When it comes to purchasing a new mattress, there are many factors to consider, such as comfort, size, and price. However, one aspect that often gets overlooked is sales tax. Depending on where you live, sales tax can significantly impact the final cost of your mattress. In this article, we will explore the sales tax policies of US-Mattress and how it may affect your purchase.Understanding US-Mattress's Sales Tax Policies

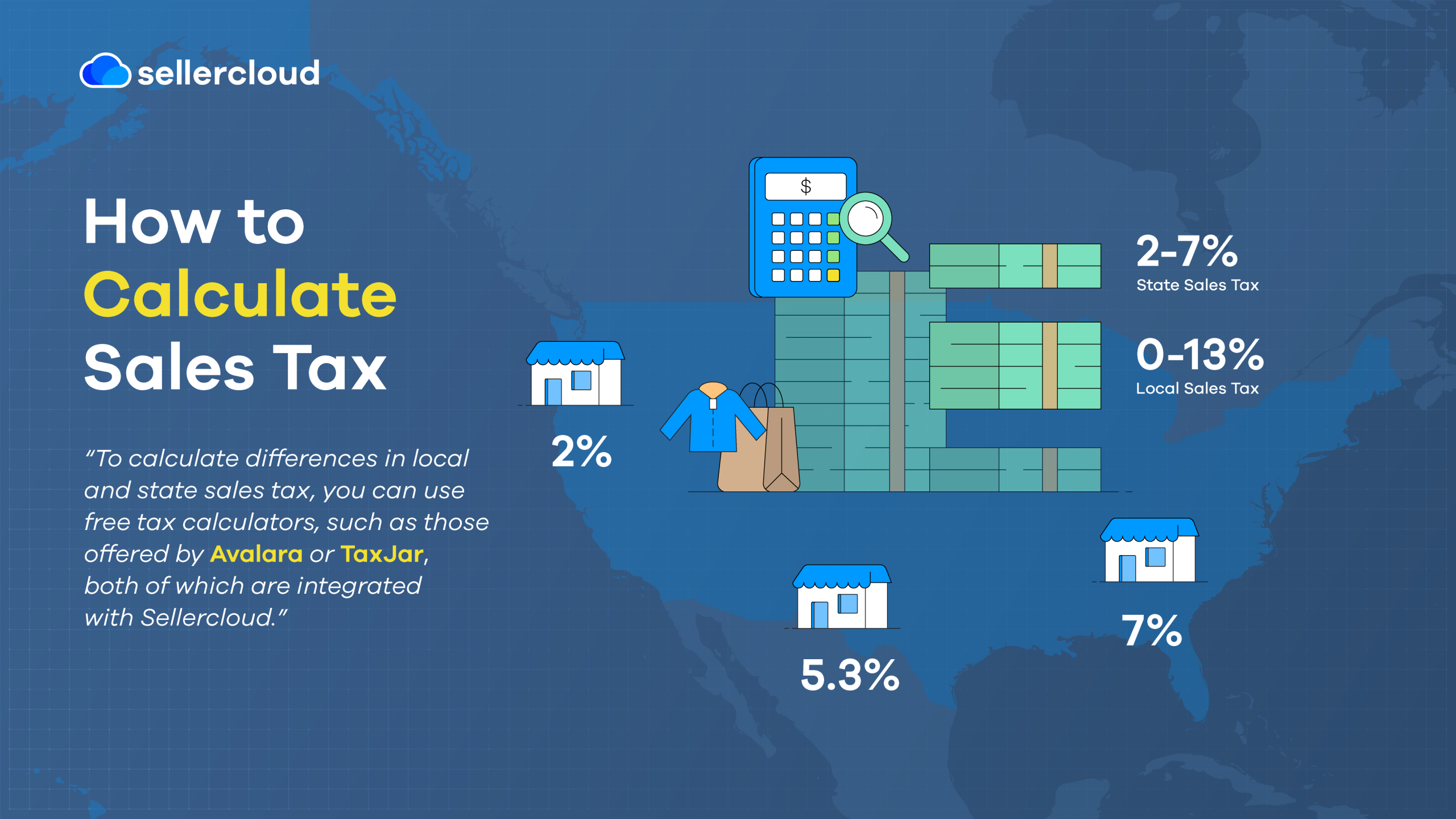

Sales tax is a tax imposed by state and local governments on retail purchases. The rate of sales tax varies from state to state and can range from 0% to over 10%. This tax is typically added to the purchase price of an item and paid by the consumer at the time of purchase.What is Sales Tax?

