1. Kitchen Table Investing: A Beginner's Guide to Building Wealth at Home

Are you tired of watching your hard-earned money sit in a savings account, barely earning any interest? Do you want to take control of your financial future but don't know where to start? Look no further than your own kitchen table. That's right, with the rise of online platforms and accessible investment options, more and more people are turning to kitchen table investing as a way to build wealth from the comfort of their own home.

But what exactly is kitchen table investing? Simply put, it's the act of investing in various assets and securities from your kitchen table, without having to leave your house or rely on a financial advisor. This type of investing is perfect for beginners who want to start small and learn as they go, or for experienced investors looking to diversify their portfolio. So why not pull up a chair and join the kitchen table investing movement?

2. The Kitchen Table Investor: Low-Risk Strategies for the Savvy Investor

One of the biggest benefits of kitchen table investing is the ability to choose low-risk investment strategies. This means you can invest in assets with a lower potential for loss, such as index funds, bonds, and real estate investment trusts (REITs). These options are perfect for those who are risk-averse or looking for a more stable return on their investment.

By utilizing these low-risk strategies, you can minimize the chances of losing your hard-earned money while still seeing a steady growth in your portfolio. And with the convenience of being able to make these investments from your kitchen table, you can easily monitor and adjust your investments as needed.

3. The Power of Kitchen Table Investing: How to Turn Your Home into a Financial Asset

Your home is not just a place to live, it can also be a valuable financial asset. By investing in real estate through platforms like Airbnb or real estate crowdfunding, you can turn your home into a source of passive income. This can be especially beneficial for those who live in high-demand areas or have extra space to rent out.

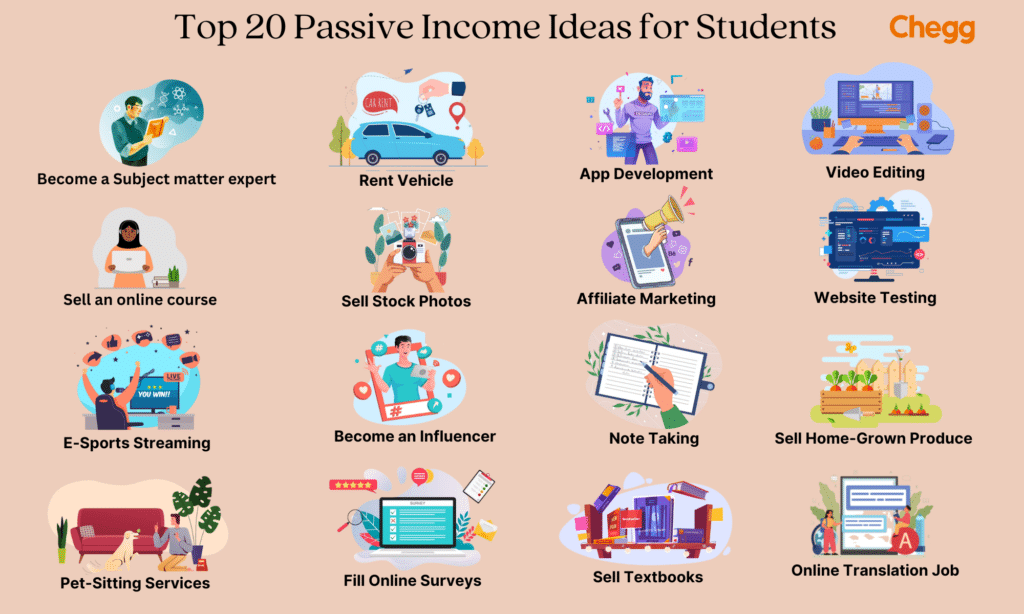

Additionally, you can also use your kitchen table as a workspace for other forms of passive income, such as creating and selling digital products or starting a blog. With the rise of the gig economy, there are endless opportunities to make money from the comfort of your own home.

