When purchasing a kitchen sink, it's important to understand the impact of Goods and Services Tax (GST) on the overall cost. GST is a value-added tax that is applied to most goods and services in India. In this article, we will break down the different aspects of GST on kitchen sinks and how it affects both consumers and businesses.Understanding GST on Kitchen Sink

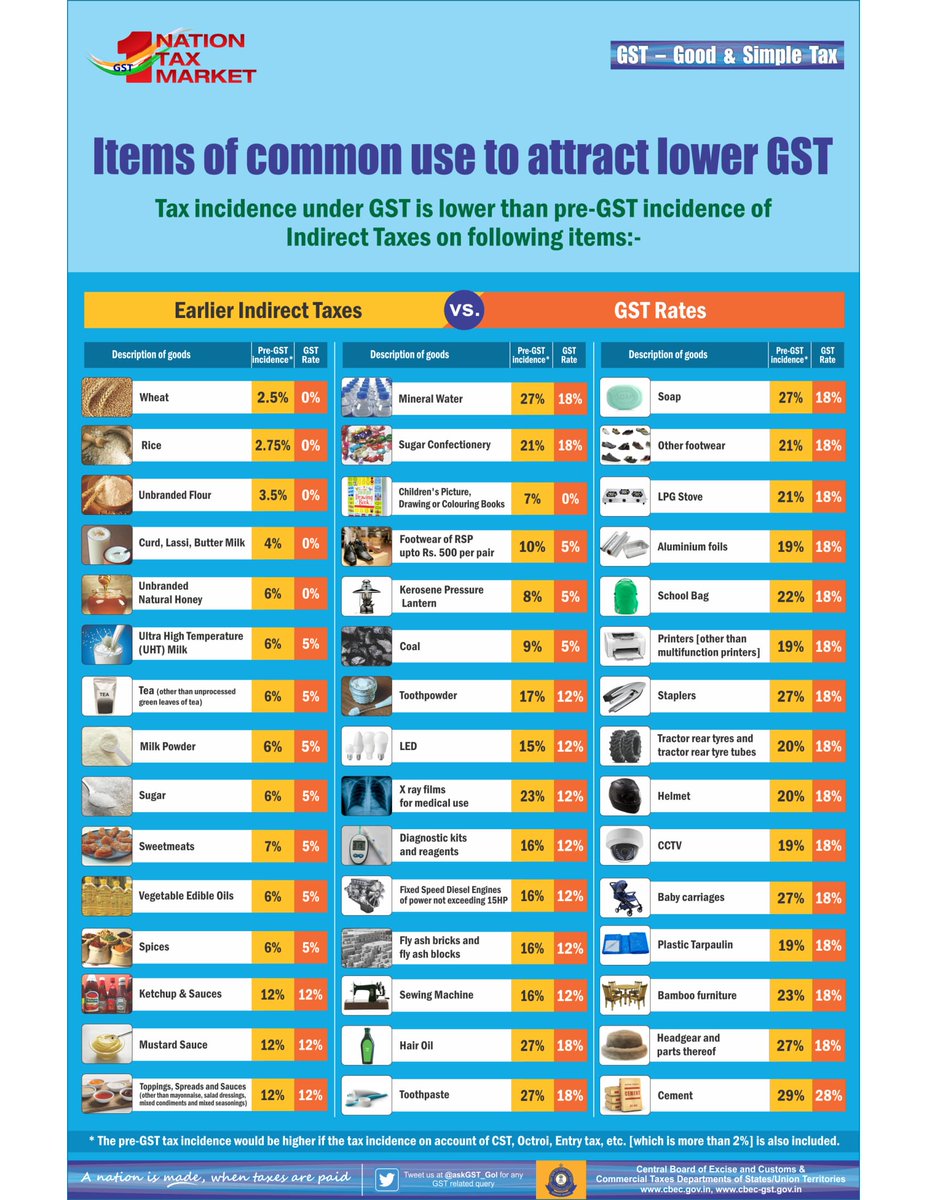

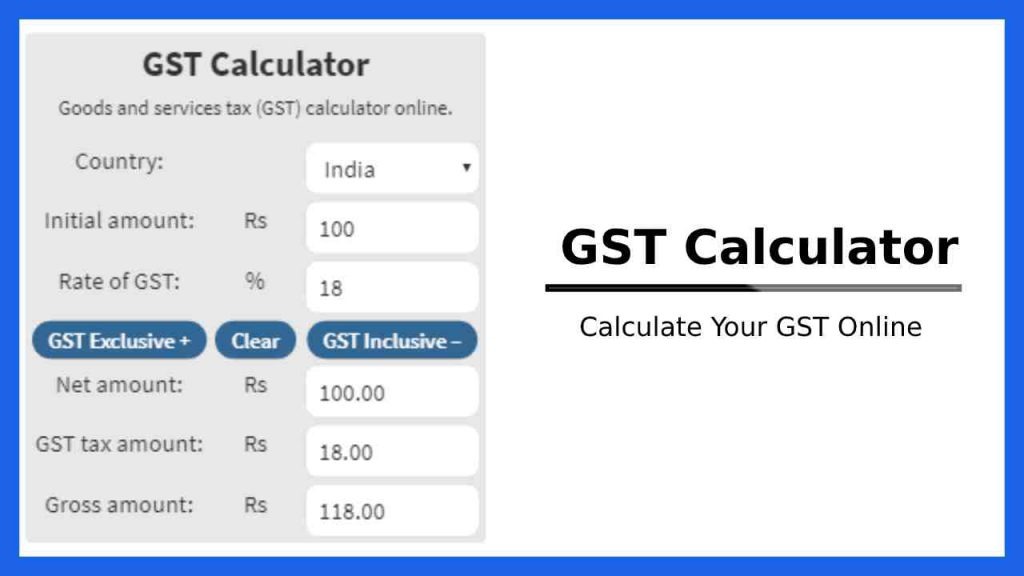

The GST rate for kitchen sinks varies depending on the type and material of the sink. Currently, the GST rate for stainless steel kitchen sinks is 18%, while granite and composite sinks fall under the 28% tax bracket. This rate is subject to change based on government policies, so it's important to stay updated on any revisions.GST Rates on Kitchen Sink

The implementation of GST has had a significant impact on the prices of kitchen sinks. With the previous tax structure, manufacturers would have to pay various taxes at different stages of production, leading to a higher cost for consumers. However, with GST, the entire process is streamlined, resulting in lower prices for the end consumer.Impact of GST on Kitchen Sink Prices

