Are you thinking about getting rid of your old Purple mattress and want to make a positive impact at the same time? Donating your mattress to charity is a great option, as it not only helps someone in need, but it also allows you to potentially receive a tax deduction. However, there are certain things you need to know before making a mattress donation to ensure you are following all the necessary steps.Donating a Purple Mattress to Charity: What You Need to Know

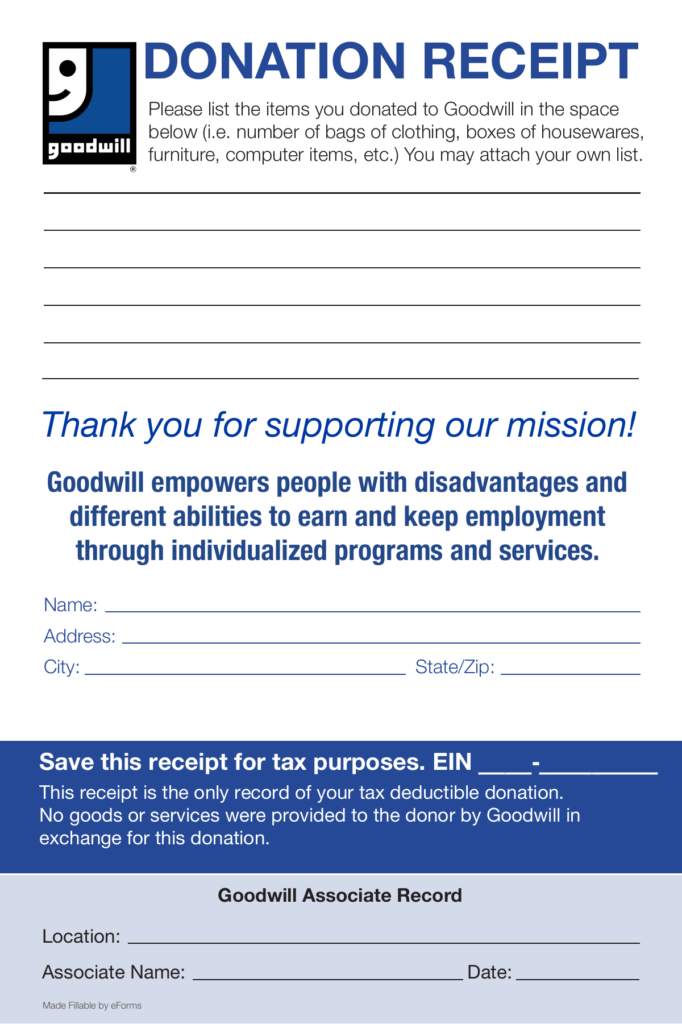

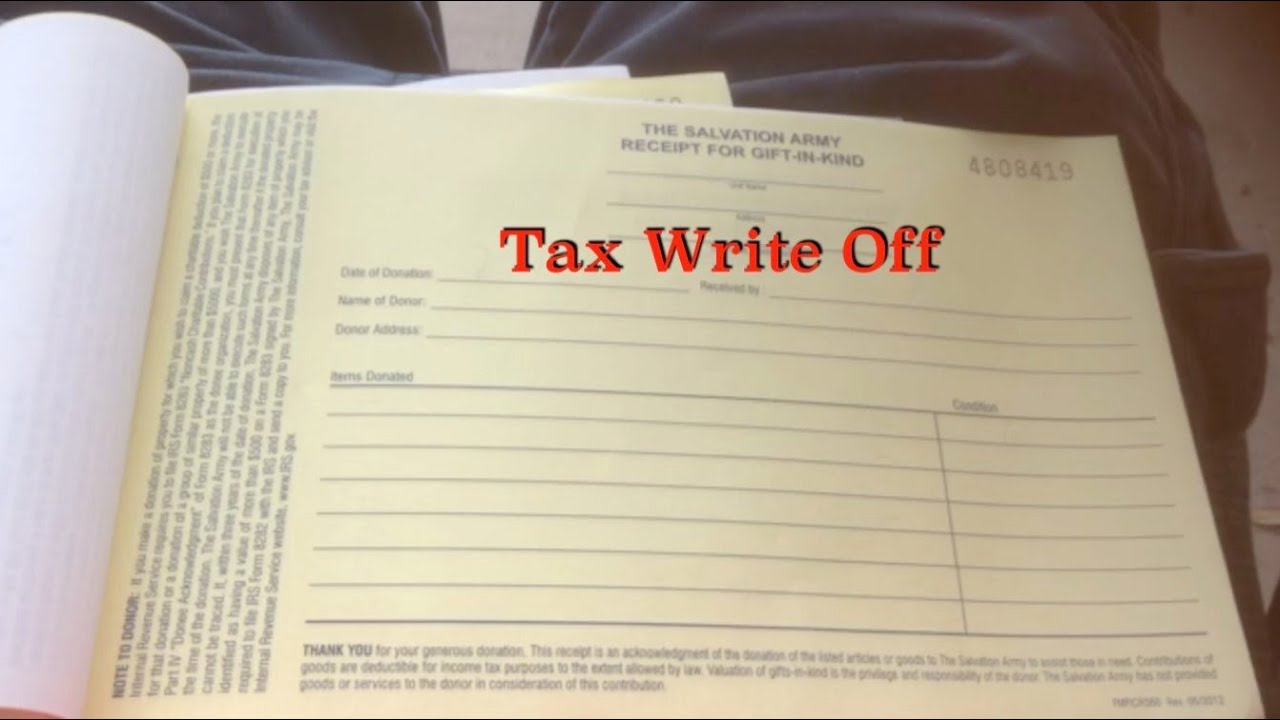

Donating a mattress to charity is a simple process, but in order to receive a tax deduction, there are a few additional steps you will need to take. First, make sure to find a reputable charity that accepts mattress donations. Many local charities, such as homeless shelters or women's shelters, may accept mattress donations. You can also check with national organizations such as Goodwill or the Salvation Army. Once you have found a charity to donate to, make sure to get a receipt for your donation. This will serve as proof of your donation and will be necessary when claiming a tax deduction. It is also important to note that the value of your mattress donation must be determined by the fair market value, not the original purchase price.How to Donate a Mattress to Charity for a Tax Deduction

When it comes to claiming a tax deduction for your mattress donation, there are a few things you need to keep in mind. First, you must itemize your deductions on your tax return in order to claim a deduction for charitable donations. This means that you will need to have other deductible expenses, such as mortgage interest or medical expenses, in addition to your mattress donation. Additionally, the total amount of your charitable donations, including your mattress donation, must exceed the standard deduction in order to be beneficial. For the 2021 tax year, the standard deduction for single filers is $12,550 and $25,100 for married couples filing jointly.Charitable Donation Tax Deductions: What You Need to Know

