If you're in the market for a new kitchen gas lighter, you may be wondering about the GST rate for this essential tool. The GST (Goods and Services Tax) is an indirect tax levied on the supply of goods and services in India, and it has replaced the previous system of taxes such as VAT, CST, and excise duty. In this article, we'll dive into the specifics of the GST rate for kitchen gas lighters and how it may affect your purchase.What is the GST rate for kitchen gas lighters?

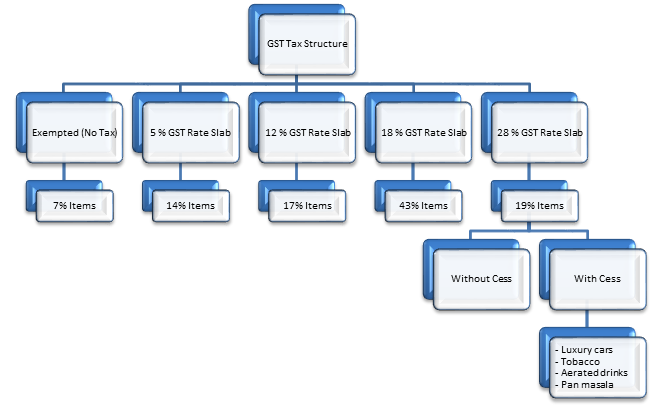

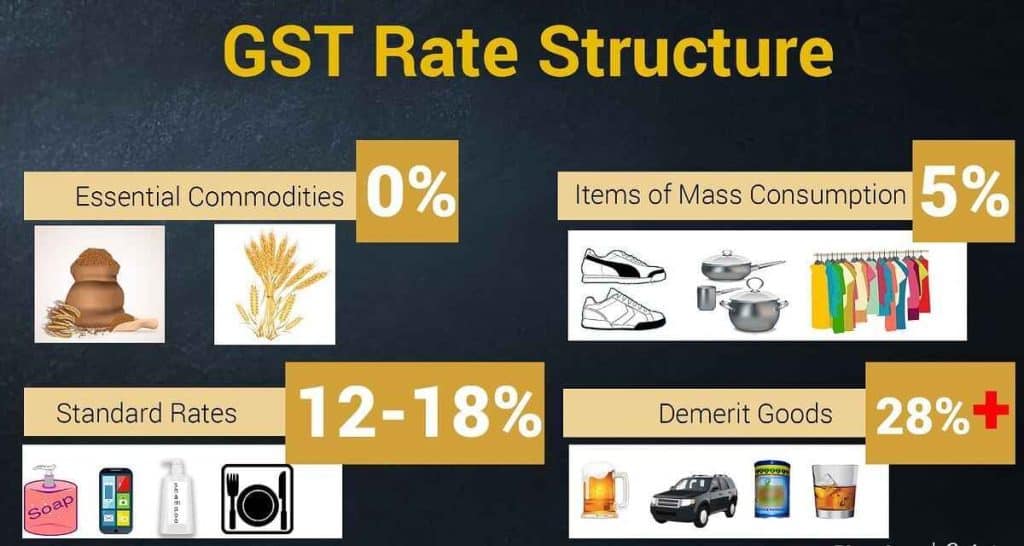

The GST rate for kitchen gas lighters falls under the category of "household articles of plastics" and is currently set at 18%. This means that for every purchase of a kitchen gas lighter, you will be charged an additional 18% on top of the product's price. This rate is the same across all states in India, making it easier to calculate the GST for your purchase.Understanding the GST rate for kitchen gas lighters in India

Calculating GST on your kitchen gas lighter purchase is a straightforward process. Simply take the product's price and multiply it by 18%, and you will get the total amount of GST that you will need to pay. For example, if your kitchen gas lighter costs Rs. 500, the GST amount will be Rs. 90 (500 x 0.18 = 90). This will bring the total price of your purchase to Rs. 590.How to calculate GST on kitchen gas lighters?

