If you're in the market for a new mattress in Florida, you may be wondering how much you'll have to pay in sales tax. As with most states, Florida has its own laws and regulations when it comes to sales tax, and mattresses are no exception. In this article, we'll break down the top 10 things you need to know about Florida's sales tax for mattresses.Understanding Florida's Sales Tax for Mattresses

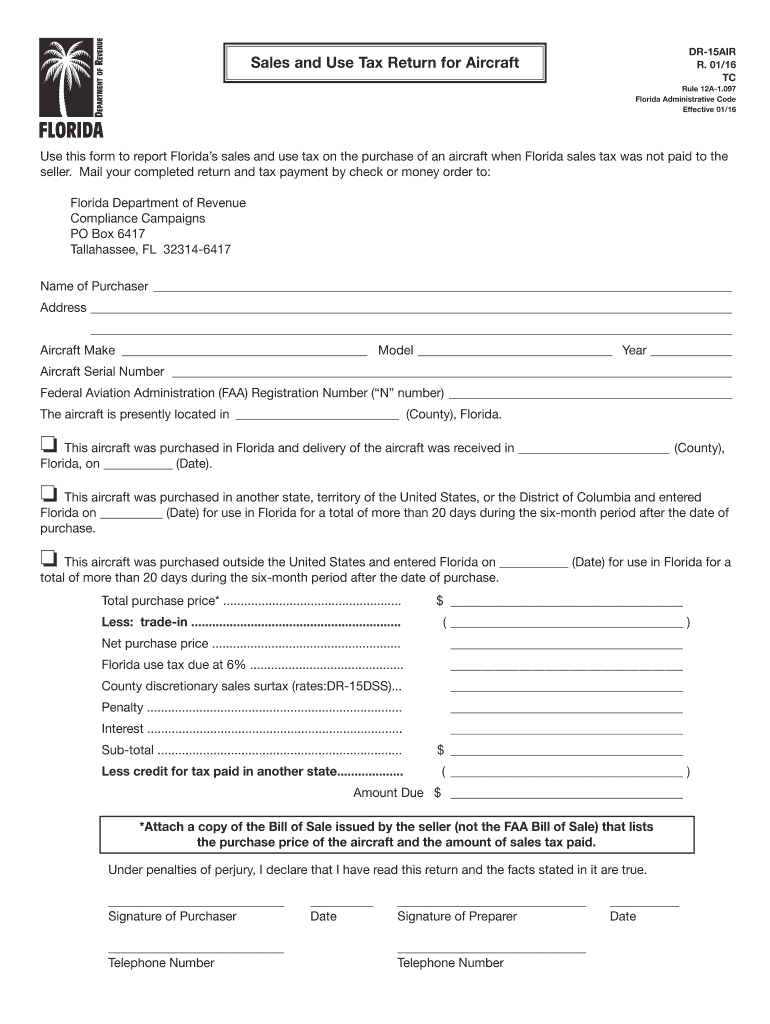

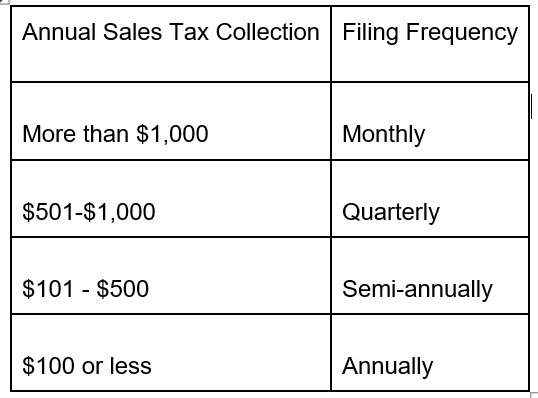

The current state sales tax rate in Florida is 6%. However, this may vary depending on the county in which you reside. Some counties may have a slightly higher or lower sales tax rate, so it's important to check with your local government for more accurate information.1. Sales Tax Rate in Florida

