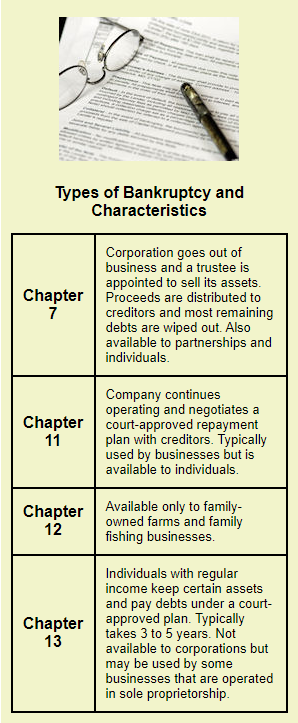

When filing for Chapter 11 bankruptcy, individuals and businesses may wonder what will happen to their assets, including their twin mattress. This article will discuss the impact of Chapter 11 on twin mattresses and provide some helpful tips for navigating this complex process.Chapter 11 Twin Mattress

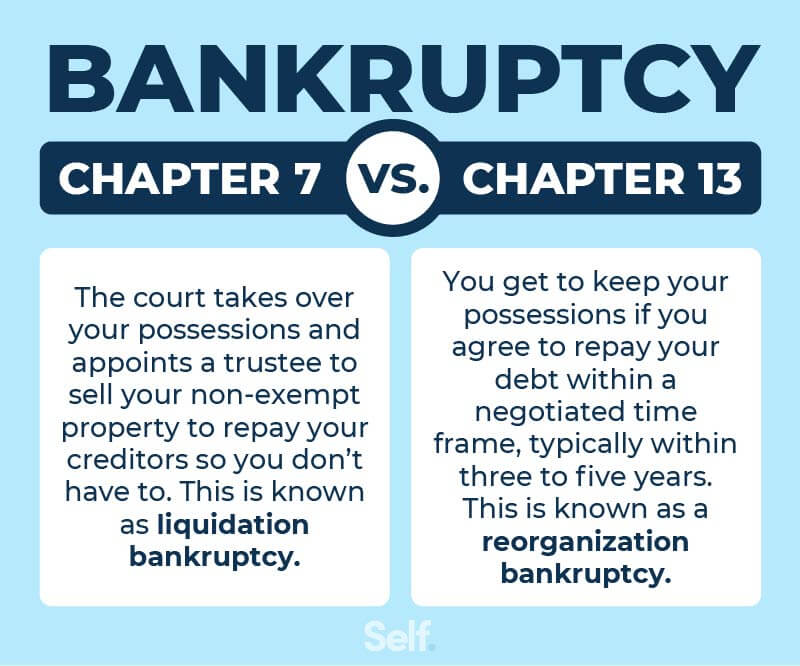

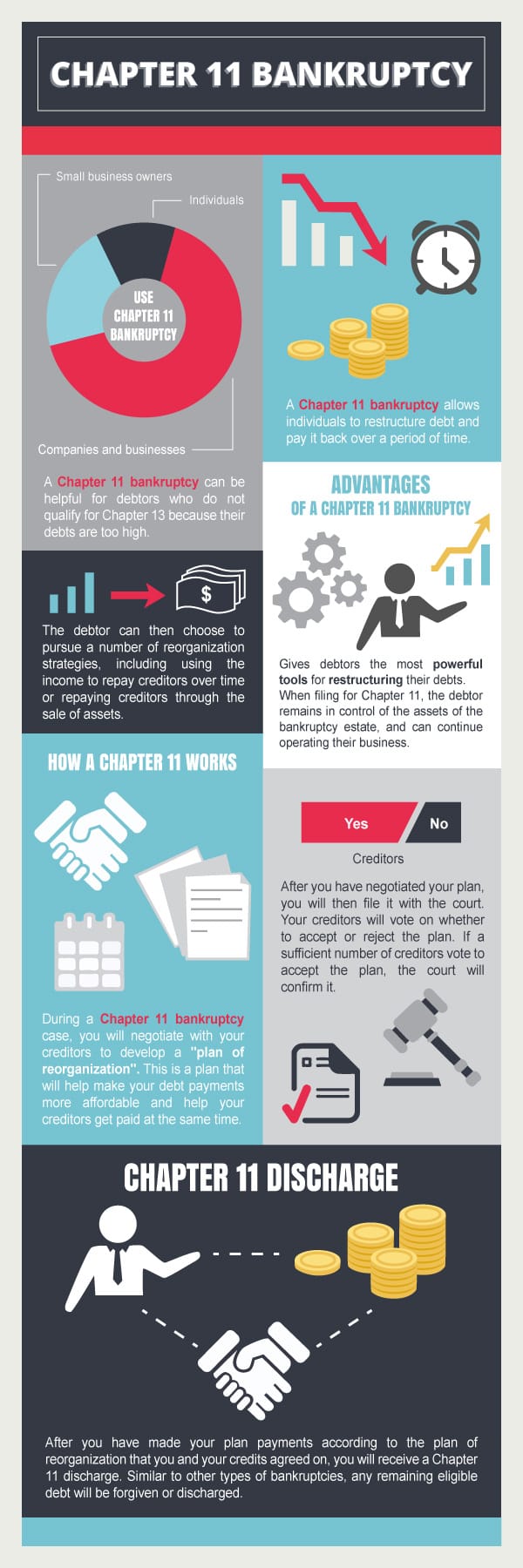

