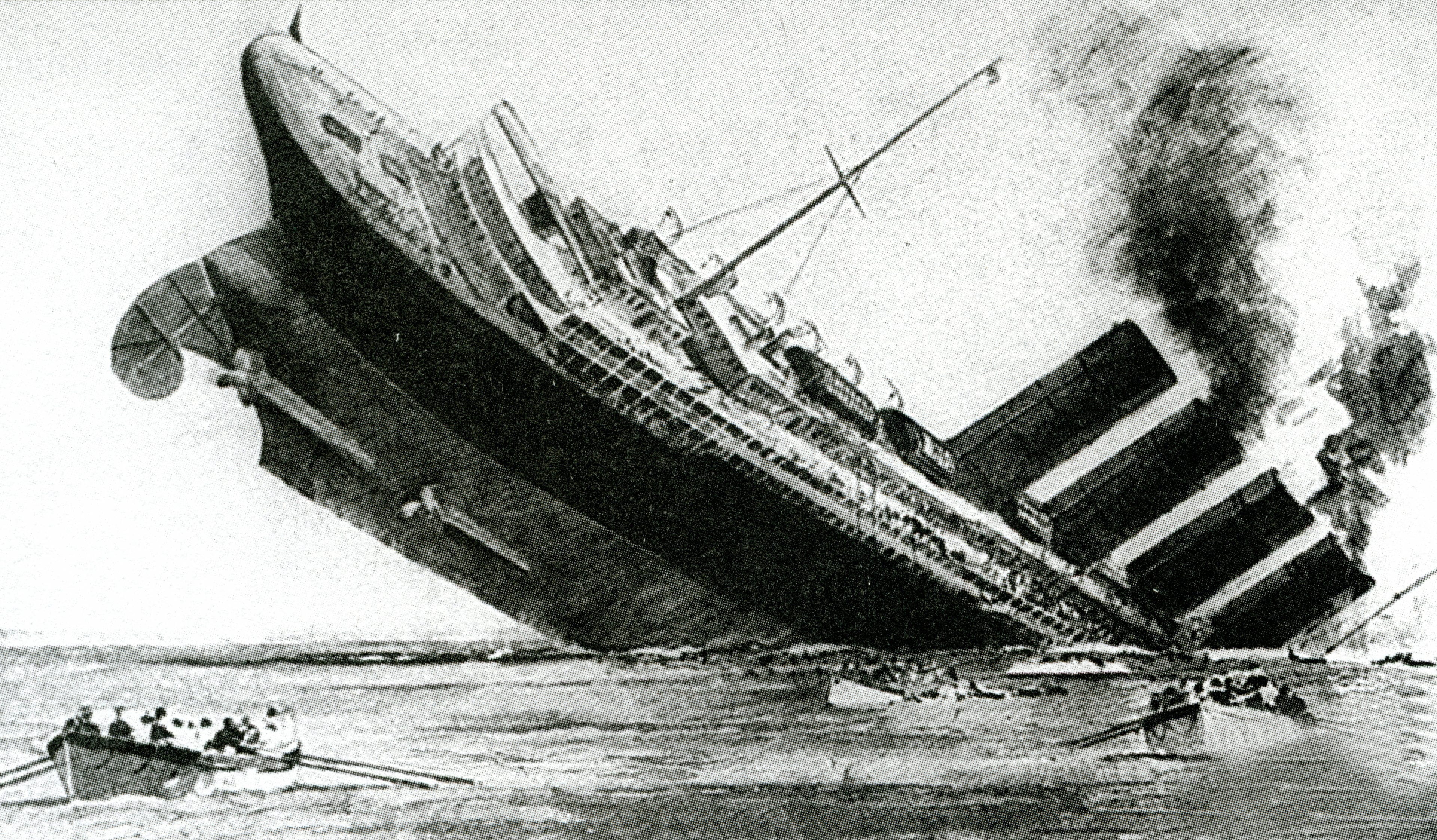

Kitchen sinking is a term used in accounting to describe a situation where a company includes all of its potential losses and expenses in its financial statements. This practice is often used to present a more accurate and realistic picture of a company's financial health. It can also be seen as a way for companies to "clean up" their financial statements by taking a one-time hit to their earnings.What is Kitchen Sinking in Accounting?

The meaning of kitchen sinking in accounting is when a company decides to include all possible losses and expenses in their financial statements, even if they have not occurred yet. This is often done in order to avoid future surprises and to provide investors with a more transparent view of the company's financial health. It can also be a way for companies to reset their earnings and start fresh.What is the Meaning of Kitchen Sinking in Accounting?

The definition of kitchen sinking in accounting is the practice of including all potential losses and expenses in a company's financial statements, even if they have not yet occurred. This is considered a more conservative approach to reporting financials, as it takes into account future potential risks and liabilities.Kitchen Sinking Definition in Accounting

Accounting kitchen sinking is when a company decides to take a one-time hit to their earnings by including all potential losses and expenses in their financial statements. This is done in order to provide a more accurate and transparent view of the company's financial health, as well as to avoid future surprises.Accounting Kitchen Sinking Explanation

One example of kitchen sinking in accounting is when a company includes all potential losses from pending lawsuits in their financial statements, even if the cases have not yet been settled. This allows the company to accurately reflect their potential liabilities and provide investors with a more transparent view of their financials.Examples of Kitchen Sinking in Accounting

The practice of kitchen sinking can have a significant impact on a company's financial statements. By including all potential losses and expenses, the company's profits for that period will be significantly reduced. This can also affect the company's overall financial health and their ability to attract investors.How Does Kitchen Sinking Affect Financial Statements?

