1. Does insurance cover Tempurpedic mattresses?

One of the most frequently asked questions when it comes to purchasing a new mattress is whether or not insurance will cover the cost. Specifically, many people wonder if their insurance will cover a high-quality mattress like a Tempurpedic. The answer is not a simple yes or no, as it ultimately depends on your insurance plan and the type of mattress you are looking to purchase.

2. What types of mattresses does insurance cover?

Insurance coverage for mattresses can vary greatly depending on the type of insurance you have. In general, most health insurance plans will not cover the cost of a mattress unless it is deemed medically necessary. This means that if you have a medical condition that requires a specific type of mattress, your insurance may cover it. However, cosmetic or comfort-related reasons for purchasing a mattress will likely not be covered by insurance.

3. Will my health insurance cover a Tempurpedic mattress?

If you have a health insurance plan that covers durable medical equipment, there is a chance that your Tempurpedic mattress may be covered. This is especially true if you have a medical condition that requires a supportive and comfortable mattress for proper treatment. However, it is important to check with your insurance provider to see if a Tempurpedic mattress is included in their coverage.

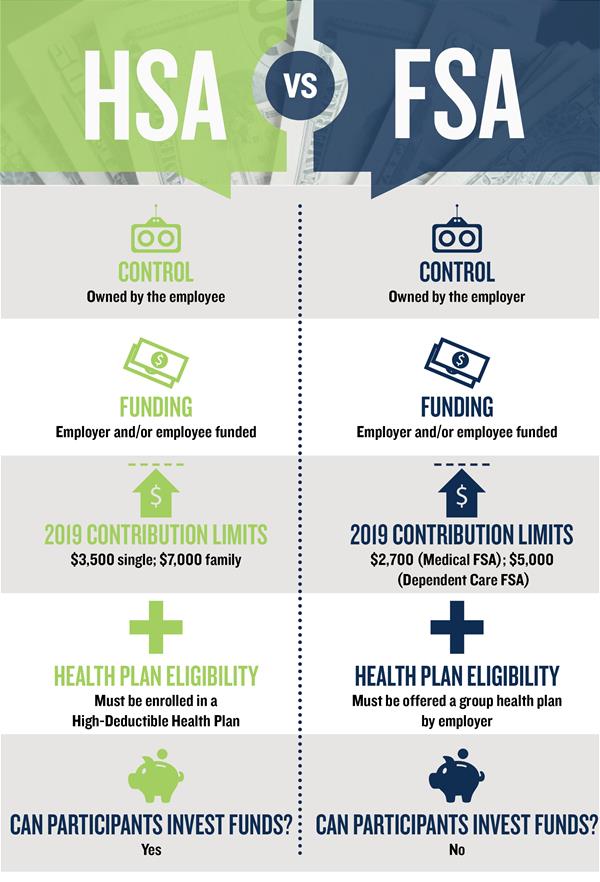

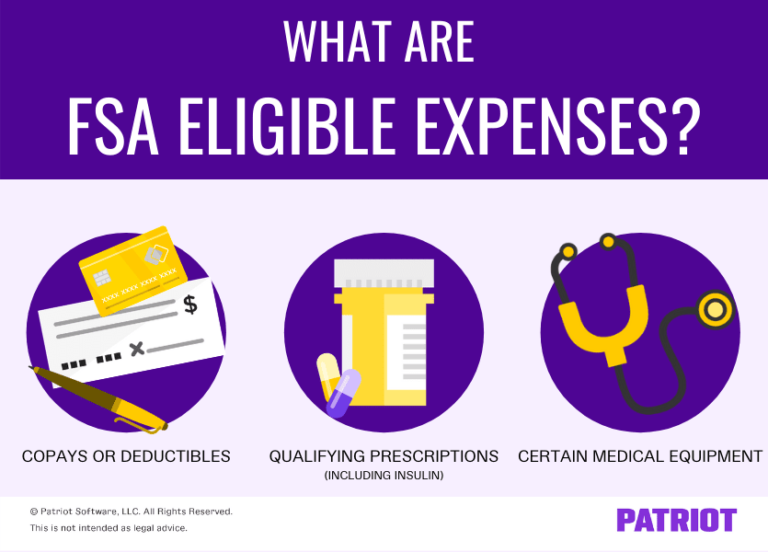

4. Can I use my HSA or FSA to purchase a Tempurpedic mattress?

If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA), you may be able to use these funds to purchase a Tempurpedic mattress. These types of accounts allow you to use pre-tax dollars for medical expenses, and a mattress may be considered a medical expense if it has been prescribed by a doctor for a specific medical condition.

5. Are there any insurance plans that specifically cover Tempurpedic mattresses?

While there are no insurance plans that specifically cover Tempurpedic mattresses, there are some insurance companies that offer supplemental plans or riders that cover durable medical equipment. These types of plans may include coverage for a Tempurpedic mattress, but it is important to check with your insurance provider to see if this is an option for you.