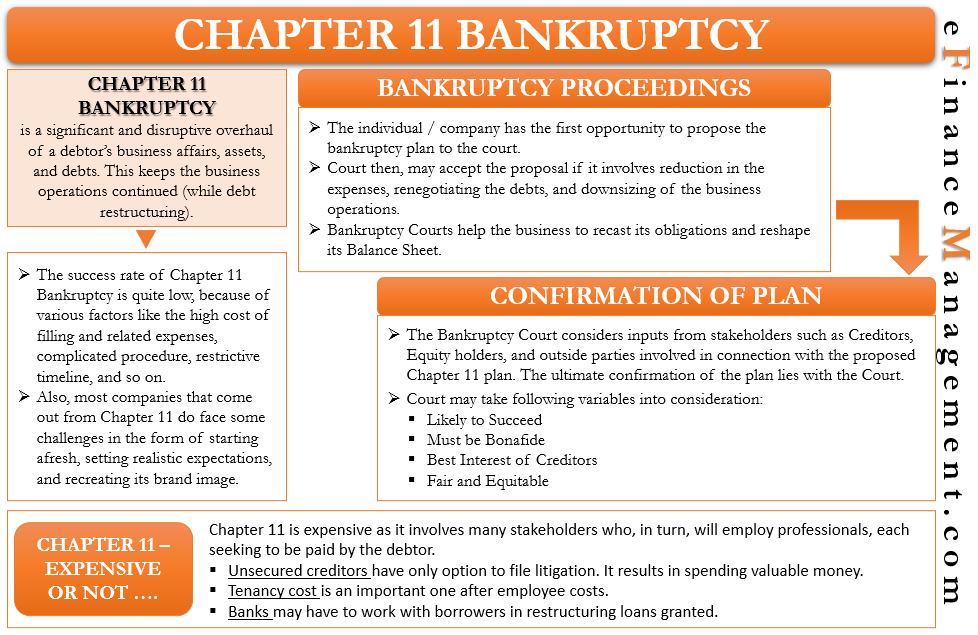

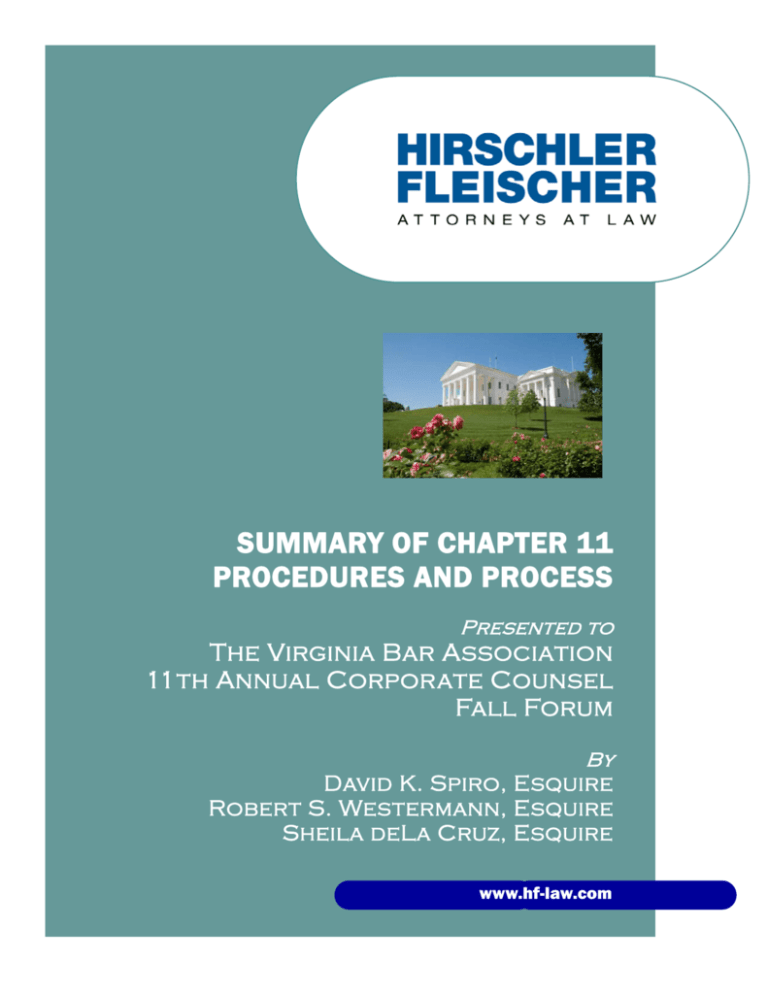

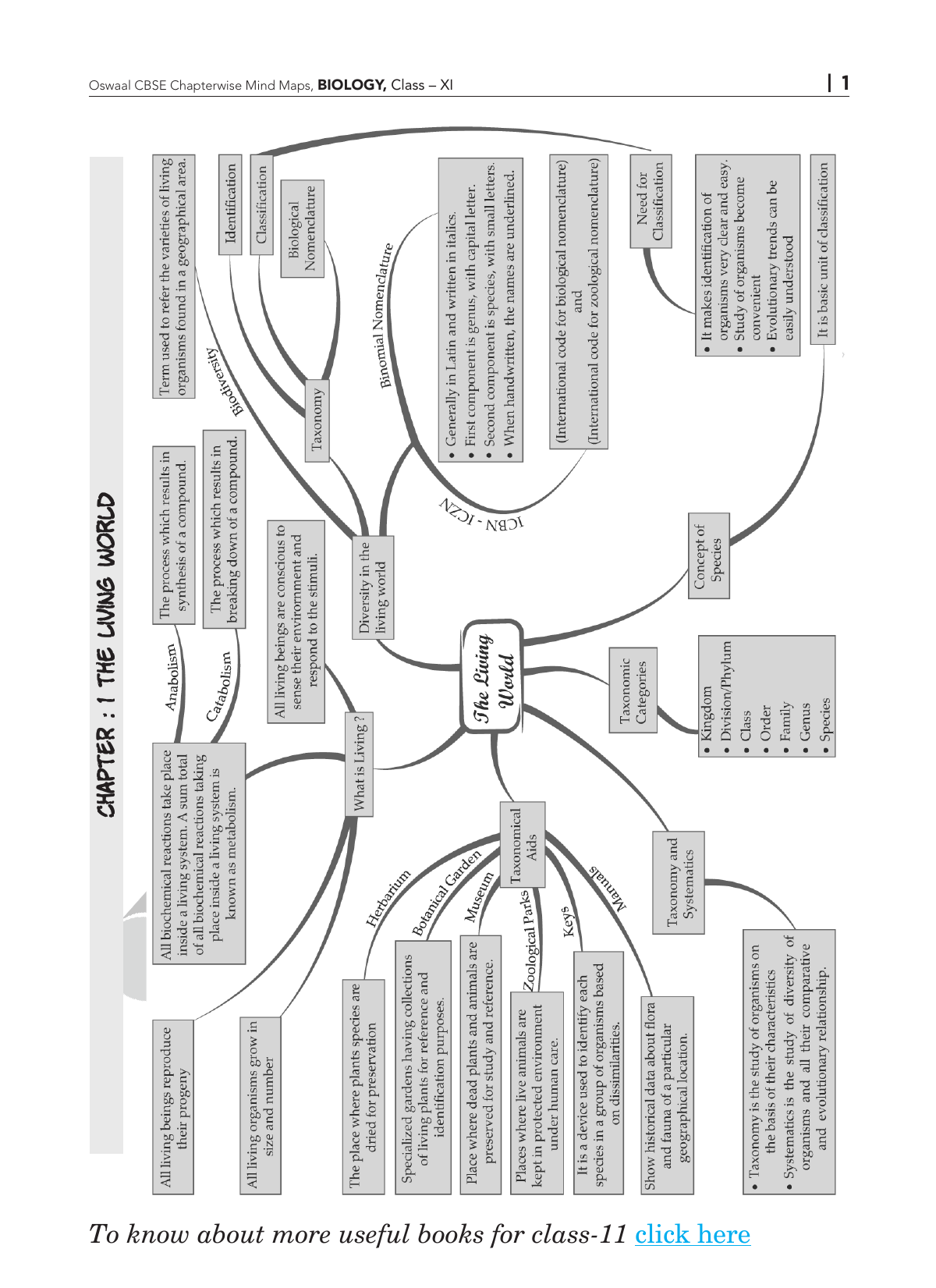

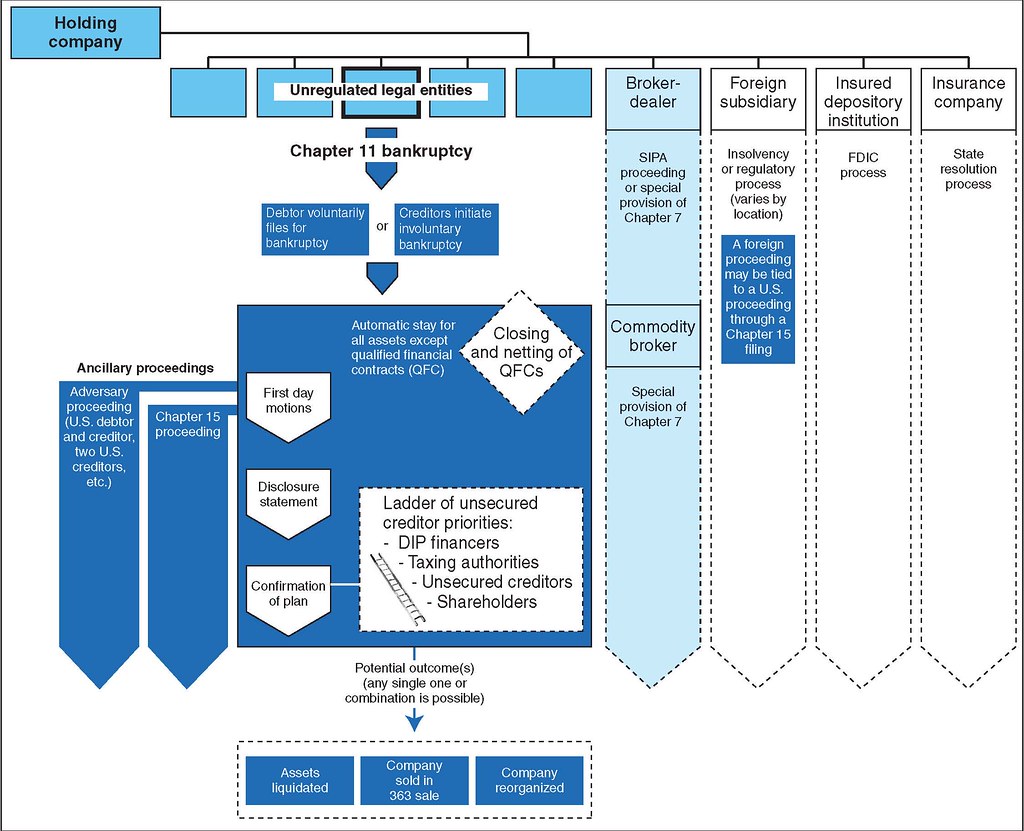

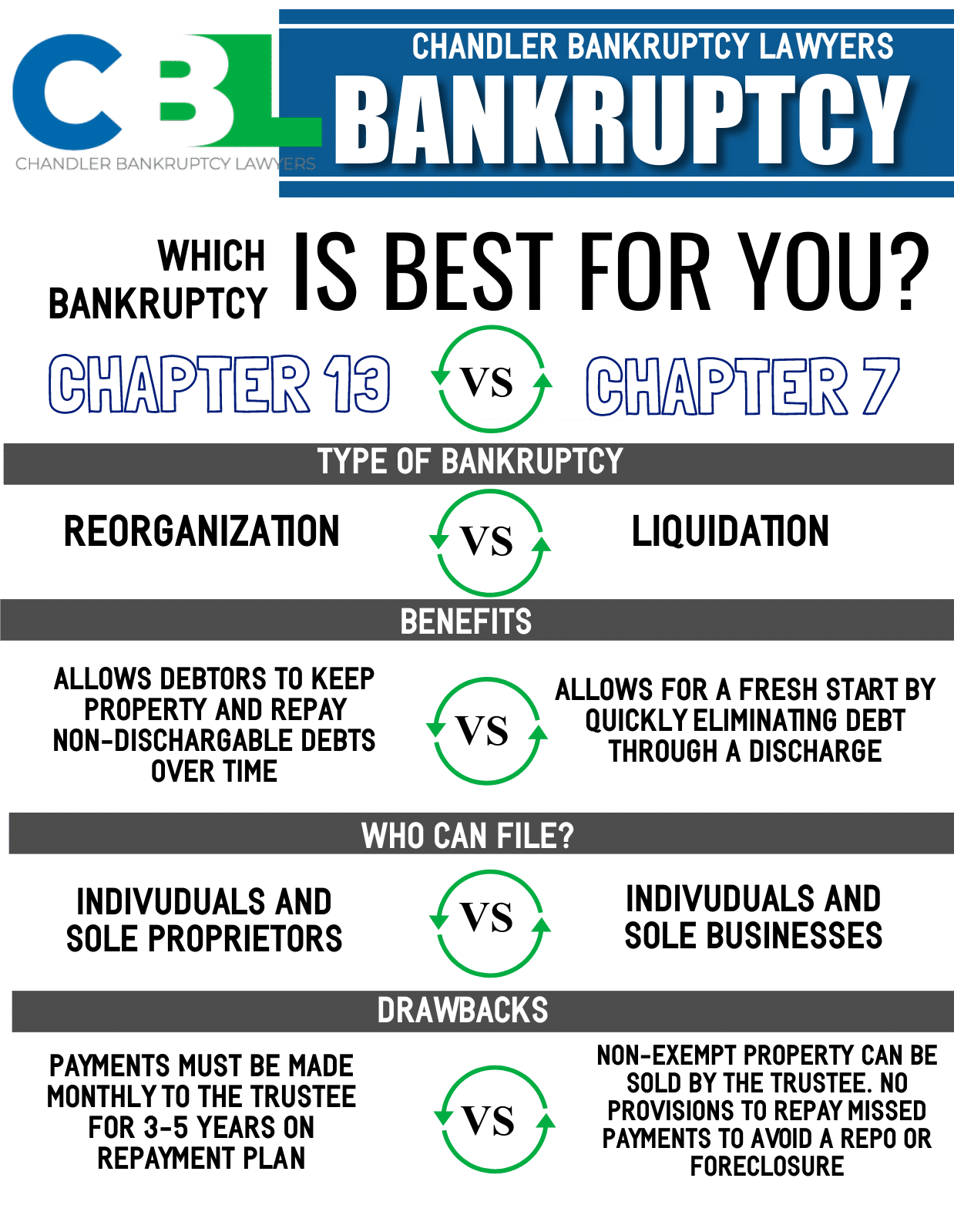

Chapter 11 bankruptcy is a type of bankruptcy that allows a business or individual to reorganize their debts and assets while staying in operation. It is often used by large corporations, but it can also be used by individuals with a significant amount of debt. This type of bankruptcy is a complex and lengthy process, but it can provide much-needed relief for those struggling with overwhelming debt.Chapter 11 Bankruptcy