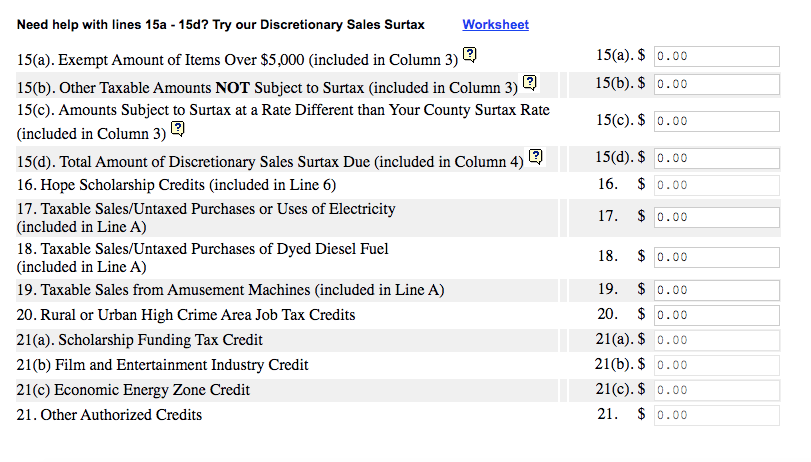

In addition to the state sales tax, some localities in Florida may also have additional local taxes on top of the state sales tax. This could include county or municipal taxes, which can range from 0.5% to 2.5%. Again, it's important to check with your local government for the exact sales tax rate in your area.2. Additional Local Taxes

In some cases, Florida's sales tax for mattresses may be waived if the mattress is considered a medical necessity. This may include mattresses used in hospitals, nursing homes, or for certain medical conditions. However, you may need to provide documentation or a prescription from a doctor to prove medical necessity.3. Exemptions for Medical Necessity

If you're purchasing a used mattress in Florida, you won't have to pay sales tax on it. This is because the sales tax has already been paid by the original owner at the time of purchase. However, you may still need to pay for any applicable local taxes.4. No Sales Tax on Used Mattresses

As with most states, if you're purchasing a mattress online in Florida, you'll still need to pay sales tax. The rate will be based on the location where the mattress is being shipped, which may be different from your own location. Online retailers are required to collect and remit sales tax on behalf of the state.5. Online Purchases

If you're purchasing a mattress as part of a bundled deal, such as a bed and mattress combo, the sales tax will only apply to the portion of the price that is attributed to the mattress. For example, if the bundle costs $1000 and the mattress is valued at $500, you'll only pay sales tax on the $500 mattress.6. Bundled Deals

If you're financing your mattress purchase in Florida, you'll still need to pay sales tax on the full price of the mattress. This is because you'll be paying the full amount for the mattress, just spread out over time. However, if you're leasing the mattress, you may only need to pay sales tax on the lease payments.7. Financing Options

If you're using a coupon or taking advantage of a sale to purchase a mattress in Florida, the sales tax will be applied to the final discounted price. This means you'll pay less in sales tax if you're able to find a good deal on your mattress purchase.8. Coupons and Discounts

