When embarking on a farmhouse kitchen and bath renovation, it's important to consider the tax implications of your project. Depending on the scope and cost of your remodel, you may be subject to certain tax rates and deductions. Understanding these rates can help you budget accordingly and potentially save money in the long run.1. Understanding Tax Rates for Farmhouse Kitchens and Baths

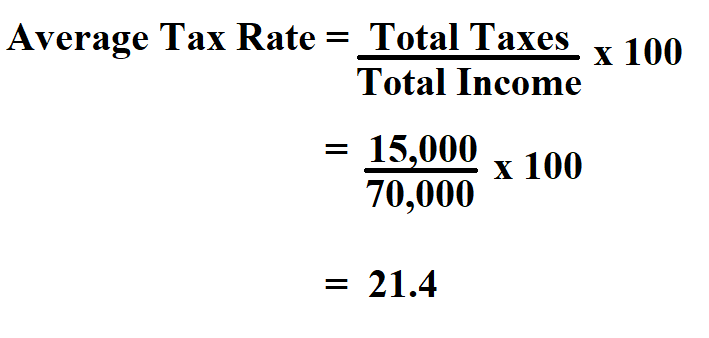

The tax rate for your farmhouse kitchen and bath renovation will depend on several factors, including the cost of materials and labor, the location of your property, and any applicable tax credits or deductions. To get an accurate estimate of your tax rate, it's best to consult with a tax professional or use online resources provided by the IRS or your state's department of revenue.2. How to Calculate Tax Rates for Your Farmhouse Kitchen and Bath Renovation

One way to potentially lower your tax bill for your farmhouse kitchen and bath renovation is to take advantage of tax deductions. These deductions can include expenses related to energy-efficient upgrades, home office deductions, and deductions for medical expenses if your renovation includes accessibility features. Be sure to keep detailed records and consult with a tax professional to determine which deductions you may be eligible for.3. Tax Deductions for Farmhouse Kitchen and Bath Upgrades

In addition to deductions, there may also be tax credits available for certain farmhouse kitchen and bath upgrades. These credits can provide a dollar-for-dollar reduction in your tax bill, so it's important to research and take advantage of any available credits. Examples of potential tax credits for home renovations include solar energy systems, electric vehicle chargers, and energy-efficient appliances.4. Farmhouse Kitchen and Bath Tax Credits: What You Need to Know