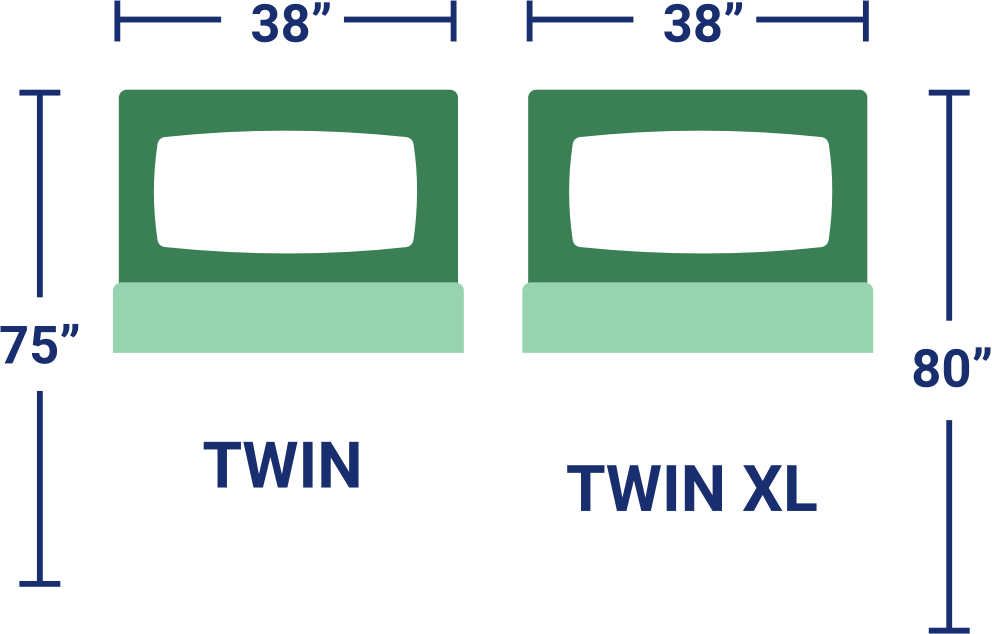

A twin mattress is a popular size for beds, especially for children's rooms or smaller living spaces. It measures 39 inches by 75 inches, making it a suitable choice for a single sleeper. When filing for Chapter 11 bankruptcy, individuals and businesses may wonder what will happen to their twin mattress, as it is considered an asset.Twin Mattress

The Chapter 11 filing process can be complex and overwhelming, especially for those unfamiliar with bankruptcy laws. It involves submitting a detailed financial report, including a list of assets and liabilities, to the bankruptcy court. This report will include information about the twin mattress and any other assets owned by the individual or business.Chapter 11 Filing

After filing for Chapter 11 bankruptcy, the court will appoint a trustee to oversee the reorganization process. This trustee will review the financial report and work with the individual or business to create a Chapter 11 bankruptcy plan. The plan will outline how the individual or business will repay their debts over a period of time, typically three to five years.Chapter 11 Process

One of the benefits of filing for Chapter 11 bankruptcy is the automatic stay, which provides bankruptcy protection from creditors. This means that creditors cannot take any further action to collect on debts, including repossessing assets such as a twin mattress. However, if the individual or business is unable to make payments on the Chapter 11 plan, the automatic stay may be lifted, and creditors can resume collection efforts.Chapter 11 Bankruptcy Protection

Under Chapter 11 bankruptcy laws, individuals and businesses are required to list all of their assets and debts. This includes the twin mattress and any other assets owned by the individual or business. The court will use this information to determine the value of the assets and to create a repayment plan that is fair for both the individual or business and their creditors.Chapter 11 Bankruptcy Laws

The Chapter 11 bankruptcy plan is a crucial part of the Chapter 11 process. It outlines how the individual or business will repay their debts over a period of time, typically three to five years. The plan must be approved by the bankruptcy court and must be feasible for the individual or business to follow. It may include selling assets, downsizing operations, and making monthly payments to creditors.Chapter 11 Bankruptcy Plan

After successfully completing the Chapter 11 bankruptcy plan, the individual or business will receive a bankruptcy discharge. This means that they are no longer responsible for repaying their debts, and creditors cannot take any further action to collect on those debts. However, the bankruptcy discharge does not necessarily mean that all assets, including the twin mattress, will be retained by the individual or business.Chapter 11 Bankruptcy Discharge

The goal of Chapter 11 bankruptcy is to provide businesses and individuals with the opportunity to reorganize their debts and assets while staying in operation. This may involve downsizing, selling assets, and making monthly payments to creditors. While it can be a challenging and lengthy process, it can provide much-needed relief for those struggling with overwhelming debt and help them get back on track financially.Chapter 11 Bankruptcy Reorganization

Why Choose a Chapter 11 Twin Mattress for Your Bedroom?

