When you walk into a Mattress Firm store to purchase a new mattress, the price tag may not be the final cost. In fact, there is an additional cost that is often overlooked – sales tax. Many customers are unaware of how sales tax applies to their mattress purchase, resulting in confusion and unexpected expenses. In this article, we will explore the ins and outs of sales tax for Mattress Firm purchases and how it may impact your final bill.Understanding Sales Tax for Mattress Firm Purchases

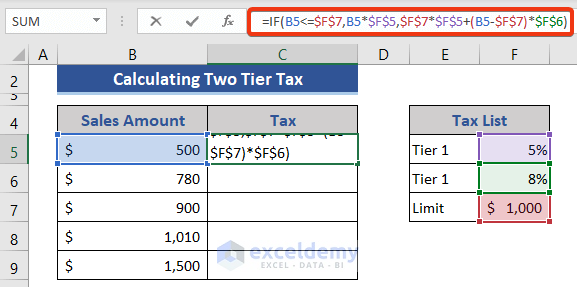

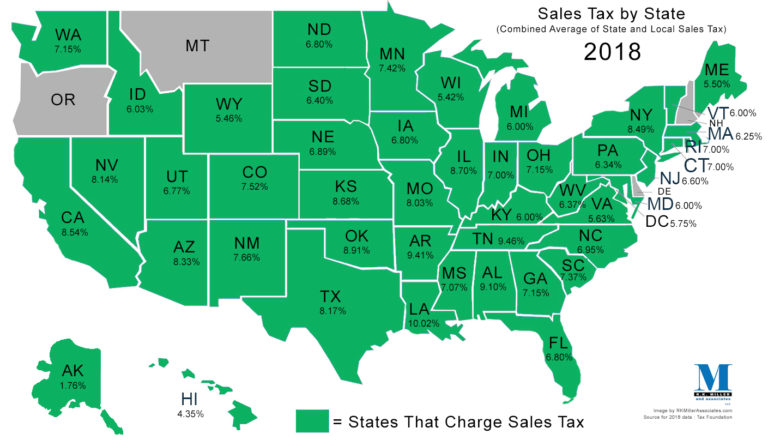

Calculating sales tax on your Mattress Firm purchase is relatively straightforward. The first step is to determine the sales tax rate in your state. This information can usually be found on your state's department of revenue website or by contacting your local tax office. Once you have the sales tax rate, simply multiply it by the price of the mattress. For example, if the sales tax rate in your state is 7% and the price of your mattress is $1,000, the sales tax would be $70.How to Calculate Sales Tax on Mattress Firm Products

