Kitchen table bills are a term that is becoming increasingly popular in the world of personal finance. But what exactly are they and how do they work? In this article, we'll dive into the details of kitchen table bills and how they can affect your finances.Understanding Kitchen Table Bills: What They Are and How They Work

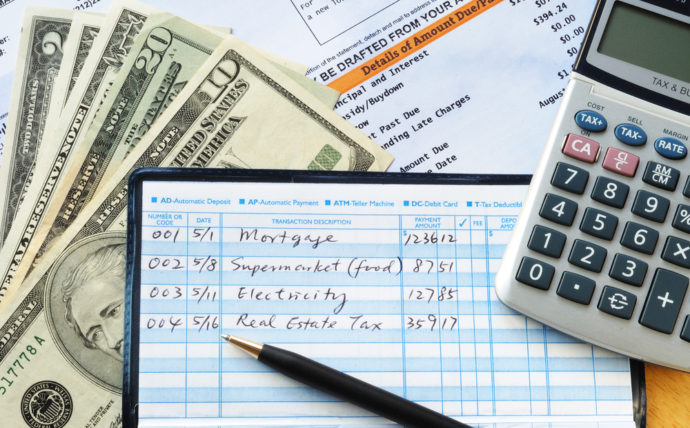

In simple terms, a kitchen table bill is a bill that is discussed and negotiated at the kitchen table between family members. These bills can range from household expenses such as rent, utilities, and groceries to larger expenses like car payments and insurance. Unlike traditional bills that are received and paid by one person, kitchen table bills involve the whole family in the decision-making process. This creates a sense of shared responsibility and transparency when it comes to household finances.What is a Kitchen Table Bill?

The concept of kitchen table bills originated from the idea of having open and honest conversations about money within the family unit. It encourages communication and collaboration between family members, making everyone feel involved in the financial decisions that affect the household. With kitchen table bills, each family member has a say in how the money is being spent and can make suggestions on how to cut costs or save money. This can lead to more efficient and effective financial management within the household.Explaining Kitchen Table Bills

The term "kitchen table bills" reflects the idea that these discussions take place in a casual and comfortable setting, where everyone can feel relaxed and open to sharing their thoughts and opinions. The kitchen table is often seen as the heart of the home, where families come together to eat, talk, and bond. By discussing bills at the kitchen table, families can create a positive and supportive environment for managing their finances, rather than feeling stressed or overwhelmed by the topic.The Meaning of Kitchen Table Bills

A kitchen table bill is not just a bill that is discussed at the kitchen table, it is a mindset and approach to managing household finances. It involves open communication, equal participation, and a focus on finding the best solutions for the entire family. This approach can also extend to other financial decisions, such as planning for the future, setting financial goals, and creating a budget. By involving everyone in the process, families can work together towards a common goal and strengthen their financial stability.Kitchen Table Bills: Definition and Explanation

One of the main benefits of kitchen table bills is that it can lead to more efficient and effective financial management. By involving everyone in the decision-making process, families can identify areas where they can cut costs, negotiate better deals, and find ways to save money. Additionally, kitchen table bills can also improve communication and understanding between family members when it comes to finances. This can lead to a stronger sense of unity and teamwork within the household.How Kitchen Table Bills Can Affect Your Finances

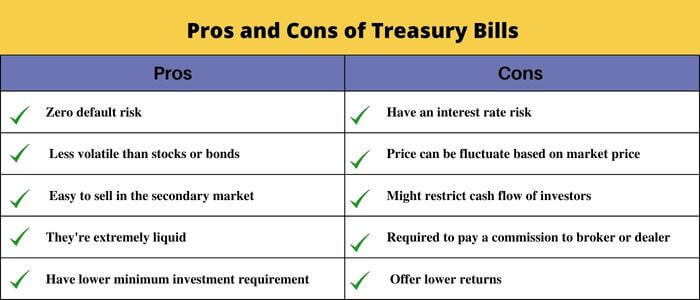

Like any financial approach, there are both pros and cons to using kitchen table bills. Some of the pros include better communication, shared responsibility, and improved financial management. However, some of the cons may include disagreements between family members and the potential for some members to take on a larger burden of responsibility. It's important for families to weigh these factors and determine if kitchen table bills are the right approach for them.The Pros and Cons of Kitchen Table Bills

The main difference between kitchen table bills and traditional bills is the level of involvement and collaboration among family members. Traditional bills are typically managed by one person, while kitchen table bills involve the whole family in the decision-making process. Kitchen table bills also place a greater emphasis on open communication and finding the best solutions for the entire family, rather than just the individual responsible for paying the bill.Kitchen Table Bills vs. Traditional Bills: What's the Difference?

