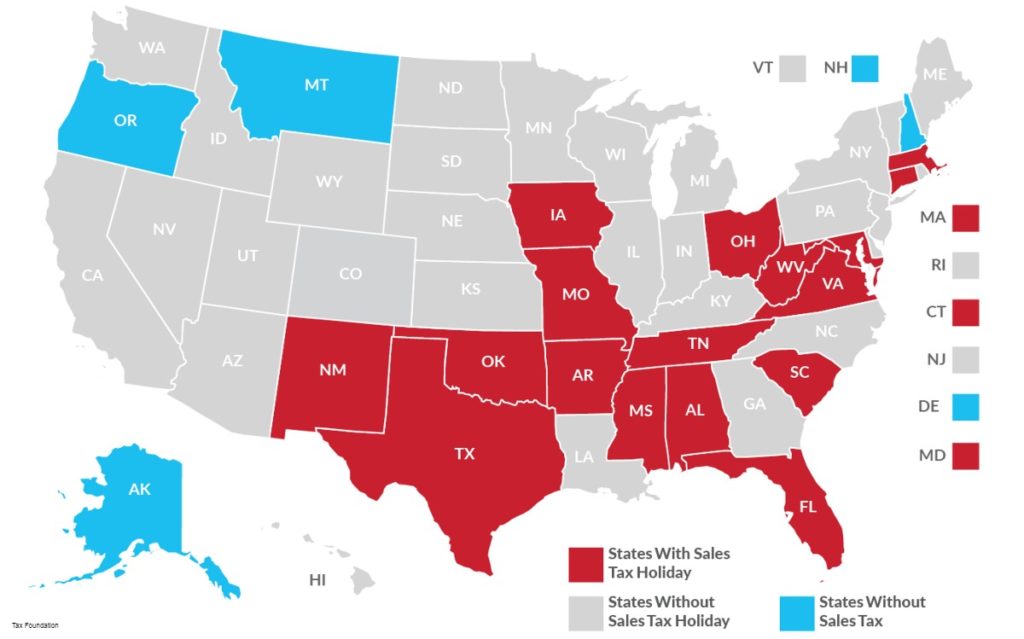

1. "Which States Have a Sales Tax on Mattresses?"

If you're in the market for a new mattress, you may be wondering if you'll have to pay sales tax on your purchase. The answer is: it depends on where you live. While some states have a sales tax on mattresses, others do not. Let's take a look at which states have a sales tax on mattresses and what that means for you.

2. "Purple Mattress Tax: What You Need to Know"

As one of the leading mattress brands on the market, Purple Mattress has gained a lot of attention in recent years. But with that attention comes questions, like whether or not you'll have to pay taxes on your Purple Mattress purchase. In this article, we'll break down everything you need to know about the Purple Mattress tax.

