Harmonized Tariff Schedule

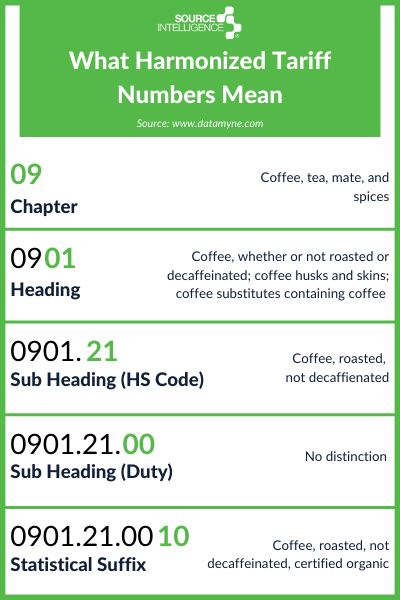

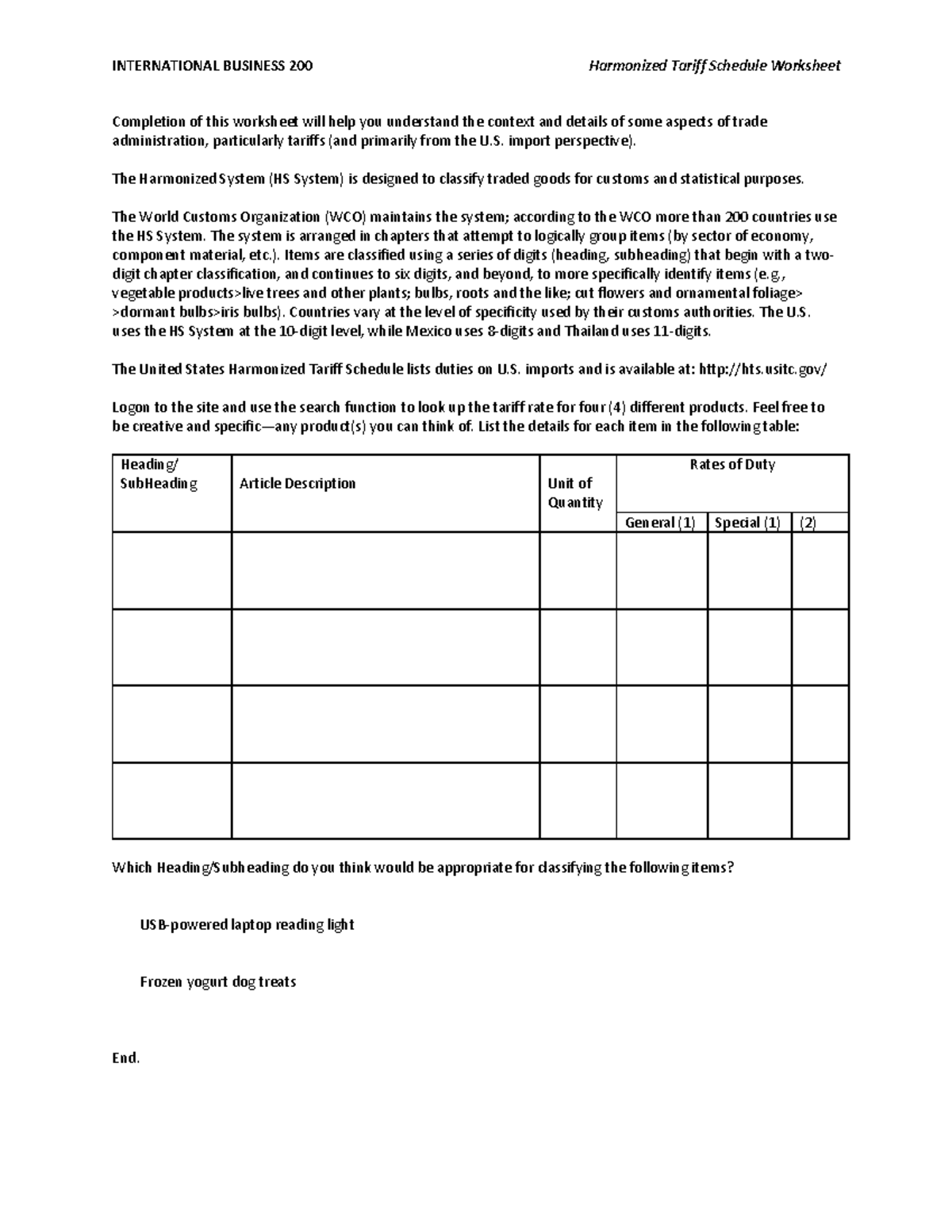

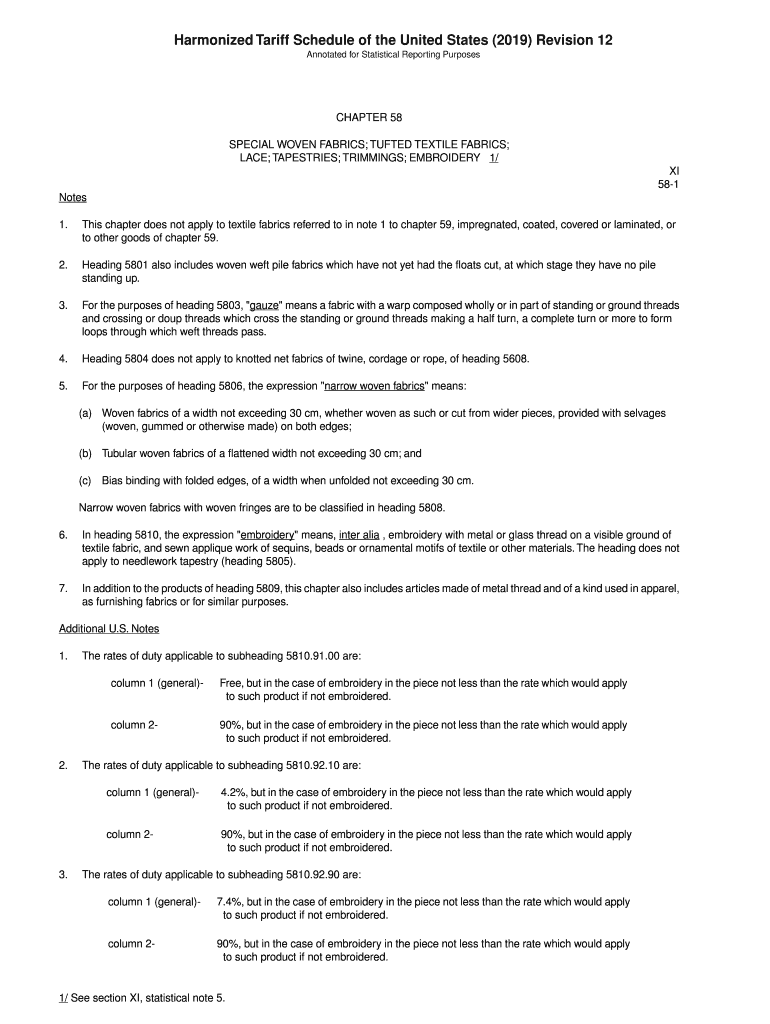

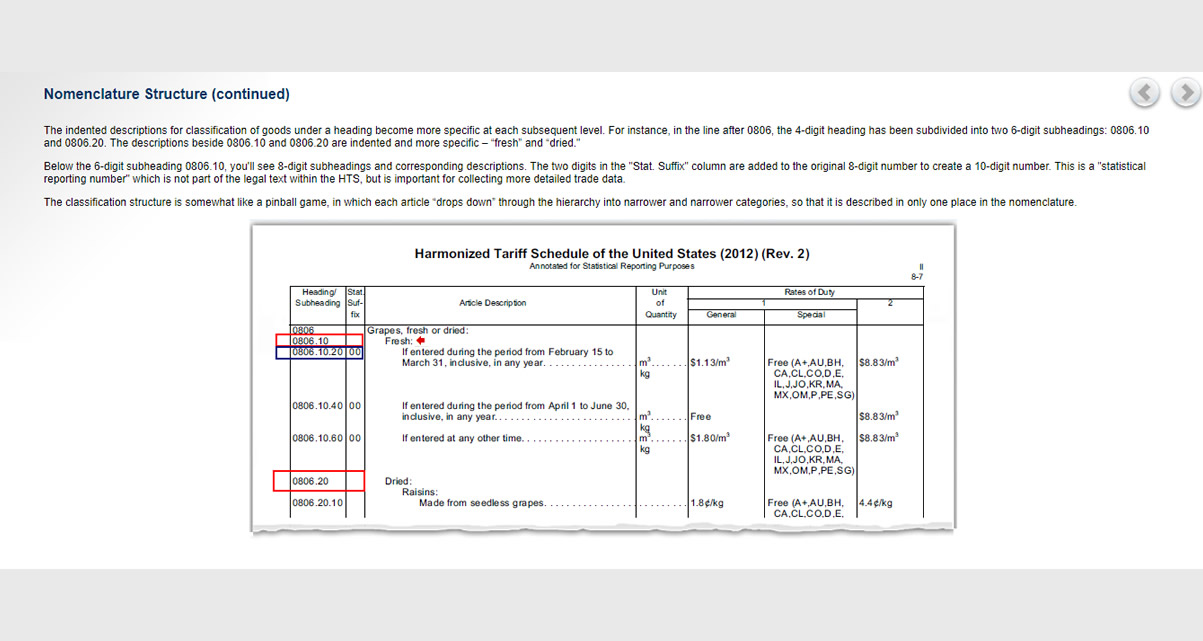

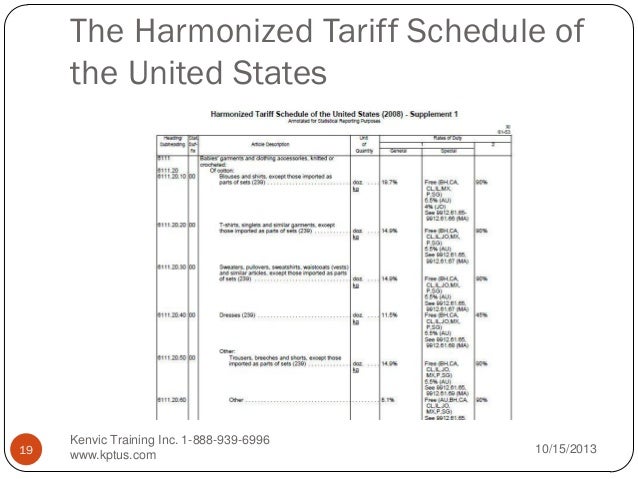

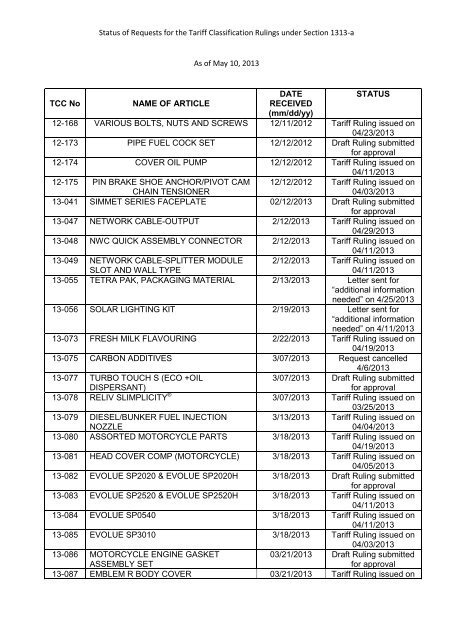

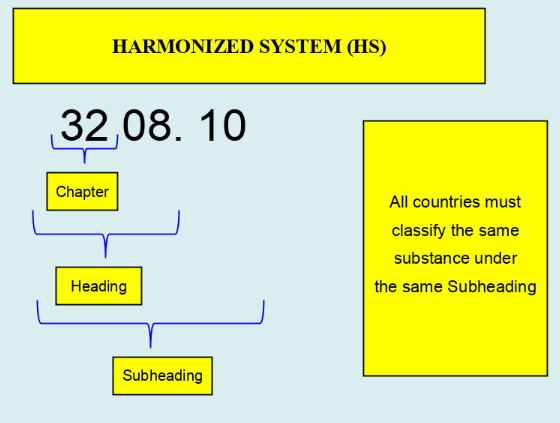

The Harmonized Tariff Schedule (HTS) is an internationally recognized system used to classify goods for trade purposes. It is a standardized system of numerical codes that are assigned to different products, including living room furniture, to help determine the import duties and taxes that must be paid when bringing these items into a country. The HTS is used by customs officials to ensure that the correct tariffs are applied to goods, making it an essential tool for importers and exporters.

