When it comes to purchasing a new mattress in Florida, there is more to consider than just the size and comfort level. You also need to factor in the state's sales and use tax, which can significantly impact the overall cost of your purchase. Luckily, the Florida Department of Revenue offers a sales tax rebate on mattresses, making it easier for consumers to afford a good night's sleep. In this article, we'll take a closer look at the top 10 things you need to know about Florida's mattress sales tax rebate.Understanding Florida's Sales and Use Tax

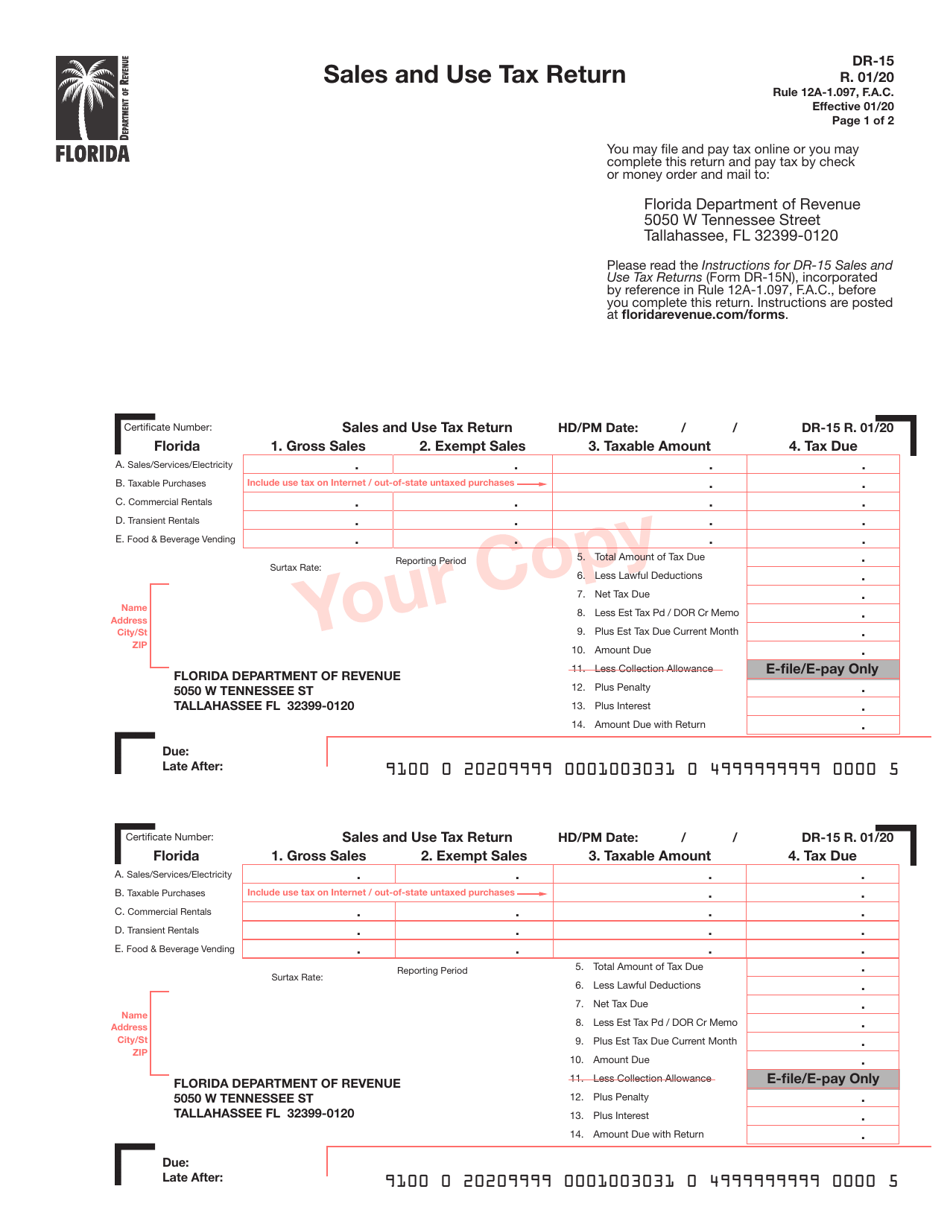

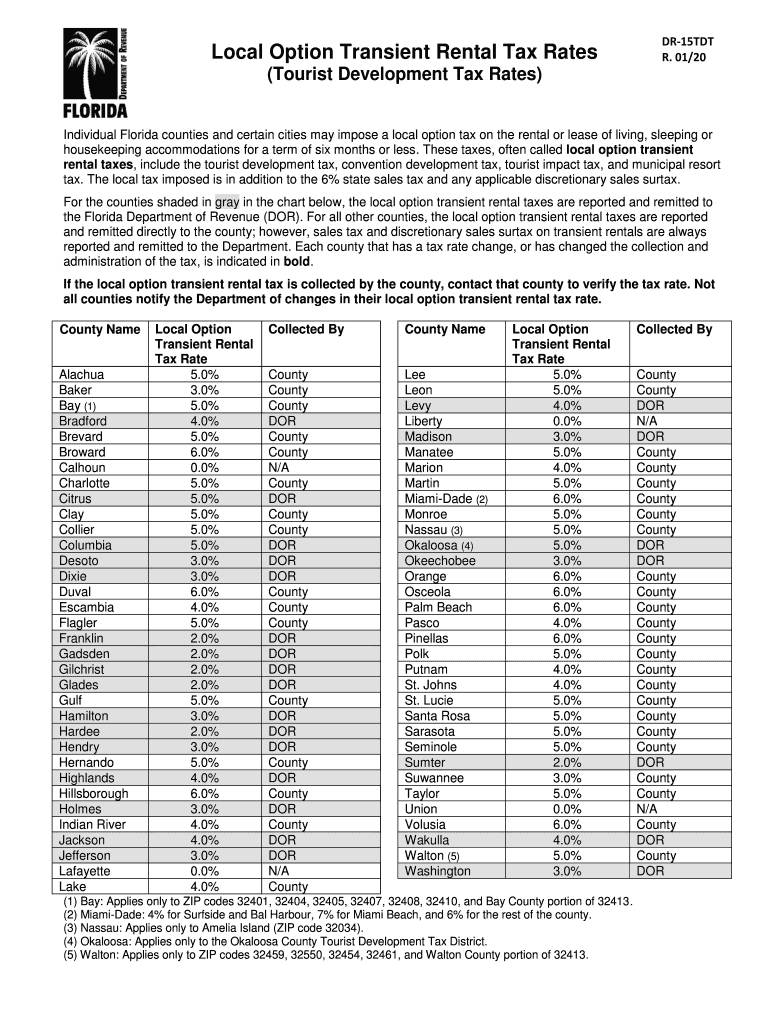

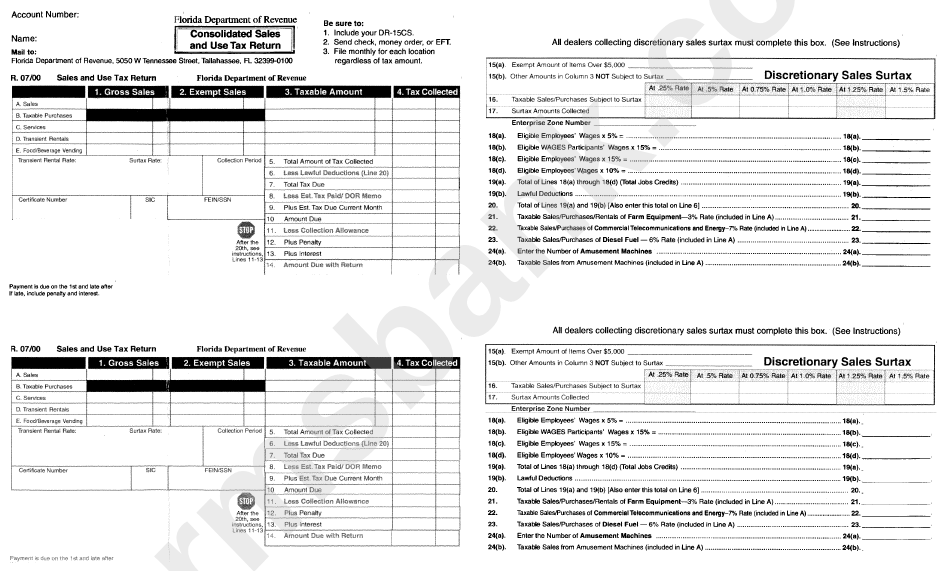

The state of Florida imposes a 6% sales tax on the sale of most goods and services. This includes mattresses, which are considered tangible personal property. In addition to the state tax, some counties and municipalities may also have their own local option tax, which can vary from 0.5% to 1.5%.1. What is the Florida sales and use tax?

