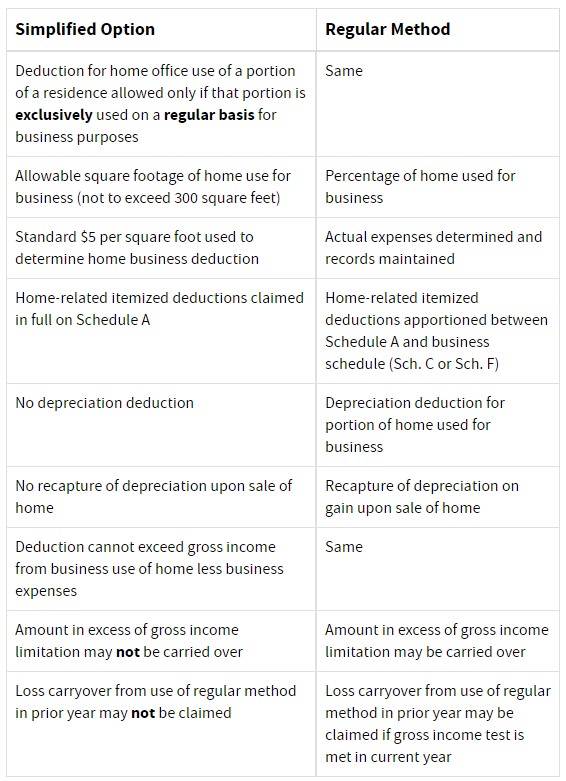

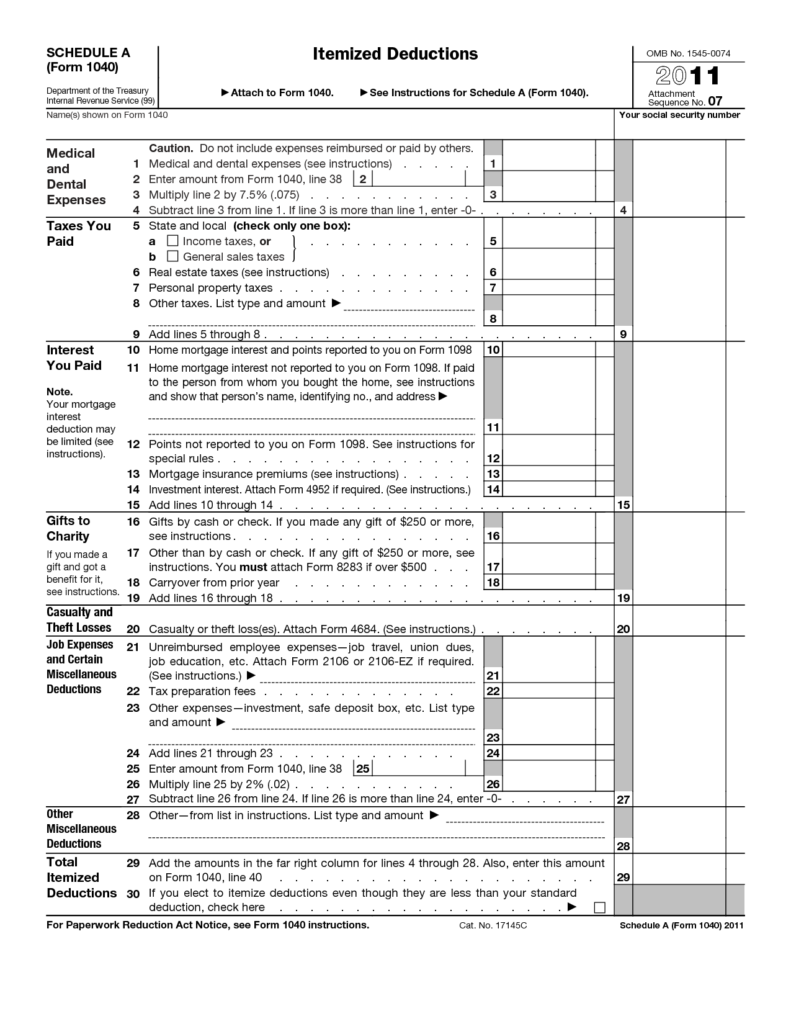

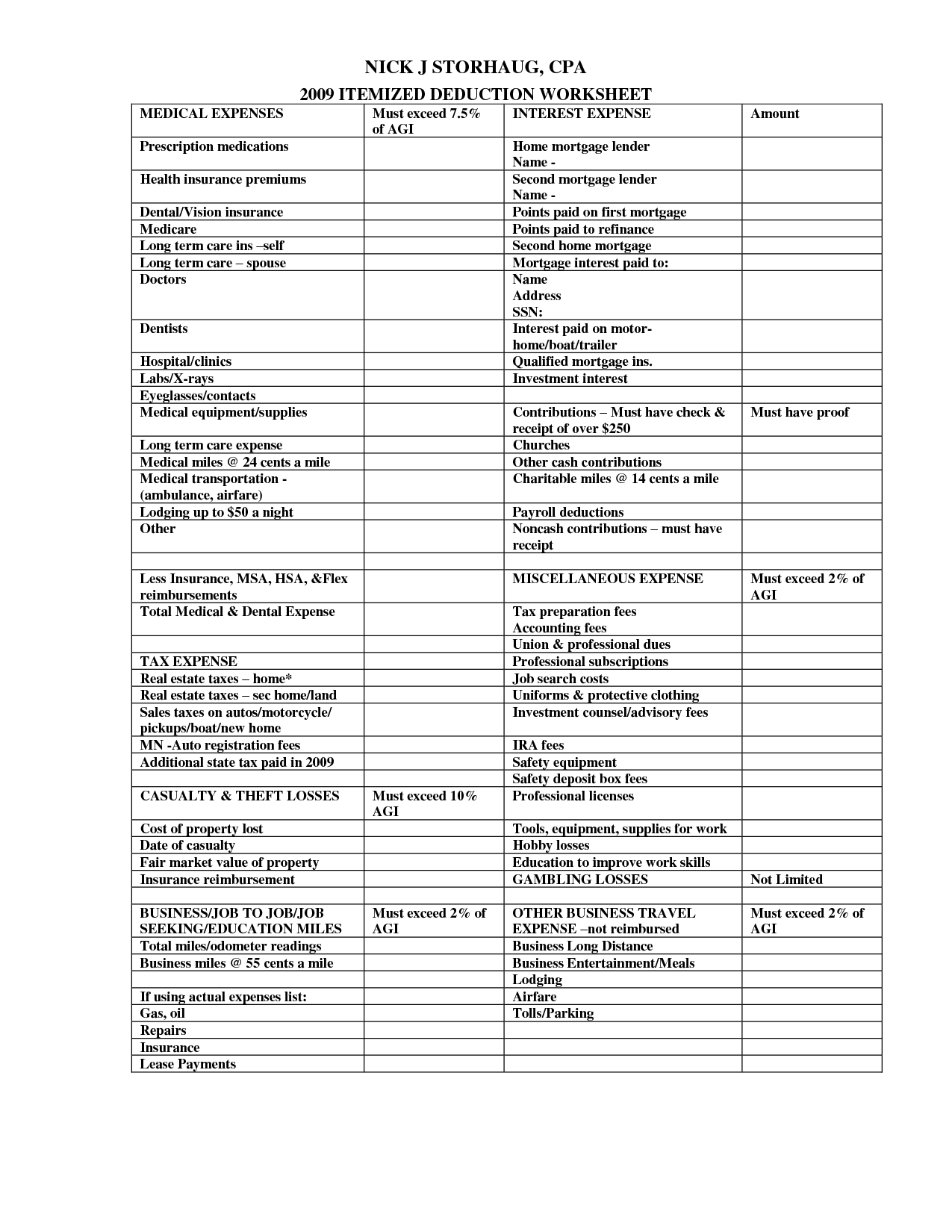

If you work from home, you may be eligible for the home office deduction. This allows you to deduct certain expenses related to your home office, such as rent, utilities, and office supplies. But when it comes to claiming this deduction, there are two methods to choose from: the simplified method and the regular method. The simplified method is a newer option that was introduced by the IRS in 2013. It allows you to calculate your deduction by multiplying a standard rate by the square footage of your home office. The regular method, on the other hand, requires you to keep track of all your actual expenses and calculate the percentage of your home that is used for business purposes. While the simplified method may seem easier, it may not always result in the highest deduction. It's important to compare both methods and choose the one that works best for your specific situation.Home Office Deduction: Simplified Method vs. Regular Method