Furniture Classification

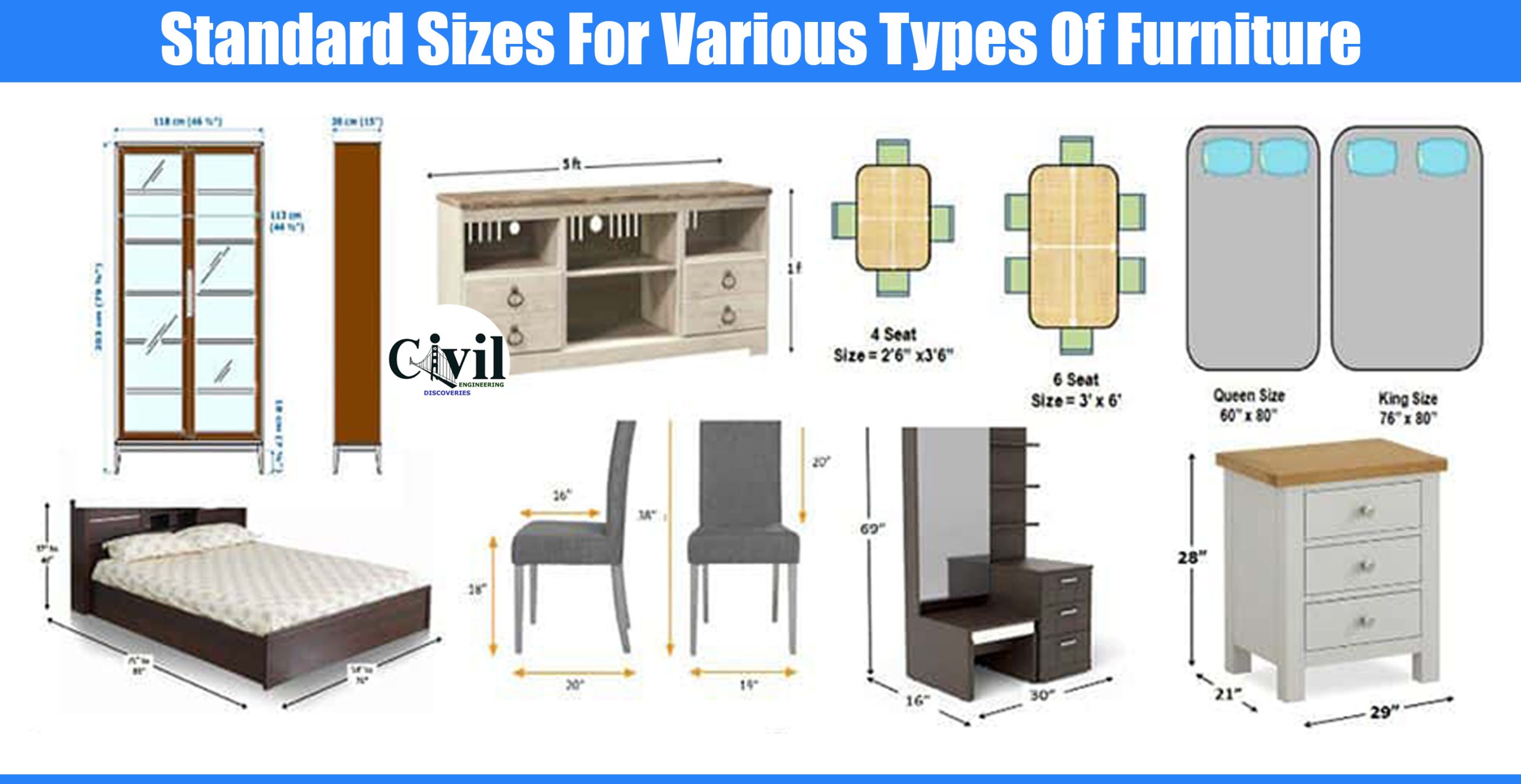

In general, living room furniture falls under the category of “furniture” in the HTS. However, there are specific subcategories that further classify different types of furniture, such as living room furniture. These subcategories are based on the material, design, and intended use of the furniture. For example, a sofa would fall under the subcategory of “upholstered seating furniture” while a coffee table would fall under the subcategory of “wooden furniture.”

Living Room Furniture Tariff

The tariff classification for living room furniture is determined by the specific subcategory it falls under in the HTS. This classification is essential because it determines the duty rate and other taxes that must be paid when importing these items. The duty rate can vary depending on the type of living room furniture and the country of import. It is crucial to correctly identify the tariff classification to avoid any potential issues or penalties when importing living room furniture.

HS Code for Living Room Furniture

The Harmonized System (HS) Code is a 6-digit code that is used to classify products in the HTS. It is an internationally recognized code that is used to identify the type of product being imported or exported. For living room furniture, the HS Code will depend on the specific type of furniture, such as sofas, chairs, tables, etc. Importers must include the correct HS Code on their shipping documents to ensure smooth clearance through customs.

Tariff Classification for Sofas

Sofas are one of the most common types of living room furniture and have a specific tariff classification in the HTS. They fall under the subcategory of “upholstered seating furniture” and are assigned a specific HS Code. The duty rate for sofas can vary depending on factors such as the material, country of origin, and any applicable trade agreements. Importers must make sure to correctly identify the tariff classification for their sofas to avoid any issues with customs.