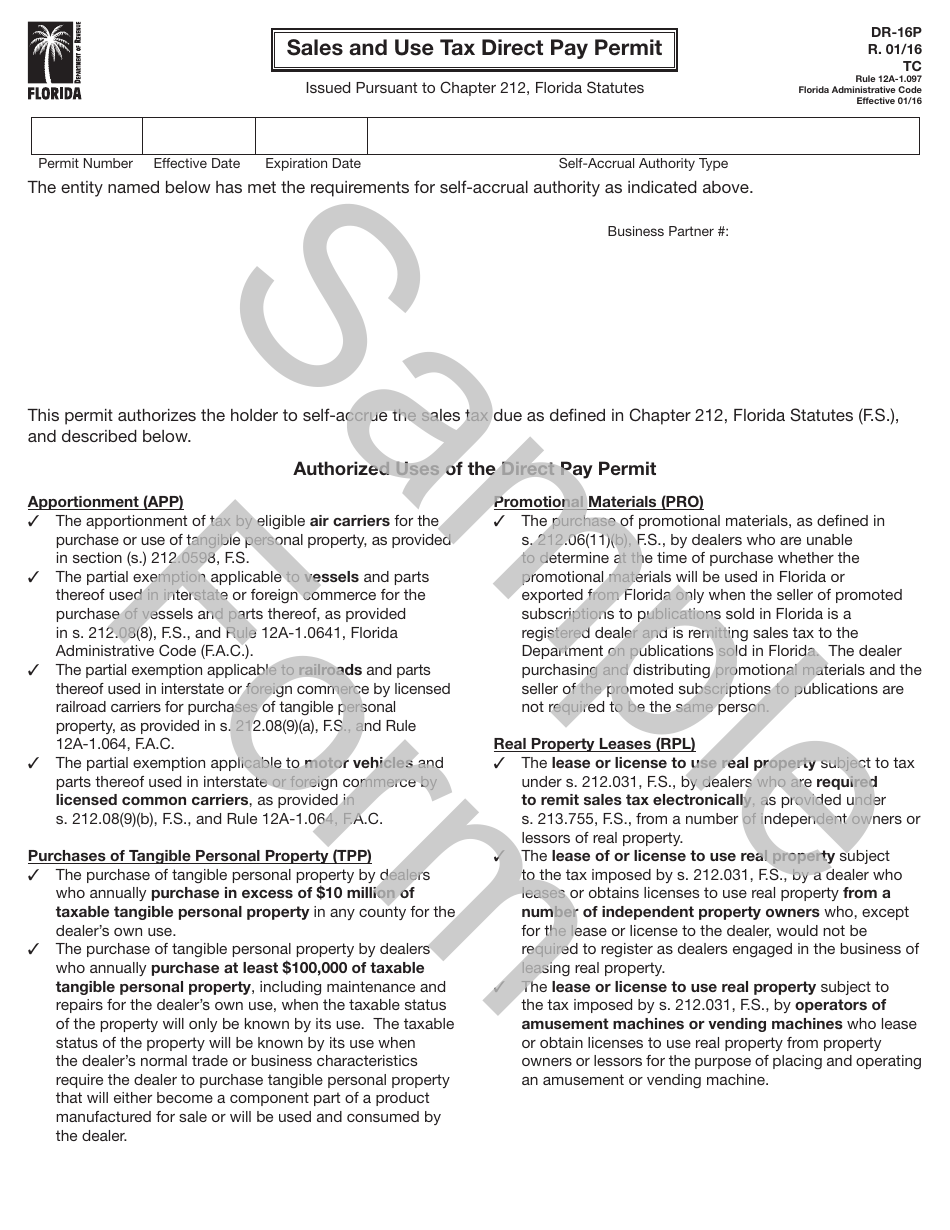

In most cases, the seller is responsible for collecting and remitting the sales tax to the state. However, if the seller is not located in Florida and does not have a physical presence (such as a store or warehouse) in the state, then the buyer is responsible for reporting and paying the use tax directly to the Florida Department of Revenue.2. Who is responsible for paying the sales tax?

The use tax is a tax on the use or consumption of goods and services in Florida that were purchased from out-of-state retailers. This tax is meant to ensure that Florida residents are not able to avoid paying sales tax by purchasing items from retailers located in other states.3. What is the use tax?

The state of Florida offers a sales tax rebate on mattresses that are purchased and used for personal, non-business purposes. The rebate applies to the state sales tax rate of 6% and does not include any local option taxes. To receive the rebate, you must submit an application to the Florida Department of Revenue within 6 months of the purchase date.4. How does the sales tax rebate work?

In order to be eligible for the sales tax rebate, you must be a Florida resident and have purchased a new mattress that is meant for personal use. The mattress must also be purchased from a Florida retailer and the application must be submitted within 6 months of the purchase date.5. Who is eligible for the sales tax rebate?

The Florida Department of Revenue's sales tax rebate applies to any new mattress that is meant for personal use. This includes traditional mattresses, as well as memory foam, latex, and hybrid mattresses. However, the rebate does not apply to used mattresses or mattresses that are purchased for resale.6. What types of mattresses are eligible for the rebate?

