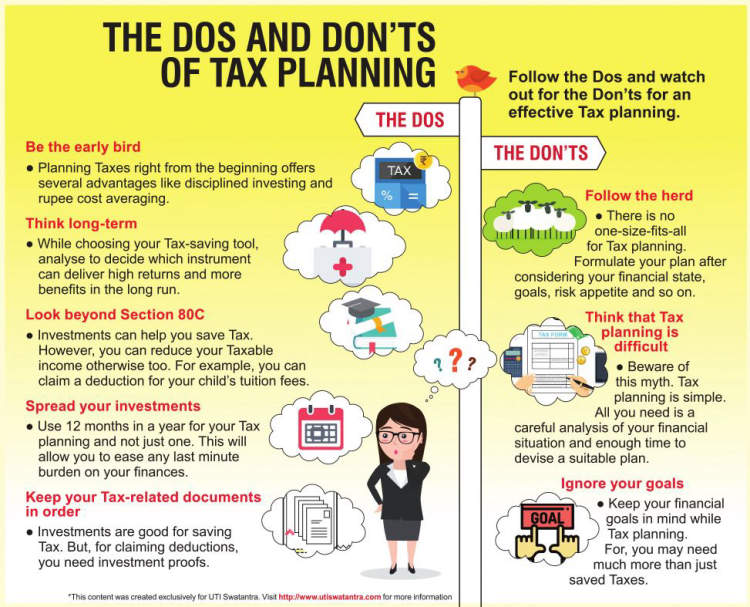

Leather sofas are a popular choice for many homeowners, not only for their luxurious appearance and durability, but also for their potential tax benefits. Yes, you read that right – purchasing a leather sofa can actually save you money on your taxes. In this article, we will explore the top 10 ways a leather sofa can provide tax deductions and help you maximize your savings."Tax Deductible Leather Sofas"

When it comes to tax deductions, every little bit counts. That's why it's important to consider the value a leather sofa can bring to your tax savings. Not only does it add to the aesthetic of your home, but it can also add to your bottom line when it comes to filing your taxes."Value a Leather Sofa for Tax Savings"

One of the main tax benefits of owning a leather sofa is the ability to deduct it as a home furnishing expense. This means that if you use the sofa for your personal residence, you may be able to deduct a portion of its cost from your taxes. It's important to keep track of your receipts and any other documentation to support your claim."Leather Sofas and Tax Benefits"

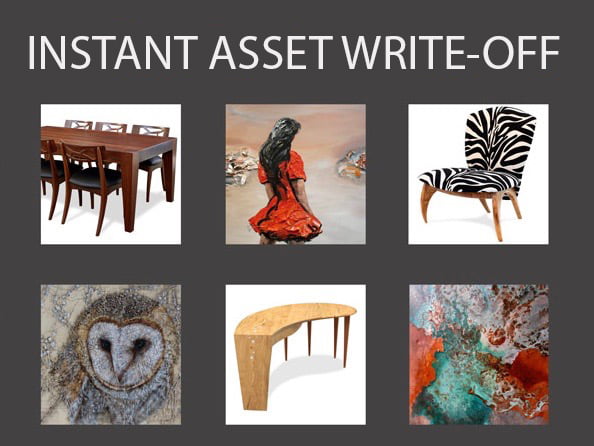

Another way to maximize your tax savings with a leather sofa is by using it for business purposes. If you have a home office, you can deduct a portion of the cost of your leather sofa as a business expense. This can be a significant deduction, especially if you use the sofa for meetings with clients or as a workspace."Maximizing Tax Savings with Leather Sofas"

As mentioned earlier, keeping track of your receipts and documentation is crucial when it comes to claiming tax deductions for your leather sofa. This also applies to any repairs or maintenance costs associated with the sofa. If you have the sofa professionally cleaned or repaired, you may be able to deduct these expenses from your taxes."Leather Sofas and Tax Deductible Expenses"

Not only can your leather sofa provide tax deductions, but other home furnishings can as well. If you purchase a matching ottoman or coffee table to go with your sofa, these can also be considered tax deductible expenses. Just remember to keep track of your receipts and document how these items are used in your home."Tax Deductible Home Furnishings"

In addition to tax deductions, owning a leather sofa can also lead to tax breaks. For example, if you donate your sofa to a charitable organization, you may be able to claim a deduction for the fair market value of the sofa. This can be a great way to give back to your community while also saving money on your taxes."Leather Sofas and Tax Breaks"

