1. Tax Loopholes for Kitchen Tables

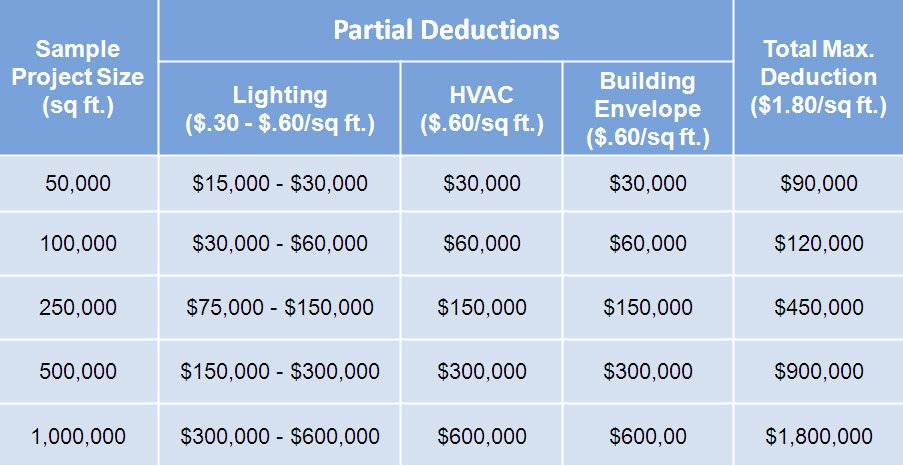

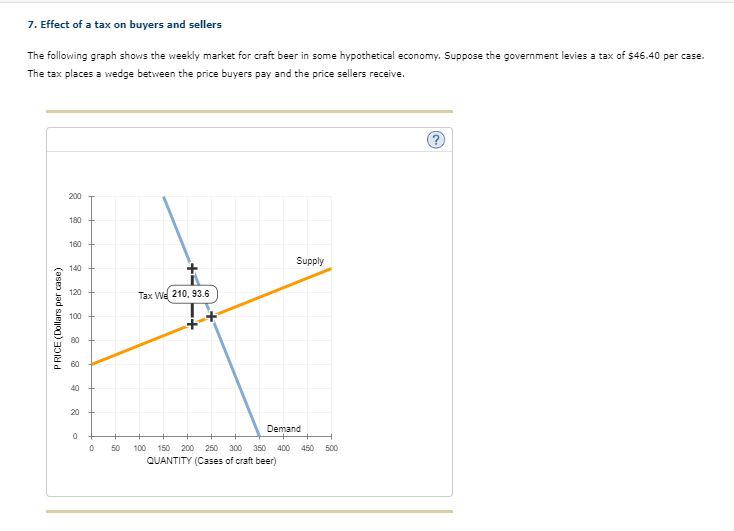

When it comes to saving money on taxes, homeowners are always on the lookout for loopholes and deductions. One often overlooked tax break is the kitchen table loophole. This loophole allows you to deduct a portion of the cost of your kitchen table, as well as any related expenses, from your taxes. Here's how you can take advantage of this money-saving opportunity.

2. How to Save Money on Kitchen Tables

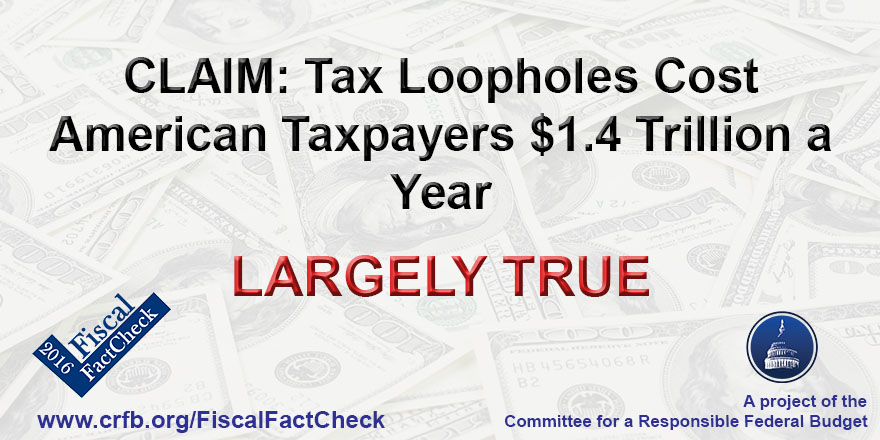

The kitchen table loophole works by allowing you to deduct the cost of your kitchen table as a "capital expense." This means that you can deduct a portion of the cost each year over the expected lifespan of the table. So, if your table is expected to last 10 years, you can deduct 10% of the cost each year. This can add up to significant savings over time.

3. The Hidden Benefits of the Kitchen Table Loophole

While the main benefit of the kitchen table loophole is the tax savings, there are also hidden benefits that can improve your overall financial situation. For one, purchasing a new kitchen table can increase the value of your home, which can lead to higher resale value. Additionally, investing in a high-quality table can save you money in the long run by reducing the need for frequent replacements.

4. Exploring the Kitchen Table Tax Break

The kitchen table loophole is not limited to just the purchase of the table itself. You can also deduct any related expenses, such as delivery and installation fees, from your taxes. This can make a significant difference in the overall cost of your new table. Just be sure to keep all receipts and documentation to support your deductions.

5. Maximizing Your Savings with the Kitchen Table Loophole

To maximize your savings with the kitchen table loophole, it's important to choose a table that meets the criteria for a capital expense. This means that the table must be a permanent fixture in your home and used for business purposes, such as working from home or hosting clients. Additionally, the table must have a useful life of more than one year.