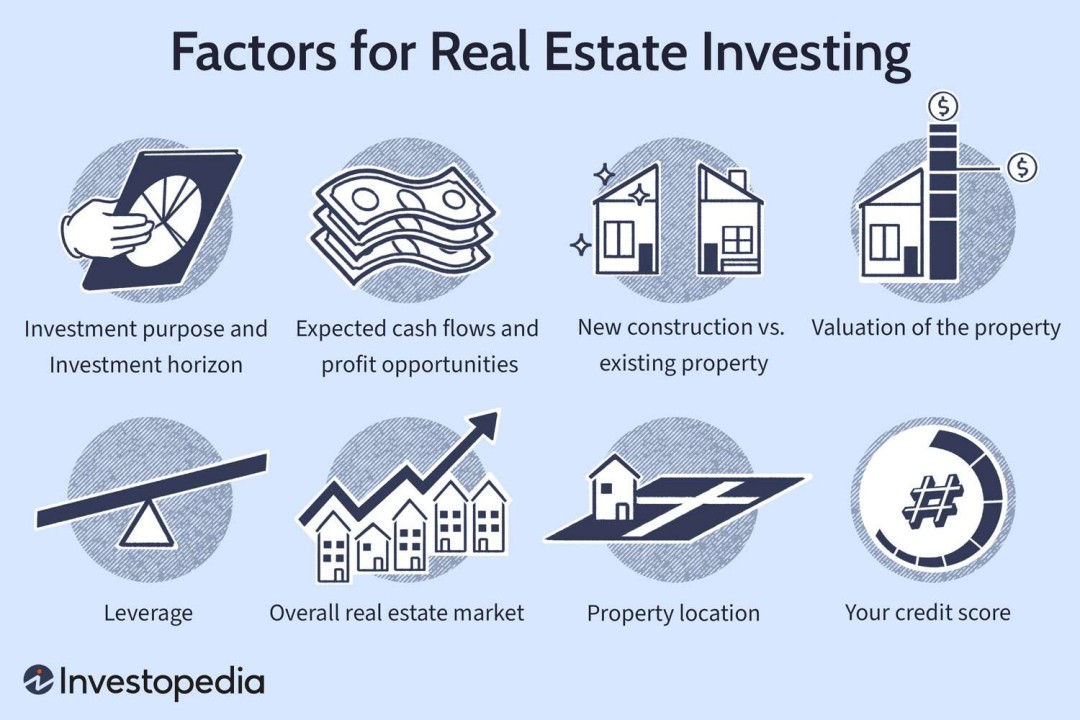

4. The Kitchen Table Investor's Guide to Real Estate Investing

Real estate investing can seem daunting, but with the accessibility of online platforms, it's easier than ever to get started. By investing in real estate investment trusts (REITs), you can own a share of large-scale commercial properties without the hassle of managing them yourself. You can also invest in real estate crowdfunding, which allows you to invest in a specific property and earn a return on your investment as the property generates income.

Whether you're looking to invest in residential or commercial properties, the kitchen table investor's guide to real estate investing can help you navigate this lucrative market and start building wealth from your own home.

