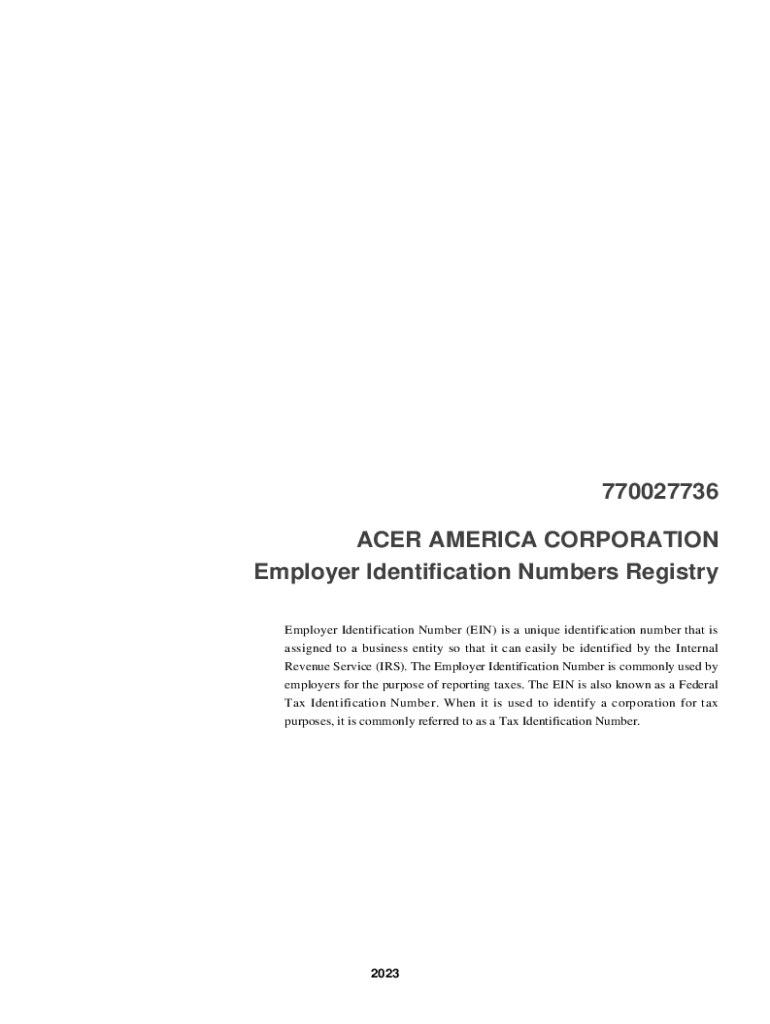

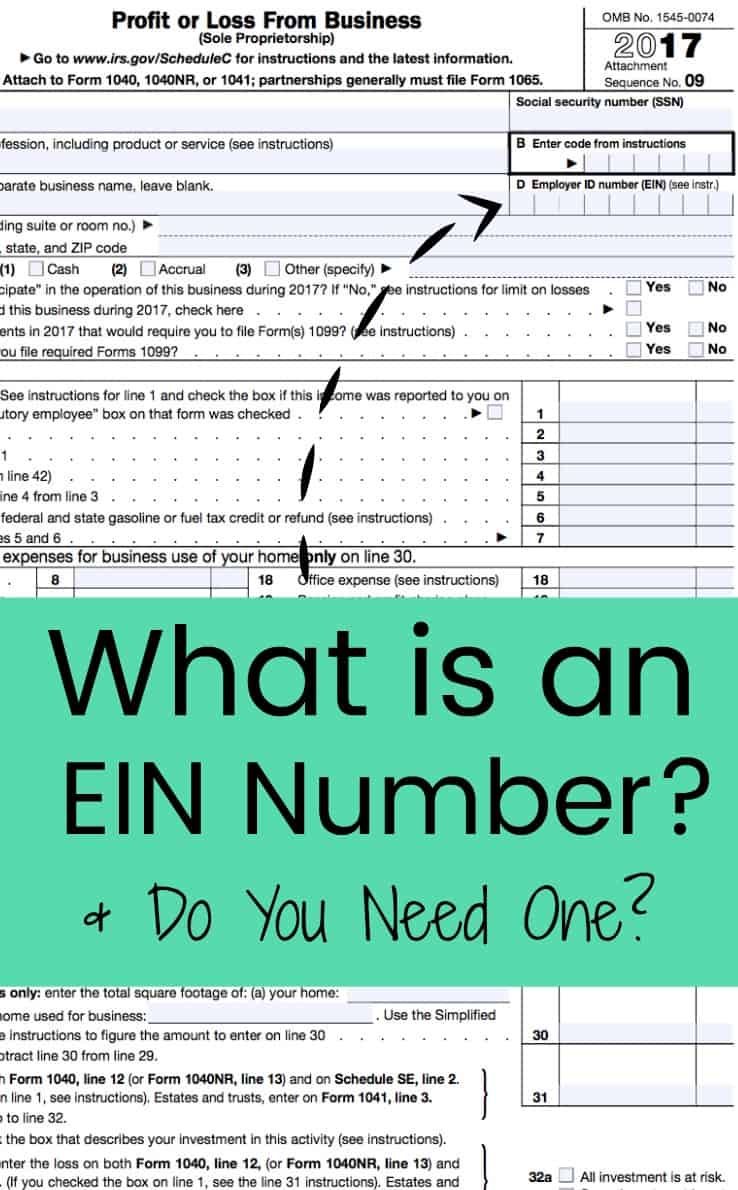

Employer Identification Number (EIN) Definition

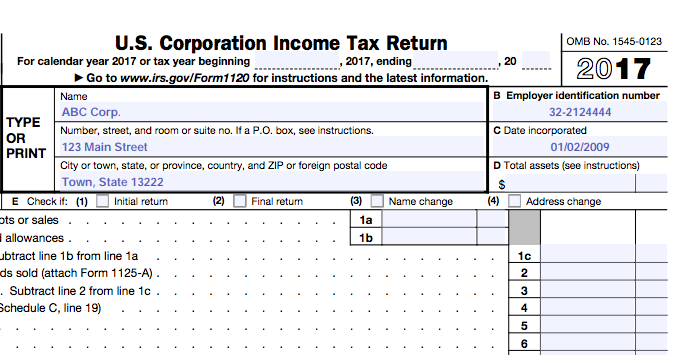

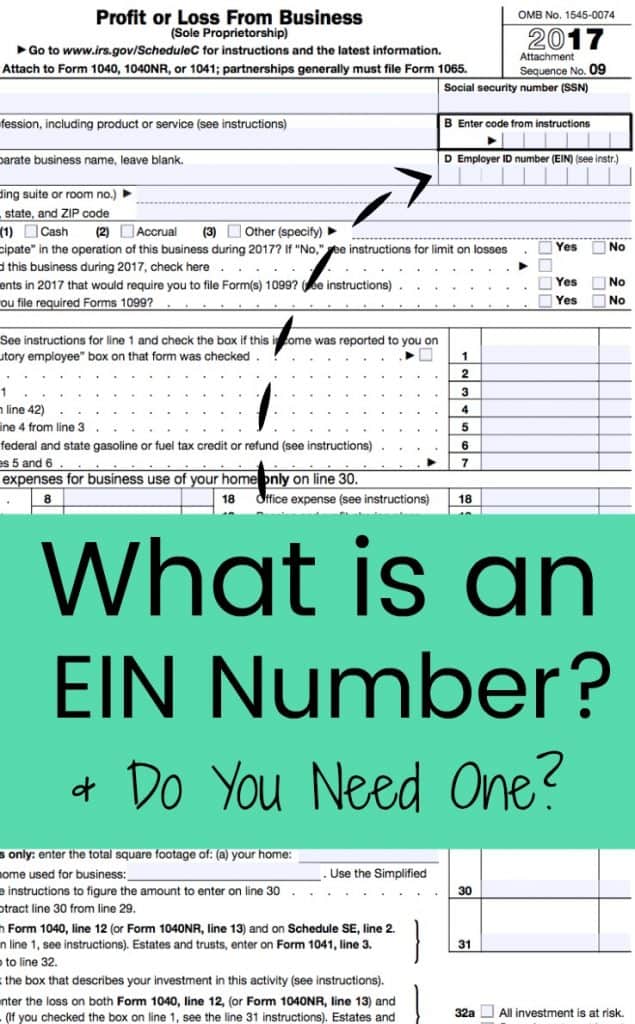

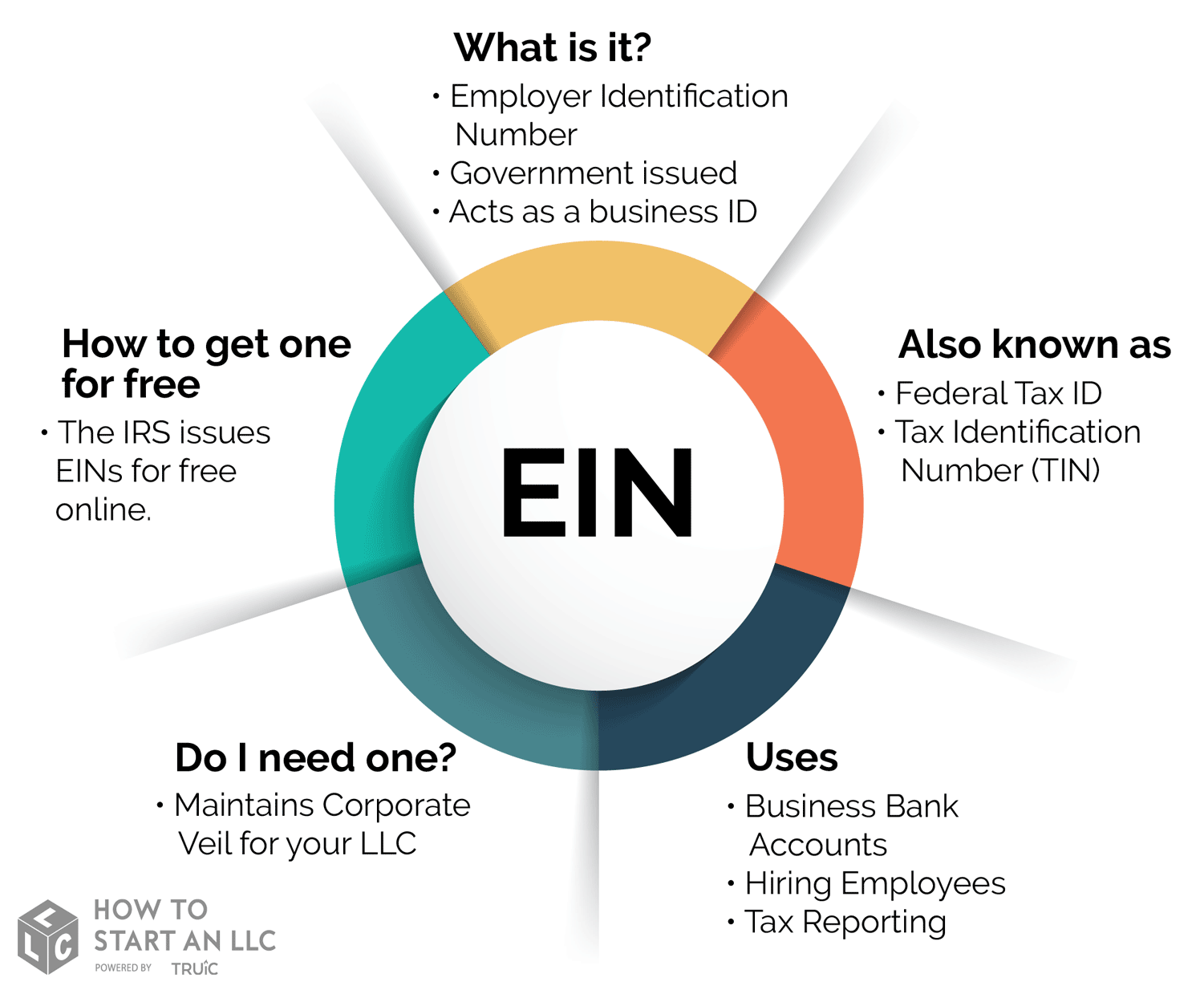

The Employer Identification Number (EIN), also known as the Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses, trusts, and other entities for tax filing and reporting purposes. It is used to identify a business entity and is similar to a Social Security Number for individuals.

