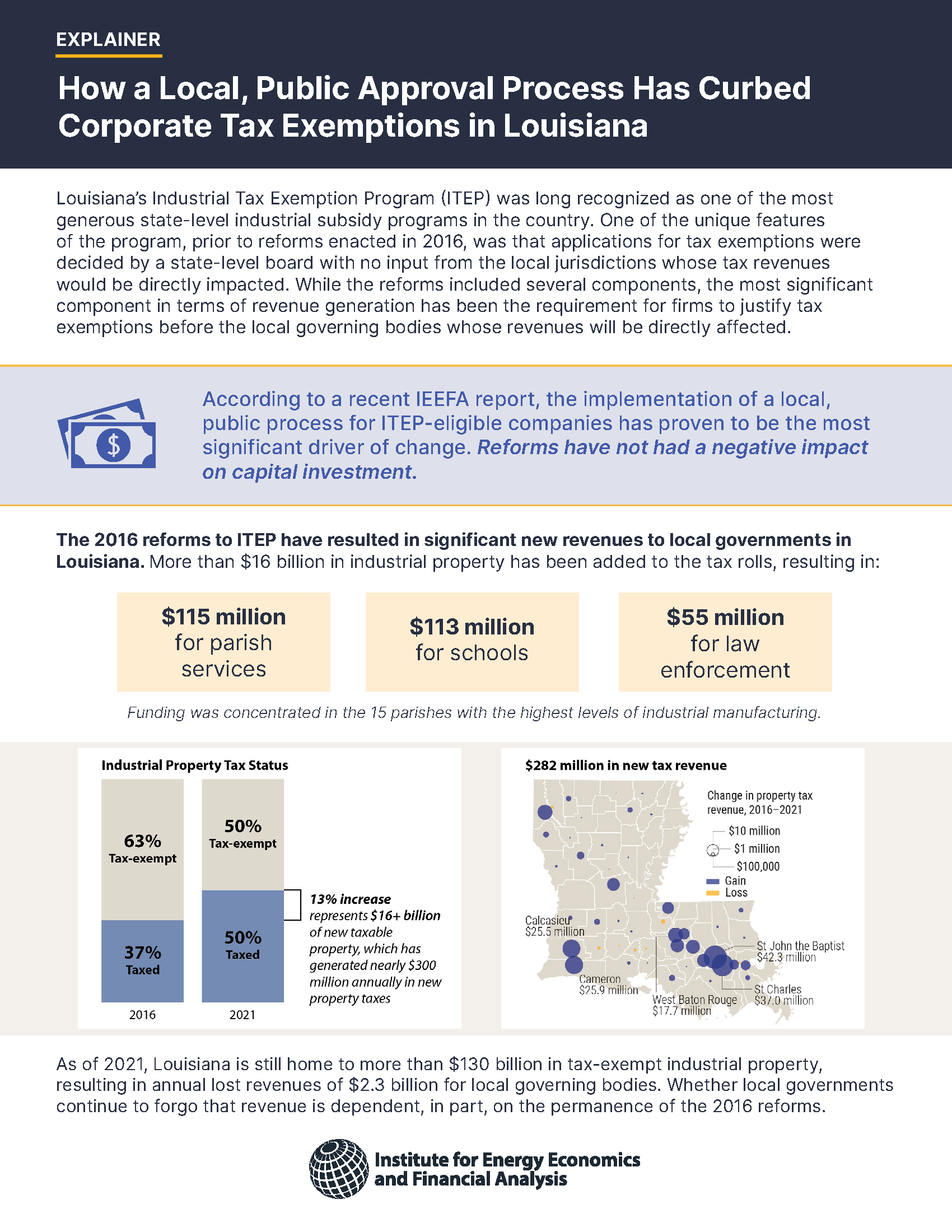

As mentioned, the sales tax rate for Leesa mattresses can vary by state and even by local jurisdiction. Here is a breakdown of the current sales tax rates for Leesa mattresses in some of the top states where they are sold: - California: 7.25% (statewide) + local tax rates - Texas: 6.25% (statewide) + local tax rates - New York: 4% (statewide) + local tax rates - Florida: 6% (statewide) + local tax rates - Illinois: 6.25% (statewide) + local tax rates5. Leesa Mattress Sales Tax: State-by-State Breakdown

Sales tax can add a significant amount to the cost of a Leesa mattress, so it's understandable if you want to find ways to save money on it. One way to potentially save on sales tax is to purchase your mattress during a sales tax holiday, as mentioned earlier. Additionally, some states may offer tax credits or deductions for certain purchases, so it's worth looking into if you can take advantage of any of these when buying a Leesa mattress.6. Tips for Saving Money on Sales Tax When Buying a Leesa Mattress

When comparing the sales tax rates for Leesa mattresses to other brands, there may not be a significant difference. However, it's worth noting that some states have different tax rates for mattresses compared to other products, so it's essential to check the specific rates for mattresses in your area. Additionally, some brands may offer promotions or discounts that could lower the overall cost of the mattress, including the sales tax.7. Comparing Sales Tax Rates for Leesa Mattresses vs. Other Brands

While it's not recommended, there may be ways to avoid paying sales tax on a Leesa mattress. Some people may try to purchase the mattress in a state with a lower sales tax rate or no sales tax at all, such as Delaware, Montana, New Hampshire, or Oregon. However, keep in mind that this may be considered tax evasion and could result in penalties. It's always best to pay the required sales tax when making a purchase.8. How to Avoid Paying Sales Tax on a Leesa Mattress

