Can You Deduct Mattress Return?

If you purchased a new mattress and it's not living up to your expectations, you may be wondering if you can return it and get your money back. But what about the taxes you paid on the purchase? Can you deduct the cost of the return on your taxes? We'll break down the answers to these questions and more below.

Can You Deduct Mattress Return on Taxes?

The short answer is no, you cannot deduct the cost of returning a mattress on your taxes. This is because the Internal Revenue Service (IRS) only allows deductions for certain expenses, such as medical expenses, charitable donations, and business expenses. The cost of returning a mattress does not fall under any of these categories and therefore cannot be deducted.

Can You Deduct Mattress Return Fee?

Typically, when returning a mattress, there may be a fee associated with the return. This can be a restocking fee or a fee for shipping the mattress back to the retailer. Unfortunately, these fees cannot be deducted on your taxes either. Just like the cost of the return itself, these fees do not fall under any deductible expenses according to the IRS.

Can You Deduct Mattress Return Shipping?

As mentioned earlier, shipping fees for returning a mattress cannot be deducted on your taxes. This includes both the cost of shipping the mattress back to the retailer and any fees associated with pick-up or delivery. While these fees may be an inconvenience, they cannot be used as a tax deduction.

Can You Deduct Mattress Return Cost?

When you return a mattress, you will likely be refunded the cost of the mattress itself. However, this cost cannot be deducted on your taxes. Again, the IRS only allows deductions for specific expenses and the cost of returning a mattress does not fall under any of those categories.

Can You Deduct Mattress Return Policy?

While the cost of returning a mattress cannot be deducted on your taxes, it's still important to understand the return policy of the retailer you purchased it from. Some retailers may offer a full refund, while others may only offer store credit or a partial refund. Knowing the return policy can help you make an informed decision when purchasing a new mattress.

Can You Deduct Mattress Return Fee on Taxes?

As we discussed earlier, any fees associated with returning a mattress, including restocking fees or shipping fees, cannot be deducted on your taxes. These fees are not considered deductible expenses by the IRS and therefore cannot be claimed on your tax return.

Can You Deduct Mattress Return Shipping on Taxes?

Unfortunately, the answer is no. The cost of returning a mattress, including any shipping fees, cannot be deducted on your taxes. However, if you are returning a mattress due to a defect or other issue, you may be eligible for a refund or replacement under the manufacturer's warranty. Be sure to keep all documentation and receipts for any returns in case you need to file a claim.

Can You Deduct Mattress Return Cost on Taxes?

As we've established, the cost of returning a mattress cannot be deducted on your taxes. This includes the cost of the mattress itself, as well as any fees associated with the return. While it may be frustrating to not be able to deduct these expenses, it's important to understand the IRS guidelines for deducting expenses.

Can You Deduct Mattress Return Policy on Taxes?

While the cost of returning a mattress cannot be deducted on your taxes, understanding the return policy is still important. Some retailers may offer a more lenient return policy, while others may be more strict. Knowing the return policy can help you make an informed decision when purchasing a new mattress.

The Impact of Mattress Returns on Your Tax Deductions

When it comes to furnishing your home, a good mattress is essential for a good night's sleep. However, what happens if you buy a mattress and it doesn't meet your expectations? Can you return it and deduct the cost from your taxes? The short answer is no, but there may be some circumstances where you can deduct the cost of a returned mattress. Let's dive deeper into this topic to understand the potential impact of mattress returns on your tax deductions.