Claiming the home office deduction can be a bit tricky, but it's definitely worth the effort if you're eligible. To claim the deduction, you must use your home office regularly and exclusively for business purposes. This means that your home office cannot double as a personal space, such as a guest room or a playroom for your children. You will also need to gather all necessary documentation, such as receipts for expenses and a floor plan of your home office, to support your deduction. It's important to keep thorough records in case of an audit. If you're unsure about how to claim the home office deduction, it's best to consult with a tax professional for guidance.How to Claim the Home Office Deduction

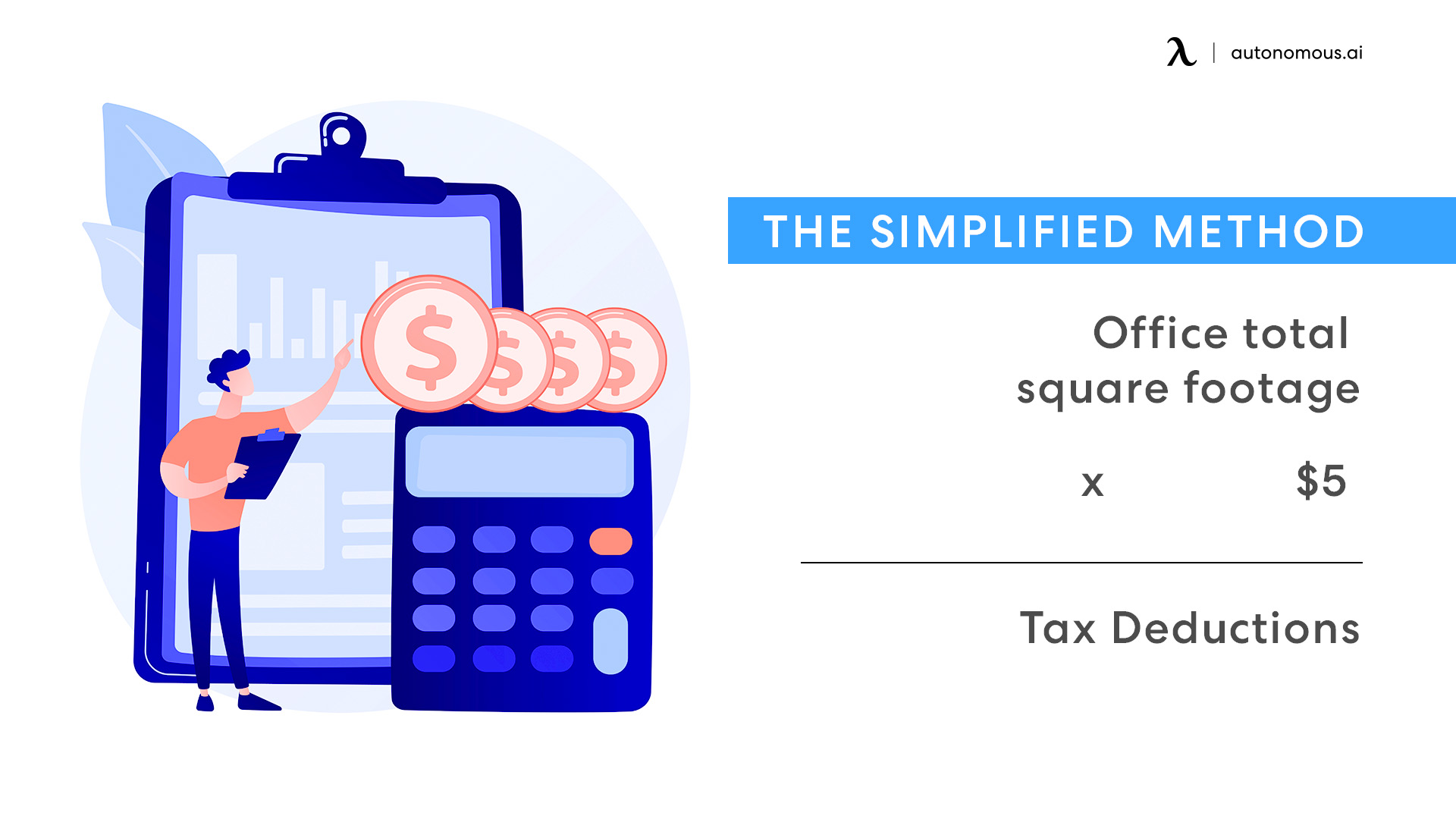

In the past, the home office deduction was considered complex and time-consuming, which discouraged many small business owners from claiming it. However, the IRS has simplified the process by introducing the simplified method, making it easier for taxpayers to take advantage of the deduction. The simplified method allows you to deduct $5 per square foot of your home office, up to a maximum of 300 square feet. This means that the maximum deduction you can claim using this method is $1,500. While this may not be as high as the regular method, it can still provide a significant tax savings for many individuals.IRS Simplifies Home Office Deduction