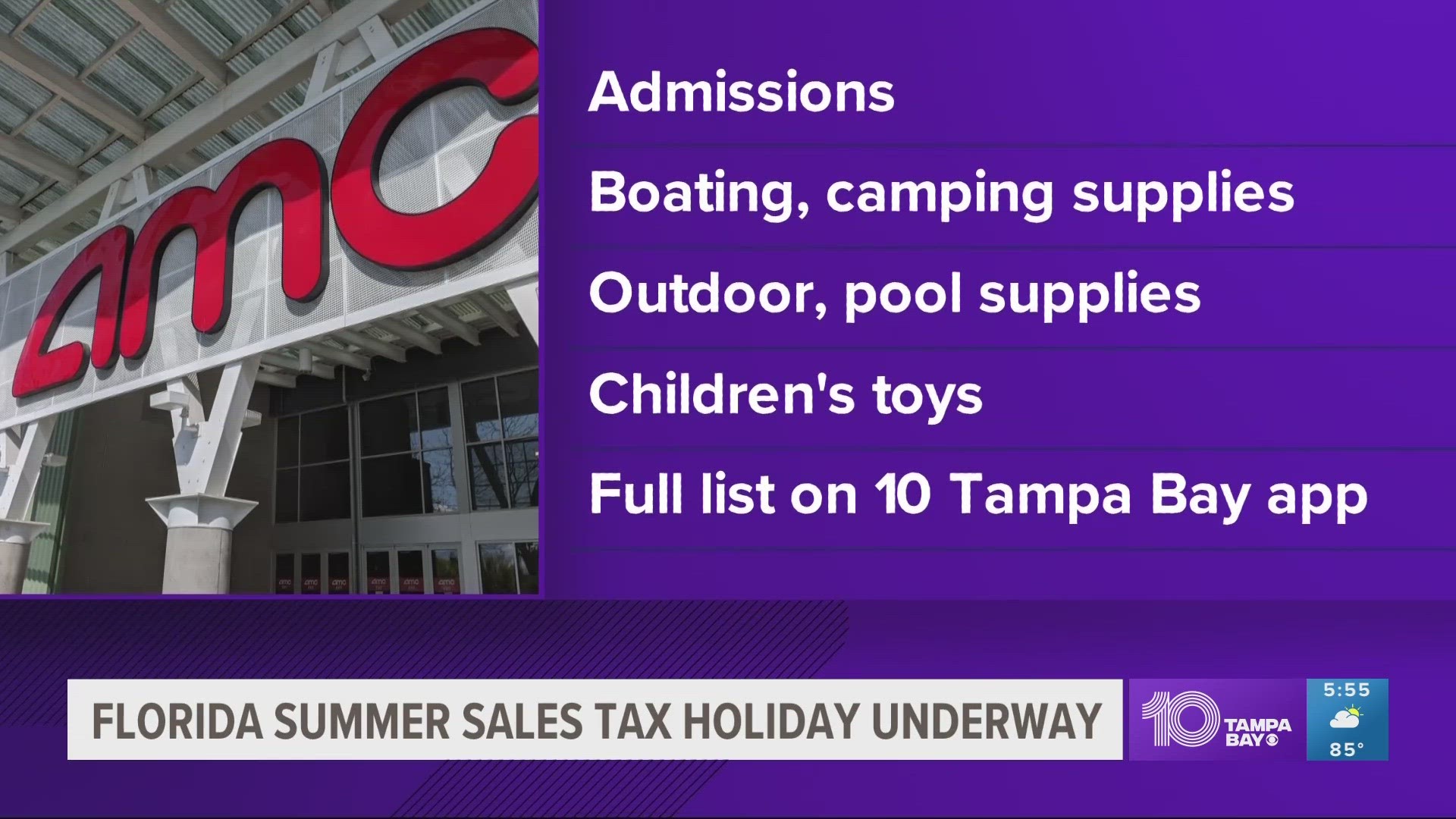

Florida does not currently have any sales tax holidays for mattresses, but it's always a good idea to check with your local government for any upcoming tax-free weekends or events. This can be a great opportunity to save on sales tax and get a better deal on your mattress purchase.9. Sales Tax Holiday

The Benefits of Buying a Mattress in Florida

Florida is a popular destination for many reasons - its beautiful beaches, warm weather, and diverse culture are just a few. But did you know that Florida also offers some unique benefits when it comes to purchasing a mattress?

Florida sales tax for mattresses

is one of the lowest in the country, making it an ideal location for those in the market for a new mattress. In this article, we will explore the reasons why buying a mattress in Florida can be advantageous for both residents and visitors alike.

Florida is a popular destination for many reasons - its beautiful beaches, warm weather, and diverse culture are just a few. But did you know that Florida also offers some unique benefits when it comes to purchasing a mattress?

Florida sales tax for mattresses

is one of the lowest in the country, making it an ideal location for those in the market for a new mattress. In this article, we will explore the reasons why buying a mattress in Florida can be advantageous for both residents and visitors alike.

Low Sales Tax

One of the main benefits of buying a mattress in Florida is the low sales tax. The state has a

6% sales tax rate

, which is significantly lower than the national average of 7.12%. This means that you can save money on your mattress purchase compared to other states. For example, if you were to buy a mattress for $1,000, you would only pay $60 in sales tax in Florida, compared to $71.20 in the national average. This may not seem like a big difference, but when you're making a big purchase like a mattress, every little bit counts.

One of the main benefits of buying a mattress in Florida is the low sales tax. The state has a

6% sales tax rate

, which is significantly lower than the national average of 7.12%. This means that you can save money on your mattress purchase compared to other states. For example, if you were to buy a mattress for $1,000, you would only pay $60 in sales tax in Florida, compared to $71.20 in the national average. This may not seem like a big difference, but when you're making a big purchase like a mattress, every little bit counts.

No Sales Tax on Online Purchases

In addition to the low sales tax rate, Florida also does not charge sales tax on online purchases. This means that if you choose to buy a mattress online, you can save even more money. With the rise of online shopping, this can be a major advantage for those looking for a new mattress. Not having to pay sales tax can result in significant savings, especially for higher-priced mattresses.

In addition to the low sales tax rate, Florida also does not charge sales tax on online purchases. This means that if you choose to buy a mattress online, you can save even more money. With the rise of online shopping, this can be a major advantage for those looking for a new mattress. Not having to pay sales tax can result in significant savings, especially for higher-priced mattresses.