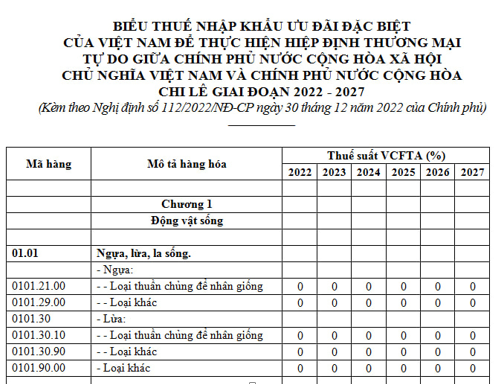

Are you planning to import foam mattresses from Vietnam? If so, it's important to understand the import duty rates for these products. Vietnam has become a popular destination for manufacturing foam mattresses due to its low labor costs and high-quality production. However, like any other country, Vietnam has import duties that companies must pay when importing goods into the country. In this article, we will discuss the top 10 foam mattress import duty rates for Vietnam made products. Foam Mattress Import Duty for Vietnam Made

Vietnam's import duty rates for foam mattresses vary depending on the type and value of the product. In general, the import duty rate for foam mattresses ranges from 5% to 10%. However, there are some exceptions and exemptions that may apply. Let's take a closer look at the top 10 foam mattress import duty rates for Vietnam made products. Vietnam Foam Mattress Import Duty

If the foam mattress is made in Vietnam and has a value of less than $50, the import duty rate is 5%. This means that for every $100 worth of foam mattresses, you will have to pay $5 in import duty. However, if the value of the foam mattress is more than $50, the import duty rate increases to 10%. This applies to both single and double mattresses. Import Duty for Vietnam Made Foam Mattress

For foam mattresses with a value of more than $50, the import duty rate is 10%. This applies to all types and sizes of foam mattresses, including queen and king sizes. So if you plan on importing high-value foam mattresses from Vietnam, be prepared to pay a 10% import duty rate. Vietnam Foam Mattress Duty

Another factor that can affect the import duty rate for foam mattresses from Vietnam is the type of foam used. If the foam is made from synthetic materials, the import duty rate remains at 10%. However, if the foam is made from natural materials such as latex, the import duty rate decreases to 5%. This is because Vietnam has a policy to encourage the use of eco-friendly products. Foam Mattress Import Duty Vietnam

In addition to the import duty rates, there are also other taxes and fees that may apply when importing foam mattresses from Vietnam. These include value-added tax (VAT), which is currently at 10%, and special consumption tax (SCT), which is based on the type and value of the product. It's important to factor in these additional costs when importing foam mattresses from Vietnam. Vietnam Foam Mattress Duty Import

For companies that are importing foam mattresses for commercial use, there may be a different import duty rate. If the foam mattresses are imported for commercial use, the import duty rate is 15%. This applies to all types and values of foam mattresses, regardless of where they are made. It's important to note that this rate only applies to companies, not individuals. Foam Mattress Duty for Vietnam Made

There are also some exemptions and special conditions that may apply for certain types of foam mattresses. For example, if the foam mattress is made from recycled materials, the import duty rate may be reduced or waived. Additionally, foam mattresses produced for export may also be eligible for tax incentives, depending on the destination country. Vietnam Made Foam Mattress Duty

It's also worth noting that import duty rates may change over time. It's important to stay updated with the current rates before importing foam mattresses from Vietnam. You can check the Vietnam Customs website for the latest import duty rates or consult with a professional import/export specialist. Import Duty for Foam Mattress from Vietnam

In conclusion, Vietnam has a range of import duty rates for foam mattresses, depending on factors such as value, materials, and intended use. The top 10 import duty rates for Vietnam made foam mattresses range from 5% to 15%. It's important to factor in these rates and other taxes and fees when importing foam mattresses from Vietnam to ensure a smooth and cost-effective process. By staying updated and consulting with professionals, you can navigate the import duty rates and successfully import foam mattresses from Vietnam. Vietnam Foam Mattress Import Tariff

The Impact of Import Duties on Vietnam-Made Foam Mattresses

Understanding the Role of Import Duties

When it comes to house design, every detail matters. From the color of the walls to the type of furniture, homeowners carefully consider each element to create their perfect living space. However, one aspect that is often overlooked is the impact of import duties on home goods, particularly

foam mattresses

. These duties, imposed by the government, can have a significant effect on the cost and availability of certain products in the market. As such, it is important for homeowners to understand the implications of these duties, especially for Vietnam-made foam mattresses.

When it comes to house design, every detail matters. From the color of the walls to the type of furniture, homeowners carefully consider each element to create their perfect living space. However, one aspect that is often overlooked is the impact of import duties on home goods, particularly

foam mattresses

. These duties, imposed by the government, can have a significant effect on the cost and availability of certain products in the market. As such, it is important for homeowners to understand the implications of these duties, especially for Vietnam-made foam mattresses.

