Living Room Of Satoshi Capital Gains Tax

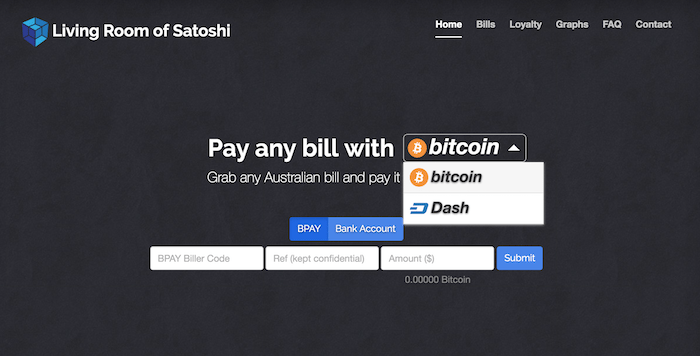

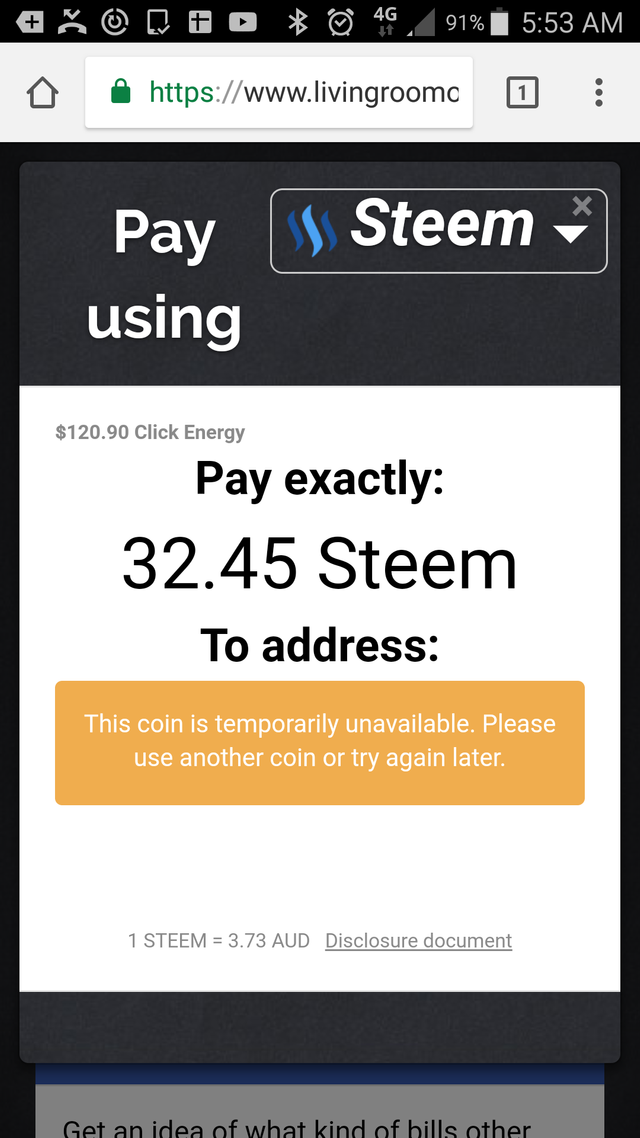

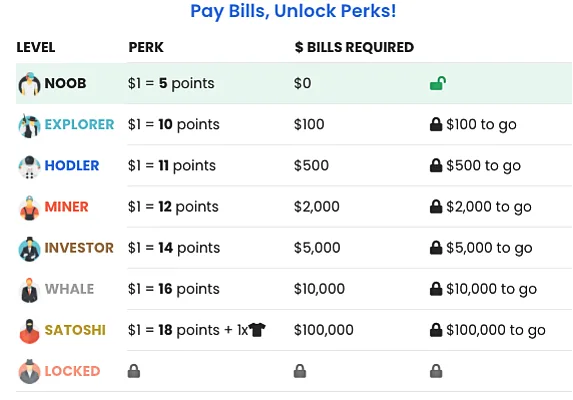

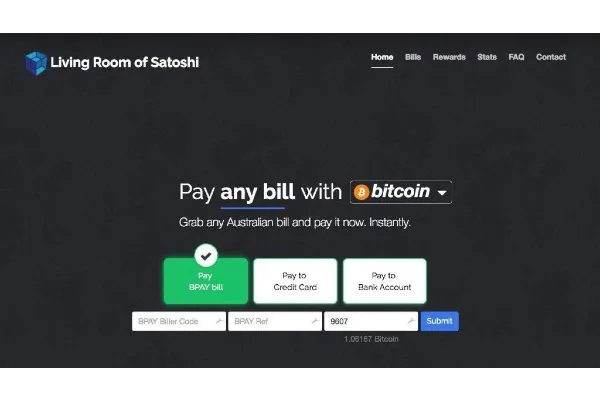

Living Room Of Satoshi, the popular Australian bill payment service, has gained a lot of attention in recent years for its convenience and user-friendly interface. However, with the rise of cryptocurrency and its use on the platform, many users are now wondering about the tax implications of using Living Room Of Satoshi.