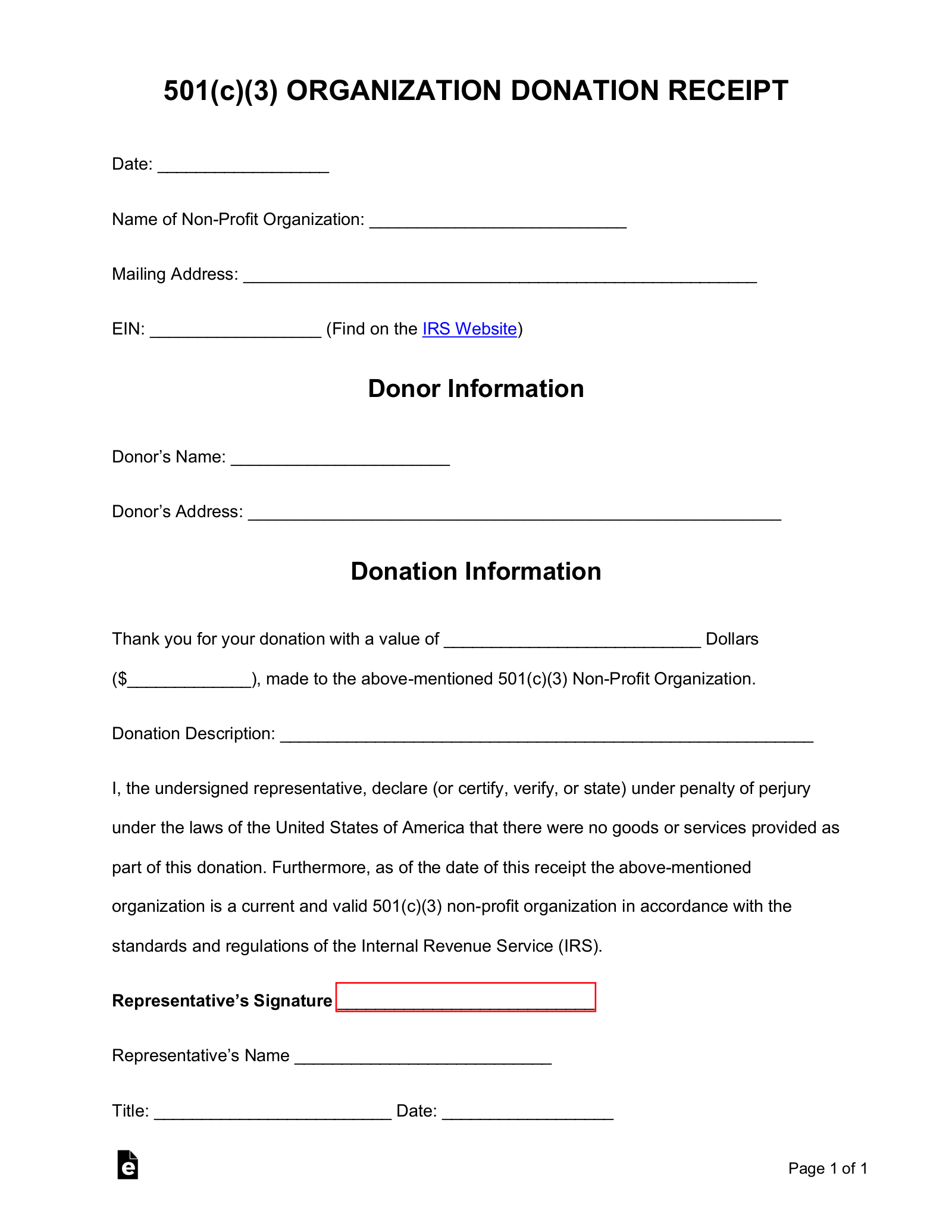

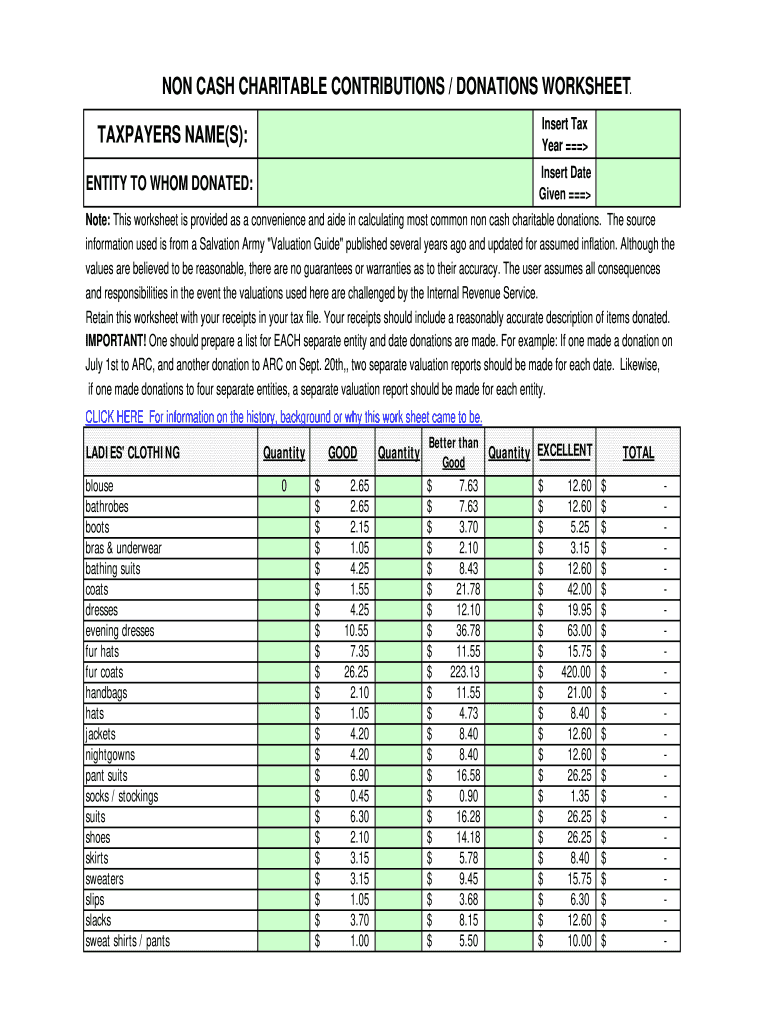

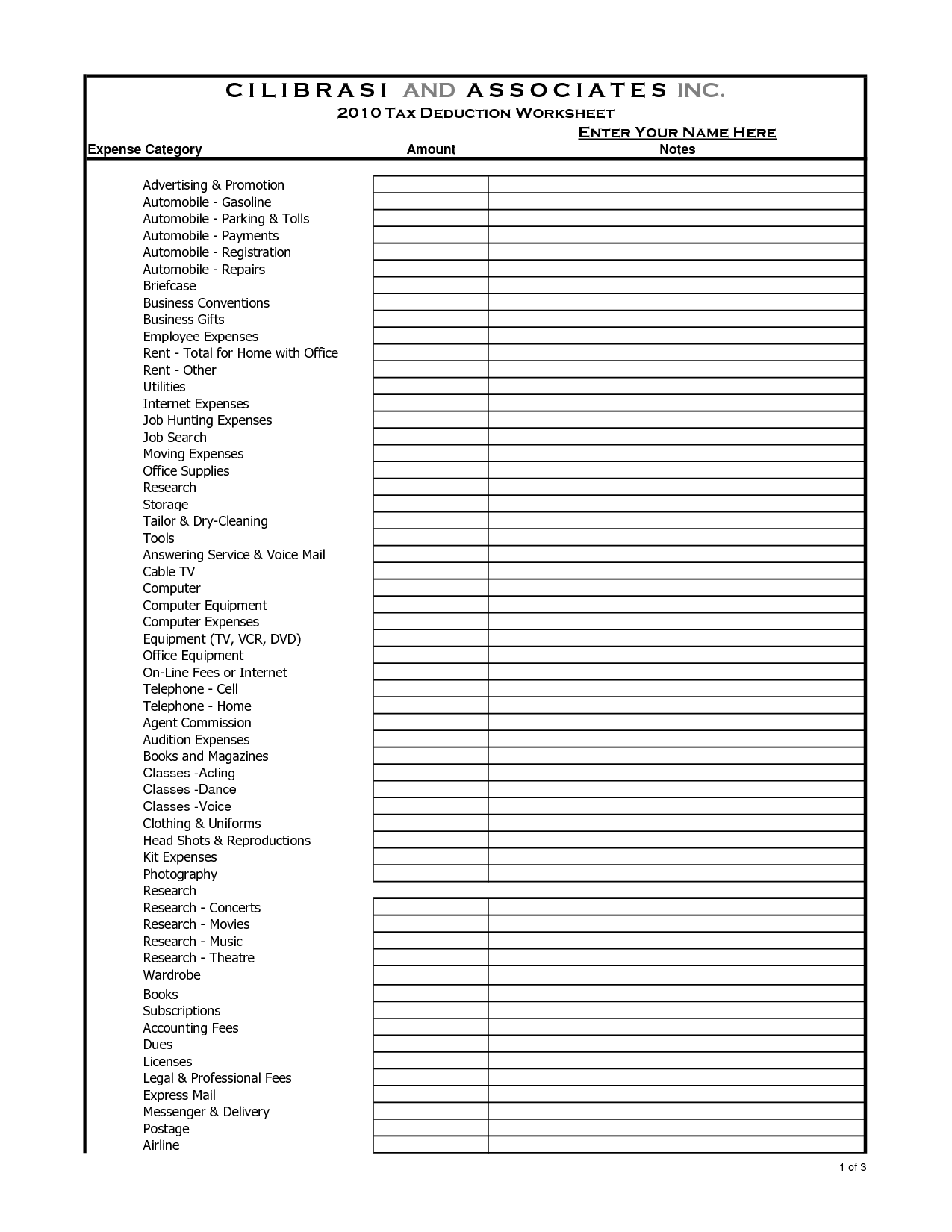

In order to receive a tax deduction for your mattress donation, you will need to file Form 8283 with your tax return. This form is used to report non-cash charitable contributions and will require you to provide details about your donation, such as the name and address of the charity, the date of the donation, and a description of the donated item. It is important to note that if your mattress is valued at more than $500, you will also need to have a qualified appraisal of the item. This will need to be submitted with your tax return in order to claim the deduction.How to Get a Tax Deduction for Donating a Mattress

If you are specifically looking to donate a Purple mattress, there are a few additional steps you will need to take. Purple offers a recycling program for their customers, where they will pick up your old mattress and properly recycle it for a small fee. However, this program does not allow for a tax deduction. If you still want to donate your Purple mattress to charity, you can do so by following the steps mentioned earlier. Just be sure to let the charity know that your mattress is a Purple brand, as some may have specific guidelines for accepting certain brands or types of mattresses.Purple Mattress Donation: How to Donate and Get a Tax Deduction