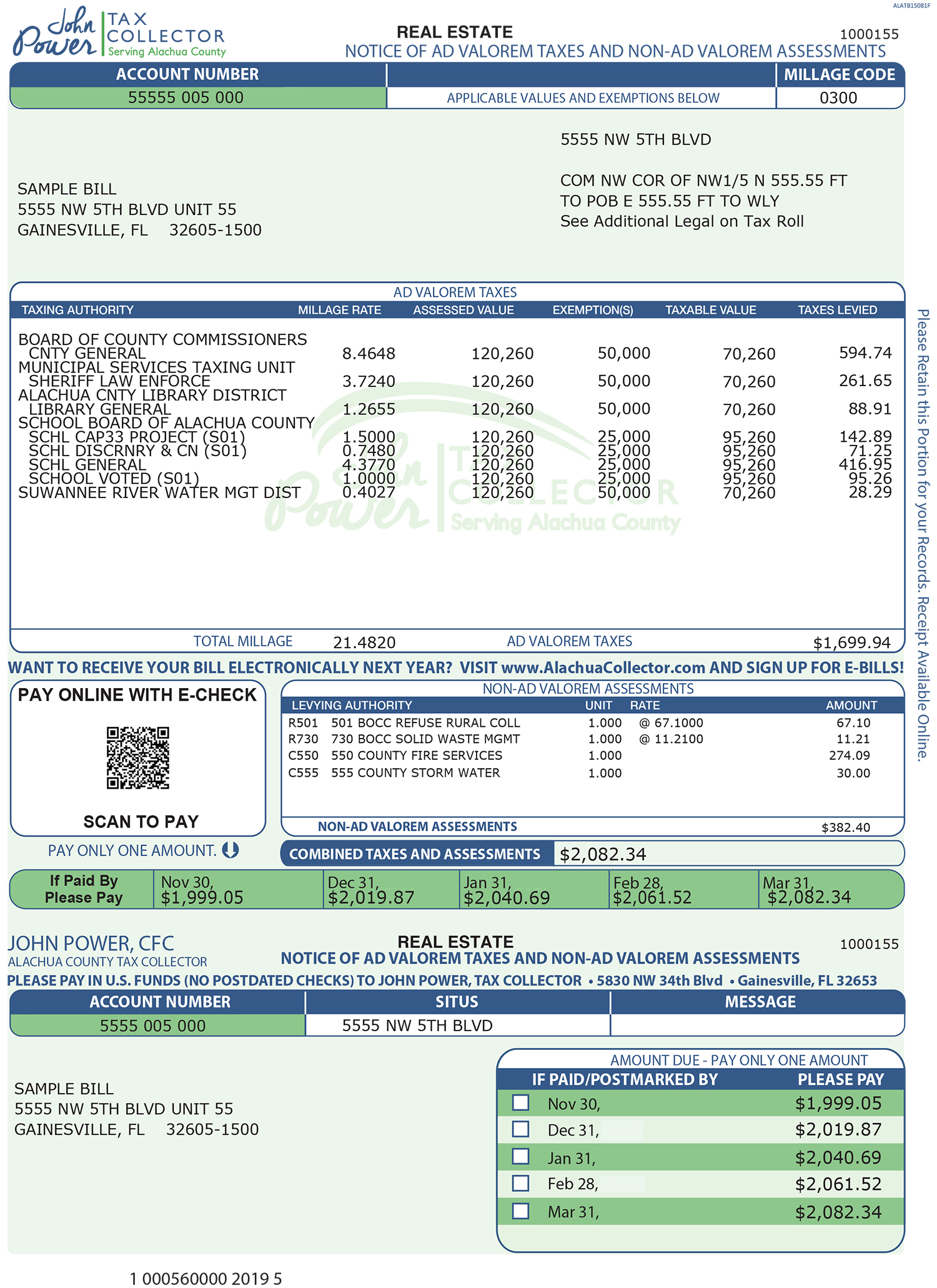

The tax rates for farmhouse kitchen and bath renovations can vary significantly from state to state. For example, some states may have higher sales tax rates on materials and labor, while others may offer tax incentives for home renovations. When planning your project, it's important to research and compare the tax rates in different states to determine which location may be most beneficial for your budget.5. Comparing Tax Rates for Farmhouse Kitchen and Bath Remodels in Different States

While tax rates may be unavoidable, there are certain strategies you can use to potentially lower your tax bill for your farmhouse kitchen and bath renovation. These can include timing your project to take advantage of tax credits or deductions, negotiating lower labor costs, and carefully tracking expenses to ensure you are eligible for any applicable deductions. Again, consulting with a tax professional can help you determine the best course of action for your specific situation.6. Tips for Lowering Your Tax Bill on Farmhouse Kitchen and Bath Renovations

When budgeting for your farmhouse kitchen and bath renovation, it's important to factor in sales tax on materials and labor. Sales tax rates can vary by state and even by county, so be sure to research the rates in your area. If you are working with a contractor, they may include sales tax in their estimate, but it's always a good idea to confirm and account for it in your budget.7. Understanding Sales Tax on Farmhouse Kitchen and Bath Materials and Labor

If you are adding a farmhouse kitchen and bath to a rental property, there may be different tax implications to consider. For example, you may be able to deduct the cost of the renovation as a business expense, or you may be subject to a different tax rate if the renovation increases the value of your property. It's important to consult with a tax professional to determine the best approach for your rental property renovation.8. Tax Implications of Adding a Farmhouse Kitchen and Bath to Your Rental Property

In addition to varying by state, tax rates for farmhouse kitchen and bath renovations can also vary by county. This is due to differences in local taxes and regulations. When planning your project, it's important to research and compare tax rates in different counties to determine which location may offer the most favorable tax rate for your renovation.9. Farmhouse Kitchen and Bath Tax Rates: How They Vary by County