Capital Gains Tax on Living Room Of Satoshi

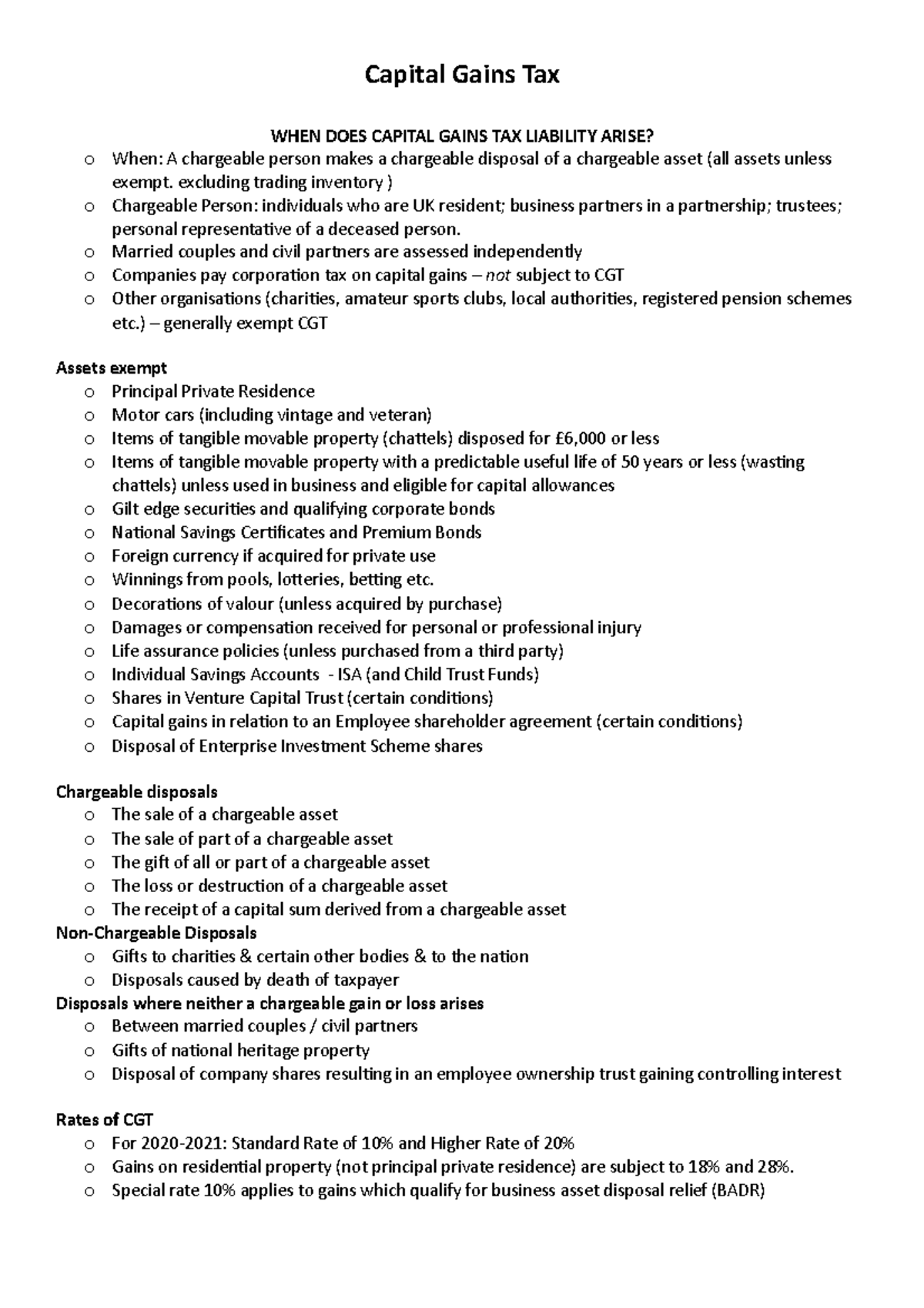

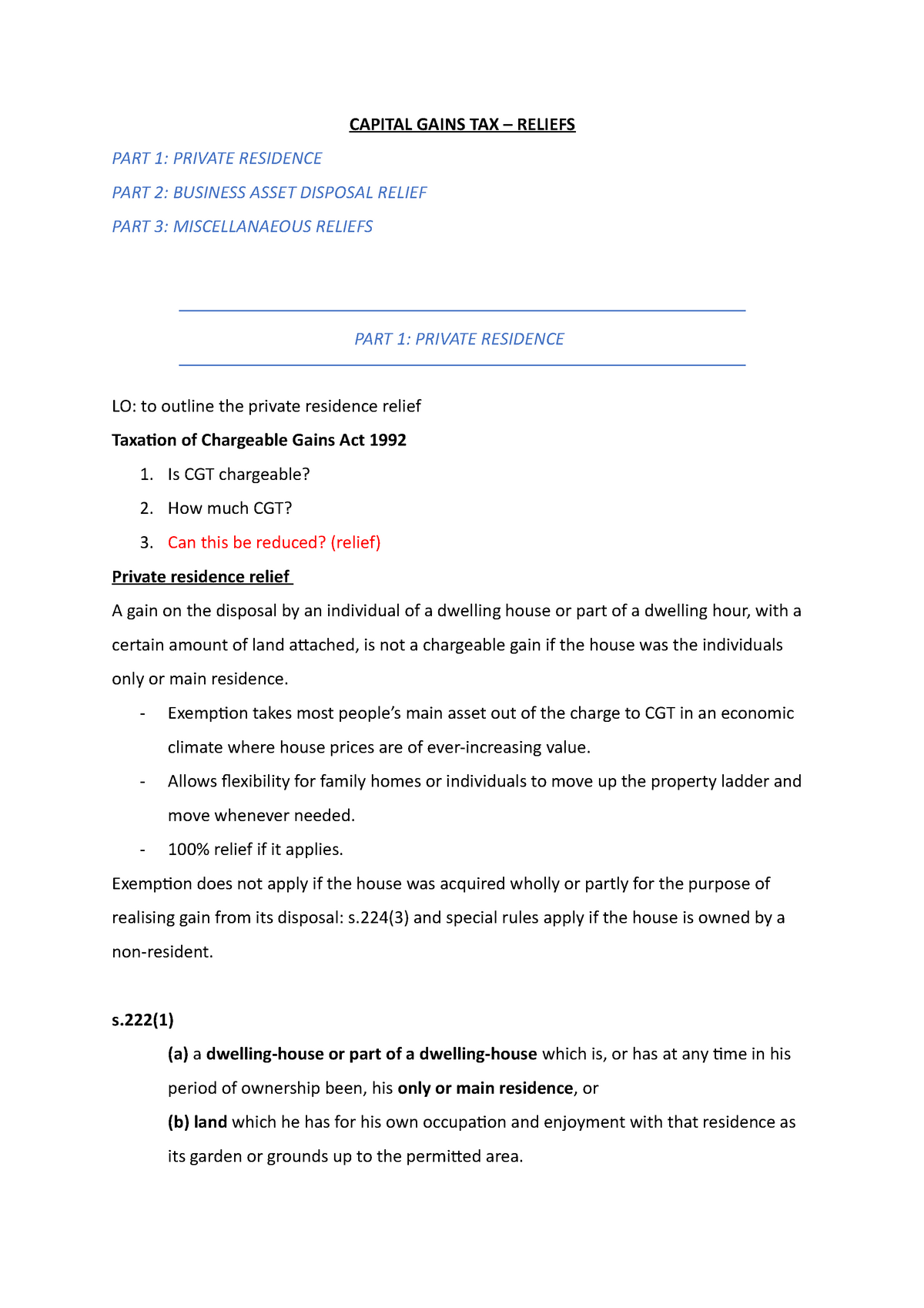

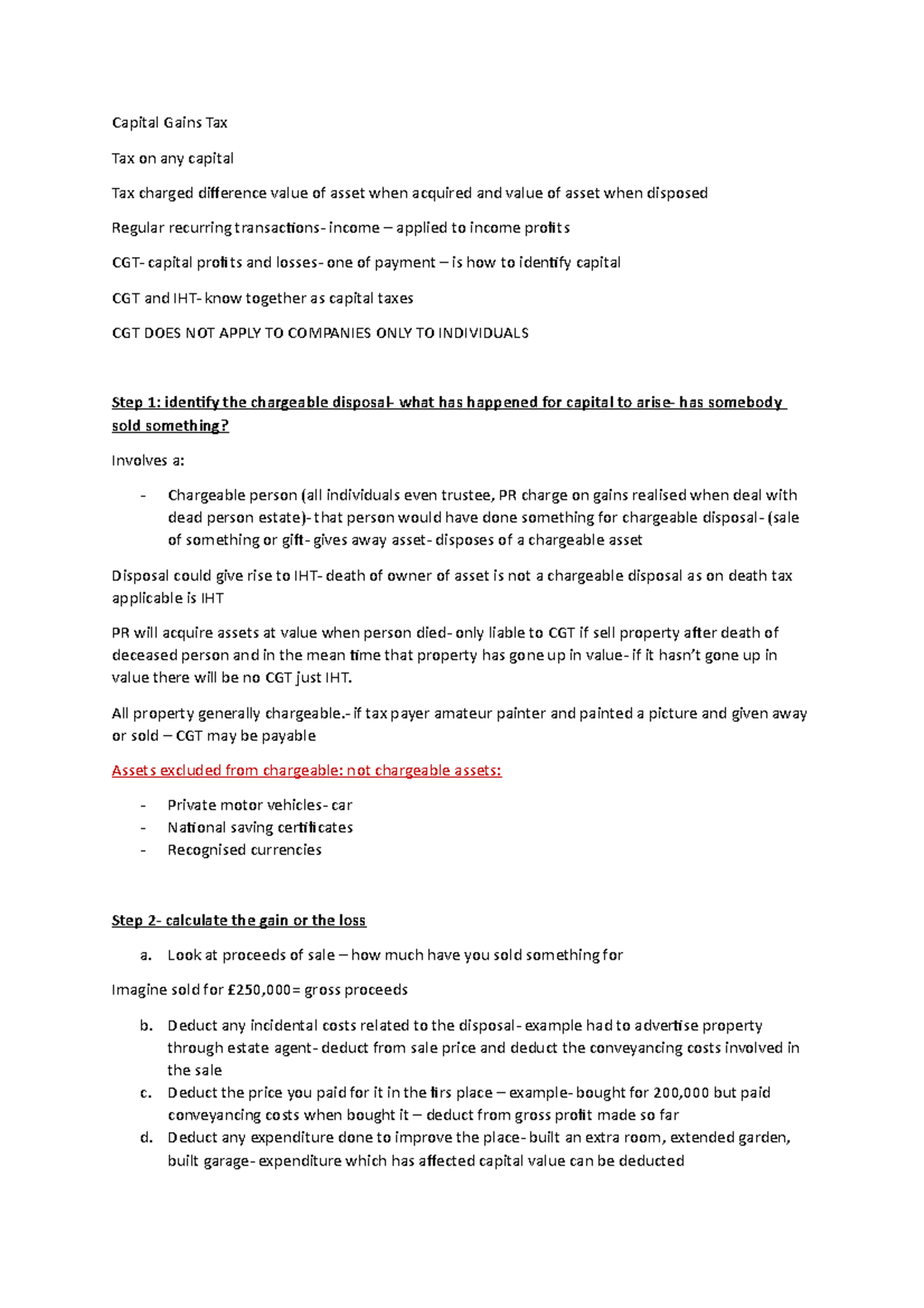

One of the biggest concerns for Living Room Of Satoshi users is the potential capital gains tax they may have to pay on their transactions. For those unfamiliar with the term, capital gains tax is a tax on the profit you make from selling an asset, such as cryptocurrency. This means that any gains you make from using Living Room Of Satoshi may be subject to this tax.