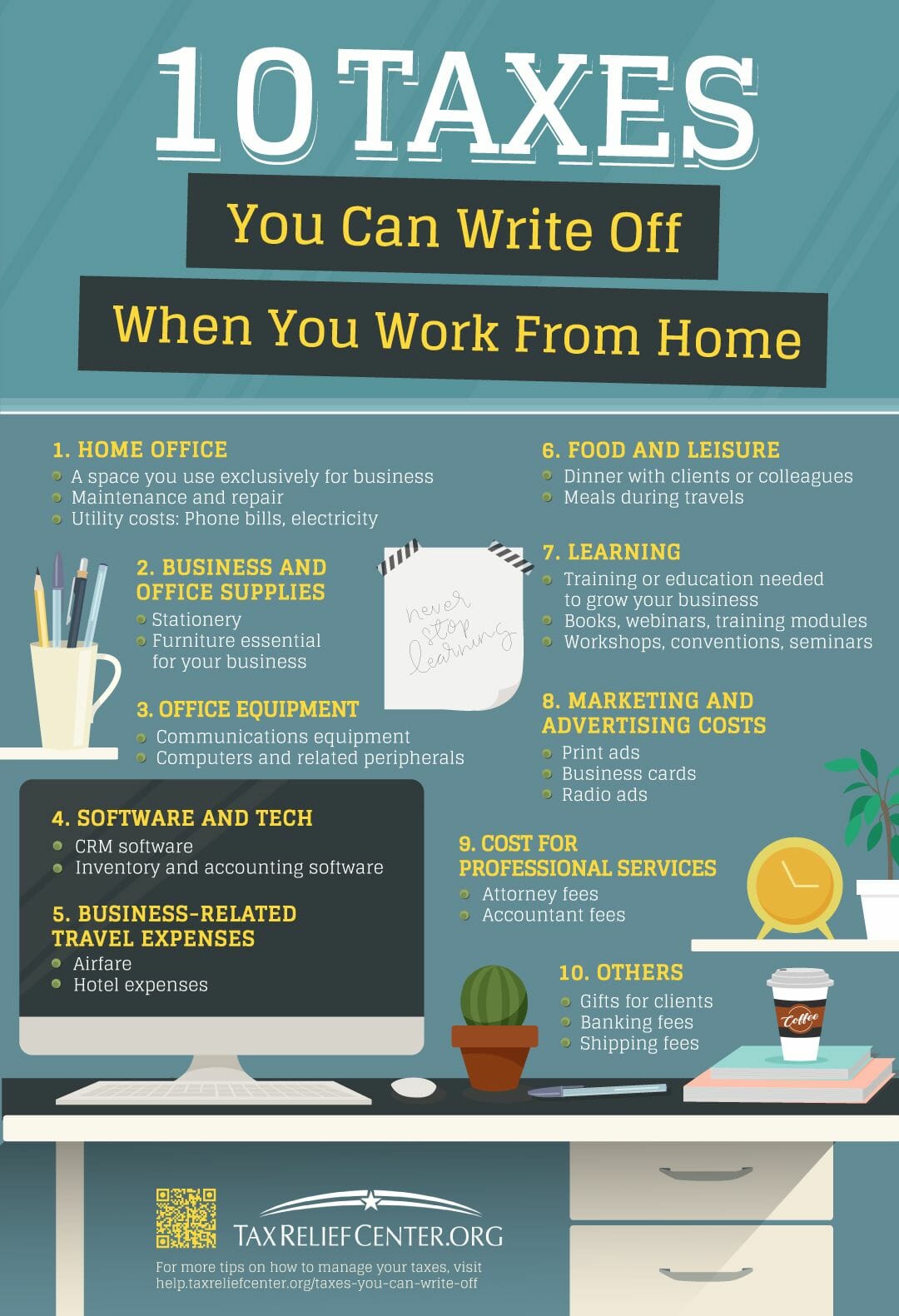

Understanding Tax Deductions

First, it's important to understand the concept of tax deductions. These are expenses that can be subtracted from your taxable income, reducing the amount of tax you owe. Common examples of tax deductions include mortgage interest, charitable donations, and medical expenses.

Mattress returns, however, do not fall under any of these categories and therefore cannot be deducted from your taxes. The reason for this is because the purchase of a mattress is considered a personal expense and not a necessary expense for the production of income or in relation to your job.

Exceptions to the Rule

While you may not be able to deduct the cost of a returned mattress from your taxes, there are a few exceptions to keep in mind. If you have a home office and use your mattress for business purposes, you may be able to deduct a portion of the cost as a business expense. This would only apply if you use your mattress exclusively for work and have a designated area in your home that is used solely for business purposes.

Another exception would be if the mattress was purchased for a rental property. In this case, the cost of the mattress may be considered a business expense and could potentially be deducted from your taxes. However, you would need to consult with a tax professional to determine the specifics of this scenario.

Other Considerations

Aside from tax deductions, there are other factors to consider when returning a mattress. If you return a mattress for a refund, you may need to report the refund as income on your tax return if you originally deducted the cost of the mattress. This is because the refund is considered a reimbursement of a previously deducted expense.

Additionally, if you received a refund or credit for the returned mattress, you may also need to adjust your state sales tax return. This is because you would have paid sales tax on the original purchase, but with the return, you are no longer entitled to that tax.

In Conclusion

While you may not be able to deduct the cost of a returned mattress from your taxes, there are certain exceptions and other considerations to keep in mind. It's always best to consult with a tax professional to fully understand the impact of a mattress return on your taxes. In the end, investing in a good quality mattress is important for your overall health and well-being, and the potential tax implications should not be the deciding factor in your purchasing decision.

HTML Code:

<h2>The Impact of Mattress Returns on Your Tax Deductions</h2>

<p>When it comes to furnishing your home, a good mattress is essential for a good night's sleep. However, what happens if you buy a mattress and it doesn't meet your expectations? Can you return it and deduct the cost from your taxes? The short answer is no, but there may be some circumstances where you can deduct the cost of a returned mattress. Let's dive deeper into this topic to understand the potential impact of mattress returns on your tax deductions.</p>

<h3>Understanding Tax Deductions</h3>

<p>First, it's important to understand the concept of tax deductions. These are expenses that can be subtracted from your taxable income, reducing the amount of tax you owe. Common examples of tax deductions include mortgage interest, charitable donations, and medical expenses.</p>

<p><b>Mattress returns, however, do not fall under any of these categories and therefore cannot be deducted from your taxes.</b> The reason for this is because the purchase of a mattress is considered a personal expense and not a necessary expense for the production of income or in relation to your job.</p>

<h3>Exceptions to the Rule</h3>

<p>While you may not be able to deduct the cost of a returned mattress from your taxes, there are a few exceptions to