There are both pros and cons to the practice of kitchen sinking in accounting. On the one hand, it allows for a more accurate and transparent view of the company's financial health. On the other hand, it can significantly impact the company's earnings and affect their ability to attract investors.Pros and Cons of Kitchen Sinking in Accounting

Kitchen sinking and big bath accounting are both methods used by companies to adjust their financial statements. While kitchen sinking involves including all potential losses and expenses, big bath accounting is when a company takes a significant one-time hit to their earnings in order to start fresh. Both methods can be seen as ways for companies to reset their earnings and provide a more accurate view of their financials.Kitchen Sinking vs Big Bath Accounting

The practice of kitchen sinking can have a significant impact on shareholders. By reducing the company's profits for that period, it can affect the value of their investments. However, it can also provide a more transparent view of the company's financial health and help to avoid future surprises that could negatively impact shareholders.Impact of Kitchen Sinking on Shareholders

In order to avoid kitchen sinking in accounting, companies should regularly review their financial statements and make necessary adjustments. They should also have a thorough understanding of potential risks and liabilities and disclose them in their financial statements in a timely manner. Additionally, companies can seek guidance from accounting professionals to ensure their financial statements accurately reflect their financial health.How to Avoid Kitchen Sinking in Accounting

Kitchen Sinking Meaning in Accounting: Understanding the Impact on House Design

Introduction

When it comes to accounting, there are many terms and concepts that may seem confusing or unfamiliar to those outside of the industry. One of these terms is "kitchen sinking," which has a completely different meaning within the world of finance and accounting. Kitchen sinking refers to the practice of recording all possible expenses, even those that are not directly related to the current period, in order to reduce future earnings and make current performance look more impressive. While this may have a positive impact on a company's financial statements, it can also have a significant impact on the design and layout of a house. In this article, we will explore the meaning of kitchen sinking in accounting and how it can affect the design of a house.

When it comes to accounting, there are many terms and concepts that may seem confusing or unfamiliar to those outside of the industry. One of these terms is "kitchen sinking," which has a completely different meaning within the world of finance and accounting. Kitchen sinking refers to the practice of recording all possible expenses, even those that are not directly related to the current period, in order to reduce future earnings and make current performance look more impressive. While this may have a positive impact on a company's financial statements, it can also have a significant impact on the design and layout of a house. In this article, we will explore the meaning of kitchen sinking in accounting and how it can affect the design of a house.

The Impact of Kitchen Sinking on House Design

The main purpose of kitchen sinking in accounting is to manipulate financial statements and make a company's performance appear better than it actually is. This is often done by recording excessive expenses, such as write-downs or restructuring costs, in the current period. While this may make the current financial statements look more favorable, it can have long-term consequences for the company's financial health. Similarly, when it comes to house design, kitchen sinking can have a significant impact on the overall functionality and aesthetics of a home.

When a company is focused on kitchen sinking, their main priority is to reduce expenses and increase short-term profits. This often leads to cutting corners and sacrificing quality in order to save money. Similarly, when designing a house, the focus may be on keeping costs low rather than creating a functional and aesthetically pleasing space. This can result in a house that lacks important features or has a poor layout, making it less desirable for potential buyers in the future.

Moreover, kitchen sinking can also have a negative impact on the design and quality of materials used in a house. In order to save money, companies may opt for cheaper materials that are of lower quality, which can result in a house that is not built to last. This can lead to costly repairs and renovations down the line, making the house less desirable and potentially lowering its value.

The main purpose of kitchen sinking in accounting is to manipulate financial statements and make a company's performance appear better than it actually is. This is often done by recording excessive expenses, such as write-downs or restructuring costs, in the current period. While this may make the current financial statements look more favorable, it can have long-term consequences for the company's financial health. Similarly, when it comes to house design, kitchen sinking can have a significant impact on the overall functionality and aesthetics of a home.

When a company is focused on kitchen sinking, their main priority is to reduce expenses and increase short-term profits. This often leads to cutting corners and sacrificing quality in order to save money. Similarly, when designing a house, the focus may be on keeping costs low rather than creating a functional and aesthetically pleasing space. This can result in a house that lacks important features or has a poor layout, making it less desirable for potential buyers in the future.

Moreover, kitchen sinking can also have a negative impact on the design and quality of materials used in a house. In order to save money, companies may opt for cheaper materials that are of lower quality, which can result in a house that is not built to last. This can lead to costly repairs and renovations down the line, making the house less desirable and potentially lowering its value.

Conclusion

In conclusion, understanding the meaning and impact of kitchen sinking in accounting is crucial for both businesses and homeowners. While it may seem like a beneficial practice in the short-term, it can have long-term consequences that can affect the financial health and overall quality of a company or a house. Therefore, it is important for individuals and businesses to prioritize long-term success and sustainability rather than manipulating financial statements for short-term gains.

In conclusion, understanding the meaning and impact of kitchen sinking in accounting is crucial for both businesses and homeowners. While it may seem like a beneficial practice in the short-term, it can have long-term consequences that can affect the financial health and overall quality of a company or a house. Therefore, it is important for individuals and businesses to prioritize long-term success and sustainability rather than manipulating financial statements for short-term gains.