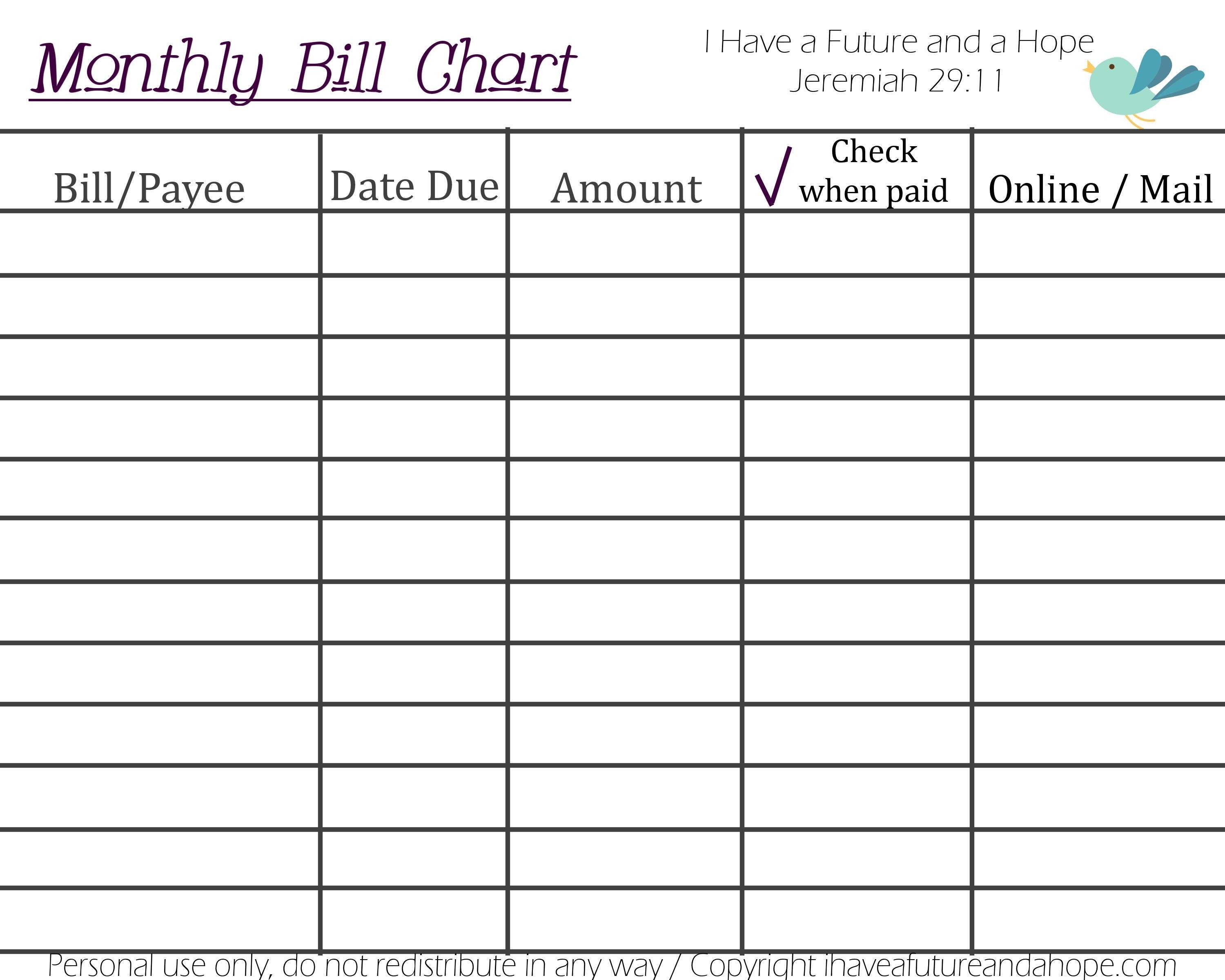

If you decide to implement kitchen table bills in your household, there are a few tips to keep in mind to ensure its effectiveness. First, set a regular time to discuss bills and stick to it. This can help create a routine and keep everyone accountable. Second, make sure everyone has a voice and is involved in the discussions. This can help avoid any feelings of resentment or unfairness within the family. And finally, be open to compromise and finding solutions that work for everyone.How to Manage Your Kitchen Table Bills Effectively