The amount of the sales tax rebate will vary depending on the purchase price of the mattress. The rebate applies to the state sales tax rate of 6%, so the higher the purchase price, the larger the rebate will be. For example, if you purchase a mattress for $1,000, you can receive a rebate of $60.7. How much of a rebate can I receive?

Once your application has been submitted, it can take up to 90 days for the Florida Department of Revenue to process and approve it. Once approved, you will receive a check for the rebate amount in the mail.8. How long does it take to receive the rebate?

Yes, there are a few restrictions to keep in mind when applying for the sales tax rebate. The mattress must be purchased from a Florida retailer and used for personal, non-business purposes. Additionally, the application must be submitted within 6 months of the purchase date and the mattress must have a purchase price of at least $200.9. Are there any restrictions on the sales tax rebate?

The Benefits of Investing in a High-Quality Mattress

The Importance of a Good Night's Sleep

A good night's sleep is crucial for our overall health and well-being. We spend approximately one-third of our lives sleeping, and the quality of our sleep directly affects our physical, mental, and emotional state. One of the key factors in achieving a good night's sleep is having a comfortable and supportive mattress. This is why investing in a high-quality mattress is so important.

A good night's sleep is crucial for our overall health and well-being. We spend approximately one-third of our lives sleeping, and the quality of our sleep directly affects our physical, mental, and emotional state. One of the key factors in achieving a good night's sleep is having a comfortable and supportive mattress. This is why investing in a high-quality mattress is so important.

The Florida Mattress Sales Tax Rebate

If you're a resident of Florida, you may be aware of the recent legislation that offers a sales tax rebate on mattress purchases. This initiative was put in place to encourage Floridians to invest in a better sleep experience and ultimately improve their overall health and productivity. The rebate allows for a tax refund of up to $150 on the purchase of a qualifying mattress, making it a great opportunity to upgrade your sleeping situation.

If you're a resident of Florida, you may be aware of the recent legislation that offers a sales tax rebate on mattress purchases. This initiative was put in place to encourage Floridians to invest in a better sleep experience and ultimately improve their overall health and productivity. The rebate allows for a tax refund of up to $150 on the purchase of a qualifying mattress, making it a great opportunity to upgrade your sleeping situation.

Choosing the Right Mattress for You

With the sales tax rebate in place, now is the perfect time to start researching and investing in a high-quality mattress. But with so many options available on the market, how do you know which one is right for you? Here are some key factors to consider when mattress shopping:

Support:

A good mattress should provide support for your body, particularly in areas such as the hips, shoulders, and lower back. Look for mattresses with a medium to firm level of support, depending on your individual needs.

Comfort:

Comfort is subjective and can vary from person to person. Some may prefer a soft and plush mattress, while others may prefer a firmer feel. It's important to test out different mattresses to find the one that feels most comfortable for you.

Materials:

The materials used in a mattress can greatly impact its comfort and durability. Look for high-quality materials such as memory foam, latex, or hybrid options that combine the benefits of different materials.

Size:

Consider the size of your bedroom and your personal sleeping preferences when choosing a mattress size. A larger mattress may offer more space, but it also takes up more room and can be more expensive.

With the sales tax rebate in place, now is the perfect time to start researching and investing in a high-quality mattress. But with so many options available on the market, how do you know which one is right for you? Here are some key factors to consider when mattress shopping:

Support:

A good mattress should provide support for your body, particularly in areas such as the hips, shoulders, and lower back. Look for mattresses with a medium to firm level of support, depending on your individual needs.

Comfort:

Comfort is subjective and can vary from person to person. Some may prefer a soft and plush mattress, while others may prefer a firmer feel. It's important to test out different mattresses to find the one that feels most comfortable for you.

Materials:

The materials used in a mattress can greatly impact its comfort and durability. Look for high-quality materials such as memory foam, latex, or hybrid options that combine the benefits of different materials.

Size:

Consider the size of your bedroom and your personal sleeping preferences when choosing a mattress size. A larger mattress may offer more space, but it also takes up more room and can be more expensive.

Invest in Your Health and Well-Being

A high-quality mattress is not just a luxurious purchase, it's an investment in your health and well-being. With the Florida mattress sales tax rebate, there's never been a better time to upgrade your sleeping experience and reap the benefits of a good night's sleep. So don't wait any longer – start researching and testing out mattresses today to find the perfect one for you. Your body will thank you for it!

A high-quality mattress is not just a luxurious purchase, it's an investment in your health and well-being. With the Florida mattress sales tax rebate, there's never been a better time to upgrade your sleeping experience and reap the benefits of a good night's sleep. So don't wait any longer – start researching and testing out mattresses today to find the perfect one for you. Your body will thank you for it!