Yes, US-Mattress charges sales tax on all purchases made through their website. This tax is based on the shipping address of the customer. If you live in a state that has a sales tax, you can expect to see it added to your total cost at checkout.Does US-Mattress Charge Sales Tax?

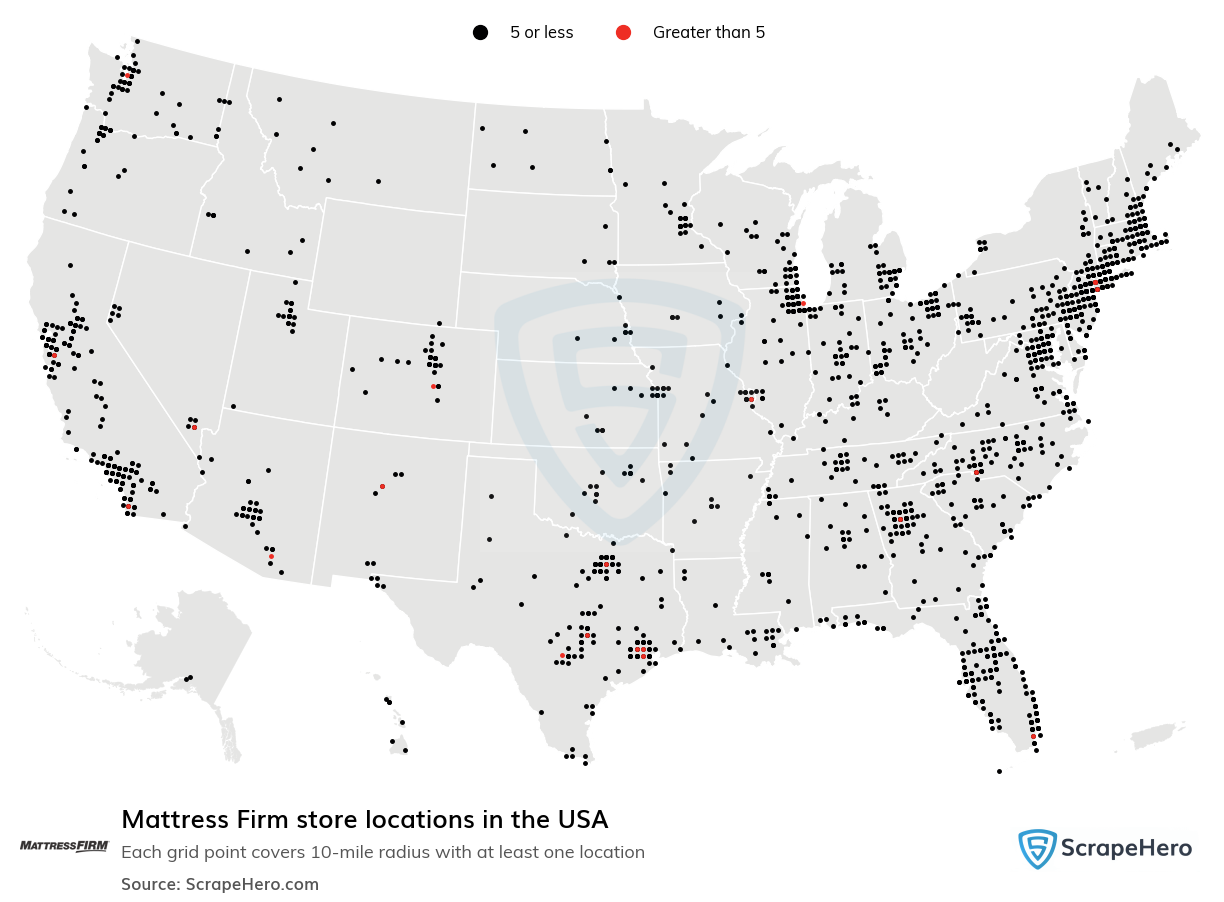

Currently, US-Mattress charges sales tax in all states except for Alaska, Delaware, Montana, New Hampshire, and Oregon. These states do not have a sales tax, so customers in these areas will not see any additional charges at checkout.What States Does US-Mattress Charge Sales Tax?

