When running a business in Florida, it's important to understand the state's sales tax laws. This is especially true if you're in the business of selling mattresses. Proper knowledge of Florida's sales tax laws can help you avoid hefty fines and penalties, and ensure that you're collecting the correct amount of tax from your customers. Here are the top 10 things you need to know about Florida's sales tax on mattresses.Florida Sales Tax: What You Need to Know

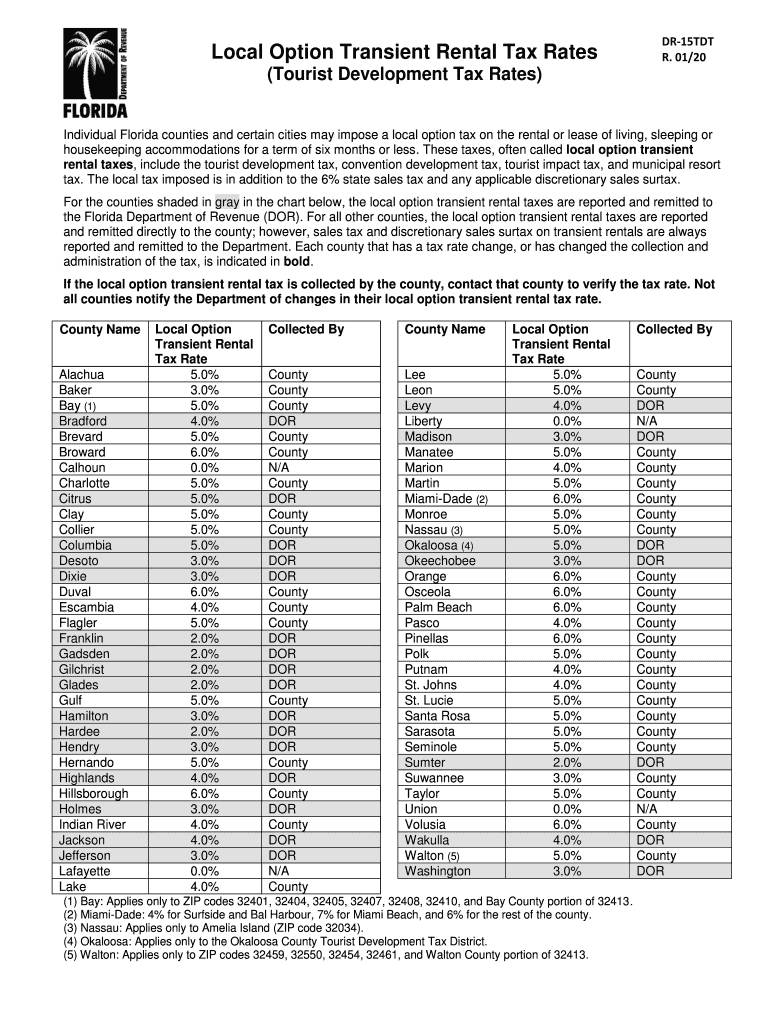

In Florida, the state imposes a sales tax rate of 6% on most goods and services, including mattresses. However, some counties and municipalities may also impose their own local sales tax, which can range from 0.5% to 2.5%. This means that the total sales tax rate on mattresses in Florida can vary depending on where your business is located.1. Florida Has a Statewide Sales Tax Rate

As a business owner, it's your responsibility to collect sales tax from your customers at the point of sale. This means that when a customer purchases a mattress from your store, you must collect the appropriate amount of sales tax and remit it to the state. Failure to do so can result in penalties and interest charges.2. Sales Tax is Collected at the Point of Sale