Living Room Of Satoshi Tax Implications

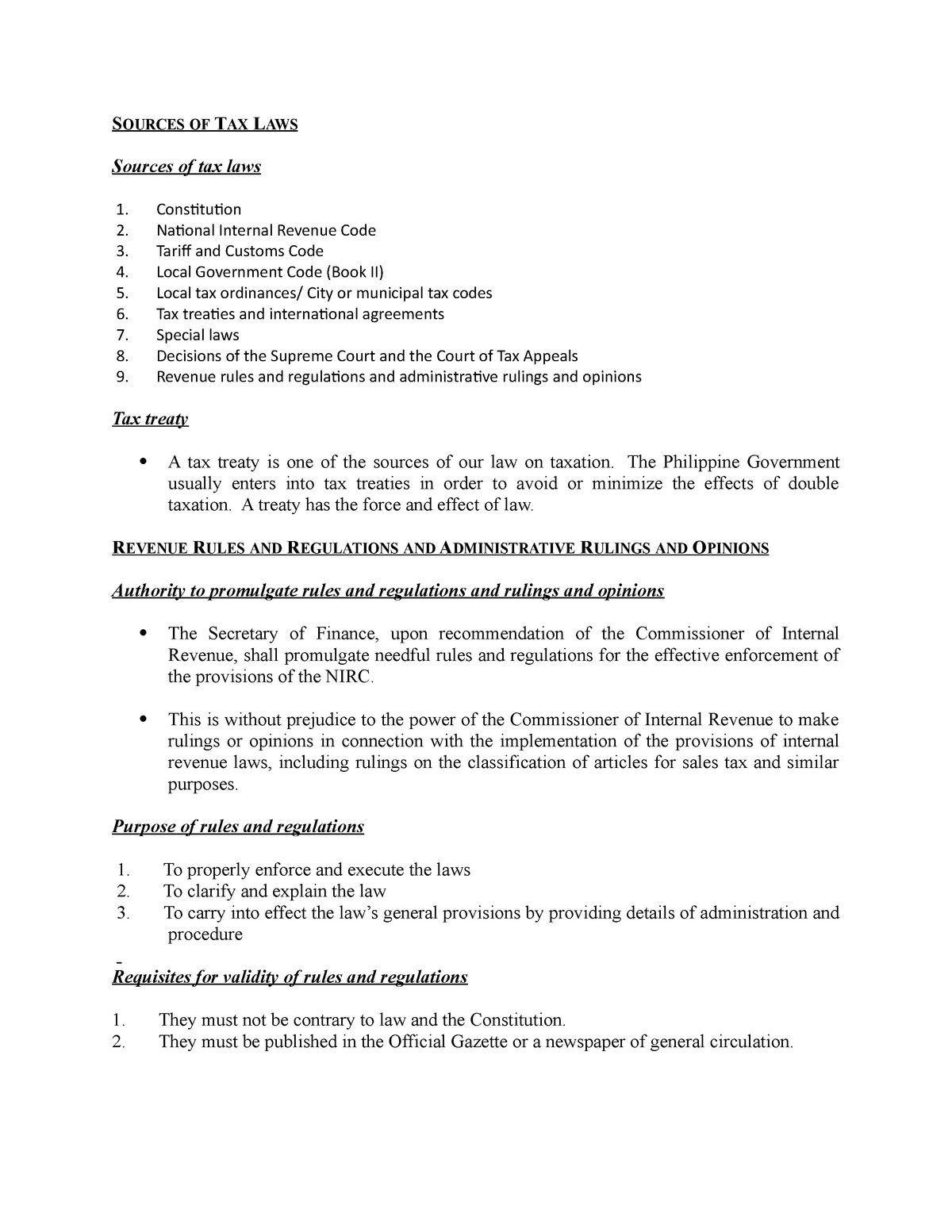

The tax implications of using Living Room Of Satoshi will depend on the laws and regulations in your country. In some countries, cryptocurrency is treated as a form of property and is subject to capital gains tax. In others, it may be considered as a currency and therefore not subject to capital gains tax.

Living Room Of Satoshi and Capital Gains Tax

It is important for Living Room Of Satoshi users to understand the potential capital gains tax implications of their transactions. This is especially important for those who are actively trading cryptocurrency on the platform. Each transaction, whether it is buying or selling, may result in a taxable gain or loss.

Understanding Capital Gains Tax for Living Room Of Satoshi

To understand how capital gains tax may apply to your Living Room Of Satoshi transactions, it is important to familiarize yourself with the tax laws in your country. You may also seek the advice of a tax professional who can help you navigate the complex world of cryptocurrency taxes.

Living Room Of Satoshi and Tax Laws

The tax laws surrounding cryptocurrency are constantly evolving, so it is important to stay informed about any changes that may affect your use of Living Room Of Satoshi. Make sure to research the tax laws in your country and stay updated on any developments that may impact your tax obligations.

How to Report Capital Gains Tax for Living Room Of Satoshi

If you are subject to capital gains tax on your Living Room Of Satoshi transactions, it is important to report these gains on your tax return. This may involve keeping track of your transactions and calculating the gains or losses you have made. Again, it is recommended to seek the advice of a tax professional to ensure accuracy and compliance with tax laws.

Living Room Of Satoshi and Tax Filing

When it comes to tax filing, it is important to report all of your income, including any gains from Living Room Of Satoshi transactions. Failure to report these gains may result in penalties and fines. It is always better to be transparent and report all of your income to avoid any potential legal issues.