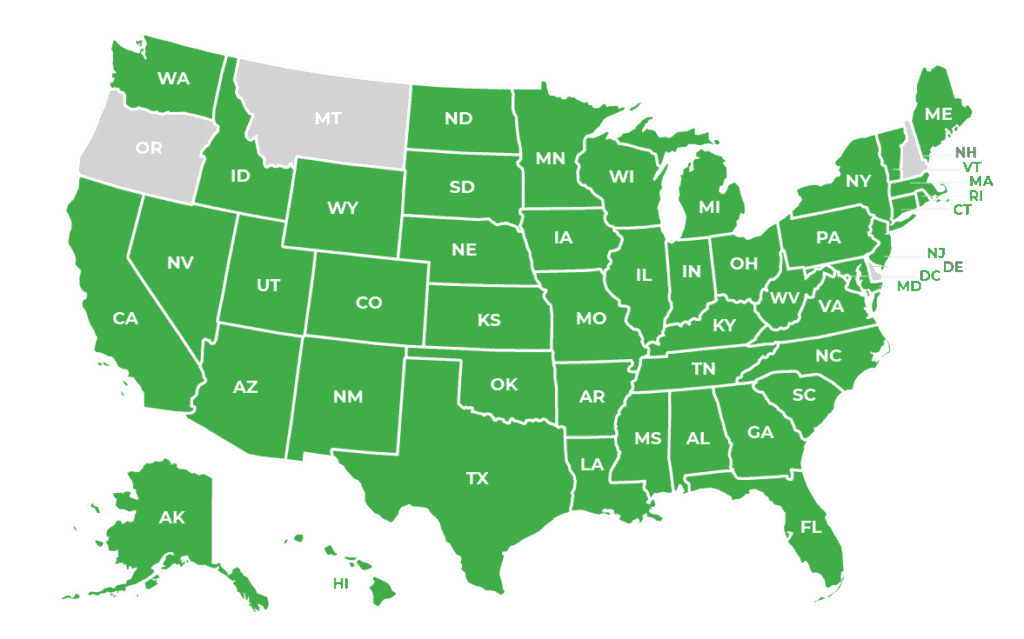

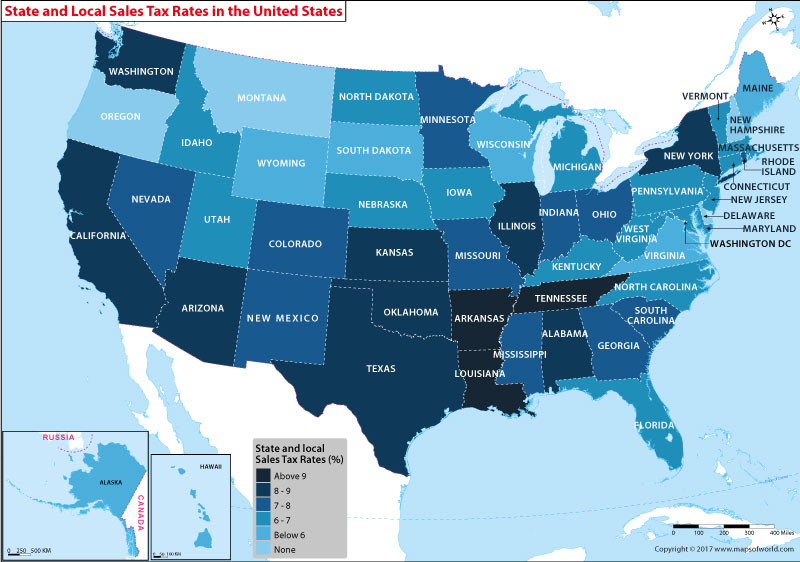

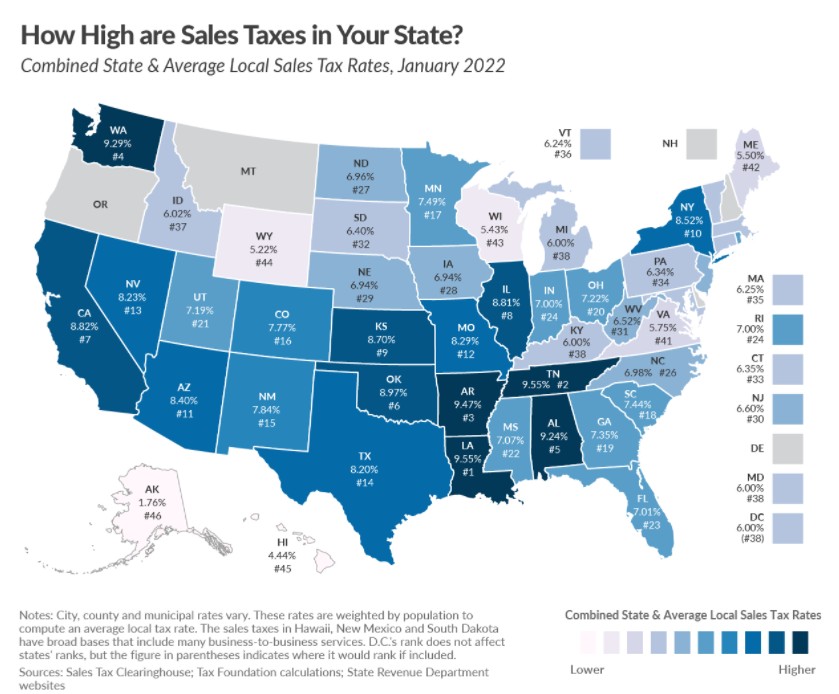

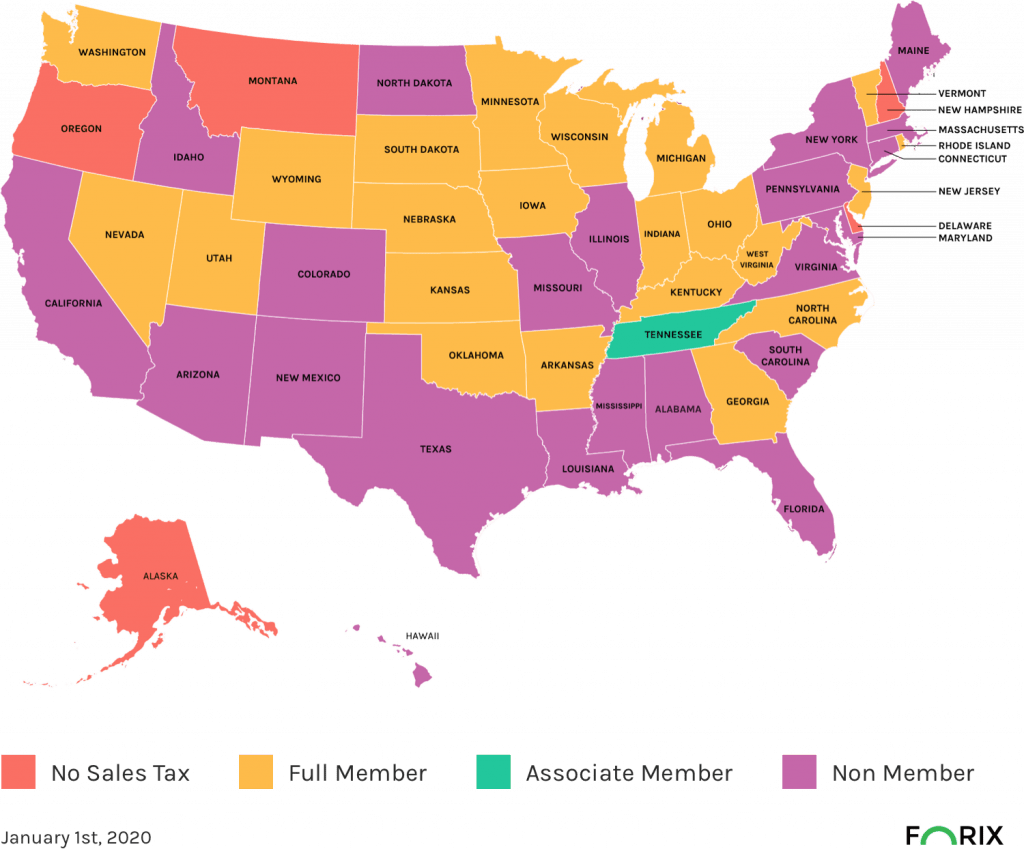

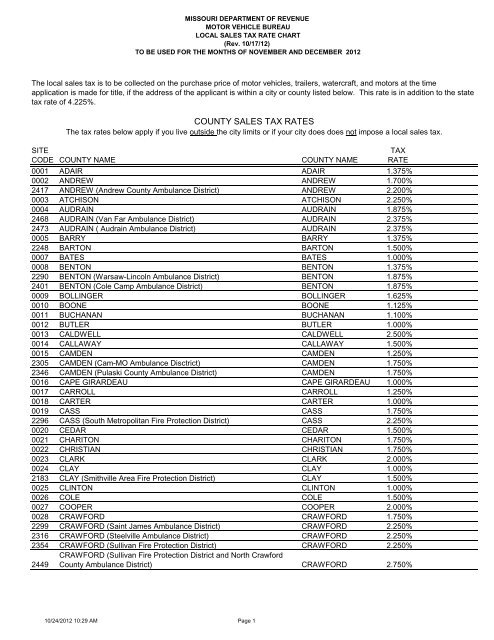

Sales tax rates vary by state and can range from 0% to over 10%. It is essential to research the sales tax rate in your state before making a purchase at Mattress Firm. Some states also have different sales tax rates for different types of products, so it is crucial to confirm the rate specifically for mattresses. It is also worth noting that some states do not have sales tax at all, such as Delaware, Montana, New Hampshire, Oregon, and Alaska. If you live in one of these states, you will not have to worry about sales tax when purchasing from Mattress Firm.State Sales Tax Rates for Mattress Firm Purchases