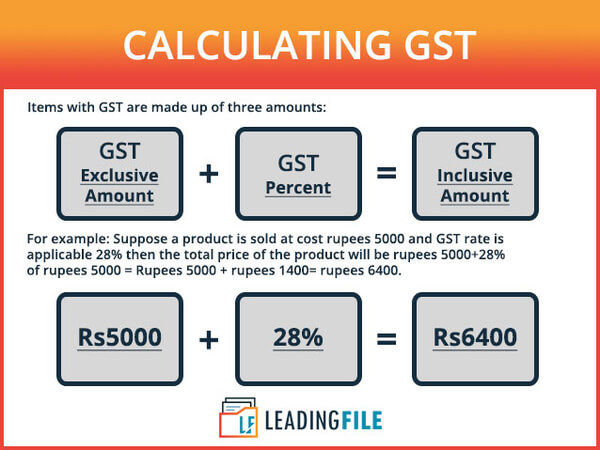

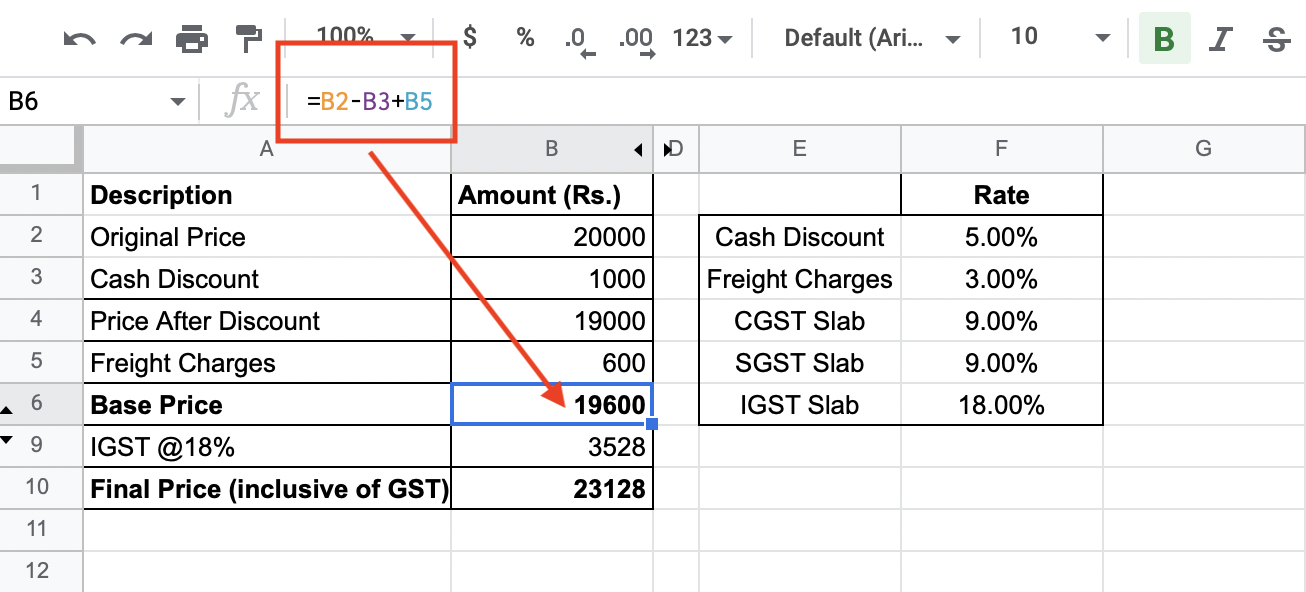

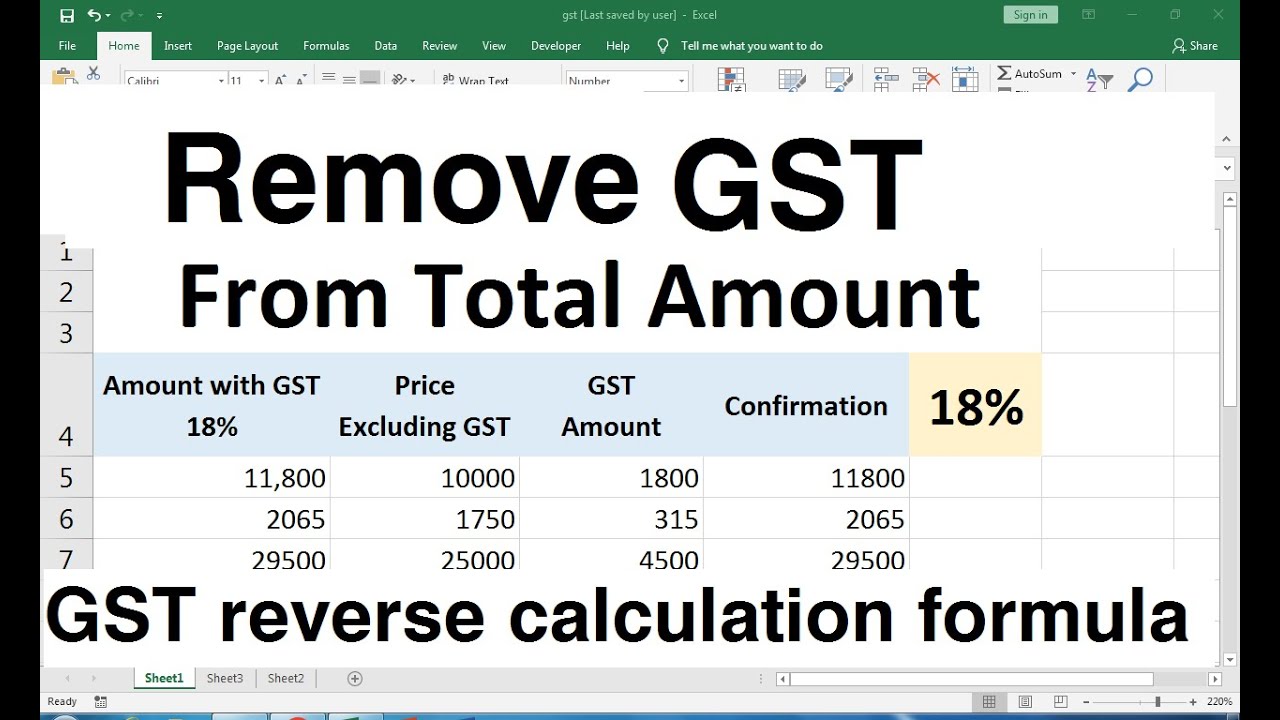

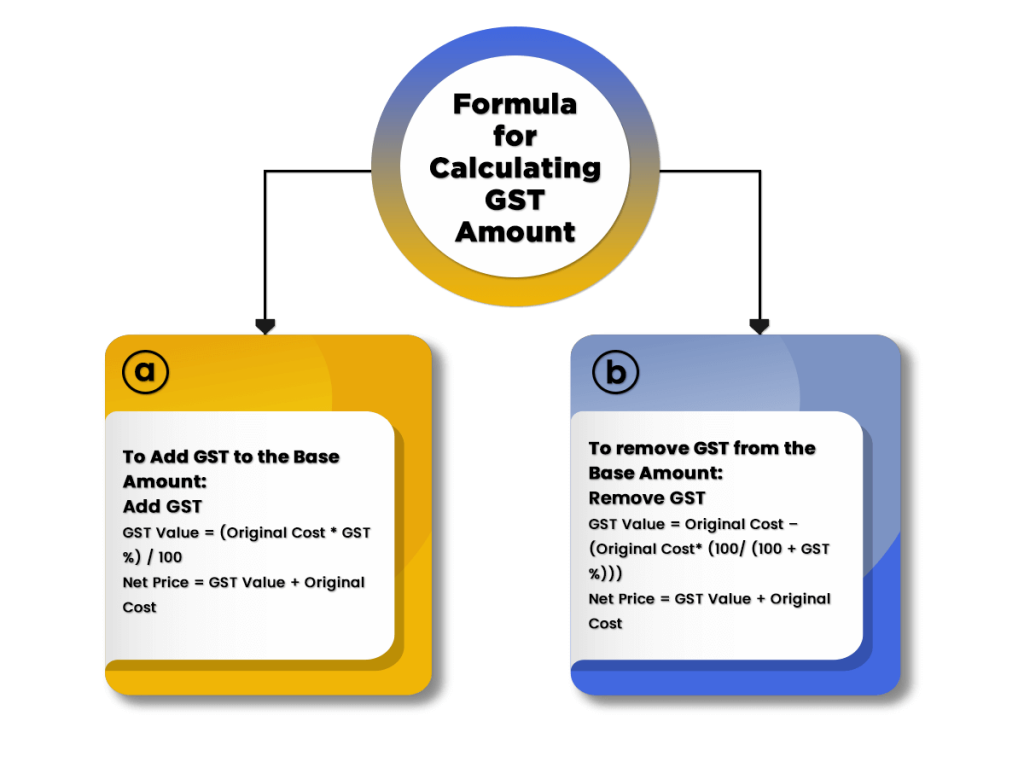

If you're unsure about how to calculate GST on your kitchen sink purchase, here's a simple formula to follow: Final Price = (Cost of the sink + Customs duty + Other taxes) + (Cost of the sink + Customs duty + Other taxes) x GST rate For example, if the cost of your sink is Rs. 5,000 and the GST rate is 18%, the final price would be Rs. 6,000.How to Calculate GST on Kitchen Sink

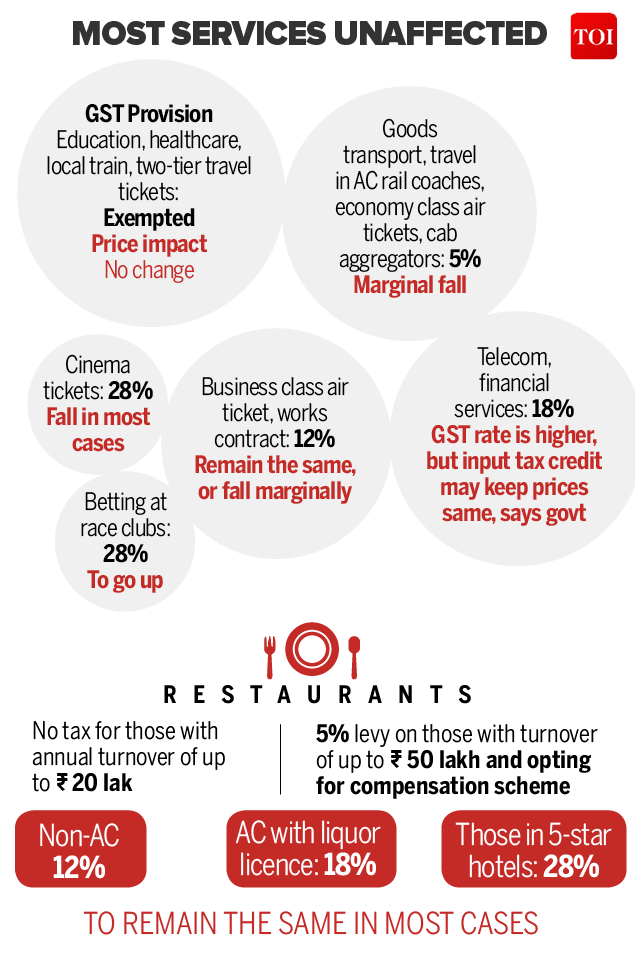

It's important to note that GST not only applies to the purchase of the kitchen sink but also the installation services. If you hire a professional to install your sink, you will be charged 18% GST on the service. However, if you choose to install the sink yourself, there will be no GST applied.GST on Kitchen Sink Installation Services

There are certain exemptions on GST for kitchen sinks, such as for those used in government projects and affordable housing schemes. Additionally, GST is not applicable on second-hand or used kitchen sinks.Exemptions on GST for Kitchen Sink