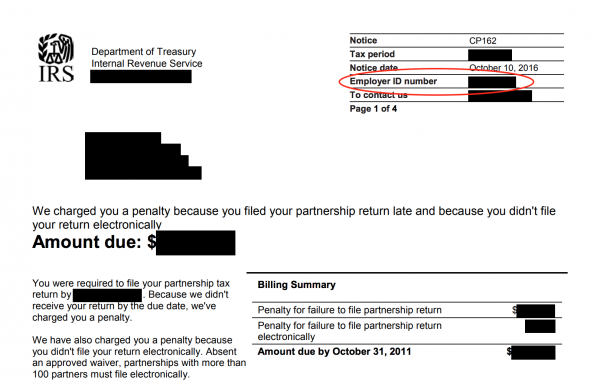

The EIN is required for businesses who have employees, operate as a corporation or partnership, or file certain taxes such as excise, employment, and alcohol, tobacco, and firearms taxes. It is also necessary for opening business bank accounts, applying for business licenses, and obtaining credit.

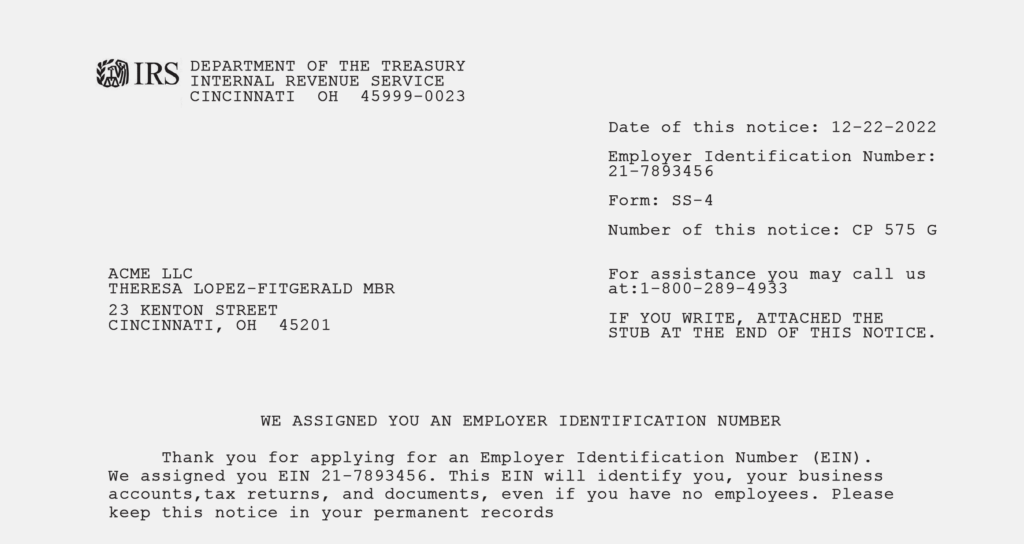

Employer Identification Number (EIN) - IRS

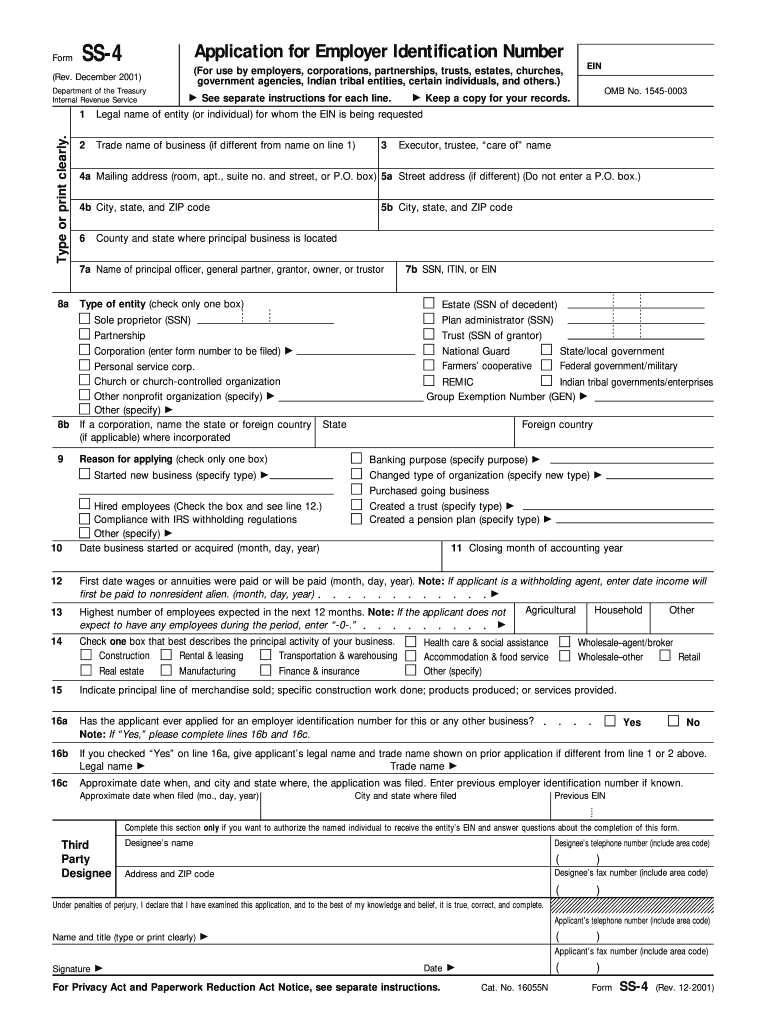

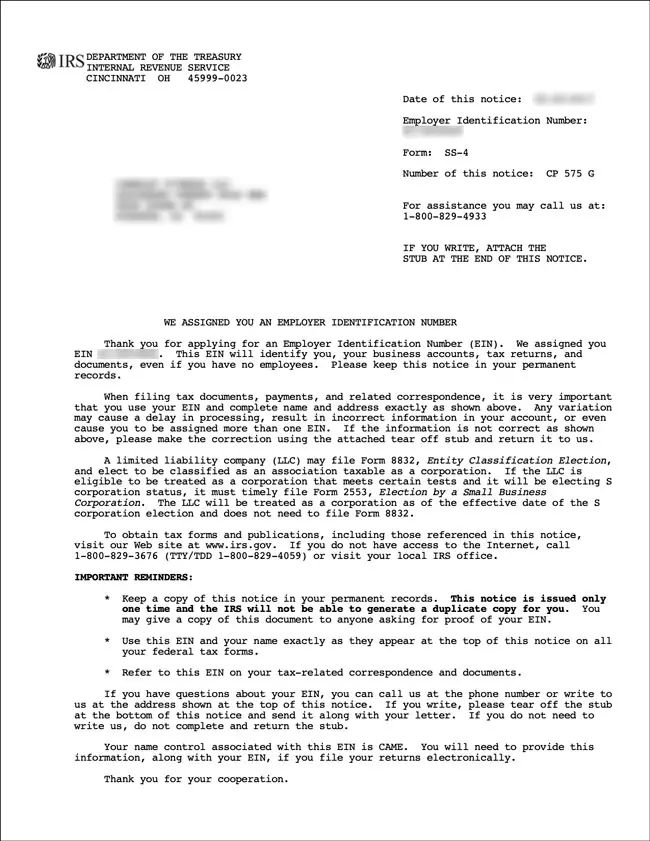

