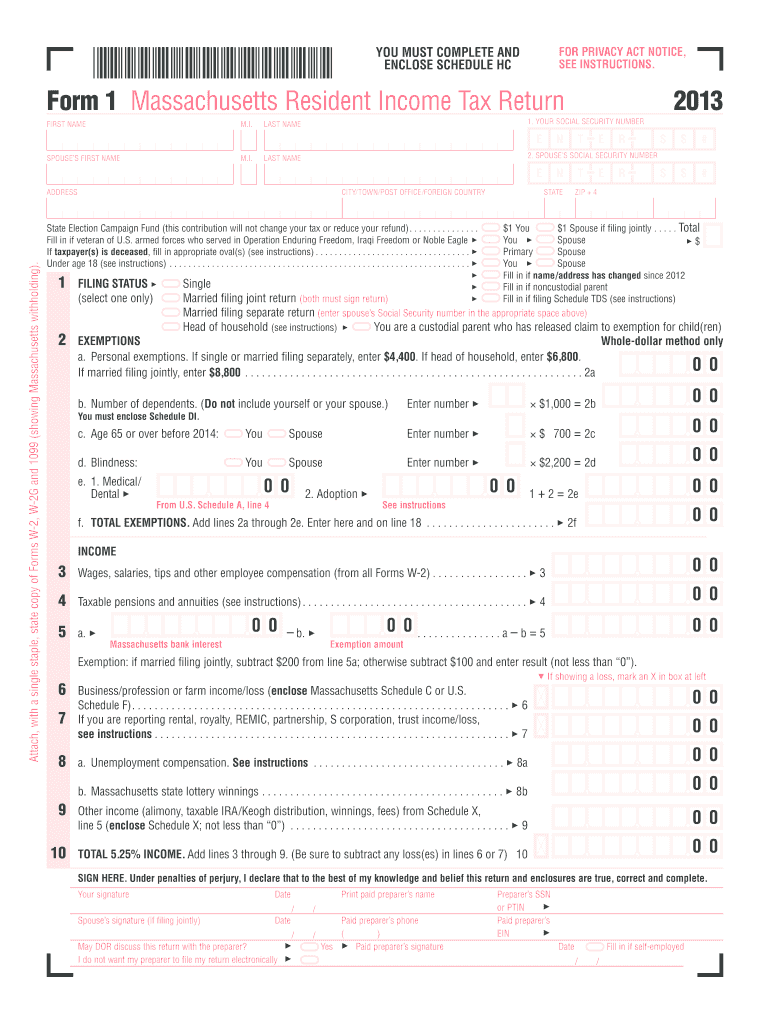

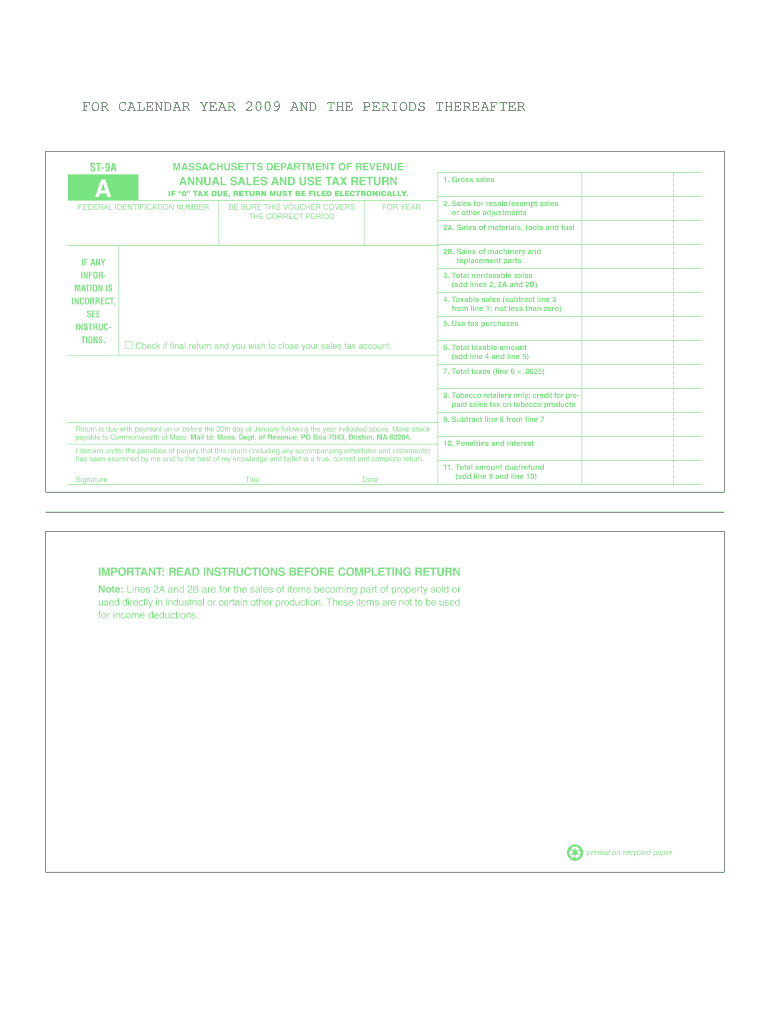

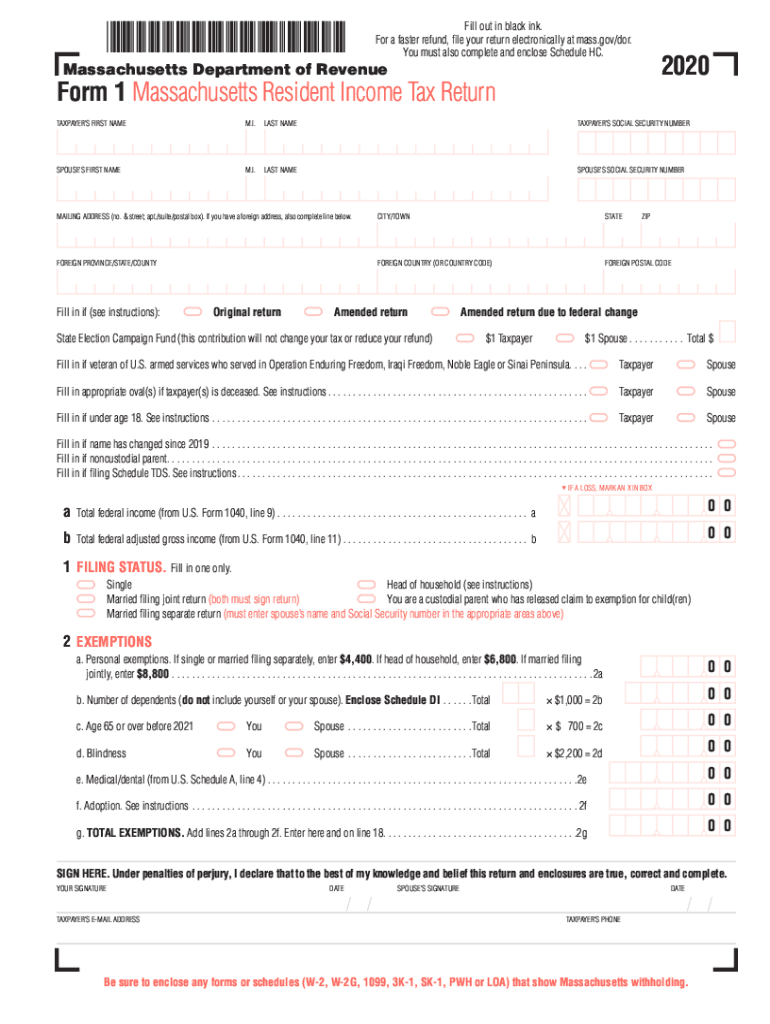

The state of Massachusetts imposes a sales and use tax on most retail sales, leases and rentals of tangible personal property, as well as certain services. The current statewide sales tax rate is 6.25%, and some local jurisdictions may also impose additional sales taxes. In this guide, we will explore the top 10 sales taxes in Massachusetts that may apply to purchasing a mattress.Massachusetts Sales and Use Tax

