Avocado mattresses are a popular choice among eco-conscious consumers, thanks to their use of organic and sustainable materials. However, when it comes to purchasing a new mattress, many people often overlook the sales tax implications. In this article, we will break down the basics of sales tax for avocado mattresses and help you understand how it may affect your purchase.Understanding Sales Tax for Avocado Mattresses

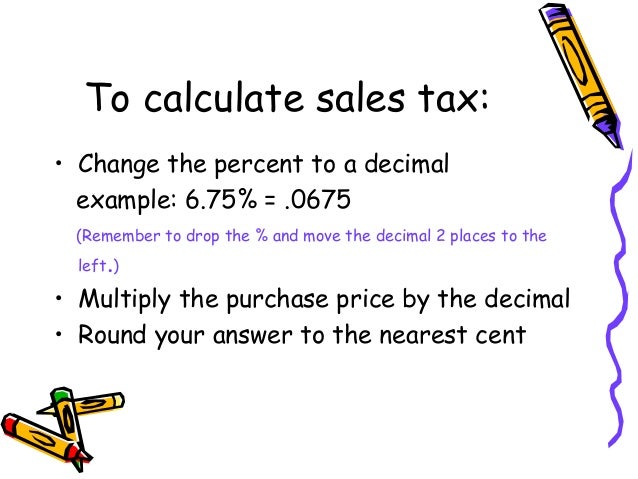

Calculating sales tax for avocado mattresses can be a bit tricky, as it varies depending on your location. The first step is to determine the sales tax rate in your state. This can range from 0% in states like Delaware, Montana, and Oregon, to as high as 10.5% in California. Once you have the sales tax rate, you can multiply it by the purchase price of your avocado mattress. For example, if you live in a state with a 7% sales tax rate and your mattress costs $1,500, you would pay an additional $105 in sales tax.How to Calculate Sales Tax on Avocado Mattresses

While sales tax is usually applied to most purchases, there are some exemptions that may apply to avocado mattresses. These exemptions typically include purchases made for resale, as well as purchases made by qualified tax-exempt organizations, such as charities or government agencies. Additionally, some states may offer sales tax exemptions for certain items, such as medical equipment or products used for agriculture. It's important to check with your state's tax laws to see if any exemptions apply to your avocado mattress purchase.Avocado Mattress Sales Tax Exemptions

As mentioned earlier, sales tax rates can vary significantly from state to state. Below is a breakdown of the sales tax rates in different states where avocado mattresses are commonly purchased: California: 7.25% - 10.5% New York: 4% - 8.875% Texas: 6.25% - 8.25% Florida: 6% - 8.5% Illinois: 6.25% Georgia: 4% - 8% Ohio: 5.75% - 8% Michigan: 6% - 7% Virginia: 5.3% - 7% Washington: 6.5% - 10.4%Avocado Mattress Sales Tax Rates by State

Sales tax laws and regulations can be complex and can vary from state to state. It's important to understand your state's specific laws and regulations regarding sales tax for avocado mattresses. For example, some states may have different tax rates for certain types of mattresses, such as memory foam or latex. There may also be regulations in place for online purchases, as many avocado mattresses are sold through e-commerce platforms. In some cases, online retailers may only be required to collect sales tax in states where they have a physical presence, but this is changing as more states pass laws requiring all online purchases to be taxed.Avocado Mattress Sales Tax Laws and Regulations

If you need to return or exchange your avocado mattress, you may be wondering what happens to the sales tax you paid. In most cases, you will not receive a refund or credit for the sales tax paid. However, if you are exchanging your mattress for a different size or model, you may only be required to pay the difference in sales tax.Avocado Mattress Sales Tax Refunds and Exchanges

When calculating sales tax for your avocado mattress, it's important to understand what is included and excluded in the purchase price. In most cases, the sales tax will be applied to the total purchase price, including any delivery or shipping fees. However, some states may exclude certain fees, such as recycling fees, from the taxable amount. It's best to check with your state's tax laws to see what is included in the taxable amount for avocado mattresses.Avocado Mattress Sales Tax Exclusions and Inclusions