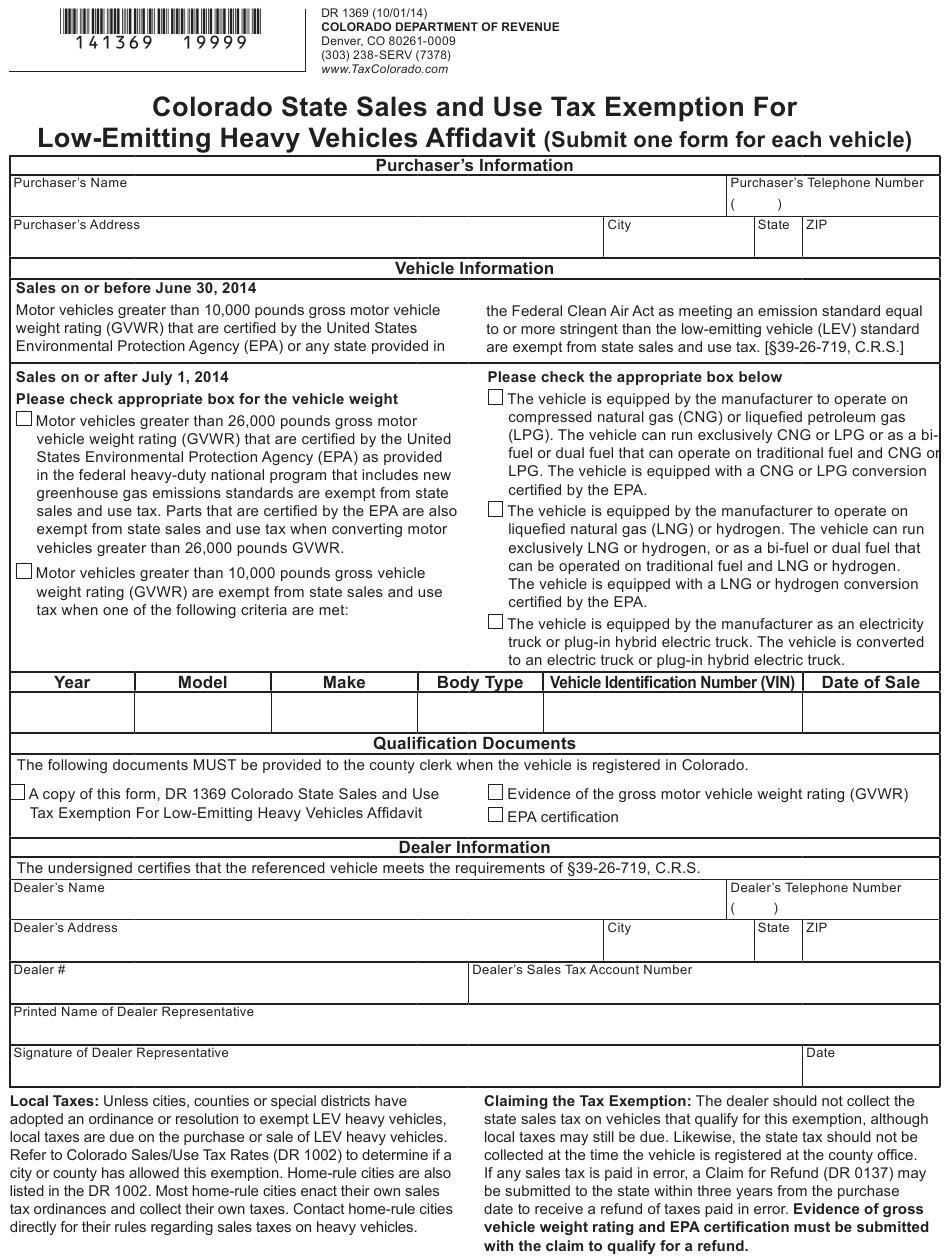

Although sales tax applies to most Mattress Firm purchases, there are some exemptions that may apply. Some states have sales tax holidays where certain products, such as mattresses, are exempt from sales tax for a limited period. Additionally, some states may exempt sales tax for certain types of customers, such as those with disabilities or senior citizens. It is essential to research your state's sales tax exemptions to see if you may qualify for any savings on your Mattress Firm purchase.Exemptions from Sales Tax for Mattress Firm Products