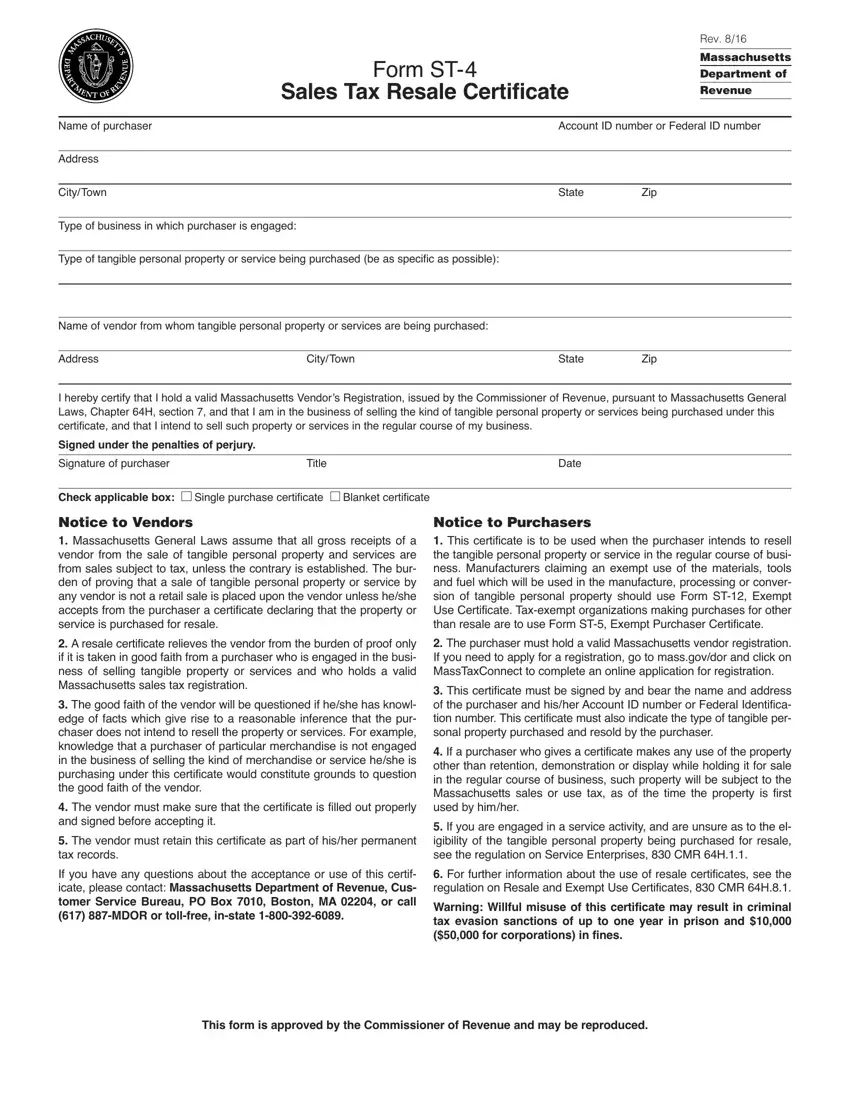

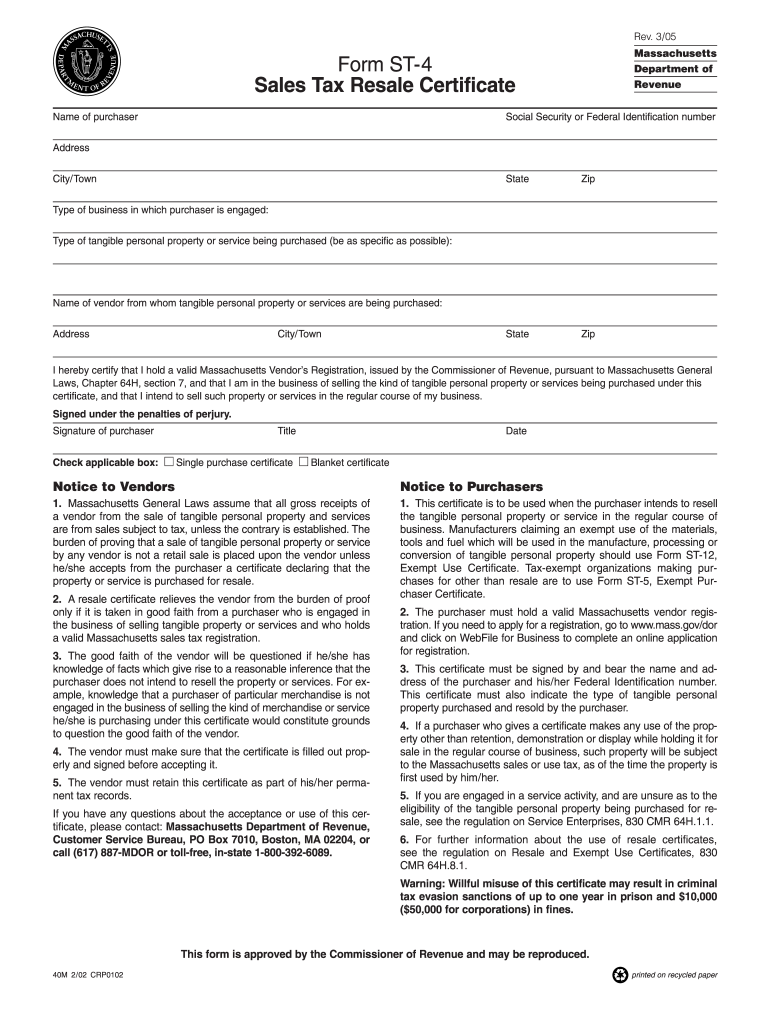

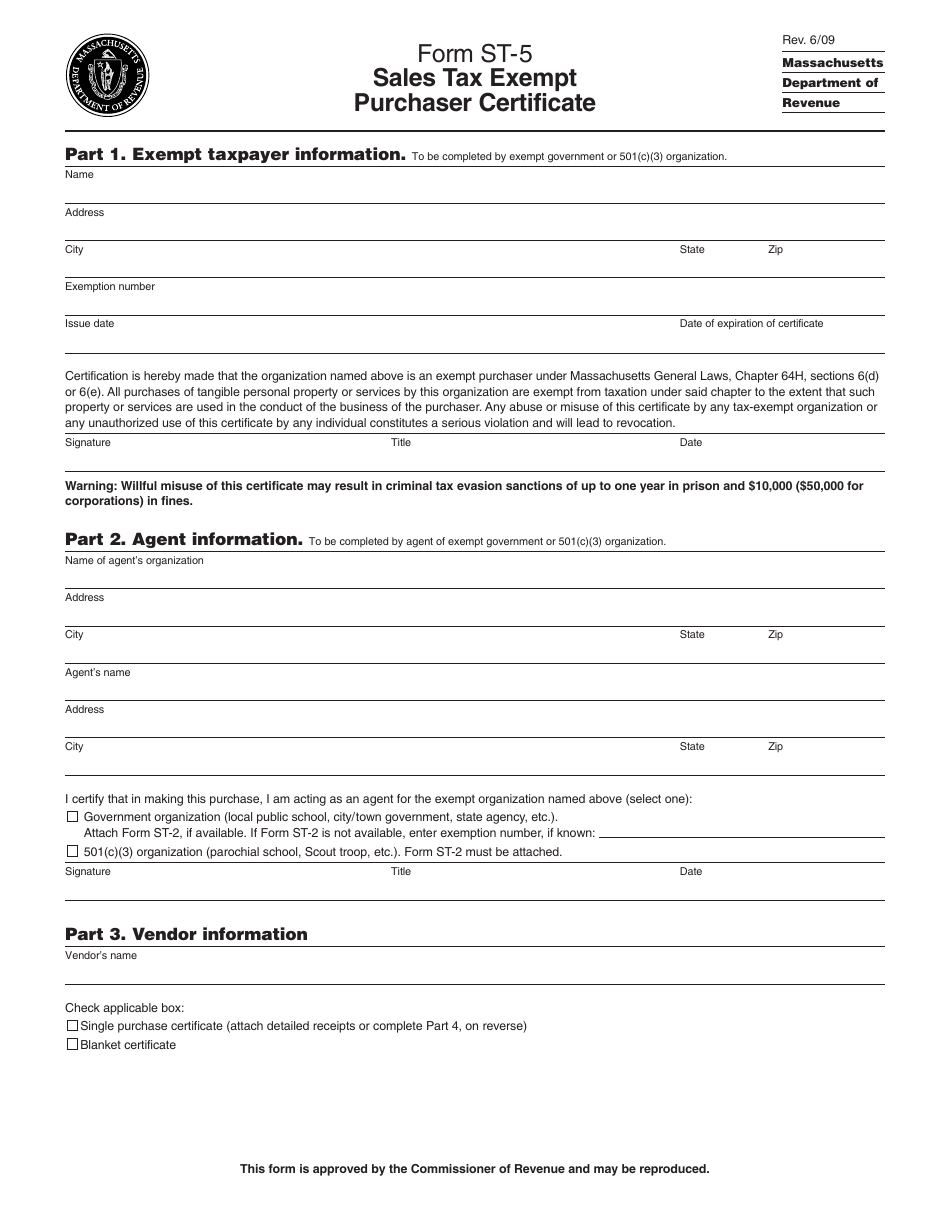

If you are a business owner in Massachusetts, it is important to understand the sales tax laws and regulations that apply to your business. The Department of Revenue provides a comprehensive Sales and Use Tax Guide for Businesses, which outlines the rules and guidelines for collecting and remitting sales taxes. This guide is a valuable resource for understanding your sales tax obligations as a business owner in Massachusetts, including any taxes that may apply to the sale of mattresses.Massachusetts Sales Tax Guide for Businesses