Overall, tax planning is a crucial aspect of any farmhouse kitchen and bath renovation. By understanding tax rates, deductions, and credits, you can potentially save money and budget more effectively for your project. It's always a good idea to consult with a tax professional to ensure you are taking advantage of all available tax benefits and to avoid any potential tax pitfalls.10. Tax Planning for Farmhouse Kitchen and Bath Renovations: What You Need to Know

The Benefits of Choosing a Farmhouse Kitchen and Bath for Your Home

When it comes to designing a home, the kitchen and bathroom are two of the most important spaces to consider. Not only are these rooms essential for daily living, but they also have a significant impact on the overall value and aesthetic of a home. With the rising popularity of farmhouse design, more and more homeowners are opting for a farmhouse kitchen and bath. But what exactly makes this style so desirable, and how does it affect tax rates?

When it comes to designing a home, the kitchen and bathroom are two of the most important spaces to consider. Not only are these rooms essential for daily living, but they also have a significant impact on the overall value and aesthetic of a home. With the rising popularity of farmhouse design, more and more homeowners are opting for a farmhouse kitchen and bath. But what exactly makes this style so desirable, and how does it affect tax rates?

The Charm of a Farmhouse Kitchen and Bath

A farmhouse kitchen and bath exude a cozy and inviting atmosphere that is both timeless and rustic. With its warm and welcoming character, this design style creates a sense of comfort and nostalgia, making it a popular choice for homeowners. The use of natural materials such as wood, stone, and metal adds to the charm and authenticity of the farmhouse aesthetic. Not only does this design style create a beautiful and functional space, but it also adds value to your home.

A farmhouse kitchen and bath exude a cozy and inviting atmosphere that is both timeless and rustic. With its warm and welcoming character, this design style creates a sense of comfort and nostalgia, making it a popular choice for homeowners. The use of natural materials such as wood, stone, and metal adds to the charm and authenticity of the farmhouse aesthetic. Not only does this design style create a beautiful and functional space, but it also adds value to your home.

Tax Benefits of a Farmhouse Kitchen and Bath

One of the main reasons why farmhouse kitchens and baths are popular among homeowners is their tax benefits. In most states, property taxes are based on the overall value of the home, including its amenities and features. By choosing to incorporate a farmhouse kitchen and bath into your home, you can increase its value and potentially reduce your tax rates. The use of high-quality materials and attention to detail in a farmhouse design can also lead to a higher assessment of your home's value, further reducing your tax burden.

One of the main reasons why farmhouse kitchens and baths are popular among homeowners is their tax benefits. In most states, property taxes are based on the overall value of the home, including its amenities and features. By choosing to incorporate a farmhouse kitchen and bath into your home, you can increase its value and potentially reduce your tax rates. The use of high-quality materials and attention to detail in a farmhouse design can also lead to a higher assessment of your home's value, further reducing your tax burden.

Long-Term Savings

Aside from the immediate tax benefits, investing in a farmhouse kitchen and bath can also lead to long-term savings. The use of energy-efficient appliances and fixtures, as well as sustainable materials, can help reduce utility costs and save you money in the long run. Additionally, the durability and timeless appeal of farmhouse design can lead to lower maintenance and renovation costs, saving you even more money over time.

Aside from the immediate tax benefits, investing in a farmhouse kitchen and bath can also lead to long-term savings. The use of energy-efficient appliances and fixtures, as well as sustainable materials, can help reduce utility costs and save you money in the long run. Additionally, the durability and timeless appeal of farmhouse design can lead to lower maintenance and renovation costs, saving you even more money over time.

Conclusion

In conclusion, choosing a farmhouse kitchen and bath for your home not only adds charm and character but also has significant tax benefits. The use of natural materials, attention to detail, and energy-efficient features make this design style a wise investment for any homeowner. So why not add a touch of farmhouse charm to your home and enjoy the many benefits it has to offer?

In conclusion, choosing a farmhouse kitchen and bath for your home not only adds charm and character but also has significant tax benefits. The use of natural materials, attention to detail, and energy-efficient features make this design style a wise investment for any homeowner. So why not add a touch of farmhouse charm to your home and enjoy the many benefits it has to offer?

:max_bytes(150000):strip_icc()/farmhouseGettyImages-464720103-5b3cf02fc9e77c00372b25ef.jpg)