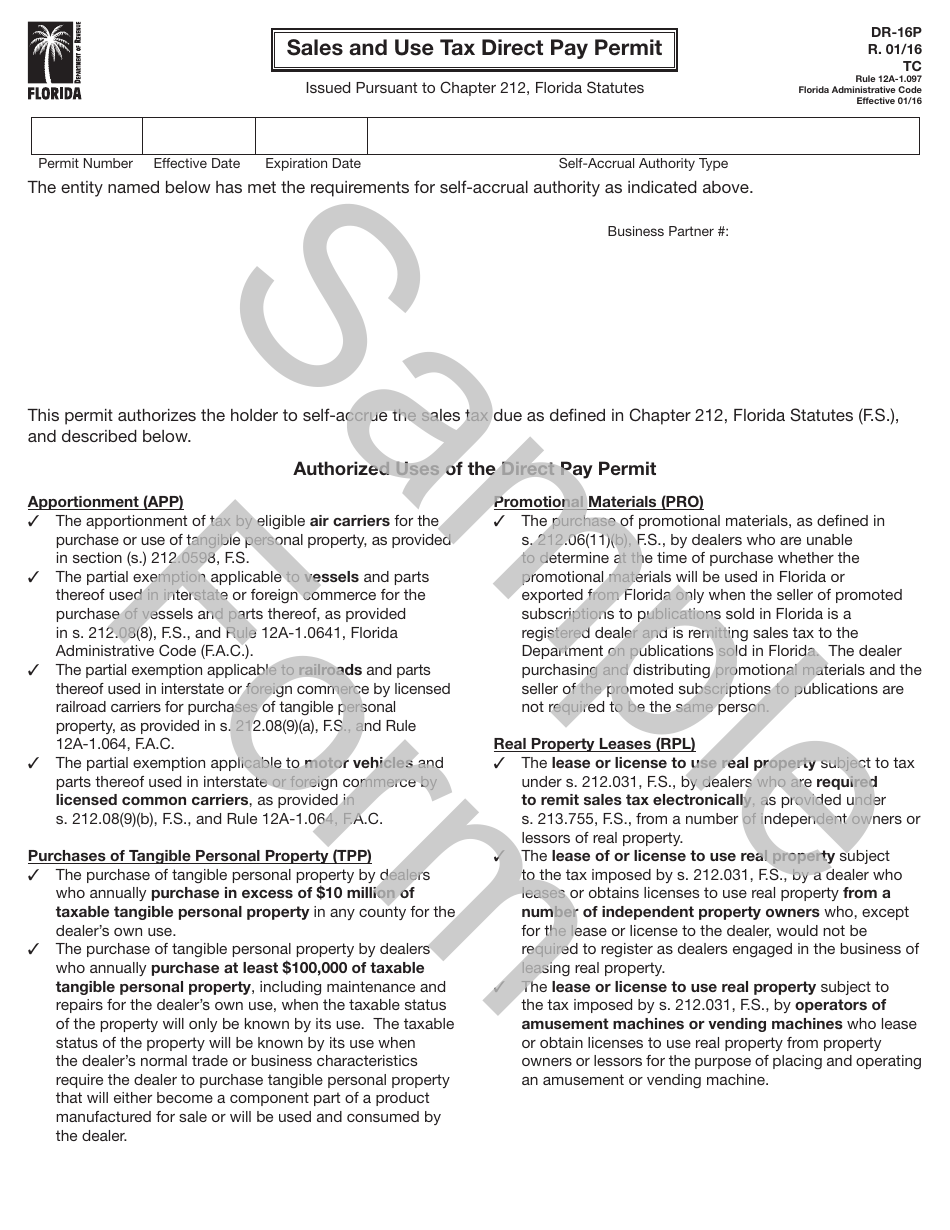

While most goods and services in Florida are subject to sales tax, there are some exemptions and exclusions that may apply. For example, if you sell mattresses to a customer who has a valid resale certificate or is purchasing the mattress for resale, then you do not need to collect sales tax. It's important to familiarize yourself with these exemptions and exclusions to avoid overcharging your customers.3. Exemptions and Exclusions May Apply