One of the most common mistakes when purchasing from Mattress Firm is forgetting to factor in sales tax. Many customers assume that the price tag is the final cost and are surprised to see the additional sales tax added at the register. To avoid this mistake, be sure to research the sales tax rate in your state and calculate it into your budget before making a purchase. Another mistake to avoid is assuming that online purchases from Mattress Firm will not include sales tax. In most cases, online purchases are subject to the same sales tax as in-store purchases. Be sure to check your state's laws regarding sales tax for online purchases to avoid any unexpected expenses.Common Sales Tax Mistakes to Avoid When Buying from Mattress Firm

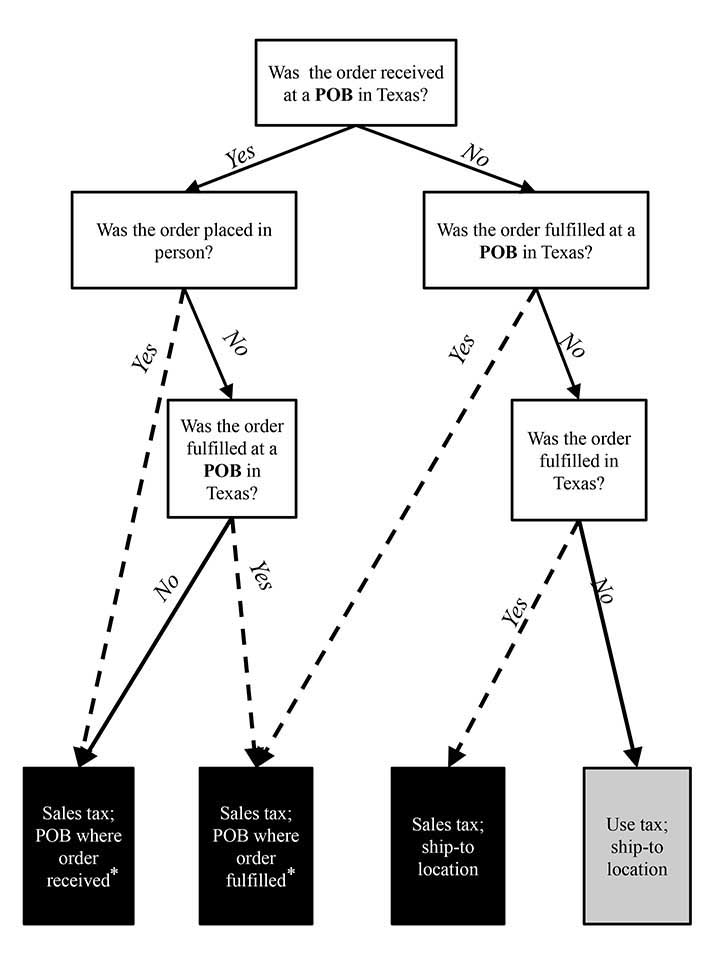

As mentioned above, sales tax laws for online purchases from Mattress Firm may vary by state. In some states, online purchases are subject to sales tax, while in others, they may be exempt. It is essential to research your state's laws to determine if you will be required to pay sales tax on your online purchase from Mattress Firm.Sales Tax Laws for Online Purchases from Mattress Firm