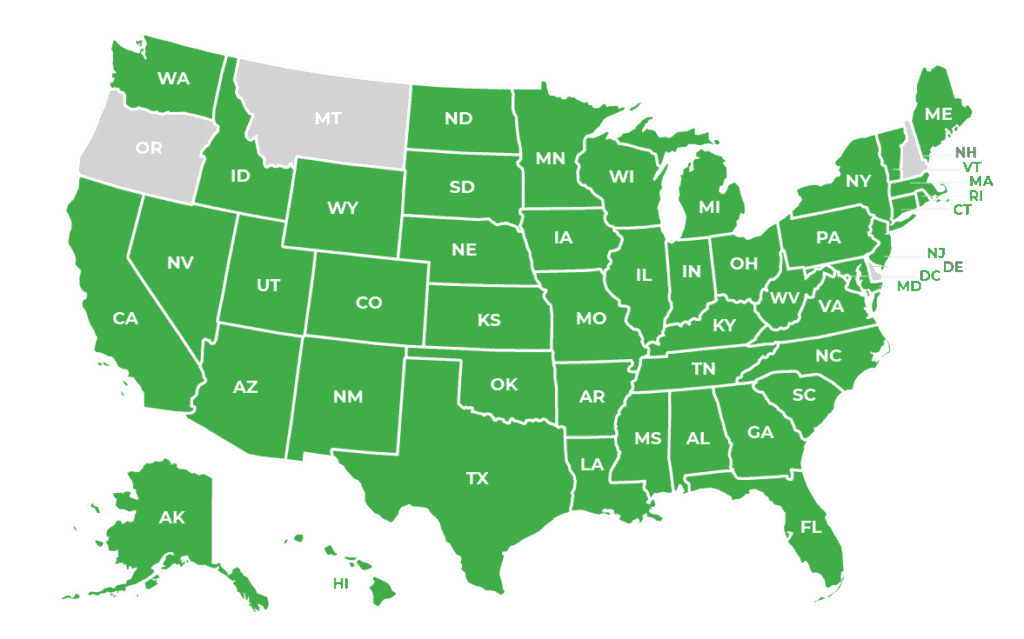

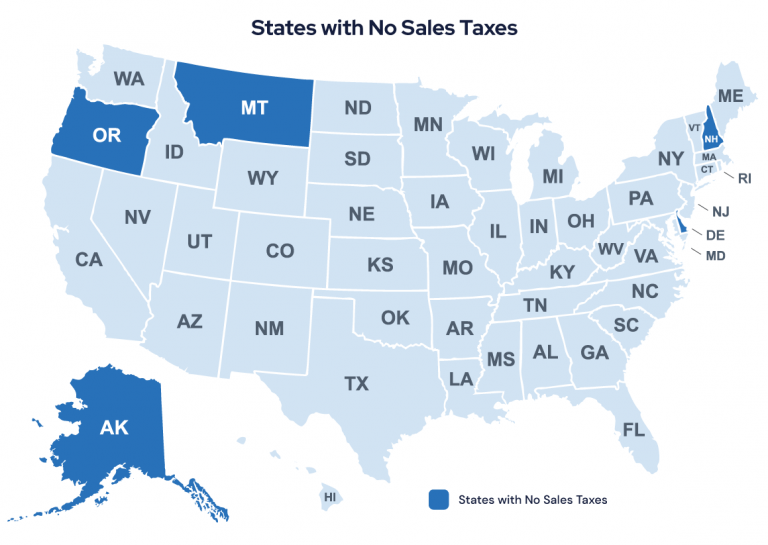

3. "States with No Sales Tax on Mattresses"

If you're looking to avoid paying sales tax on your mattress purchase, you may want to consider moving to one of the states that does not have a sales tax on mattresses. These states include Alaska, Delaware, Montana, New Hampshire, and Oregon. Keep in mind, however, that some of these states may have local sales taxes in certain areas.