Depending on the sales tax rate in your area, the impact of sales tax on the cost of a Leesa mattress can vary. However, it's essential to remember that sales tax is a mandatory cost that you should factor into your budget when purchasing a new mattress. While it may increase the overall cost, it also goes towards supporting your local economy and essential services.9. Understanding the Impact of Sales Tax on the Cost of a Leesa Mattress

Here are some frequently asked questions about sales tax and Leesa mattresses: Q: Why do I have to pay sales tax on a mattress? A: Sales tax is a mandatory tax on most goods and services, including mattresses, and goes towards funding local and state services. Q: Can I negotiate or reduce the sales tax on a Leesa mattress? A: No, sales tax is a fixed rate set by state and local tax laws. Q: Do I have to pay sales tax when buying a Leesa mattress online? A: Yes, online purchases are subject to the same sales tax rates as in-store purchases. Q: Is sales tax included in the advertised price of a Leesa mattress? A: No, sales tax is not typically included in the advertised price and will be added at the time of purchase.10. Common Questions About Sales Tax and Leesa Mattresses

How Sales Tax Impacts Your Leesa Mattress Purchase

The Importance of Understanding Sales Tax in Your Mattress Purchase

When shopping for a new mattress, there are many factors to consider - size, material, firmness, and price, to name a few. However, one important factor that often gets overlooked is sales tax. Depending on where you live, sales tax can significantly impact the final price of your mattress purchase, and it's crucial to understand how it will affect your budget.

Sales tax

is a percentage added to the price of goods and services at the point of sale. It is imposed by state and local governments and can vary greatly depending on your location. For example, in some states, sales tax can be as low as 2%, while in others, it can be as high as 10%.

Leesa mattresses

are sold nationwide, and as a consumer, it's essential to know how sales tax will impact your purchase.

When shopping for a new mattress, there are many factors to consider - size, material, firmness, and price, to name a few. However, one important factor that often gets overlooked is sales tax. Depending on where you live, sales tax can significantly impact the final price of your mattress purchase, and it's crucial to understand how it will affect your budget.

Sales tax

is a percentage added to the price of goods and services at the point of sale. It is imposed by state and local governments and can vary greatly depending on your location. For example, in some states, sales tax can be as low as 2%, while in others, it can be as high as 10%.

Leesa mattresses

are sold nationwide, and as a consumer, it's essential to know how sales tax will impact your purchase.

The Impact of Sales Tax on Your Leesa Mattress Purchase

When buying a

Leesa mattress

, the sales tax you pay will depend on the state in which you live. For example, if you live in a state with a high sales tax rate, such as California, your final price for a

Leesa mattress

will be significantly higher than someone living in a state with a lower sales tax rate. This can end up costing you hundreds of dollars more for the same mattress.

It's also crucial to consider the type of sales tax imposed in your state. Some states have a flat sales tax rate, while others have a combination of state and local taxes. This can further impact the final price of your

Leesa mattress

purchase.

Understanding

the sales tax rate and structure in your state can help you make an informed decision when purchasing a

Leesa mattress

. It's essential to do your research and consider the overall cost, including sales tax, before making your final decision.

When buying a

Leesa mattress

, the sales tax you pay will depend on the state in which you live. For example, if you live in a state with a high sales tax rate, such as California, your final price for a

Leesa mattress

will be significantly higher than someone living in a state with a lower sales tax rate. This can end up costing you hundreds of dollars more for the same mattress.

It's also crucial to consider the type of sales tax imposed in your state. Some states have a flat sales tax rate, while others have a combination of state and local taxes. This can further impact the final price of your

Leesa mattress

purchase.

Understanding

the sales tax rate and structure in your state can help you make an informed decision when purchasing a

Leesa mattress

. It's essential to do your research and consider the overall cost, including sales tax, before making your final decision.

How to Save on Sales Tax for Your Leesa Mattress Purchase

While sales tax is an unavoidable expense, there are ways to save money on your

Leesa mattress

purchase. One option is to take advantage of sales tax holidays. These are specific days or weekends throughout the year where sales tax is waived on certain goods, including mattresses.

Another way to save on sales tax is by purchasing your

Leesa mattress

online. In some states, online purchases are not subject to sales tax, which can save you a significant amount of money. However, it's crucial to check with your state's laws to ensure you are not breaking any tax regulations.

In conclusion, sales tax is an important factor to consider when purchasing a

Leesa mattress

. It can significantly impact the final cost and should not be overlooked. By understanding the sales tax rate and structure in your state, you can make an informed decision and potentially save money on your

Leesa mattress

purchase.

While sales tax is an unavoidable expense, there are ways to save money on your

Leesa mattress

purchase. One option is to take advantage of sales tax holidays. These are specific days or weekends throughout the year where sales tax is waived on certain goods, including mattresses.

Another way to save on sales tax is by purchasing your

Leesa mattress

online. In some states, online purchases are not subject to sales tax, which can save you a significant amount of money. However, it's crucial to check with your state's laws to ensure you are not breaking any tax regulations.

In conclusion, sales tax is an important factor to consider when purchasing a

Leesa mattress

. It can significantly impact the final cost and should not be overlooked. By understanding the sales tax rate and structure in your state, you can make an informed decision and potentially save money on your

Leesa mattress

purchase.

/AMI089-4600040ba9154b9ab835de0c79d1343a.jpg)