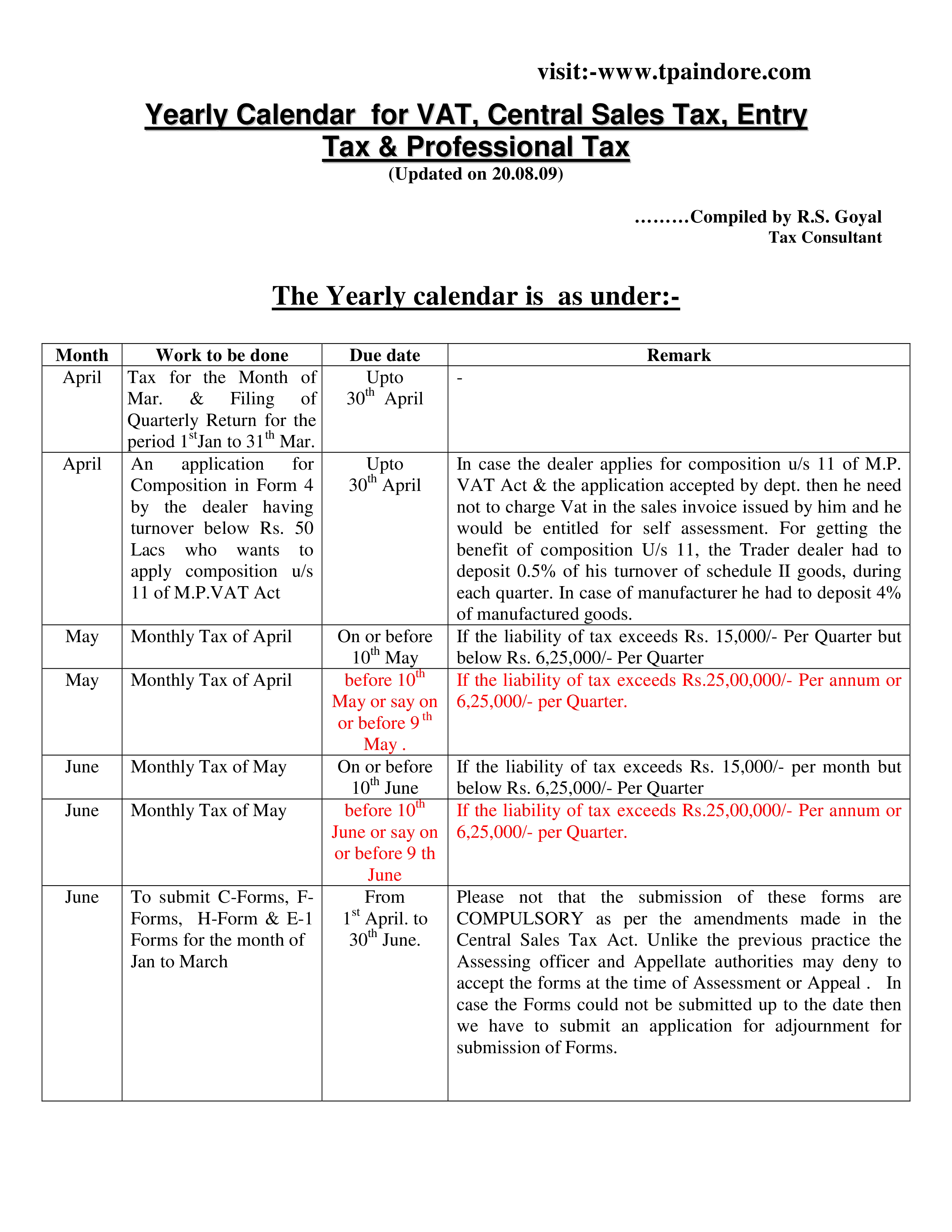

Sales tax must be filed and paid by a specific deadline, which varies depending on your state. In most cases, sales tax is due on a monthly, quarterly, or annual basis. Some states may also require online retailers to collect and remit sales tax on a more frequent basis, such as on a daily or weekly basis. It's important to keep track of these deadlines and ensure that you are filing and paying your sales tax on time to avoid any penalties or interest charges.Avocado Mattress Sales Tax Filing and Payment Deadlines