Before claiming the home office deduction, it's important to understand the rules and requirements set by the IRS. The first and most important requirement is that your home office must be used for business purposes only. Additionally, your home office must be your primary place of business, or where you regularly meet with clients or customers. If you have another office outside of your home, you may still be eligible for the home office deduction as long as you use your home office for administrative or management tasks. It's also worth noting that the home office deduction is only available for self-employed individuals, not for employees who are working from home due to the COVID-19 pandemic.Home Office Deduction: What You Need to Know

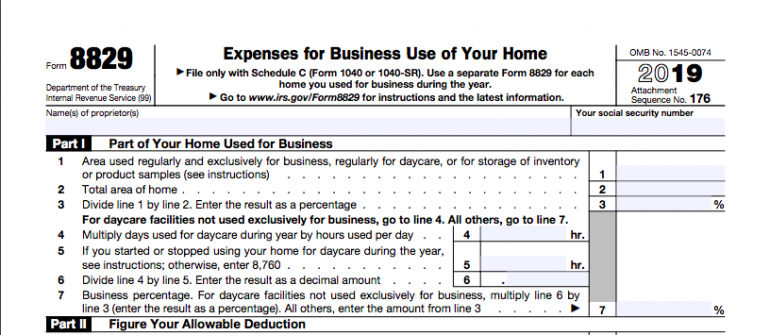

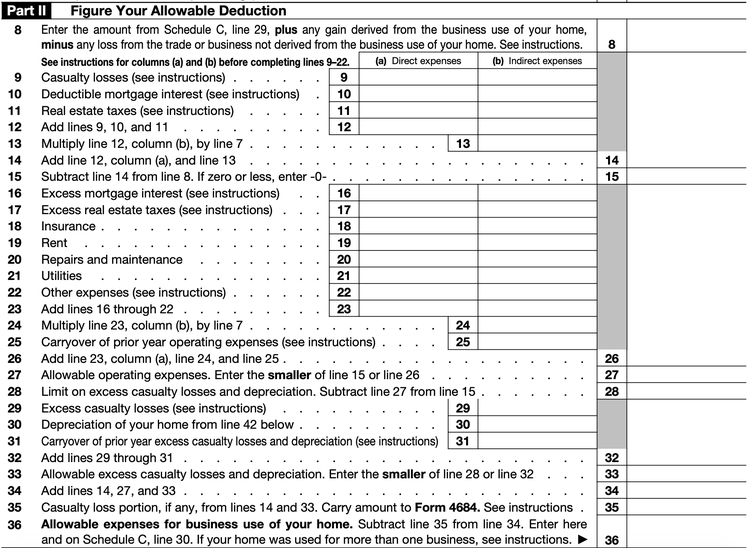

Calculating the home office deduction using the regular method can be a bit more complicated than the simplified method. To determine the deduction amount, you'll need to calculate the percentage of your home that is used for business purposes. This can be done by dividing the square footage of your home office by the total square footage of your home. For example, if your home office is 200 square feet and your total home size is 2,000 square feet, your business percentage would be 10%. Next, you'll need to add up all your actual expenses related to your home, such as rent, utilities, and insurance. Then, multiply these expenses by your business percentage to determine the amount that can be deducted.How to Calculate the Home Office Deduction