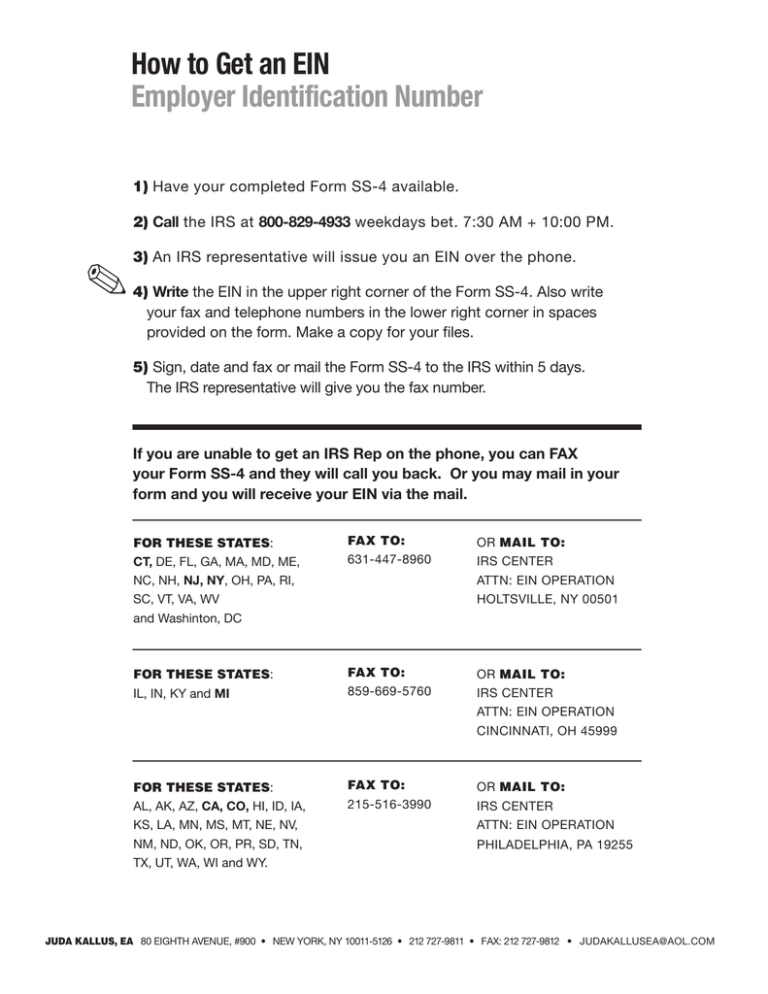

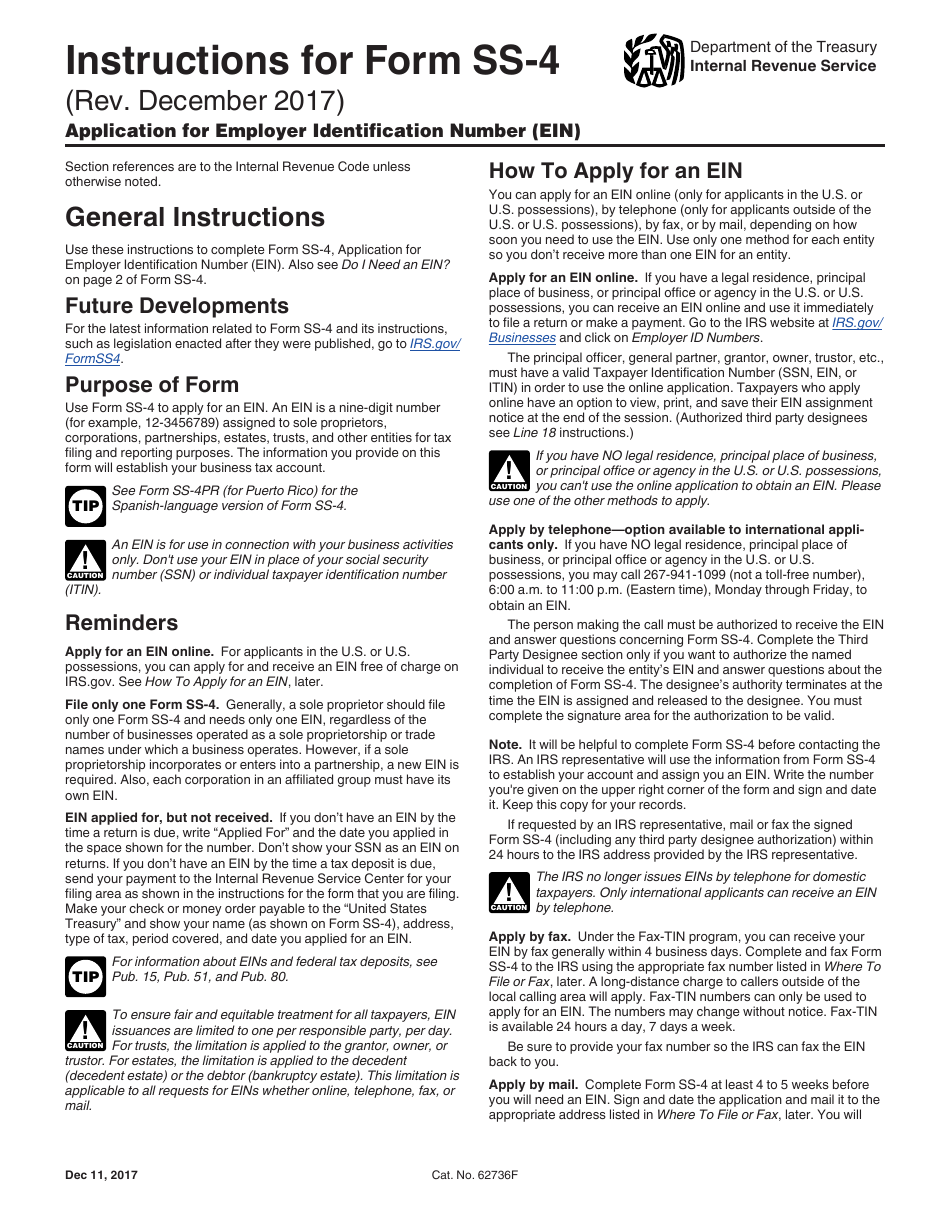

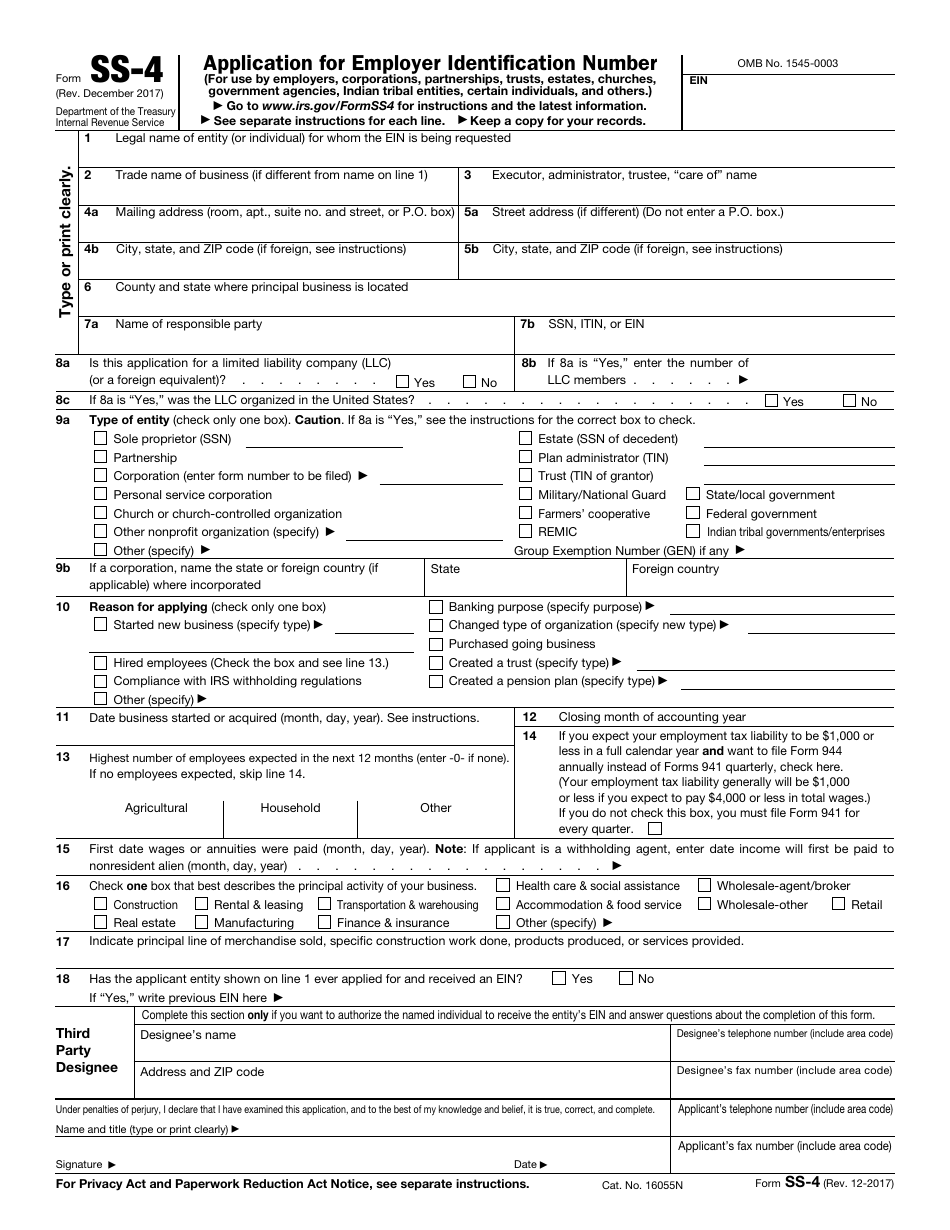

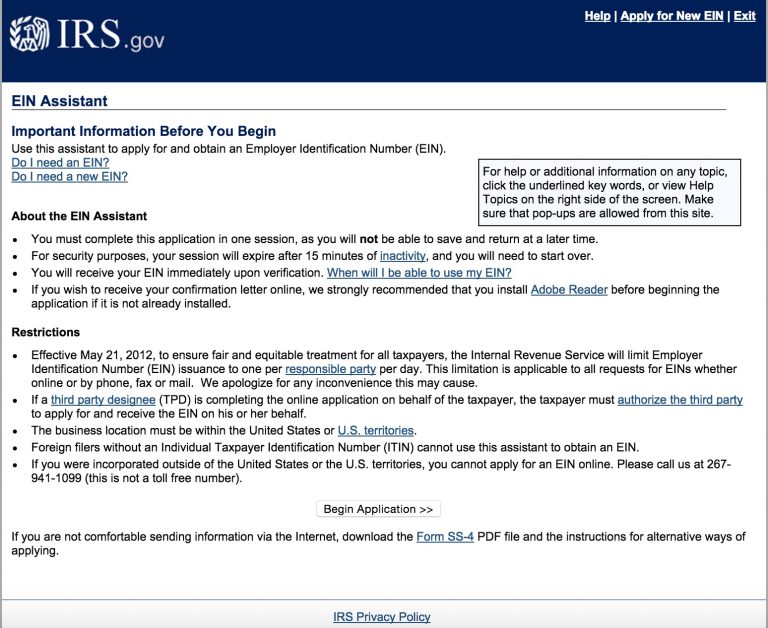

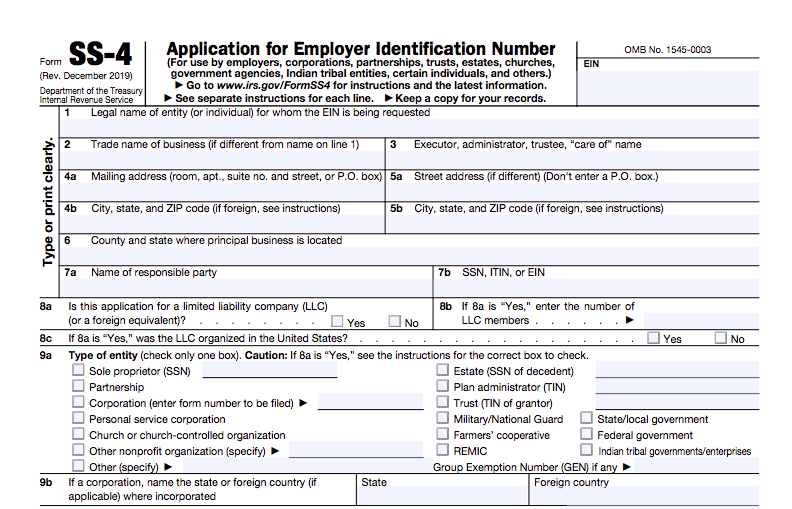

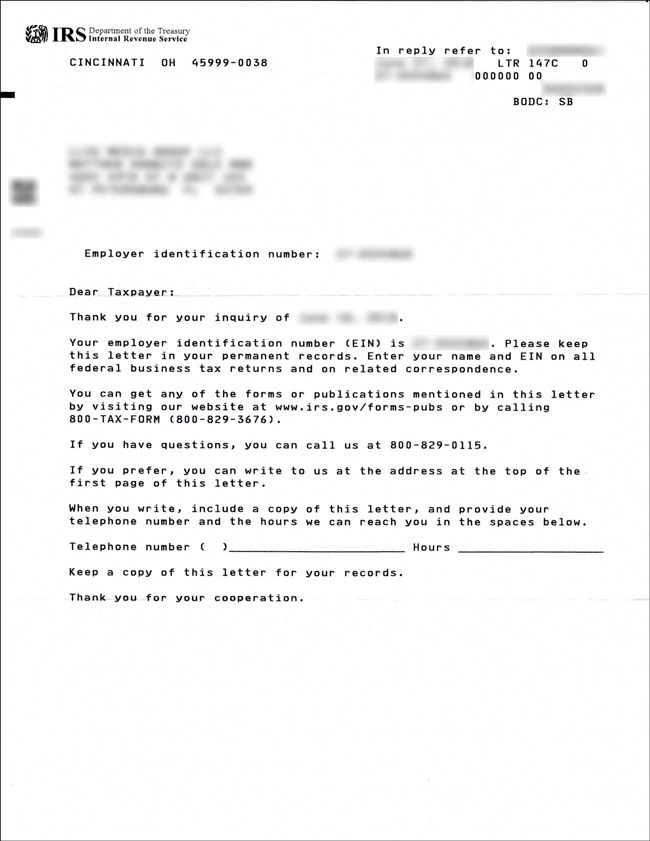