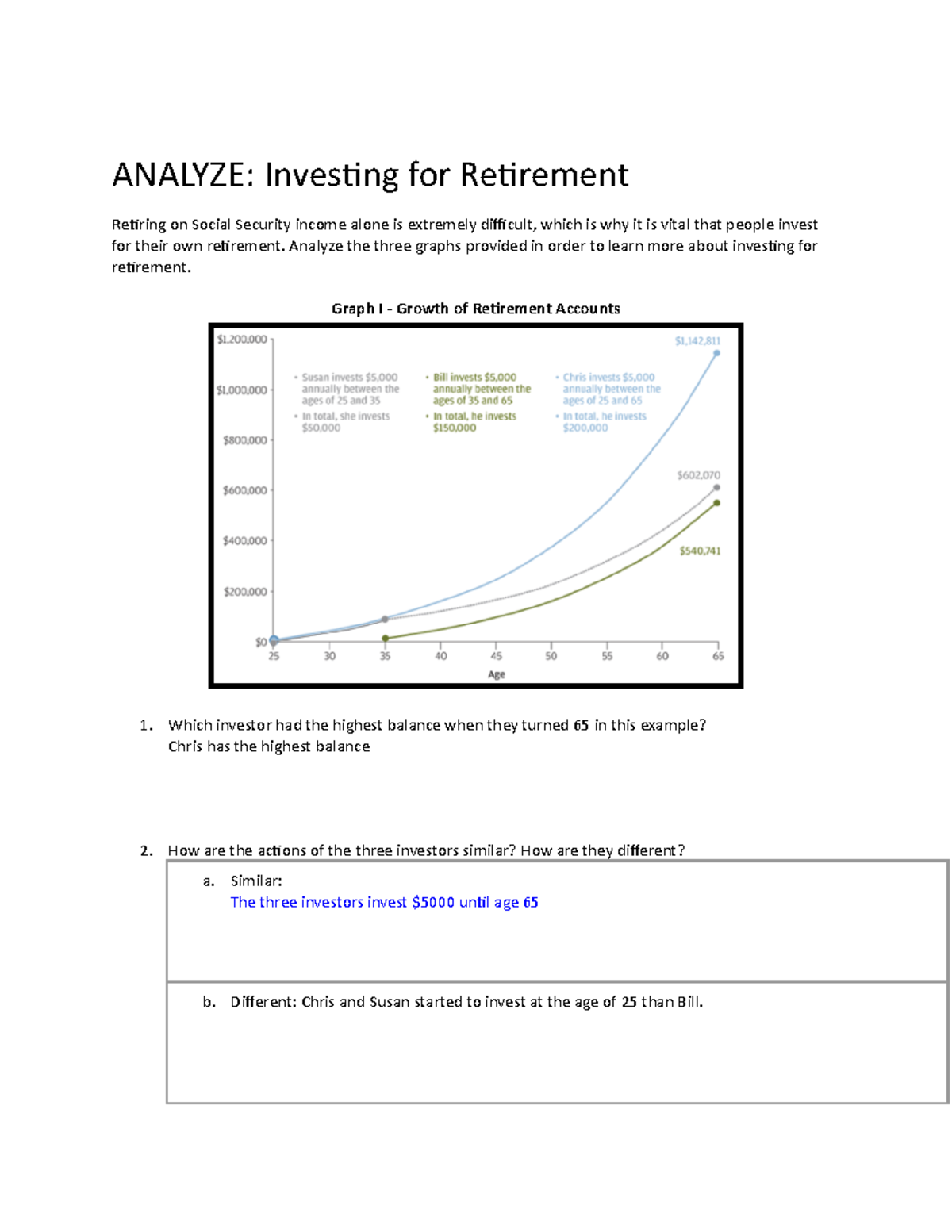

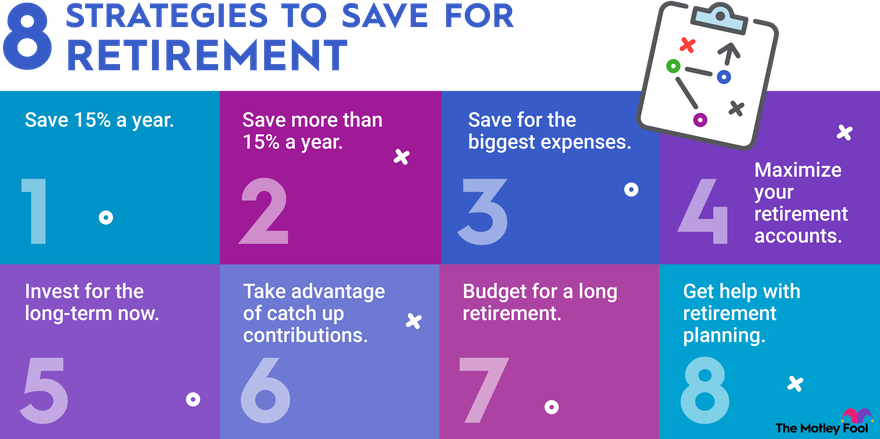

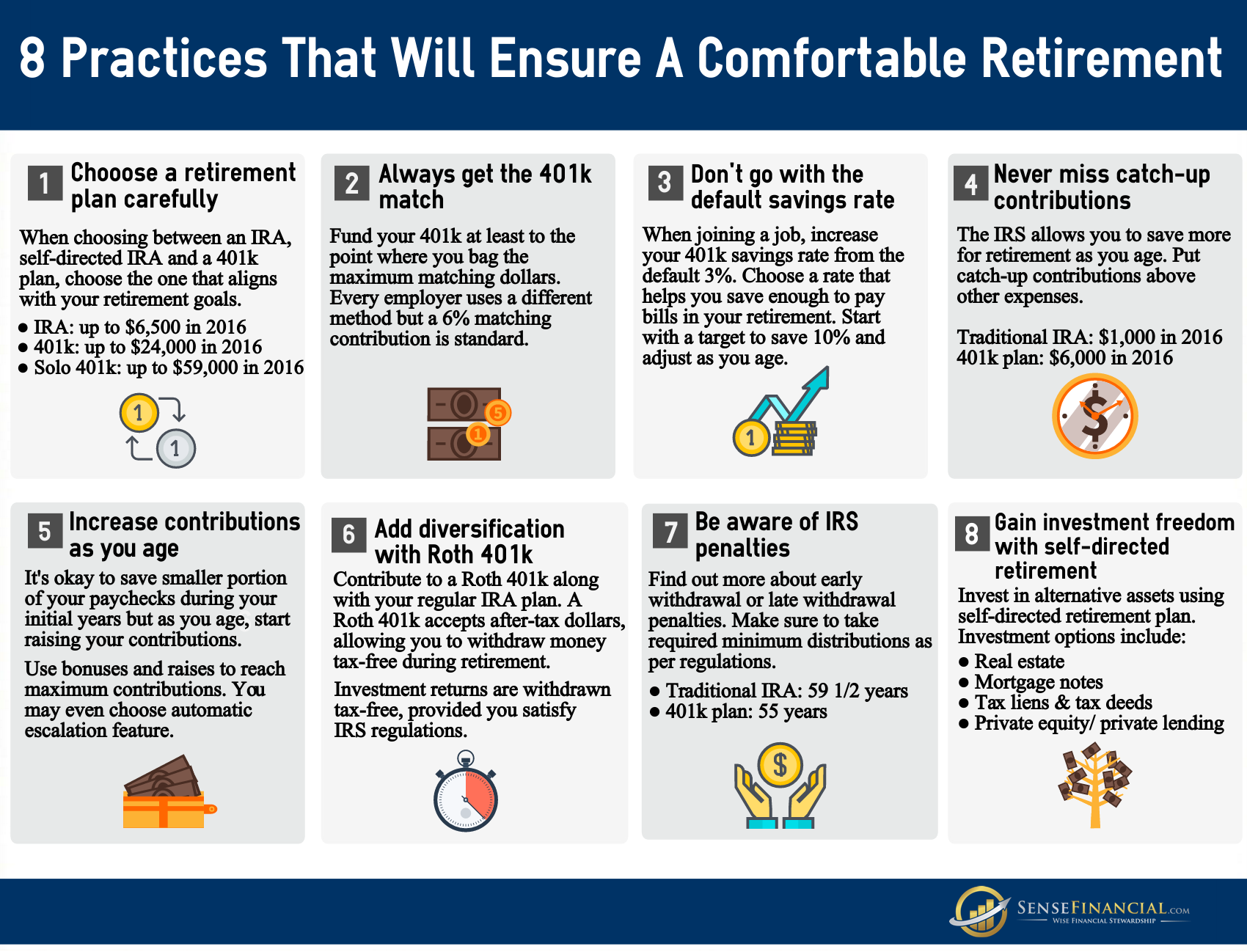

5. Kitchen Table Investing for Retirement: How to Secure Your Financial Future

Retirement may seem far away, but it's never too early to start planning for it. Kitchen table investing can be a great way to build a strong financial foundation for your retirement years. By investing in a diverse portfolio of assets and letting them grow over time, you can ensure a comfortable retirement for yourself and your loved ones.