6. The Kitchen Table Loophole: A Guide for Homeowners

If you're a homeowner looking to take advantage of the kitchen table loophole, there are a few key things to keep in mind. First, make sure to consult with a tax professional to ensure you are following all guidelines and laws. Next, keep detailed records of all expenses related to your kitchen table, including the purchase price and any installation or delivery fees.

7. Understanding the Kitchen Table Tax Deduction

The kitchen table loophole falls under the category of a "home office deduction." This means that the table must be used for business purposes and you must be able to prove this with documentation. If you work from home or have a designated home office, the kitchen table can be a valuable addition to your tax deductions.

8. The Kitchen Table Loophole and Its Impact on Your Finances

The kitchen table loophole may seem like a small tax break, but it can have a significant impact on your finances over time. By deducting a portion of the cost each year, you can save money on your taxes and potentially increase the value of your home. This can help you achieve long-term financial goals and improve your overall financial stability.

9. Creative Ways to Use the Kitchen Table Loophole

While the kitchen table loophole is primarily used for tax purposes, there are also creative ways to take advantage of this deduction. For example, if you have a rental property, you can purchase a new kitchen table for the tenants to use and deduct the cost from your taxes. This can make your rental property more appealing to potential tenants and also save you money in the long run.

10. The Kitchen Table Loophole: How to Take Advantage of It

To take advantage of the kitchen table loophole, it's important to do your research and stay organized. Keep track of all expenses related to your table and consult with a tax professional to ensure you are following all guidelines. By using this tax break, you can save money on your taxes and improve your overall financial situation.

The Impact of the "Kitchen Table Loophole" on House Design

How This Loophole is Affecting the Way We Design Our Homes

The "kitchen table loophole" refers to a common practice in house design where homeowners are able to bypass certain regulations and building codes by simply adding furniture, such as a kitchen table, to a room. This loophole has been used for years by homeowners, contractors, and designers alike, often with little consequences. However, recent changes in building codes and regulations have shed light on the potential dangers and drawbacks of this practice, leading to a shift in the way we approach house design.

One of the main concerns with the "kitchen table loophole" is the safety of the home. By adding furniture to a room, homeowners may be unknowingly creating potential hazards, such as blocking emergency exits or obstructing electrical outlets. In the event of a fire or other emergency, these hazards can have serious consequences and put the lives of occupants at risk. This has prompted stricter enforcement of building codes and regulations, making it more difficult to use the "kitchen table loophole" in house design.

In addition to safety concerns, the "kitchen table loophole" also has implications for the functionality and aesthetics of a home. By using this loophole, homeowners may be sacrificing the flow of their living space and limiting the potential of their home's design. For instance, adding a kitchen table to a room may seem like a simple solution for creating a dining area, but it may also disrupt the natural flow of the room and make it feel cramped and cluttered. This loophole can also lead to a lack of intention in design, as homeowners may rely on furniture to fill in gaps instead of carefully planning and designing each room for its intended purpose.

As a result of these concerns, there has been a shift towards more intentional and thoughtful house design. Designers and homeowners are now taking into consideration the safety, functionality, and aesthetics of a home, rather than relying on loopholes to cut corners. This has led to a rise in innovative and creative design solutions that not only meet building codes and regulations, but also enhance the overall living experience.

In conclusion, the "kitchen table loophole" has greatly impacted the way we design our homes. While it may have been a convenient and common practice in the past, it is becoming increasingly clear that this loophole has its drawbacks and can compromise the safety and functionality of a home. By being more intentional and thoughtful in our approach to house design, we can create spaces that not only meet all necessary standards, but also enhance our daily lives.

The "kitchen table loophole" refers to a common practice in house design where homeowners are able to bypass certain regulations and building codes by simply adding furniture, such as a kitchen table, to a room. This loophole has been used for years by homeowners, contractors, and designers alike, often with little consequences. However, recent changes in building codes and regulations have shed light on the potential dangers and drawbacks of this practice, leading to a shift in the way we approach house design.

One of the main concerns with the "kitchen table loophole" is the safety of the home. By adding furniture to a room, homeowners may be unknowingly creating potential hazards, such as blocking emergency exits or obstructing electrical outlets. In the event of a fire or other emergency, these hazards can have serious consequences and put the lives of occupants at risk. This has prompted stricter enforcement of building codes and regulations, making it more difficult to use the "kitchen table loophole" in house design.

In addition to safety concerns, the "kitchen table loophole" also has implications for the functionality and aesthetics of a home. By using this loophole, homeowners may be sacrificing the flow of their living space and limiting the potential of their home's design. For instance, adding a kitchen table to a room may seem like a simple solution for creating a dining area, but it may also disrupt the natural flow of the room and make it feel cramped and cluttered. This loophole can also lead to a lack of intention in design, as homeowners may rely on furniture to fill in gaps instead of carefully planning and designing each room for its intended purpose.

As a result of these concerns, there has been a shift towards more intentional and thoughtful house design. Designers and homeowners are now taking into consideration the safety, functionality, and aesthetics of a home, rather than relying on loopholes to cut corners. This has led to a rise in innovative and creative design solutions that not only meet building codes and regulations, but also enhance the overall living experience.

In conclusion, the "kitchen table loophole" has greatly impacted the way we design our homes. While it may have been a convenient and common practice in the past, it is becoming increasingly clear that this loophole has its drawbacks and can compromise the safety and functionality of a home. By being more intentional and thoughtful in our approach to house design, we can create spaces that not only meet all necessary standards, but also enhance our daily lives.

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)