If you're in the market for a new mattress, you may have noticed that many mattress retailers, including popular chain Mattress Firm, offer financing options to help you spread out the cost over time. While this can be a convenient way to afford a higher-end mattress, it's important to understand the interest rates associated with these loans. Interest rates can significantly impact the total cost of your purchase and affect your budget in the long run.1. Understanding Interest Rates for Mattress Firm Financing

When considering financing options for your mattress purchase, it's important to shop around and compare interest rates from different lenders. Check with your bank or credit union to see if they offer competitive rates for personal loans, which can often have lower interest rates than store credit cards or financing plans. Additionally, make sure to check the fine print for any hidden fees or penalties.2. How to Get the Best Interest Rate on a Mattress Loan

Many mattress retailers, including Mattress Firm, offer their own store credit cards with special financing options for customers. While these cards may offer perks such as 0% interest for a certain period of time, it's important to compare the interest rates for these cards to other financing options. Oftentimes, the interest rates for store credit cards can be higher than traditional personal loans.3. Comparing Interest Rates for Mattress Firm Credit Cards

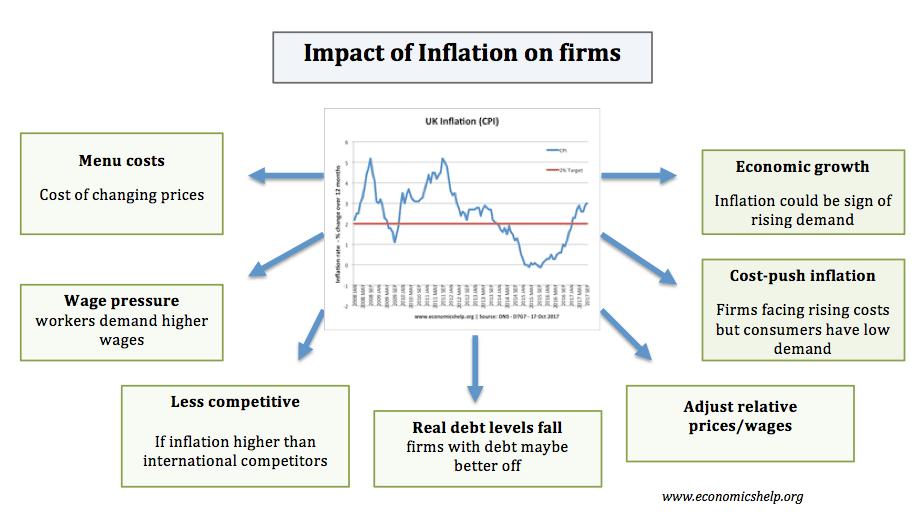

As a consumer, it's important to understand the role of interest rates in a retailer's business model. These rates can greatly affect a mattress company's profits and sales. For example, if a store offers 0% interest financing options, they may make up for it by increasing the price of their mattresses. On the other hand, higher interest rates may deter customers from making a purchase altogether.4. The Impact of Interest Rates on Mattress Firm's Business Model

If you've already chosen to finance your mattress purchase through Mattress Firm, there are still ways to potentially lower your interest rate. Consider negotiating with the salesperson or reaching out to customer service to see if they can offer a lower rate. You may also want to mention competitive rates you've found elsewhere to see if they can match or beat them.5. Tips for Negotiating a Lower Interest Rate with Mattress Firm

