Finding the right mattress can be a daunting task, especially for those who are dealing with medical conditions that require specialized support. For individuals who are covered by Medicare, it's important to know what types of medical equipment and supplies are covered by their insurance. One common question that arises is whether Medicare covers low air loss mattresses. In this article, we'll explore the answer to this question and provide you with all the information you need to know about Medicare coverage for low air loss mattresses.Does Medicare Cover Low Air Loss Mattress?

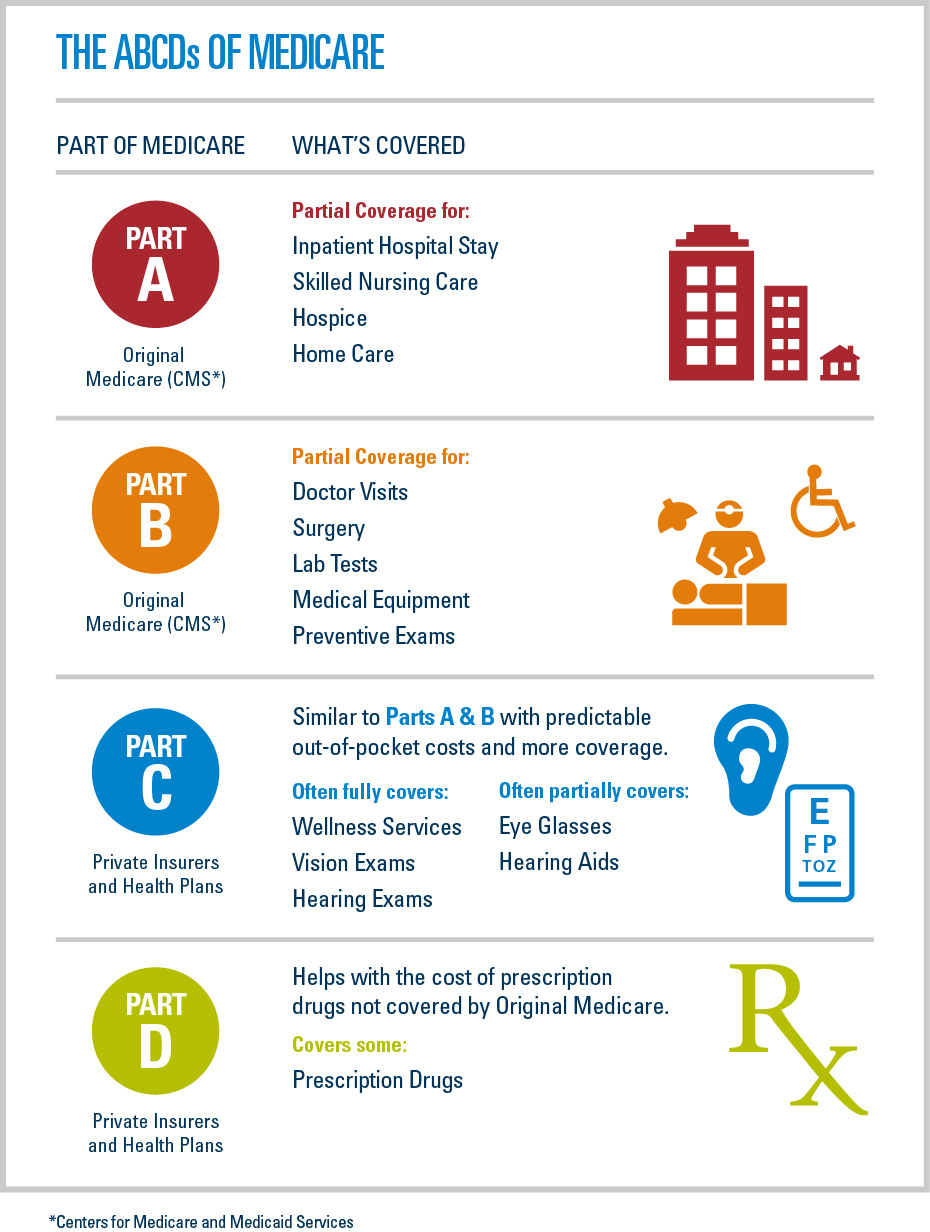

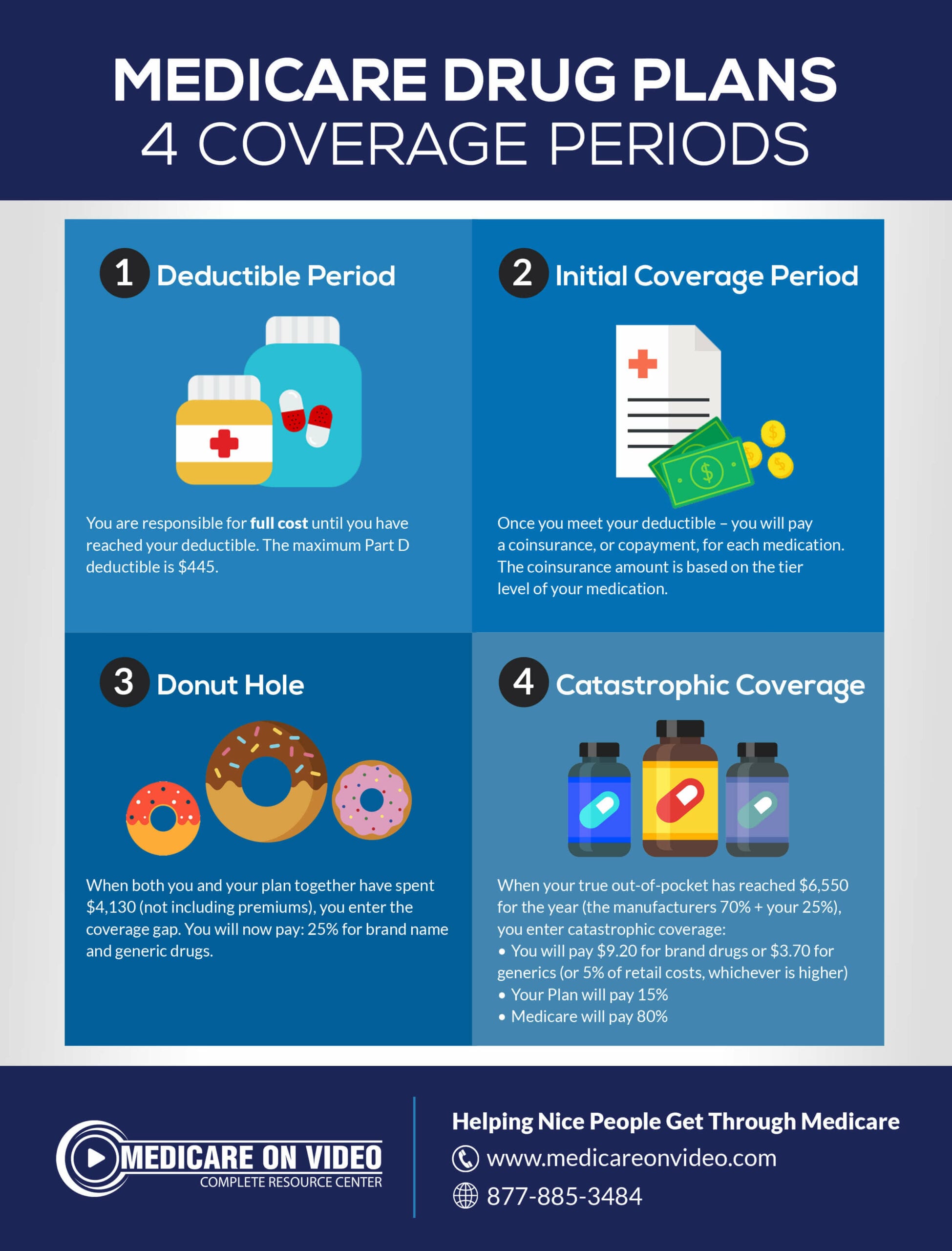

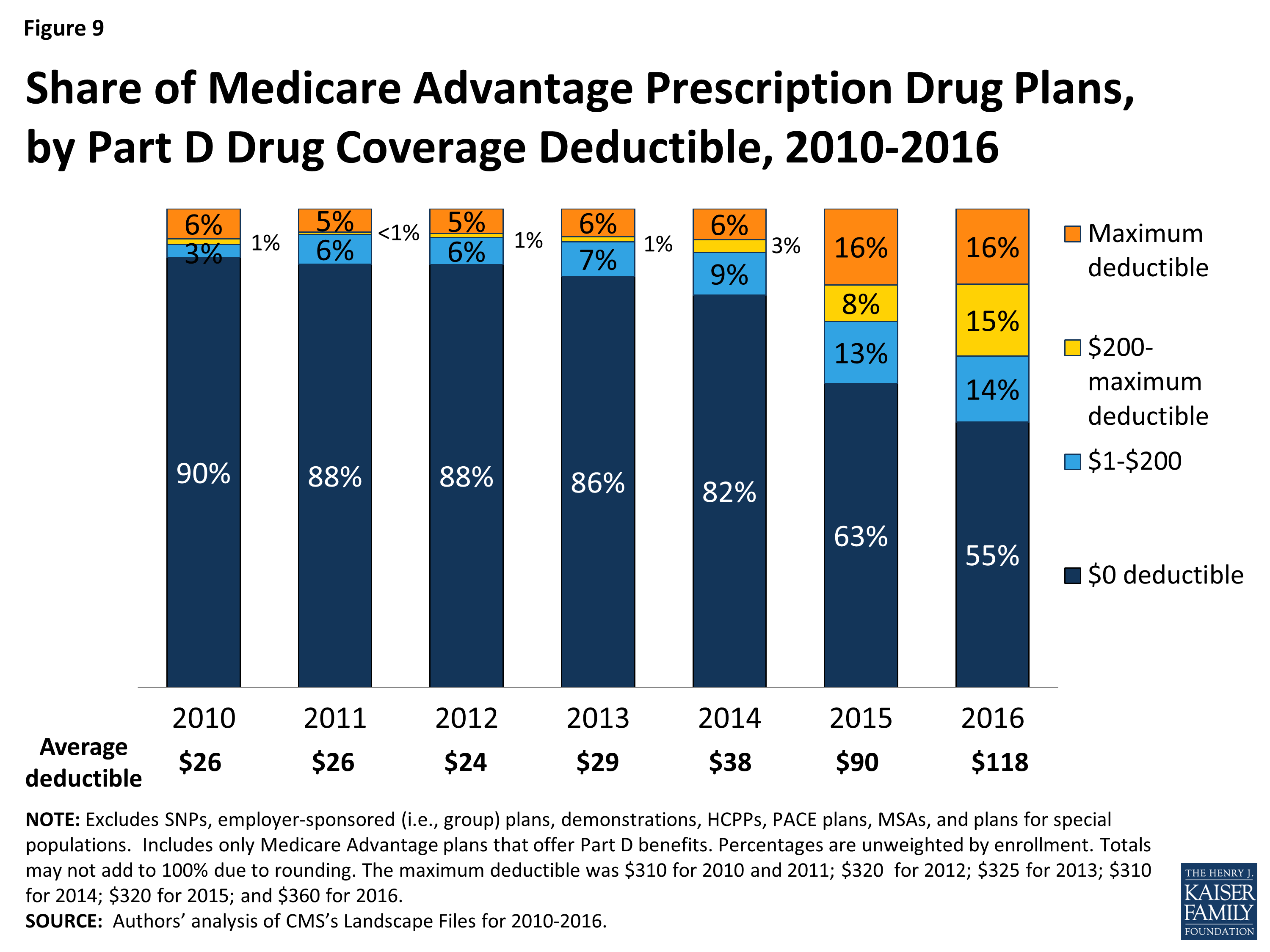

Medicare is a federally funded health insurance program that primarily covers individuals over the age of 65, as well as those with certain disabilities and medical conditions. It is divided into different parts, each covering specific services and supplies. Part B of Medicare covers medically necessary equipment and supplies, including hospital beds and mattresses. Low air loss mattresses fall under the category of "Group 2" support surfaces, which also includes powered pressure-reducing mattresses and overlays. These mattresses are designed to help prevent and treat pressure ulcers, a common issue for individuals who are bedridden or have limited mobility. They do this by using a system of air chambers that constantly adjust the pressure and support to the patient's body, reducing the risk of pressure ulcers.Low Air Loss Mattress Coverage by Medicare

