If you're in the market for a new mattress, you may be wondering if you can use your flex spending account to cover the cost. The short answer is yes, but there are some rules and guidelines you'll need to follow. In this article, we'll dive into the details of using flex spending for mattress purchases and help you understand how it all works.Can a Mattress Be Covered by Flex Spending?

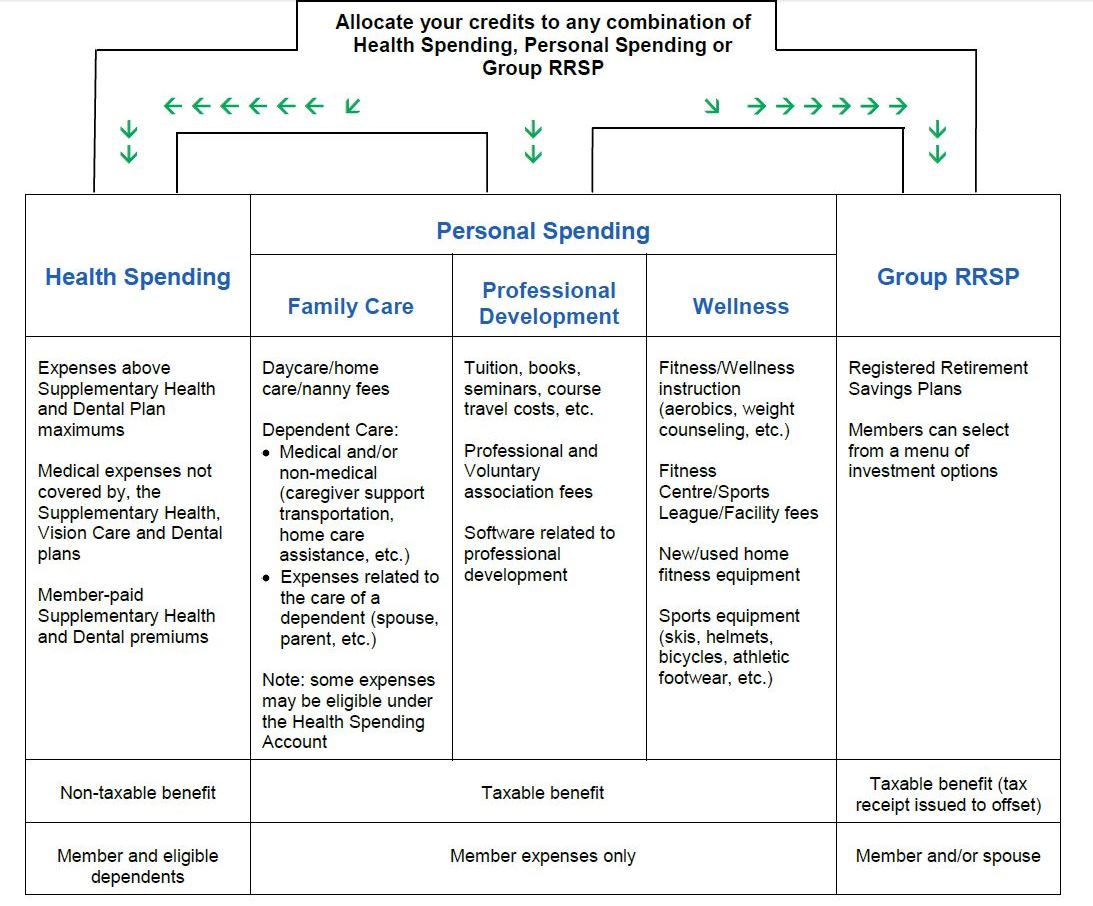

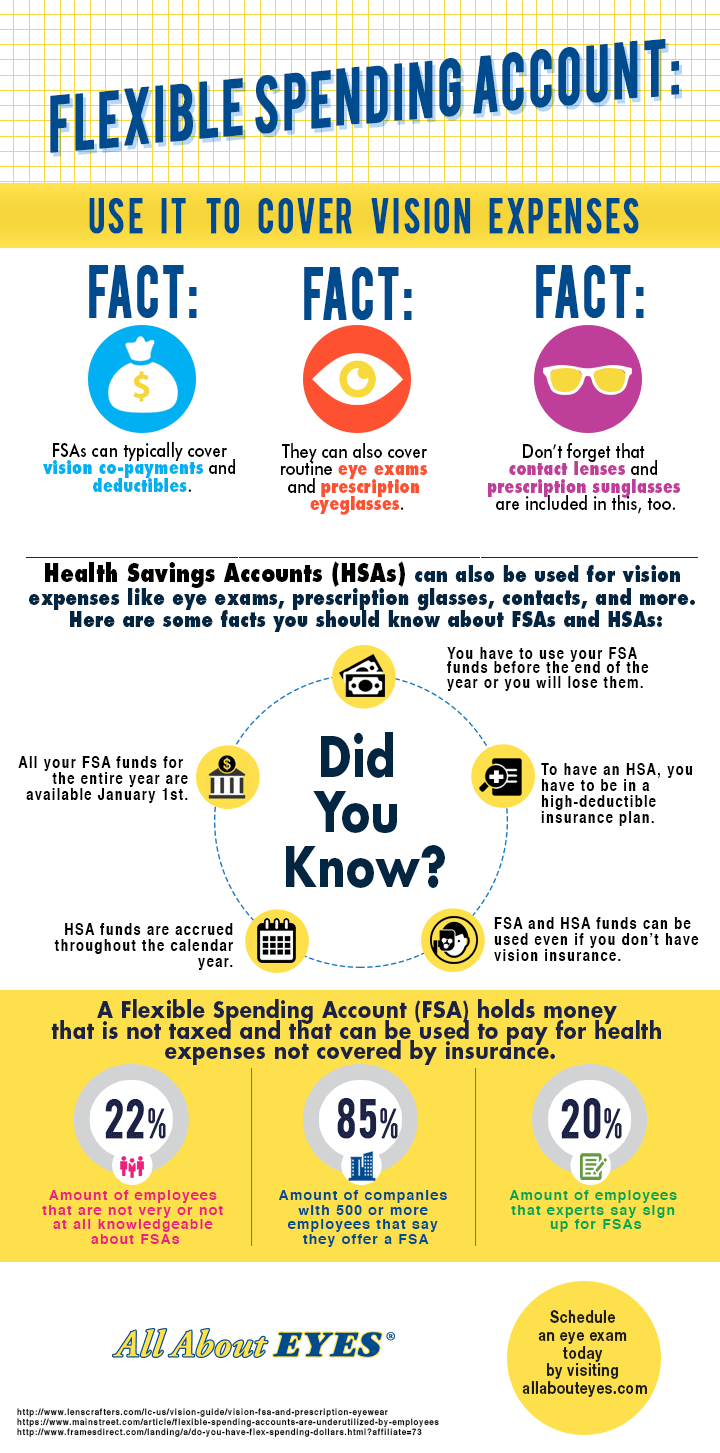

Flexible Spending Accounts, or flex spending for short, are a popular way for individuals to set aside pre-tax dollars for medical expenses. These accounts are set up through your employer and allow you to save money on eligible healthcare expenses. While many people are familiar with using flex spending for things like doctor visits and prescription medications, it's also possible to use it for larger purchases like a mattress.Flex Spending for Mattresses

So, how exactly can you use flex spending for a mattress? The first thing you'll need to do is check with your flex spending plan administrator to make sure mattresses are an eligible expense. While most plans do cover mattresses, some may have specific guidelines or restrictions. Once you've confirmed that your plan allows it, you can use your flex spending account to cover the cost of a new mattress.Using Flex Spending for Mattress Purchases

As mentioned, most flex spending plans do cover mattresses as an eligible expense. However, there are a few criteria that must be met in order for the purchase to be eligible. First, the mattress must be deemed medically necessary. This means that it must be prescribed by a doctor to treat a specific medical condition. Secondly, the mattress must not be considered a luxury or optional item. This means that it can't have features like built-in massagers or fancy materials that aren't necessary for its medical purpose.Flex Spending Eligibility for Mattresses