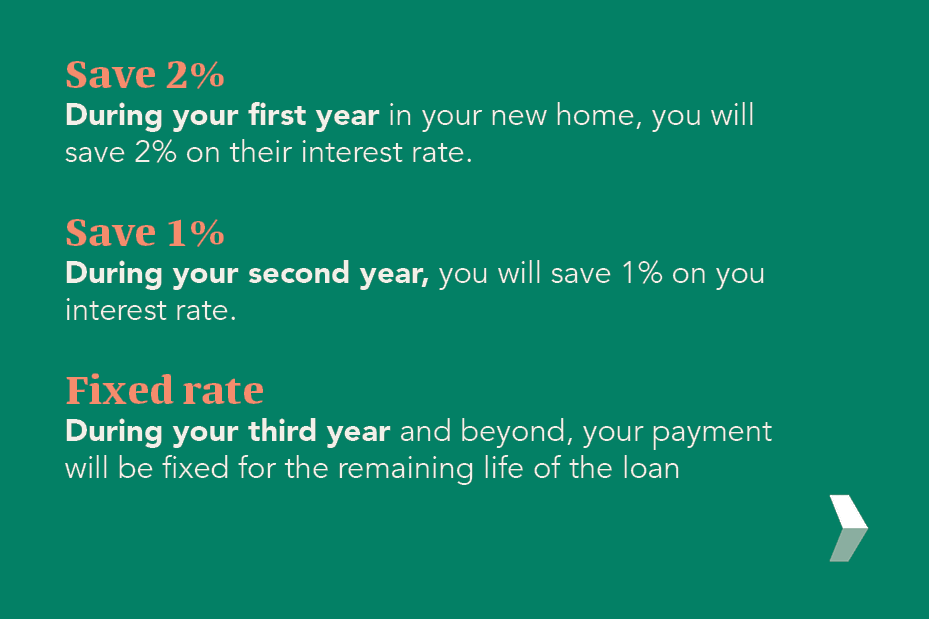

Mattress Firm offers a variety of financing options for their customers, including store credit cards, personal loans, and lease-to-own programs. It's important to carefully consider each option and determine which one is best for your financial situation. Remember to compare interest rates, fees, and payment terms to make an informed decision.6. Exploring Different Financing Options for Mattress Firm Purchases

Before signing any financing agreement with Mattress Firm, make sure to carefully read the fine print. Pay attention to any hidden fees, such as application fees or prepayment penalties, and make sure you understand the interest rate and how it will affect the total cost of your purchase. Don't be afraid to ask questions or negotiate for better terms.7. Understanding the Fine Print: Hidden Fees and Interest Rates at Mattress Firm