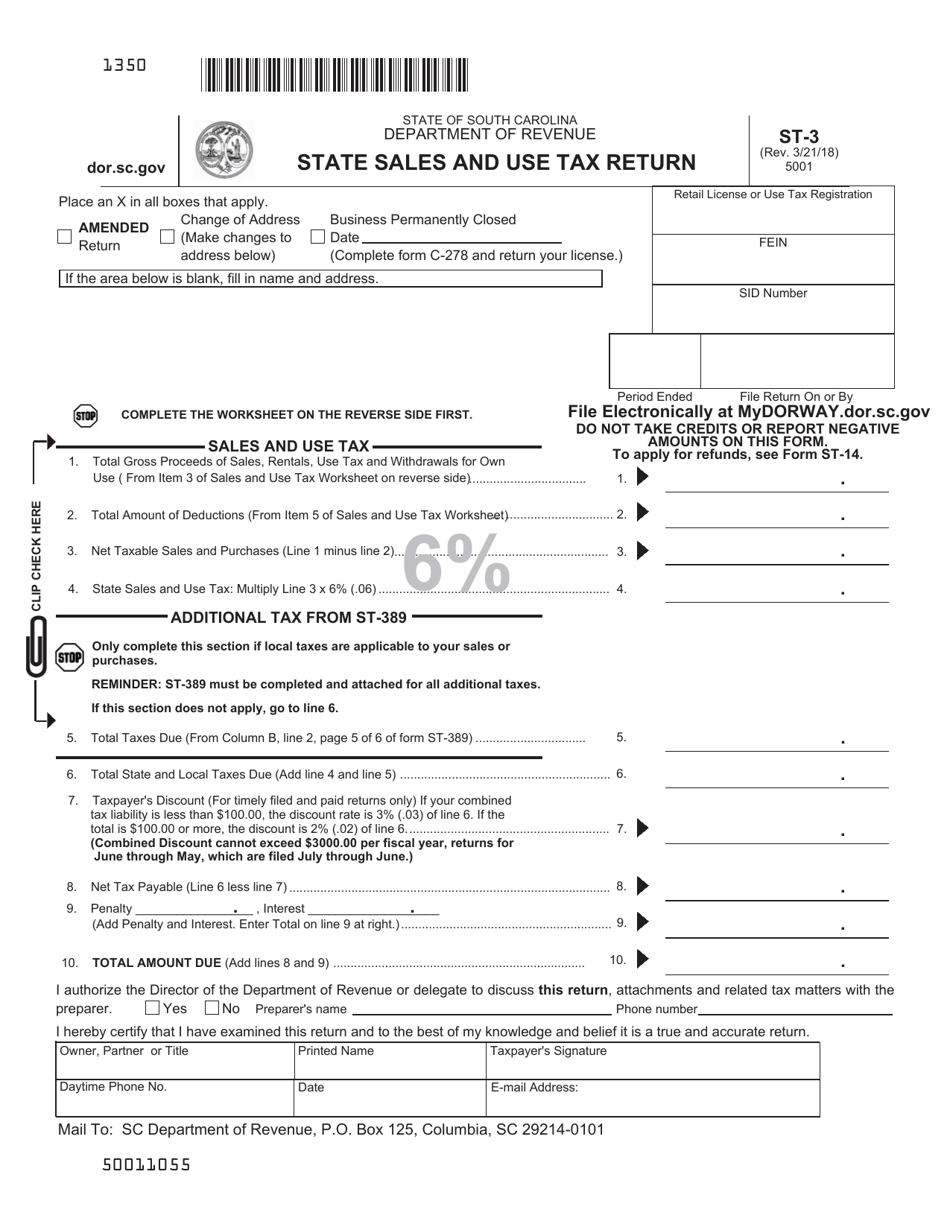

The amount of sales tax you will pay depends on the state and local tax rates. For example, if you live in California, the sales tax rate is 7.25%. If you purchase a mattress for $1,000, you can expect to pay an additional $72.50 in sales tax.How Much Sales Tax Will I Pay?