Duty Rates for Living Room Furniture

The duty rate for living room furniture can vary depending on the type of furniture and the country of import. Generally, the duty rate for furniture falls between 0-20%, but it can be higher for certain types of furniture or countries. The duty rate is applied to the value of the furniture, including the cost of shipping and insurance. Importers must be aware of the duty rates for their specific type of living room furniture to accurately calculate the total cost of importing these items.

Import Tariffs for Living Room Furniture

Import tariffs are the taxes that are imposed on goods when they are brought into a country. These tariffs are determined by the tariff classification, which is based on the HTS code and the duty rate assigned to that code. Import tariffs can vary depending on the country of import, the type of living room furniture, and any applicable trade agreements. Importers must be aware of the import tariffs for their specific type of living room furniture to accurately calculate the total cost of importing these items.

Tariff Codes for Living Room Furniture

Tariff codes are the numerical codes used to classify goods in the HTS. Each type of living room furniture has a specific tariff code, which is used to determine the duty rate and other taxes that must be paid when importing these items. It is crucial for importers to accurately identify the tariff code for their living room furniture to avoid any issues with customs.

Customs Tariff for Living Room Furniture

The customs tariff is a tax that is imposed on goods when they are brought into a country. It is based on the value of the goods, including the cost of shipping and insurance, and is determined by the tariff classification. The customs tariff can vary depending on the type of living room furniture and the country of import. Importers must be aware of the customs tariff for their specific type of living room furniture to accurately calculate the total cost of importing these items.