If you sell mattresses online to customers in Florida, you are still required to collect and remit sales tax. This is true even if your business is located outside of Florida. The state considers any business that has a physical presence in Florida, such as a warehouse or office, to have nexus and therefore must collect sales tax on all sales made to Florida customers.4. Online Sales are Subject to Sales Tax

In some cases, you may offer a bundle deal where you sell a mattress along with other items, such as a bed frame or sheets. In these cases, the sales tax on the mattress may be different from the sales tax on the other items. It's important to understand how bundled sales are taxed to ensure you are collecting the correct amount of sales tax from your customers.5. Bundled Sales Are Taxed Differently

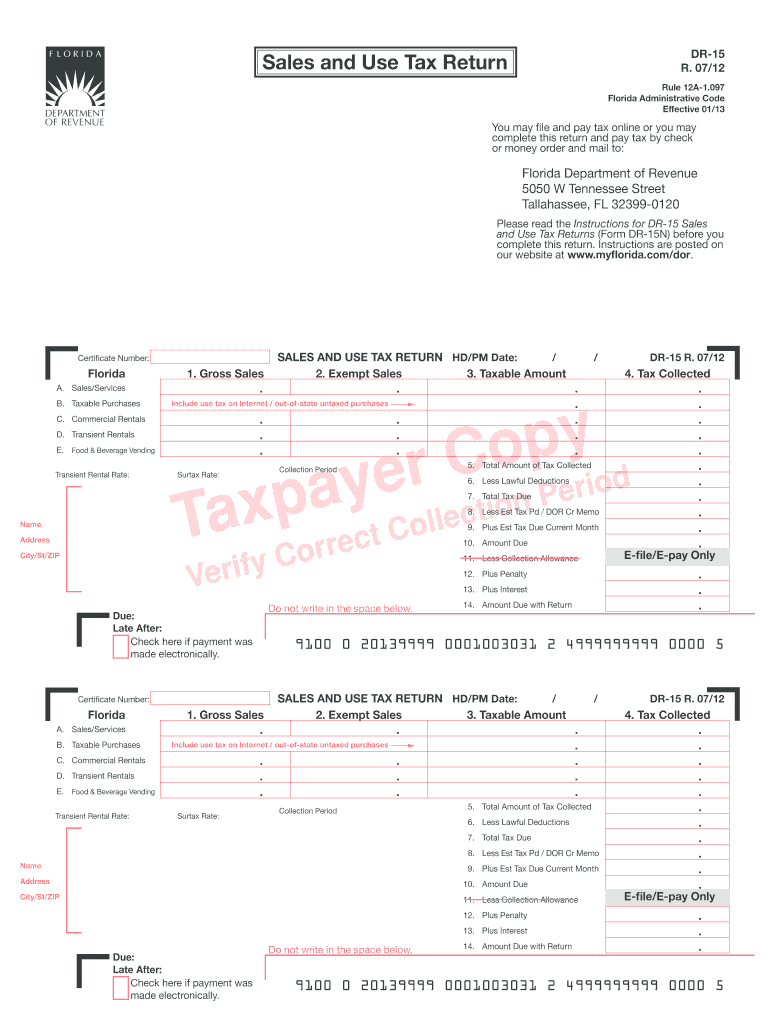

As a business owner, you are responsible for filing and remitting sales tax returns to the state on a regular basis. In Florida, sales tax returns must be filed either monthly, quarterly, or annually, depending on your business's sales volume. It's important to keep track of your sales and file your returns on time to avoid penalties.6. Sales Tax Returns Must Be Filed Regularly

If you fail to file your sales tax returns or remit the appropriate amount of sales tax on time, you may be subject to penalties and interest charges. These can add up quickly, so it's important to stay on top of your sales tax obligations to avoid any additional costs to your business.7. Late Payments Can Result in Penalties and Interest

If you sell mattresses to a tax-exempt organization, such as a non-profit or government entity, you may be exempt from collecting sales tax. However, you must obtain a valid exemption certificate from the organization and keep it on file for auditing purposes.8. Tax-Exempt Organizations May Be Exempt from Sales Tax

If you purchase mattresses from out-of-state vendors for use in your business, you may be subject to use tax. This is a tax on goods and services that are used or consumed in Florida but were not subject to sales tax. It's important to keep track of these purchases and remit the appropriate amount of use tax to the state.9. Use Tax May Apply to Out-of-State Purchases

Understanding Florida's Sales Tax on Mattresses

What is sales tax?