The Importance of a Quality Mattress

When it comes to designing your bedroom, the mattress is often the most overlooked aspect. However, it is arguably the most important piece of furniture in the room. After all, we spend a third of our lives sleeping, and a good night's rest is essential for our overall health and well-being. That's why it's crucial to choose a high-quality mattress that offers both comfort and support.

When it comes to designing your bedroom, the mattress is often the most overlooked aspect. However, it is arguably the most important piece of furniture in the room. After all, we spend a third of our lives sleeping, and a good night's rest is essential for our overall health and well-being. That's why it's crucial to choose a high-quality mattress that offers both comfort and support.

The Benefits of a Twin Mattress

If you have a smaller bedroom or live in a studio apartment, a twin mattress may be the perfect solution for you. It is the smallest standard mattress size, measuring 38 inches wide and 75 inches long. Despite its size, a twin mattress still offers plenty of space for a single sleeper, making it ideal for children's bedrooms or guest rooms.

If you have a smaller bedroom or live in a studio apartment, a twin mattress may be the perfect solution for you. It is the smallest standard mattress size, measuring 38 inches wide and 75 inches long. Despite its size, a twin mattress still offers plenty of space for a single sleeper, making it ideal for children's bedrooms or guest rooms.

The Chapter 11 Twin Mattress Advantage

One of the top choices for a twin mattress is the Chapter 11 brand. This brand is known for its commitment to quality and innovation, making them a popular choice among homeowners and interior designers alike. The Chapter 11 twin mattress offers a comfortable and supportive sleep experience, thanks to its high-density foam and innerspring coil system. It also comes with a 10-year warranty, ensuring that you will have a comfortable and durable mattress for years to come.

One of the top choices for a twin mattress is the Chapter 11 brand. This brand is known for its commitment to quality and innovation, making them a popular choice among homeowners and interior designers alike. The Chapter 11 twin mattress offers a comfortable and supportive sleep experience, thanks to its high-density foam and innerspring coil system. It also comes with a 10-year warranty, ensuring that you will have a comfortable and durable mattress for years to come.

Designing Your Bedroom with a Twin Mattress

Not only is the Chapter 11 twin mattress a practical choice, but it also offers a sleek and modern design that can elevate the look of your bedroom. It comes in a range of styles and colors, making it easy to find one that fits your personal aesthetic. With its compact size, a twin mattress also allows for more space in your bedroom to add other essential furniture pieces, such as a bedside table or dresser.

In conclusion,

choosing a Chapter 11 twin mattress for your bedroom can provide numerous benefits, from comfort and support to style and functionality. With its small size and quality construction, it is a smart choice for anyone looking to design a cozy and inviting bedroom space. So why settle for a mediocre mattress when you can have the best with a Chapter 11 twin mattress? Upgrade your bedroom design today and experience the difference for yourself.

Not only is the Chapter 11 twin mattress a practical choice, but it also offers a sleek and modern design that can elevate the look of your bedroom. It comes in a range of styles and colors, making it easy to find one that fits your personal aesthetic. With its compact size, a twin mattress also allows for more space in your bedroom to add other essential furniture pieces, such as a bedside table or dresser.

In conclusion,

choosing a Chapter 11 twin mattress for your bedroom can provide numerous benefits, from comfort and support to style and functionality. With its small size and quality construction, it is a smart choice for anyone looking to design a cozy and inviting bedroom space. So why settle for a mediocre mattress when you can have the best with a Chapter 11 twin mattress? Upgrade your bedroom design today and experience the difference for yourself.

:max_bytes(150000):strip_icc()/chapter11.asp-final-a6438081c9404e558ffd30fea56fff87.png)

:max_bytes(150000):strip_icc()/saatva-63d06d85b09f424c82c644989f06b2b6.jpg)

:max_bytes(150000):strip_icc()/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png)