With the power of compounding interest, even small investments made from your kitchen table can have a big impact on your financial future. So start planning for retirement now and reap the rewards later.

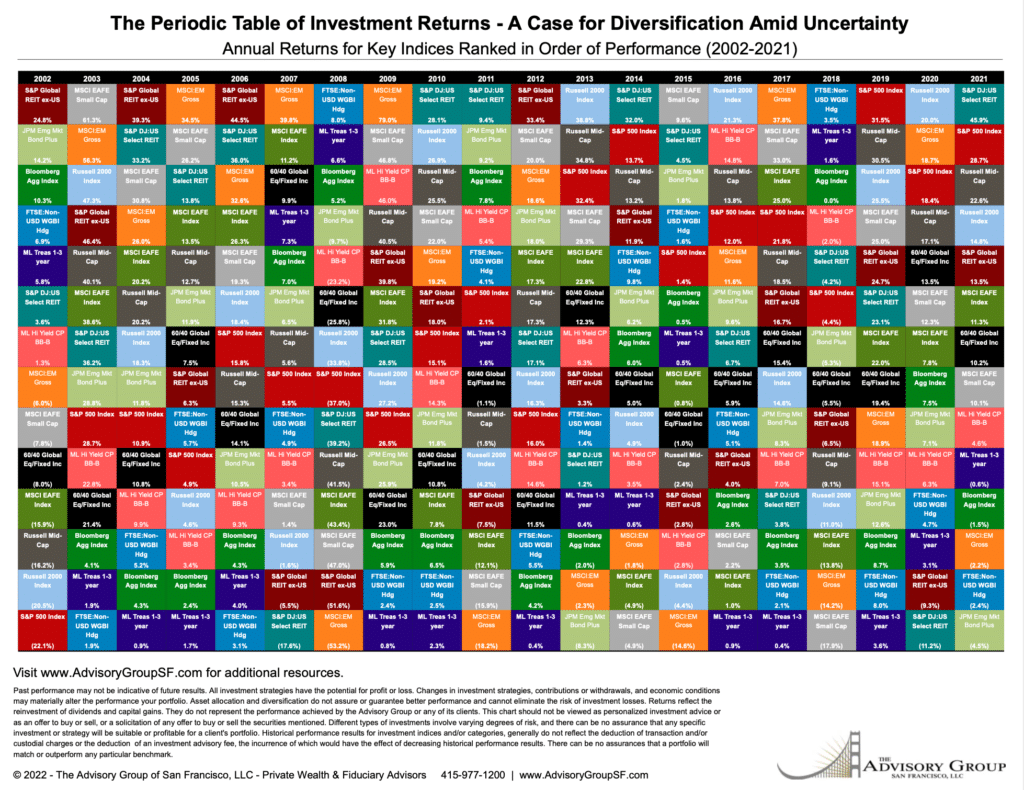

6. The Kitchen Table Investor's Guide to Stock Market Investing

Many people shy away from stock market investing due to the perceived risk and complexity. However, with the help of online platforms, you can easily invest in the stock market from your kitchen table with minimal risk. By diversifying your investments and doing thorough research, you can make educated decisions and potentially see a high return on your investments.

It's important to remember that the stock market is constantly changing, so it's essential to stay informed and be prepared to adapt your investments as needed. But with the convenience and accessibility of kitchen table investing, you can easily keep track of your investments and make informed decisions for your financial future.