Sales tax is a type of tax imposed by the government on the sale of certain goods and services. It is usually calculated as a percentage of the sale price and is collected by the seller at the time of purchase. The purpose of sales tax is to generate revenue for the state and local government to fund public services and programs.

Sales tax is a type of tax imposed by the government on the sale of certain goods and services. It is usually calculated as a percentage of the sale price and is collected by the seller at the time of purchase. The purpose of sales tax is to generate revenue for the state and local government to fund public services and programs.

How is sales tax applied to mattresses in Florida?

In Florida, sales tax is applied to the sale of mattresses and other bedding products. The current sales tax rate in Florida is 6%, but some counties may add an additional surtax. This means that when purchasing a mattress, you will pay 6% of the total purchase price in sales tax.

In Florida, sales tax is applied to the sale of mattresses and other bedding products. The current sales tax rate in Florida is 6%, but some counties may add an additional surtax. This means that when purchasing a mattress, you will pay 6% of the total purchase price in sales tax.

Exceptions to sales tax on mattresses

While most mattresses are subject to sales tax in Florida, there are some exceptions. If you purchase a mattress for resale, you may be able to obtain a resale certificate from the Florida Department of Revenue and avoid paying sales tax. Additionally, if you are purchasing a mattress for use in a tax-exempt organization, such as a nonprofit or government agency, you may also be exempt from paying sales tax.

While most mattresses are subject to sales tax in Florida, there are some exceptions. If you purchase a mattress for resale, you may be able to obtain a resale certificate from the Florida Department of Revenue and avoid paying sales tax. Additionally, if you are purchasing a mattress for use in a tax-exempt organization, such as a nonprofit or government agency, you may also be exempt from paying sales tax.

Online purchases and sales tax

With the rise of online shopping, it's important to note that sales tax also applies to online purchases of mattresses in Florida. If you purchase a mattress from an out-of-state retailer that does not have a physical presence in Florida, you may still be responsible for paying sales tax on your purchase. This is known as a use tax, and it is meant to level the playing field between in-state and out-of-state retailers.

With the rise of online shopping, it's important to note that sales tax also applies to online purchases of mattresses in Florida. If you purchase a mattress from an out-of-state retailer that does not have a physical presence in Florida, you may still be responsible for paying sales tax on your purchase. This is known as a use tax, and it is meant to level the playing field between in-state and out-of-state retailers.

Be aware of sales tax when purchasing a mattress in Florida

It's important to keep in mind the sales tax rate when budgeting for a new mattress in Florida. The added 6% (plus any additional surtax) can significantly increase the total cost of your purchase. However, it's also important to note that sales tax revenue helps fund important public services and programs in the state.

In conclusion

, understanding Florida's sales tax laws on mattresses can help you make informed decisions when purchasing a new mattress. Whether you're buying for personal use or for resale, it's important to be aware of the sales tax rate and any exemptions that may apply. By staying informed, you can ensure that your mattress purchase in Florida is both legal and budget-friendly.

It's important to keep in mind the sales tax rate when budgeting for a new mattress in Florida. The added 6% (plus any additional surtax) can significantly increase the total cost of your purchase. However, it's also important to note that sales tax revenue helps fund important public services and programs in the state.

In conclusion

, understanding Florida's sales tax laws on mattresses can help you make informed decisions when purchasing a new mattress. Whether you're buying for personal use or for resale, it's important to be aware of the sales tax rate and any exemptions that may apply. By staying informed, you can ensure that your mattress purchase in Florida is both legal and budget-friendly.