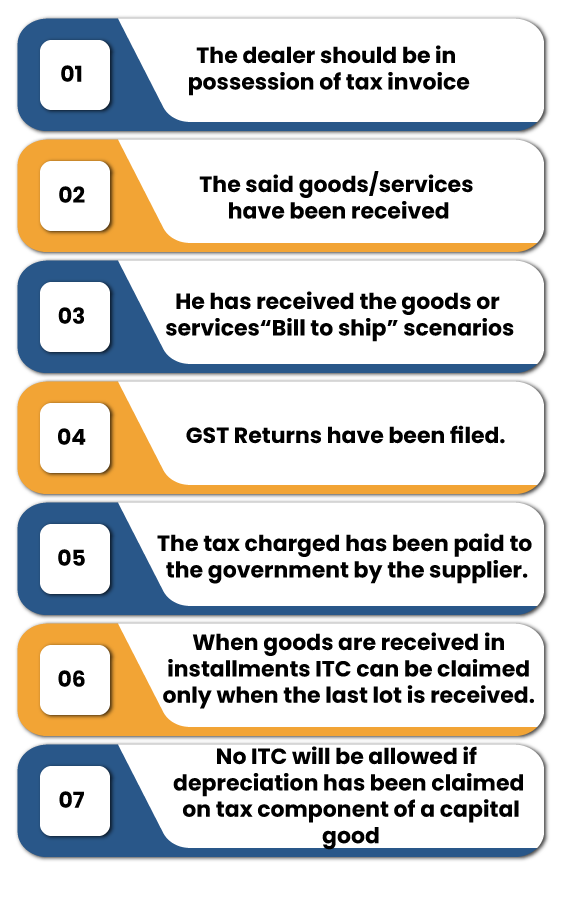

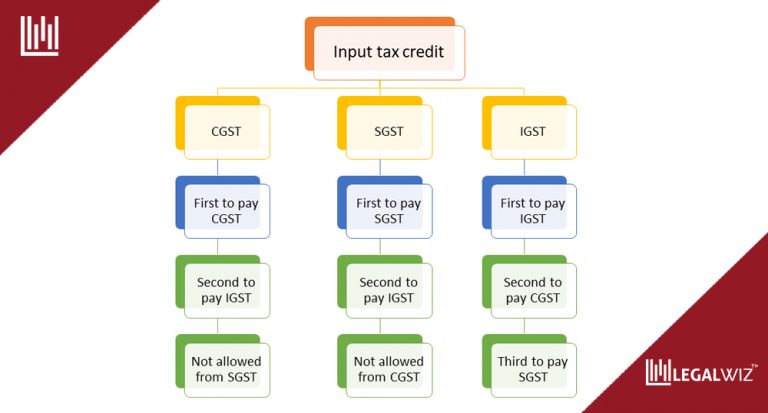

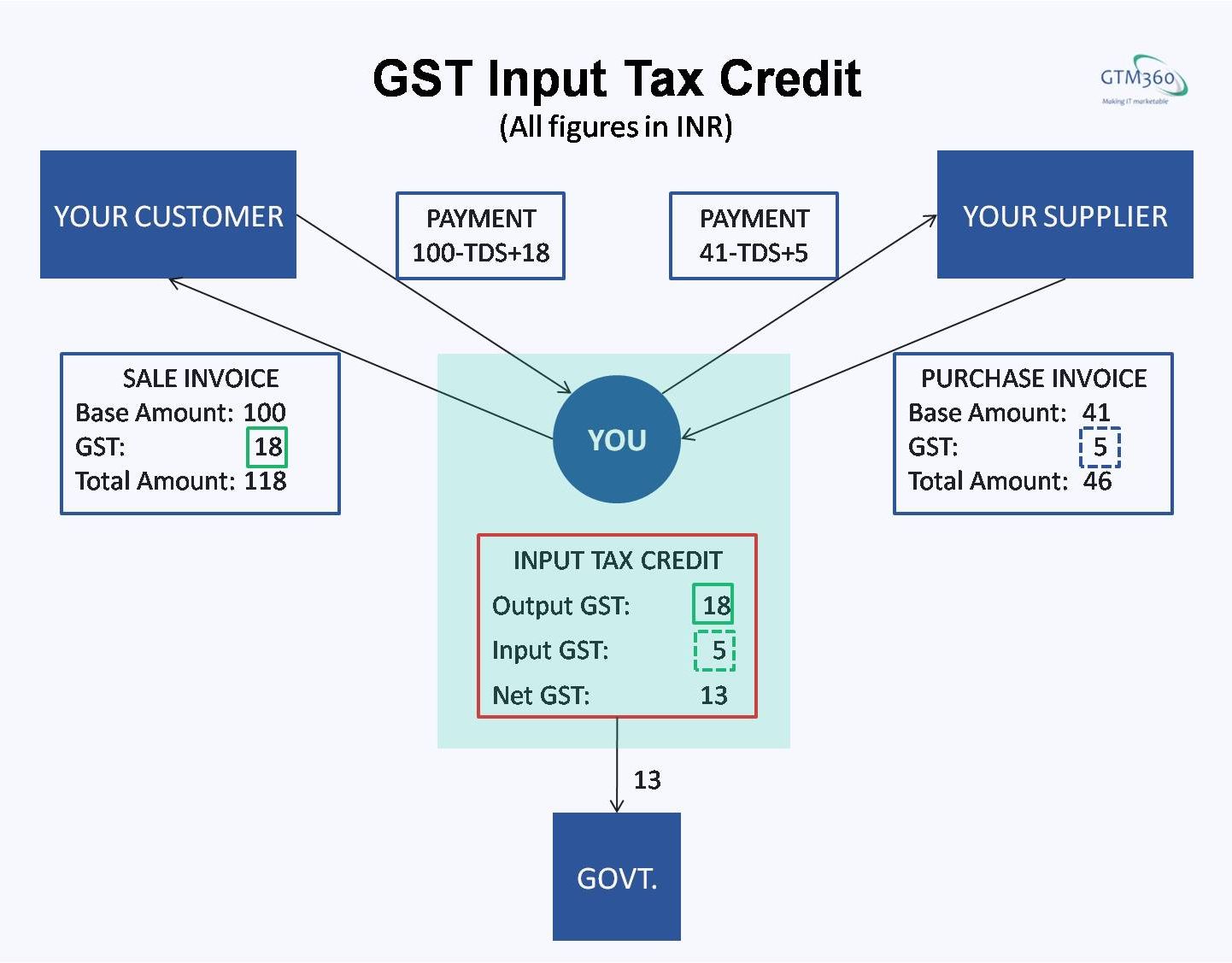

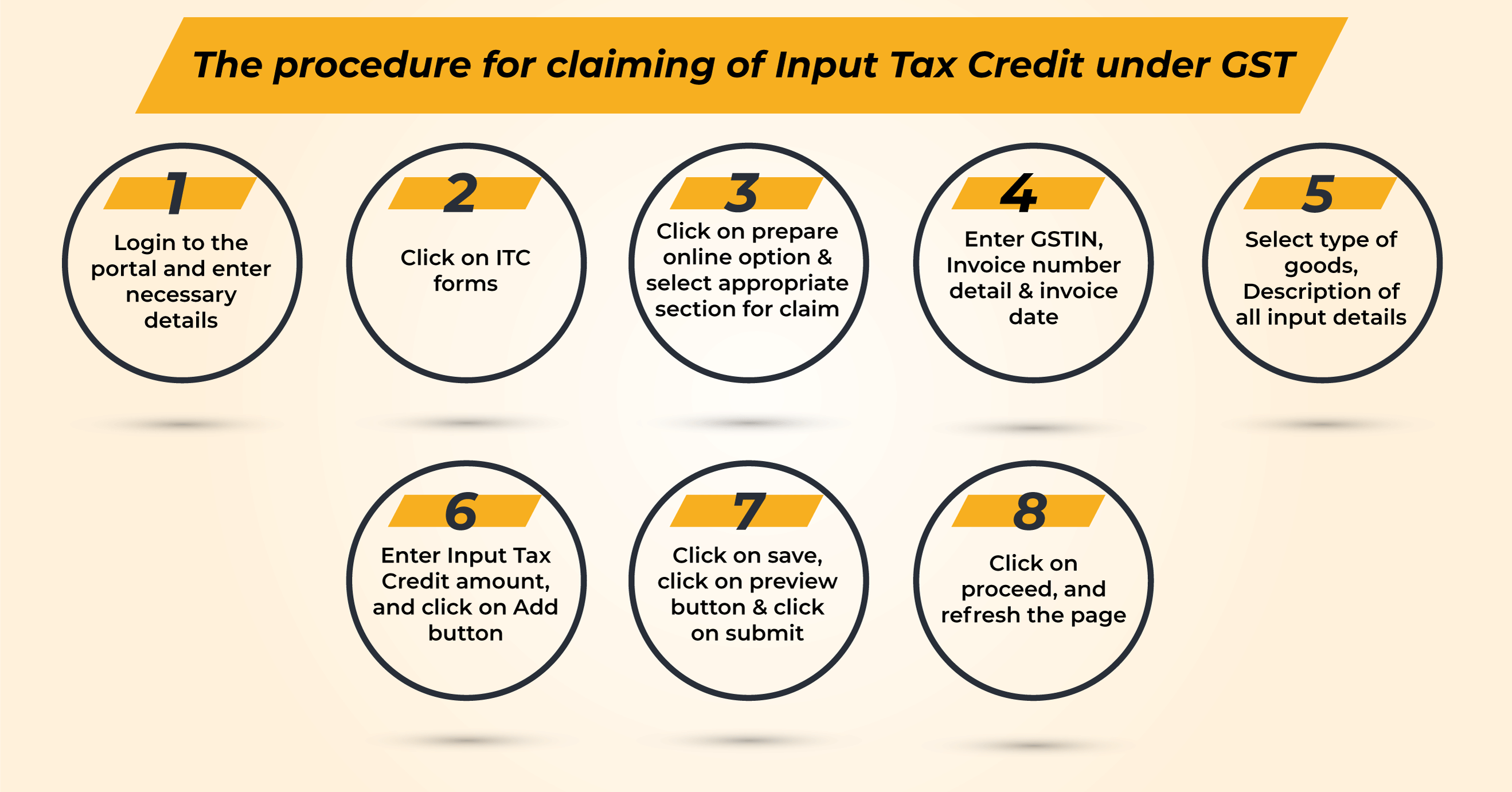

Businesses that purchase kitchen sinks for commercial use can claim input tax credit under GST. This means that the tax paid on the purchase of the sink can be deducted from the total GST liability, reducing the overall tax burden.GST Input Tax Credit for Kitchen Sink

For imported kitchen sinks, GST is applicable at the time of customs clearance. The rate of GST will be calculated based on the cost of the sink, customs duty, and other taxes paid during the import process.GST on Imported Kitchen Sinks