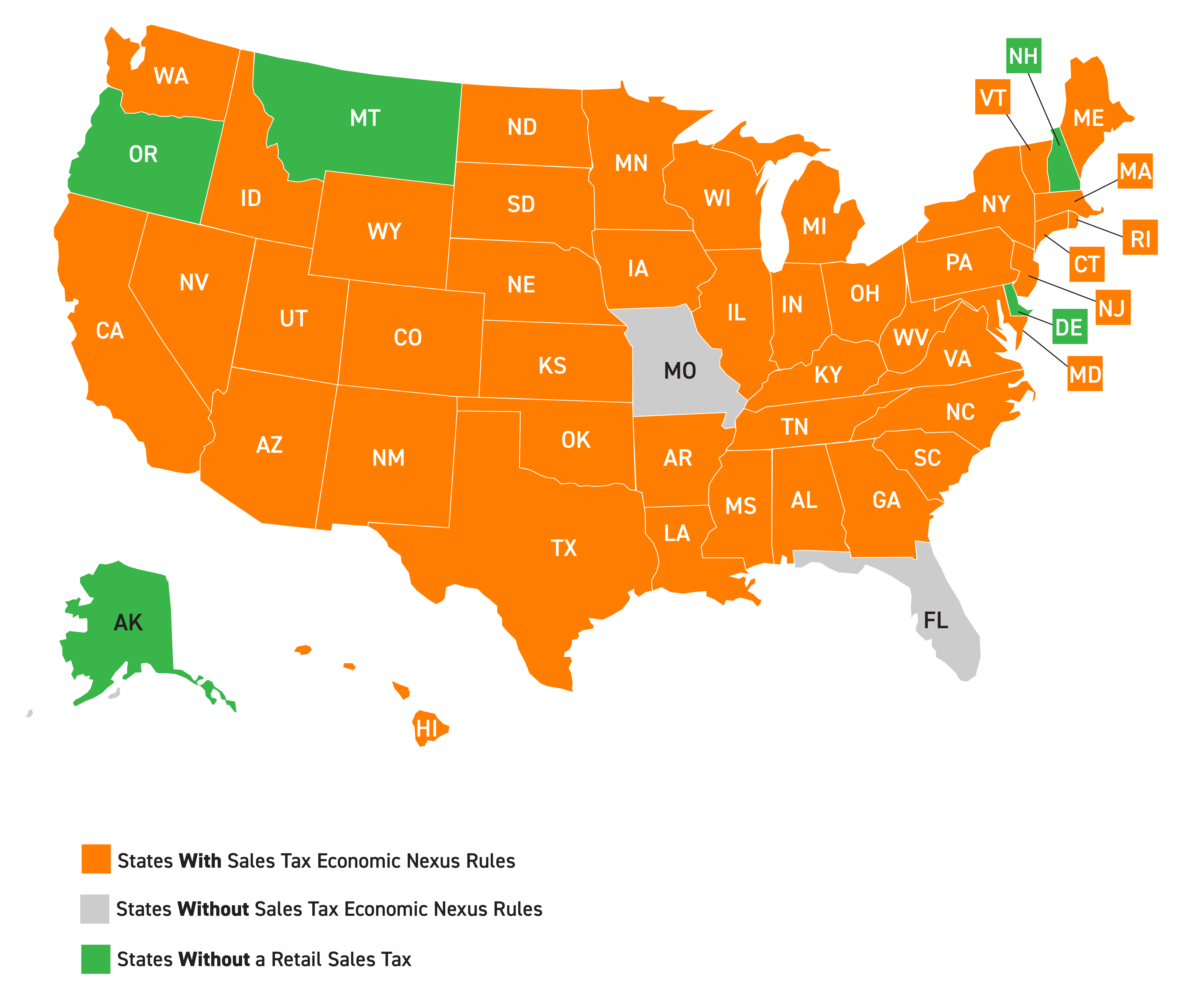

4. "Purple Mattress Tax: A State-by-State Guide"

Each state has its own unique tax laws, which means the Purple Mattress tax may vary depending on where you live. Our state-by-state guide will break down the sales tax laws for each state and how they may affect your Purple Mattress purchase. This will help you better understand what to expect when it comes to taxes on your new mattress.