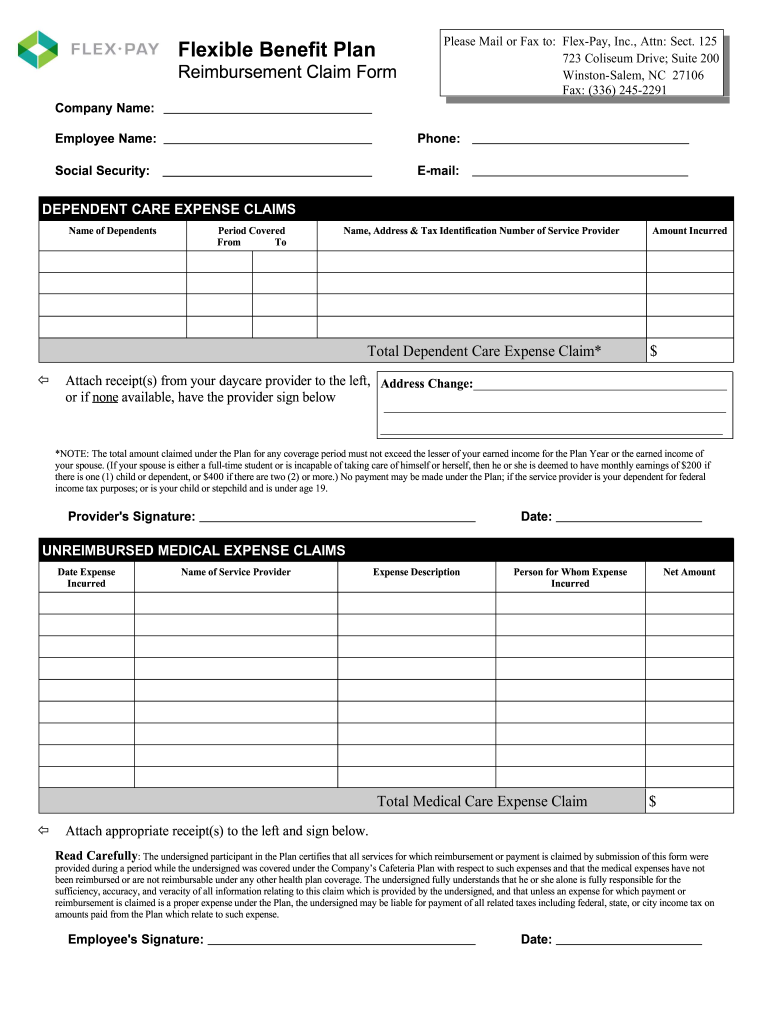

Using your flex spending account for a mattress purchase is fairly straightforward. Once you've confirmed that your plan allows it and the mattress meets the eligibility criteria, you'll need to submit a claim for reimbursement. This typically involves submitting a receipt or invoice for the mattress along with a letter of medical necessity from your doctor. Your flex spending plan administrator will review the claim and reimburse you for the approved amount.How to Use Flex Spending for a Mattress

It's important to note that while flex spending can cover the cost of a mattress, it may not cover the entire expense. Your plan may have a maximum amount that can be used for mattress purchases, or it may only cover a portion of the cost. Additionally, if you have a high deductible health plan, you may need to meet your deductible before your flex spending account can be used for any expenses.Flex Spending and Mattress Expenses

If you know you'll need to purchase a new mattress in the future, it may be worth considering increasing your flex spending contributions during open enrollment. By setting aside more pre-tax dollars, you can potentially save more money on the cost of your mattress. Just be sure to check with your plan administrator to make sure your plan allows for an increased contribution.Maximizing Flex Spending for Mattress Purchases

As with any type of flex spending expense, it's important to follow the rules and guidelines set by your plan. This includes making sure the mattress is medically necessary and falls under the eligible expense category. It's also important to keep detailed records and submit all necessary documentation for reimbursement. Failure to follow the rules could result in your claim being denied.Flex Spending Rules for Mattresses

While using flex spending for a mattress purchase may seem confusing at first, it can ultimately save you money on a necessary expense. By understanding the rules and guidelines, and working closely with your plan administrator, you can make the most of your flex spending account and get the mattress you need.Understanding Flex Spending for Mattresses

In conclusion, flex spending can be used to cover the cost of a mattress as long as it meets certain criteria and is deemed medically necessary. By understanding the rules and guidelines, you can make the most of your flex spending account and potentially save money on a necessary expense. Be sure to consult with your plan administrator and keep detailed records to ensure a smooth reimbursement process.Flex Spending and Mattress Coverage

Flex Spending Accounts and Mattresses: A Smart Investment for Your Health and Home

What is a Flex Spending Account (FSA)?