As mentioned earlier, the GST rate for kitchen gas lighters is the same across all states in India. This uniform rate makes it easier for consumers to understand and calculate the GST for their purchases, regardless of their location. However, it is worth noting that some states may offer a slight discount on the GST rate for certain products as part of their state-level tax policies.Comparing the GST rates for kitchen gas lighters in different states

The introduction of GST has had a significant impact on the prices of various goods and services in India, including kitchen gas lighters. Under the previous tax system, different states had different tax rates, resulting in varying prices for the same product in different regions. With the implementation of GST, this has been standardized, leading to a more consistent pricing structure for kitchen gas lighters across the country.Impact of GST on the price of kitchen gas lighters

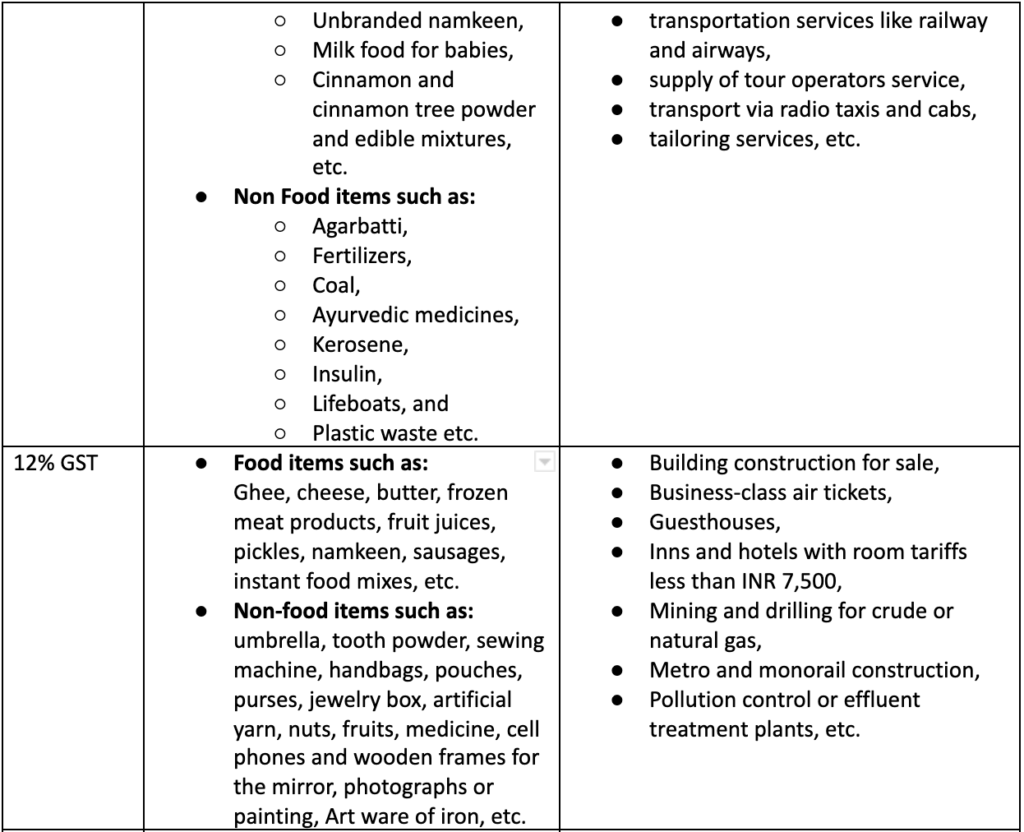

While the general GST rate for kitchen gas lighters is 18%, there are certain exceptions and variations that may apply. For example, kitchen gas lighters that are made of materials other than plastic may fall under different tax categories and have a different GST rate. It is always best to check with the seller or manufacturer to ensure that you are aware of the correct GST rate for the specific kitchen gas lighter you are purchasing.Exploring the different GST rates for kitchen gas lighters in India

While the GST rate for kitchen gas lighters is fixed at 18%, there are ways to save on your purchase. One way is to look for discounts and offers from retailers or manufacturers. Another option is to purchase your kitchen gas lighter from a seller who is registered under the Composition Scheme, which allows them to charge a lower rate of GST (typically 5%). However, it is essential to note that businesses under the Composition Scheme may not be eligible for input tax credit and may have other limitations.How to save on GST when purchasing kitchen gas lighters?