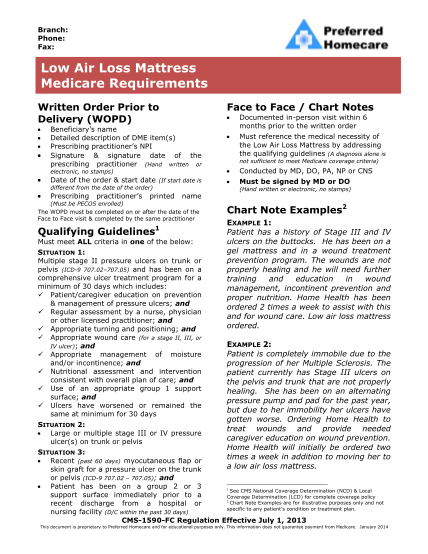

Now that we know low air loss mattresses are considered a medical necessity and fall under the coverage of Medicare Part B, let's take a closer look at the specifics of their coverage. Medicare will cover up to 80% of the cost of a low air loss mattress, with the remaining 20% being the patient's responsibility. This coverage extends to both the purchase or rental of the mattress, as well as necessary replacement parts and supplies. It's important to note that Medicare coverage is subject to certain criteria and requirements. The mattress must be prescribed by a doctor and deemed medically necessary for the patient's condition. Additionally, the supplier of the mattress must be enrolled in Medicare and meet all of their standards for suppliers.Medicare Coverage for Low Air Loss Mattress

While Medicare does cover low air loss mattresses, it's essential to understand that not all types of mattresses are covered. Medicare only covers mattresses that meet their specific criteria and are considered medically necessary. This means that not all low air loss mattresses will be covered, and it's crucial to work closely with your doctor and supplier to ensure the mattress you choose is eligible for coverage. Another important factor to consider is that Medicare covers the cost of the mattress, but not the bed frame. This means that if you need a specific bed frame to support your low air loss mattress, you will likely need to cover the cost out of pocket.Low Air Loss Mattress and Medicare Coverage

Now that we have covered the basics of Medicare coverage for low air loss mattresses, let's dive deeper into the details. Medicare has specific guidelines for the frequency of replacement or rental of a low air loss mattress. The maximum rental period for a standard mattress is 13 months, with the option for an additional 3 months if deemed medically necessary. After this time, Medicare will cover the cost of a replacement mattress. However, if a patient's medical condition requires a more specialized mattress, such as one with advanced features or a higher weight capacity, Medicare may cover the cost of a replacement mattress sooner. It's essential to work closely with your doctor and supplier to ensure you are getting the appropriate mattress for your needs.Understanding Medicare Coverage for Low Air Loss Mattress

Now that we have covered all the necessary information about Medicare coverage for low air loss mattresses, let's recap what you need to know. Medicare does cover low air loss mattresses, but only if they meet specific criteria and are deemed medically necessary. You will need a doctor's prescription and to purchase the mattress from a Medicare-approved supplier. It's also crucial to understand that Medicare only covers the cost of the mattress, not any additional equipment or supplies. It's essential to work closely with your doctor and supplier to ensure you are getting the appropriate mattress and any necessary replacement parts or supplies.Low Air Loss Mattress and Medicare: What You Need to Know

If you believe that a low air loss mattress is necessary for your medical condition, the first step is to speak with your doctor. They will need to write a prescription for the mattress and provide documentation to support its medical necessity. Once you have the prescription, you can work with a Medicare-approved supplier to purchase or rent the mattress. It's important to note that Medicare may require additional documentation to prove the medical necessity of the mattress. This could include medical records, a detailed written order, and a certificate of medical necessity. It's crucial to work closely with your doctor and supplier to ensure all necessary documentation is provided to Medicare.How to Get Medicare to Cover a Low Air Loss Mattress

In conclusion, low air loss mattresses are a covered benefit by Medicare, but only if they meet specific criteria and are deemed medically necessary. If you believe you could benefit from a low air loss mattress, speak with your doctor and supplier to determine the best course of action for your specific medical needs.Low Air Loss Mattress: A Covered Benefit by Medicare?