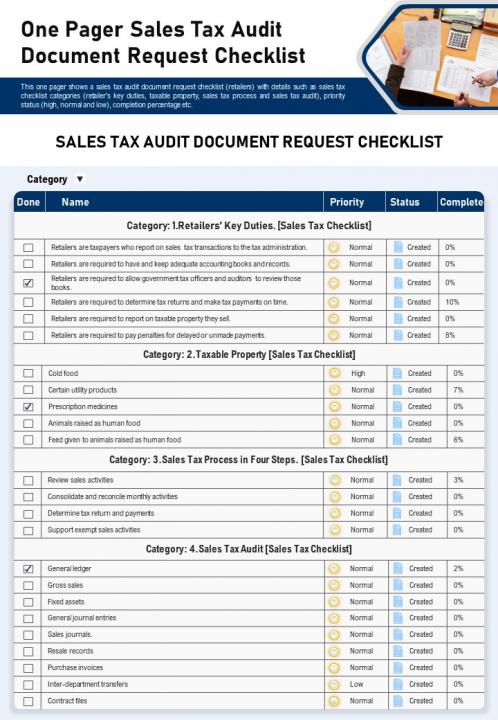

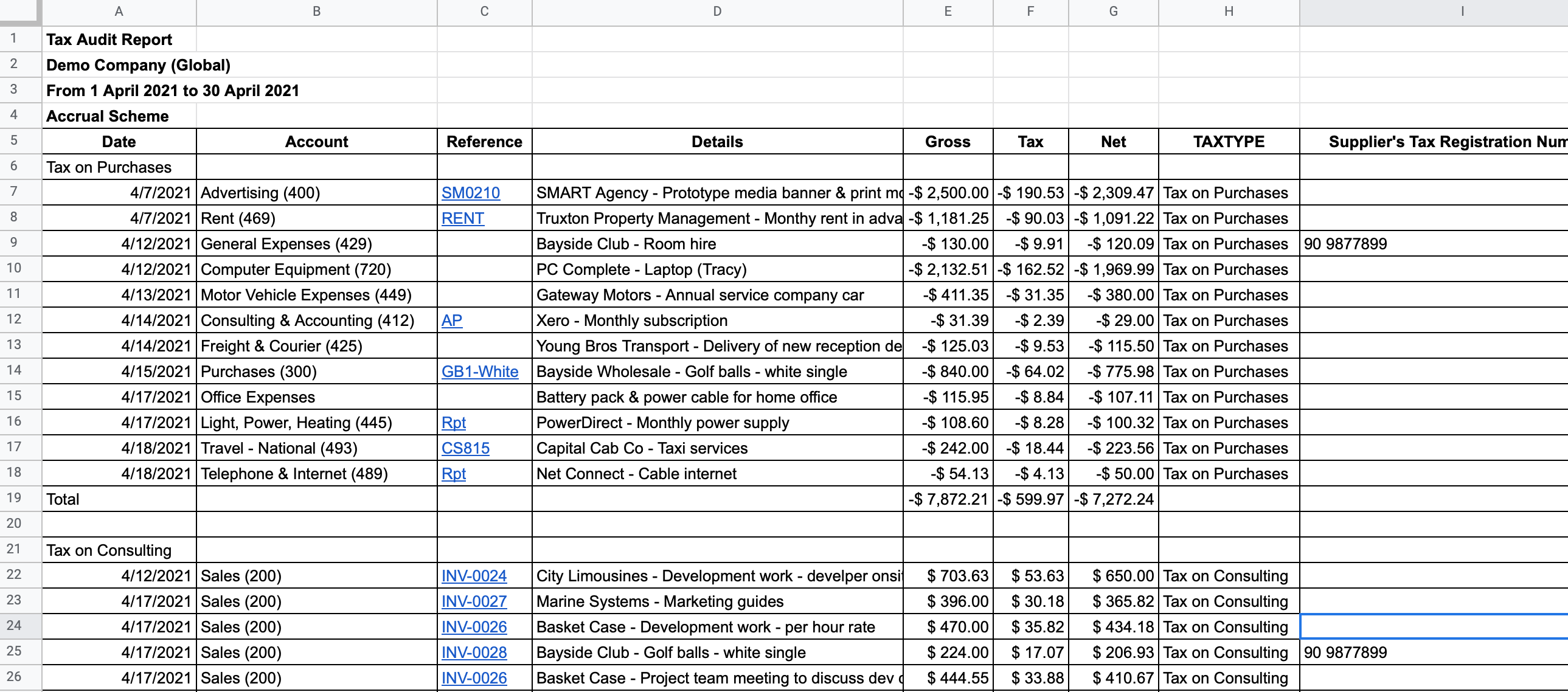

If you own a business and purchase mattresses from Mattress Firm for resale, you may be required to file sales tax on those purchases. The process for filing sales tax varies by state, so it is crucial to research your state's requirements. In general, you will need to keep detailed records of your purchases and sales and report them to your state's department of revenue. It is recommended to consult with a tax professional to ensure you are correctly filing sales tax for your Mattress Firm purchases.How to File Sales Tax for Mattress Firm Purchases

In addition to state sales tax, some areas may also have local sales tax. This additional tax is often used to fund local projects or services and may vary by city or county. If you live in an area with local sales tax, be sure to factor it into your budget when making a purchase at Mattress Firm.Understanding Local Sales Tax for Mattress Firm Stores