The 18% GST rate for kitchen gas lighters is made up of two components - the CGST (Central Goods and Services Tax) and the SGST (State Goods and Services Tax). These two components are charged at 9% each and are collected by the central and state governments, respectively. This combined rate of 18% is applicable for all goods and services that fall under the category of household articles of plastics.Breaking down the components of GST for kitchen gas lighters

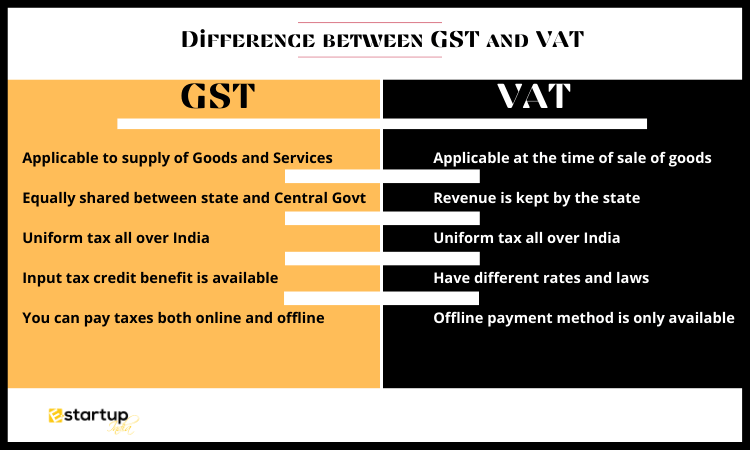

Before the implementation of GST, kitchen gas lighters were subject to VAT (Value Added Tax) in certain states. VAT was a state-level tax that was charged on the value added to a product at each stage of the production process. Under GST, VAT has been replaced by SGST, which is also a state-level tax but is calculated and collected differently. However, the overall impact on the final price of the product remains the same.Understanding the difference between GST and VAT for kitchen gas lighters