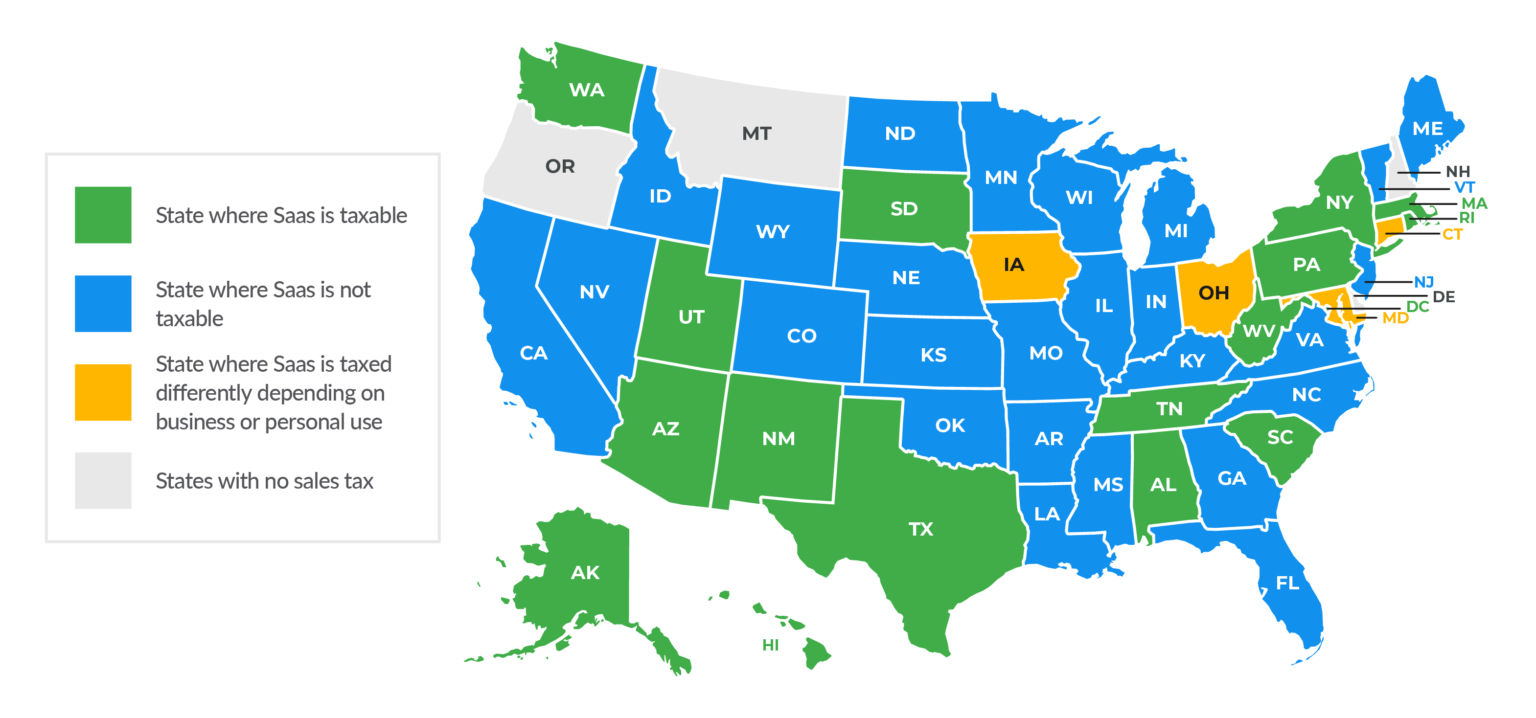

5. "Do I Have to Pay Sales Tax on a Purple Mattress?"

If you're considering purchasing a Purple Mattress, you may be wondering if you'll have to pay sales tax on top of the cost of the mattress. The answer is yes, in most states. Sales tax is typically applied to all retail purchases, including mattresses. However, the amount of tax you'll pay may vary depending on where you live.