Speaking of charitable donations, another way to take advantage of tax deductions is by donating your leather sofa to a non-profit organization. This can be a great option if you are looking to upgrade to a newer sofa and want to get rid of your old one. Just make sure to get a receipt from the organization for your records."Leather Sofas for Tax Deductible Donations"

Another potential tax benefit of owning a leather sofa is the ability to claim a tax exemption for it. In certain situations, a tax exemption can be claimed for home furnishings that are used for medical purposes. For example, if you have a leather sofa in a room that is primarily used for medical treatments, you may be able to claim it as a medical expense."Leather Sofas and Tax Exemptions"

We briefly touched on the tax benefits of using your leather sofa for business purposes, but it's worth mentioning again. If you have a dedicated home office, you can deduct a portion of your leather sofa as a business expense. This can be especially helpful for small business owners looking to save money on their taxes."Tax Deductible Furniture for Home Office"

Last but not least, owning a leather sofa can also lead to tax deductions through charitable contributions. If you decide to sell your sofa and donate the proceeds to a charitable organization, you may be able to deduct the full sale amount from your taxes. This can be a great way to give back and save money at the same time. In conclusion, owning a leather sofa can provide numerous tax benefits and deductions. From deducting the cost of the sofa as a home furnishing expense to claiming a tax exemption for medical use, there are many ways to save money on your taxes with a leather sofa. Just remember to keep track of your receipts and documentation, and consult with a tax professional if you have any questions or concerns."Leather Sofas and Tax Deductible Charitable Contributions"

The Benefits of Owning a Leather Sofa for Tax Deduction

A Valuable Addition to Your Home

When it comes to decorating your home, it's important to choose pieces that not only look good, but also have practical benefits.

A leather sofa

is a perfect example of this, as it not only adds a touch of elegance and sophistication to your living space, but it can also provide you with a

tax deduction

come tax season.

When it comes to decorating your home, it's important to choose pieces that not only look good, but also have practical benefits.

A leather sofa

is a perfect example of this, as it not only adds a touch of elegance and sophistication to your living space, but it can also provide you with a

tax deduction

come tax season.

How Does It Work?

The Internal Revenue Service (IRS) allows for certain home improvements to be deducted from your taxes, and a

leather sofa

can fall under this category. According to the IRS, any furniture or home decor that is used for business purposes can be deducted as a business expense. This means that if you work from home, or use a dedicated space in your house for business-related activities, you can claim a portion of your

leather sofa

as a tax deduction.

The Internal Revenue Service (IRS) allows for certain home improvements to be deducted from your taxes, and a

leather sofa

can fall under this category. According to the IRS, any furniture or home decor that is used for business purposes can be deducted as a business expense. This means that if you work from home, or use a dedicated space in your house for business-related activities, you can claim a portion of your

leather sofa

as a tax deduction.

The Value of Investing in a Leather Sofa

Not only does a

leather sofa

have aesthetic value, but it also holds its value over time. Leather is a durable and high-quality material that can withstand wear and tear, making it a wise investment for your home. Additionally, the IRS allows for a tax deduction on the depreciation of business assets, meaning that you can continue to claim a portion of your

leather sofa

as a deduction over several years.

Not only does a

leather sofa

have aesthetic value, but it also holds its value over time. Leather is a durable and high-quality material that can withstand wear and tear, making it a wise investment for your home. Additionally, the IRS allows for a tax deduction on the depreciation of business assets, meaning that you can continue to claim a portion of your

leather sofa

as a deduction over several years.

Other Tax Benefits of Home Design

In addition to a

leather sofa

, there are many other home design elements that can provide you with tax benefits. For example, energy-efficient upgrades such as solar panels or energy-efficient windows can qualify for tax credits. Donating old furniture or home decor to charity can also provide you with a tax deduction.

In addition to a

leather sofa

, there are many other home design elements that can provide you with tax benefits. For example, energy-efficient upgrades such as solar panels or energy-efficient windows can qualify for tax credits. Donating old furniture or home decor to charity can also provide you with a tax deduction.

Conclusion

When it comes to designing your home, it's important to consider the practical benefits as well. A

leather sofa

not only adds value and elegance to your living space, but it can also provide you with a tax deduction. So when you're considering your next home decor purchase, remember the added value a

leather sofa

can bring to your home both aesthetically and financially.

When it comes to designing your home, it's important to consider the practical benefits as well. A

leather sofa

not only adds value and elegance to your living space, but it can also provide you with a tax deduction. So when you're considering your next home decor purchase, remember the added value a

leather sofa

can bring to your home both aesthetically and financially.