Flex Spending Accounts (FSA) are a popular healthcare benefit offered by employers that allows employees to set aside a portion of their pre-tax income for medical expenses. These accounts are designed to help individuals and families save money on healthcare costs and can be used for a variety of eligible expenses such as doctor visits, prescriptions, and medical equipment.

Flex Spending Accounts (FSA) are a popular healthcare benefit offered by employers that allows employees to set aside a portion of their pre-tax income for medical expenses. These accounts are designed to help individuals and families save money on healthcare costs and can be used for a variety of eligible expenses such as doctor visits, prescriptions, and medical equipment.

Can a Mattress be Covered by Flex Spending?

The short answer is yes, a mattress can be covered by flex spending. While mattresses may not be the first thing that comes to mind when thinking about healthcare expenses, they can actually play a significant role in improving your overall health and well-being.

The short answer is yes, a mattress can be covered by flex spending. While mattresses may not be the first thing that comes to mind when thinking about healthcare expenses, they can actually play a significant role in improving your overall health and well-being.

The Health Benefits of a Quality Mattress

Investing in a high-quality mattress can have a positive impact on your physical and mental health. A good night's sleep is crucial for the body to repair and recharge, and a supportive and comfortable mattress is essential for achieving this. A poor-quality mattress can lead to a variety of health issues such as back pain, muscle tension, and poor sleep quality, which can have a domino effect on your overall health.

Investing in a high-quality mattress can have a positive impact on your physical and mental health. A good night's sleep is crucial for the body to repair and recharge, and a supportive and comfortable mattress is essential for achieving this. A poor-quality mattress can lead to a variety of health issues such as back pain, muscle tension, and poor sleep quality, which can have a domino effect on your overall health.

How Can a Mattress be Covered by Flex Spending?

To use your FSA funds for a mattress, you will need a letter of medical necessity from your doctor stating that a new mattress is necessary for your health. This can be due to a medical condition such as chronic back pain or sleep apnea. With this letter, you can then submit a claim for reimbursement with your FSA provider. However, it's important to note that not all FSA plans cover mattresses, so it's best to check with your provider before making a purchase.

To use your FSA funds for a mattress, you will need a letter of medical necessity from your doctor stating that a new mattress is necessary for your health. This can be due to a medical condition such as chronic back pain or sleep apnea. With this letter, you can then submit a claim for reimbursement with your FSA provider. However, it's important to note that not all FSA plans cover mattresses, so it's best to check with your provider before making a purchase.

Investing in Your Health and Your Home

A mattress is not only a crucial component of a good night's sleep but also an investment in your health and overall well-being. With the option to use FSA funds for a new mattress, it's a smart way to make a quality purchase while also saving money on healthcare expenses. Additionally, a new mattress can also enhance the aesthetic and comfort of your home, making it a worthwhile investment in both your health and your home.

A mattress is not only a crucial component of a good night's sleep but also an investment in your health and overall well-being. With the option to use FSA funds for a new mattress, it's a smart way to make a quality purchase while also saving money on healthcare expenses. Additionally, a new mattress can also enhance the aesthetic and comfort of your home, making it a worthwhile investment in both your health and your home.

In Conclusion

In conclusion, a mattress can be covered by flex spending if it is deemed medically necessary by a doctor. Investing in a quality mattress is an investment in your health and home, and using your FSA funds can make it even more affordable. So if you're in need of a new mattress, consider utilizing your FSA benefits to improve your sleep and overall well-being.

In conclusion, a mattress can be covered by flex spending if it is deemed medically necessary by a doctor. Investing in a quality mattress is an investment in your health and home, and using your FSA funds can make it even more affordable. So if you're in need of a new mattress, consider utilizing your FSA benefits to improve your sleep and overall well-being.

:max_bytes(150000):strip_icc()/woolrich-sherpa-heated-mattress-pad-68fd0d42b7ee4a37a98b71df6d715a9b.jpg)