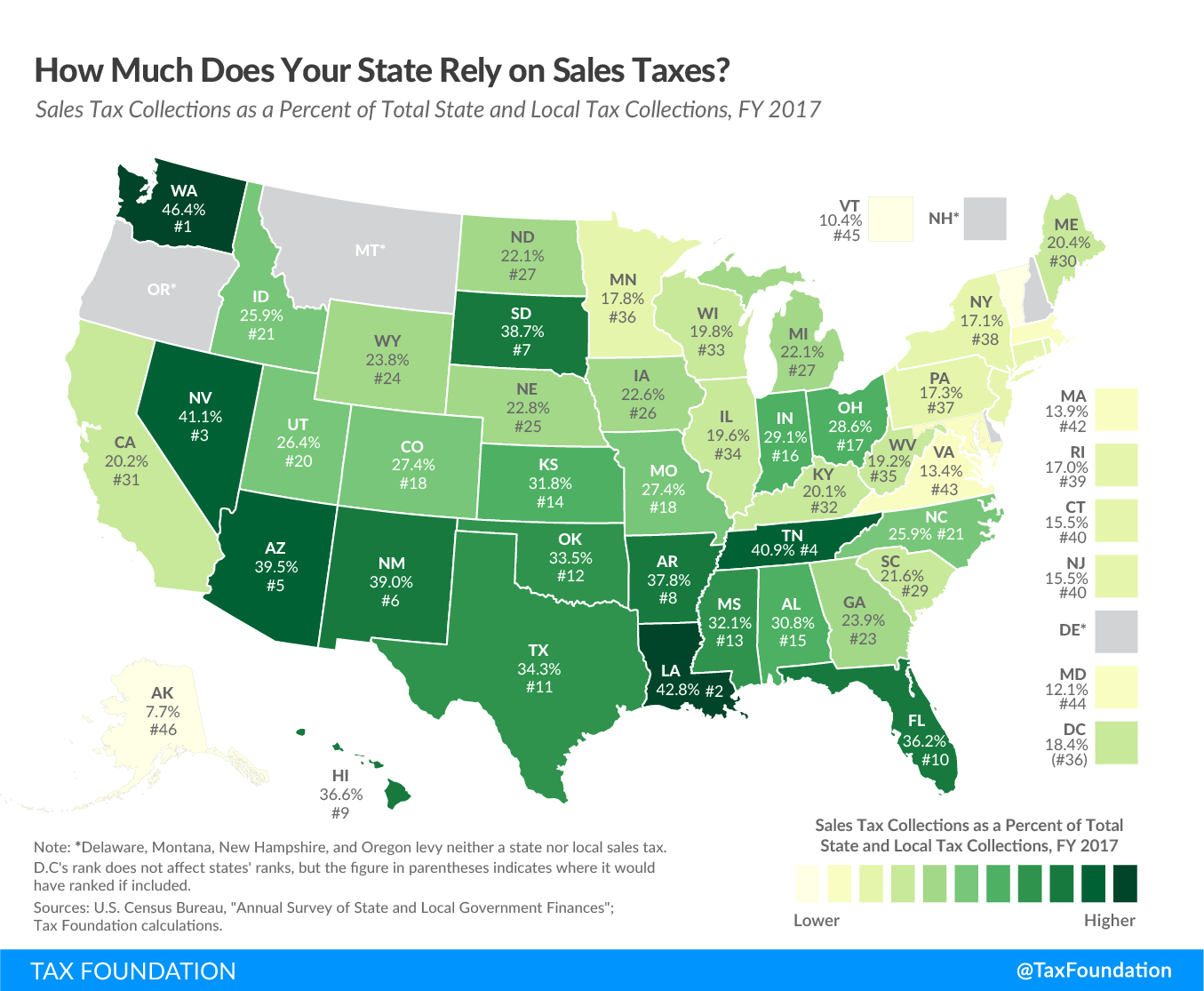

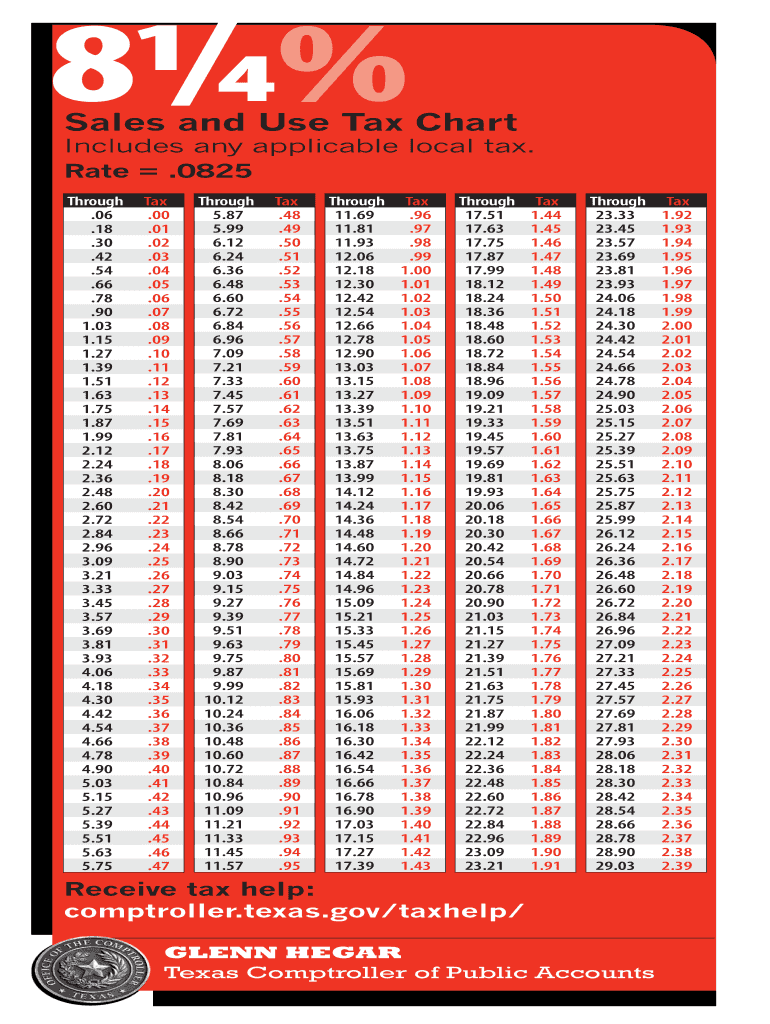

6. "States with the Highest Sales Tax on Mattresses"

When it comes to sales tax on mattresses, some states have higher rates than others. For example, California has a state sales tax rate of 7.25%, while Tennessee has a state sales tax rate of 7%. In addition to state sales tax, some states also have local taxes that may increase the overall tax rate. It's important to be aware of these rates when making your mattress purchase.

