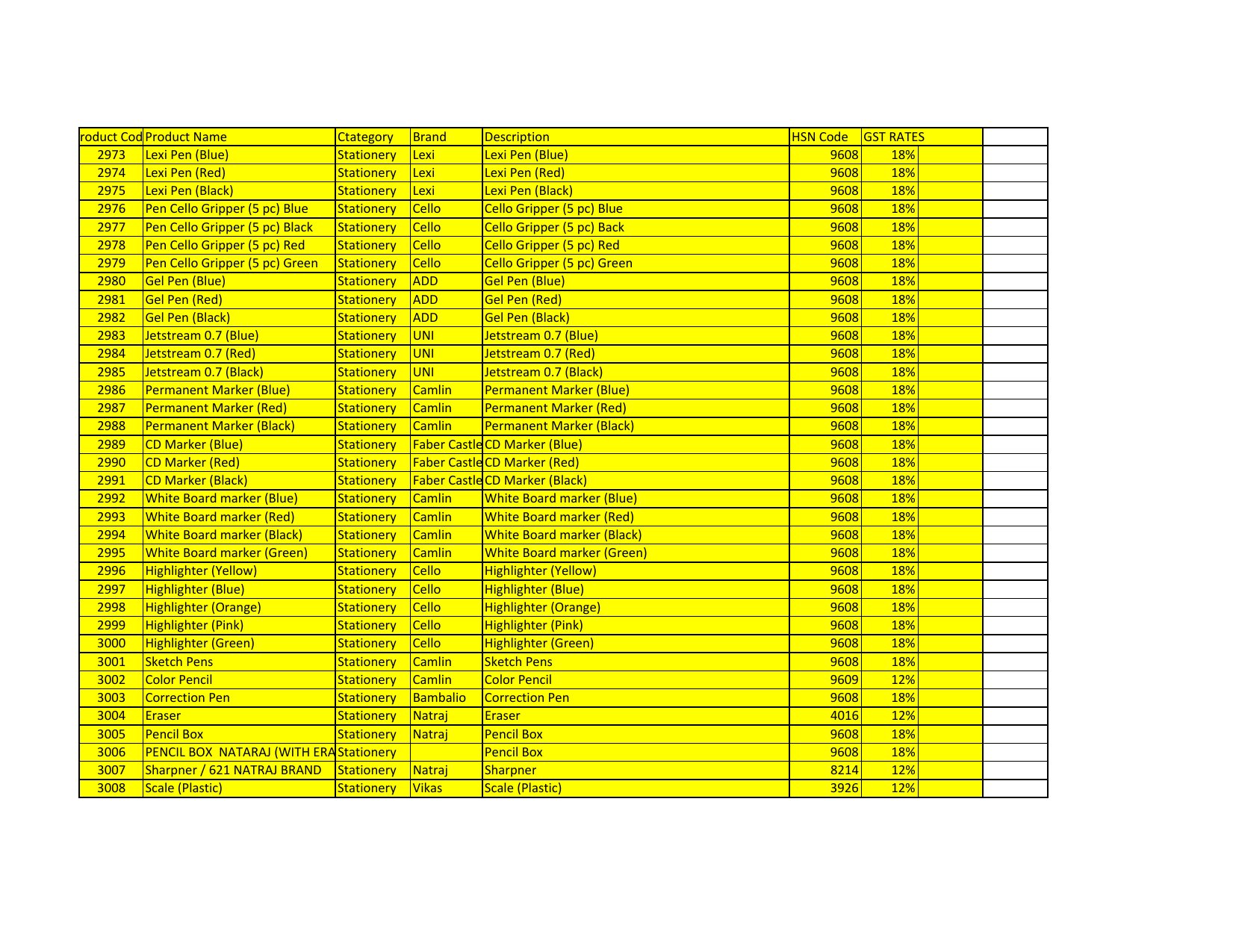

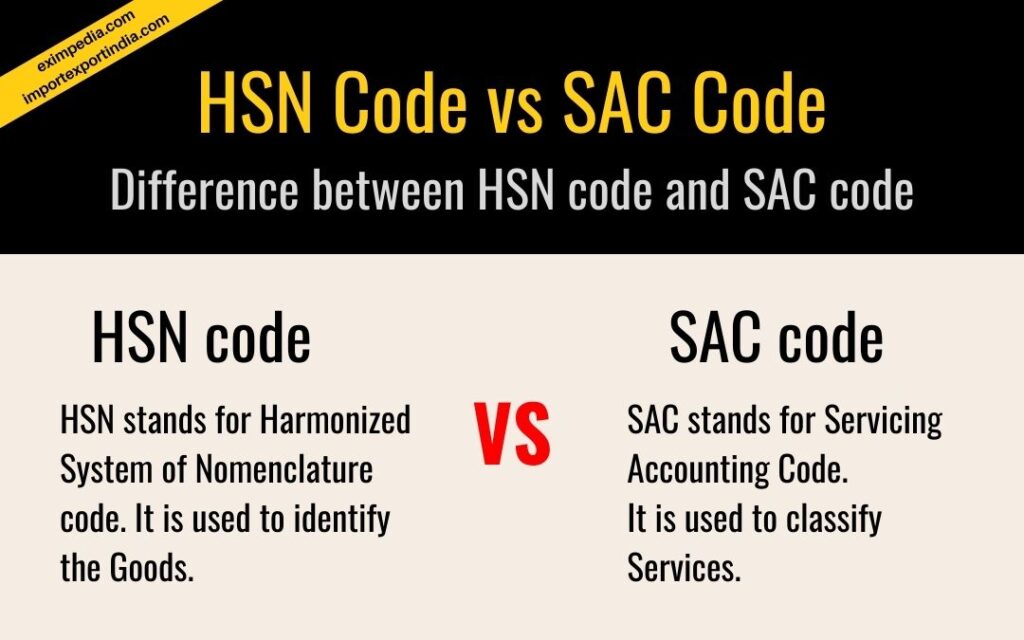

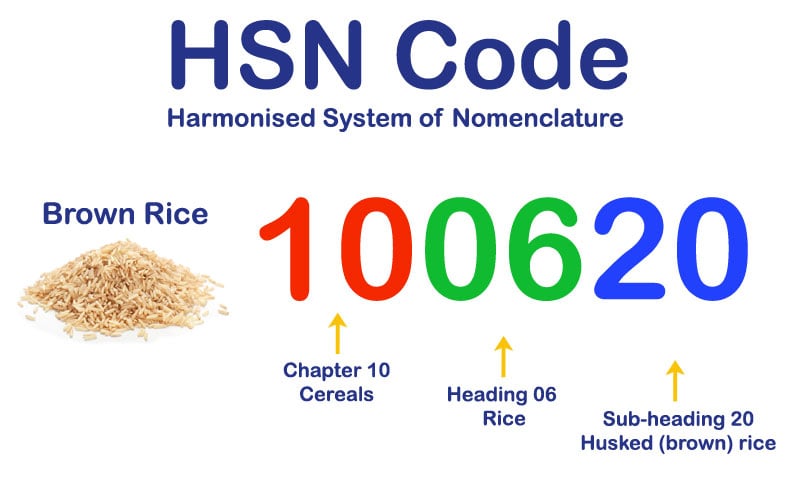

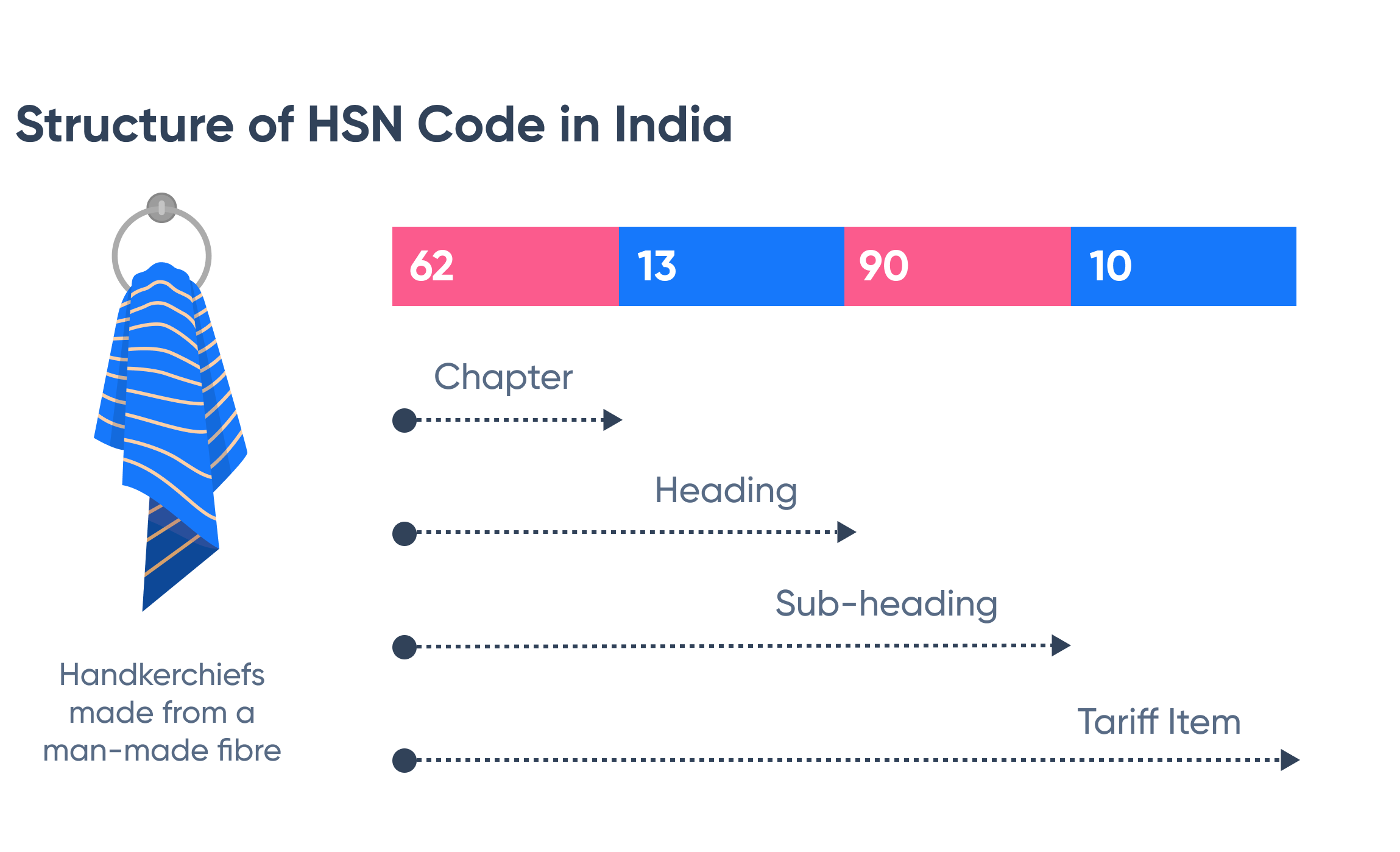

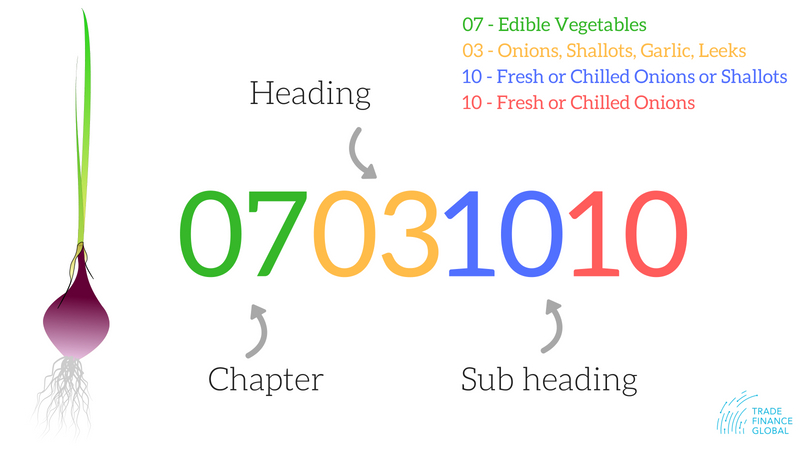

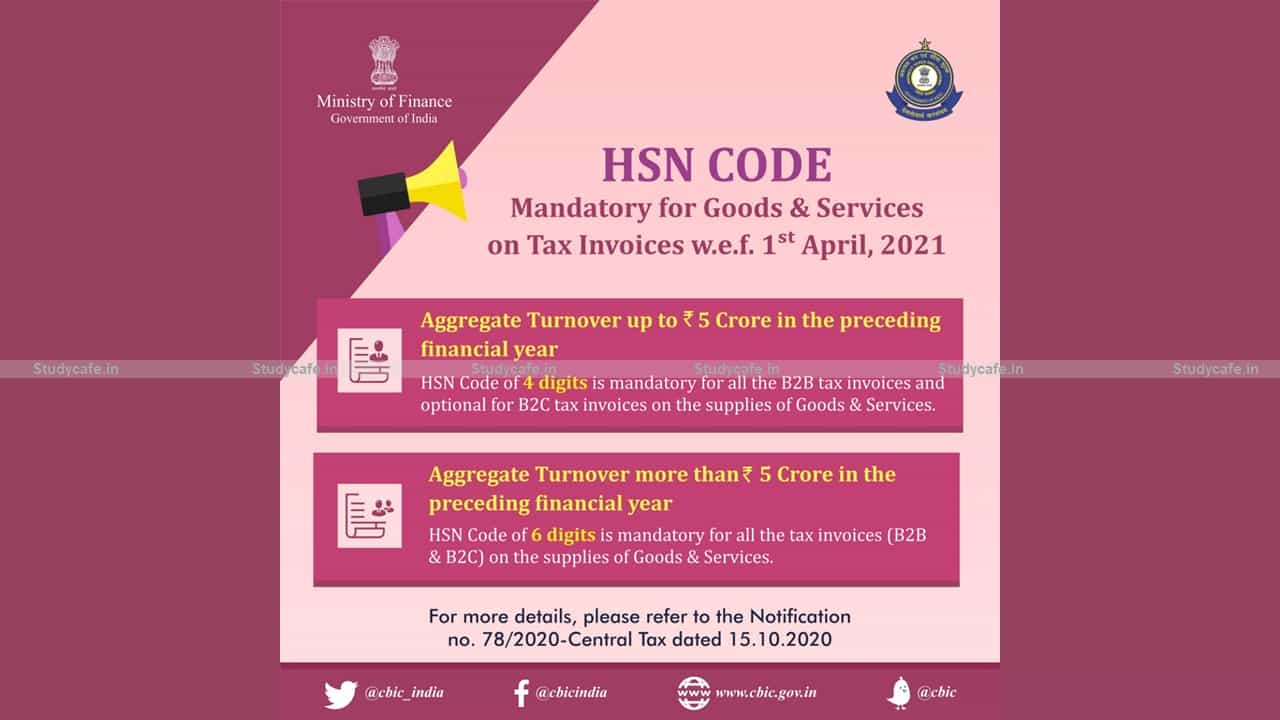

When it comes to buying a new bed mattress, it's important to know the HSN code that applies to this essential household item. The Harmonized System of Nomenclature (HSN) is an internationally recognized system of names and numbers used to classify traded products. Each product is assigned a specific code that helps with customs clearance and taxation. In this article, we will discuss the top 10 HSN codes for bed mattresses to help you make an informed purchase.HSN Code for Bed Mattress