As mentioned earlier, in order to claim the home office deduction, your home office must be used regularly and exclusively for business purposes. This means that you cannot use your home office for personal activities, such as watching TV or storing personal items. You also need to be able to prove that your home office is your principal place of business. This can be done by showing that you conduct the majority of your business activities from your home office, or that you use your home office to meet with clients or customers. It's important to carefully follow all rules and requirements set by the IRS to avoid any potential issues or audits in the future.Home Office Deduction: Rules and Requirements

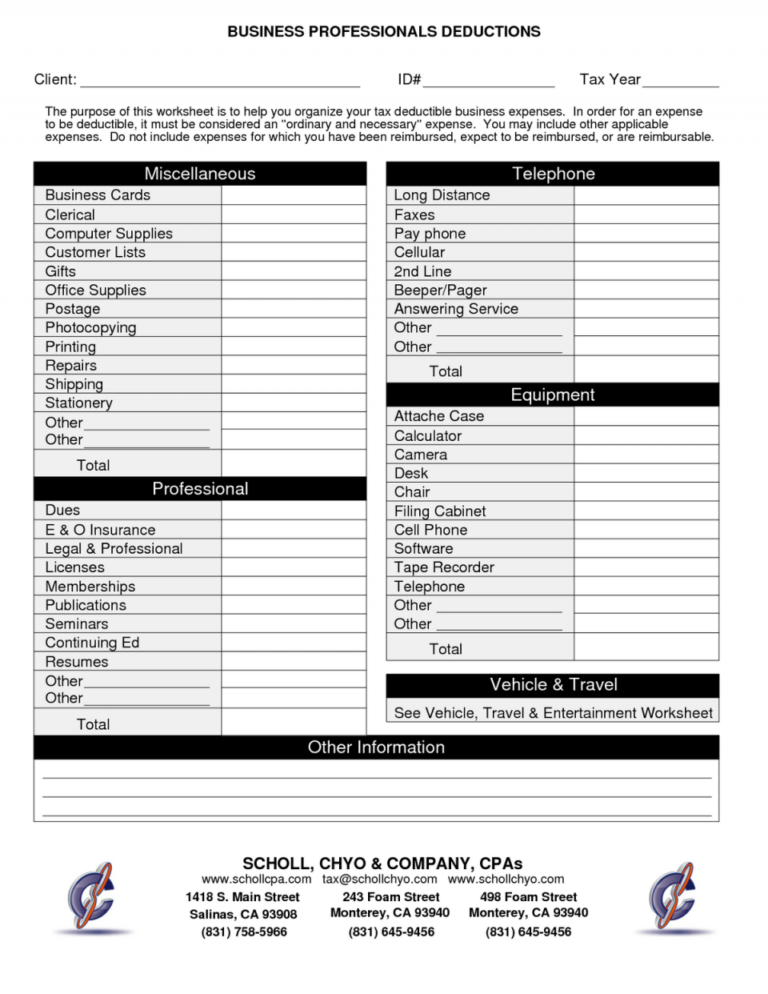

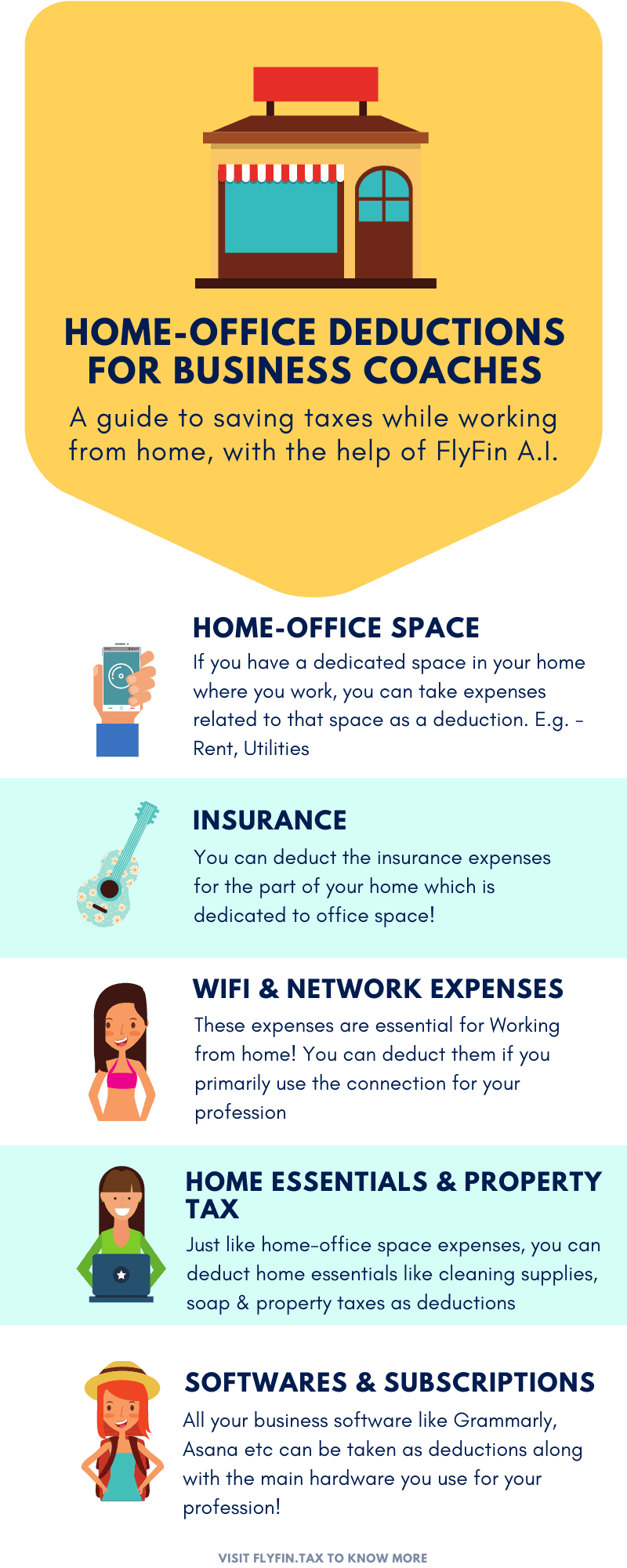

If you're eligible for the home office deduction, it's important to take advantage of it to maximize your tax savings. One way to do this is by keeping thorough records of all your business expenses, including receipts and invoices for office supplies, equipment, and any other expenses related to your home office. You can also deduct a percentage of your home's mortgage interest, property taxes, and homeowner's insurance, as well as a portion of your internet and phone bills. By carefully tracking all these expenses, you can ensure that you're getting the most out of your home office deduction.Maximizing Your Home Office Deduction

When claiming the home office deduction, it's important to avoid common mistakes that could lead to an audit or a disallowed deduction. One of the most common mistakes is claiming a space that is not used exclusively for business purposes. Another mistake is claiming a deduction for a home office that is used for both personal and business purposes. This is not allowed under the IRS rules and could result in penalties and interest if audited. It's important to familiarize yourself with all the rules and requirements before claiming the home office deduction to avoid any potential mistakes.Home Office Deduction: Common Mistakes to Avoid

If you're self-employed and use a portion of your home for business purposes, you may be wondering if you can claim the home office deduction. The answer is yes, as long as you meet all the requirements set by the IRS. However, if you're an employee who is working from home due to the pandemic, you are not eligible for the home office deduction. This is because employees are reimbursed for their work-related expenses by their employer, and therefore cannot claim them on their personal tax return.Home Office Deduction: Can You Claim It?

In order to qualify for the home office deduction, you must meet certain criteria set by the IRS. The most important requirement is that your home office must be used regularly and exclusively for business purposes. You must also conduct the majority of your business activities from your home office, or use your home office to meet with clients or customers. If you meet these qualifications, you may be eligible to claim the home office deduction on your tax return.Home Office Deduction: How to Qualify

Maximizing Your Home Office Deduction: How to Utilize Your Dining Room for Work

The Rise of Working from Home

In recent years, there has been a significant increase in the number of people working from home. Whether it's due to the flexibility it offers, the rising cost of office space, or the current global pandemic, the trend of remote work is here to stay. As more individuals transition to a remote work setup, the need for a dedicated home office space has become essential. While some may have the luxury of a spare room to convert into an office, others may have to get creative with their existing living space. This is where the

home office deduction dining room

comes in.