7. "Purple Mattress Tax: Understanding State Sales Tax Laws"

The world of sales tax laws can be complex and confusing. But when it comes to purchasing a Purple Mattress, it's important to have a basic understanding of how state sales tax laws work. This will help you determine how much you'll pay in taxes on your mattress purchase and ensure that you're following all necessary laws and regulations.

8. "Which States Have a Luxury Tax on Mattresses?"

In addition to sales tax, some states also have luxury taxes on certain goods, including mattresses. This means that if you're purchasing a high-end mattress, you may be subject to an additional tax. It's important to research the luxury tax laws in your state and factor that into your mattress budget.

9. "Purple Mattress Tax: How Much Will You Pay?"

It's natural to want to know how much you'll have to pay in taxes on your Purple Mattress purchase. While the exact amount will vary depending on where you live, we can give you a general idea. For example, if you live in a state with a 7% sales tax and purchase a Purple Mattress for $1,000, you'll pay an additional $70 in taxes.

10. "States with the Lowest Sales Tax on Mattresses"

If you're looking to save some money on your mattress purchase, you may want to consider buying it in a state with a lower sales tax rate. For example, Alaska has no state sales tax, meaning you'll only have to pay local taxes. Other states with low sales tax rates include Hawaii, Wisconsin, and Wyoming. Do some research to see which state may offer the best tax savings for your mattress purchase.

The Impact of Purple Mattress on House Design in Tax States

The Rise of Purple Mattress

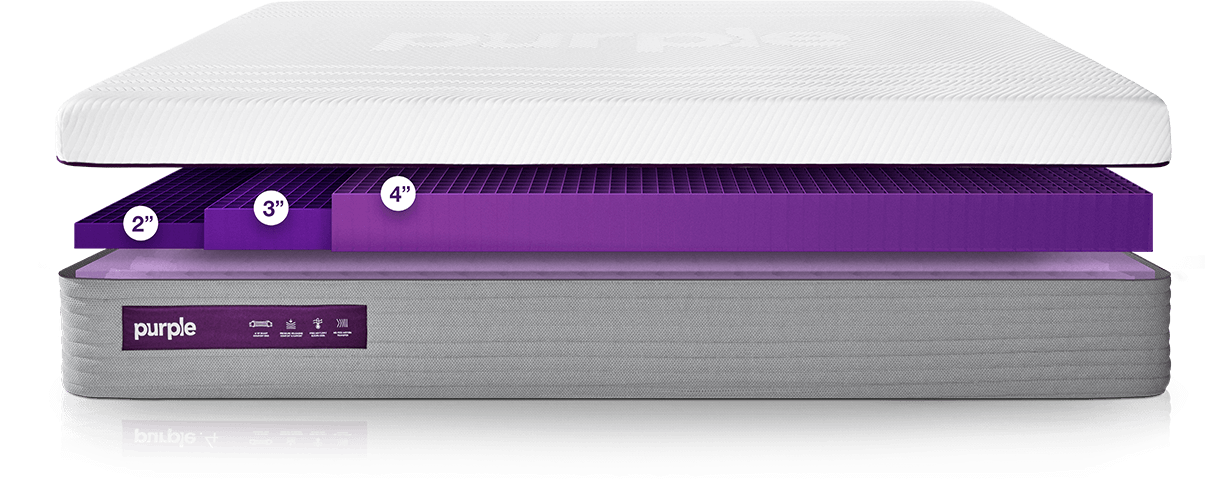

Purple mattress is a popular choice for homeowners looking for a comfortable and supportive sleeping surface. Its unique design, made of a hyper-elastic polymer material, has gained a lot of attention in recent years. Not only does it offer superior comfort and pressure relief, but it also has a long lifespan and is environmentally friendly. With its growing popularity, purple mattress has also made its way into the realm of house design.