7. The Kitchen Table Investor's Guide to Passive Income: How to Make Money While You Sleep

Passive income is the holy grail of financial freedom, and kitchen table investing can help you achieve it. By investing in rental properties, dividend-paying stocks, or other passive income streams, you can generate a steady stream of income without having to actively work for it.

The beauty of passive income is that it continues to come in even when you're not actively working, giving you more time and freedom to enjoy life. So why not start building your passive income streams from your kitchen table?

8. Kitchen Table Investing: How to Grow Your Wealth with Small Investments

One of the greatest benefits of kitchen table investing is the ability to start small. You don't need a large sum of money to begin investing, and you can gradually increase your investments over time as your knowledge and experience grow. This makes it a great option for those who may not have a lot of disposable income but still want to take control of their financial future.

With the power of compounding interest and the ability to invest in a diverse range of assets, even small investments made from your kitchen table can grow into a substantial amount over time. So don't let a limited budget hold you back from building wealth – start kitchen table investing today.

9. The Kitchen Table Investor's Guide to Building a Diversified Investment Portfolio

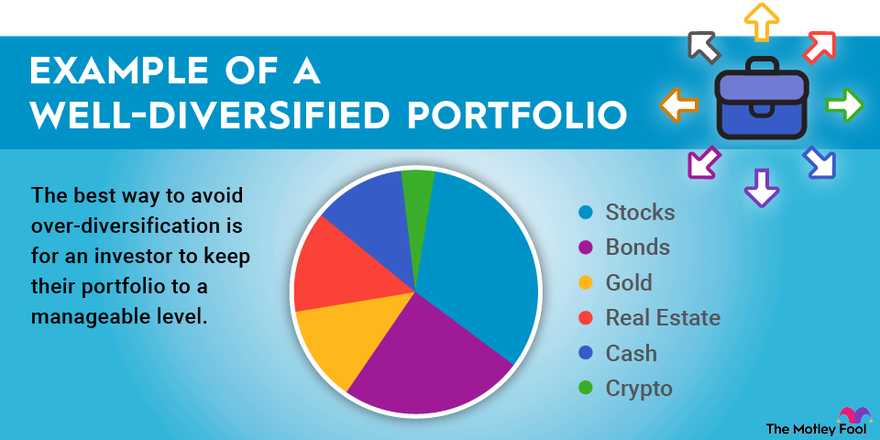

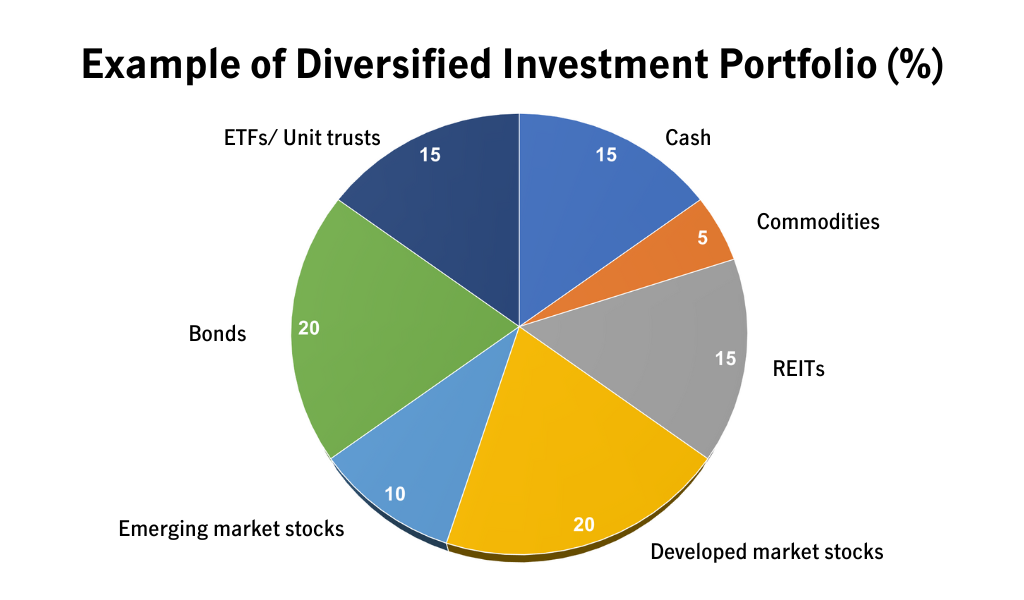

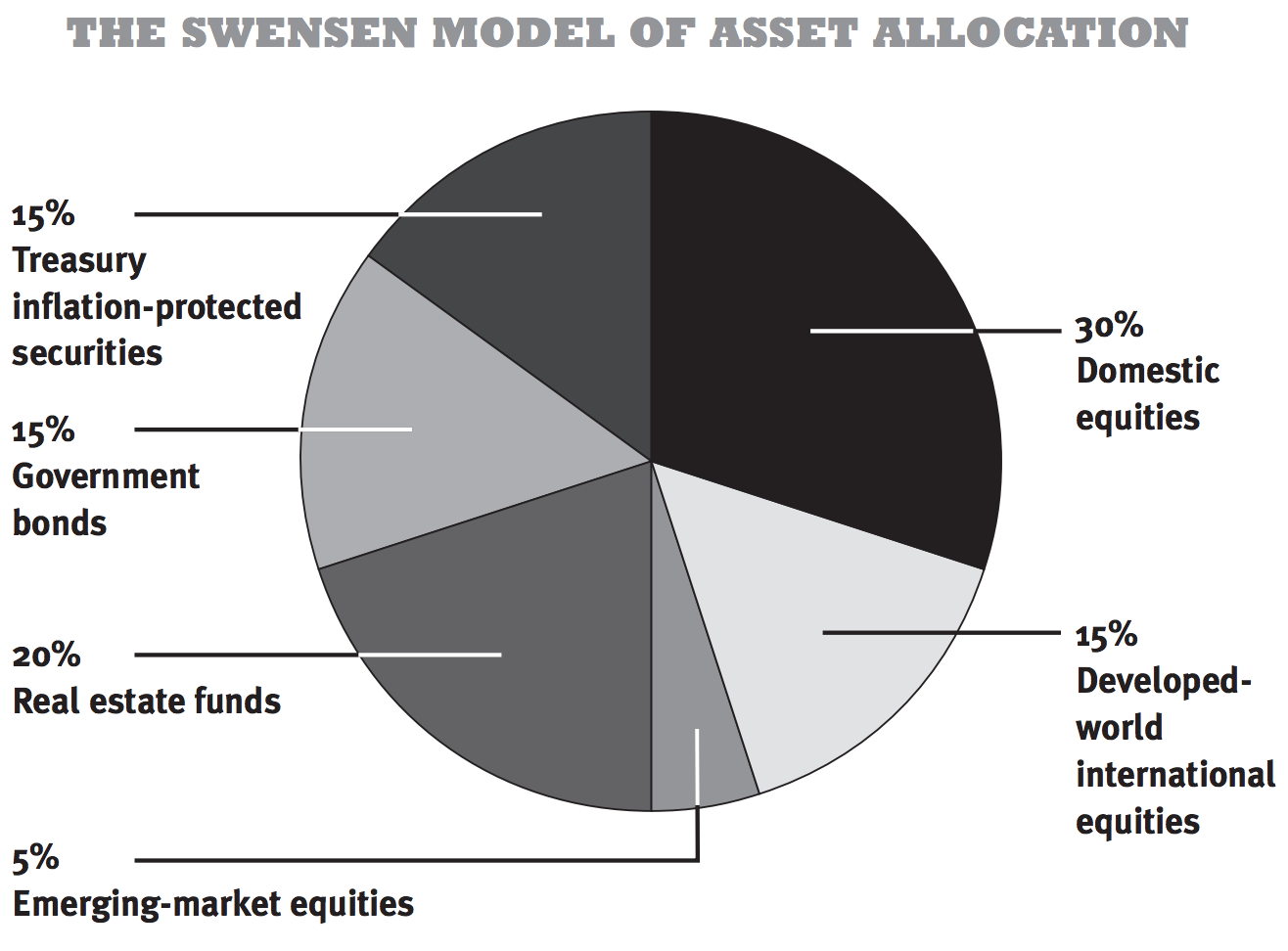

Diversification is key to successful investing, and kitchen table investing allows you to easily build a diverse portfolio. By investing in a mix of assets, such as stocks, bonds, real estate, and alternative investments, you can minimize risk and potentially see a higher return on your investments.