When it comes to donating a mattress and receiving a tax deduction, it is important to follow all of the necessary steps and keep proper documentation. This will ensure that you are able to receive the maximum benefit from your donation. Make sure to research the charity you are donating to and understand their guidelines for mattress donations. It is also a good idea to take photos of your mattress before donating it as proof of its condition. And don't forget to get a receipt and file Form 8283 with your tax return.How to Donate a Mattress and Get a Tax Deduction

Donating to charity not only helps those in need, but it can also benefit you come tax time. However, it is important to fully understand the rules and regulations surrounding charitable donation tax deductions in order to receive the maximum benefit. This includes knowing the fair market value of your donation, properly documenting your donation, and filing the necessary forms with your tax return. It is also a good idea to consult with a tax professional if you have any questions about claiming a deduction for your mattress donation or any other charitable contributions.Charitable Donation Tax Deductions: A Complete Guide

Donating your mattress to charity is a wonderful way to give back to your community and potentially receive a tax deduction. However, it is important to do your research and follow all necessary steps in order to ensure a smooth donation process. Remember to choose a reputable charity, get a receipt for your donation, and file all necessary forms with your tax return. And don't forget to spread the word about your experience to encourage others to do the same.Donating a Mattress to Charity: What You Need to Know

If you are looking to donate more than just your mattress, you may be wondering how to receive a tax deduction for your furniture donations. The process is very similar to donating a mattress, but it is important to note that the fair market value of your furniture may be different than the value of your mattress. Make sure to research the fair market value of your furniture before making a donation to ensure you are properly reporting it on your tax return.How to Get a Tax Deduction for Donating Furniture

Donating to charity not only helps others, but it can also provide a tax break for you. By following the necessary steps and properly documenting your donation, you can receive a tax deduction for your Purple mattress donation. Make sure to check with your chosen charity for any specific guidelines and always consult with a tax professional if you have any questions. Your generosity can make a difference in someone's life and provide a benefit for you at the same time.Purple Mattress Donation: How to Donate and Get a Tax Break

How Donating Your Purple Mattress Can Benefit Your Taxes and the Community

What is a Purple Mattress?