Implementing kitchen table bills can have a positive impact on household budgeting. By involving everyone in the decision-making process, families can create a budget that reflects the needs and priorities of the entire household. This can lead to a more realistic and effective budget that is easier to stick to. Overall, kitchen table bills can be a beneficial approach to managing household finances. By encouraging open communication, shared responsibility, and teamwork, families can improve their financial stability and strengthen their relationships.The Impact of Kitchen Table Bills on Household Budgeting

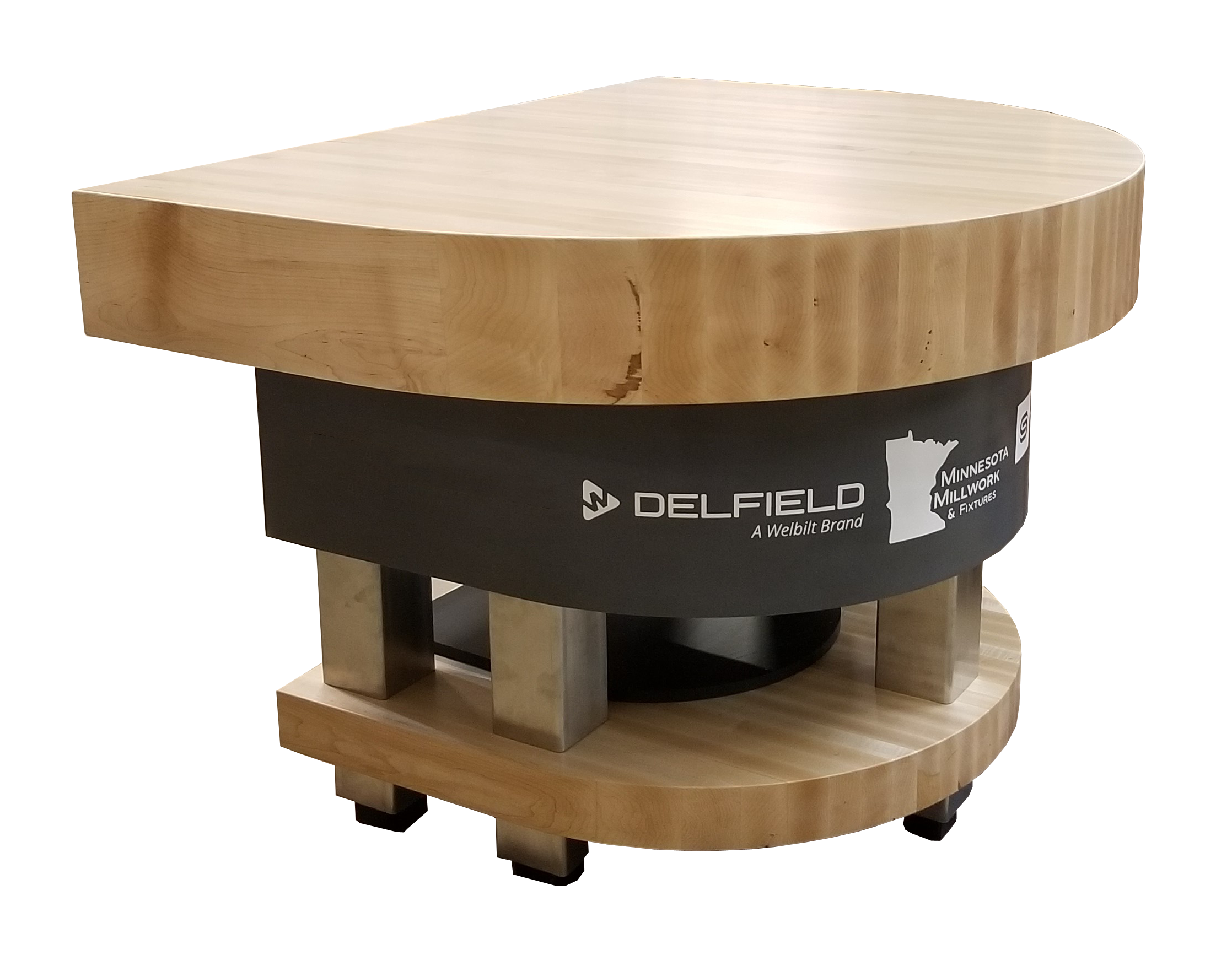

The Importance of Kitchen Table Bills in House Design

Understanding the Meaning behind Kitchen Table Bills

When it comes to designing a house, there are many aspects to consider – from the layout and color scheme to the furniture and decor. However, one important factor that is often overlooked is the kitchen table bills. So, what exactly do these bills mean and why are they so important?