In some cases, customers may be able to avoid paying sales tax on their US-Mattress purchase. If you live in a state that does not have a sales tax or are purchasing the mattress for a tax-exempt organization, you may be eligible for tax exemption. However, you will need to provide proper documentation to US-Mattress in order to receive this exemption.Can I Avoid Paying Sales Tax on My US-Mattress Purchase?

As an online retailer, some may wonder why US-Mattress is required to charge sales tax. This is due to a Supreme Court ruling in 2018, which allows states to require online retailers to collect sales tax, even if they do not have a physical presence in that state. This ruling was made to level the playing field for brick-and-mortar stores that have been at a disadvantage when it comes to sales tax.Why Does US-Mattress Charge Sales Tax?

While sales tax may not be the most exciting topic when it comes to purchasing a new mattress, it is important to understand how it may impact your final cost. By knowing the sales tax policies of US-Mattress, you can accurately budget for your purchase and avoid any surprises at checkout. If you have any further questions about sales tax, be sure to reach out to the US-Mattress customer service team for assistance.Final Thoughts

How US-Mattress Handles Sales Tax for Your Mattress Purchase

Understanding the Impact of Sales Tax on Your Mattress Purchase

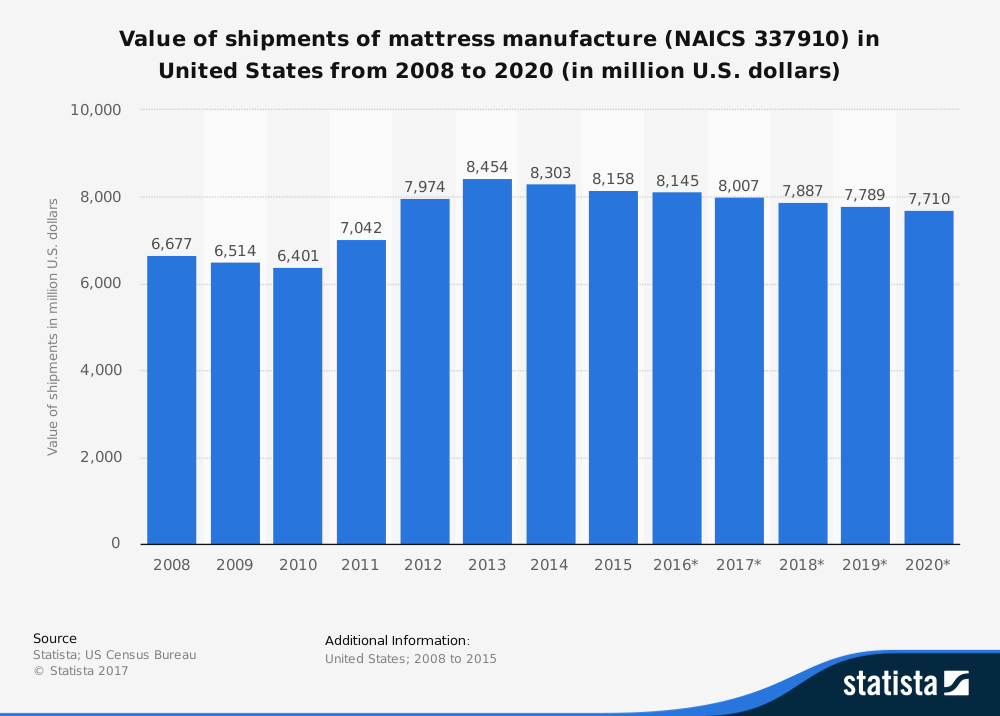

When shopping for a new mattress, many people are concerned about the total cost of their purchase. One important factor to consider is the impact of sales tax. Depending on where you live, the sales tax rate can vary significantly and can add a significant amount to the final price of your mattress. This is why it's important to understand how US-Mattress handles sales tax for your mattress purchase.