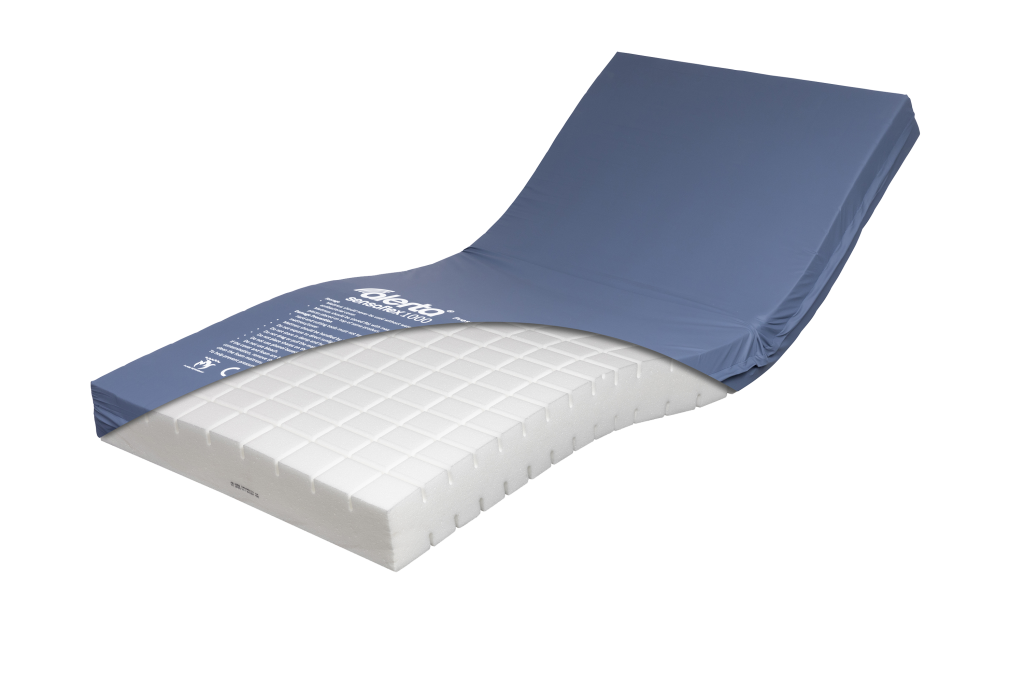

The Rising Demand for Foam Mattresses

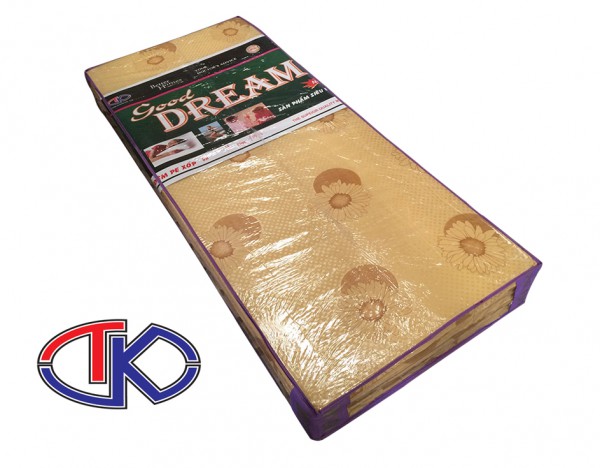

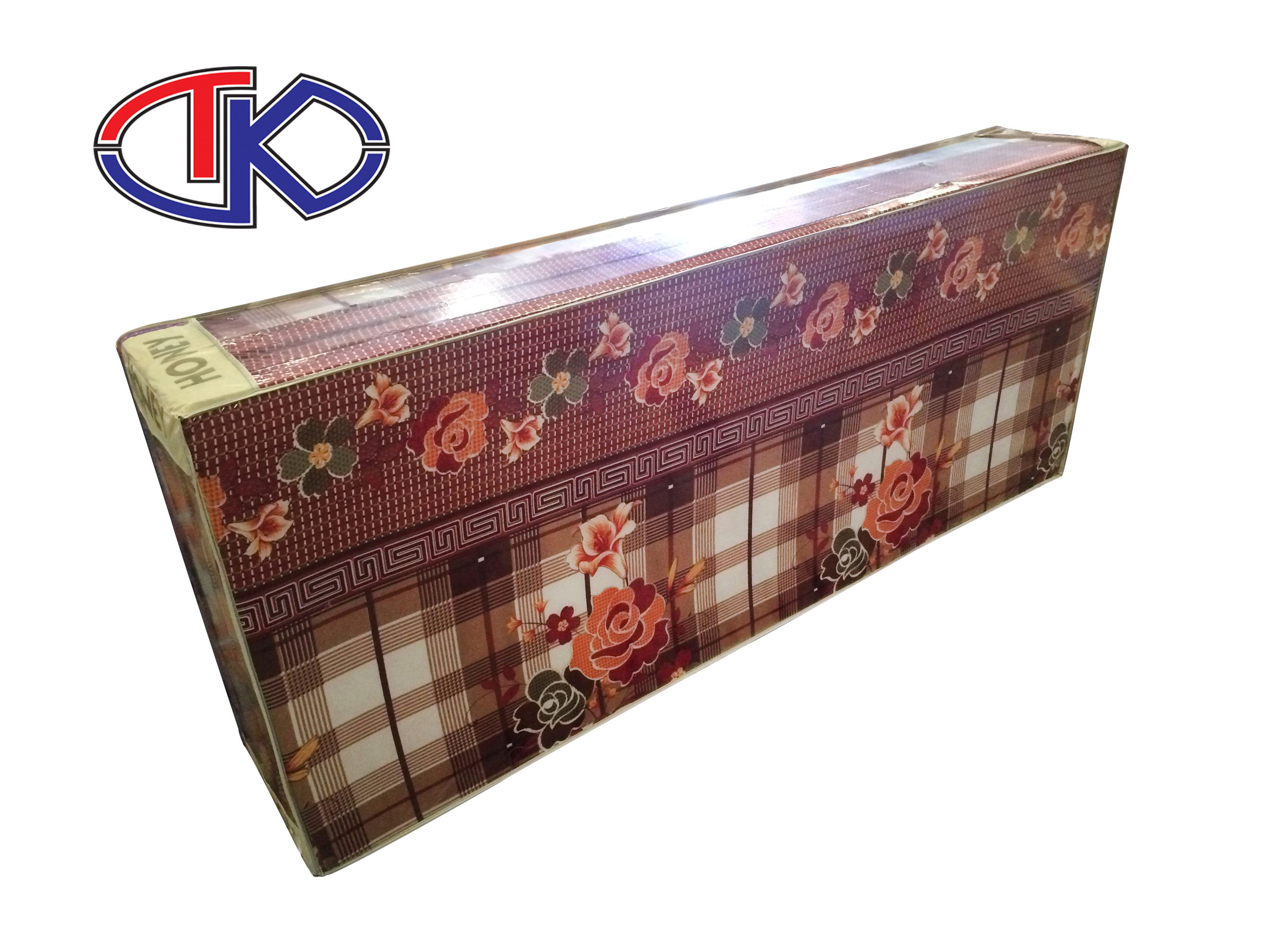

In recent years, the demand for foam mattresses has been steadily increasing. This is due to their many advantages over traditional spring mattresses, such as superior comfort, support, and durability. As a result, many homeowners are opting for foam mattresses as their go-to choice for a good night's sleep. However, with the rise in demand comes the need for production and import of these mattresses, which can be affected by import duties.

Import Duties on Vietnam-Made Foam Mattresses

Vietnam has become a major player in the foam mattress industry, with many manufacturers based in the country. However, the recent imposition of import duties on these mattresses has caused a stir in the market. The Vietnamese government has imposed a duty of

X

% on foam mattresses imported into the country, which has resulted in a price increase for these products. This has made it challenging for both manufacturers and consumers, as they have to navigate through the added cost and limited availability of Vietnam-made foam mattresses.

In recent years, the demand for foam mattresses has been steadily increasing. This is due to their many advantages over traditional spring mattresses, such as superior comfort, support, and durability. As a result, many homeowners are opting for foam mattresses as their go-to choice for a good night's sleep. However, with the rise in demand comes the need for production and import of these mattresses, which can be affected by import duties.

Import Duties on Vietnam-Made Foam Mattresses

Vietnam has become a major player in the foam mattress industry, with many manufacturers based in the country. However, the recent imposition of import duties on these mattresses has caused a stir in the market. The Vietnamese government has imposed a duty of

X

% on foam mattresses imported into the country, which has resulted in a price increase for these products. This has made it challenging for both manufacturers and consumers, as they have to navigate through the added cost and limited availability of Vietnam-made foam mattresses.