As with any type of tax, it's important to comply with sales tax laws and regulations to avoid any potential audits or penalties. This means accurately reporting and paying your sales tax on time and keeping detailed records of your avocado mattress purchase. If you are ever audited by the IRS or your state's tax agency, having proper documentation and records will make the process much smoother and can help you avoid any fines or penalties.Avocado Mattress Sales Tax Audit and Compliance

If you have any questions or concerns about sales tax for your avocado mattress purchase, there are resources available to help you. You can contact your state's tax agency or seek assistance from a tax professional who can guide you through the process. Additionally, many avocado mattress retailers may also have customer support teams that can assist you with any sales tax inquiries.Avocado Mattress Sales Tax Resources and Support

The Benefits of an Avocado Mattress Sales Tax

Eco-Friendly and Sustainable Materials

When it comes to designing your dream home, every detail matters. From the paint on the walls to the furniture you choose, you want to ensure that your living space is not only aesthetically pleasing but also environmentally responsible. That's where an

avocado mattress sales tax

comes into play.

An

avocado mattress

is made from natural and sustainable materials, such as GOTS-certified organic cotton and natural latex. This means that not only is it better for the environment, but it is also better for your health. These materials are free from harmful chemicals and toxins, making it a safe and healthy choice for your home.

When it comes to designing your dream home, every detail matters. From the paint on the walls to the furniture you choose, you want to ensure that your living space is not only aesthetically pleasing but also environmentally responsible. That's where an

avocado mattress sales tax

comes into play.

An

avocado mattress

is made from natural and sustainable materials, such as GOTS-certified organic cotton and natural latex. This means that not only is it better for the environment, but it is also better for your health. These materials are free from harmful chemicals and toxins, making it a safe and healthy choice for your home.

Supporting Local Businesses

By choosing to purchase an

avocado mattress

and paying the associated sales tax, you are not only investing in a high-quality product, but you are also supporting local businesses. Avocado Mattress is a California-based company, and all their mattresses are handcrafted in their Los Angeles factory. By paying the sales tax, you are contributing to the growth of the local economy and helping to create jobs for your community.

By choosing to purchase an

avocado mattress

and paying the associated sales tax, you are not only investing in a high-quality product, but you are also supporting local businesses. Avocado Mattress is a California-based company, and all their mattresses are handcrafted in their Los Angeles factory. By paying the sales tax, you are contributing to the growth of the local economy and helping to create jobs for your community.