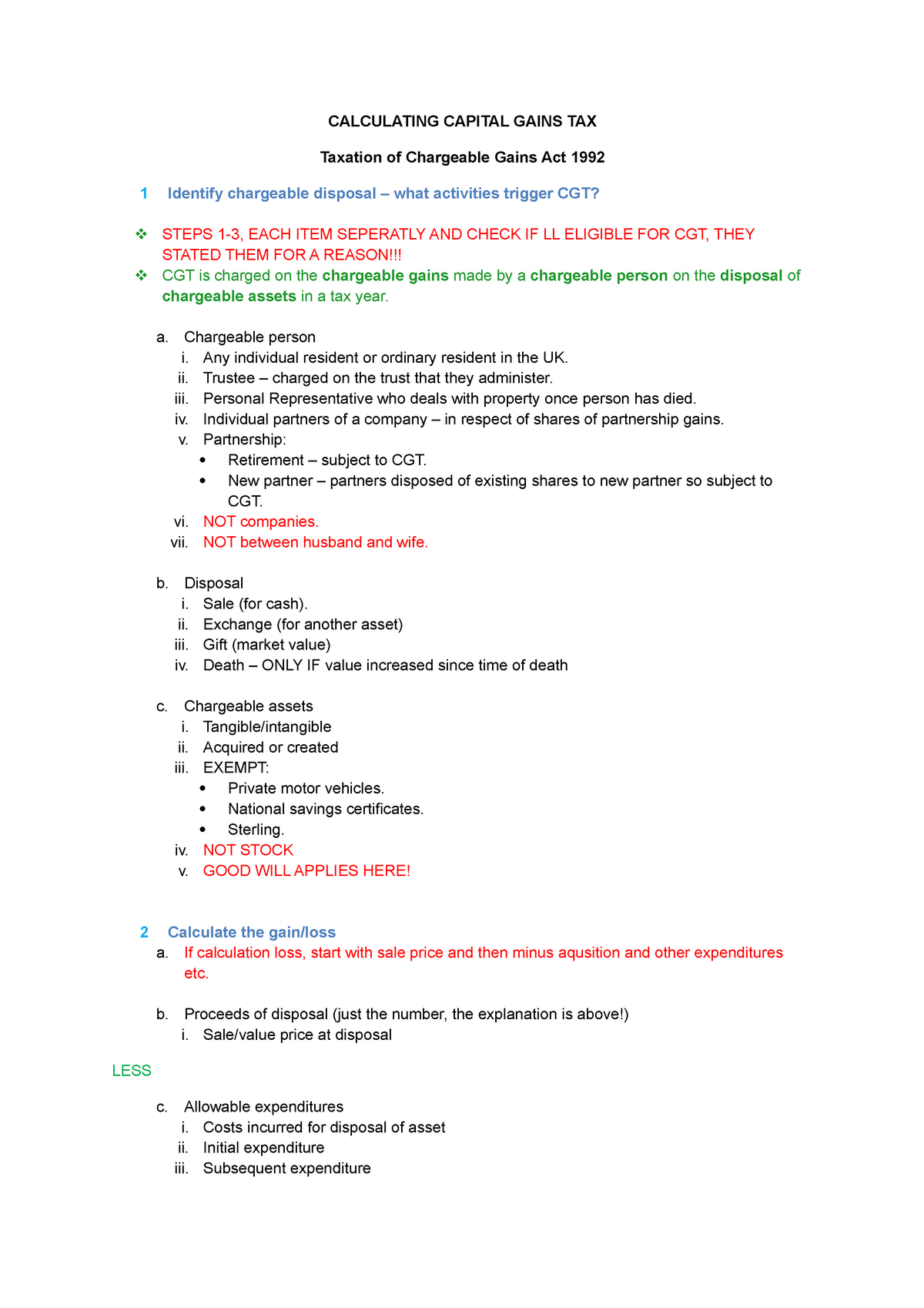

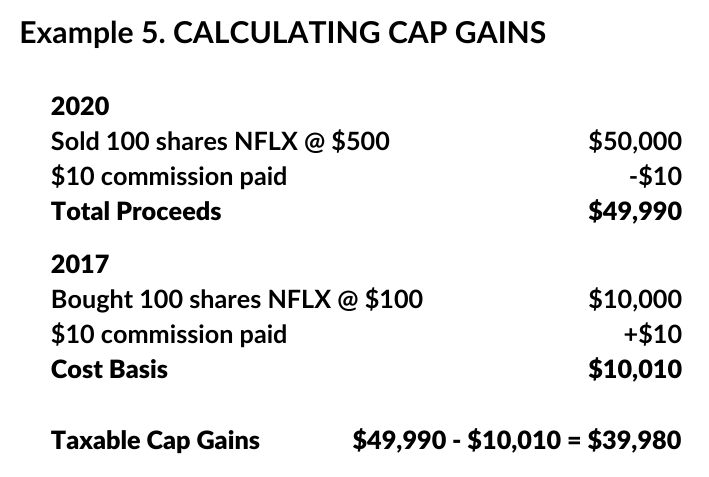

Calculating Capital Gains Tax for Living Room Of Satoshi

The process of calculating capital gains tax for Living Room Of Satoshi can be complicated, especially for those who are new to cryptocurrency. The amount of tax you owe will depend on factors such as your income, tax rate, and the length of time you held the cryptocurrency. As mentioned before, it is best to seek the advice of a tax professional for accurate calculations.

Living Room Of Satoshi and Tax Planning

Finally, it is important for Living Room Of Satoshi users to engage in tax planning to minimize their tax liabilities. This may involve strategies such as holding onto cryptocurrency for a longer period of time to qualify for lower tax rates or offsetting gains with losses from other investments. Again, consulting a tax professional can help you make informed decisions and optimize your tax situation.