Tariff Classification for Chairs

Chairs are another common type of living room furniture and have a specific tariff classification in the HTS. They fall under the subcategory of “upholstered seating furniture” and are assigned a specific HS Code. The duty rate for chairs can vary depending on factors such as the material, country of origin, and any applicable trade agreements. Importers must make sure to correctly identify the tariff classification for their chairs to avoid any issues with customs.

The Importance of Proper Tariff Classification for Living Room Furniture

What is Tariff Classification?

Tariff classification is the process of determining the correct tariff code for a particular product. This code is used to identify the rate of duty that must be paid for importing or exporting goods. In the case of living room furniture, the correct classification is crucial for ensuring that the appropriate duties and taxes are paid and that the furniture complies with all relevant regulations.

Tariff classification is the process of determining the correct tariff code for a particular product. This code is used to identify the rate of duty that must be paid for importing or exporting goods. In the case of living room furniture, the correct classification is crucial for ensuring that the appropriate duties and taxes are paid and that the furniture complies with all relevant regulations.

Why is it Important?

Proper tariff classification for living room furniture is important for several reasons. Firstly, it ensures that the correct amount of duty is paid, avoiding potential fines and penalties for incorrect classification. It also allows for accurate tracking of imports and exports, which is essential for trade statistics and economic analysis. Additionally, correct classification ensures compliance with safety and quality standards, protecting both consumers and the environment.

Proper tariff classification for living room furniture is important for several reasons. Firstly, it ensures that the correct amount of duty is paid, avoiding potential fines and penalties for incorrect classification. It also allows for accurate tracking of imports and exports, which is essential for trade statistics and economic analysis. Additionally, correct classification ensures compliance with safety and quality standards, protecting both consumers and the environment.

The Impact on House Design

The classification of living room furniture can also have a significant impact on house design. Different tariff codes may apply to different types of furniture, such as sofas, coffee tables, and entertainment centers. This can affect the cost and availability of these items, as well as the overall style and design of a living room.

Proper classification also plays a role in sustainable house design

, as certain materials and production methods may be subject to different tariffs. This can incentivize the use of environmentally friendly materials and processes, leading to more sustainable and eco-friendly furniture options for consumers.

The classification of living room furniture can also have a significant impact on house design. Different tariff codes may apply to different types of furniture, such as sofas, coffee tables, and entertainment centers. This can affect the cost and availability of these items, as well as the overall style and design of a living room.

Proper classification also plays a role in sustainable house design

, as certain materials and production methods may be subject to different tariffs. This can incentivize the use of environmentally friendly materials and processes, leading to more sustainable and eco-friendly furniture options for consumers.

Getting it Right

It is important for designers, manufacturers, and importers to understand the

tariff codes for living room furniture

in order to properly classify their products. This can be a complex process, as there are many different codes that may apply based on factors such as materials, construction, and purpose. Seeking the assistance of a professional customs broker or tariff classification specialist can help ensure accurate classification and compliance with all regulations.

In conclusion, proper tariff classification for living room furniture is essential for both the financial and design aspects of house design. It allows for the correct payment of duties, compliance with regulations, and the creation of sustainable and environmentally friendly furniture options. By understanding and accurately classifying living room furniture, designers and manufacturers can continue to create beautiful and functional living spaces for consumers.

It is important for designers, manufacturers, and importers to understand the

tariff codes for living room furniture

in order to properly classify their products. This can be a complex process, as there are many different codes that may apply based on factors such as materials, construction, and purpose. Seeking the assistance of a professional customs broker or tariff classification specialist can help ensure accurate classification and compliance with all regulations.

In conclusion, proper tariff classification for living room furniture is essential for both the financial and design aspects of house design. It allows for the correct payment of duties, compliance with regulations, and the creation of sustainable and environmentally friendly furniture options. By understanding and accurately classifying living room furniture, designers and manufacturers can continue to create beautiful and functional living spaces for consumers.

:max_bytes(150000):strip_icc()/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)