Kitchen sink accessories such as faucets, soap dispensers, and drainers also fall under the GST tax bracket. The rate of GST for these accessories will depend on their individual classification and will be added to the final price of the sink.GST on Kitchen Sink Accessories

In recent years, the government has made changes to the GST structure to promote the growth of the kitchen sink industry. These changes include reducing the GST rate for certain types of sinks and offering tax incentives for small businesses in the industry. It's important to stay updated on these changes to understand how they may affect your kitchen sink purchase. In conclusion, understanding GST on kitchen sinks can help you make a more informed decision when purchasing one for your home or business. By considering the GST rates, exemptions, and input tax credit, you can save money and ensure a smoother buying process. Stay updated on any changes in the GST structure to make the most of your kitchen sink purchase.Recent Changes in GST for Kitchen Sink Industry

The Impact of GST on Kitchen Sink: A Comprehensive Guide to House Design

Introduction to House Design

House design is an essential aspect of creating a functional and visually appealing home. It involves careful planning, coordination, and execution of various elements to achieve a cohesive and comfortable living space. From the layout and color scheme to the furniture and decor, every detail plays a crucial role in shaping the overall design of a house.

House design is an essential aspect of creating a functional and visually appealing home. It involves careful planning, coordination, and execution of various elements to achieve a cohesive and comfortable living space. From the layout and color scheme to the furniture and decor, every detail plays a crucial role in shaping the overall design of a house.

The Role of Kitchen Sink in House Design

Among the many elements of house design, the kitchen sink holds a significant importance. It is not just a functional fixture but also a design statement in itself. The right kitchen sink can enhance the aesthetic appeal of a kitchen while also providing practicality and convenience. This is why homeowners and interior designers alike pay special attention to the selection and placement of kitchen sinks in a house.

Among the many elements of house design, the kitchen sink holds a significant importance. It is not just a functional fixture but also a design statement in itself. The right kitchen sink can enhance the aesthetic appeal of a kitchen while also providing practicality and convenience. This is why homeowners and interior designers alike pay special attention to the selection and placement of kitchen sinks in a house.

The Introduction of GST on Kitchen Sink

With the implementation of Goods and Services Tax (GST) in many countries, including India, the kitchen sink market has seen significant changes. GST is a value-added tax levied on goods and services at every stage of the supply chain, from production to consumption. This tax has replaced multiple indirect taxes, making the taxation process simpler and more transparent.

With the implementation of Goods and Services Tax (GST) in many countries, including India, the kitchen sink market has seen significant changes. GST is a value-added tax levied on goods and services at every stage of the supply chain, from production to consumption. This tax has replaced multiple indirect taxes, making the taxation process simpler and more transparent.