In conclusion, while the use of Living Room Of Satoshi may come with some tax implications, it is still a convenient and popular platform for bill payments. By staying informed about tax laws and seeking professional advice, users can ensure they are in compliance with tax regulations while enjoying the benefits of this innovative service.

Maximizing the Value of Your Home: The Importance of a Well-Designed Living Room

Creating a Space for Capital Gains

When it comes to increasing the value of your home, the living room plays a crucial role. This is especially true in the case of

capital gains tax

, as a well-designed living room can significantly impact the overall value of your property. With the rising trend of

house design

and

interior decorating

, homeowners are realizing the potential of their living rooms to not only serve as a functional space but also as a powerful tool for financial gain.

When it comes to increasing the value of your home, the living room plays a crucial role. This is especially true in the case of

capital gains tax

, as a well-designed living room can significantly impact the overall value of your property. With the rising trend of

house design

and

interior decorating

, homeowners are realizing the potential of their living rooms to not only serve as a functional space but also as a powerful tool for financial gain.

The Power of First Impressions

The living room is often the first space that potential buyers or renters see when they enter a home. As the saying goes, first impressions are everything, and this rings true for the real estate market. A well-designed living room can instantly capture the attention of buyers and make them more likely to consider your property over others. This is where

capital gains

come into play – a higher perceived value of your home can lead to a higher selling price and ultimately, a higher return on investment.

The living room is often the first space that potential buyers or renters see when they enter a home. As the saying goes, first impressions are everything, and this rings true for the real estate market. A well-designed living room can instantly capture the attention of buyers and make them more likely to consider your property over others. This is where

capital gains

come into play – a higher perceived value of your home can lead to a higher selling price and ultimately, a higher return on investment.

Creating the Perfect Ambiance

In addition to increasing the perceived value of your home, a well-designed living room can also create the perfect ambiance for potential buyers or renters.

House design

and

interior decorating

have evolved to incorporate not just aesthetic appeal, but also functionality and comfort. By creating a warm and inviting living room, potential buyers will be able to envision themselves living in the space, making them more likely to invest in your property. This can also lead to a quicker sale or rental, saving you time and money in the long run.

In addition to increasing the perceived value of your home, a well-designed living room can also create the perfect ambiance for potential buyers or renters.

House design

and

interior decorating

have evolved to incorporate not just aesthetic appeal, but also functionality and comfort. By creating a warm and inviting living room, potential buyers will be able to envision themselves living in the space, making them more likely to invest in your property. This can also lead to a quicker sale or rental, saving you time and money in the long run.

The Financial Benefits of a Well-Designed Living Room

In addition to increasing the value of your home, a well-designed living room can also have financial benefits in terms of

capital gains tax

. By increasing the value of your property, you may be eligible for tax deductions, reducing the amount of capital gains tax you owe. This is why it is essential to invest in the design and décor of your living room – it not only enhances the overall value of your home, but it can also save you money in the long run.

In conclusion, the living room is a crucial element in maximizing the value of your home. By investing in

house design

and

interior decorating

, you can create a space that not only appeals to potential buyers or renters but also has financial benefits in terms of

capital gains tax

. So don't underestimate the power of a well-designed living room – it can make all the difference in the value and sale of your home.

In addition to increasing the value of your home, a well-designed living room can also have financial benefits in terms of

capital gains tax

. By increasing the value of your property, you may be eligible for tax deductions, reducing the amount of capital gains tax you owe. This is why it is essential to invest in the design and décor of your living room – it not only enhances the overall value of your home, but it can also save you money in the long run.

In conclusion, the living room is a crucial element in maximizing the value of your home. By investing in

house design

and

interior decorating

, you can create a space that not only appeals to potential buyers or renters but also has financial benefits in terms of

capital gains tax

. So don't underestimate the power of a well-designed living room – it can make all the difference in the value and sale of your home.

:max_bytes(150000):strip_icc()/TermDefinitions_Satoshi-91924de4c94845f6ba22454037bfe209.jpg)