In recent years, there has been a significant increase in the number of people working from home. Whether it's due to the flexibility it offers, the rising cost of office space, or the current global pandemic, the trend of remote work is here to stay. As more individuals transition to a remote work setup, the need for a dedicated home office space has become essential. While some may have the luxury of a spare room to convert into an office, others may have to get creative with their existing living space. This is where the

home office deduction dining room

comes in.

Transforming Your Dining Room into a Productive Workspace

The dining room is often an underutilized space in many homes. It's typically reserved for special occasions and gatherings, but it can also serve as an excellent space for a home office. With a few simple adjustments, you can transform your dining room into a functional and productive workspace while still maintaining its elegant appeal.

First and foremost, designate a specific area of your dining room for work. This not only helps create a separation between your work and personal life, but it also allows you to take advantage of the

home office deduction

on your taxes. The designated area should have sufficient lighting, access to outlets, and be free from distractions.

The dining room is often an underutilized space in many homes. It's typically reserved for special occasions and gatherings, but it can also serve as an excellent space for a home office. With a few simple adjustments, you can transform your dining room into a functional and productive workspace while still maintaining its elegant appeal.

First and foremost, designate a specific area of your dining room for work. This not only helps create a separation between your work and personal life, but it also allows you to take advantage of the

home office deduction

on your taxes. The designated area should have sufficient lighting, access to outlets, and be free from distractions.

Making the Most of Your Home Office Deduction

Now that you have designated your dining room as your

home office

, you can start deducting expenses associated with it on your taxes. This includes a percentage of your mortgage or rent, utilities, and even furniture purchases. However, it's essential to keep detailed records and consult with a tax professional to ensure you are accurately claiming these deductions.

Moreover, as you are now using your dining room for work, you can also claim a deduction for any improvements made to the space. This could include painting the walls, installing shelves or cabinets for storage, or even purchasing a new desk or chair. These improvements not only enhance your workspace, but they also add value to your home.

Now that you have designated your dining room as your

home office

, you can start deducting expenses associated with it on your taxes. This includes a percentage of your mortgage or rent, utilities, and even furniture purchases. However, it's essential to keep detailed records and consult with a tax professional to ensure you are accurately claiming these deductions.

Moreover, as you are now using your dining room for work, you can also claim a deduction for any improvements made to the space. This could include painting the walls, installing shelves or cabinets for storage, or even purchasing a new desk or chair. These improvements not only enhance your workspace, but they also add value to your home.

Creating a Balance Between Work and Life

While transforming your dining room into a home office can be a practical and cost-effective solution, it's essential to strike a balance between work and life. It can be tempting to work longer hours when your office is just a few steps away, but it's crucial to maintain a healthy work-life balance. Set boundaries and establish a routine to ensure you are not overworking yourself. Remember to take breaks, step away from your desk, and enjoy your dining room as a space for relaxation and enjoyment.

In conclusion, the

home office deduction dining room

is an excellent way to maximize your tax deductions while creating a functional and stylish workspace. With some creativity and strategic planning, you can transform your dining room into a productive and enjoyable home office without breaking the bank. So, why not make the most of your dining room and take advantage of the benefits of working from home?

While transforming your dining room into a home office can be a practical and cost-effective solution, it's essential to strike a balance between work and life. It can be tempting to work longer hours when your office is just a few steps away, but it's crucial to maintain a healthy work-life balance. Set boundaries and establish a routine to ensure you are not overworking yourself. Remember to take breaks, step away from your desk, and enjoy your dining room as a space for relaxation and enjoyment.

In conclusion, the

home office deduction dining room

is an excellent way to maximize your tax deductions while creating a functional and stylish workspace. With some creativity and strategic planning, you can transform your dining room into a productive and enjoyable home office without breaking the bank. So, why not make the most of your dining room and take advantage of the benefits of working from home?

:max_bytes(150000):strip_icc()/200196510-001-56a0a4663df78cafdaa38959.jpg)