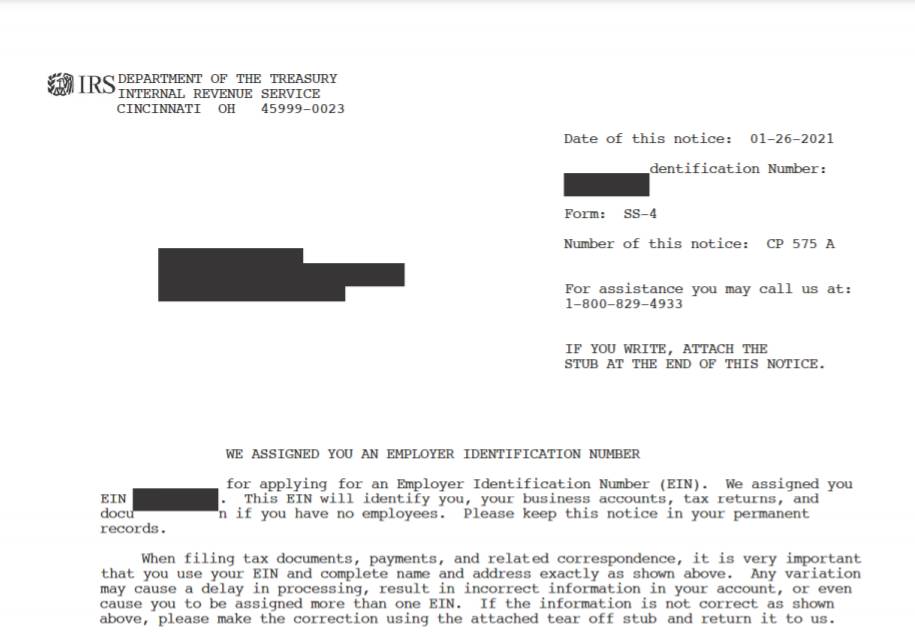

The IRS is responsible for assigning and maintaining EINs. Businesses can apply for an EIN online through the IRS website or by mail, fax, or phone. The application process is free, and the EIN is issued immediately upon completion.