Purple mattress is a popular choice for homeowners looking for a comfortable and supportive sleeping surface. Its unique design, made of a hyper-elastic polymer material, has gained a lot of attention in recent years. Not only does it offer superior comfort and pressure relief, but it also has a long lifespan and is environmentally friendly. With its growing popularity, purple mattress has also made its way into the realm of house design.

The Tax Benefits of Purple Mattress

One of the main reasons for the rise of purple mattress in house design is its impact on tax states. As more and more states continue to implement taxes on traditional mattresses, purple mattress has become a more appealing option for homeowners. This is because purple mattress is classified as a medical device due to its ability to relieve pressure and improve sleep quality. As a result, it is exempt from sales tax in many states, making it a more cost-effective choice for homeowners.

One of the main reasons for the rise of purple mattress in house design is its impact on tax states. As more and more states continue to implement taxes on traditional mattresses, purple mattress has become a more appealing option for homeowners. This is because purple mattress is classified as a medical device due to its ability to relieve pressure and improve sleep quality. As a result, it is exempt from sales tax in many states, making it a more cost-effective choice for homeowners.

The Aesthetic Appeal of Purple Mattress

Aside from its tax benefits, purple mattress also offers a unique and modern aesthetic to house design. Its signature purple color adds a pop of vibrancy to any room and can serve as a statement piece. Additionally, its sleek and minimalist design can complement a variety of interior styles, from contemporary to bohemian. With purple mattress, homeowners have the opportunity to combine comfort and style in their house design.

Aside from its tax benefits, purple mattress also offers a unique and modern aesthetic to house design. Its signature purple color adds a pop of vibrancy to any room and can serve as a statement piece. Additionally, its sleek and minimalist design can complement a variety of interior styles, from contemporary to bohemian. With purple mattress, homeowners have the opportunity to combine comfort and style in their house design.

The Versatility of Purple Mattress

Another factor contributing to the impact of purple mattress on house design is its versatility. Unlike traditional mattresses that are limited to bedroom use, purple mattress can be incorporated into various areas of the house. Its lightweight and compact design make it easy to move around, making it a great addition to living rooms, guest rooms, and even outdoor spaces. This flexibility allows homeowners to create a more comfortable and inviting environment in their homes.

Another factor contributing to the impact of purple mattress on house design is its versatility. Unlike traditional mattresses that are limited to bedroom use, purple mattress can be incorporated into various areas of the house. Its lightweight and compact design make it easy to move around, making it a great addition to living rooms, guest rooms, and even outdoor spaces. This flexibility allows homeowners to create a more comfortable and inviting environment in their homes.

Incorporating Purple Mattress into Your Home

With its numerous benefits, it's no wonder that purple mattress has become a popular choice for house design in tax states. If you're considering incorporating purple mattress into your home, there are many creative ways to do so. From using it as a seating option in your living room to incorporating it into your outdoor patio furniture, the possibilities are endless. Not only will it add a touch of comfort and style to your home, but it will also save you money in the long run.

In conclusion,

purple mattress has made a significant impact on house design in tax states. Its unique design, tax benefits, aesthetic appeal, and versatility make it a desirable choice for homeowners looking to improve their sleep quality and enhance their living spaces. With purple mattress, you can achieve both comfort and style in your home. So why settle for a traditional mattress when you can have the best of both worlds with purple mattress?

With its numerous benefits, it's no wonder that purple mattress has become a popular choice for house design in tax states. If you're considering incorporating purple mattress into your home, there are many creative ways to do so. From using it as a seating option in your living room to incorporating it into your outdoor patio furniture, the possibilities are endless. Not only will it add a touch of comfort and style to your home, but it will also save you money in the long run.

In conclusion,

purple mattress has made a significant impact on house design in tax states. Its unique design, tax benefits, aesthetic appeal, and versatility make it a desirable choice for homeowners looking to improve their sleep quality and enhance their living spaces. With purple mattress, you can achieve both comfort and style in your home. So why settle for a traditional mattress when you can have the best of both worlds with purple mattress?