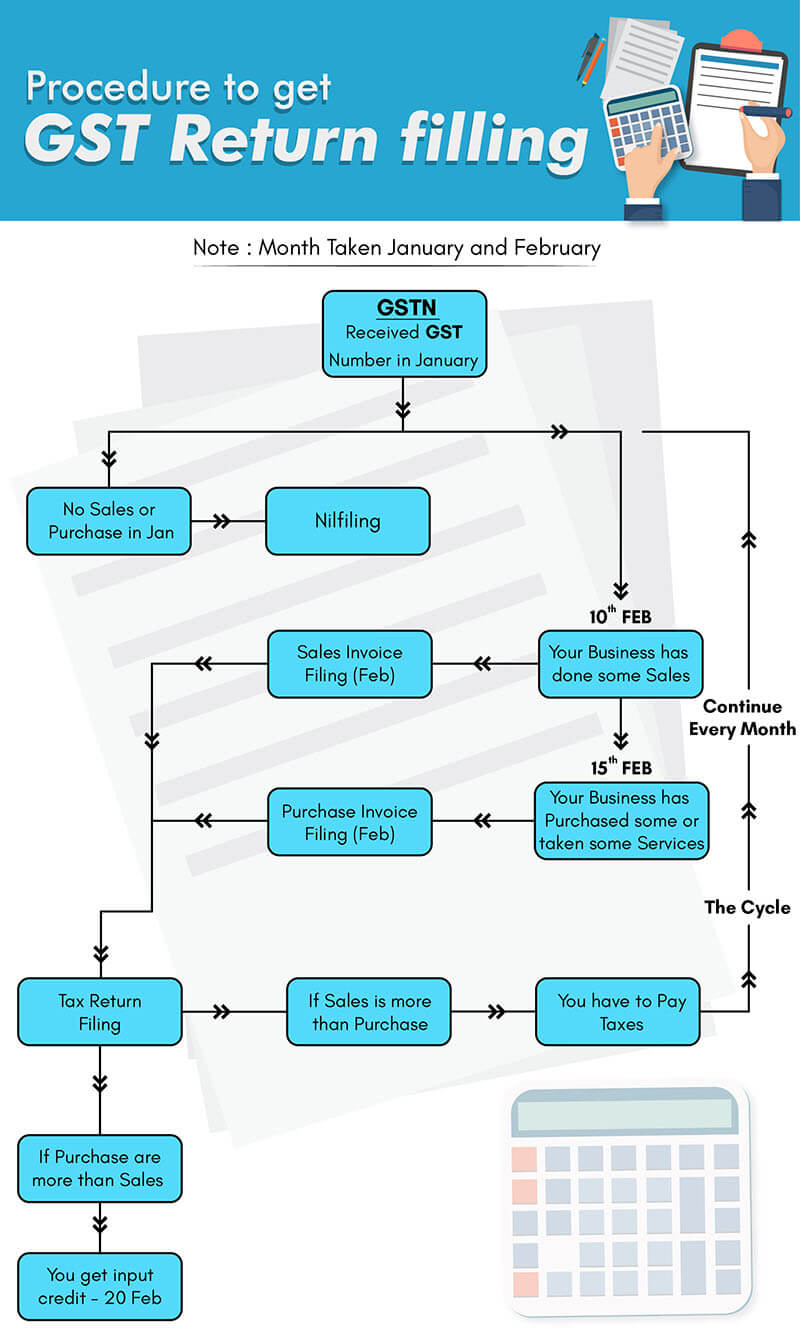

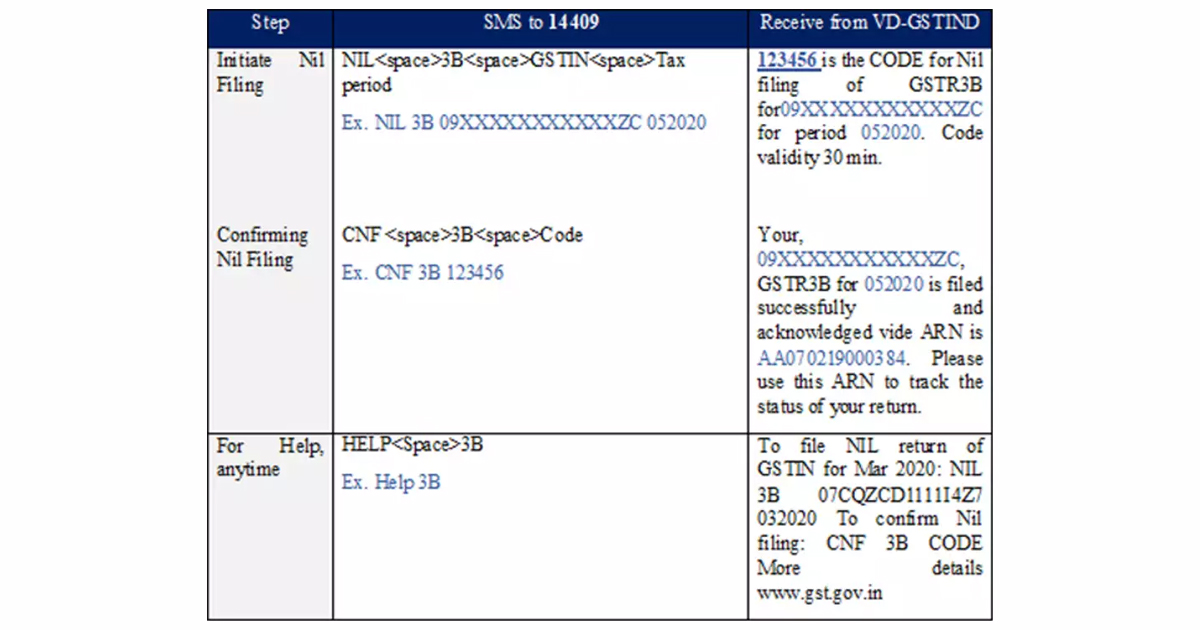

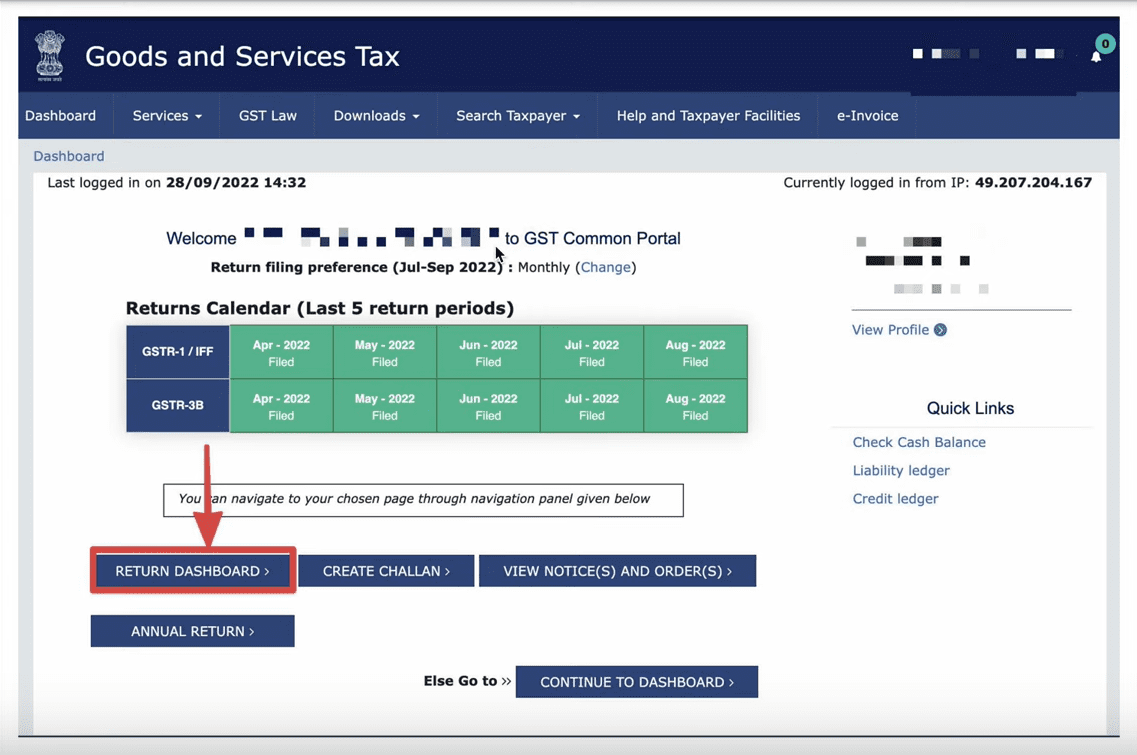

As a consumer, you do not have to file GST returns for your purchases of kitchen gas lighters. It is the responsibility of the seller or manufacturer to collect and file GST returns with the government. However, if you are a business owner purchasing kitchen gas lighters for commercial purposes, you will need to file GST returns as per the guidelines set by the government.How to file GST returns for kitchen gas lighters?

Kitchen Gas Lighter: A Must-Have Accessory for Every Modern Kitchen

Introduction

A kitchen gas lighter is a small but essential tool that has become a staple in every modern kitchen. It is a convenient and safe alternative to traditional matchsticks and lighters, making it a must-have accessory for every household. With the introduction of Goods and Services Tax (GST) in India, the market for kitchen gas lighters has seen a significant rise. In this article, we will discuss the impact of GST on the pricing of kitchen gas lighters and how it has made them more affordable for consumers.

A kitchen gas lighter is a small but essential tool that has become a staple in every modern kitchen. It is a convenient and safe alternative to traditional matchsticks and lighters, making it a must-have accessory for every household. With the introduction of Goods and Services Tax (GST) in India, the market for kitchen gas lighters has seen a significant rise. In this article, we will discuss the impact of GST on the pricing of kitchen gas lighters and how it has made them more affordable for consumers.

What is a Kitchen Gas Lighter?