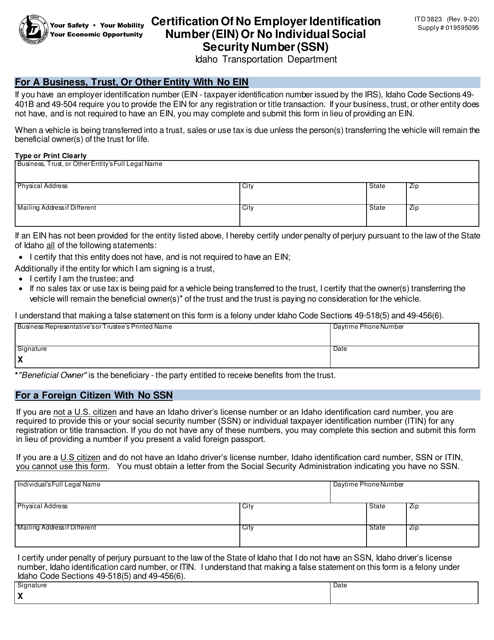

Businesses must have a valid Taxpayer Identification Number (TIN) to apply for an EIN. This can be a Social Security Number (SSN) for sole proprietors or a SSN or Individual Taxpayer Identification Number (ITIN) for the responsible party of the business. Non-resident aliens can apply for an EIN with an ITIN through the mail or by phone.

Employer Identification Number (EIN) - Investopedia

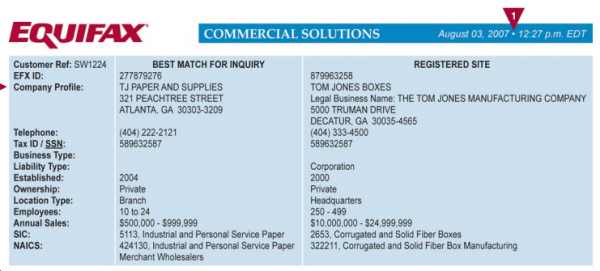

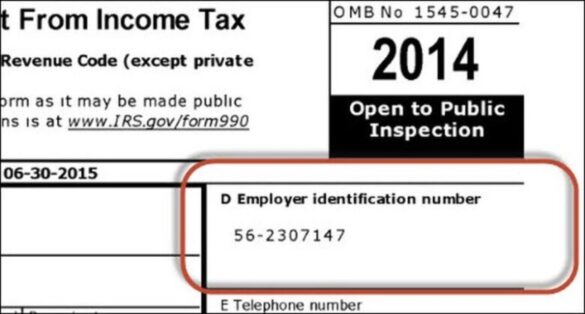

According to Investopedia, an EIN is used by the IRS for tax purposes but is not considered confidential like a Social Security Number. It is used for legal, administrative, and public record purposes, and can be used by banks, financial institutions, and business partners to verify a business's identity.

Investopedia also notes that EINs are not transferable and should be kept secure to prevent identity theft and fraud. Businesses should safeguard their EINs and only provide it to trusted sources when required.

Employer Identification Number (EIN) - Wikipedia

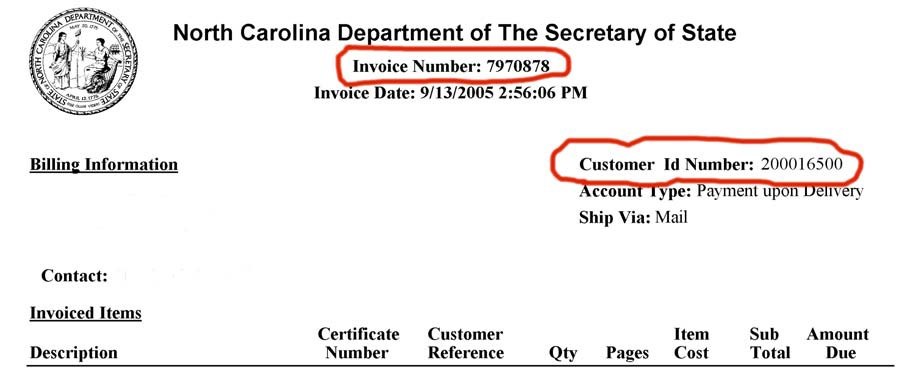

Wikipedia provides a brief overview of the EIN and its purpose. It also notes that some states require businesses to obtain a state tax ID number in addition to their EIN for state tax purposes.

Additionally, Wikipedia mentions that nonprofit organizations and certain types of businesses, such as partnerships and limited liability companies, may also be required to have an EIN.

How to Find a Company's EIN - The Balance Small Business

The Balance Small Business provides a step-by-step guide on how to find a company's EIN. This includes checking for the EIN on previous tax filings, contacting the company directly, and using third-party databases.

It also mentions that if a business is publicly traded, their EIN can be found on the Securities and Exchange Commission (SEC) website.

How to Look Up an EIN Number for a Business - NerdWallet

NerdWallet also offers tips on finding a company's EIN, such as checking for the EIN on business documents, searching through state business registrations, and using the IRS's Business Identity Theft Affidavit if the EIN is stolen or lost.

The article also advises against using third-party websites that charge a fee for finding EINs, as the information can be obtained for free through the IRS or other sources.

How to Find a Company's EIN Number - LegalZoom

LegalZoom provides information on the importance of having an EIN for businesses and how to obtain one. It also offers a service for obtaining an EIN on behalf of a business for a fee.