The convenience of kitchen table investing also allows you to easily monitor and adjust your investments to ensure they are in line with your goals and risk tolerance. So don't put all your eggs in one basket – use your kitchen table as a platform to build a well-rounded investment portfolio.

10. Kitchen Table Investing: How to Make Smart Financial Decisions for Your Family's Future

At the end of the day, kitchen table investing is all about taking control of your financial future and securing a better future for yourself and your family. By making smart investment decisions and continuously learning and adapting, you can build a strong financial foundation that will benefit not just yourself, but also future generations.

So why wait? Start kitchen table investing today and take the first step towards a brighter financial future for you and your loved ones.

Kitchen Table Investing: A Budget-Friendly Way to Design Your Dream Home

The Appeal of Kitchen Table Investing

When it comes to designing your dream home, the cost of hiring a professional designer can quickly add up. This is where "kitchen table investing" comes in – a budget-friendly approach to house design that allows you to take control of the process and create a space that truly reflects your style and personality. But what exactly is kitchen table investing and how can it benefit you?

When it comes to designing your dream home, the cost of hiring a professional designer can quickly add up. This is where "kitchen table investing" comes in – a budget-friendly approach to house design that allows you to take control of the process and create a space that truly reflects your style and personality. But what exactly is kitchen table investing and how can it benefit you?

What is Kitchen Table Investing?

Kitchen table investing is a term that refers to the DIY approach of designing and decorating your own home. This method involves taking on the role of the designer and making all the decisions on your own, from the layout and color scheme to the furniture and decor. It's called "kitchen table" investing because it often involves sitting down at your own kitchen table with a pen and paper, sketching out your ideas and making plans for your dream home.

budget-friendly

One of the main appeals of kitchen table investing is its cost-effectiveness. By eliminating the need for a professional designer, you can save a significant amount of money on design fees. Plus, you have the freedom to control the budget and make decisions based on what works best for you financially. This allows you to invest in high-quality materials and pieces that will truly elevate your home, without breaking the bank.

personalization

Another advantage of kitchen table investing is the level of personalization it offers. With a professional designer, you may have limited input on the design process and may end up with a space that doesn't truly reflect your taste. But with kitchen table investing, you have complete creative control and can design a home that is uniquely yours. This personal touch adds a special charm and character to your space.

Kitchen table investing is a term that refers to the DIY approach of designing and decorating your own home. This method involves taking on the role of the designer and making all the decisions on your own, from the layout and color scheme to the furniture and decor. It's called "kitchen table" investing because it often involves sitting down at your own kitchen table with a pen and paper, sketching out your ideas and making plans for your dream home.

budget-friendly

One of the main appeals of kitchen table investing is its cost-effectiveness. By eliminating the need for a professional designer, you can save a significant amount of money on design fees. Plus, you have the freedom to control the budget and make decisions based on what works best for you financially. This allows you to invest in high-quality materials and pieces that will truly elevate your home, without breaking the bank.

personalization

Another advantage of kitchen table investing is the level of personalization it offers. With a professional designer, you may have limited input on the design process and may end up with a space that doesn't truly reflect your taste. But with kitchen table investing, you have complete creative control and can design a home that is uniquely yours. This personal touch adds a special charm and character to your space.

.jpg)

/4243163-v1-05dfe20436f042999666243640fd84cd.png)

/real-estate-investing-101-357985-final-5bdb4da04cedfd0026ac6b3f.png)