The Impact of GST on Kitchen Sink Prices

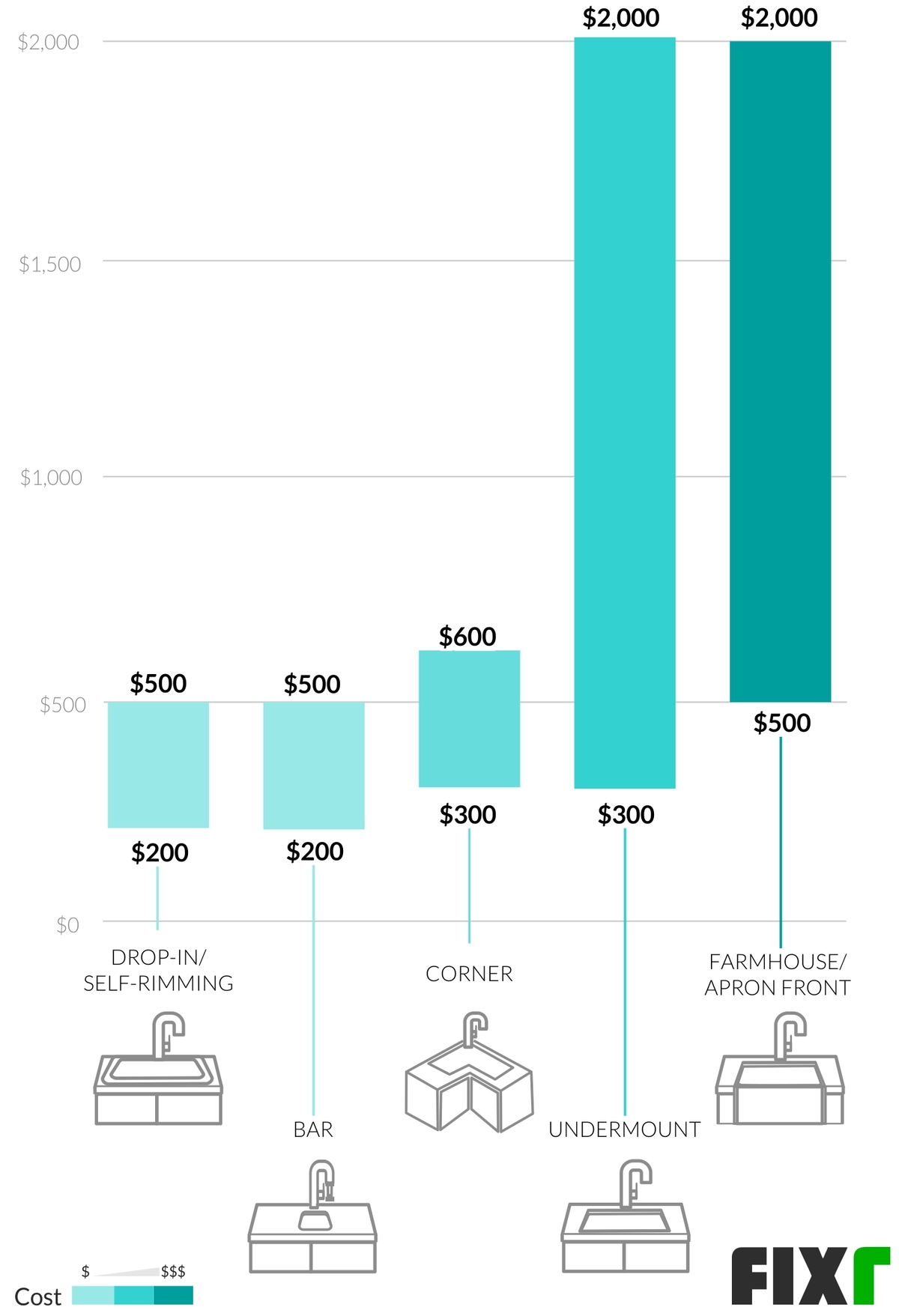

The introduction of GST has had a direct impact on the prices of kitchen sinks. Under the previous tax regime, different taxes were applied to the production and sale of kitchen sinks, resulting in a higher cost for consumers. However, with the implementation of GST, the overall tax burden on kitchen sinks has reduced, leading to a decrease in their prices.

Featured Keywords:

GST on kitchen sink, house design, functional, visually appealing, layout, color scheme, furniture, decor, design statement, practicality, convenience, interior designers, Goods and Services Tax, value-added tax, supply chain, production, consumption, indirect taxes, tax regime, tax burden, decrease in prices.

The introduction of GST has had a direct impact on the prices of kitchen sinks. Under the previous tax regime, different taxes were applied to the production and sale of kitchen sinks, resulting in a higher cost for consumers. However, with the implementation of GST, the overall tax burden on kitchen sinks has reduced, leading to a decrease in their prices.

Featured Keywords:

GST on kitchen sink, house design, functional, visually appealing, layout, color scheme, furniture, decor, design statement, practicality, convenience, interior designers, Goods and Services Tax, value-added tax, supply chain, production, consumption, indirect taxes, tax regime, tax burden, decrease in prices.

The Benefits of GST on Kitchen Sink

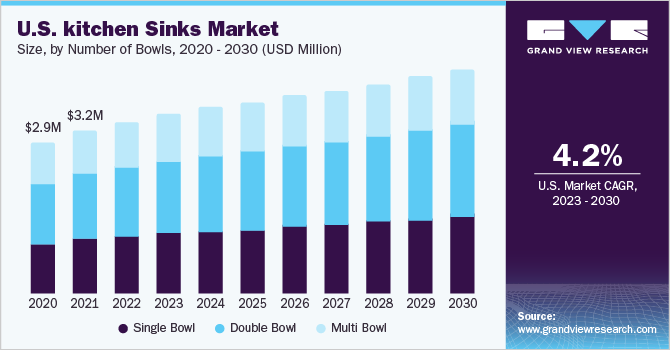