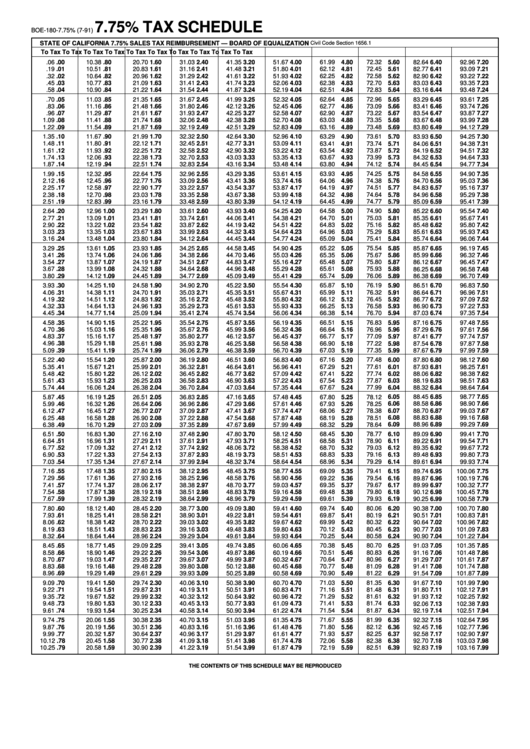

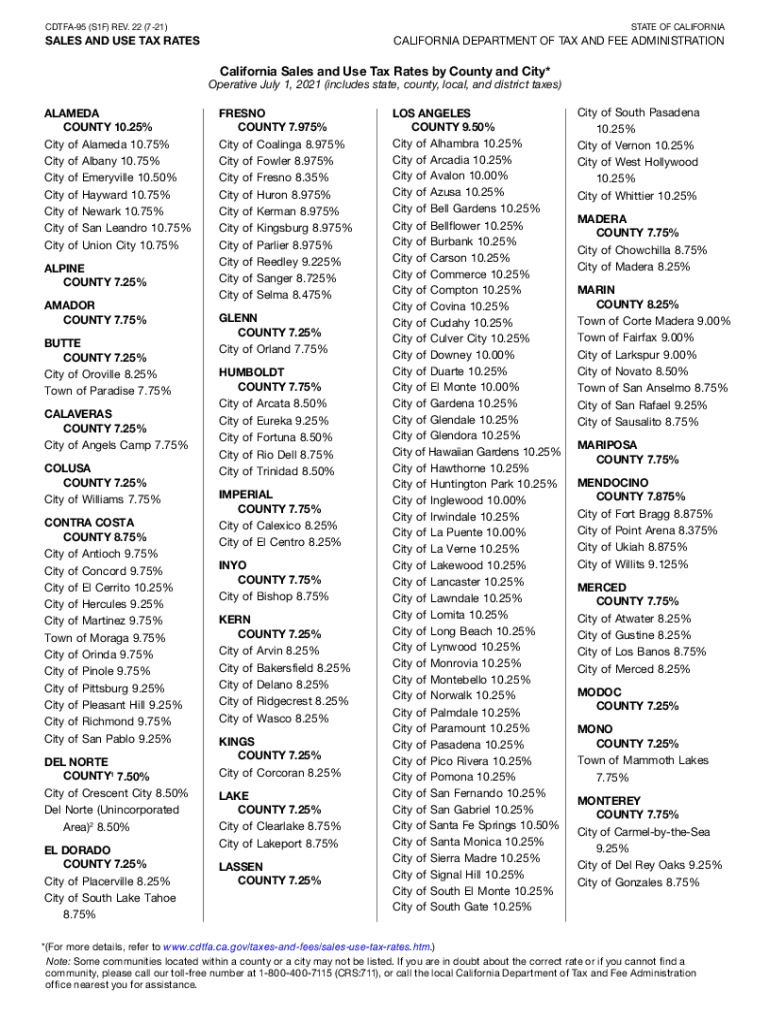

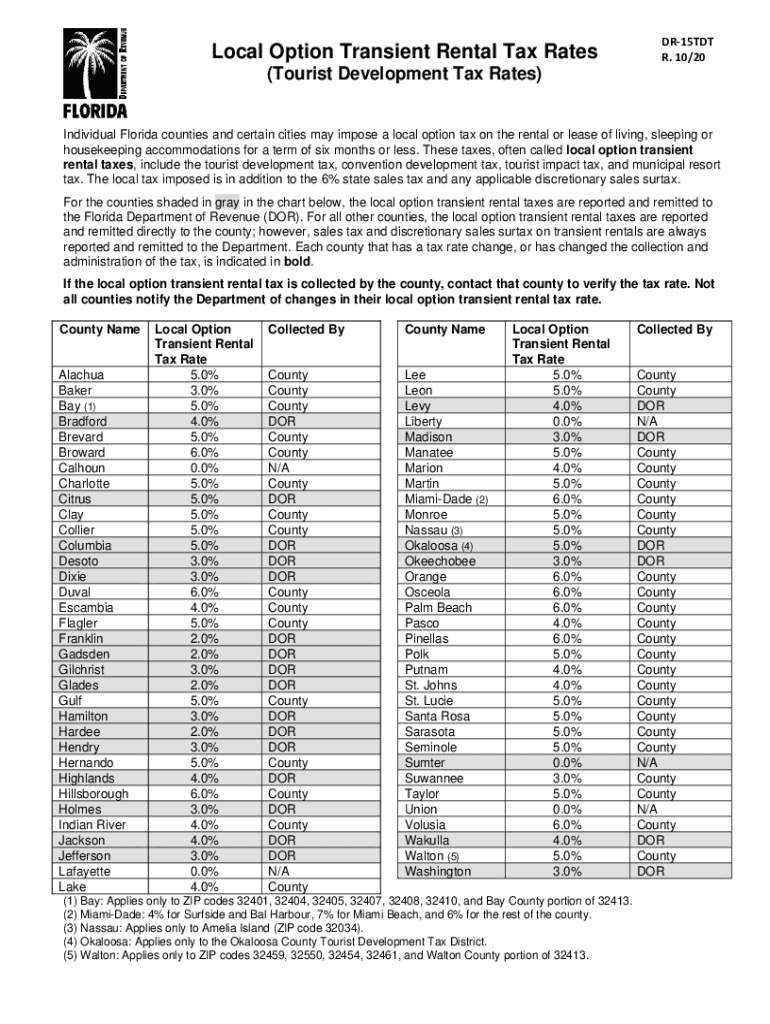

In addition to the statewide sales tax rate, many cities and counties in Massachusetts may also impose their own sales tax rates. These local taxes vary by location and can range from 0.25% to 1%, and are in addition to the statewide tax rate. It is important to check with the specific city or county where you are purchasing a mattress to determine if any local sales taxes apply.Massachusetts Sales Tax Rates By City & County 2021

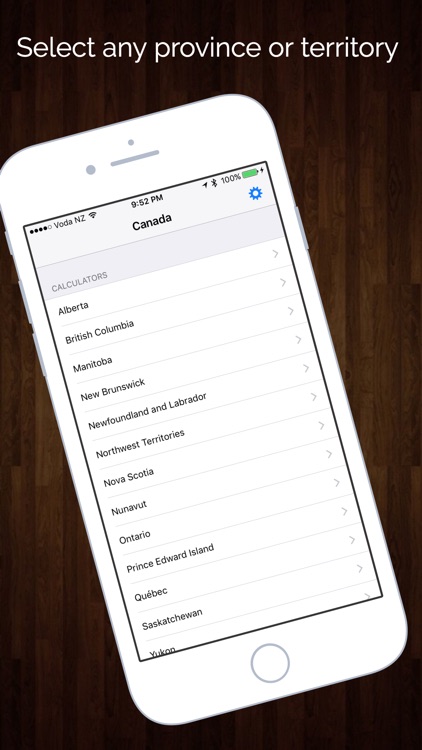

As a consumer, it can be helpful to have a sales tax calculator handy when making purchases in Massachusetts. The Department of Revenue offers an online calculator that allows you to easily calculate the total sales tax on a purchase. This can be especially useful when making large purchases such as a mattress, where the sales tax can significantly impact the final cost.Massachusetts Sales Tax Calculator

While most purchases in Massachusetts are subject to the statewide sales tax rate, there are some exemptions that may apply. For example, certain essential items like groceries and prescription medications are exempt from sales tax. Additionally, there are exemptions for certain types of clothing, such as footwear and clothing items under $175. It is important to review the list of sales tax exemptions to determine if any may apply to your purchase of a mattress in Massachusetts.Massachusetts Sales Tax Exemptions