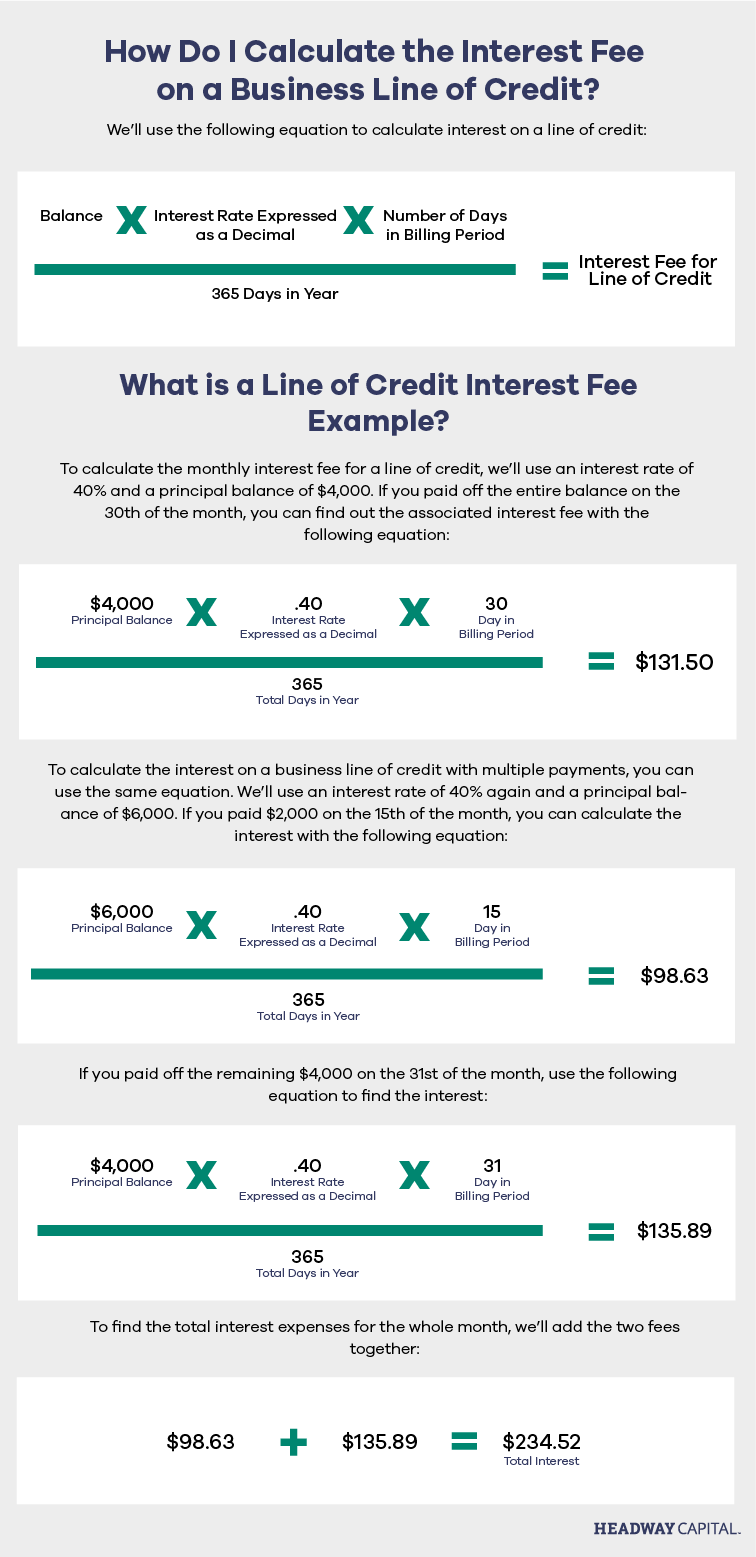

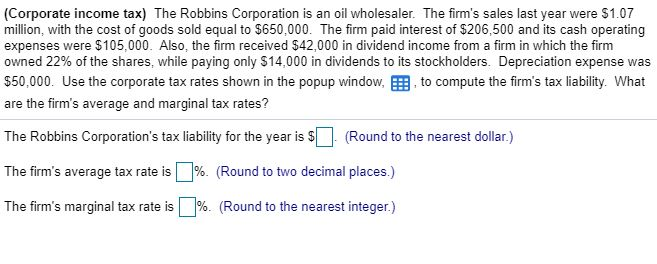

When shopping for a mattress, it's important to not just look at the sticker price, but also consider the total cost with interest included. To calculate the true cost, add up the total amount you will pay in interest over the life of the loan. This will give you a better understanding of the financial impact of your purchase and help you make an informed decision.8. How to Calculate the True Cost of a Mattress with Interest Rates

Mattress Firm, like many other retailers, often runs sales and promotions throughout the year to entice customers to make a purchase. However, it's important to keep in mind that even with a discount, the interest rate on your financing plan can greatly affect the final cost. Always consider the interest rate and any potential fees before making a decision based on a sale or promotion.9. The Role of Interest Rates in Mattress Firm's Sales and Promotions

In conclusion, when it comes to financing your mattress purchase at Mattress Firm, it's important to do your research and understand the interest rates associated with different financing options. Consider negotiating for a lower rate, carefully read the fine print, and calculate the true cost of your purchase with interest included. With the right knowledge and approach, you can make an informed decision and get the best deal on your new mattress.10. Navigating Interest Rates and Payment Plans at Mattress Firm: A Customer's Guide

The Importance of Choosing the Right Mattress Firm Interest Rate

Mattresses are an essential part of our daily lives, providing us with the much-needed rest and comfort after a long day. However, when it comes to purchasing a new mattress, many people tend to focus solely on the design and brand, overlooking another crucial factor – the mattress firm interest rate .