Investing in Quality and Durability

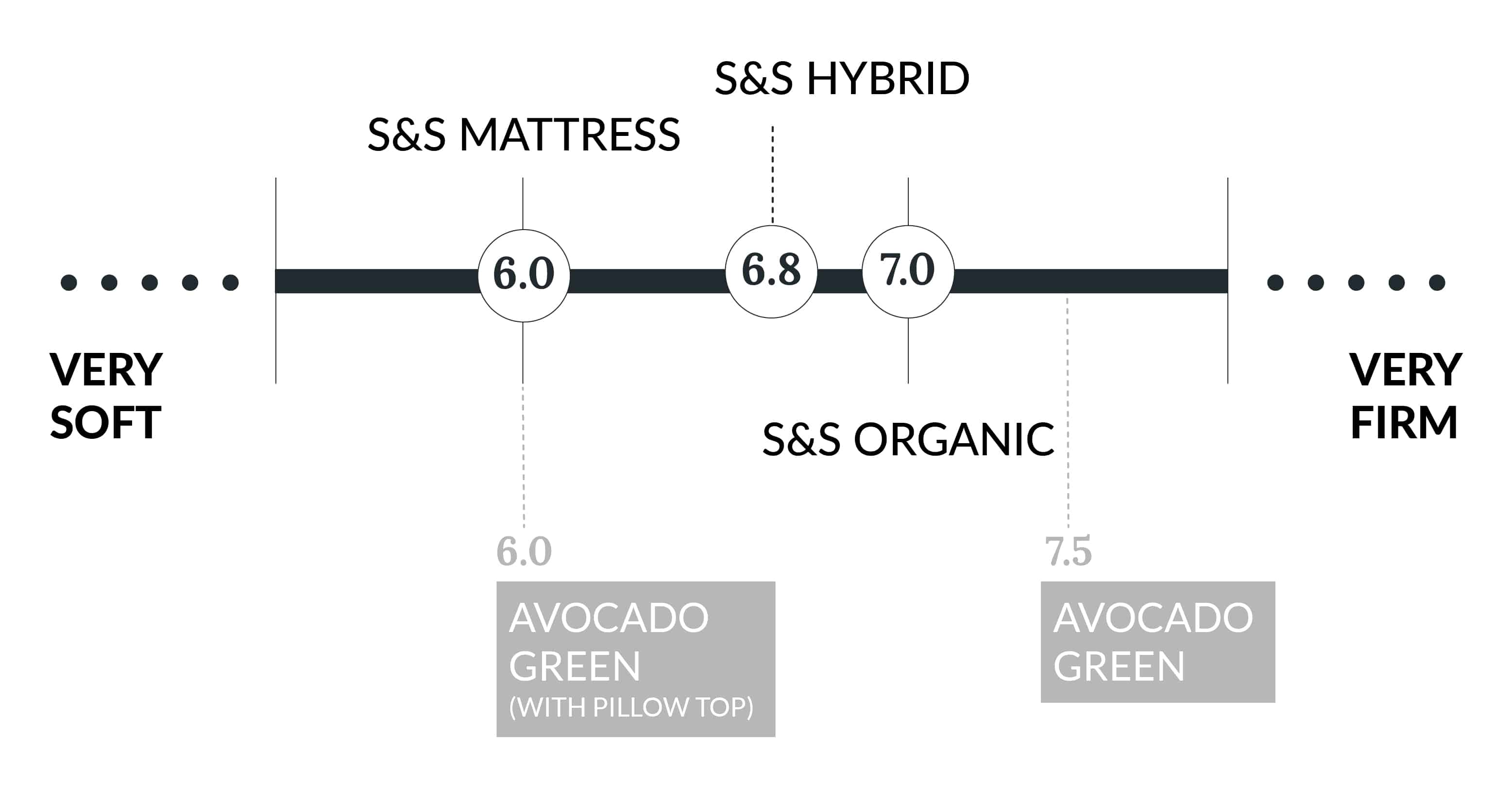

When it comes to mattresses, you truly get what you pay for. An

avocado mattress

may have a slightly higher price point due to the sales tax, but it is an investment in quality and durability. These mattresses are designed to last for years, reducing the need for frequent replacements. This not only saves you money in the long run but also reduces waste and the environmental impact of constantly discarding and replacing mattresses.

When it comes to mattresses, you truly get what you pay for. An

avocado mattress

may have a slightly higher price point due to the sales tax, but it is an investment in quality and durability. These mattresses are designed to last for years, reducing the need for frequent replacements. This not only saves you money in the long run but also reduces waste and the environmental impact of constantly discarding and replacing mattresses.

Conclusion

In conclusion, while paying a sales tax on top of the cost of an

avocado mattress

may seem like an extra expense, the benefits far outweigh the cost. By choosing an eco-friendly and sustainable option, supporting local businesses, and investing in quality and durability, you are not only creating a healthier and more responsible home, but you are also making a positive impact on the environment and your community. So next time you're in the market for a new mattress, consider the benefits of an

avocado mattress sales tax

.

In conclusion, while paying a sales tax on top of the cost of an

avocado mattress

may seem like an extra expense, the benefits far outweigh the cost. By choosing an eco-friendly and sustainable option, supporting local businesses, and investing in quality and durability, you are not only creating a healthier and more responsible home, but you are also making a positive impact on the environment and your community. So next time you're in the market for a new mattress, consider the benefits of an

avocado mattress sales tax

.