The Effect on House Design

The impact of import duties on foam mattresses goes beyond just the cost and availability. It also affects the overall house design, as homeowners may have to compromise on their preferred choice of mattress due to the increased cost. Additionally, the limited availability of Vietnam-made foam mattresses means that consumers may have to settle for other options, which may not meet their desired standards for comfort and support. This can significantly affect the quality of sleep and overall well-being of individuals.

In conclusion, import duties have a significant impact on the foam mattress industry, particularly for Vietnam-made products. As consumers, it is important to be aware of these duties and the implications they have on house design and our daily lives. It is also crucial for the government to consider the effects of these duties and find a balance that benefits both the industry and the consumers.

The impact of import duties on foam mattresses goes beyond just the cost and availability. It also affects the overall house design, as homeowners may have to compromise on their preferred choice of mattress due to the increased cost. Additionally, the limited availability of Vietnam-made foam mattresses means that consumers may have to settle for other options, which may not meet their desired standards for comfort and support. This can significantly affect the quality of sleep and overall well-being of individuals.

In conclusion, import duties have a significant impact on the foam mattress industry, particularly for Vietnam-made products. As consumers, it is important to be aware of these duties and the implications they have on house design and our daily lives. It is also crucial for the government to consider the effects of these duties and find a balance that benefits both the industry and the consumers.

:strip_icc()/how-to-clean-a-bathroom-sink-drain-01-c728294c8bee42428afdf3e69f449279.jpg)