Apart from reducing the prices of kitchen sinks, GST has also brought other benefits to the market. With the elimination of multiple taxes, the cost of production has reduced, resulting in increased competition among manufacturers. This has led to a wider variety of kitchen sinks at competitive prices, giving consumers more options to choose from.

Apart from reducing the prices of kitchen sinks, GST has also brought other benefits to the market. With the elimination of multiple taxes, the cost of production has reduced, resulting in increased competition among manufacturers. This has led to a wider variety of kitchen sinks at competitive prices, giving consumers more options to choose from.

Conclusion

In conclusion, the introduction of GST on kitchen sinks has had a positive impact on house design. With reduced prices and increased competition, homeowners now have more choices when it comes to selecting the perfect kitchen sink for their homes. As GST continues to streamline the taxation process, we can expect to see further improvements in the kitchen sink market and overall house design.

In conclusion, the introduction of GST on kitchen sinks has had a positive impact on house design. With reduced prices and increased competition, homeowners now have more choices when it comes to selecting the perfect kitchen sink for their homes. As GST continues to streamline the taxation process, we can expect to see further improvements in the kitchen sink market and overall house design.

.jpg)

:max_bytes(150000):strip_icc()/Basic-kitchen-sink-types-1821207_color_rev-0b539306b9ef4236a136624ad2a89a4c.jpg)