The HSN code for a mattress is 9404. This code is used for all types of mattresses, including spring, foam, and latex. It also includes mattress supports and cushions. This code is important when importing or exporting mattresses, as it helps with customs clearance and can affect the taxes and duties applied to the product.HSN Code for Mattress

While the HSN code for a bed may seem obvious, it's important to know the specific code that applies to the type of bed you are purchasing. The code for a wooden bed frame is 9403 50 00, while a metal bed frame falls under 9403 20 10. Knowing these codes can help you accurately report the value of your bed when importing or exporting.HSN Code for Bed

Since a bed is considered a piece of furniture, it falls under the larger HSN category of 9403. This code covers all types of furniture, including beds, chairs, tables, and cabinets. When importing or exporting furniture, it's important to know the specific code that applies to the item, as it can affect the taxes and duties applied.HSN Code for Furniture

The HSN code for a bedroom set, including a bed, wardrobe, and bedside tables, is 9403 90 90. This code is used for complete sets of furniture for a specific room, making it easier for customs to classify and tax the products. If you are purchasing a complete bedroom set, be sure to provide this code to the customs agent.HSN Code for Bedroom

A bed mattress is an essential household item, and as such, it falls under the HSN code 9404. This code covers all types of bedding, including mattresses, pillows, and bed linens. If you are importing or exporting household items, knowing this code can help with customs clearance and taxation.HSN Code for Household Items

In addition to a bed mattress falling under the HSN code 9404, other sleeping products such as sleep masks, earplugs, and sleep aids also fall under this code. These products are considered essential for a good night's sleep and are therefore classified under the same HSN code as mattresses.HSN Code for Sleeping Products

A bed mattress can also be classified as a home furnishing, which falls under the HSN code 9403. This code covers all types of furnishings for the home, including furniture, linens, and decorative items. Knowing this code can help with customs clearance and taxation when importing or exporting home furnishings.HSN Code for Home Furnishings