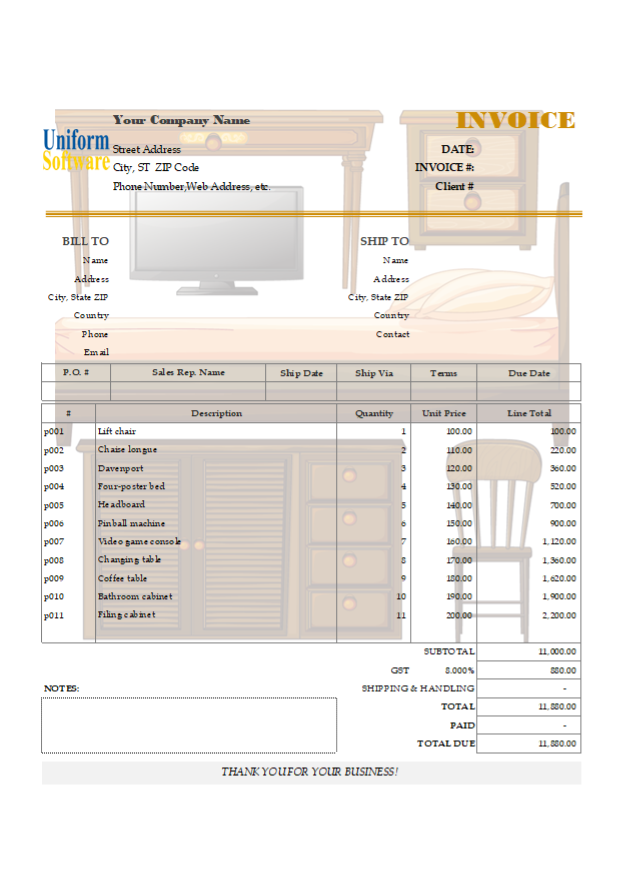

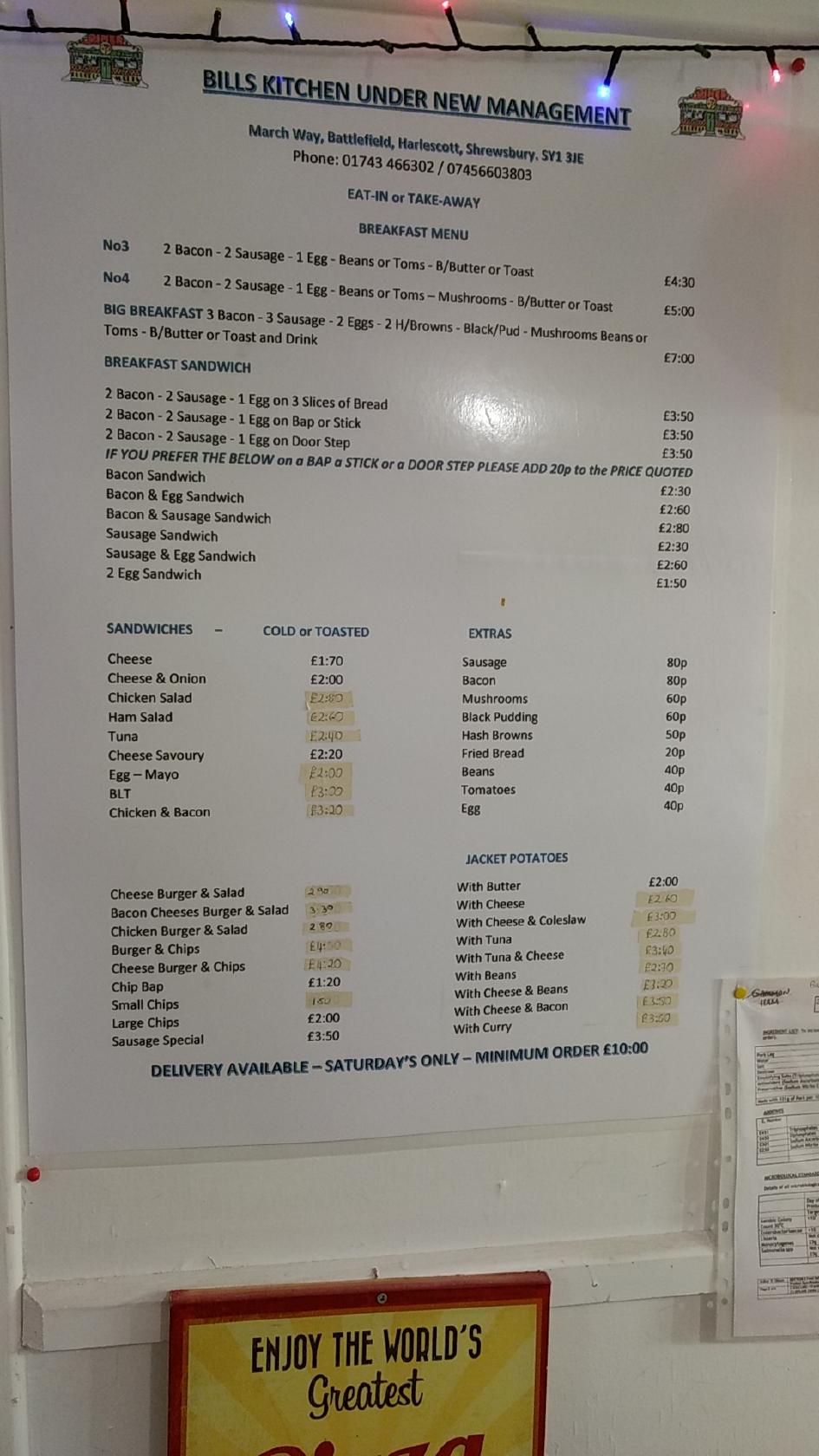

In simple terms, kitchen table bills refer to the total cost of all the materials and labor that go into building a kitchen. This includes everything from the countertops and cabinets to the appliances and installation fees. It is essentially a breakdown of all the expenses that go into creating a functional and aesthetically pleasing kitchen.

But why is it important to pay attention to these bills?

For one, the kitchen is often considered the heart of the home, where meals are cooked, memories are made, and guests are entertained. It is also one of the most heavily used and functional spaces in a house. As such, it is essential to ensure that the kitchen is not only visually appealing but also built to last.