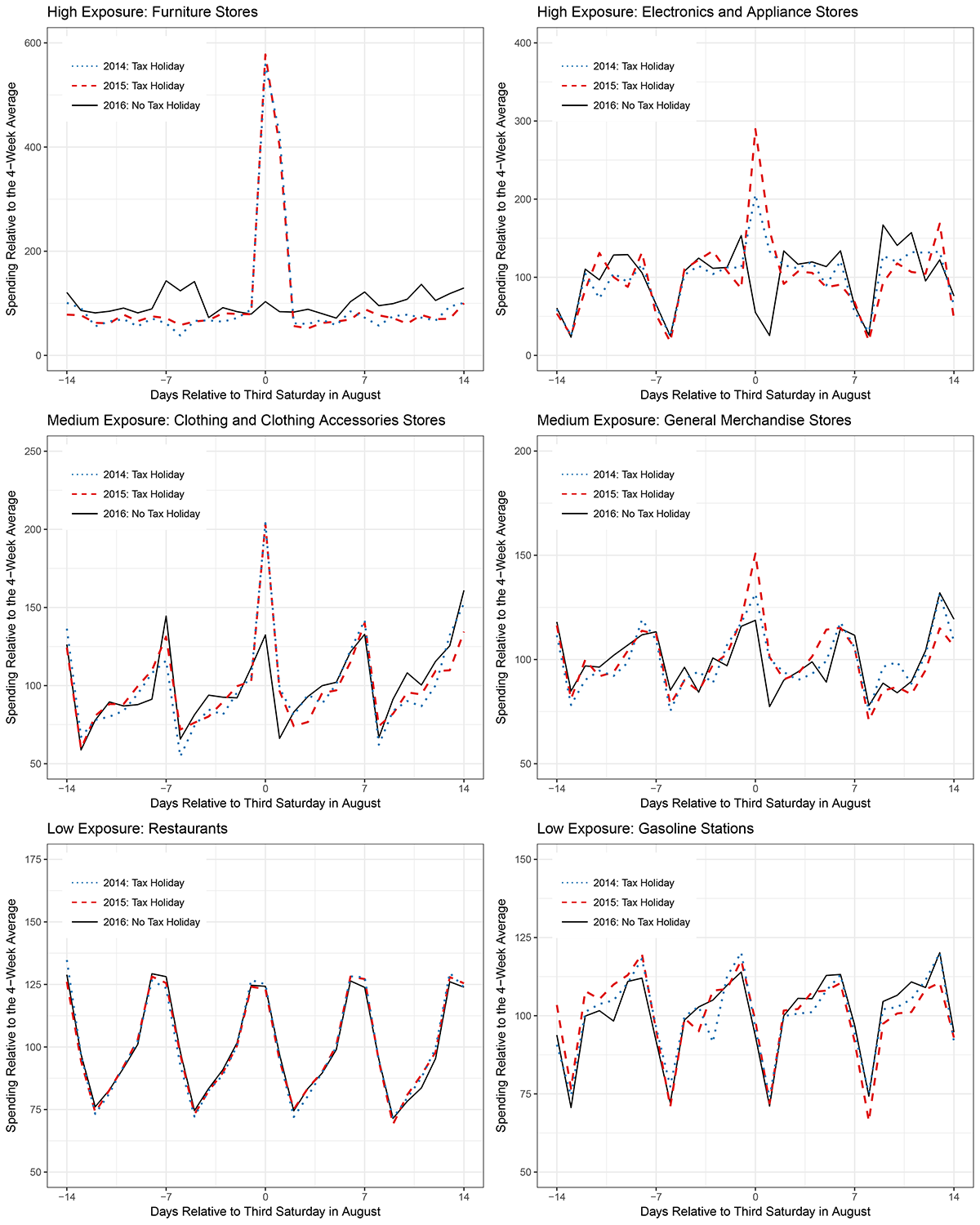

Every year, the state of Massachusetts holds a tax-free weekend where most purchases under $2,500 are exempt from the sales tax. This can be a great opportunity to save on larger purchases, such as a mattress. However, it is important to note that this sales tax holiday only applies to the statewide tax rate and does not exempt any local sales taxes that may apply.Massachusetts Sales Tax Holiday

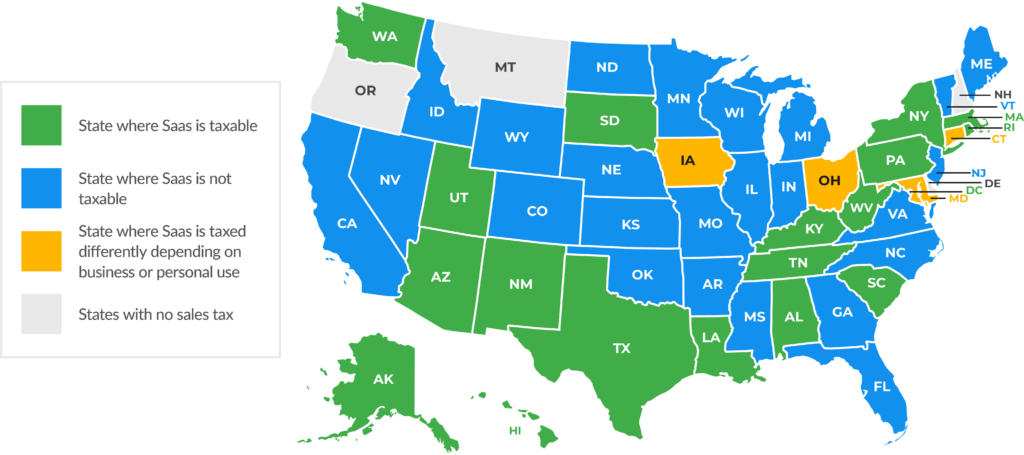

In recent years, many states including Massachusetts have implemented sales tax laws on online purchases. This means that if you purchase a mattress online from a retailer located in Massachusetts, you will be subject to the statewide sales tax rate. However, if you purchase from an out-of-state retailer, you may still be responsible for paying the sales tax directly to the state.Massachusetts Sales Tax on Online Purchases

In addition to tangible personal property, some services in Massachusetts are also subject to the sales tax. This can include services such as landscaping, dry cleaning, and personal training. If you are purchasing a mattress from a retailer that also offers delivery and set-up services, you may be subject to the sales tax on those services as well.Massachusetts Sales Tax on Services