If you own a business and purchase mattresses from Mattress Firm for resale, you may be exempt from paying sales tax on those purchases. To qualify for this exemption, you will need to provide a valid resale certificate to Mattress Firm. This certificate proves that you are purchasing the mattresses for resale and will not be using them for personal use. It is essential to understand your state's laws regarding sales tax exemptions for resale purchases to ensure you are following all regulations.Sales Tax Exemptions for Mattress Firm Purchases for Resale

If you own a business and purchase mattresses from Mattress Firm, it is crucial to keep detailed records of your sales and purchases. In the event of a sales tax audit, you will need to provide documentation to support your sales tax filings. This documentation can include purchase receipts, sales records, and resale certificates. It is also recommended to consult with a tax professional to ensure you are correctly filing sales tax and are prepared for any potential audits. In conclusion, sales tax can add an additional cost to your Mattress Firm purchase, so it is essential to understand how it applies to your specific situation. Be sure to research your state's sales tax laws and exemptions and consult with a tax professional if needed. By understanding sales tax for Mattress Firm purchases, you can avoid any unexpected expenses and make a more informed buying decision.Sales Tax Audit Tips for Mattress Firm Businesses

The Impact of Sales Tax on Mattress Firm

Understanding the Importance of Sales Tax in the Mattress Industry

As the popularity of online shopping continues to rise, the issue of sales tax has become a hot topic in the retail world. This is especially true in the mattress industry, where sales tax can have a significant impact on both consumers and businesses alike. With the recent controversy surrounding mattress firm

sales tax

, it is important to understand the implications of this tax on the company and the overall industry.

As the popularity of online shopping continues to rise, the issue of sales tax has become a hot topic in the retail world. This is especially true in the mattress industry, where sales tax can have a significant impact on both consumers and businesses alike. With the recent controversy surrounding mattress firm

sales tax

, it is important to understand the implications of this tax on the company and the overall industry.

The Basics of Sales Tax

Before diving into the specifics of how sales tax affects the mattress firm industry, it is essential to have a basic understanding of what sales tax is and how it works. Sales tax is a percentage-based tax that is added to the cost of goods and services at the point of sale. It is typically collected by the seller and then remitted to the state government.

Before diving into the specifics of how sales tax affects the mattress firm industry, it is essential to have a basic understanding of what sales tax is and how it works. Sales tax is a percentage-based tax that is added to the cost of goods and services at the point of sale. It is typically collected by the seller and then remitted to the state government.

The Debate Surrounding Mattress Firm Sales Tax

The Impact on Consumers

The debate over sales tax on mattresses directly affects consumers, as they are the ones who ultimately bear the burden of this tax. When sales tax is applied to a mattress purchase, the overall cost of the product increases, making it more expensive for consumers. This can be a significant factor for those who are already on a tight budget and looking to save money on household essentials.

The debate over sales tax on mattresses directly affects consumers, as they are the ones who ultimately bear the burden of this tax. When sales tax is applied to a mattress purchase, the overall cost of the product increases, making it more expensive for consumers. This can be a significant factor for those who are already on a tight budget and looking to save money on household essentials.

The Impact on Businesses

For businesses like Mattress Firm, sales tax can also have a significant impact on their operations. When sales tax is added to their products, it can affect their profit margins and potentially drive away customers who are looking for a better deal. This can be especially detrimental in a competitive industry like the mattress market, where businesses are constantly vying for customers.

For businesses like Mattress Firm, sales tax can also have a significant impact on their operations. When sales tax is added to their products, it can affect their profit margins and potentially drive away customers who are looking for a better deal. This can be especially detrimental in a competitive industry like the mattress market, where businesses are constantly vying for customers.

In Conclusion

In conclusion, sales tax is a crucial factor in the mattress firm industry, and its impact cannot be ignored. It affects both consumers and businesses, and the ongoing debate surrounding its application to mattress sales is one that will continue to shape the industry. As consumers, it is essential to be aware of the sales tax on mattresses and how it may impact our purchasing decisions.

In conclusion, sales tax is a crucial factor in the mattress firm industry, and its impact cannot be ignored. It affects both consumers and businesses, and the ongoing debate surrounding its application to mattress sales is one that will continue to shape the industry. As consumers, it is essential to be aware of the sales tax on mattresses and how it may impact our purchasing decisions.