Purple mattresses

have become increasingly popular in recent years due to their unique design and comfortable materials. These mattresses are known for their use of a proprietary material called "Hyper-Elastic Polymer" which provides pressure relief and support for a better night's sleep. With its distinctive purple color and innovative technology, these mattresses have gained a loyal following among consumers.

Purple mattresses

have become increasingly popular in recent years due to their unique design and comfortable materials. These mattresses are known for their use of a proprietary material called "Hyper-Elastic Polymer" which provides pressure relief and support for a better night's sleep. With its distinctive purple color and innovative technology, these mattresses have gained a loyal following among consumers.

Why Donate Your Purple Mattress?

If you have decided it is time to upgrade to a new mattress, you may be wondering what to do with your old one. While simply throwing it away may seem like the easiest option, donating your

Purple mattress

can actually have some benefits for both your taxes and the community.

If you have decided it is time to upgrade to a new mattress, you may be wondering what to do with your old one. While simply throwing it away may seem like the easiest option, donating your

Purple mattress

can actually have some benefits for both your taxes and the community.

The Tax Benefits of Donating Your Purple Mattress

Donating your Purple mattress

to a qualified charitable organization can make you eligible for a tax deduction. The IRS allows taxpayers to deduct the fair market value of donated items, including mattresses, on their tax returns. This means that if your Purple mattress is still in good condition and can be used by someone else, you can claim its value as a charitable donation on your taxes.

Donating your Purple mattress

to a qualified charitable organization can make you eligible for a tax deduction. The IRS allows taxpayers to deduct the fair market value of donated items, including mattresses, on their tax returns. This means that if your Purple mattress is still in good condition and can be used by someone else, you can claim its value as a charitable donation on your taxes.

How Your Donation Helps the Community

By donating your

Purple mattress

, you are not only getting a potential tax deduction but also helping those in need. Many charitable organizations, such as homeless shelters and donation centers, rely on donated items to support their cause. Your mattress could provide a comfortable place to sleep for someone who may not have a bed of their own.

By donating your

Purple mattress

, you are not only getting a potential tax deduction but also helping those in need. Many charitable organizations, such as homeless shelters and donation centers, rely on donated items to support their cause. Your mattress could provide a comfortable place to sleep for someone who may not have a bed of their own.

How to Properly Donate Your Purple Mattress

When donating your

Purple mattress

, it is important to make sure it is in good condition and clean. Most organizations will not accept mattresses that are torn, stained, or have any damage. It is also recommended to call ahead and confirm that the organization is able to accept mattress donations, as some may have specific guidelines or restrictions.

When donating your

Purple mattress

, it is important to make sure it is in good condition and clean. Most organizations will not accept mattresses that are torn, stained, or have any damage. It is also recommended to call ahead and confirm that the organization is able to accept mattress donations, as some may have specific guidelines or restrictions.

In Conclusion

Not only can donating your

Purple mattress

benefit your taxes, but it can also make a positive impact on your community. So instead of throwing away your old mattress, consider donating it and giving it a second life. Not only will you be helping others, but you may also sleep better knowing your old mattress is being put to good use.

Not only can donating your

Purple mattress

benefit your taxes, but it can also make a positive impact on your community. So instead of throwing away your old mattress, consider donating it and giving it a second life. Not only will you be helping others, but you may also sleep better knowing your old mattress is being put to good use.

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/D2LTRFIHZZEXTAJ55QIZBWGJEU.jpg)