When shopping for a new mattress, many people are concerned about the total cost of their purchase. One important factor to consider is the impact of sales tax. Depending on where you live, the sales tax rate can vary significantly and can add a significant amount to the final price of your mattress. This is why it's important to understand how US-Mattress handles sales tax for your mattress purchase.

The Basics of Sales Tax

Sales tax is a state and local tax that is added to the cost of certain goods and services. The rate and rules for sales tax vary from state to state, and some states do not have a sales tax at all. This tax is typically collected by the retailer at the time of purchase and then remitted to the state government.

Sales tax is a state and local tax that is added to the cost of certain goods and services. The rate and rules for sales tax vary from state to state, and some states do not have a sales tax at all. This tax is typically collected by the retailer at the time of purchase and then remitted to the state government.

US-Mattress and Sales Tax

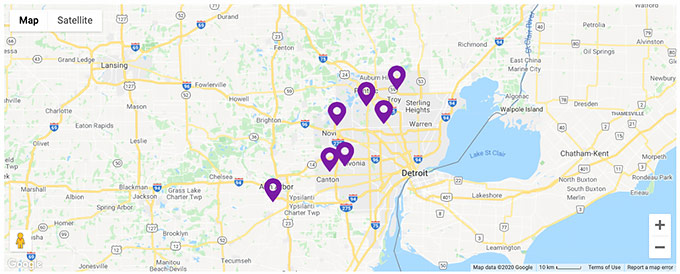

So, does US-Mattress charge sales tax? The answer is yes, but it depends on where you live. US-Mattress collects sales tax for orders shipped to states where they have a physical presence. This includes their headquarters in Michigan and their warehouses in other states. However, if you live in a state where US-Mattress does not have a physical presence, you will not be charged sales tax on your purchase.

So, does US-Mattress charge sales tax? The answer is yes, but it depends on where you live. US-Mattress collects sales tax for orders shipped to states where they have a physical presence. This includes their headquarters in Michigan and their warehouses in other states. However, if you live in a state where US-Mattress does not have a physical presence, you will not be charged sales tax on your purchase.

Why US-Mattress Collects Sales Tax

US-Mattress collects sales tax in states where they have a physical presence because they are required to do so by law. This ensures that they are in compliance with state tax laws and regulations. By collecting sales tax, US-Mattress is able to continue offering their customers the best prices and selection on mattresses and other bedding products.

US-Mattress collects sales tax in states where they have a physical presence because they are required to do so by law. This ensures that they are in compliance with state tax laws and regulations. By collecting sales tax, US-Mattress is able to continue offering their customers the best prices and selection on mattresses and other bedding products.

How Sales Tax is Calculated

The amount of sales tax you will pay on your mattress purchase from US-Mattress is based on the sales tax rate in the state where the order is being shipped. This rate can vary from state to state and can also vary within a state, depending on local tax laws. US-Mattress uses the most current sales tax rates provided by each state's tax authority to calculate the correct amount of tax for your purchase.

The amount of sales tax you will pay on your mattress purchase from US-Mattress is based on the sales tax rate in the state where the order is being shipped. This rate can vary from state to state and can also vary within a state, depending on local tax laws. US-Mattress uses the most current sales tax rates provided by each state's tax authority to calculate the correct amount of tax for your purchase.

Conclusion

In conclusion, US-Mattress does charge sales tax for orders shipped to states where they have a physical presence. This is required by law and ensures that US-Mattress is in compliance with state tax laws. However, if you live in a state where US-Mattress does not have a physical presence, you will not be charged sales tax on your purchase. By understanding how sales tax is handled for your mattress purchase, you can make an informed decision and get the best deal on your new mattress.

In conclusion, US-Mattress does charge sales tax for orders shipped to states where they have a physical presence. This is required by law and ensures that US-Mattress is in compliance with state tax laws. However, if you live in a state where US-Mattress does not have a physical presence, you will not be charged sales tax on your purchase. By understanding how sales tax is handled for your mattress purchase, you can make an informed decision and get the best deal on your new mattress.