6. How can I find out if my insurance covers a Tempurpedic mattress?

If you are considering purchasing a Tempurpedic mattress and are unsure if your insurance will cover it, the best course of action is to contact your insurance provider directly. They will be able to provide you with the most accurate and up-to-date information regarding your coverage and any potential reimbursement options.

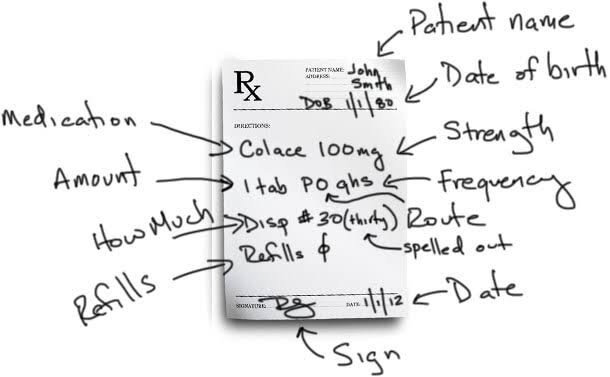

7. What documentation do I need to submit to my insurance for coverage of a Tempurpedic mattress?

If you do find out that your insurance may cover a Tempurpedic mattress, you will likely need to provide certain documentation to support your claim. This may include a doctor's prescription for the mattress, a letter of medical necessity, or a detailed invoice from the mattress retailer. Be sure to check with your insurance provider to see exactly what documentation they require for reimbursement.

8. Are there any restrictions on the type of Tempurpedic mattress that insurance will cover?

If your insurance does cover a Tempurpedic mattress, there may be some restrictions on the type of mattress that is covered. For example, they may only cover specific models or sizes, or require that the mattress meets certain medical criteria. Again, it is important to check with your insurance provider to see what their specific guidelines are.

9. Can I get a prescription for a Tempurpedic mattress to increase chances of insurance coverage?

If you are considering purchasing a Tempurpedic mattress and are hoping for insurance coverage, you may wonder if getting a prescription from your doctor could increase your chances of being reimbursed. While this may help, it ultimately depends on your insurance provider and their coverage policies. It is always best to check with them directly to see what options are available to you.

10. What should I do if my insurance denies coverage for a Tempurpedic mattress?

If your insurance denies coverage for a Tempurpedic mattress, there are a few steps you can take. First, you can try appealing the decision by providing additional documentation or evidence to support your claim. If this is not successful, you may want to consider using your HSA or FSA funds to cover the cost, or looking into other supplemental insurance plans that may cover durable medical equipment.

Does Insurance Cover Tempurpedic Mattress?

Understanding Insurance Coverage for Mattresses

When it comes to purchasing a new mattress, many people wonder if their insurance will cover the cost. This is especially true for those looking to upgrade to a high-end mattress like a

Tempurpedic

.

Insurance coverage for mattresses

can vary depending on your specific policy and the type of mattress you are looking to buy. It's important to do your research and understand what your insurance will and will not cover before making a purchase.

When it comes to purchasing a new mattress, many people wonder if their insurance will cover the cost. This is especially true for those looking to upgrade to a high-end mattress like a

Tempurpedic

.

Insurance coverage for mattresses

can vary depending on your specific policy and the type of mattress you are looking to buy. It's important to do your research and understand what your insurance will and will not cover before making a purchase.

The Type of Insurance Policy You Have

The type of insurance policy you have will play a significant role in whether or not your

mattress will be covered

. If you have homeowner's insurance, your mattress may be covered if it was damaged due to a covered peril such as fire or water damage. However, this coverage may be limited and may not cover the full cost of a new mattress.

If you have renter's insurance, your mattress may also be covered under personal property coverage. However, again, this coverage may be limited and may not cover the full cost of a new mattress. It's important to review your policy and talk to your insurance provider to fully understand your coverage.

The type of insurance policy you have will play a significant role in whether or not your

mattress will be covered

. If you have homeowner's insurance, your mattress may be covered if it was damaged due to a covered peril such as fire or water damage. However, this coverage may be limited and may not cover the full cost of a new mattress.

If you have renter's insurance, your mattress may also be covered under personal property coverage. However, again, this coverage may be limited and may not cover the full cost of a new mattress. It's important to review your policy and talk to your insurance provider to fully understand your coverage.

Additional Insurance Options

Conclusion

In conclusion,

insurance coverage for Tempurpedic mattresses

can vary depending on your specific policy and the type of mattress you are looking to buy. It's important to review your policy and talk to your insurance provider to fully understand your coverage. If your insurance does not cover your mattress, there are other options such as purchasing a separate insurance plan or investing in a mattress protector with a warranty. Remember to do your research and choose the best option for your needs and budget.

In conclusion,

insurance coverage for Tempurpedic mattresses

can vary depending on your specific policy and the type of mattress you are looking to buy. It's important to review your policy and talk to your insurance provider to fully understand your coverage. If your insurance does not cover your mattress, there are other options such as purchasing a separate insurance plan or investing in a mattress protector with a warranty. Remember to do your research and choose the best option for your needs and budget.