The Role of Interest Rates in Mattress Purchases

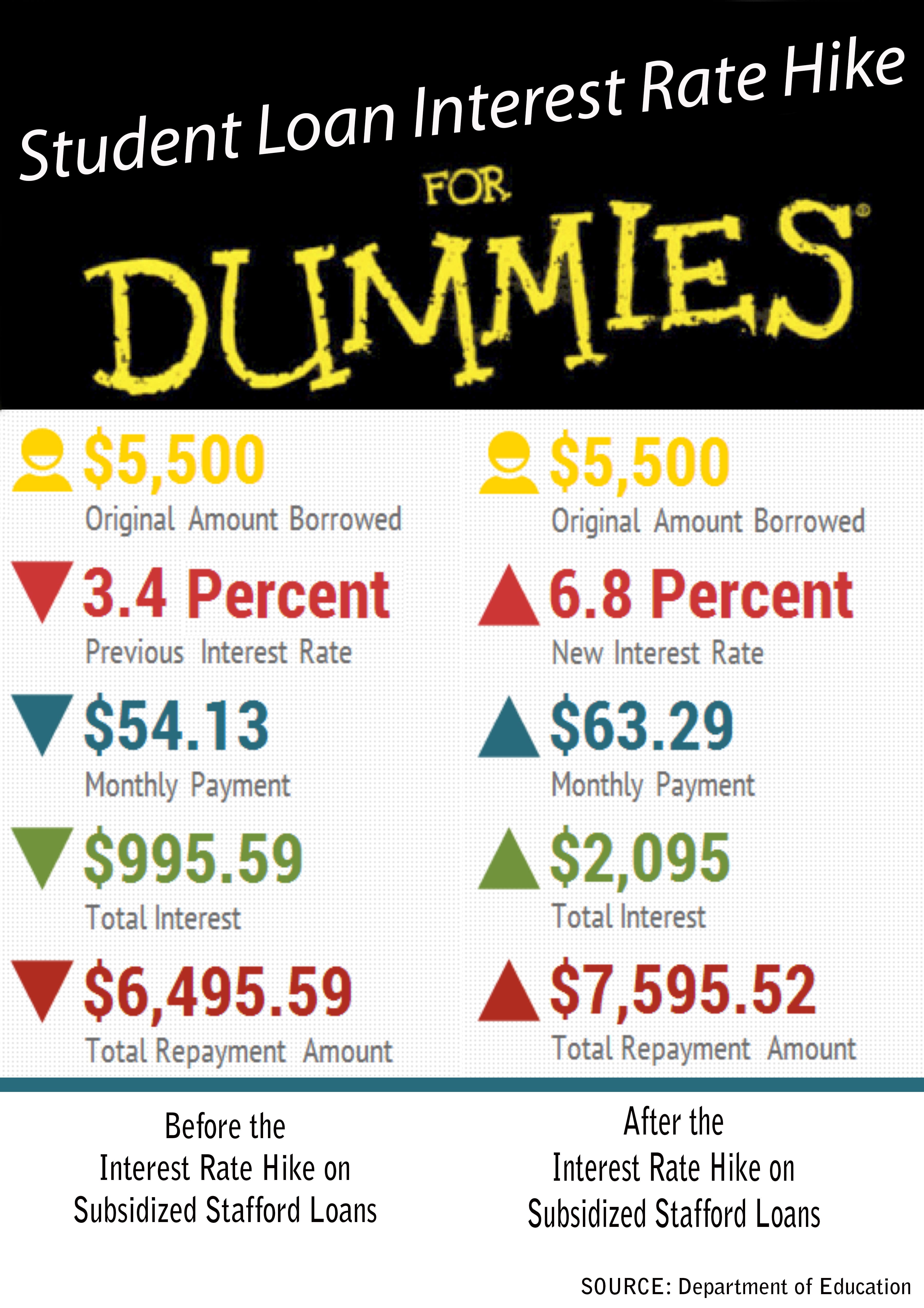

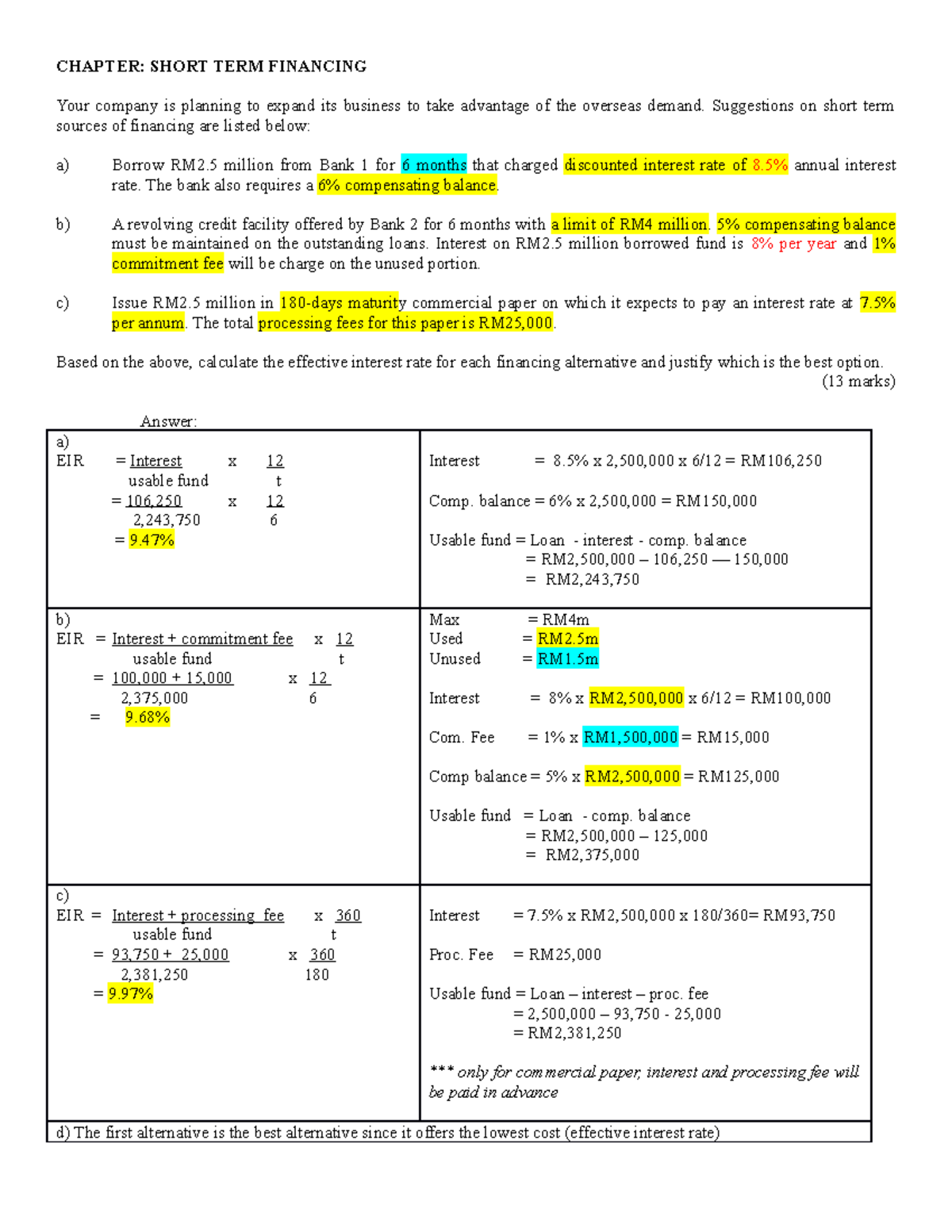

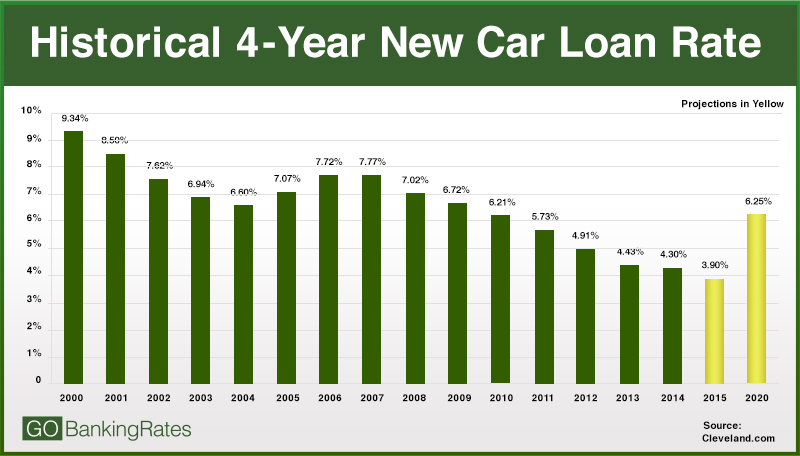

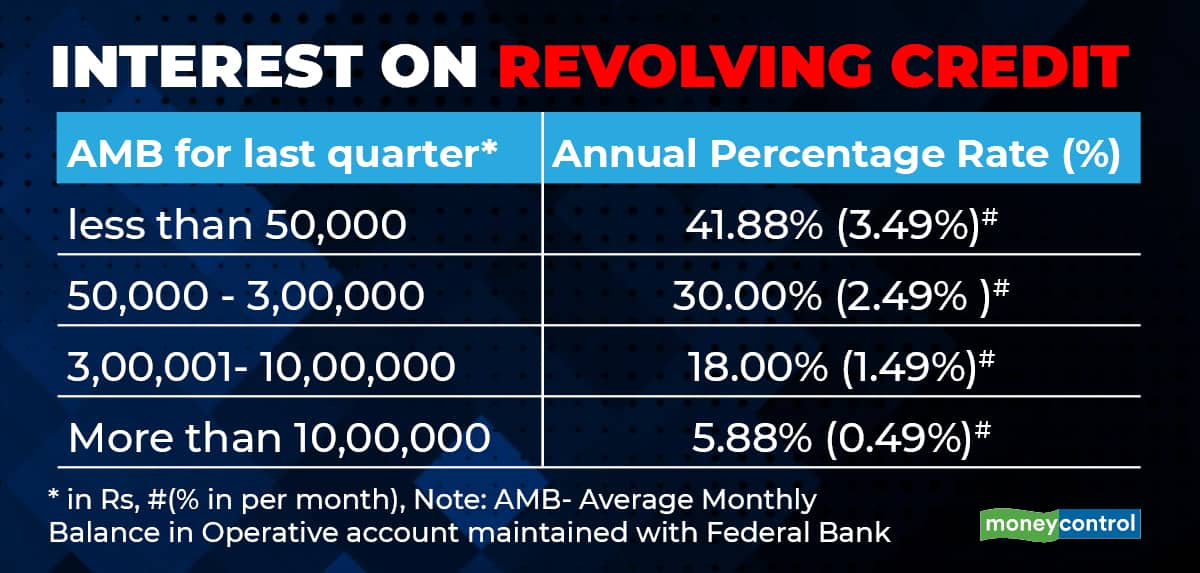

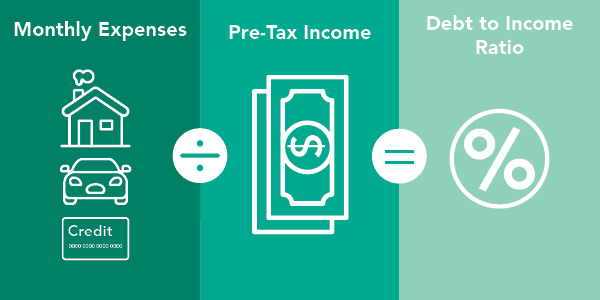

Interest rates refer to the percentage charged by a lender for borrowing money. When it comes to purchasing a mattress, it is crucial to understand how interest rates can affect your overall cost and financial stability.

Choosing the right mattress firm interest rate can make a significant difference in your monthly budget and long-term financial goals. A higher interest rate can result in higher monthly payments, making it more challenging to manage your finances. On the other hand, a lower interest rate can save you a considerable amount of money over the course of the loan.