As mentioned earlier, there are exemptions for certain types of clothing in Massachusetts. However, it is important to note that not all clothing items are exempt from sales tax. For example, formal wear and costume rentals are subject to the sales tax. When purchasing a mattress, it is important to check the sales tax rate for any clothing items that may be included in the purchase.Massachusetts Sales Tax on Clothing

Many states exempt food and groceries from sales tax, but unfortunately, Massachusetts is not one of them. Most food and grocery items are subject to the statewide sales tax rate, with the exception of certain items such as baby formula and dietary supplements. If you are purchasing a mattress from a retailer that also offers food and grocery items, you may be responsible for paying the sales tax on those items as well.Massachusetts Sales Tax on Food and Groceries

Sales Taxes in Massachusetts on Mattresses

The Impact of Sales Taxes on Mattress Purchases

When it comes to buying a new mattress, many people often overlook the added cost of sales taxes. However, in the state of Massachusetts, the sales tax on mattresses can have a significant impact on the overall cost of your purchase. With a sales tax rate of 6.25%, it is important for consumers to understand how this affects their budget and decision-making process.

Sales taxes

are a type of consumption tax that is added to the price of goods and services at the point of purchase. While each state has its own sales tax rate, Massachusetts falls in the middle range compared to other states. This can make a big difference when purchasing a high-ticket item such as a mattress.

Massachusetts

is known for having strict laws when it comes to sales tax exemptions. This means that most purchases, including mattresses, are subject to the 6.25% sales tax rate. However, there are a few exceptions to this rule.

When it comes to buying a new mattress, many people often overlook the added cost of sales taxes. However, in the state of Massachusetts, the sales tax on mattresses can have a significant impact on the overall cost of your purchase. With a sales tax rate of 6.25%, it is important for consumers to understand how this affects their budget and decision-making process.

Sales taxes

are a type of consumption tax that is added to the price of goods and services at the point of purchase. While each state has its own sales tax rate, Massachusetts falls in the middle range compared to other states. This can make a big difference when purchasing a high-ticket item such as a mattress.

Massachusetts

is known for having strict laws when it comes to sales tax exemptions. This means that most purchases, including mattresses, are subject to the 6.25% sales tax rate. However, there are a few exceptions to this rule.

Exemptions for Sales Taxes on Mattresses

Individuals who have a valid medical reason for purchasing a specialized mattress may be exempt from paying sales taxes. This includes those who suffer from chronic pain, orthopedic issues, or other medical conditions that require a specific type of mattress for proper support and comfort.

Additionally,

Mattresses

purchased for resale or for business purposes may also be exempt from sales taxes. This is important for furniture stores and other retailers who sell mattresses as part of their inventory.

Individuals who have a valid medical reason for purchasing a specialized mattress may be exempt from paying sales taxes. This includes those who suffer from chronic pain, orthopedic issues, or other medical conditions that require a specific type of mattress for proper support and comfort.

Additionally,

Mattresses

purchased for resale or for business purposes may also be exempt from sales taxes. This is important for furniture stores and other retailers who sell mattresses as part of their inventory.

How to Save on Sales Taxes for Mattress Purchases

While sales taxes cannot be avoided completely, there are ways to save on the cost of a new mattress in Massachusetts. First, it is important to research and compare prices from different retailers to find the best deal. Some stores may offer discounts or promotions that can help offset the cost of sales taxes.

Another way to save is by taking advantage of sales tax holidays. In Massachusetts, there are two days each year where certain items, including mattresses, are exempt from sales taxes. These holidays typically take place in August and November and can provide significant savings for those in the market for a new mattress.

In conclusion, sales taxes can have a considerable impact on the cost of purchasing a mattress in Massachusetts. It is important for consumers to be aware of these taxes and look for ways to save, whether it be through exemptions or taking advantage of sales tax holidays. By understanding the implications of sales taxes, individuals can make informed decisions and ensure they are getting the best value for their money.

While sales taxes cannot be avoided completely, there are ways to save on the cost of a new mattress in Massachusetts. First, it is important to research and compare prices from different retailers to find the best deal. Some stores may offer discounts or promotions that can help offset the cost of sales taxes.

Another way to save is by taking advantage of sales tax holidays. In Massachusetts, there are two days each year where certain items, including mattresses, are exempt from sales taxes. These holidays typically take place in August and November and can provide significant savings for those in the market for a new mattress.

In conclusion, sales taxes can have a considerable impact on the cost of purchasing a mattress in Massachusetts. It is important for consumers to be aware of these taxes and look for ways to save, whether it be through exemptions or taking advantage of sales tax holidays. By understanding the implications of sales taxes, individuals can make informed decisions and ensure they are getting the best value for their money.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AHLTPZCG2FDGZOI56MK2C2FH5E.jpg)

.jpeg?1560128104)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/KKPD6TAOO3EZ3BJ4DUT3ROMND4.jpg)