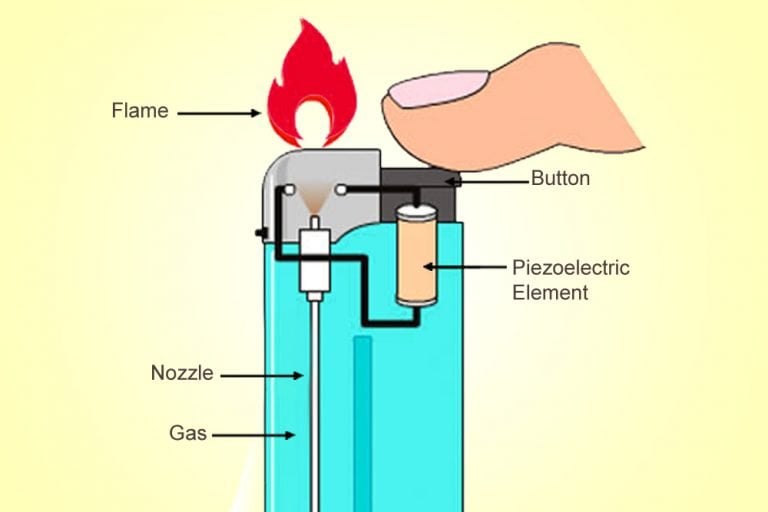

A kitchen gas lighter is a handheld device that is used to ignite gas stoves and ovens. It works by producing a spark that lights up the gas burner, eliminating the need for matches or lighters. It is a safer and more efficient way of lighting up gas appliances in the kitchen. Kitchen gas lighters come in various designs and sizes, but they all serve the same purpose of making cooking easier and more convenient.

A kitchen gas lighter is a handheld device that is used to ignite gas stoves and ovens. It works by producing a spark that lights up the gas burner, eliminating the need for matches or lighters. It is a safer and more efficient way of lighting up gas appliances in the kitchen. Kitchen gas lighters come in various designs and sizes, but they all serve the same purpose of making cooking easier and more convenient.

GST Rate on Kitchen Gas Lighters

Before the implementation of GST, kitchen gas lighters were subjected to various indirect taxes, such as VAT and excise duty, which made them expensive for consumers. However, with the introduction of GST, all these taxes have been subsumed into one, making it a simpler and more transparent tax system. The GST rate on kitchen gas lighters is 18%, which is significantly lower compared to the previous tax rates. This has resulted in a decrease in the overall cost of kitchen gas lighters, making them more affordable for consumers.

Before the implementation of GST, kitchen gas lighters were subjected to various indirect taxes, such as VAT and excise duty, which made them expensive for consumers. However, with the introduction of GST, all these taxes have been subsumed into one, making it a simpler and more transparent tax system. The GST rate on kitchen gas lighters is 18%, which is significantly lower compared to the previous tax rates. This has resulted in a decrease in the overall cost of kitchen gas lighters, making them more affordable for consumers.

Impact of GST on Kitchen Gas Lighter Market

The implementation of GST has had a positive impact on the kitchen gas lighter market. With the removal of multiple taxes and a decrease in the overall tax rate, manufacturers have been able to reduce their production costs. This has enabled them to offer their products at a lower price, making them more competitive in the market. As a result, there has been an increase in the demand for kitchen gas lighters, and more households are now opting for this convenient and cost-effective tool.

The implementation of GST has had a positive impact on the kitchen gas lighter market. With the removal of multiple taxes and a decrease in the overall tax rate, manufacturers have been able to reduce their production costs. This has enabled them to offer their products at a lower price, making them more competitive in the market. As a result, there has been an increase in the demand for kitchen gas lighters, and more households are now opting for this convenient and cost-effective tool.

Conclusion

In conclusion, a kitchen gas lighter is an essential accessory for every modern kitchen, and with the implementation of GST, it has become more affordable for consumers. The decrease in tax rates and the simplification of the tax system have made it easier for manufacturers to offer their products at a lower price, making them accessible to a wider audience. With the rising demand and competitive pricing, the market for kitchen gas lighters is expected to grow further in the coming years. So, if you haven't already, it's time to upgrade your kitchen with a reliable and efficient kitchen gas lighter.

In conclusion, a kitchen gas lighter is an essential accessory for every modern kitchen, and with the implementation of GST, it has become more affordable for consumers. The decrease in tax rates and the simplification of the tax system have made it easier for manufacturers to offer their products at a lower price, making them accessible to a wider audience. With the rising demand and competitive pricing, the market for kitchen gas lighters is expected to grow further in the coming years. So, if you haven't already, it's time to upgrade your kitchen with a reliable and efficient kitchen gas lighter.

.png)