How Low Air Loss Mattresses Can Benefit Medicare Patients

Understanding the Importance of Mattresses in Healthcare

When it comes to healthcare, we often think of medications, treatments, and doctor's visits. However, one important aspect that is often overlooked is the quality of

mattresses

used for patients. A good mattress can make a significant difference in the comfort and well-being of patients, especially those who are

covered by Medicare

. With the rise of chronic illnesses, such as pressure ulcers and bedsores, healthcare providers are turning to low air loss mattresses as a solution. But the question remains, does Medicare cover low air loss mattresses? Let's explore the benefits and coverage of these specialized mattresses.

When it comes to healthcare, we often think of medications, treatments, and doctor's visits. However, one important aspect that is often overlooked is the quality of

mattresses

used for patients. A good mattress can make a significant difference in the comfort and well-being of patients, especially those who are

covered by Medicare

. With the rise of chronic illnesses, such as pressure ulcers and bedsores, healthcare providers are turning to low air loss mattresses as a solution. But the question remains, does Medicare cover low air loss mattresses? Let's explore the benefits and coverage of these specialized mattresses.

The Benefits of Low Air Loss Mattresses for Medicare Patients

Low air loss mattresses are designed to provide patients with a comfortable and therapeutic sleeping surface. They have a unique feature where air is slowly released through small holes in the mattress, creating a cushioning effect that helps to distribute weight evenly and reduce pressure on the body. This feature is especially beneficial for patients who are bedridden or have limited mobility, as it helps to prevent pressure ulcers and bedsores from developing. Low air loss mattresses also have adjustable settings that allow for personalized comfort, making them suitable for a wide range of patients with varying needs.

Low air loss mattresses are designed to provide patients with a comfortable and therapeutic sleeping surface. They have a unique feature where air is slowly released through small holes in the mattress, creating a cushioning effect that helps to distribute weight evenly and reduce pressure on the body. This feature is especially beneficial for patients who are bedridden or have limited mobility, as it helps to prevent pressure ulcers and bedsores from developing. Low air loss mattresses also have adjustable settings that allow for personalized comfort, making them suitable for a wide range of patients with varying needs.

The Coverage of Low Air Loss Mattresses under Medicare

The good news is that

Medicare does cover low air loss mattresses

for eligible patients. According to Medicare guidelines, these mattresses are typically covered under the category of durable medical equipment (DME). To be eligible for coverage, the patient must have a medical need for the mattress, and a healthcare provider must prescribe it for their treatment. Additionally, the patient must have Medicare Part B coverage, and the supplier must be enrolled in Medicare. It's also essential to note that Medicare only covers the cost of the mattress, not any additional features or upgrades.

The good news is that

Medicare does cover low air loss mattresses

for eligible patients. According to Medicare guidelines, these mattresses are typically covered under the category of durable medical equipment (DME). To be eligible for coverage, the patient must have a medical need for the mattress, and a healthcare provider must prescribe it for their treatment. Additionally, the patient must have Medicare Part B coverage, and the supplier must be enrolled in Medicare. It's also essential to note that Medicare only covers the cost of the mattress, not any additional features or upgrades.

The Bottom Line

A good mattress is crucial for the comfort and well-being of patients, and low air loss mattresses provide numerous benefits for those covered by Medicare. These specialized mattresses not only help to prevent and treat pressure ulcers and bedsores, but they also improve overall comfort and aid in the healing process. With Medicare coverage, patients can have access to this advanced technology without having to worry about the cost. So if you or a loved one is in need of a low air loss mattress, be sure to consult with your healthcare provider and inquire about Medicare coverage.

A good mattress is crucial for the comfort and well-being of patients, and low air loss mattresses provide numerous benefits for those covered by Medicare. These specialized mattresses not only help to prevent and treat pressure ulcers and bedsores, but they also improve overall comfort and aid in the healing process. With Medicare coverage, patients can have access to this advanced technology without having to worry about the cost. So if you or a loved one is in need of a low air loss mattress, be sure to consult with your healthcare provider and inquire about Medicare coverage.