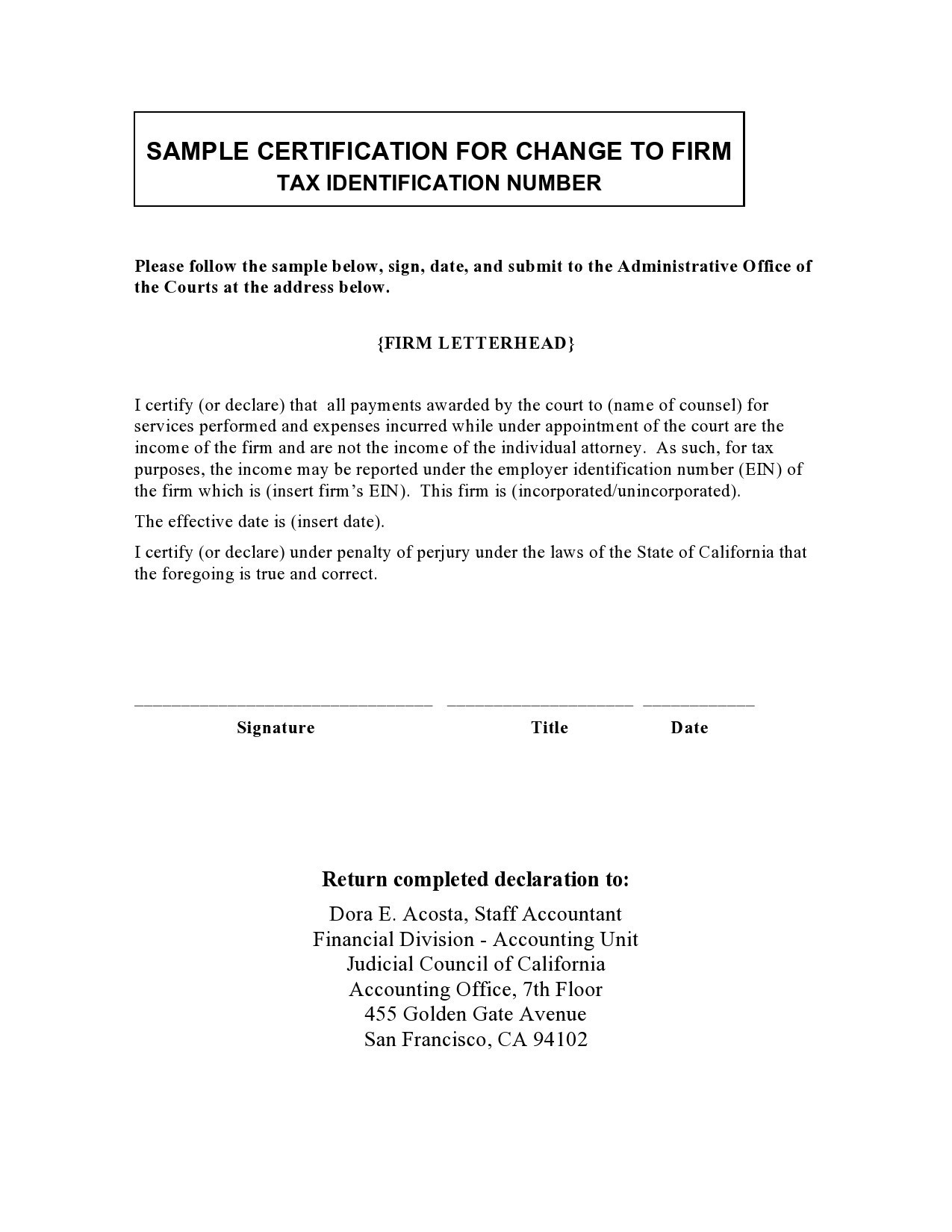

The article also mentions that businesses may need to update their EIN if there are changes in ownership, such as a merger or acquisition.

How to Find a Company's EIN Number - Chron

Chron outlines various ways to find a company's EIN, including checking for the number on business licenses, contacting the company's bank or accountant, and using the IRS's online EIN Assistant tool.

The article also warns against giving out an EIN to unauthorized sources, as it can potentially lead to identity theft.

How to Find a Company's EIN Number - Bizfluent

Bizfluent explains the purpose of an EIN and how to obtain one for businesses. It also suggests checking with the company's state tax agency or Secretary of State's office for their EIN.

Additionally, the article mentions that businesses should keep their EIN on file and provide it to the appropriate parties when necessary.

How to Find a Company's EIN Number - Small Business - Chron

Chron's small business section provides more specific information for small business owners on how to find their EIN. This includes checking for the number on tax documents, contacting the company's bank or credit card provider, and using the IRS's Business Identity Theft Affidavit.

The article also notes that businesses may need to update their EIN if they change their business structure or tax status.

The Importance of an Employer EIN Number for Mattress Firm Inc

What is an Employer EIN Number?

An Employer EIN Number, also known as an Employer Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses for tax purposes. This number is used to identify a business entity and is typically required for tax filing and reporting, as well as opening a business bank account and hiring employees.

An Employer EIN Number, also known as an Employer Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses for tax purposes. This number is used to identify a business entity and is typically required for tax filing and reporting, as well as opening a business bank account and hiring employees.

Why is an Employer EIN Number Necessary for Mattress Firm Inc?

As a business, Mattress Firm Inc is required to have an Employer EIN Number. This number is necessary for various reasons, including paying taxes, filing tax returns, and hiring employees. Without an Employer EIN Number, Mattress Firm Inc would not be able to conduct business legally and could face penalties and fines from the IRS.

As a business, Mattress Firm Inc is required to have an Employer EIN Number. This number is necessary for various reasons, including paying taxes, filing tax returns, and hiring employees. Without an Employer EIN Number, Mattress Firm Inc would not be able to conduct business legally and could face penalties and fines from the IRS.

The Benefits of Having an Employer EIN Number for Mattress Firm Inc

Having an Employer EIN Number not only ensures that Mattress Firm Inc is operating legally, but it also offers several benefits. First and foremost, it allows the business to separate personal and business finances, making it easier to track and manage expenses and income. This can also help with tax deductions and audits.

Having an Employer EIN Number not only ensures that Mattress Firm Inc is operating legally, but it also offers several benefits. First and foremost, it allows the business to separate personal and business finances, making it easier to track and manage expenses and income. This can also help with tax deductions and audits.

How to Obtain an Employer EIN Number for Mattress Firm Inc

Obtaining an Employer EIN Number for Mattress Firm Inc is a simple process. The business can apply for an EIN number online, by mail, fax, or phone through the IRS website. It is important to have all the necessary information and documents ready, such as the business name, business structure, and owner's information.

Obtaining an Employer EIN Number for Mattress Firm Inc is a simple process. The business can apply for an EIN number online, by mail, fax, or phone through the IRS website. It is important to have all the necessary information and documents ready, such as the business name, business structure, and owner's information.

In Conclusion

Having an Employer EIN Number is crucial for businesses like Mattress Firm Inc. It not only ensures that the business is operating legally, but it also offers several benefits such as separating personal and business finances and facilitating tax filing and reporting. As a responsible and professional business, Mattress Firm Inc should make it a priority to obtain an Employer EIN Number.

Having an Employer EIN Number is crucial for businesses like Mattress Firm Inc. It not only ensures that the business is operating legally, but it also offers several benefits such as separating personal and business finances and facilitating tax filing and reporting. As a responsible and professional business, Mattress Firm Inc should make it a priority to obtain an Employer EIN Number.

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png)