Bedding, including mattresses, pillows, and blankets, falls under the HSN code 9404. This code is used for all types of bedding materials and helps customs classify and tax these essential household items. If you are purchasing bedding, be sure to provide this code to the customs agent to ensure a smooth transaction.HSN Code for Bedding

Lastly, the HSN code for sleeping accessories, such as bed frames, headboards, and footboards, is 9403. These items are considered accessories to a bed and fall under the larger category of furniture. Knowing this code can help with customs clearance and taxation when importing or exporting sleeping accessories. In conclusion, knowing the HSN code for bed mattresses is important when making a purchase or importing/exporting these essential household items. It helps with customs clearance and taxation and ensures a smooth transaction. Be sure to use the correct code for the specific type of bed or bedding you are purchasing to avoid any delays or issues.HSN Code for Sleeping Accessories

The Importance of Choosing the Right Bed Mattress for Your House Design

Creating a Comfortable and Stylish Bedroom

When it comes to designing your home, the bedroom is often overlooked. However, it is one of the most important spaces in your house as it is where you relax, rejuvenate and get a good night's sleep. And when it comes to creating the perfect bedroom, one crucial element that should not be overlooked is the bed mattress. Not only does it play a significant role in your comfort, but it also has the power to elevate the overall design of your bedroom. Therefore, it is essential to understand the

HSN code for bed mattress

and how to choose the right one for your house design.

When it comes to designing your home, the bedroom is often overlooked. However, it is one of the most important spaces in your house as it is where you relax, rejuvenate and get a good night's sleep. And when it comes to creating the perfect bedroom, one crucial element that should not be overlooked is the bed mattress. Not only does it play a significant role in your comfort, but it also has the power to elevate the overall design of your bedroom. Therefore, it is essential to understand the

HSN code for bed mattress

and how to choose the right one for your house design.

The HSN Code for Bed Mattress

For those unfamiliar with the term, HSN stands for Harmonized System of Nomenclature. It is a global standard for classifying goods and products for international trade. Each product is assigned a unique code, making it easier for customs and other authorities to identify and track them. The

HSN code for bed mattress

falls under the category of bedding, mattresses, and sleeping bags, with the code 9404. This code is essential, especially for those who are importing or exporting bed mattresses for their house design.

For those unfamiliar with the term, HSN stands for Harmonized System of Nomenclature. It is a global standard for classifying goods and products for international trade. Each product is assigned a unique code, making it easier for customs and other authorities to identify and track them. The

HSN code for bed mattress

falls under the category of bedding, mattresses, and sleeping bags, with the code 9404. This code is essential, especially for those who are importing or exporting bed mattresses for their house design.

Choosing the Right Bed Mattress for Your House Design

Now that we understand the importance of the

HSN code for bed mattress

, let's focus on choosing the right one for your house design. The first step is to determine the size of your bed and the type of mattress that would best suit your needs. There are various types of mattresses available, such as memory foam, innerspring, latex, and hybrid, each with its unique features. Consider factors such as firmness, support, and durability before making a decision. It is also essential to keep in mind the overall design and color scheme of your bedroom, as the bed mattress should complement and enhance the aesthetic of the room.

In conclusion, the bed mattress is a crucial element in creating a comfortable and stylish bedroom. It not only affects your quality of sleep but also contributes to the overall design of your house. Therefore, understanding the

HSN code for bed mattress

and choosing the right one for your house design is essential. With the right bed mattress, you can create a relaxing and inviting space that you will look forward to coming back to every night.

Now that we understand the importance of the

HSN code for bed mattress

, let's focus on choosing the right one for your house design. The first step is to determine the size of your bed and the type of mattress that would best suit your needs. There are various types of mattresses available, such as memory foam, innerspring, latex, and hybrid, each with its unique features. Consider factors such as firmness, support, and durability before making a decision. It is also essential to keep in mind the overall design and color scheme of your bedroom, as the bed mattress should complement and enhance the aesthetic of the room.

In conclusion, the bed mattress is a crucial element in creating a comfortable and stylish bedroom. It not only affects your quality of sleep but also contributes to the overall design of your house. Therefore, understanding the

HSN code for bed mattress

and choosing the right one for your house design is essential. With the right bed mattress, you can create a relaxing and inviting space that you will look forward to coming back to every night.

:max_bytes(150000):strip_icc()/gray-kitchen-cabinet-ideas-22-cathie-hong-interiors-scandinavian-c08d577bdaf54eb7a7715b0bacfec108.jpeg)