Factors Affecting Mattress Firm Interest Rates

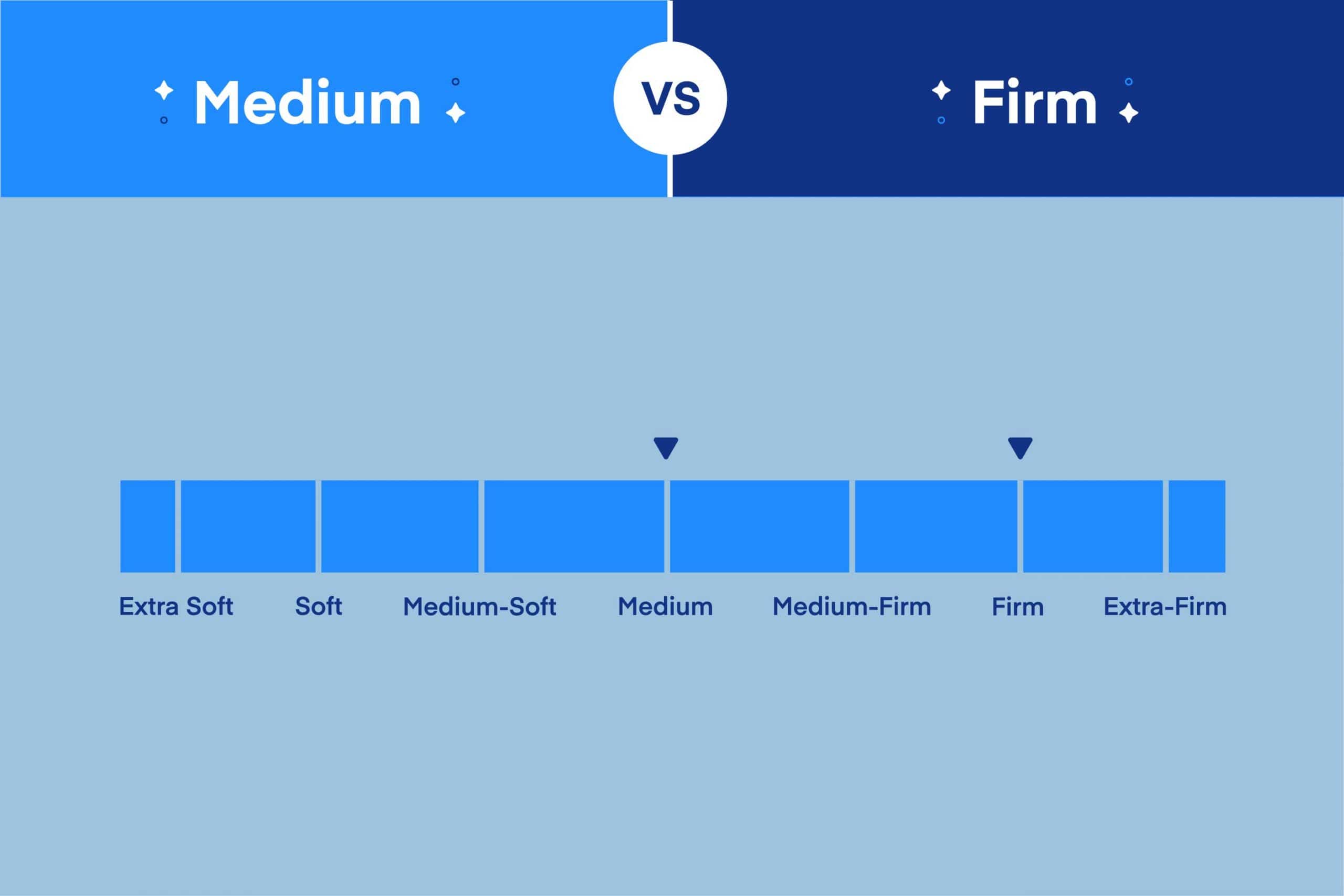

Several factors can impact the interest rates offered by mattress firms. These include your credit score, the length of the loan, and the type of mattress you are purchasing. Your credit score is a crucial factor as it reflects your creditworthiness and affects the interest rate offered by the lender. A higher credit score can result in lower interest rates, while a lower score may lead to higher rates.

The length of the loan also plays a significant role in determining the interest rate. A longer loan term may result in a lower monthly payment, but it also means paying more in interest over time. On the other hand, a shorter loan term may result in a higher monthly payment, but it can save you money in the long run.

The Importance of Comparing Mattress Firm Interest Rates

With the plethora of mattress options available in the market, it is essential to do your research and compare interest rates offered by various firms. This will not only help you find the best deal but also ensure that you are getting a competitive interest rate.

Furthermore, it is crucial to carefully read the terms and conditions of the loan, including any hidden fees or charges, before signing the contract. This will help you avoid any unpleasant surprises and make an informed decision.

In conclusion, when it comes to purchasing a new mattress, the mattress firm interest rate should not be overlooked. It plays a significant role in determining the overall cost and can have a long-term impact on your financial stability. By understanding the factors affecting interest rates and comparing different options, you can make an informed decision and find the best deal for your new mattress.

:max_bytes(150000):strip_icc()/Warm-and-cozy-living-room-Amy-Youngblood-589f82173df78c47587b80b6.png)