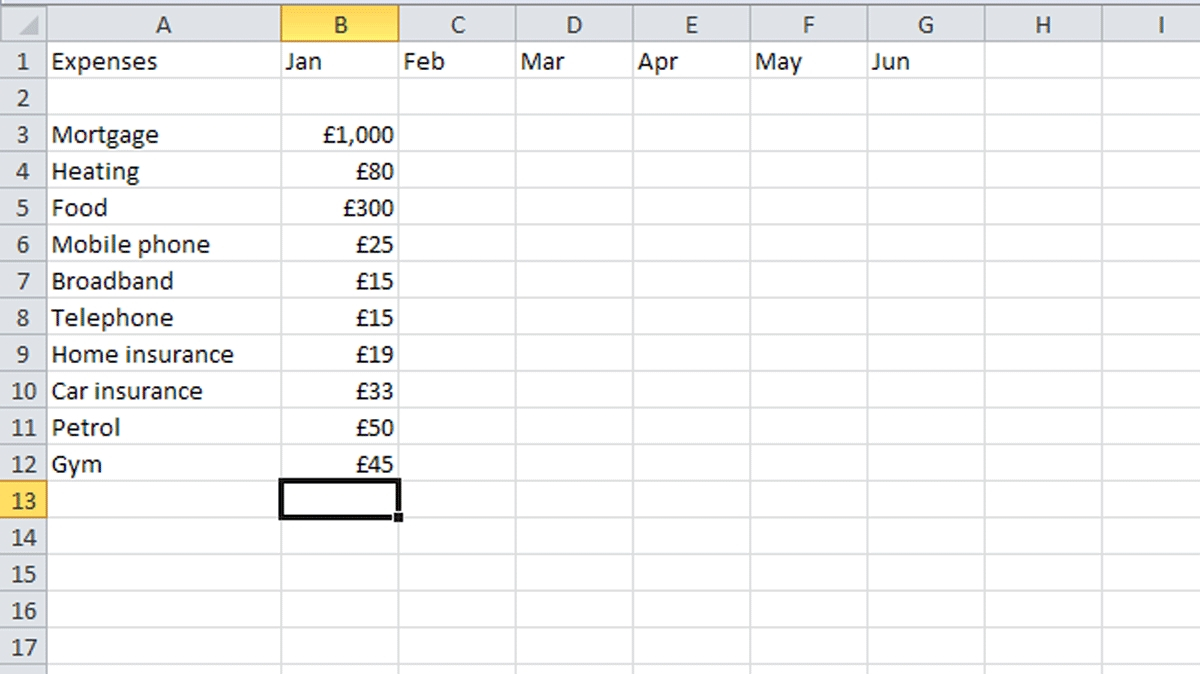

Kitchen table bills also play a crucial role in budgeting and planning.

By knowing the total cost of your kitchen, you can better allocate your resources and make informed decisions about which design elements to prioritize. It also allows you to set a realistic budget and avoid any unexpected expenses that may arise during the construction process.

Moreover, understanding the meaning behind kitchen table bills can help you

identify areas where you can save money without compromising on quality.

For example, you may opt for less expensive materials for the cabinets or choose energy-efficient appliances to lower your utility bills in the long run.

Lastly, kitchen table bills can also impact the resale value of your home.

A well-designed and functional kitchen can significantly increase the value of a house, making it a worthwhile investment. By paying attention to these bills and investing in a quality kitchen, you can potentially increase the overall value of your property.

In conclusion, kitchen table bills are an essential aspect of house design that should not be overlooked. By understanding their meaning and importance, you can make informed decisions, budget effectively, and create a functional and valuable kitchen for your home. So, the next time you embark on a house renovation or construction project, remember to give due consideration to your kitchen table bills.

When it comes to designing a house, there are many aspects to consider – from the layout and color scheme to the furniture and decor. However, one important factor that is often overlooked is the kitchen table bills. So, what exactly do these bills mean and why are they so important?

In simple terms, kitchen table bills refer to the total cost of all the materials and labor that go into building a kitchen. This includes everything from the countertops and cabinets to the appliances and installation fees. It is essentially a breakdown of all the expenses that go into creating a functional and aesthetically pleasing kitchen.

But why is it important to pay attention to these bills?

For one, the kitchen is often considered the heart of the home, where meals are cooked, memories are made, and guests are entertained. It is also one of the most heavily used and functional spaces in a house. As such, it is essential to ensure that the kitchen is not only visually appealing but also built to last.

Kitchen table bills also play a crucial role in budgeting and planning.

By knowing the total cost of your kitchen, you can better allocate your resources and make informed decisions about which design elements to prioritize. It also allows you to set a realistic budget and avoid any unexpected expenses that may arise during the construction process.

Moreover, understanding the meaning behind kitchen table bills can help you

identify areas where you can save money without compromising on quality.

For example, you may opt for less expensive materials for the cabinets or choose energy-efficient appliances to lower your utility bills in the long run.

Lastly, kitchen table bills can also impact the resale value of your home.

A well-designed and functional kitchen can significantly increase the value of a house, making it a worthwhile investment. By paying attention to these bills and investing in a quality kitchen, you can potentially increase the overall value of your property.

In conclusion, kitchen table bills are an essential aspect of house design that should not be overlooked. By understanding their meaning and importance, you can make informed decisions, budget effectively, and create a functional and valuable kitchen for your home. So, the next time you embark on a house renovation or construction project, remember to give due consideration to your kitchen table bills.